A Small Business Invoice Form is a crucial document used to request payment from clients for goods or services provided. It typically includes details such as invoice number, date, client information, itemized list of products or services, prices, and payment terms. This form helps streamline billing processes and ensures accurate financial record-keeping for small businesses.

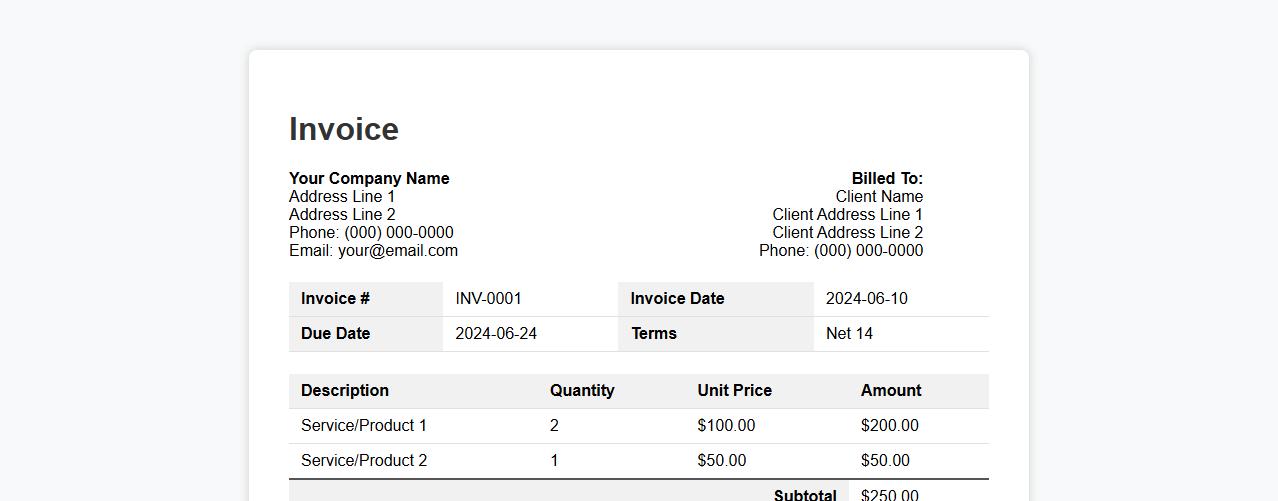

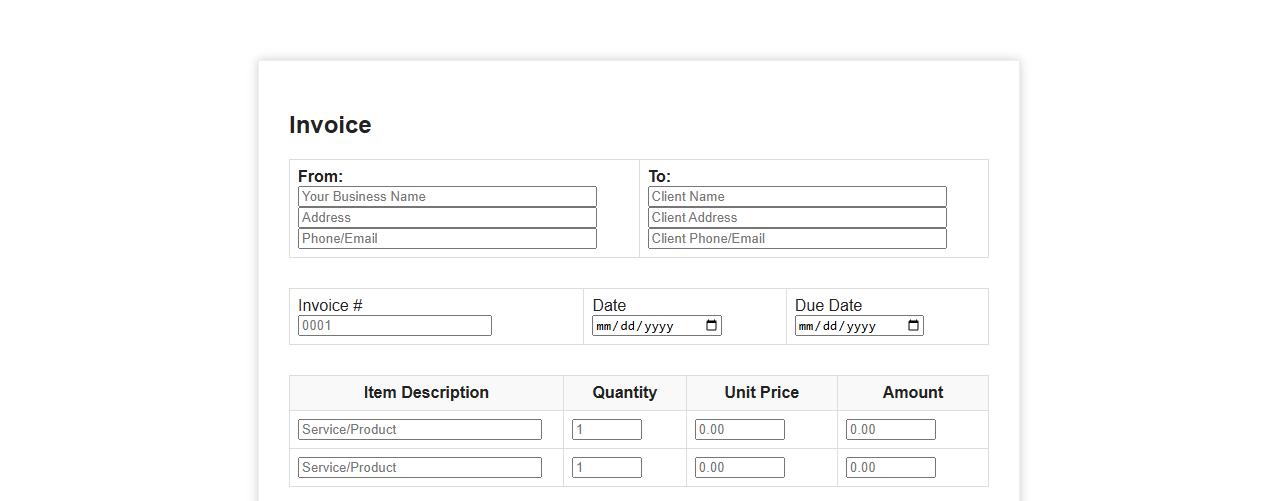

Customizable small business invoice form template

Enhance your billing process with our customizable small business invoice form template, designed for ease and efficiency. Tailor each section to meet your specific needs while maintaining a professional appearance. Streamline payments and keep clear records effortlessly.

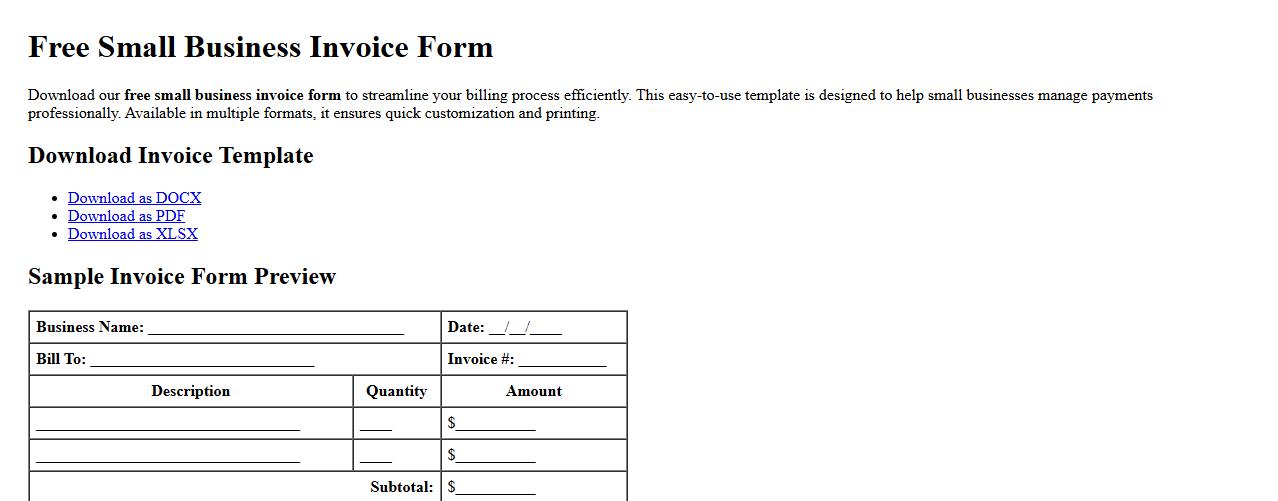

Free downloadable small business invoice form

Download our free small business invoice form to streamline your billing process efficiently. This easy-to-use template is designed to help small businesses manage payments professionally. Available in multiple formats, it ensures quick customization and printing.

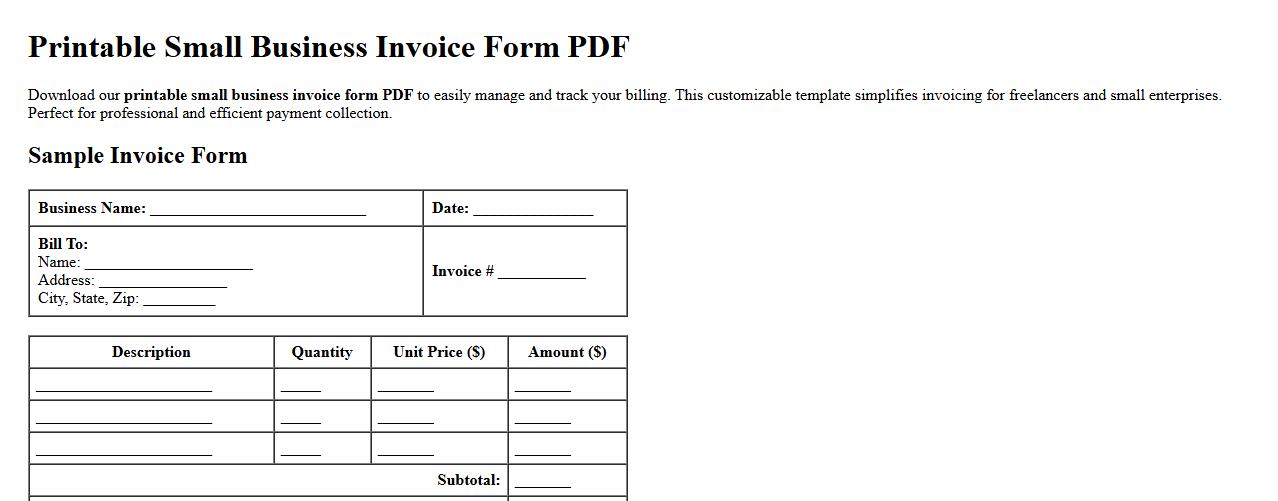

Printable small business invoice form PDF

Download our printable small business invoice form PDF to easily manage and track your billing. This customizable template simplifies invoicing for freelancers and small enterprises. Perfect for professional and efficient payment collection.

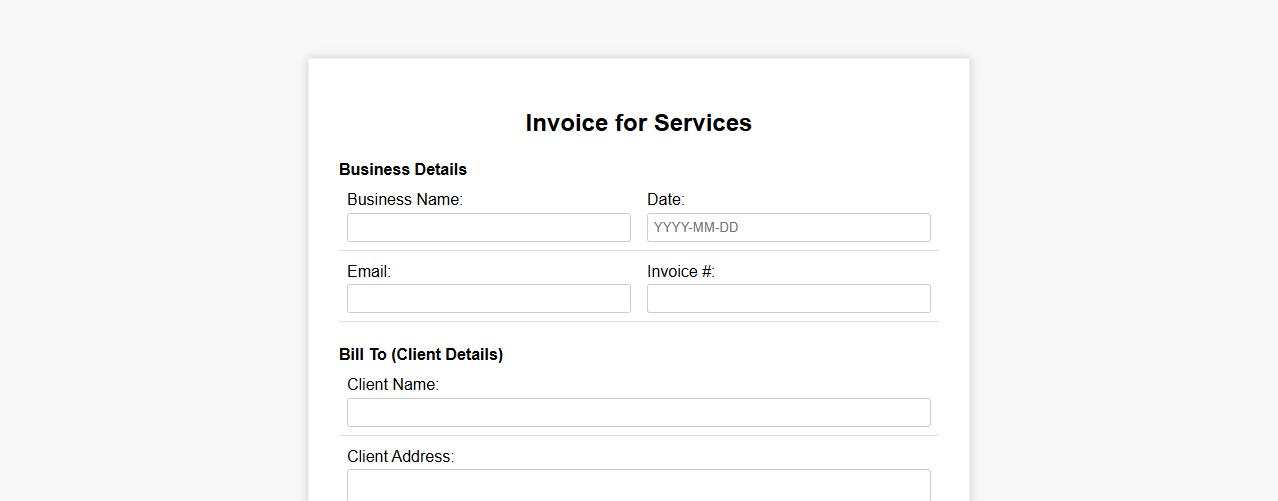

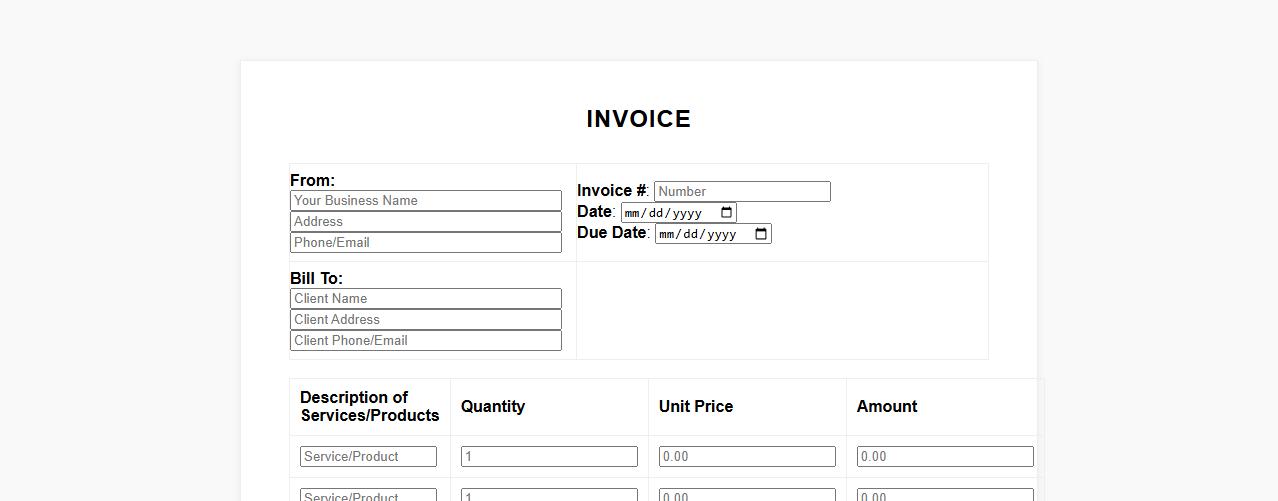

Simple small business invoice form for services

Create a simple small business invoice form designed specifically for services, making billing straightforward and professional. This form includes essential fields such as client details, service descriptions, rates, and total amount due. Perfect for small businesses looking to streamline their invoicing process efficiently.

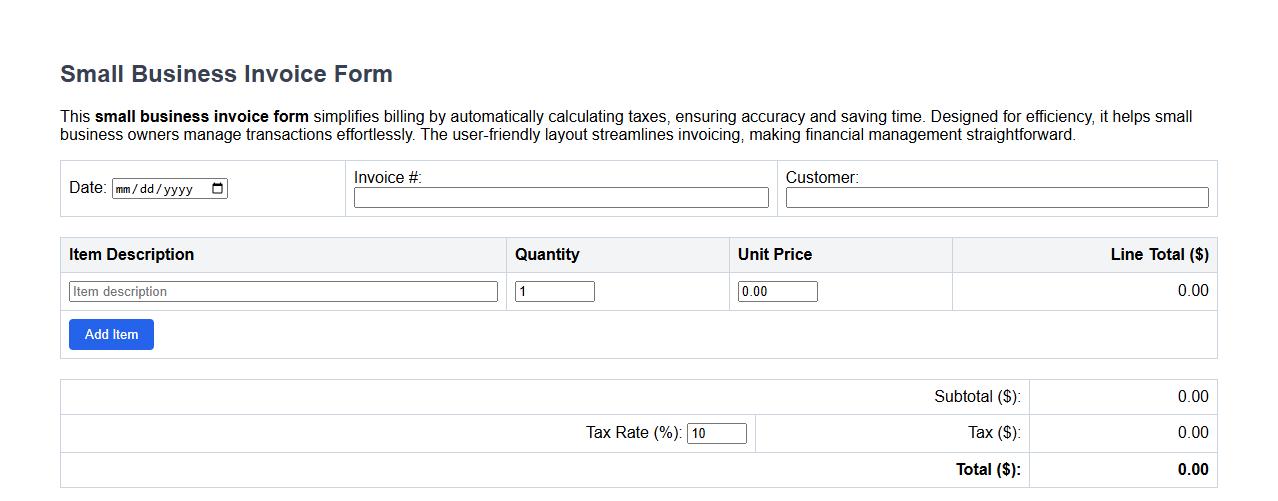

Small business invoice form with tax calculation

This small business invoice form simplifies billing by automatically calculating taxes, ensuring accuracy and saving time. Designed for efficiency, it helps small business owners manage transactions effortlessly. The user-friendly layout streamlines invoicing, making financial management straightforward.

Excel small business invoice form template

Our Excel small business invoice form template is designed to help entrepreneurs streamline their billing process efficiently. This easy-to-use template ensures professional, accurate invoices, allowing small businesses to maintain clear financial records. Customize it to fit your branding and simplify your invoicing tasks today.

Small business invoice form with payment terms

Create a small business invoice form that clearly outlines payment terms, ensuring transparency and timely payments. This form helps streamline billing by detailing services, costs, and agreed-upon payment deadlines. Including concise payment terms reduces disputes and improves cash flow for small business operations.

Automated small business invoice form generator

The automated small business invoice form generator streamlines billing by creating customized invoices quickly and accurately. It reduces manual errors and saves time, allowing businesses to focus on growth. With easy integration and user-friendly templates, managing invoices becomes effortless.

Small business invoice form with itemized list

Efficiently manage your billing with this small business invoice form, featuring an itemized list to clearly outline each product or service provided. It ensures transparency and accuracy in transactions, making it easier to track payments and maintain financial records. Ideal for entrepreneurs looking to streamline their invoicing process.

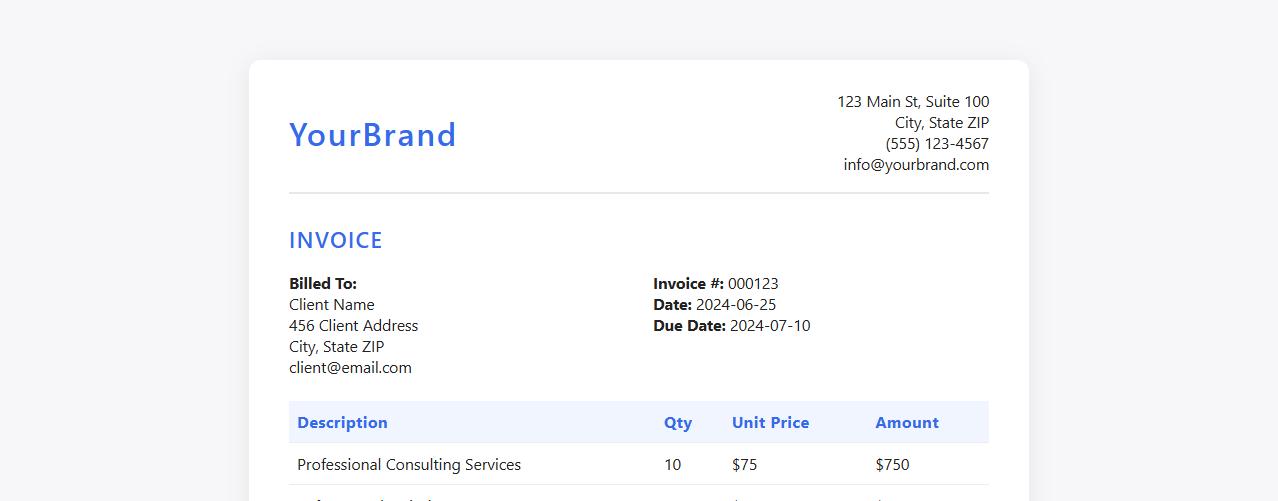

Professional small business invoice form design

Our professional small business invoice form design ensures clarity and efficiency in billing processes. Tailored to meet the needs of small enterprises, the layout enhances readability and brand identity. Simplify your invoicing while maintaining a polished and organized appearance.

What are the essential legal elements required in a small business invoice form?

An invoice must include the seller's and buyer's full legal names and contact details to ensure accountability. It should clearly state the invoice date, unique invoice number, and a detailed description of goods or services provided. Additionally, the total amount due, including applicable taxes, must be clearly presented for legal and financial transparency.

How should payment terms and late fee policies be worded on an invoice?

Payment terms should be clearly stated, indicating the payment due date and acceptable payment methods to avoid confusion. Late fee policies must specify the exact penalty rate or amount charged if payment is delayed, using firm and professional language. Clear wording such as "Payment due within 30 days" and "Late fee of 1.5% per month applies to overdue balances" is recommended.

Which fields must be included for tax compliance on a small business invoice?

For tax compliance, the invoice must include the tax identification number (TIN) or VAT number of the business issuing the invoice. It should also itemize applicable taxes with accurate rates and total tax amounts clearly displayed. The breakdown of taxable and non-taxable items must be presented to meet local tax authority requirements.

How can digital signatures be validated on electronic invoice forms?

Digital signatures on electronic invoices must use verified encryption standards to ensure authenticity and integrity. Validation involves checking the signer's certificate against a trusted certificate authority to confirm identity. Employing digital signature software compliant with legal standards helps guarantee non-repudiation and trustworthiness.

What are best practices for numbering and tracking small business invoices?

Invoices should follow a sequential numbering system incorporating date and client identifiers to streamline record keeping. Use software tools that automatically generate and track invoice numbers to minimize errors and improve organization. Consistent numbering and tracking facilitates easy retrieval, audit compliance, and effective financial management.