A Tax Invoice Form Sample provides a clear template for documenting sales transactions, including essential details like buyer and seller information, item descriptions, quantities, prices, and tax amounts. This sample ensures compliance with tax regulations by accurately reflecting taxable supplies and the corresponding GST or VAT charges. Utilizing a well-structured Tax Invoice Form Sample helps businesses maintain transparent records and streamline their accounting processes.

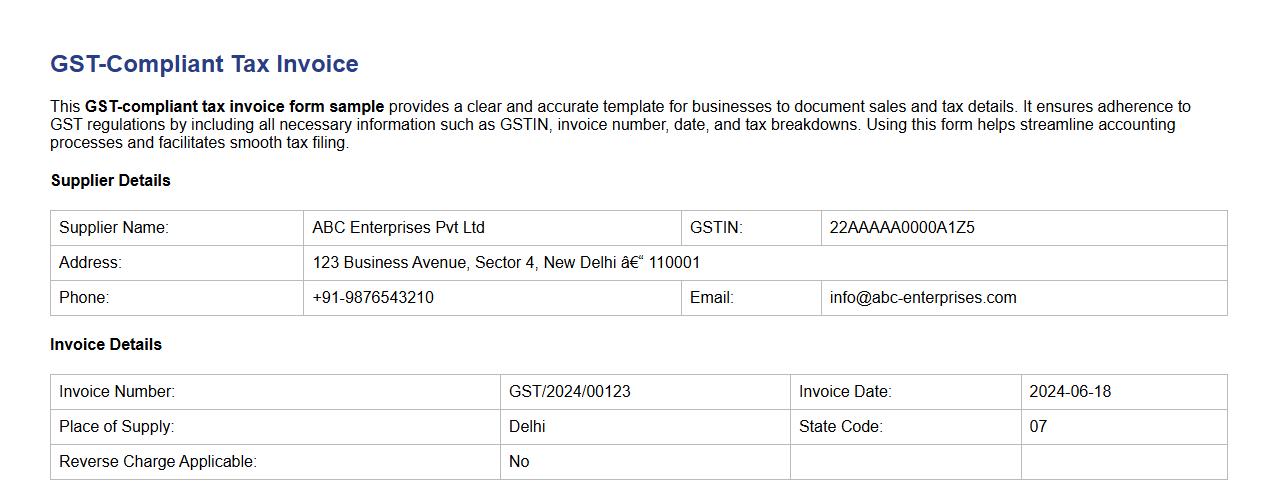

GST-compliant tax invoice form sample

This GST-compliant tax invoice form sample provides a clear and accurate template for businesses to document sales and tax details. It ensures adherence to GST regulations by including all necessary information such as GSTIN, invoice number, date, and tax breakdowns. Using this form helps streamline accounting processes and facilitates smooth tax filing.

PDF format tax invoice form sample download

Download a PDF format tax invoice form sample to simplify your billing process. This easy-to-use template ensures accurate recording of transactions and compliance with tax regulations. Customize and print the invoice for professional business use.

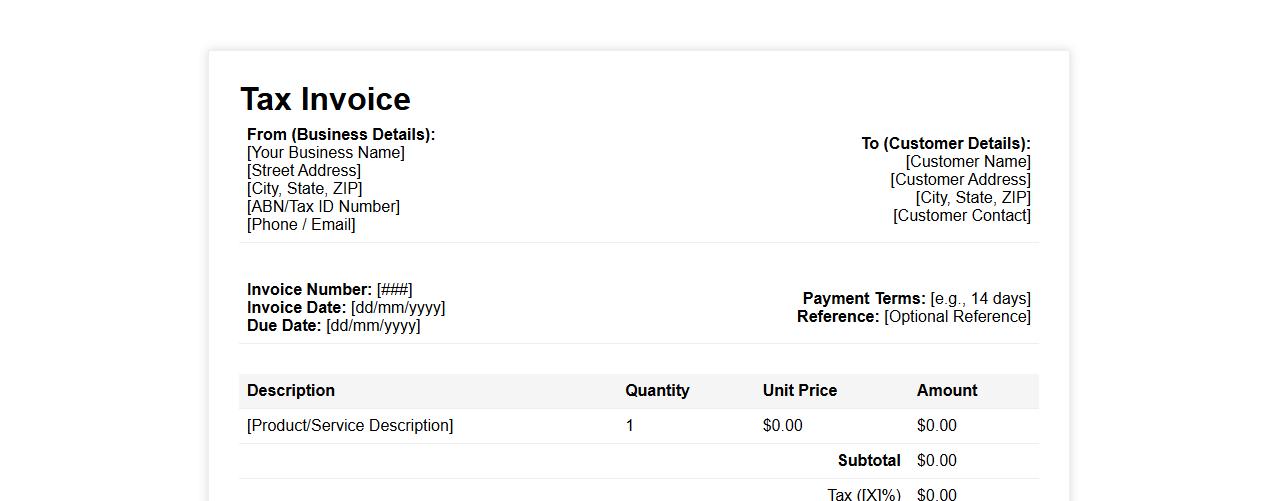

Small business tax invoice form sample template

Download this small business tax invoice form sample template to streamline your billing process efficiently. Designed for clarity and ease of use, it ensures accurate record-keeping and professional presentation. Customize the template to fit your specific business needs and ensure compliance with tax requirements.

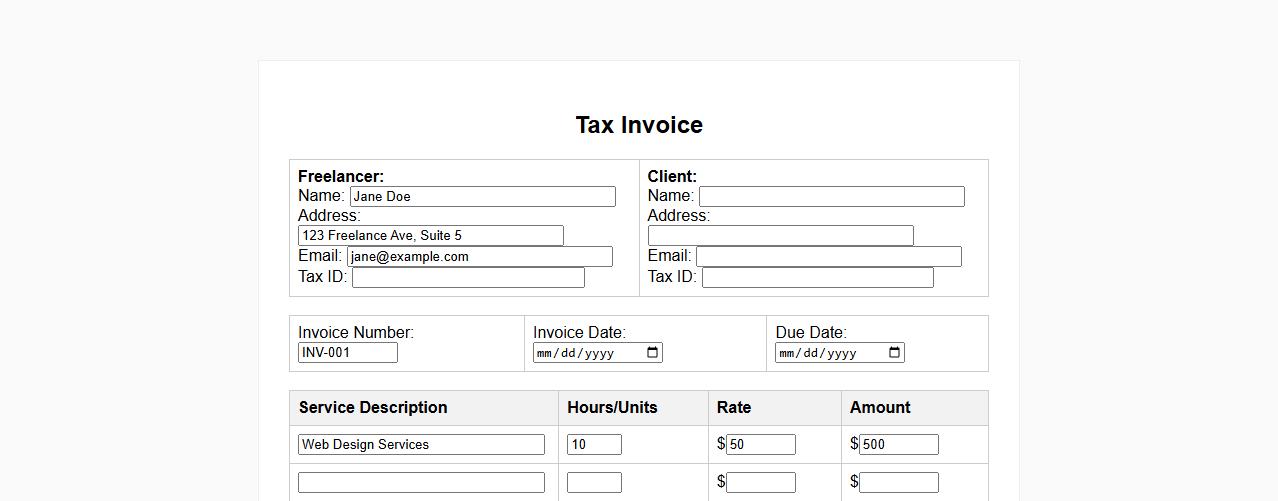

Tax invoice form sample for freelance services

This tax invoice form sample is designed specifically for freelance services, ensuring all necessary details are clearly outlined for accurate billing and tax compliance. It includes fields for service description, payment terms, and client information, making it easy to customize for various freelance projects. Using this template helps freelancers maintain professionalism and streamline their invoicing process.

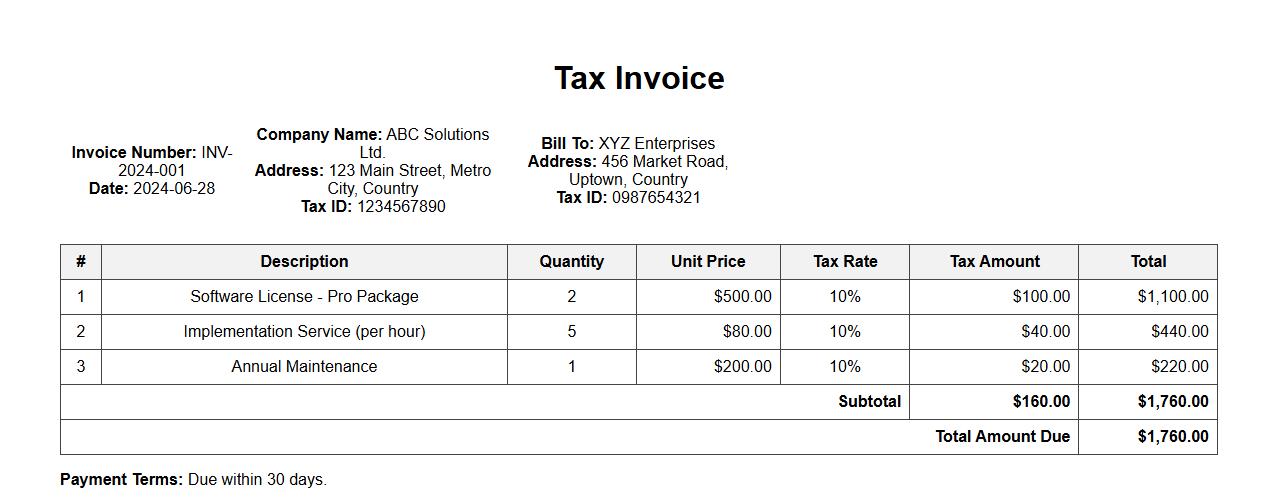

Tax invoice form sample with itemized breakdown

This tax invoice form sample provides a clear itemized breakdown of each charge for accurate billing and record-keeping. It ensures transparency by listing individual items, quantities, prices, and applicable taxes. Use this template to streamline your invoicing process and maintain compliant financial documentation.

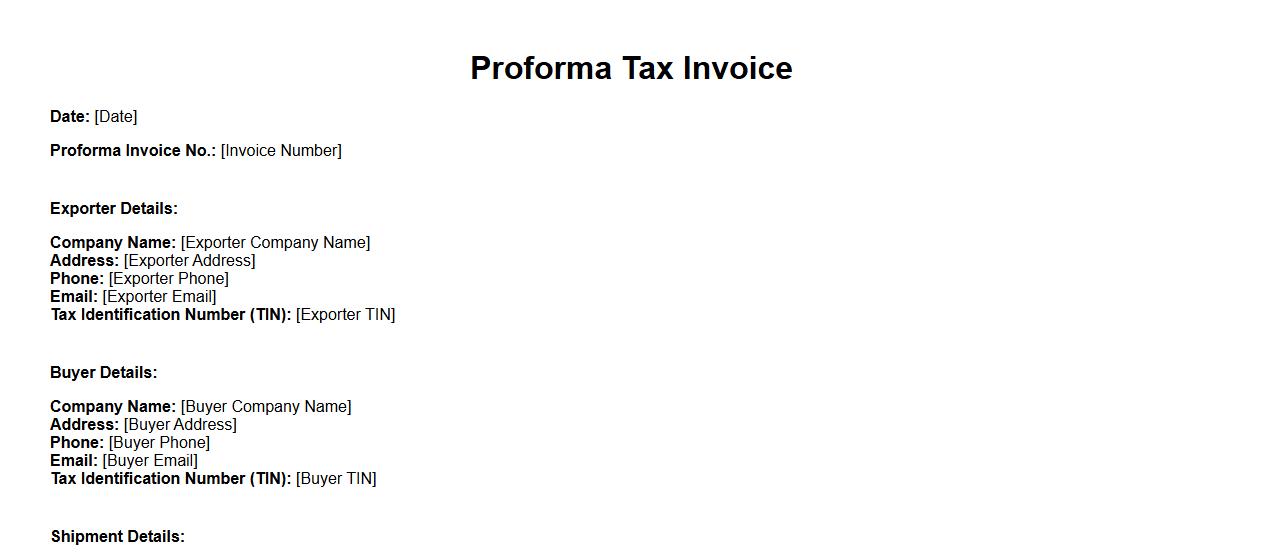

Proforma tax invoice form sample for export

A Proforma tax invoice form sample for export serves as a preliminary bill of sale, outlining the estimated costs and details of goods shipped internationally. It helps streamline customs clearance and facilitates smooth transactions between exporters and buyers. This document is essential for accurate financial and tax record-keeping in export operations.

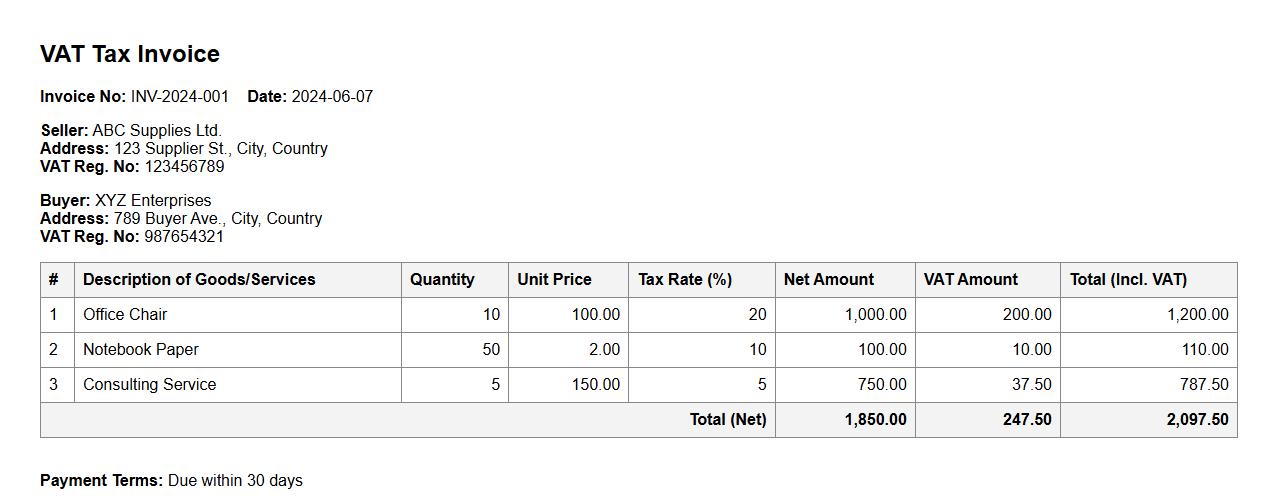

VAT tax invoice form sample with multiple tax rates

This VAT tax invoice form sample is designed to accommodate multiple tax rates seamlessly, ensuring accurate tax calculation and compliance. It simplifies the process of itemizing goods and services while clearly displaying varying VAT percentages. Ideal for businesses handling diverse products with different tax obligations.

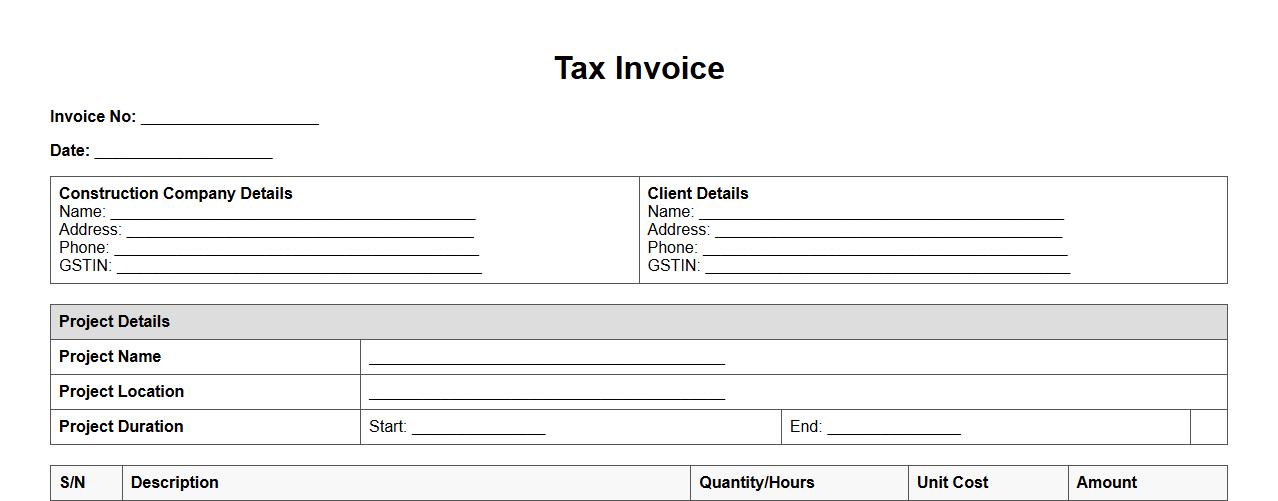

Tax invoice form sample for construction companies

This tax invoice form sample is specifically designed for construction companies to efficiently document transactions. It includes essential sections for project details, material costs, labor charges, and tax calculations. Using this form helps ensure compliance with tax regulations and facilitates accurate financial record-keeping.

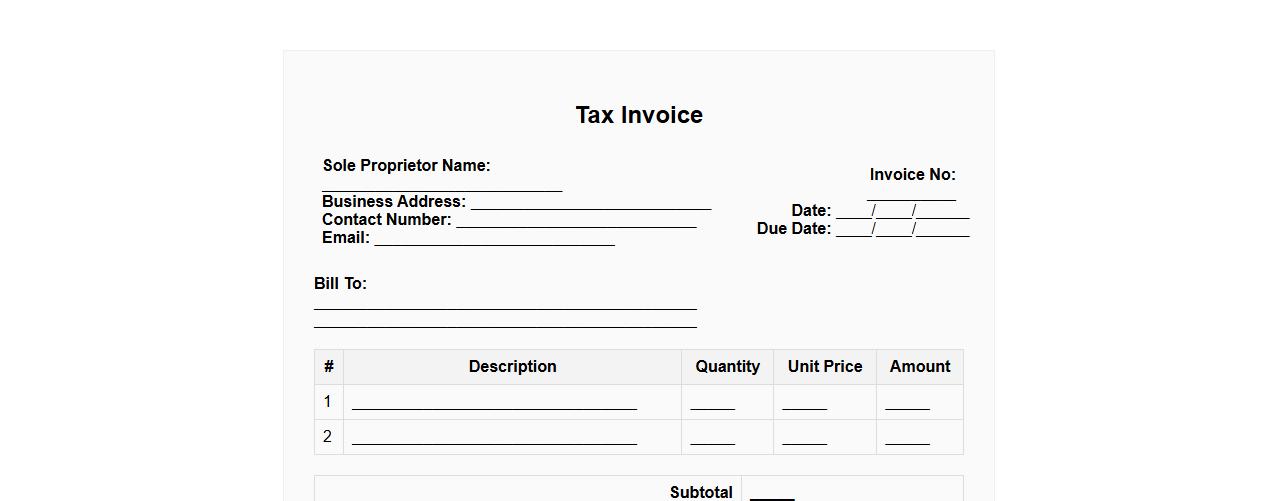

Simple tax invoice form sample for sole proprietors

This simple tax invoice form sample is designed specifically for sole proprietors, providing a clear and professional layout for billing clients. It includes essential fields such as invoice number, date, item description, quantity, and total amount. This form helps ensure accurate record-keeping and smooth financial transactions for small business owners.

What mandatory fields must be included on a tax invoice form for VAT compliance?

A tax invoice must include the vendor's name and VAT registration number to ensure legal identification. The invoice date and a unique invoice number are essential for proper record keeping. Additionally, detailed descriptions of goods or services, their quantities, unit prices, and the total VAT amount must be clearly stated.

How should digital signatures be applied to electronic tax invoice documents?

Digital signatures on electronic tax invoices must use secure cryptographic methods to guarantee authenticity and integrity. These signatures should be applied using certified digital certificate providers recognized by tax authorities. Applying a digital timestamp alongside the signature helps verify the exact time the invoice was signed.

What is the correct format for itemized GST breakdown on a tax invoice form?

The itemized GST breakdown must clearly separate the taxable value of goods or services and the GST amount applied. Each line item should display the GST rate and the corresponding GST figure to comply with transparency standards. Totals for both taxable amounts and GST must be summed together at the bottom of the invoice.

Are tax invoice forms required to display a sequential invoice numbering system?

Yes, tax invoices must feature a sequential and unique invoice numbering system to prevent duplication and fraud. The numbering system aids in audit trails and easy verification by tax authorities. Maintaining chronological order in invoices is critical for compliance and reporting accuracy.

How does cross-border sales affect tax invoice documentation requirements?

Cross-border sales often require additional documentation, including the country of origin and destination details on the tax invoice. Tax rules may vary significantly, necessitating the inclusion of applicable export declarations or tax exemption notes. Properly documenting these details ensures compliance with both domestic VAT laws and international trade regulations.