A Tax Invoice Excel Format is a pre-designed spreadsheet template used to create professional and accurate tax invoices quickly. This format typically includes sections for seller and buyer details, item descriptions, quantities, prices, tax rates, and total amounts, ensuring compliance with tax regulations. Utilizing a Tax Invoice Excel Format streamlines invoicing processes and helps maintain clear financial records.

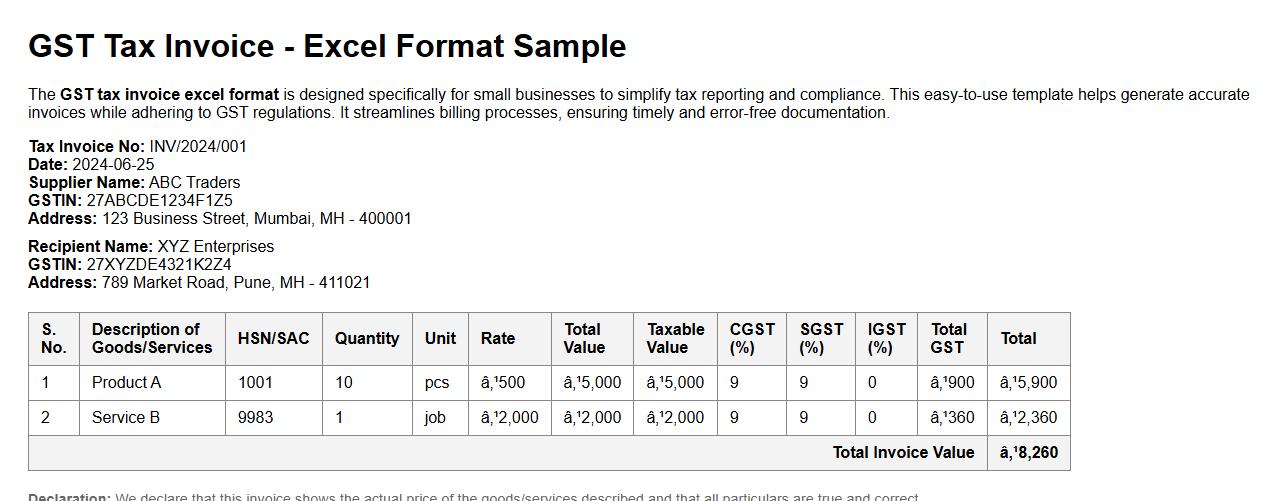

GST tax invoice excel format for small businesses

The GST tax invoice excel format is designed specifically for small businesses to simplify tax reporting and compliance. This easy-to-use template helps generate accurate invoices while adhering to GST regulations. It streamlines billing processes, ensuring timely and error-free documentation.

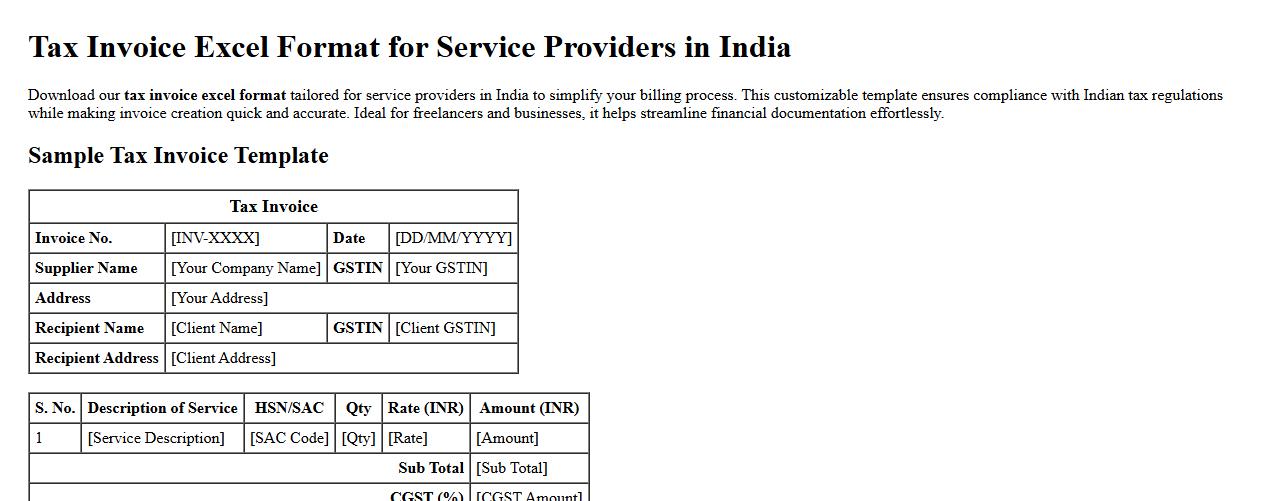

Tax invoice excel format for service providers in India

Download our tax invoice excel format tailored for service providers in India to simplify your billing process. This customizable template ensures compliance with Indian tax regulations while making invoice creation quick and accurate. Ideal for freelancers and businesses, it helps streamline financial documentation effortlessly.

Free downloadable tax invoice excel format with logo

Download a free tax invoice Excel format designed for easy customization and professional presentation. This template includes space to add your company logo, ensuring a branded and official invoice. Simplify your billing process with this ready-to-use, editable Excel file.

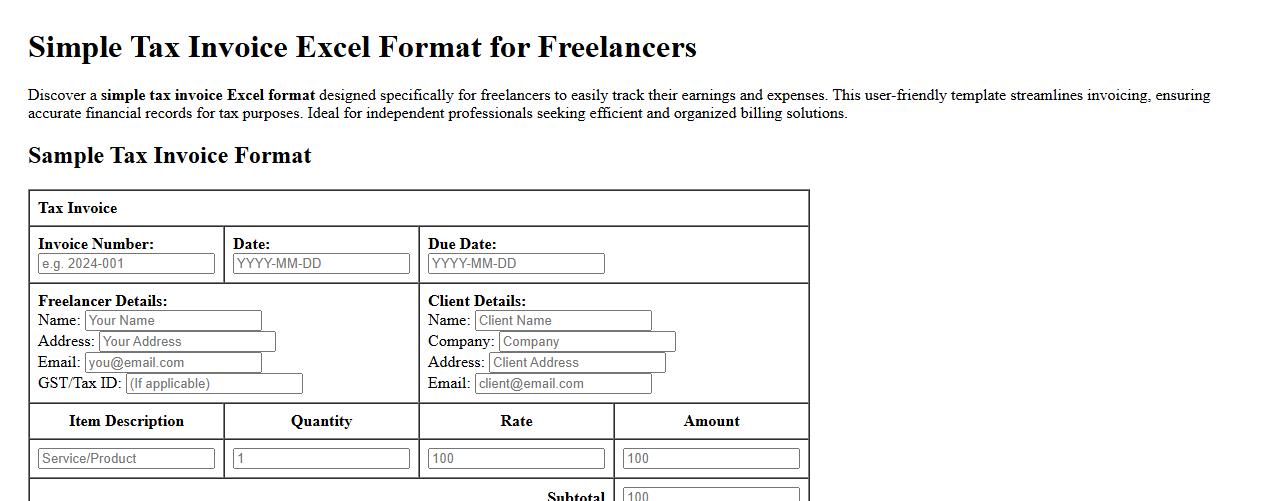

Simple tax invoice excel format for freelancers

Discover a simple tax invoice Excel format designed specifically for freelancers to easily track their earnings and expenses. This user-friendly template streamlines invoicing, ensuring accurate financial records for tax purposes. Ideal for independent professionals seeking efficient and organized billing solutions.

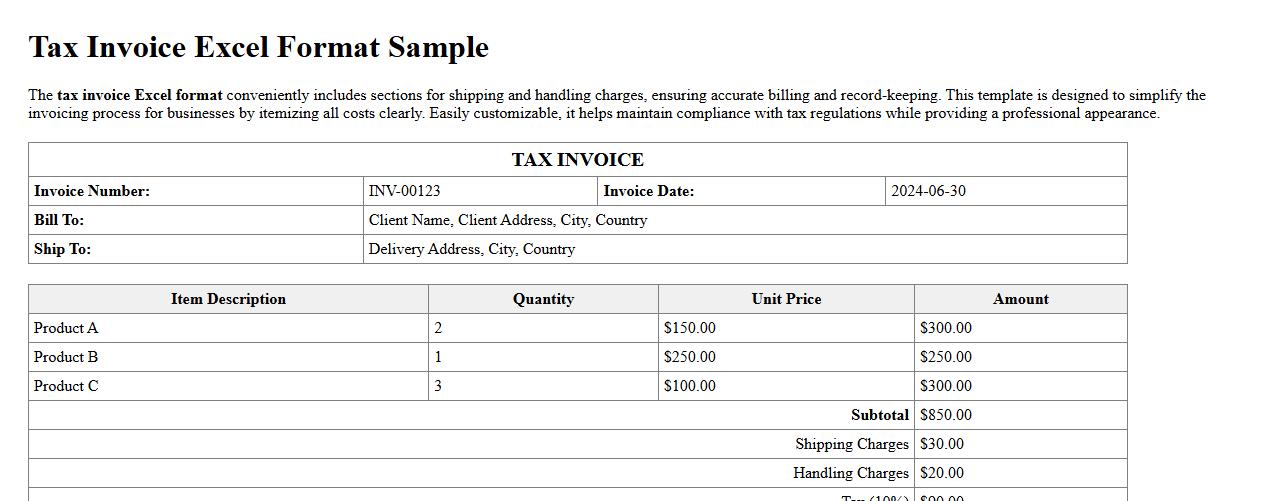

Tax invoice excel format including shipping and handling charges

The tax invoice Excel format conveniently includes sections for shipping and handling charges, ensuring accurate billing and record-keeping. This template is designed to simplify the invoicing process for businesses by itemizing all costs clearly. Easily customizable, it helps maintain compliance with tax regulations while providing a professional appearance.

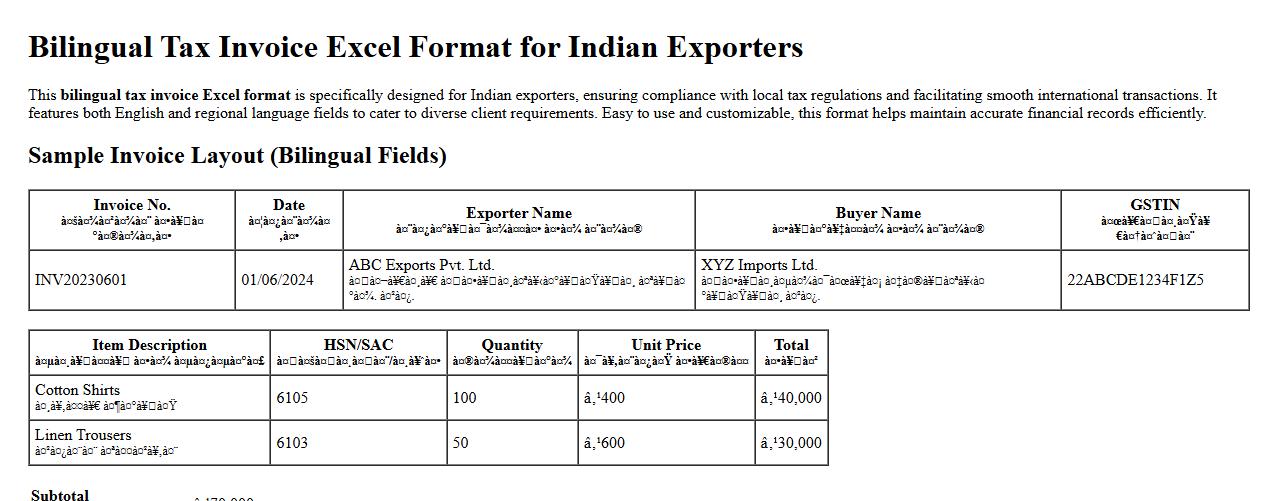

Bilingual tax invoice excel format for Indian exporters

This bilingual tax invoice Excel format is specifically designed for Indian exporters, ensuring compliance with local tax regulations and facilitating smooth international transactions. It features both English and regional language fields to cater to diverse client requirements. Easy to use and customizable, this format helps maintain accurate financial records efficiently.

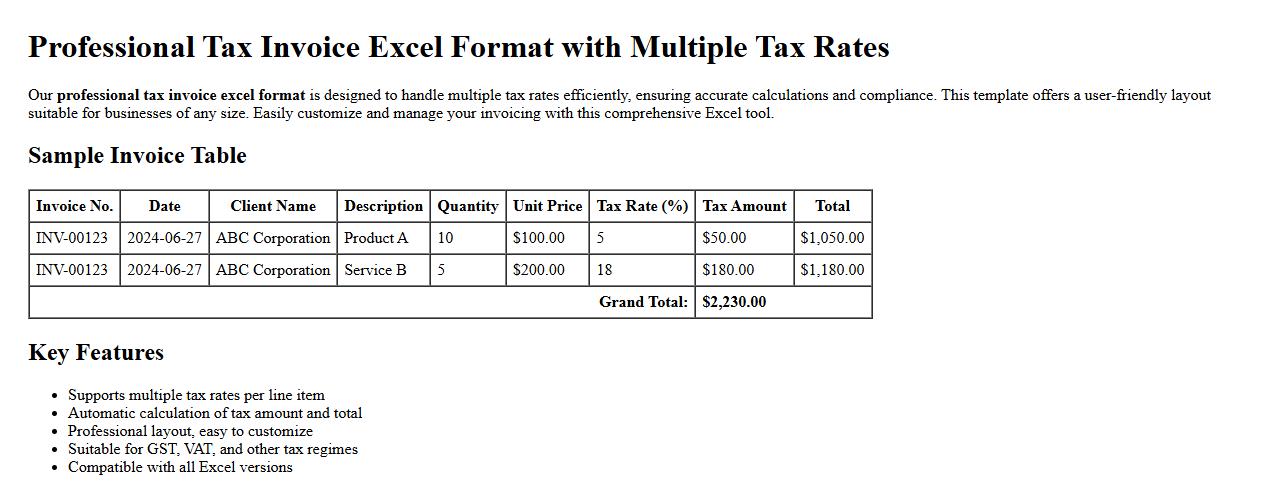

Professional tax invoice excel format with multiple tax rates

Our professional tax invoice excel format is designed to handle multiple tax rates efficiently, ensuring accurate calculations and compliance. This template offers a user-friendly layout suitable for businesses of any size. Easily customize and manage your invoicing with this comprehensive Excel tool.

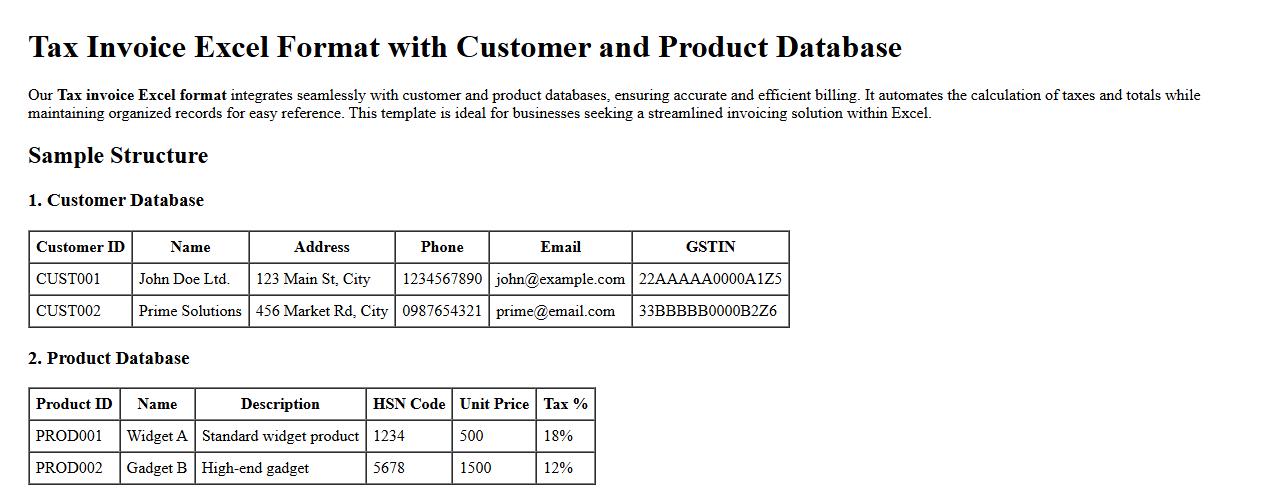

Tax invoice excel format with customer and product database

Our Tax invoice Excel format integrates seamlessly with customer and product databases, ensuring accurate and efficient billing. It automates the calculation of taxes and totals while maintaining organized records for easy reference. This template is ideal for businesses seeking a streamlined invoicing solution within Excel.

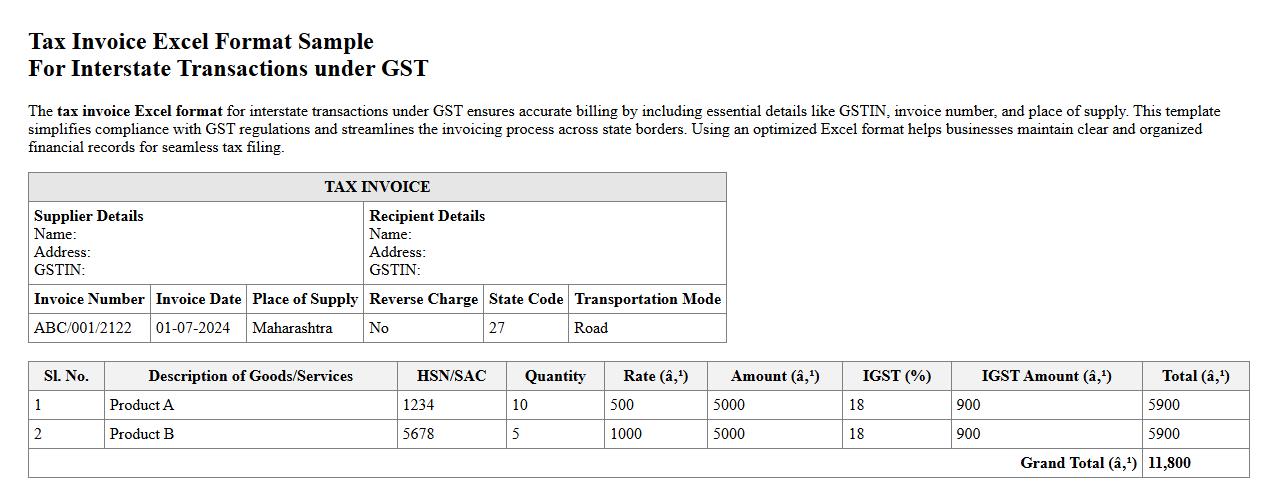

Tax invoice excel format for interstate transactions under GST

The tax invoice Excel format for interstate transactions under GST ensures accurate billing by including essential details like GSTIN, invoice number, and place of supply. This template simplifies compliance with GST regulations and streamlines the invoicing process across state borders. Using an optimized Excel format helps businesses maintain clear and organized financial records for seamless tax filing.

What are essential columns to include in a tax invoice Excel template?

An Excel tax invoice template must have columns for invoice number, date, customer details, and item descriptions. Including columns for quantity, unit price, and total amount is crucial for accurate billing. Additionally, tax-related columns like GST rate and GST amount ensure compliance with tax regulations.

How to automate GST calculations in an Excel tax invoice?

Automate GST calculations by using formulas that multiply the taxable amount by the GST rate. For example, use =B2*C2 where B2 is the taxable value and C2 is the GST rate. This approach reduces errors and speeds up the invoicing process.

Which Excel formula best validates invoice numbers for duplicates?

The COUNTIF formula is effective for checking duplicate invoice numbers in Excel. Use =COUNTIF($A$2:$A$100, A2)>1 to identify any duplicates in the invoice number column. This validation helps maintain unique records and improves data integrity.

How to protect sensitive data on Excel tax invoices?

Protect sensitive data by using Excel's worksheet protection feature to lock specific cells or entire sheets. Password-protecting the workbook limits unauthorized access to confidential tax and customer information. Additionally, use data encryption for enhanced security on sensitive files.

What are common compliance errors in Excel-based tax invoice formats?

Common compliance errors include missing or incorrect GST registration numbers and improper tax rate application. Errors often occur when invoice details like date or customer information are incomplete or inaccurate. Ensuring proper formatting and verification can help avoid these frequent mistakes.