A Commercial Invoice Sample serves as a detailed document used in international trade to outline the specifics of goods sold, including quantity, price, and terms of sale. This sample helps exporters and importers ensure accurate customs clearance and compliance with regulatory requirements. Understanding the essential elements of a Commercial Invoice Sample is crucial for smooth shipping and avoiding delays.

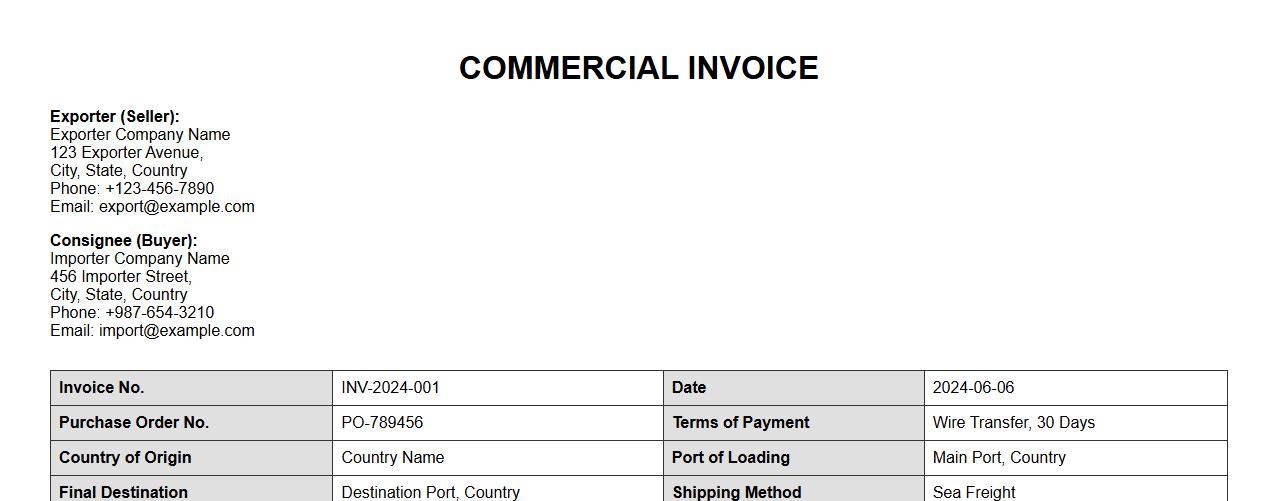

Commercial invoice sample for export shipment

A commercial invoice sample for export shipment is a crucial document that details the transaction between the seller and buyer, including product descriptions, quantities, and pricing. It serves as a proof of sale and is essential for customs clearance and international shipping. Properly prepared invoices help ensure smooth export processes and compliance with regulations.

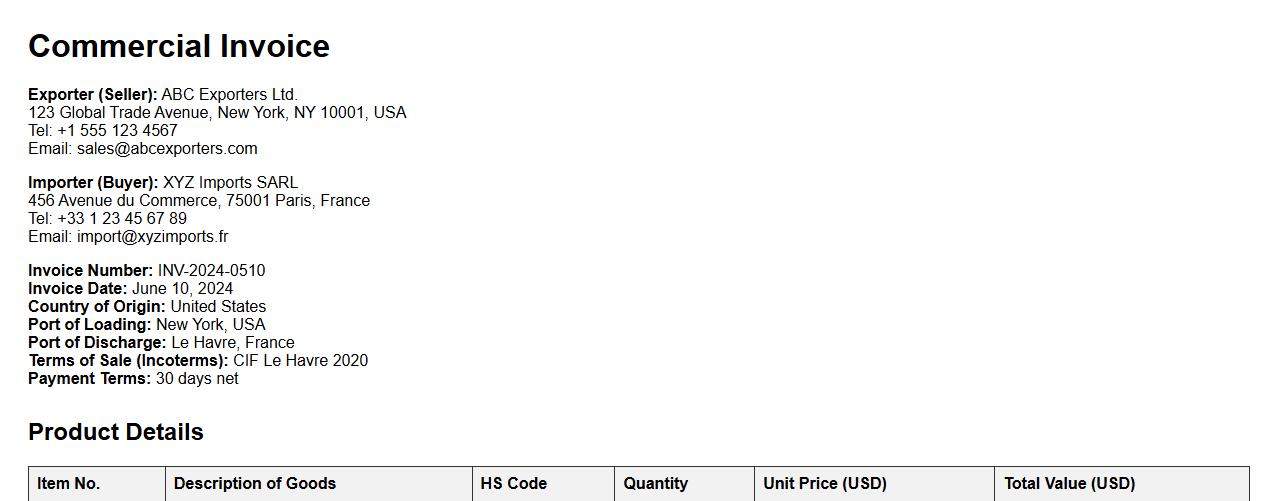

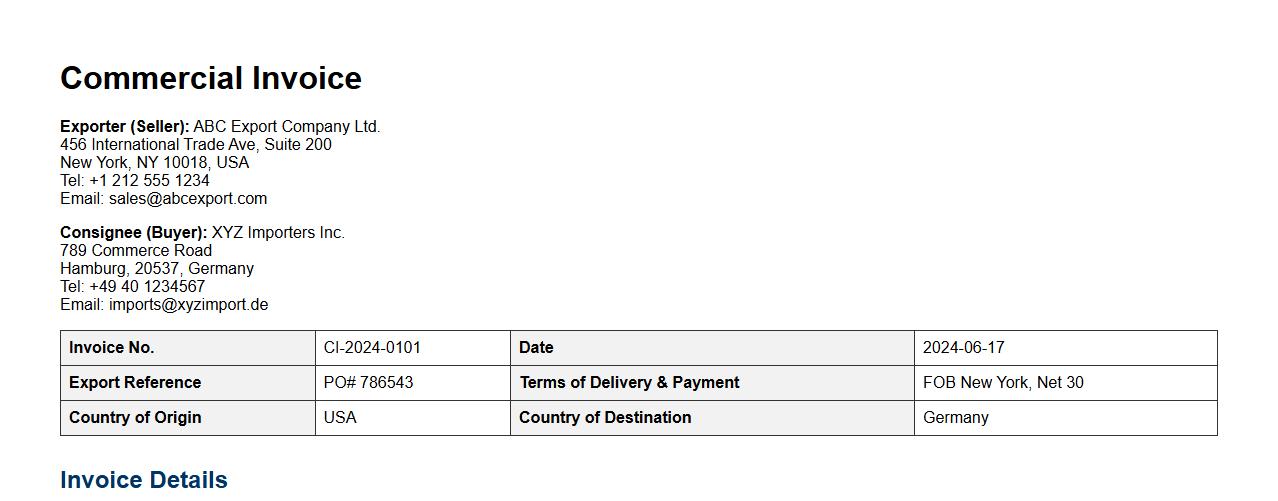

Commercial invoice sample for international trade

A commercial invoice sample for international trade is a vital document detailing the transaction between exporter and importer, including product descriptions, quantities, prices, and terms of sale. It serves as a key customs declaration and helps ensure smooth cross-border shipment processing. Accurately prepared commercial invoices reduce delays and facilitate compliance with international trade regulations.

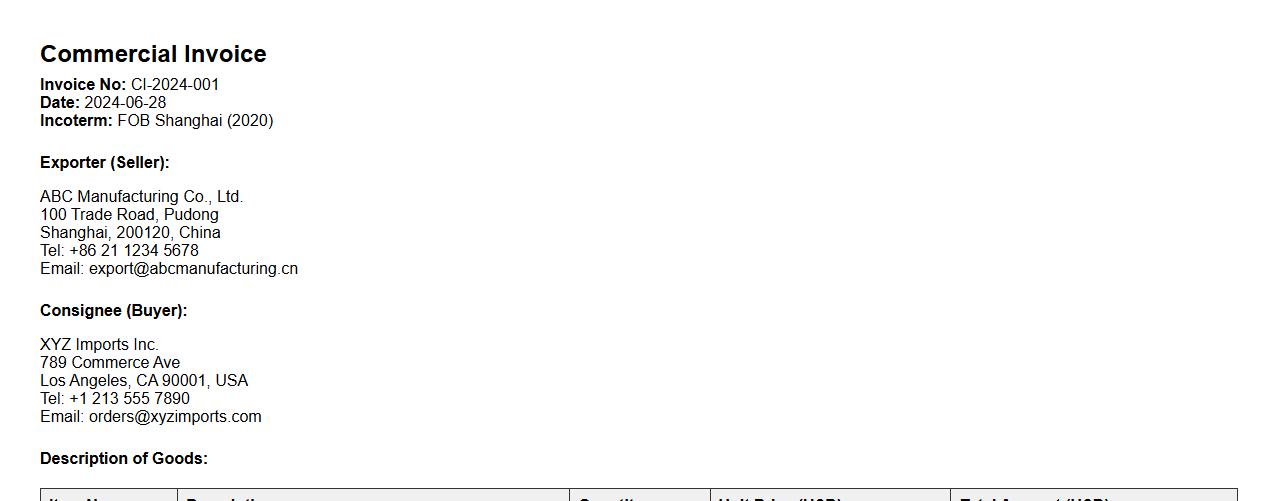

Commercial invoice sample with incoterms

A commercial invoice sample with Incoterms clearly outlines the transaction details, including the terms of sale and shipping responsibilities between buyer and seller. It serves as an essential document for customs clearance and international trade compliance. Utilizing a proper sample helps ensure accuracy and legal clarity in export-import processes.

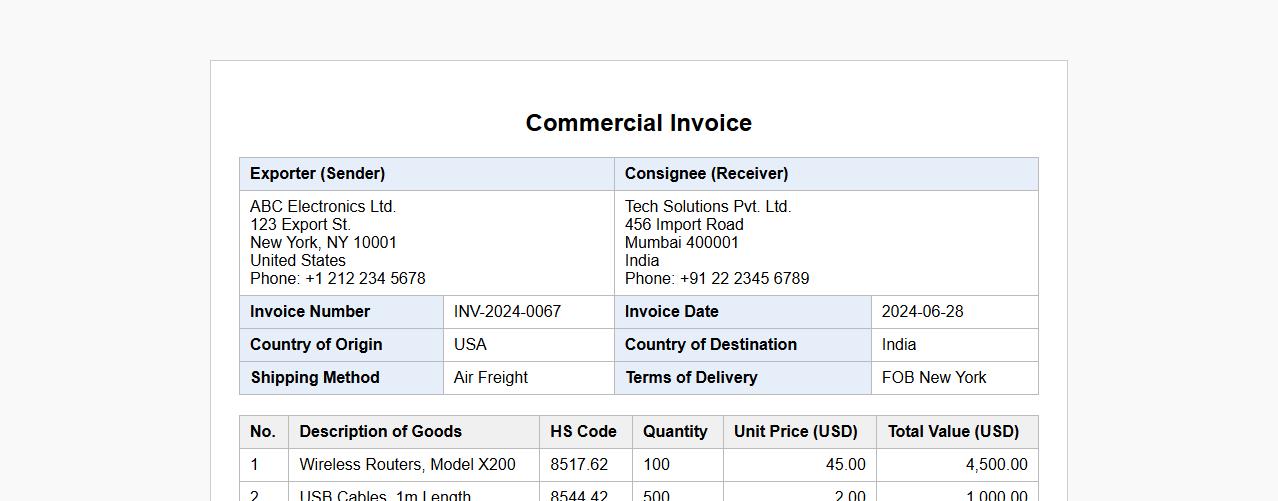

Commercial invoice sample for customs clearance

A commercial invoice sample is essential for smooth customs clearance, providing detailed information about the shipped goods. It includes product descriptions, quantities, values, and shipping details to ensure accurate customs processing. Using a clear and precise invoice helps avoid delays and additional fees during import or export procedures.

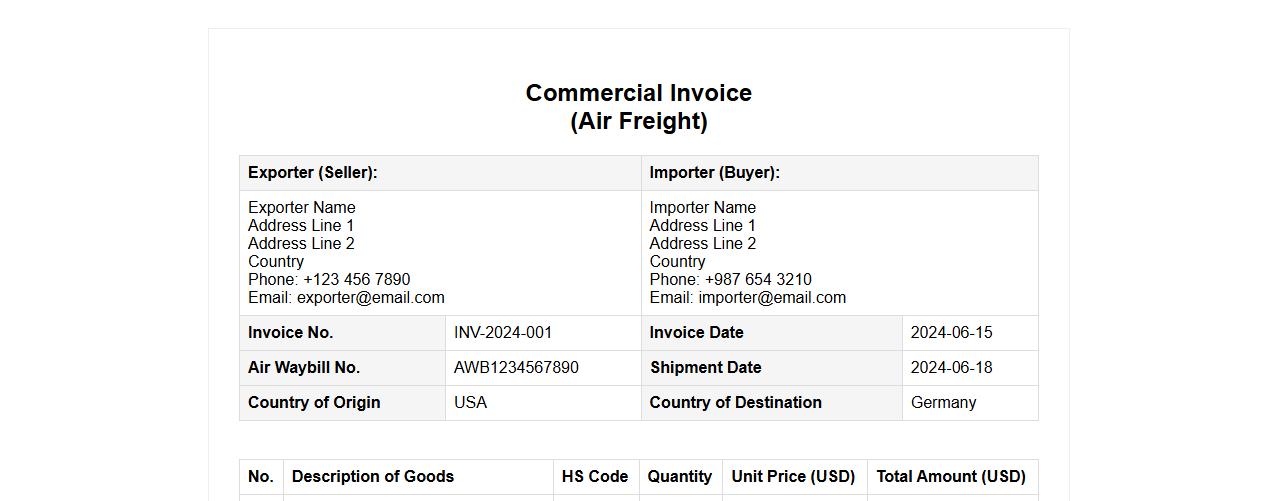

Commercial invoice sample for air freight

A commercial invoice sample for air freight provides a detailed record of goods shipped by air, outlining the buyer, seller, and product information. This document is essential for customs clearance, helping ensure the shipment complies with international trade laws. It typically includes product descriptions, quantities, values, and shipment terms, facilitating smooth air cargo processing.

Commercial invoice sample with hs code

A commercial invoice sample with HS code provides a detailed bill of goods shipped, including the Harmonized System code for accurate classification. This crucial document ensures smooth customs clearance and compliance with international trade regulations. It helps exporters and importers clearly communicate product details and values.

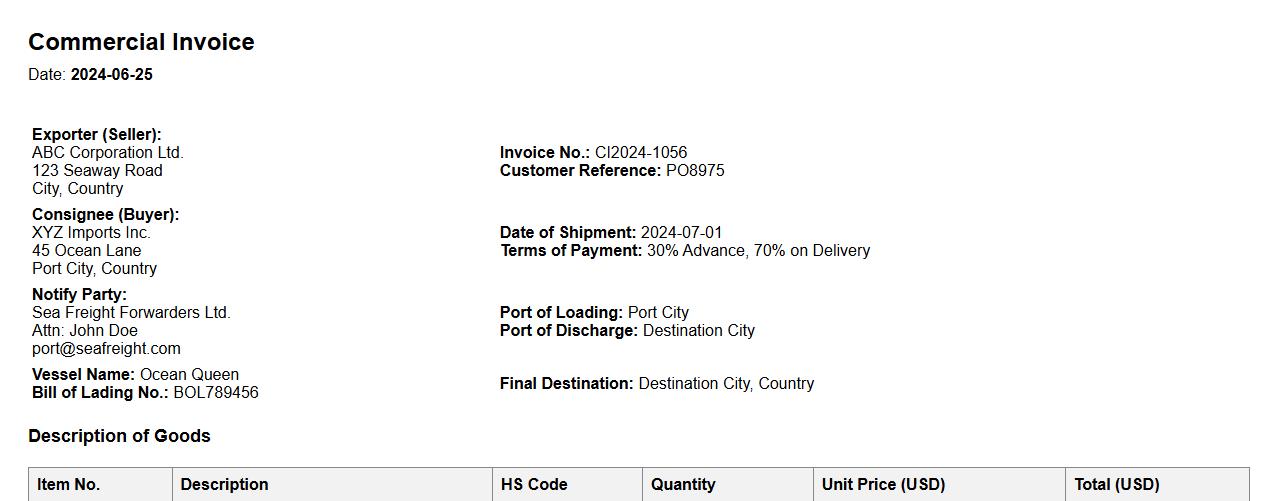

Commercial invoice sample for sea shipment

A commercial invoice sample for sea shipment provides a detailed record of goods being transported by sea, including descriptions, quantities, and values essential for customs clearance. It serves as a key document in international trade, ensuring smooth processing and compliance with shipping regulations. Using an accurate commercial invoice sample helps streamline the shipping process and avoid delays at ports.

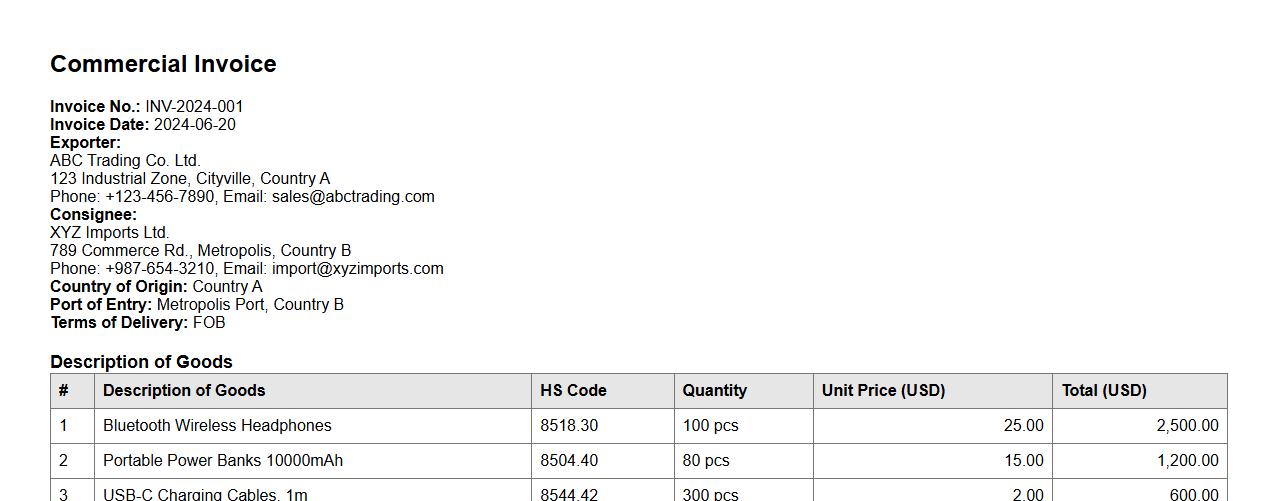

Commercial invoice sample for multiple items

A commercial invoice sample for multiple items provides a detailed breakdown of various products included in a shipment, listing quantities, descriptions, prices, and total amounts. This document is essential for customs clearance and serves as proof of transaction between buyer and seller. Properly itemized commercial invoices help ensure accurate import duties and smooth international trade processes.

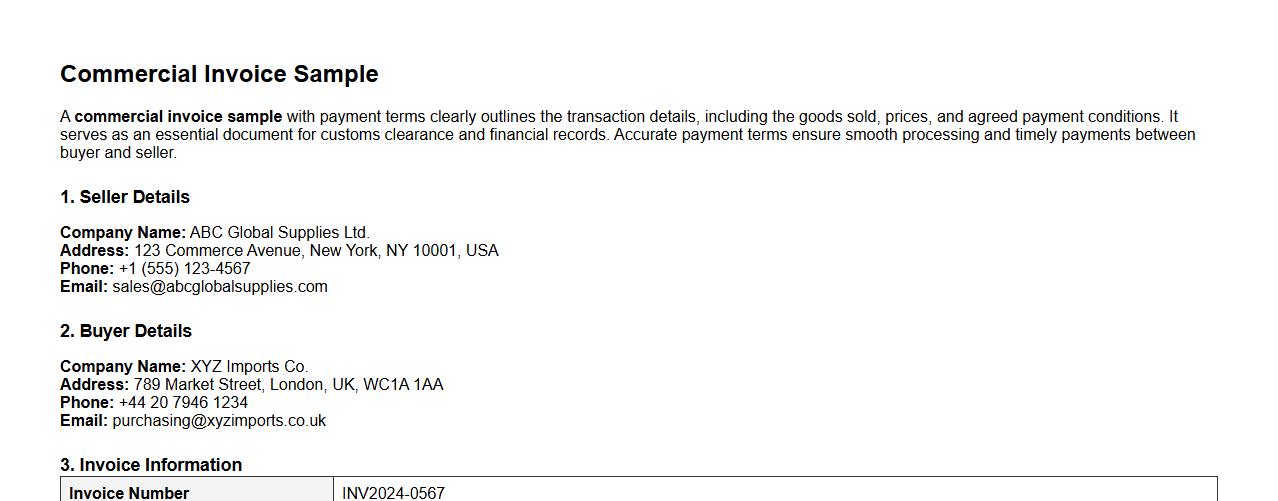

Commercial invoice sample with payment terms

A commercial invoice sample with payment terms clearly outlines the transaction details, including the goods sold, prices, and agreed payment conditions. It serves as an essential document for customs clearance and financial records. Accurate payment terms ensure smooth processing and timely payments between buyer and seller.

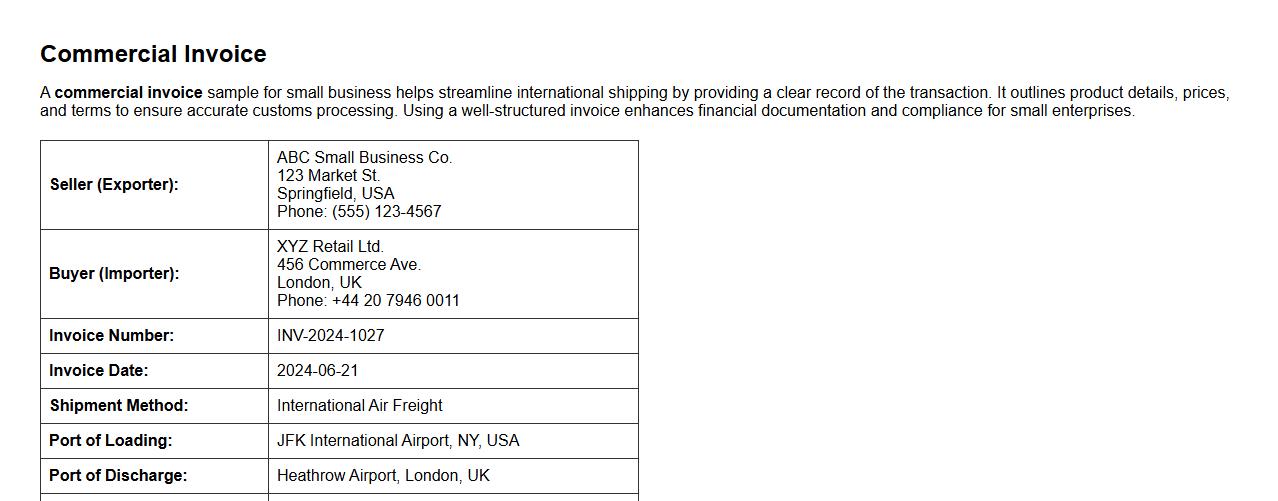

Commercial invoice sample for small business

A commercial invoice sample for small business helps streamline international shipping by providing a clear record of the transaction. It outlines product details, prices, and terms to ensure accurate customs processing. Using a well-structured invoice enhances financial documentation and compliance for small enterprises.

What are the essential elements required in a commercial invoice for international shipping compliance?

A commercial invoice must include accurate details such as the seller's and buyer's names and addresses, a detailed description of the goods, and their quantity. It should also specify the unit price, total value, currency used, and the terms of sale. Additionally, the invoice must feature the invoice date, invoice number, and relevant signatures for authenticity and legal purposes.

How do Incoterms impact the details included in a commercial invoice?

Incoterms define the responsibilities of buyers and sellers regarding transportation costs, risks, and insurance in international trade. These terms directly influence the commercial invoice by specifying who pays for shipping, customs duties, and insurance coverage. Correctly stating the applicable Incoterm on the invoice ensures clarity and compliance with international shipping agreements.

Which authorities typically require commercial invoice verification at customs clearance?

Customs authorities in both the exporting and importing countries require verification of the commercial invoice to assess duties and ensure regulatory compliance. Other agencies such as the tax department, quarantine inspection, and trade compliance bodies may also review the invoice. Proper verification helps prevent shipment delays and avoids penalties related to incorrect or missing documentation.

What are the common reasons for commercial invoice discrepancies leading to shipment delays?

Invoice discrepancies often arise from incorrect product descriptions, mismatched quantities, or errors in total value and currency. Missing signatures or inaccurate HS codes can also trigger customs delays. Ensuring detailed and error-free invoices minimizes the risk of shipment hold-ups and enhances smooth customs clearance.

How should HS codes be accurately reflected within a commercial invoice?

HS codes must be detailed and correspond exactly to the product descriptions to comply with customs classification guidelines. Accurate HS codes facilitate correct duty assessment and expedite the customs clearance process. Including the full HS code on the commercial invoice reduces the risk of misclassification and shipment delays.