A Sales Invoice Template is a pre-designed document used to itemize products or services sold, including quantities, prices, and total amounts due. It ensures consistency and professionalism in billing, facilitating smooth payment processes between businesses and customers. Customizable features allow for the inclusion of company logos, payment terms, and contact information.

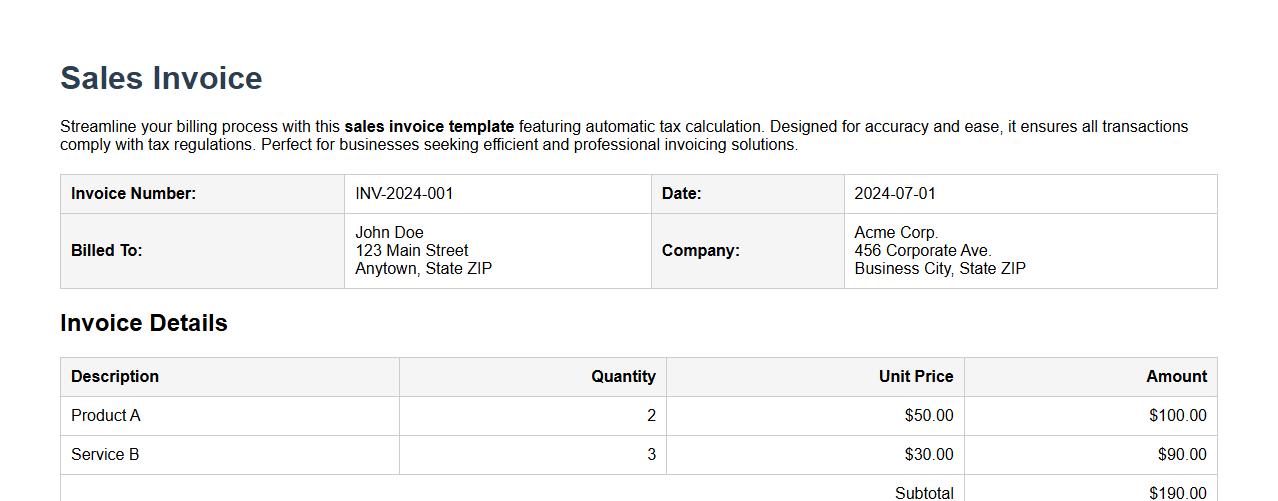

Sales invoice template with tax calculation

Streamline your billing process with this sales invoice template featuring automatic tax calculation. Designed for accuracy and ease, it ensures all transactions comply with tax regulations. Perfect for businesses seeking efficient and professional invoicing solutions.

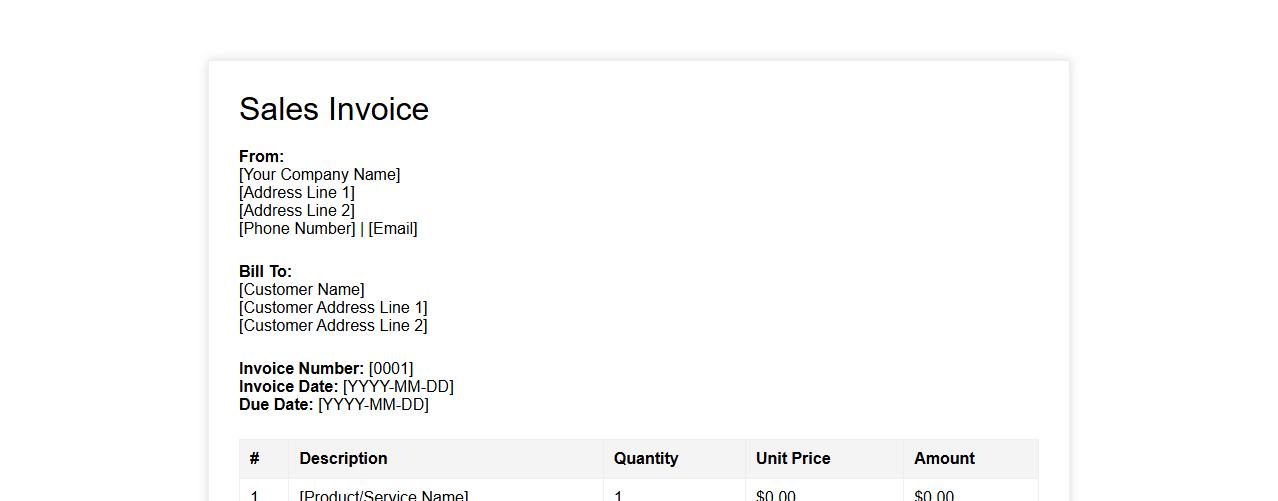

Sales invoice template with payment terms

A sales invoice template with payment terms provides a clear and professional format to document transactions and specify payment deadlines. This template helps businesses streamline billing processes while ensuring customers understand their payment obligations. Efficient invoicing promotes timely payments and enhances financial management.

Customizable sales invoice template for freelancers

Streamline your billing process with this customizable sales invoice template designed specifically for freelancers. Easily tailor the layout and details to fit your unique business needs, ensuring professional and clear invoices every time. Enhance your payment efficiency and maintain a polished brand image effortlessly.

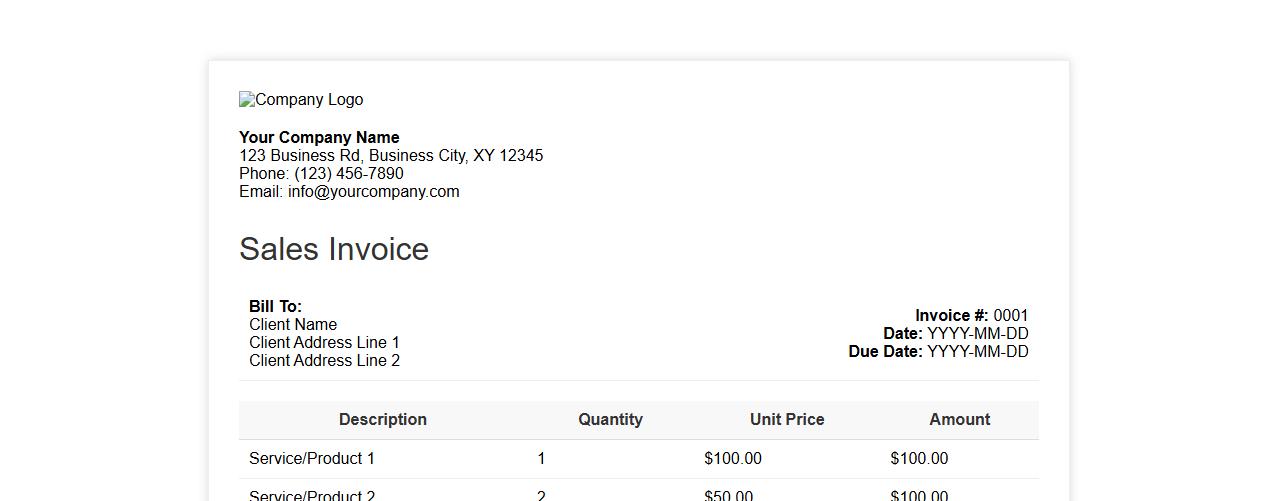

Printable sales invoice template with company logo

This printable sales invoice template features a professional design with a customizable company logo, ensuring brand consistency. Easily editable fields allow for quick entry of sales details, making it perfect for small businesses and freelancers. The template is designed for clear readability and efficient record-keeping.

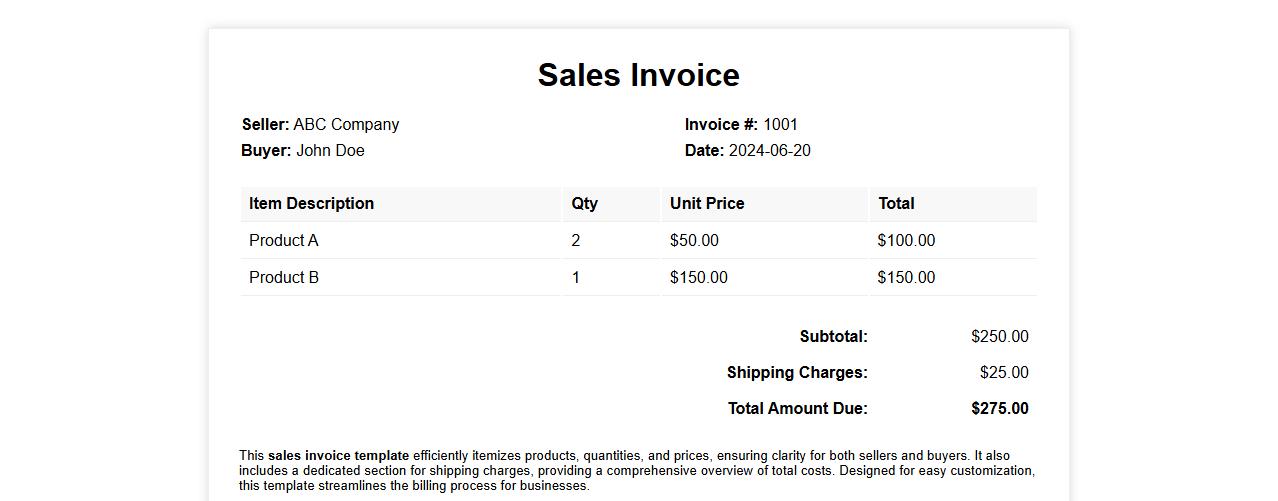

Sales invoice template including shipping charges

This sales invoice template efficiently itemizes products, quantities, and prices, ensuring clarity for both sellers and buyers. It also includes a dedicated section for shipping charges, providing a comprehensive overview of total costs. Designed for easy customization, this template streamlines the billing process for businesses.

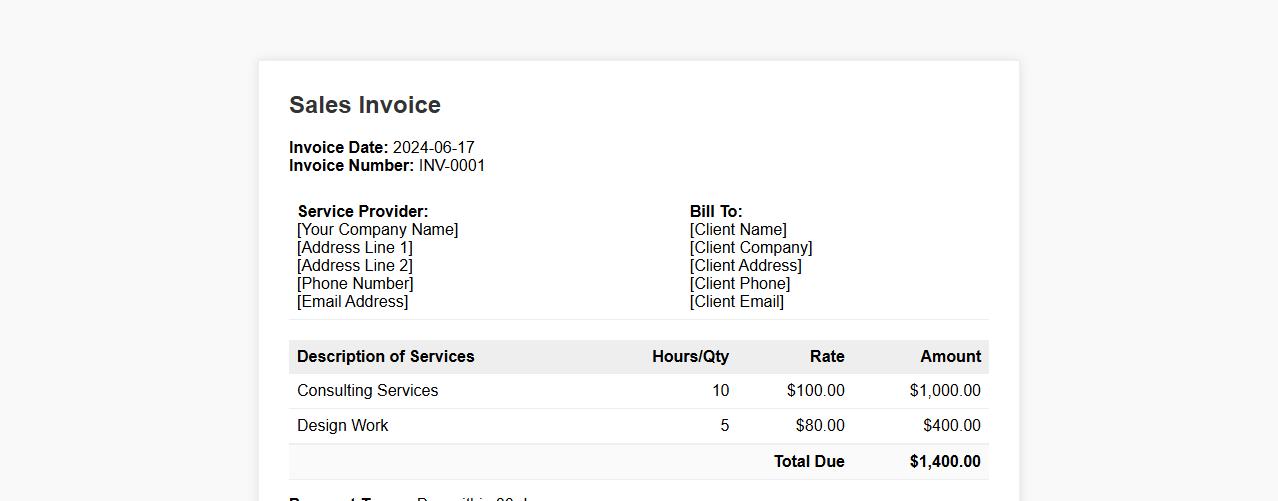

Sales invoice template for services rendered

A sales invoice template for services rendered simplifies billing by clearly detailing the services provided, payment terms, and total amount due. It enhances professionalism and ensures accurate record-keeping for both service providers and clients. Using this template helps streamline the invoicing process and improves financial management.

Automated sales invoice template in Excel

Streamline your billing process with our automated sales invoice template in Excel, designed to save time and reduce errors. This template allows easy customization and instant calculation of totals, taxes, and discounts. Perfect for businesses seeking efficient and professional invoice management.

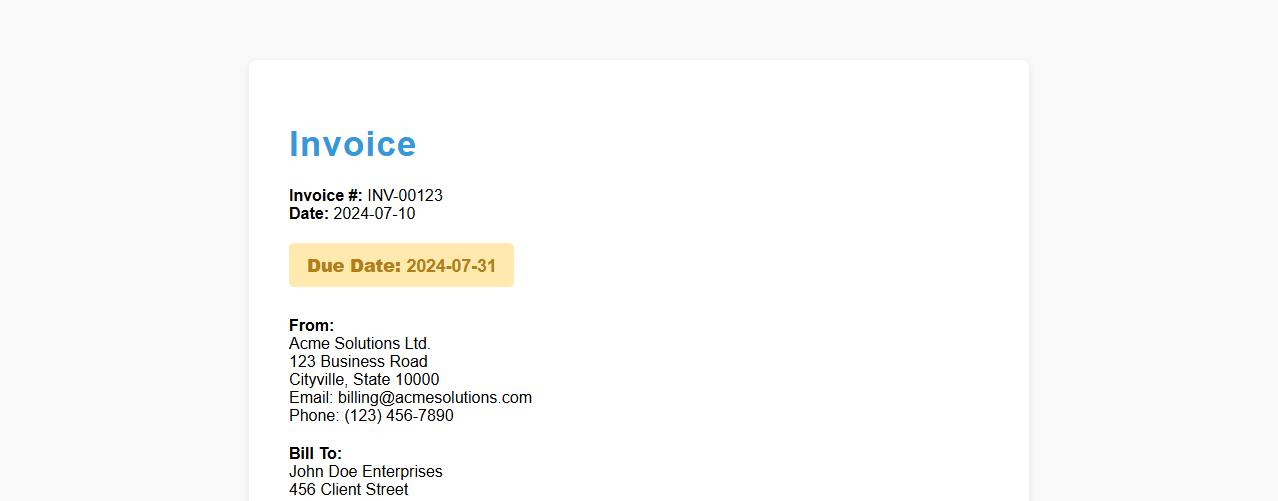

Professional sales invoice template with due date

Our professional sales invoice template is designed to streamline your billing process with a clear layout and an emphasized due date for timely payments. It ensures all transaction details are presented accurately and professionally. Easily customizable, this template helps enhance your business's financial management and client communication.

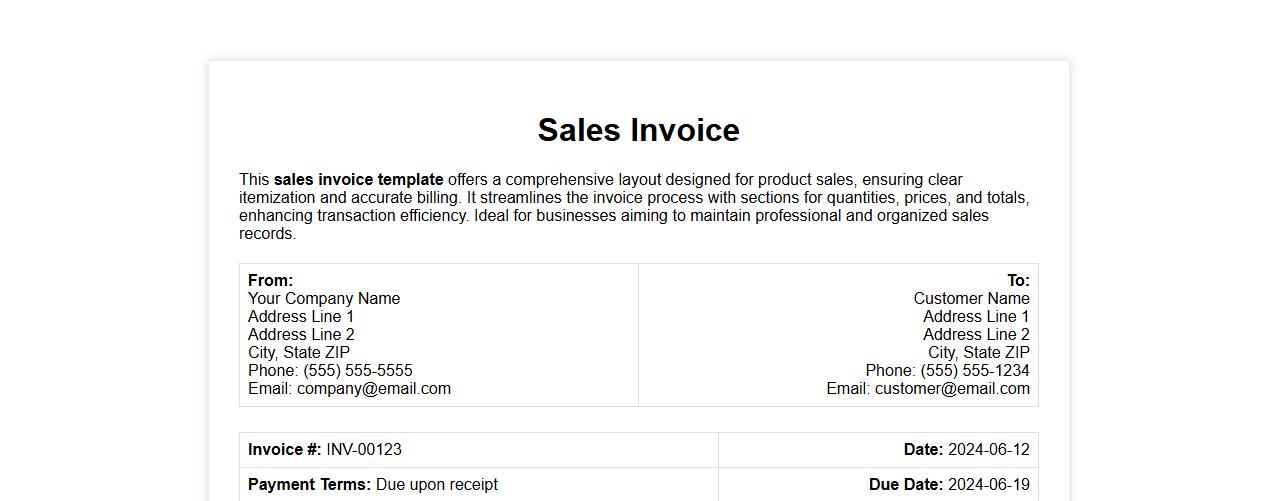

Detailed sales invoice template for product sales

This sales invoice template offers a comprehensive layout designed for product sales, ensuring clear itemization and accurate billing. It streamlines the invoice process with sections for quantities, prices, and totals, enhancing transaction efficiency. Ideal for businesses aiming to maintain professional and organized sales records.

What are the mandatory elements for a legally compliant sales invoice?

A legally compliant sales invoice must include the seller's name, address, and tax identification number. It should clearly state the invoice date, unique invoice number, and details of goods or services provided. Additionally, the invoice must show the quantity, unit price, total amount, and applicable taxes.

How should multi-currency transactions be documented in a sales invoice?

Multi-currency sales invoices must indicate the currency used for the transaction, alongside the amounts specified in that currency. It is essential to show the exchange rate applied and the equivalent total in the seller's base currency. This ensures transparency and proper accounting for foreign currency conversions.

What identifier should be used to track recurring sales invoices?

Recurring sales invoices should use a unique, sequential invoice number for easy identification and tracking. Incorporating a recurring invoice reference or subscription ID helps link related invoices logically. This system improves accounting accuracy and facilitates auditing procedures.

How does VAT/GST registration affect invoice formatting?

Invoices issued by VAT/GST registered businesses must include the tax registration number prominently displayed on the document. The invoice should also clearly separate the taxable amount, tax rate, and the calculated VAT/GST. Failure to format invoices according to VAT/GST rules may result in non-compliance penalties.

What security measures protect digital sales invoices from tampering?

Digital sales invoices are protected using electronic signatures and encryption technologies to ensure authenticity. Secure invoice management software often includes audit trails that log any changes made to documents. These measures prevent unauthorized alterations and maintain the integrity of digital records.