A Invoice Template Sample provides a structured format to streamline billing processes, ensuring all essential details like item descriptions, prices, and payment terms are clearly presented. This customizable template helps businesses maintain professionalism and accuracy when requesting payments from clients. Using a well-designed invoice template improves financial record-keeping and speeds up transaction processing.

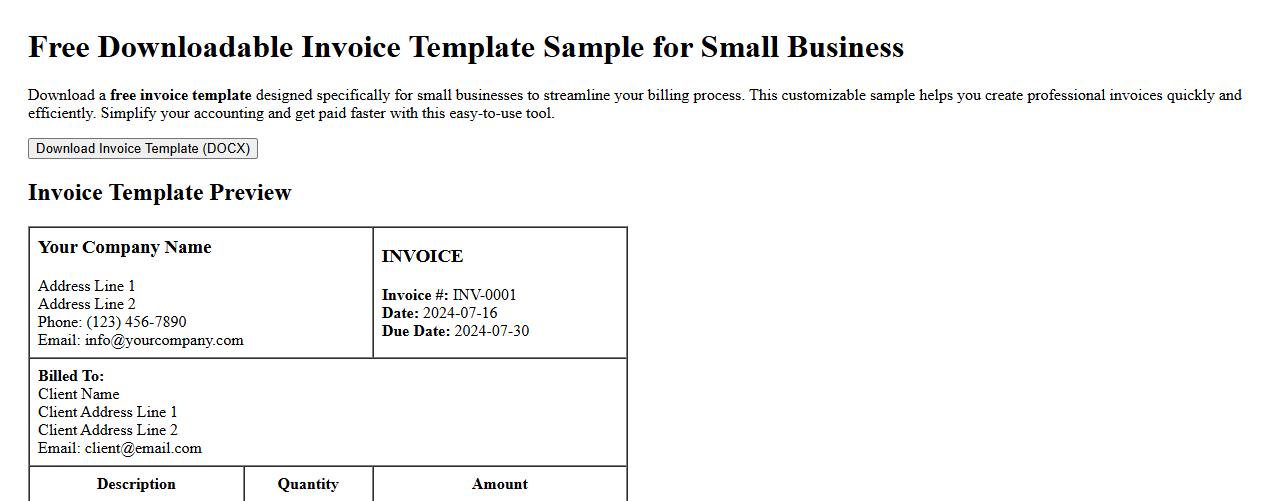

Free downloadable invoice template sample for small business

Download a free invoice template designed specifically for small businesses to streamline your billing process. This customizable sample helps you create professional invoices quickly and efficiently. Simplify your accounting and get paid faster with this easy-to-use tool.

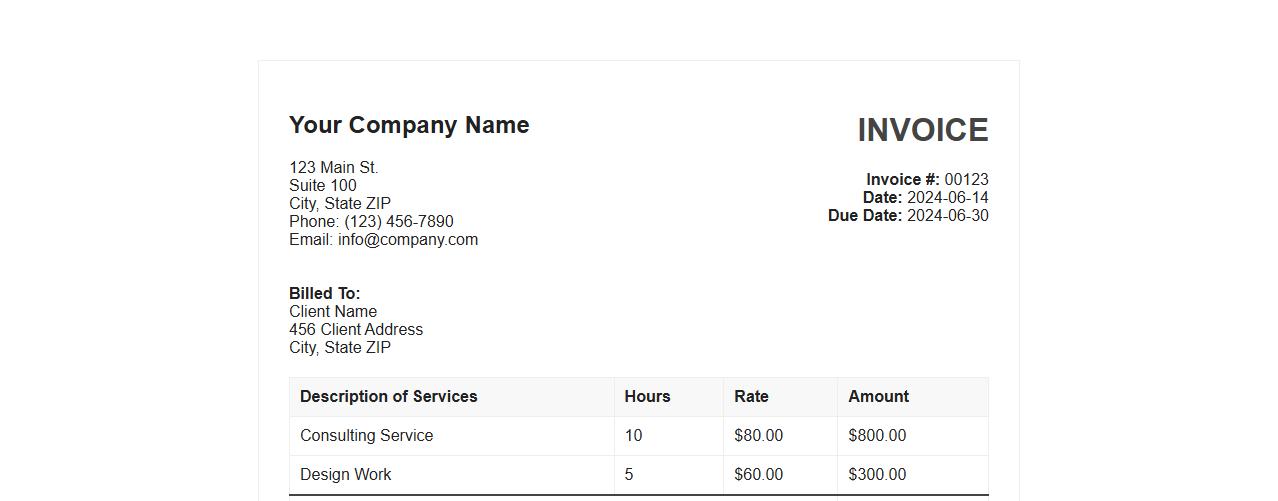

Simple service invoice template sample PDF

This simple service invoice template sample PDF provides a clean and professional format for billing clients. It is designed to clearly outline services rendered, payment terms, and due dates. This template ensures efficient and organized invoicing for service providers.

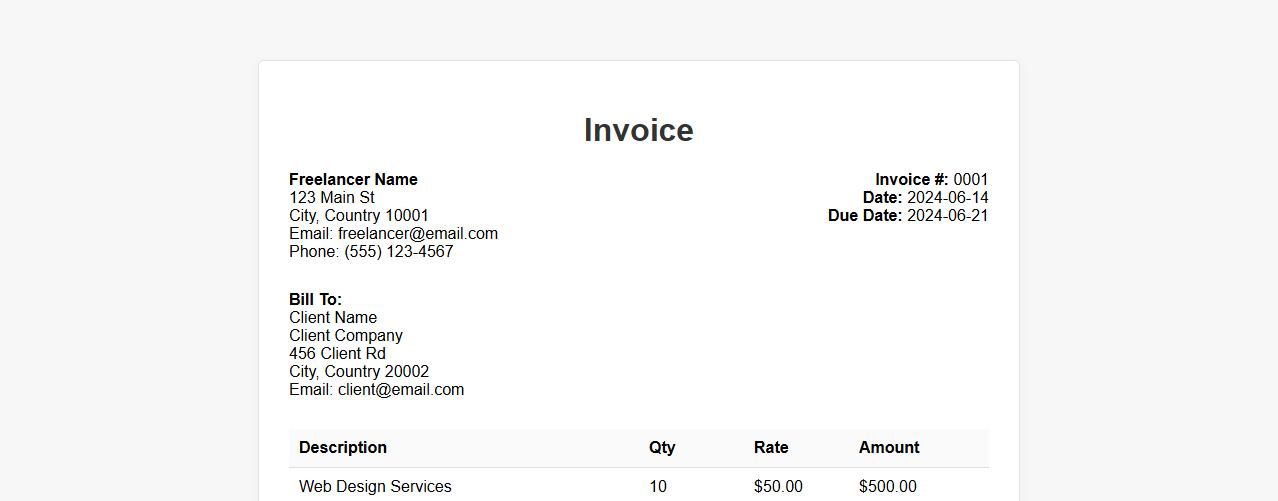

Professional invoice template sample for freelancers

Enhance your billing process with this professional invoice template designed specifically for freelancers. It offers a clean, organized layout that ensures clear communication of services and payment details. Easily customizable, it helps you maintain a polished, professional image with every transaction.

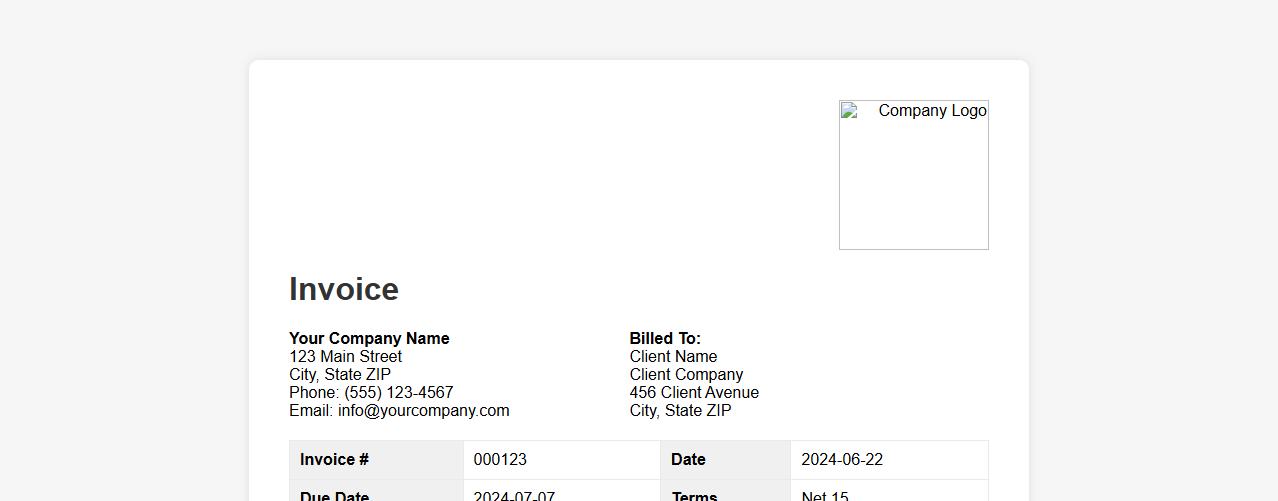

Customizable invoice template sample with company logo

Create a professional and customizable invoice template sample that includes your company logo for a personalized touch. Easily modify details to suit your business needs and enhance brand recognition. This template ensures clear, organized billing for efficient client communication.

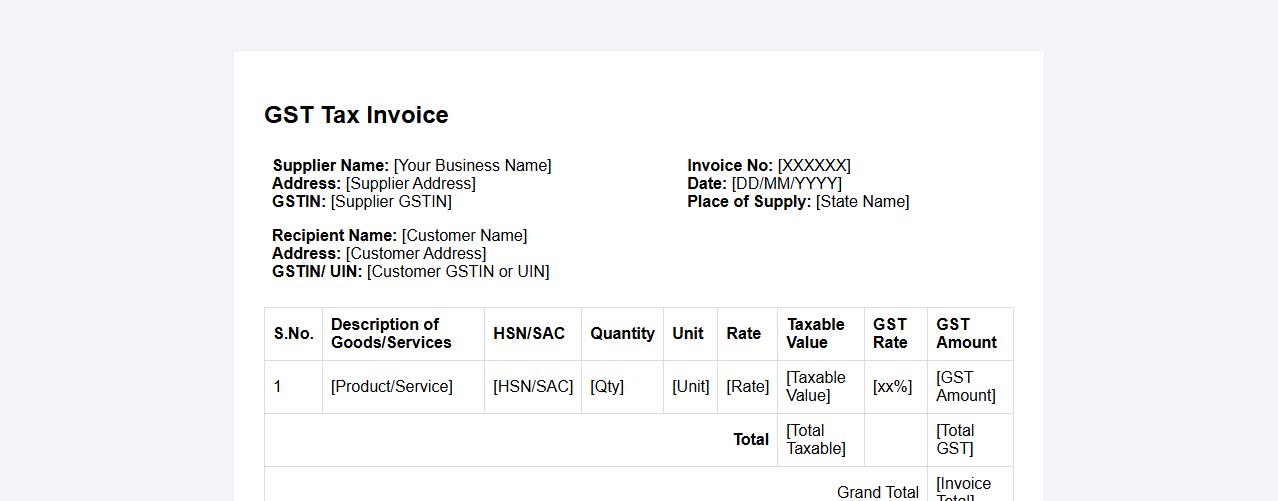

Tax-compliant invoice template sample for GST

This tax-compliant invoice template for GST ensures accurate calculation and clear presentation of all taxable supplies, maintaining adherence to government regulations. It features fields for GSTIN, invoice number, taxable value, and tax amount, facilitating seamless filing and record keeping. Designed for businesses of all sizes, this template supports efficient invoicing with full compliance.

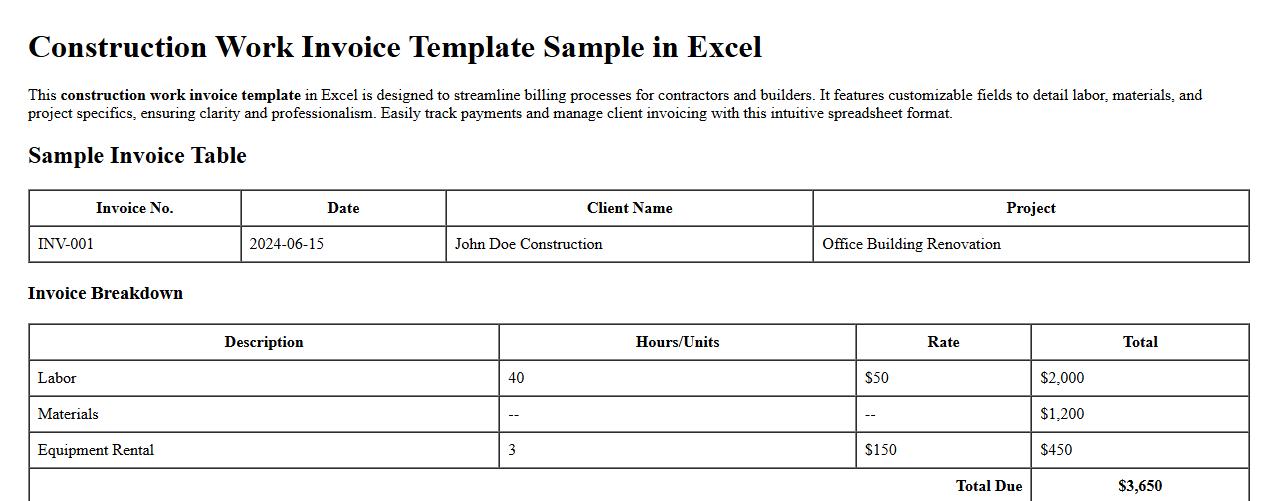

Construction work invoice template sample in Excel

This construction work invoice template in Excel is designed to streamline billing processes for contractors and builders. It features customizable fields to detail labor, materials, and project specifics, ensuring clarity and professionalism. Easily track payments and manage client invoicing with this intuitive spreadsheet format.

Hourly rate invoice template sample for consultants

Our hourly rate invoice template sample for consultants provides a professional and clear format to bill clients accurately for time worked. It helps streamline payment processes by detailing hours, rates, and total costs. This template ensures transparency and efficiency in consultant-client financial interactions.

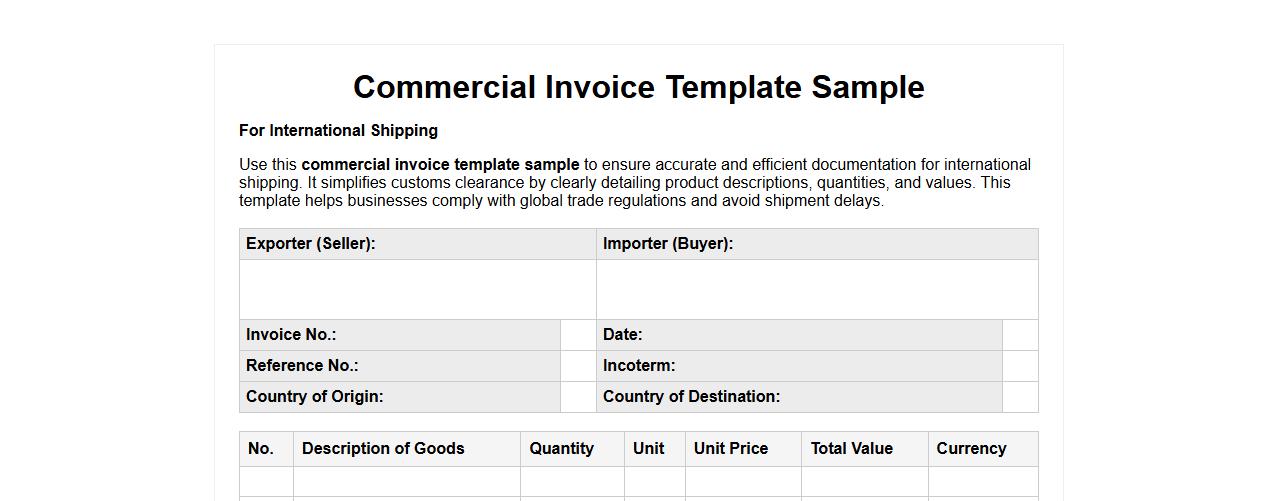

Commercial invoice template sample for international shipping

Use this commercial invoice template sample to ensure accurate and efficient documentation for international shipping. It simplifies customs clearance by clearly detailing product descriptions, quantities, and values. This template helps businesses comply with global trade regulations and avoid shipment delays.

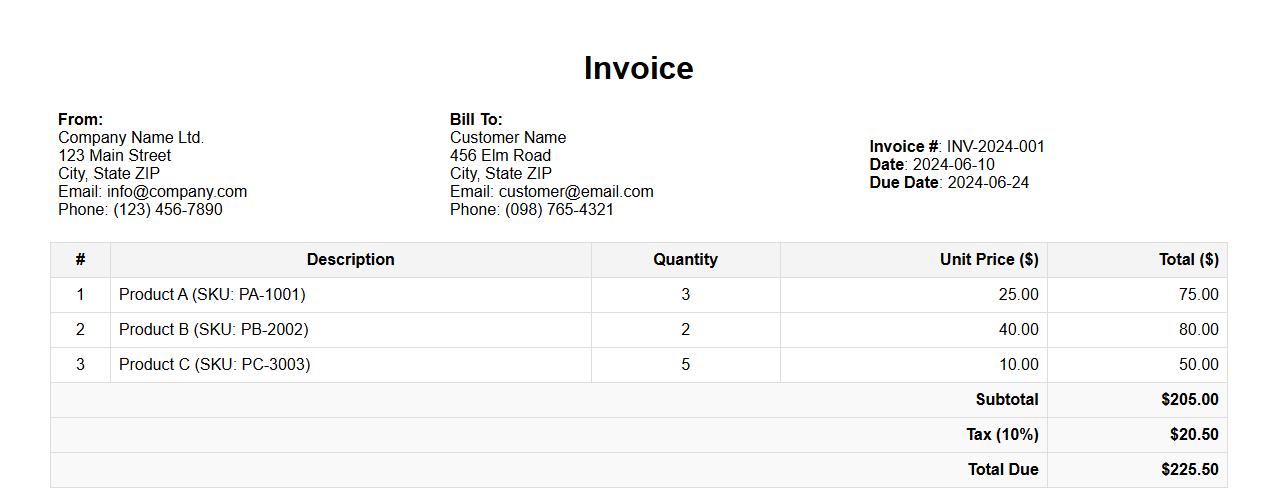

Detailed itemized invoice template sample for products

This detailed itemized invoice template sample provides a clear and organized layout for billing products, ensuring every item is accurately listed with prices and quantities. It is designed to enhance transparency and facilitate easy record-keeping for both businesses and customers. The template supports efficient transaction tracking and payment processing.

What are the mandatory fields for a compliant invoice?

A compliant invoice must include the seller's and buyer's full legal names and addresses. It should display a unique invoice number, date of issue, description of goods or services, and the total amount due. Additionally, tax details such as VAT or GST registration numbers and applied rates must be clearly stated.

How should invoice numbers be structured to prevent duplicates?

Invoice numbers should follow a sequential and unique format to avoid duplication. Incorporating date elements like year and month helps in organizing and tracking invoices efficiently. Using prefixes or suffixes related to departments or projects is another effective method to maintain uniqueness.

What supporting documents are required for international invoices?

International invoices must often be accompanied by customs declarations, proof of export, and shipping documents such as bills of lading. Additional documents like import licenses or certificates of origin may be required depending on the destination country. These documents ensure smooth customs clearance and validate the transaction legally.

How is VAT or GST calculated and displayed on invoices?

VAT or GST is calculated by applying the applicable tax rate to the taxable amount before adding it to the total price. The invoice must separately list the tax rate and the calculated tax amount for transparency. This clear breakdown helps both sellers and buyers comply with tax regulations effectively.

What are the best practices for digital invoice archiving?

Digital invoice archiving should ensure secure storage with backup systems to prevent data loss. Organizing files by date, client, or invoice number enhances retrieval efficiency. Additionally, compliance with local data retention laws and using trusted software platforms are essential for long-term management.