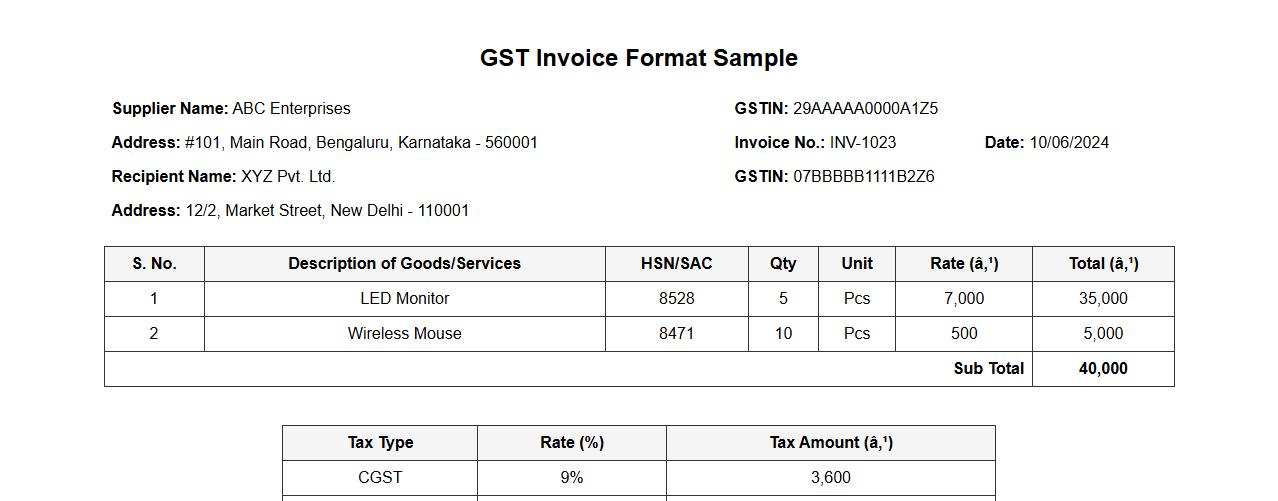

A GST Invoice Format Sample typically includes essential details such as the supplier and recipient's information, GSTIN, invoice number, date, description of goods or services, taxable value, GST rates, and total amount. This standardized format ensures compliance with tax regulations and facilitates seamless filing of GST returns. Businesses use this template to maintain transparency and accuracy in their financial transactions.

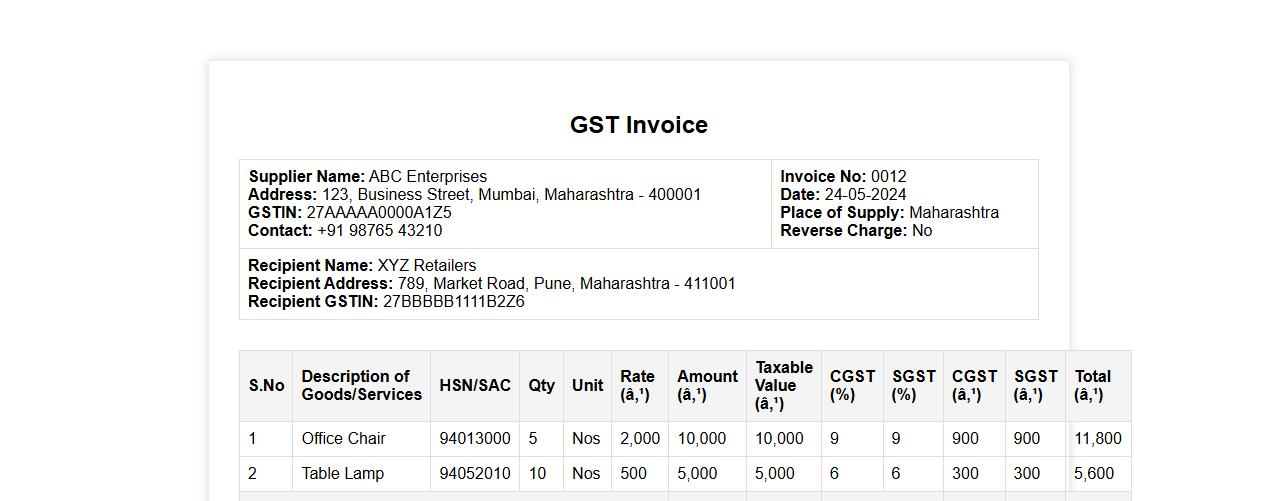

GST invoice format sample for small businesses in India

A GST invoice format sample for small businesses in India helps ensure compliance with tax regulations by including essential details like GSTIN, invoice number, and taxable value. This format simplifies billing while maintaining transparency and accuracy in transactions. Businesses can customize it to streamline their invoicing process and meet government standards.

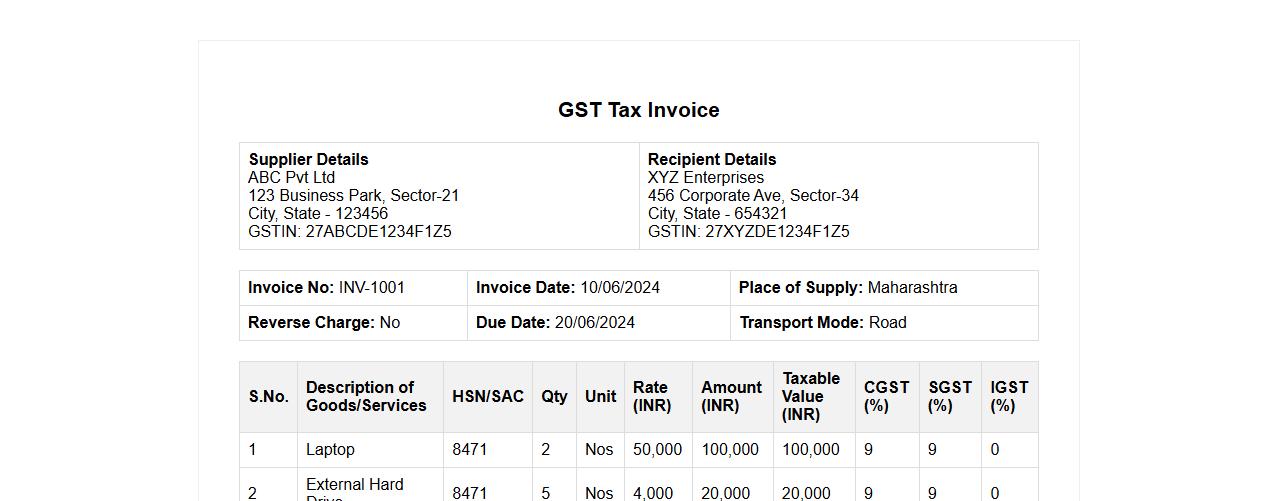

GST invoice format sample with HSN code

Discover a comprehensive GST invoice format sample with HSN code that ensures compliance with tax regulations and streamlines your billing process. This format includes all essential components like GSTIN, invoice number, and itemized details with accurate HSN codes for easy classification. Use this template to maintain transparency and accuracy in your business transactions.

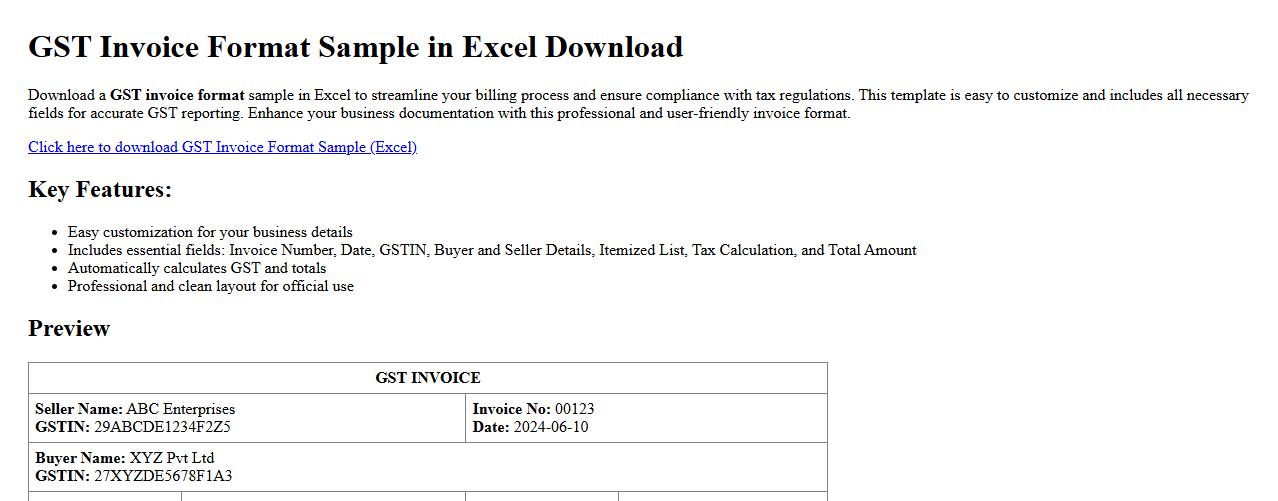

GST invoice format sample in Excel download

Download a GST invoice format sample in Excel to streamline your billing process and ensure compliance with tax regulations. This template is easy to customize and includes all necessary fields for accurate GST reporting. Enhance your business documentation with this professional and user-friendly invoice format.

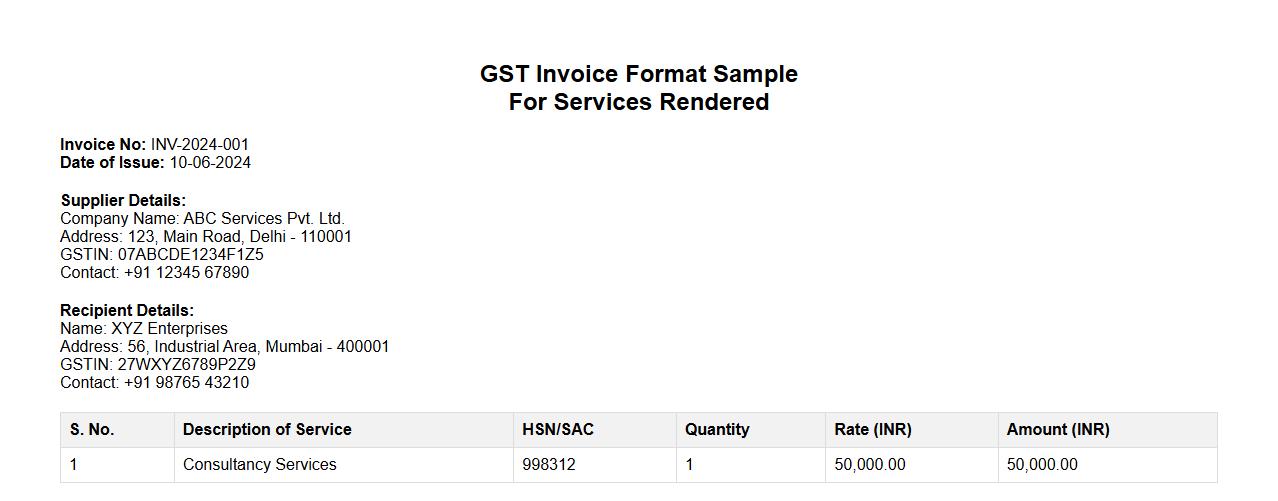

GST invoice format sample for services rendered

Explore this GST invoice format sample designed specifically for services rendered, ensuring compliance with tax regulations. This format includes all essential details like service description, GST rates, and total amount payable. Use it to streamline your billing process and maintain accurate financial records.

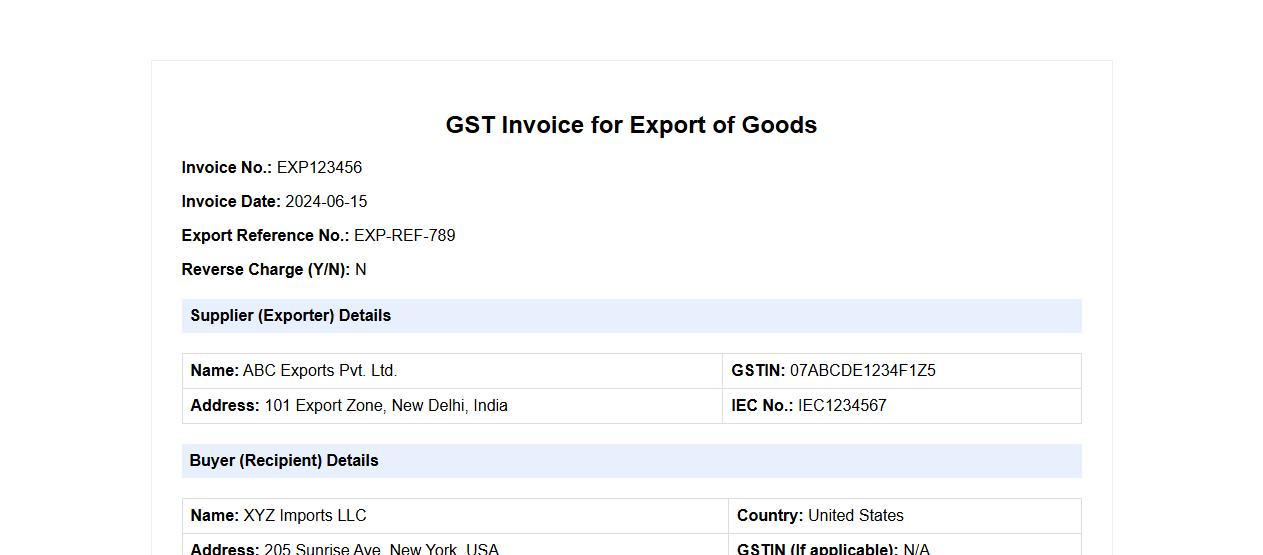

GST invoice format sample for export of goods

Explore our GST invoice format sample tailored for the export of goods, ensuring compliance with Indian tax regulations. This template includes all essential details like supplier and buyer information, HSN codes, and export-specific GST provisions. Use it to streamline your invoicing process and maintain accurate export documentation.

GST invoice format sample with multiple tax rates

This GST invoice format sample demonstrates how to efficiently display multiple tax rates on a single invoice. It ensures compliance with tax regulations while maintaining clarity for both sellers and buyers. The format supports detailed tax computations for accurate billing and record-keeping.

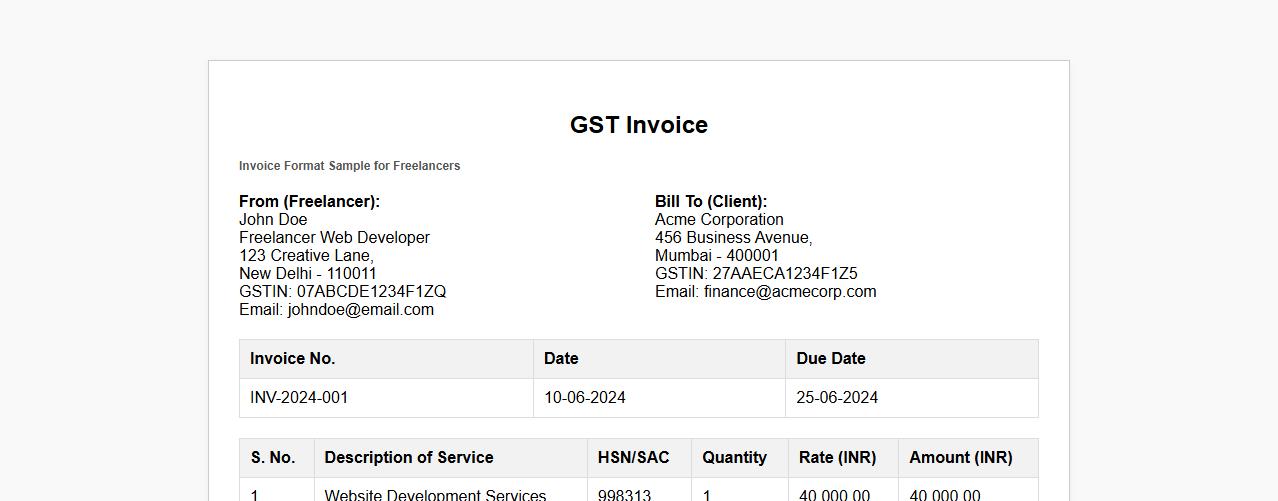

GST invoice format sample for freelancers

Discover a comprehensive GST invoice format sample for freelancers designed to simplify your billing process. This template ensures compliance with tax regulations while maintaining a professional appearance. Ideal for freelancers seeking clear and accurate invoicing solutions.

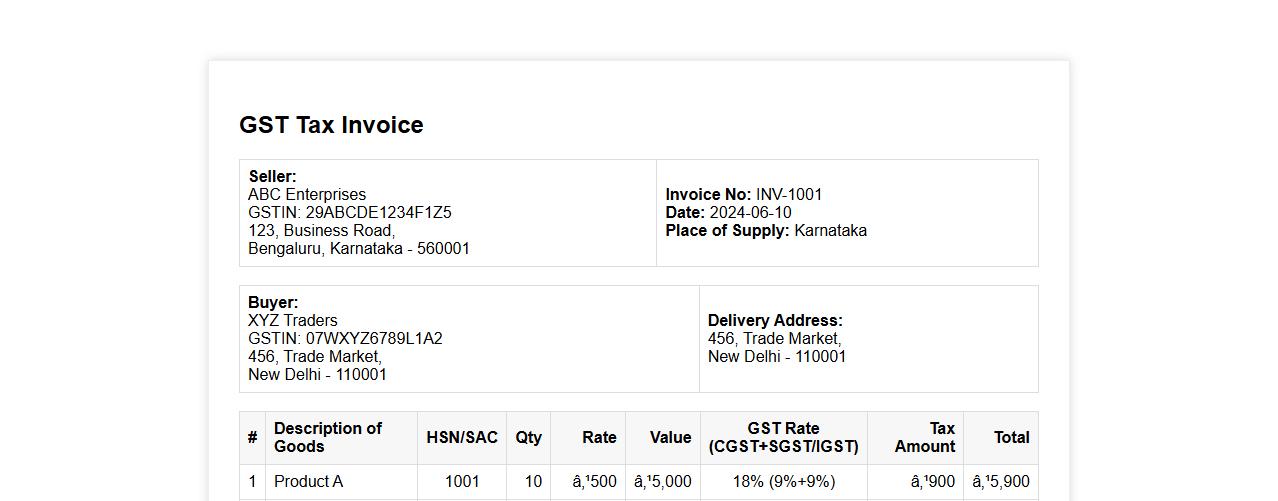

GST invoice format sample including IGST, CGST, and SGST

Explore a comprehensive GST invoice format sample that clearly includes sections for IGST, CGST, and SGST, ensuring compliance with tax regulations. This template helps businesses accurately record tax details for inter-state and intra-state transactions. Using this format simplifies invoice creation and facilitates transparent financial reporting.

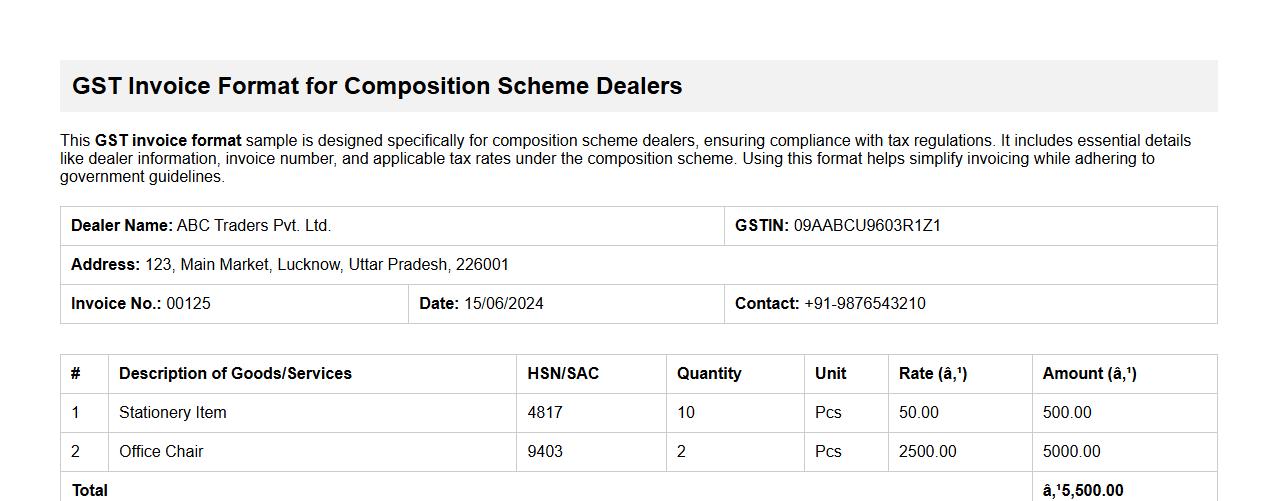

GST invoice format sample for composition scheme dealers

This GST invoice format sample is designed specifically for composition scheme dealers, ensuring compliance with tax regulations. It includes essential details like dealer information, invoice number, and applicable tax rates under the composition scheme. Using this format helps simplify invoicing while adhering to government guidelines.

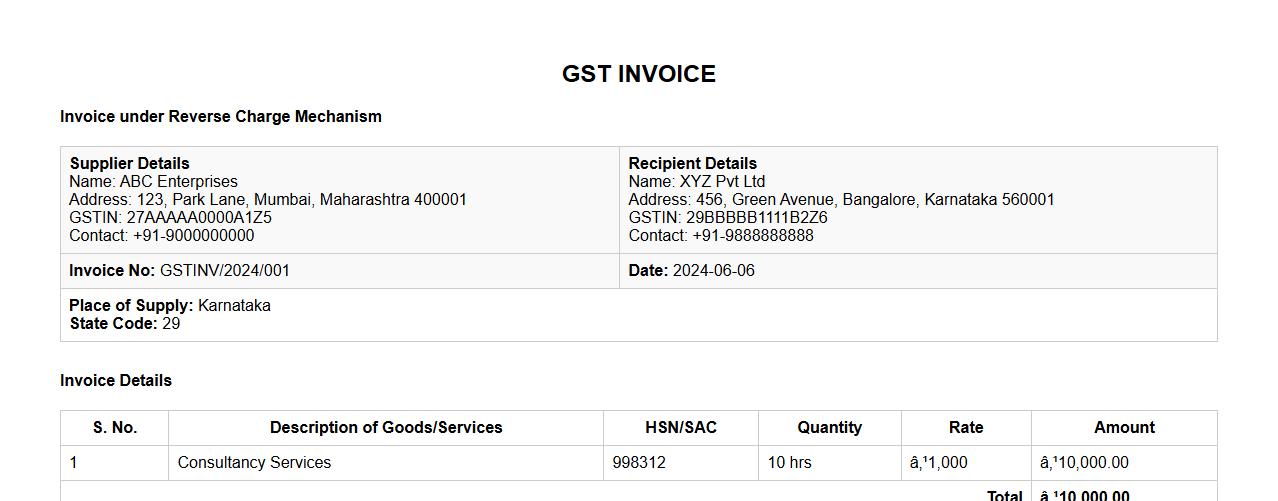

GST invoice format sample with reverse charge mechanism

The GST invoice format with reverse charge mechanism is a specialized template designed to comply with tax regulations where the recipient is liable to pay the tax instead of the supplier. This format includes specific fields such as supplier details, recipient information, invoice number, date, and the reverse charge indication. Utilizing this sample ensures accurate tax reporting and seamless transaction processing under the GST law.

What mandatory fields must be included in a GST invoice format as per the latest regulations?

A GST invoice must contain the supplier's name, GSTIN, invoice number, and date. It must also include the recipient's details, including their GSTIN for B2B transactions. Additionally, the invoice should specify the description of goods or services, quantity, taxable value, and applicable tax rates.

How should HSN/SAC codes be displayed in a compliant GST invoice template?

The HSN or SAC code must be clearly mentioned alongside the description of goods or services. For B2B invoices, displaying the HSN code is mandatory especially if the aggregate turnover exceeds the prescribed limit. This ensures clarity in classification and smooth tax compliance.

What are the rules for issuing revised GST invoices for B2B transactions?

Revised GST invoices must mention the original invoice number and date for reference. They should detail only the changes made in the invoice to maintain transparency. These revised invoices must be issued within the stipulated time frame as prescribed under GST law.

Is a digital signature required on electronic GST invoice formats?

There is no mandatory requirement for a digital signature on electronic GST invoices as per the latest rules. However, companies may choose to digitally sign invoices for authenticity and security purposes. The key is ensuring all required invoice details are accurately presented and accessible.

How should export invoices under GST be formatted differently from domestic invoices?

Export invoices must clearly state that the supply is an export and include relevant shipping details. They should also mention the invoice type, such as "Supply to SEZ" or "Export without payment of IGST," as applicable. Additionally, the GSTIN of the recipient and exporter should be correctly featured to qualify for export benefits.