A Invoice Receipt Form Sample provides a clear template for documenting transactions between a buyer and a seller, ensuring accurate record-keeping. It typically includes essential details such as item descriptions, quantities, prices, payment terms, and date of purchase. Using this form helps streamline accounting processes and supports financial transparency for businesses.

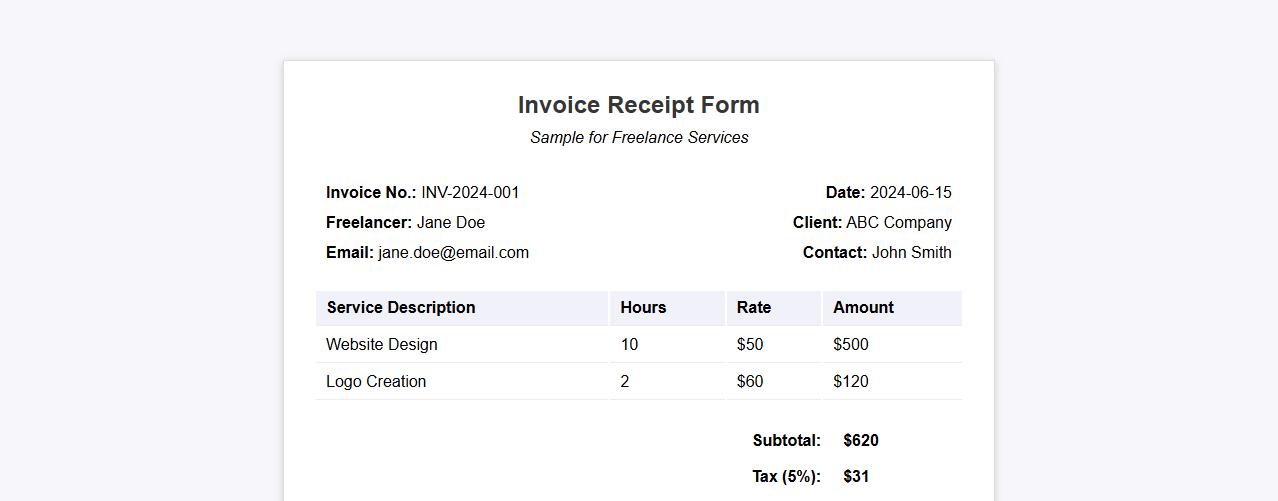

Invoice receipt form sample for freelance services

This invoice receipt form sample is designed specifically for freelance services, ensuring clear documentation of payments received. It helps freelancers maintain organized financial records and provides clients with proof of transaction. Use this template to streamline your billing process efficiently.

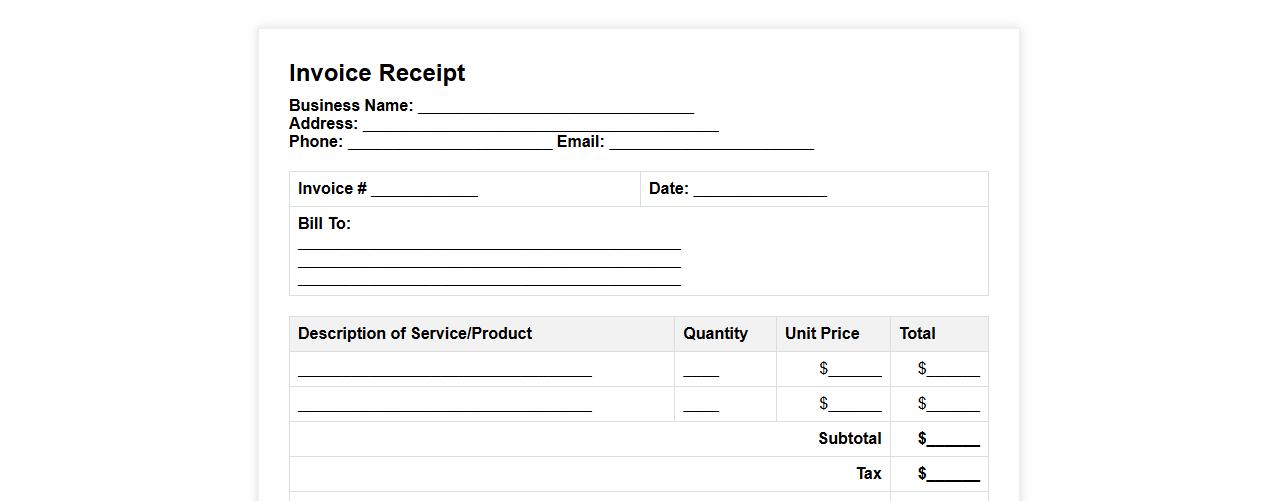

Printable invoice receipt form sample for small business

This printable invoice receipt form sample is designed to help small businesses efficiently document transactions. It provides a clear layout for listing services, prices, and payment details. Using this template ensures professional and organized record-keeping for both sellers and clients.

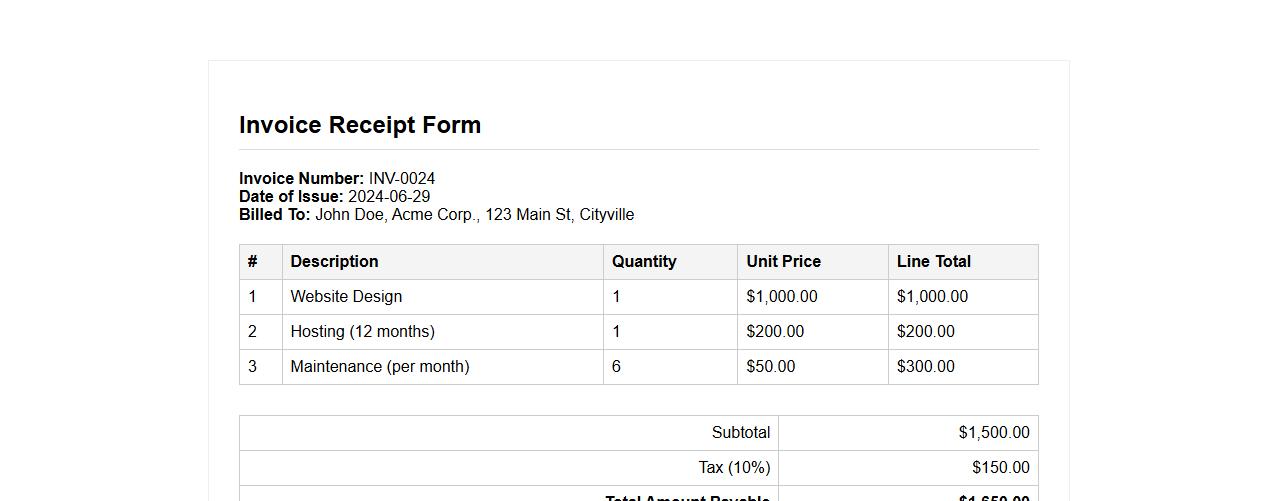

Invoice receipt form sample with tax calculation

This invoice receipt form sample includes detailed tax calculation to ensure accuracy in billing. It provides a clear layout for itemizing charges, taxes, and total amounts payable. Designed for ease of use, this form helps streamline financial documentation and record-keeping.

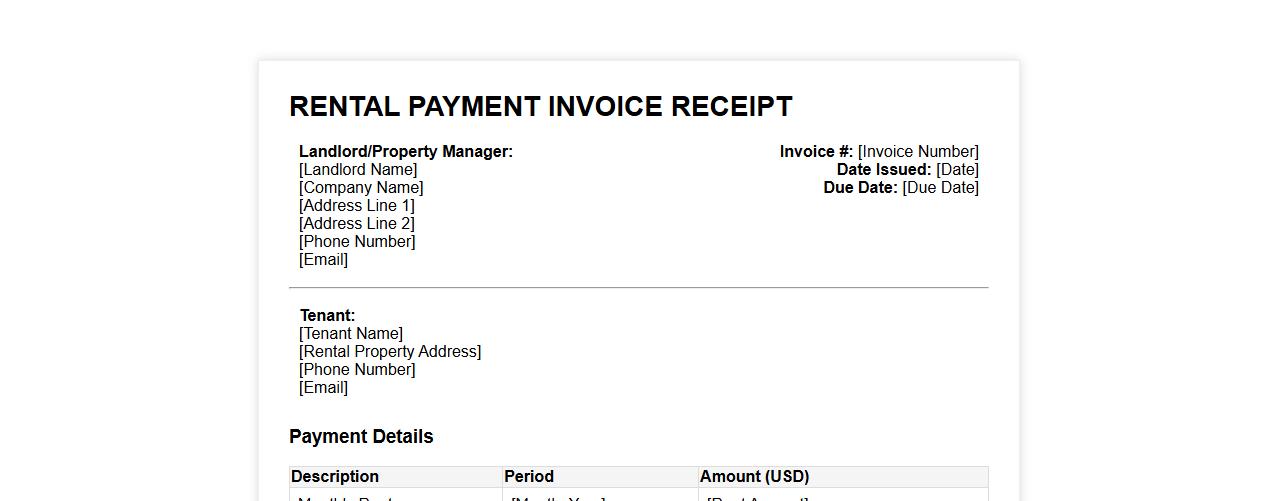

PDF invoice receipt form sample for rental payments

This PDF invoice receipt form sample is designed specifically for rental payments, providing a clear and professional template. It helps landlords and tenants track payment details efficiently and ensures accurate record-keeping. Easily customizable, this form simplifies the billing process for rental transactions.

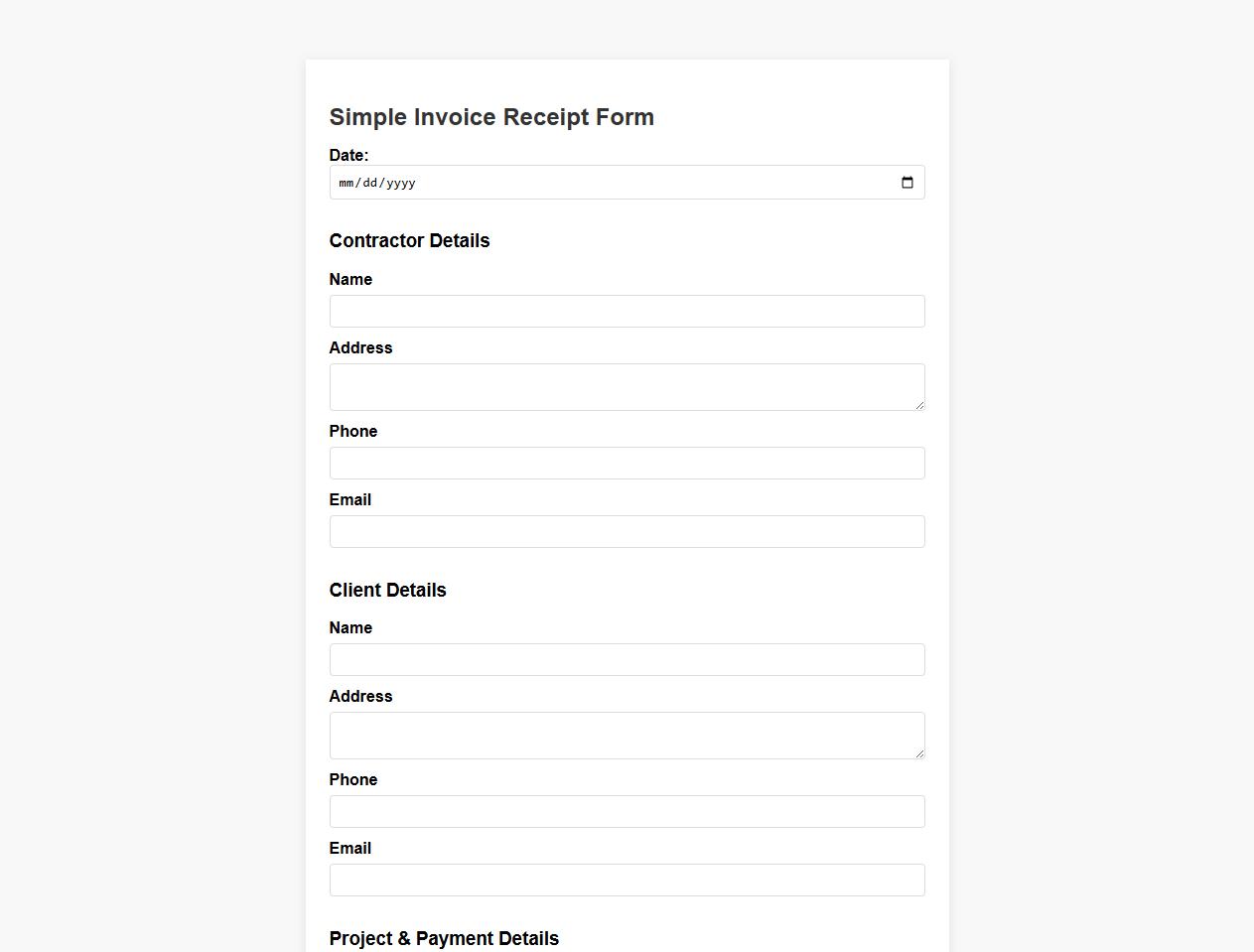

Simple invoice receipt form sample for contractors

This simple invoice receipt form sample is designed specifically for contractors to easily document payments and project details. It ensures clear communication between contractors and clients by providing a straightforward format. Users can efficiently record transaction information, making billing and record-keeping hassle-free.

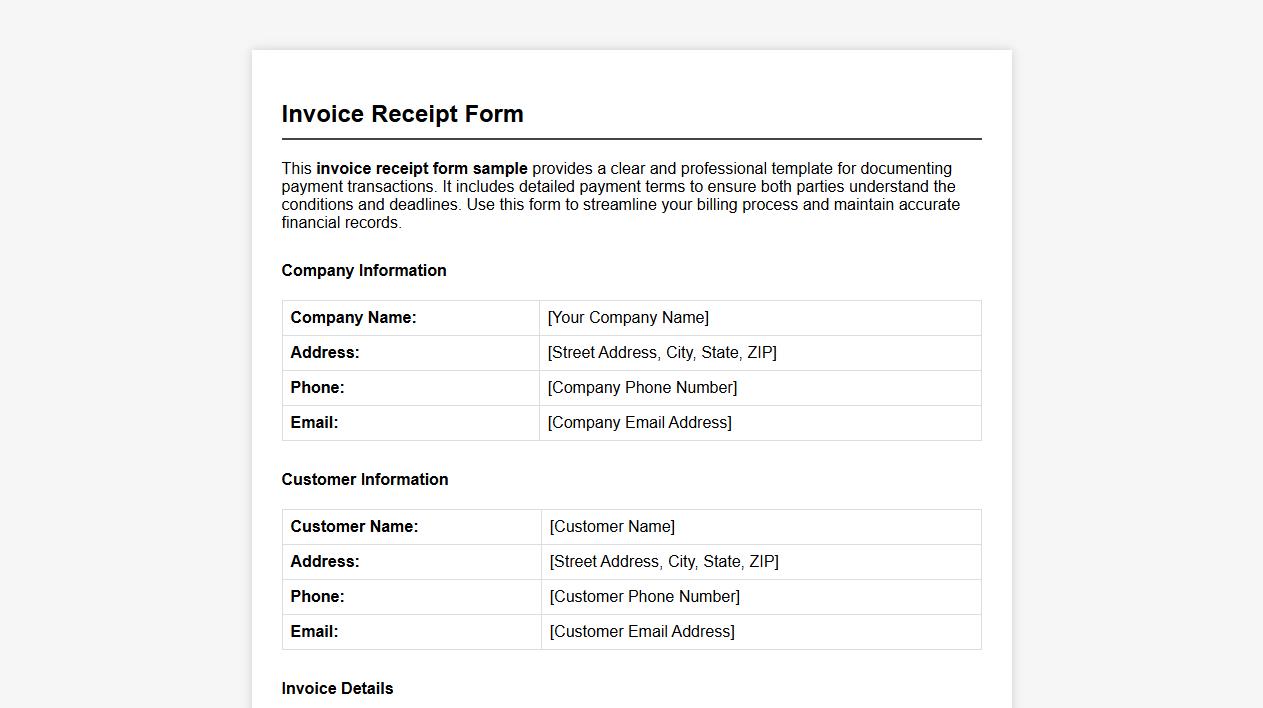

Invoice receipt form sample including payment terms

This invoice receipt form sample provides a clear and professional template for documenting payment transactions. It includes detailed payment terms to ensure both parties understand the conditions and deadlines. Use this form to streamline your billing process and maintain accurate financial records.

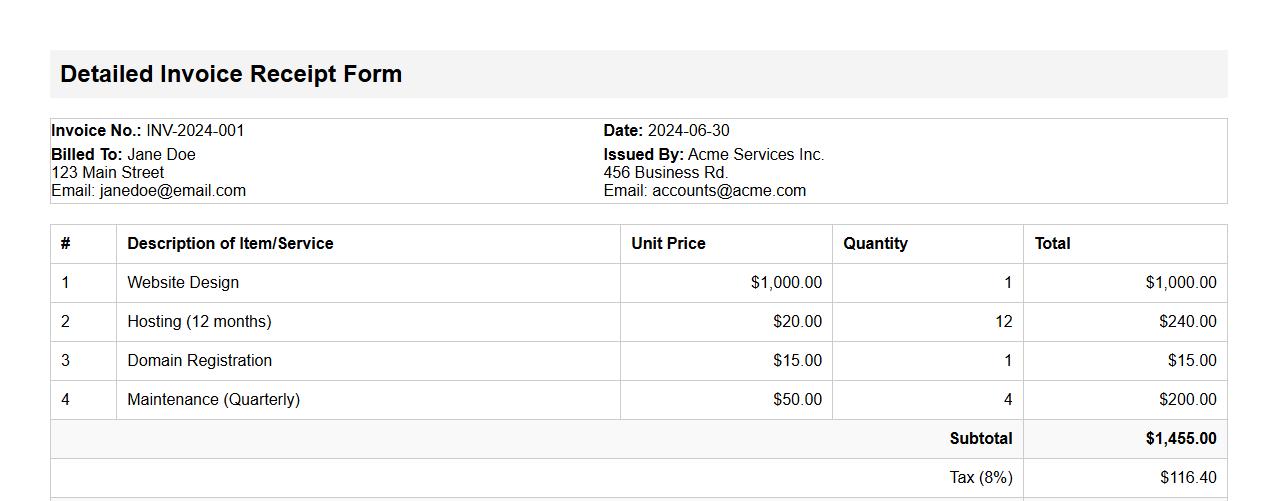

Detailed invoice receipt form sample with itemized list

This invoice receipt form sample provides a detailed and itemized list to clearly outline all transactions. It ensures accurate record-keeping and transparent billing for both parties. Ideal for businesses requiring precise documentation of purchased items and services.

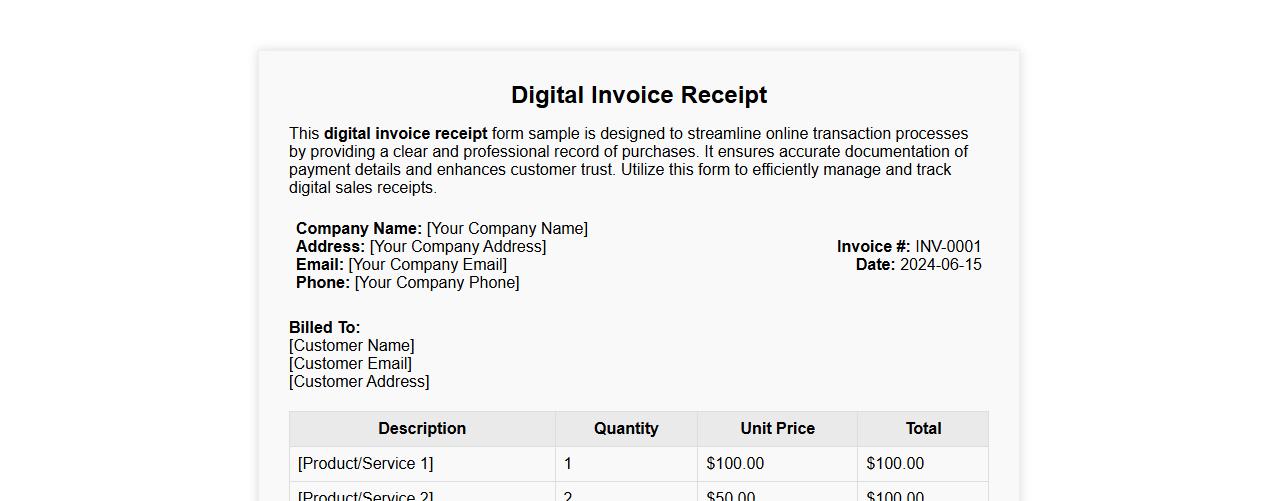

Digital invoice receipt form sample for online transactions

This digital invoice receipt form sample is designed to streamline online transaction processes by providing a clear and professional record of purchases. It ensures accurate documentation of payment details and enhances customer trust. Utilize this form to efficiently manage and track digital sales receipts.

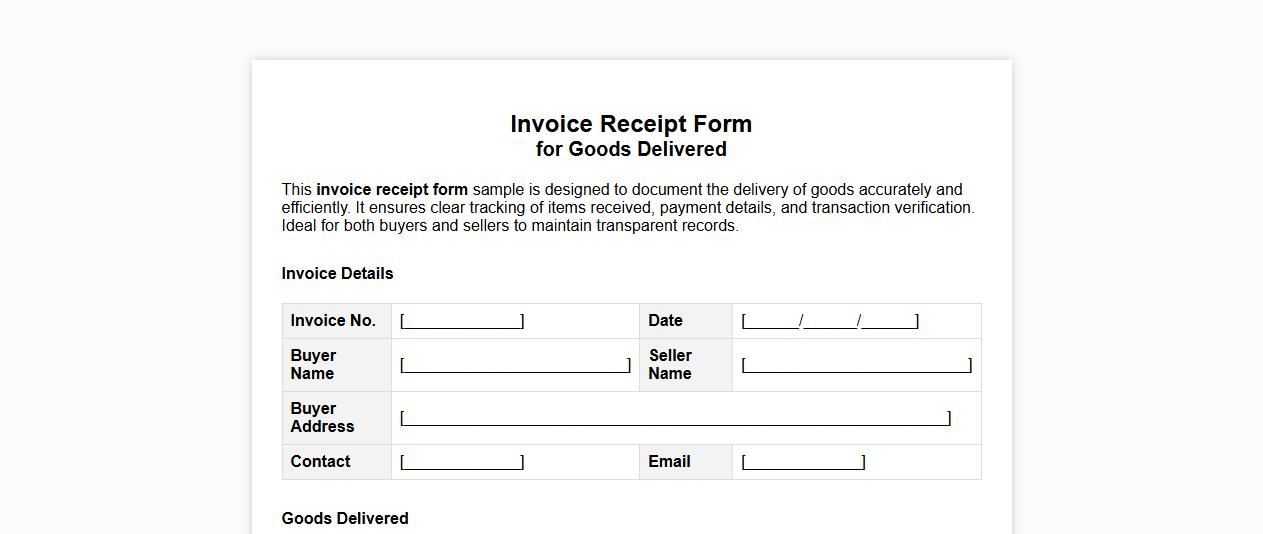

Invoice receipt form sample for goods delivered

This invoice receipt form sample is designed to document the delivery of goods accurately and efficiently. It ensures clear tracking of items received, payment details, and transaction verification. Ideal for both buyers and sellers to maintain transparent records.

What fields are mandatory on an invoice receipt form for tax compliance?

For tax compliance, an invoice receipt form must include the seller's name, address, and tax identification number. It should also clearly list the buyer's details including their name and tax ID if applicable. Additionally, the invoice must contain the date, a unique invoice number, description of goods or services, quantities, unit price, total amount, and applicable tax rates and amounts.

How should payment terms be explicitly stated in an invoice receipt form?

Payment terms must be clearly stated to specify the due date or payment period, such as "Net 30 days." It's important to include accepted payment methods and any late payment penalties or discounts for early payment. Clear payment terms help avoid disputes and improve cash flow management.

What metadata can be used to uniquely track invoice receipt forms?

Unique tracking of invoice receipt forms relies on metadata such as a unique invoice number, issuance date, and buyer and seller tax IDs. Additional useful metadata includes payment status, currency codes, and digital signatures. This data ensures accuracy, traceability, and audit readiness.

How do you handle multi-currency amounts in an invoice receipt form?

When dealing with multi-currency amounts, the invoice must list the currency for each amount clearly using ISO currency codes (e.g., USD, EUR). Exchange rates applied at the time of invoice creation should be stated to allow for accurate conversion. It's also essential to specify the base currency used for tax calculations and payment.

What digital signature standards are accepted on electronic invoice receipt forms?

Accepted digital signature standards on electronic invoices include PKI-based signatures compliant with eIDAS and related local regulations. Common formats include PAdES, XAdES, and CAdES, ensuring authenticity and integrity. These standards enable legal recognition and secure validation of electronic invoices.