A Consulting Services Invoice Form is a professional document used by consultants to bill clients for services rendered. It typically includes details such as service descriptions, hours worked, rates, and total payment due. This form ensures clear communication and facilitates timely payments in consulting engagements.

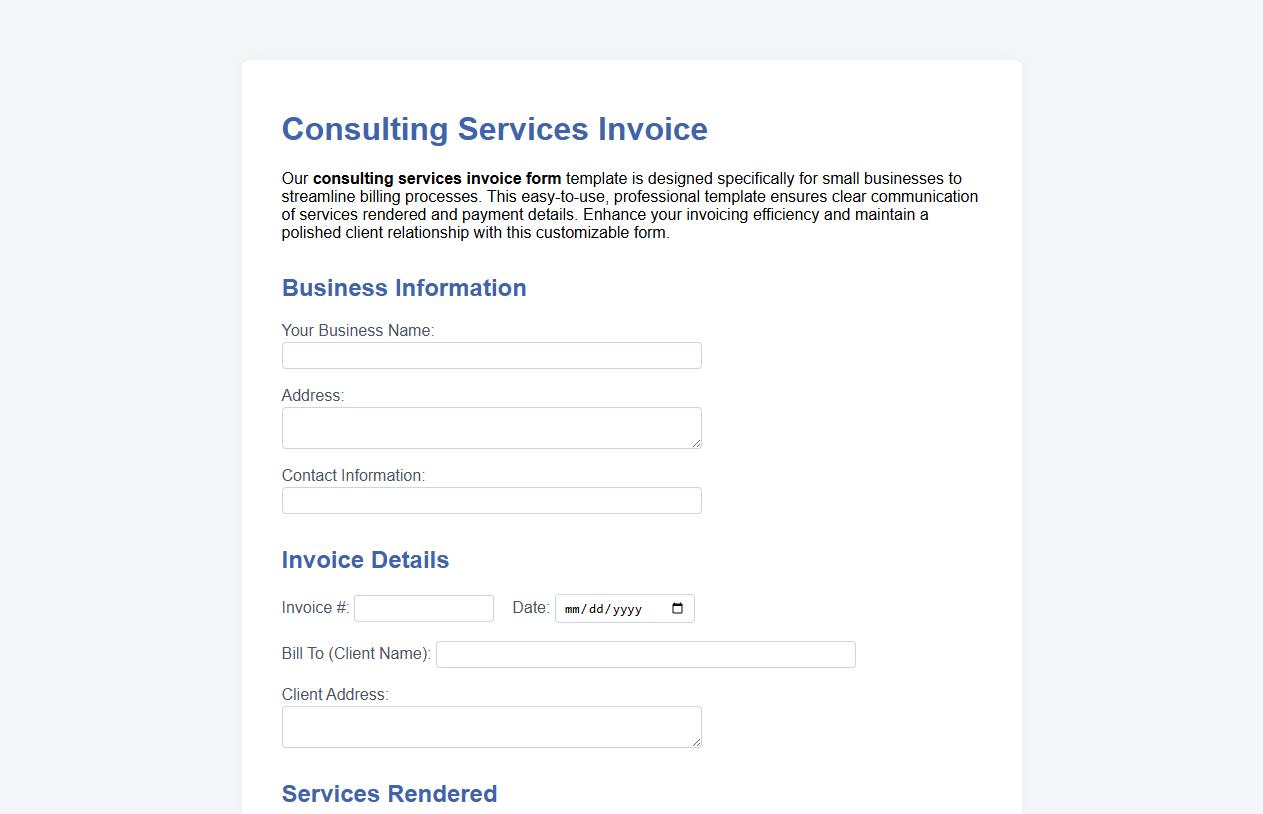

Consulting services invoice form template for small business

Our consulting services invoice form template is designed specifically for small businesses to streamline billing processes. This easy-to-use, professional template ensures clear communication of services rendered and payment details. Enhance your invoicing efficiency and maintain a polished client relationship with this customizable form.

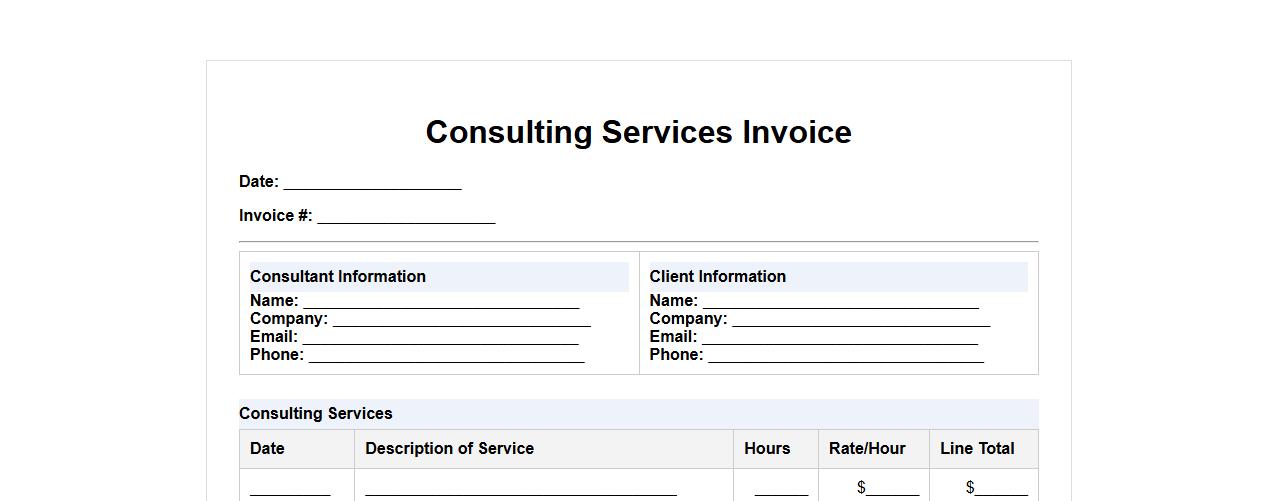

Downloadable consulting services invoice form PDF

Download our consulting services invoice form PDF for a professional and easy way to bill your clients. This template ensures clear itemization and smooth payment processing. Perfect for consultants seeking reliable invoicing solutions.

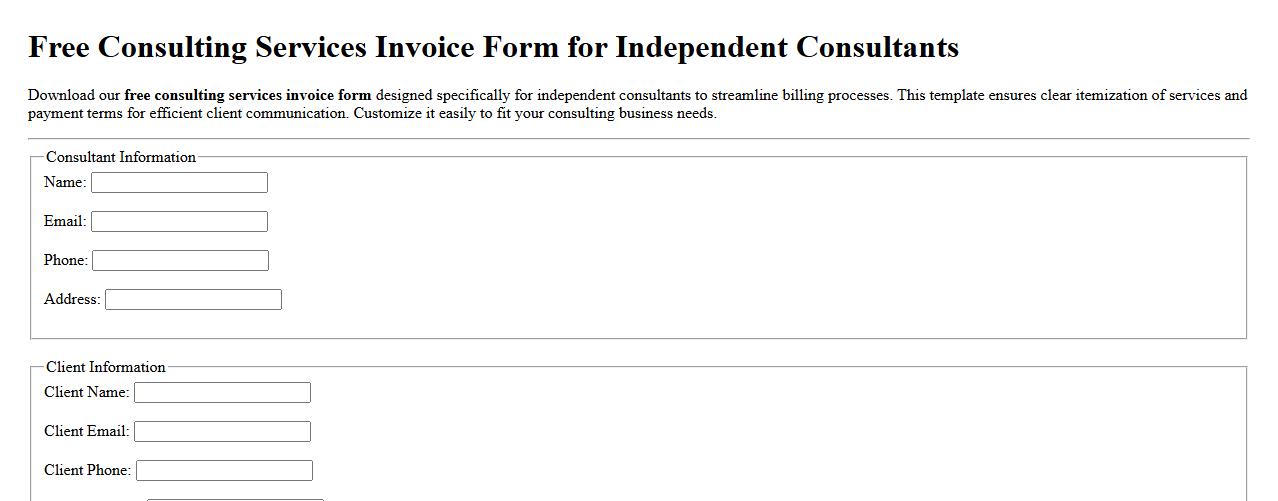

Free consulting services invoice form for independent consultants

Download our free consulting services invoice form designed specifically for independent consultants to streamline billing processes. This template ensures clear itemization of services and payment terms for efficient client communication. Customize it easily to fit your consulting business needs.

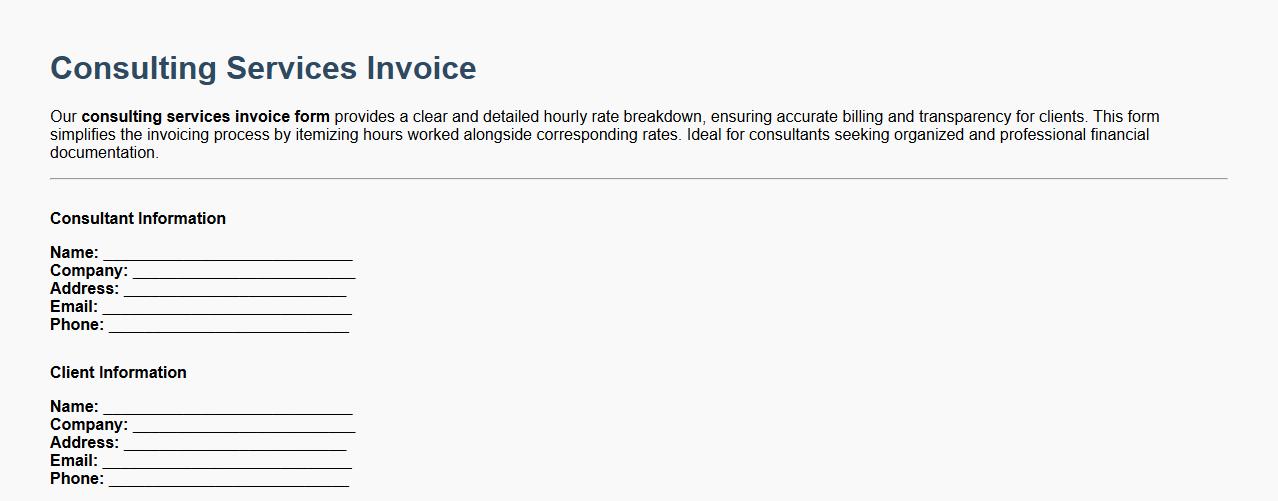

Consulting services invoice form with hourly rate breakdown

Our consulting services invoice form provides a clear and detailed hourly rate breakdown, ensuring accurate billing and transparency for clients. This form simplifies the invoicing process by itemizing hours worked alongside corresponding rates. Ideal for consultants seeking organized and professional financial documentation.

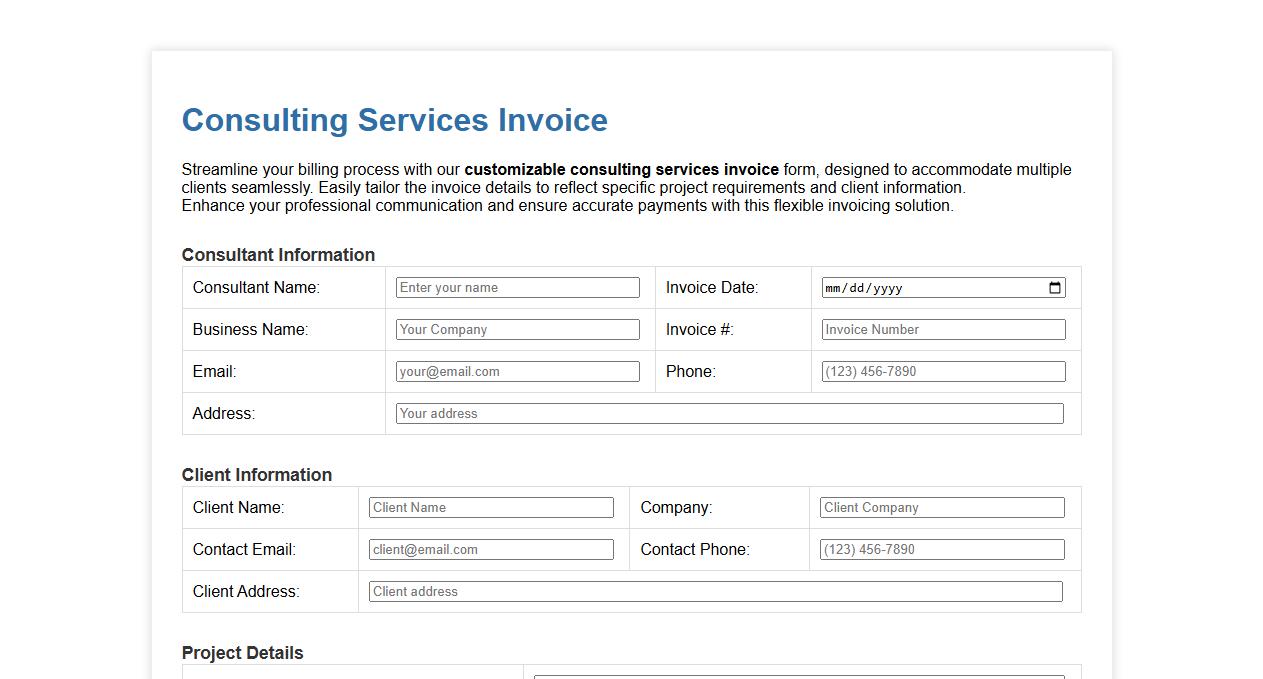

Customizable consulting services invoice form for multiple clients

Streamline your billing process with our customizable consulting services invoice form, designed to accommodate multiple clients seamlessly. Easily tailor the invoice details to reflect specific project requirements and client information. Enhance your professional communication and ensure accurate payments with this flexible invoicing solution.

Consulting services invoice form including travel expenses

This consulting services invoice form is designed to accurately capture billable hours along with detailed travel expenses, ensuring clear and professional billing. It simplifies the invoicing process by itemizing services rendered and associated costs for easy client review. Ideal for consultants seeking transparent and organized financial documentation.

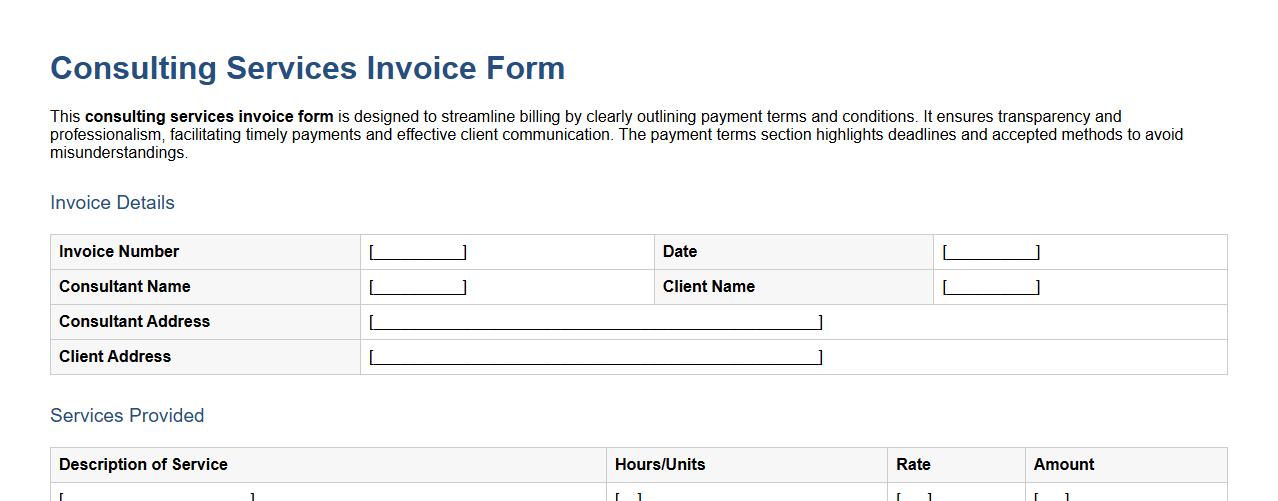

Consulting services invoice form with payment terms section

This consulting services invoice form is designed to streamline billing by clearly outlining payment terms and conditions. It ensures transparency and professionalism, facilitating timely payments and effective client communication. The payment terms section highlights deadlines and accepted methods to avoid misunderstandings.

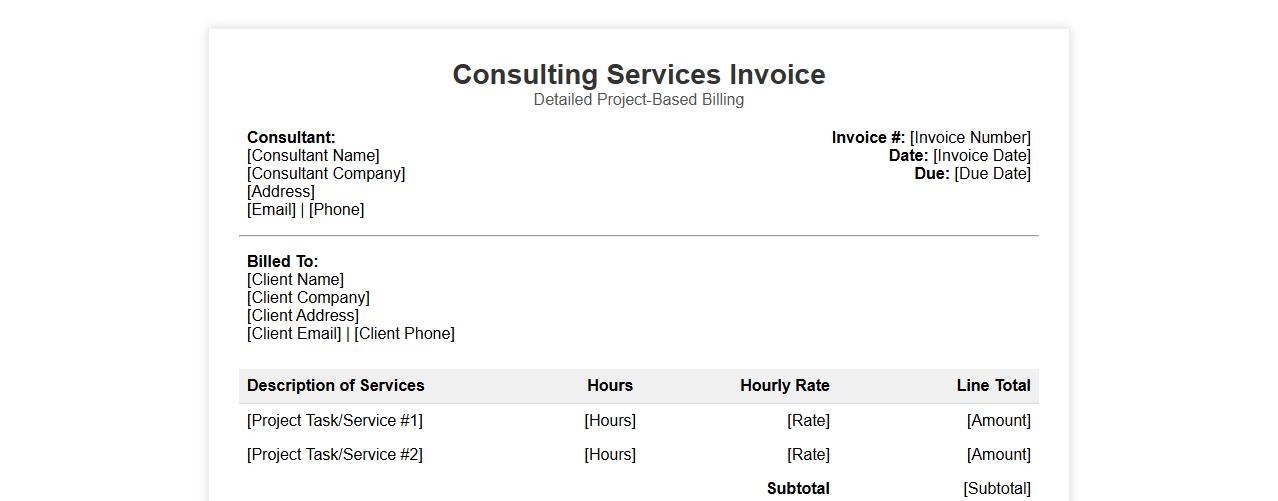

Detailed consulting services invoice form for project-based work

This invoice form is designed for detailed consulting services, streamlining project-based billing with clear service descriptions, hourly rates, and total costs. It ensures accurate client invoicing and efficient project financial management. Ideal for consultants seeking professional and organized billing documentation.

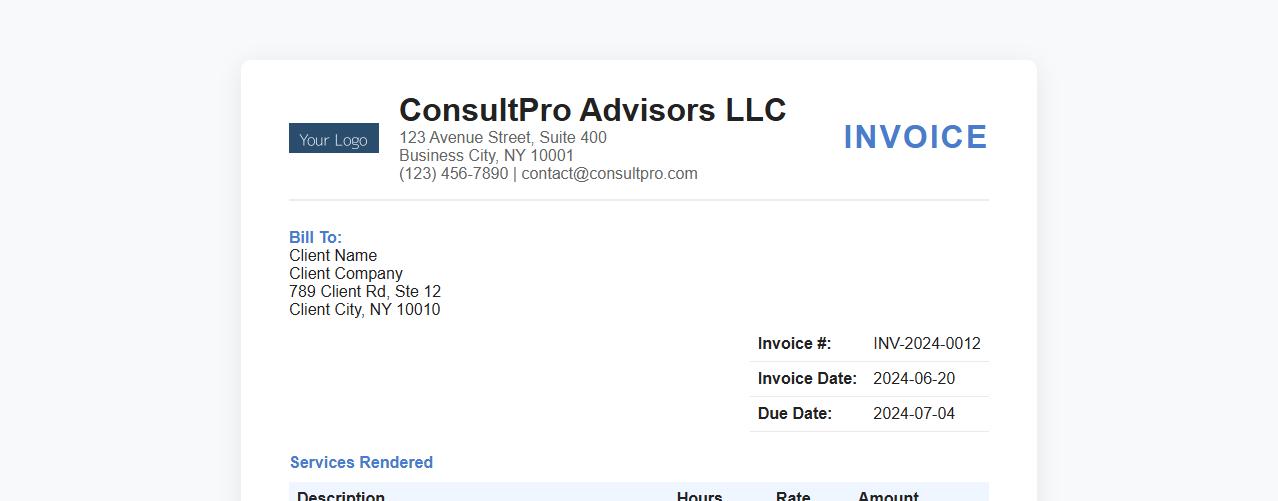

Professional consulting services invoice form with company logo

Streamline your billing process with our professional consulting services invoice form, designed to prominently feature your company logo for brand consistency. This customizable template ensures accurate tracking of services rendered and payments due. Enhance your business presentations with a sleek, easy-to-use invoice that leaves a lasting impression.

Which regulatory compliance details should be included in a consulting services invoice form?

Including tax identification numbers such as VAT or GST is crucial for regulatory compliance on consulting invoices. The invoice must also display the legal business names and addresses of both the consulting firm and the client. Additionally, the invoice date and a unique invoice number help meet financial reporting standards.

How should travel expenses be itemized in a consulting services invoice letter?

Travel expenses must be listed separately with a clear description of each cost, such as airfare, lodging, or meals. Including the date and purpose of travel ensures transparency and client trust. Detailed itemization helps distinguish travel costs from consulting fees for accurate reimbursement.

What is the best way to document milestone payments in a consulting invoice form?

Milestone payments should be broken down by specific deliverables and their corresponding due dates. Each milestone should have a clear description with the agreed payment amount next to it. This format provides clarity on project progress and ensures aligned expectations between consultant and client.

How can late payment penalties be communicated in a consulting service invoice letter?

Late payment penalties must be clearly stated in a separate section of the invoice, specifying the penalty rate and the grace period. Using straightforward language about the consequences of delayed payments promotes timely settlements. Including contact information for payment disputes fosters clear communication and resolution.

Which essential client information must appear on a consulting invoice for audit purposes?

The consulting invoice should always include the client's legal name, address, and contact details for proper audit traceability. Providing the purchase order (PO) number or contract reference strengthens invoice validation in auditing processes. This information supports verification, compliance, and seamless reconciliation of accounts.