A Sales Invoice Format in Excel provides a customizable template to record sales transactions efficiently, including details like item descriptions, quantities, prices, and total amounts. This format enhances accuracy and simplifies the billing process by automating calculations and allowing easy data entry. Businesses benefit from its flexibility, enabling tailored invoices that maintain professional presentation and streamline financial record-keeping.

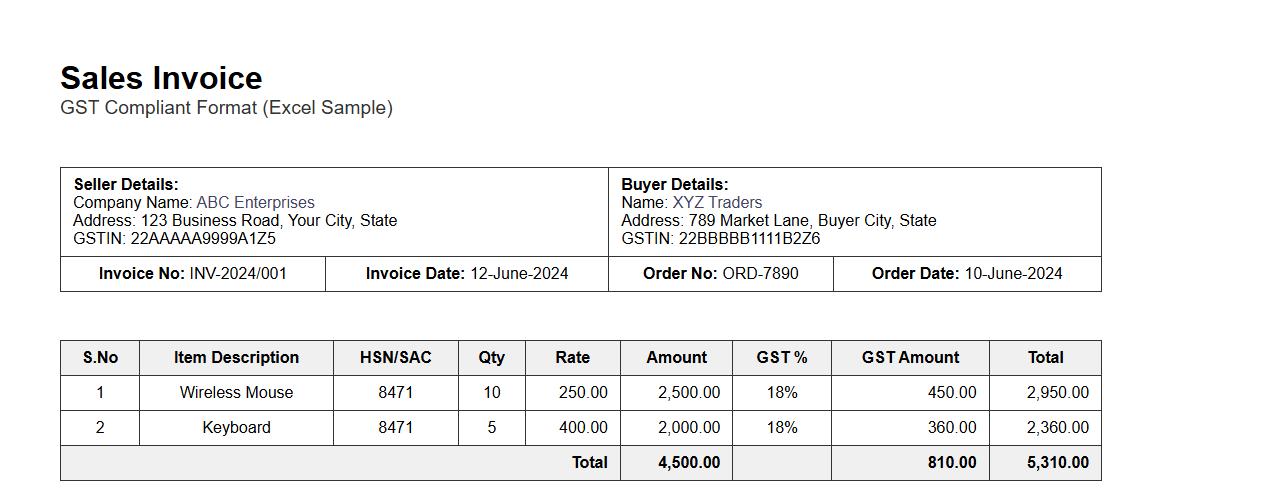

Sales invoice format in excel with gst

A sales invoice format in Excel with GST is a structured template designed to simplify billing and ensure compliance with tax regulations. It enables easy calculation of GST amounts, providing clear details of taxable values and taxes for both buyers and sellers. This format enhances accuracy, professionalism, and record-keeping in business transactions.

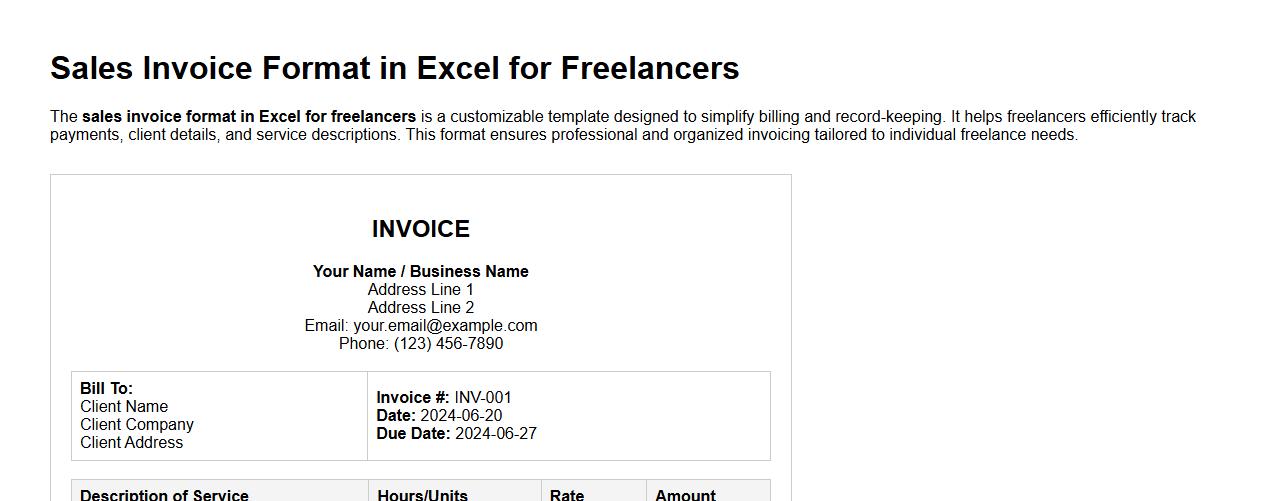

Sales invoice format in excel for freelancers

The sales invoice format in Excel for freelancers is a customizable template designed to simplify billing and record-keeping. It helps freelancers efficiently track payments, client details, and service descriptions. This format ensures professional and organized invoicing tailored to individual freelance needs.

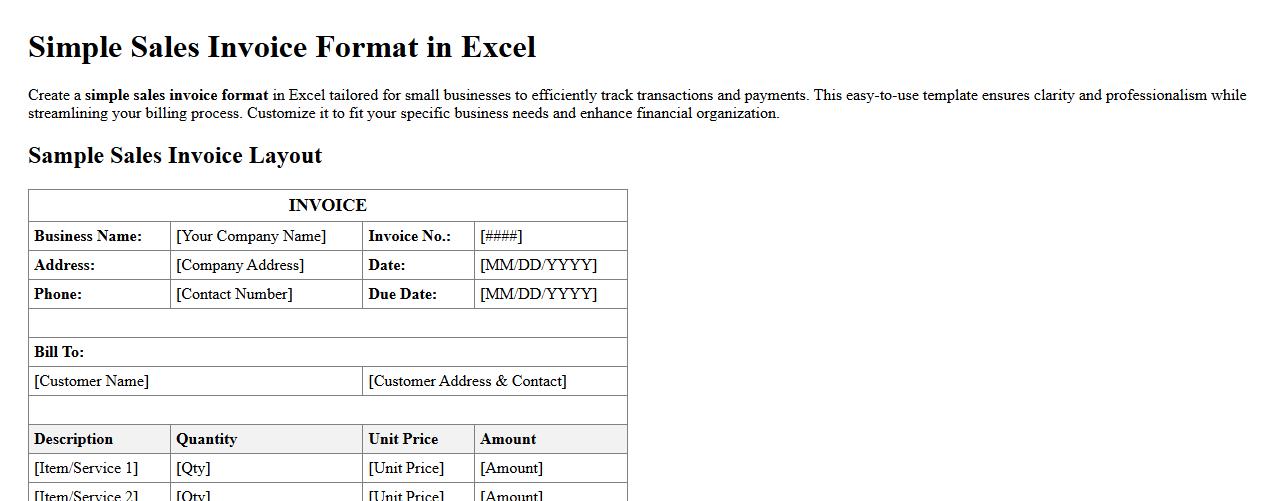

Simple sales invoice format in excel for small business

Create a simple sales invoice format in Excel tailored for small businesses to efficiently track transactions and payments. This easy-to-use template ensures clarity and professionalism while streamlining your billing process. Customize it to fit your specific business needs and enhance financial organization.

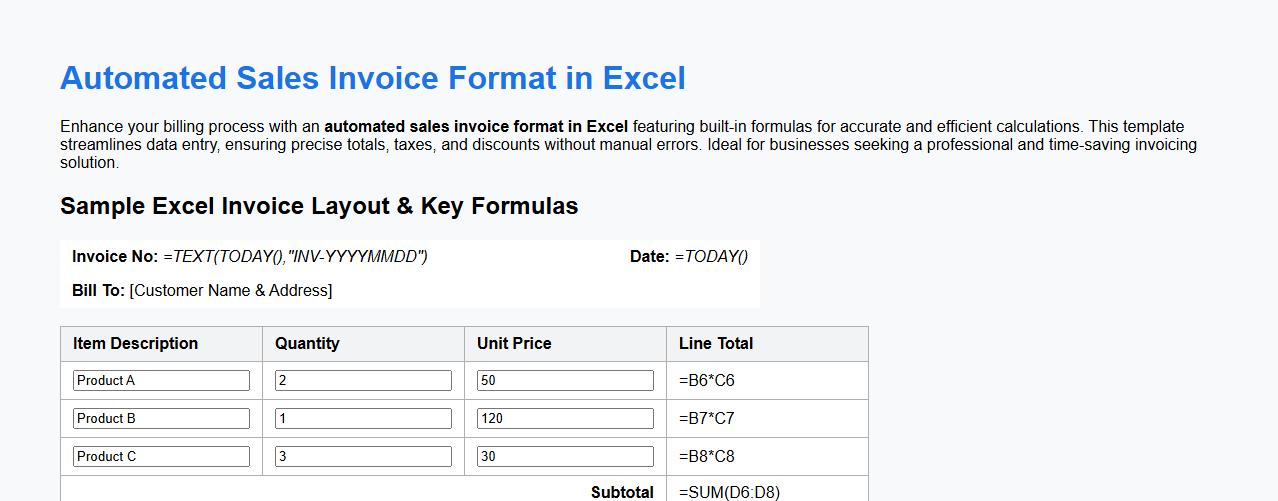

Automated sales invoice format in excel with formulas

Enhance your billing process with an automated sales invoice format in Excel featuring built-in formulas for accurate and efficient calculations. This template streamlines data entry, ensuring precise totals, taxes, and discounts without manual errors. Ideal for businesses seeking a professional and time-saving invoicing solution.

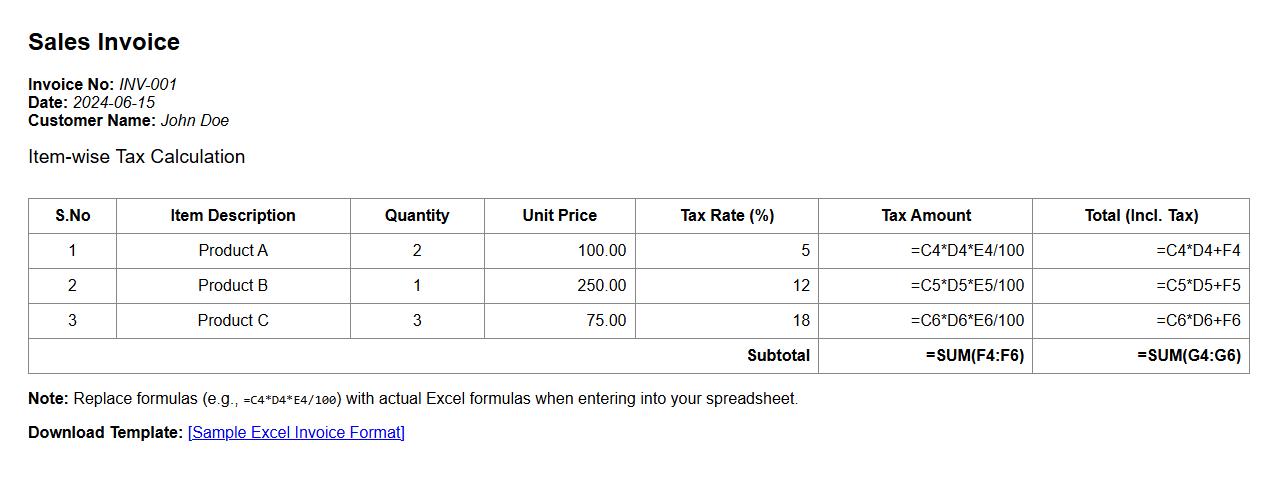

Sales invoice format in excel with item-wise tax calculation

Discover a practical sales invoice format in Excel designed for efficient item-wise tax calculation. This format streamlines billing by clearly displaying each product's price, quantity, and applicable taxes. It's ideal for businesses seeking accuracy and transparency in their invoicing process.

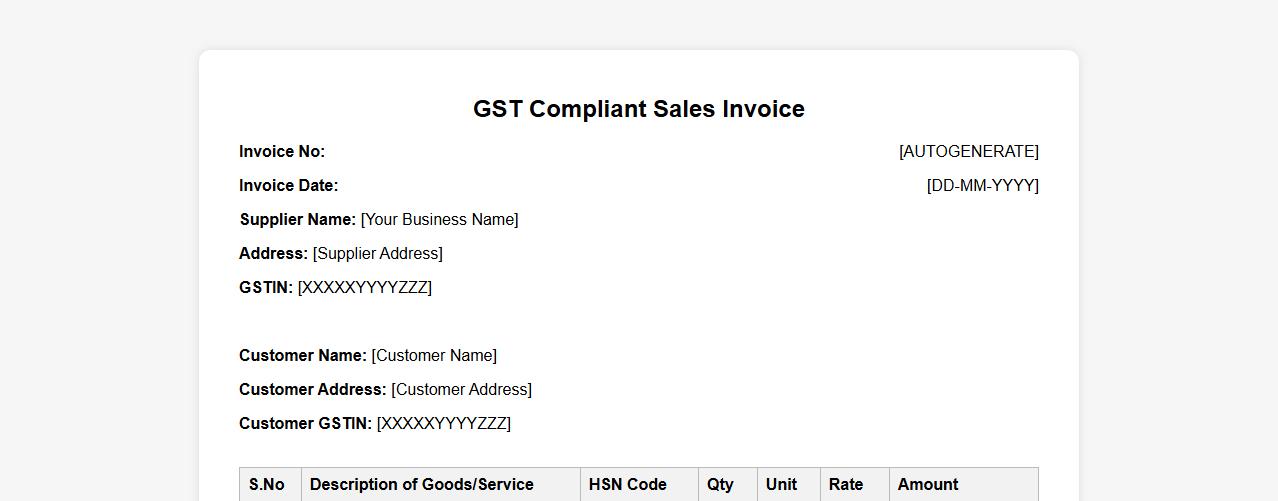

Gst compliant sales invoice format in excel with hsn code

Create a GST compliant sales invoice format in Excel that includes HSN codes for accurate tax calculation and regulatory adherence. This format ensures seamless billing and GST reporting for businesses. Easily customize and maintain detailed records with this efficient invoicing solution.

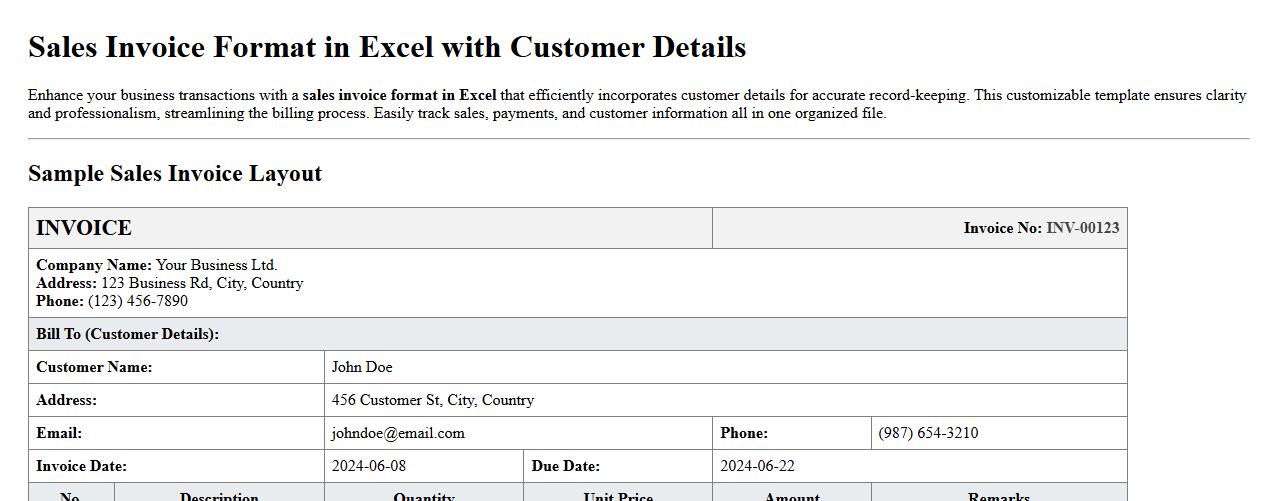

Sales invoice format in excel with customer details

Enhance your business transactions with a sales invoice format in Excel that efficiently incorporates customer details for accurate record-keeping. This customizable template ensures clarity and professionalism, streamlining the billing process. Easily track sales, payments, and customer information all in one organized file.

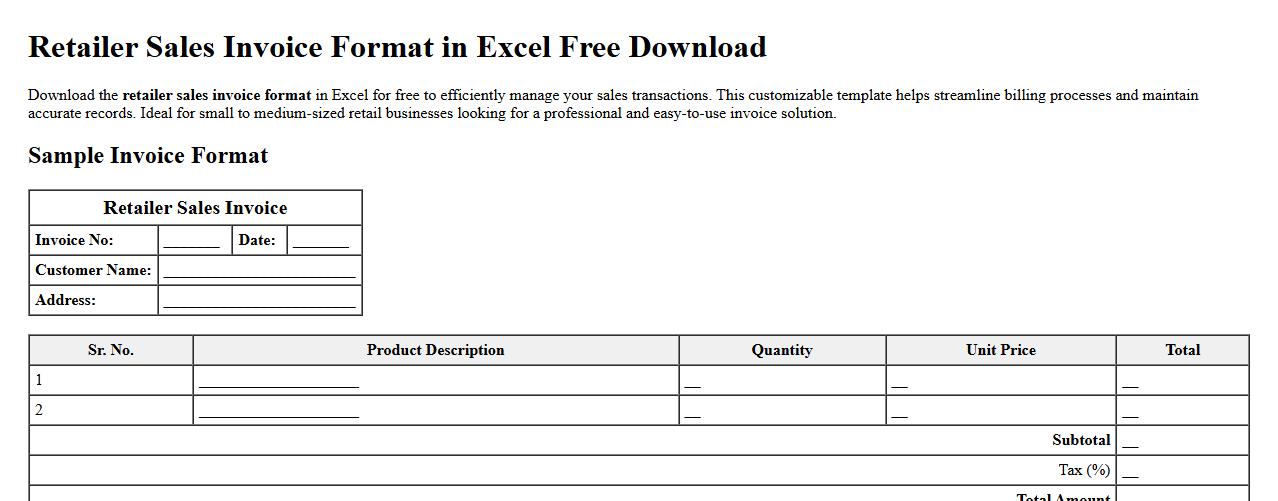

Retailer sales invoice format in excel free download

Download the retailer sales invoice format in Excel for free to efficiently manage your sales transactions. This customizable template helps streamline billing processes and maintain accurate records. Ideal for small to medium-sized retail businesses looking for a professional and easy-to-use invoice solution.

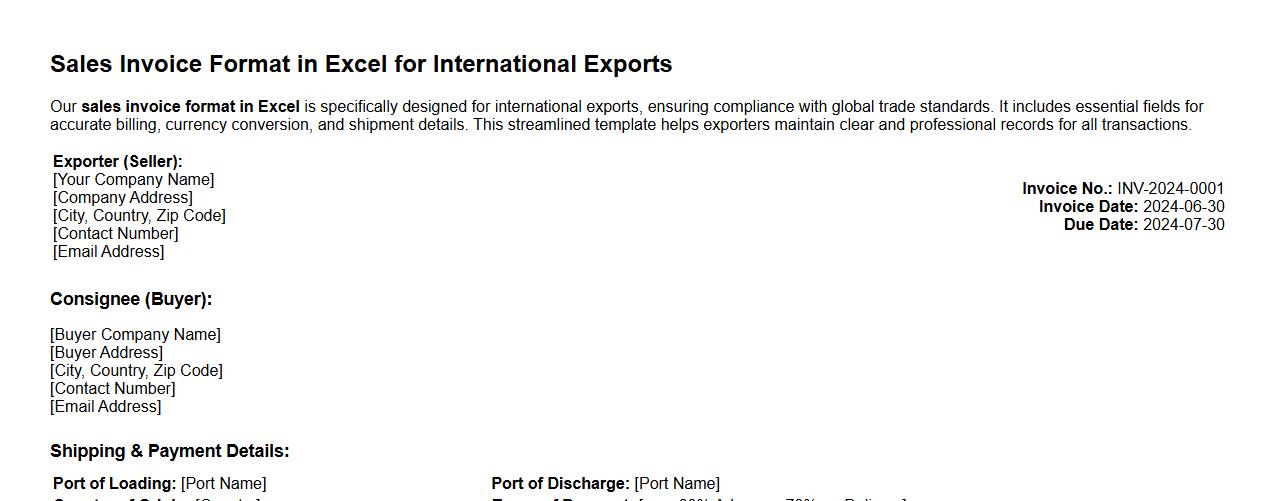

Sales invoice format in excel for international exports

Our sales invoice format in Excel is specifically designed for international exports, ensuring compliance with global trade standards. It includes essential fields for accurate billing, currency conversion, and shipment details. This streamlined template helps exporters maintain clear and professional records for all transactions.

What are the essential columns needed in a sales invoice Excel template?

An effective sales invoice Excel template must include columns such as Item Description, Quantity, Unit Price, and Total Amount to comprehensively capture transaction details. Additional columns for Tax Rate, Discount, and Net Amount are vital for accurate billing and record-keeping. Including columns for Invoice Number and Date ensures proper tracking and organization of sales data.

How to automate invoice numbering in an Excel sales invoice format?

Automating invoice numbering in Excel can be achieved using formulas like =MAX() combined with +1 to increment numbers automatically. Alternatively, Excel VBA macros can generate sequential invoice numbers based on existing entries. This automation minimizes manual errors and improves consistency across sales invoice documents.

Which Excel functions best calculate service and product totals in a sales invoice?

The SUMPRODUCT function is highly effective for calculating service and product totals by multiplying quantities and unit prices across rows. SUM functions can total entire columns for overall invoice amounts efficiently. Combining these functions with IF statements helps to customize totals according to conditions like discounts or tax applications.

How can tax rates and discounts be dynamically applied in a sales invoice Excel sheet?

Dynamic application of tax rates and discounts is best managed by using cell references and formulas such as =Price*(1-TaxRate) or =Price*(1-Discount). Dropdown lists or data validation features enable easy adjustment of these rates without manual formula edits. This approach ensures real-time accurate calculations reflecting current tax laws and promotional discounts.

What methods ensure client and transaction data security in Excel invoice documents?

Protecting client and transaction data in Excel involves password-protecting files and using sheet protection features to restrict unauthorized edits. Encrypting Excel files and setting restricted access permissions enhance data confidentiality. Regular backups and version control also secure sensitive invoice information against loss or tampering.