A VAT Invoice Sample Form provides a clear template for issuing invoices that comply with value-added tax regulations, ensuring accurate calculation and reporting of VAT amounts. It includes essential details such as the supplier's and customer's information, invoice date, itemized description of goods or services, VAT rate, and total amount payable. Using a standardized VAT Invoice Sample Form helps businesses maintain consistency and meet legal documentation requirements.

Downloadable VAT invoice sample form PDF

Download a VAT invoice sample form PDF to streamline your billing process and ensure compliance with tax regulations. This easily editable template allows you to accurately document transactions and VAT details for your business. Save time and maintain professionalism with a clear, downloadable invoice form.

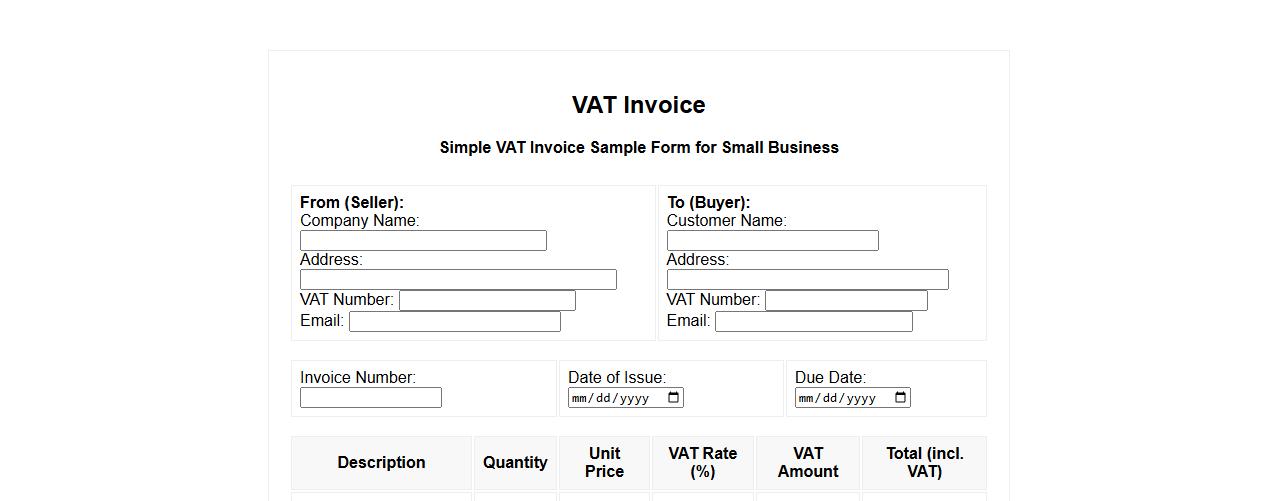

Simple VAT invoice sample form for small business

This simple VAT invoice sample form is designed specifically for small businesses to streamline their billing process. It includes essential fields to ensure compliance with VAT regulations while maintaining clarity and ease of use. Perfect for entrepreneurs seeking an efficient way to manage invoices without unnecessary complexity.

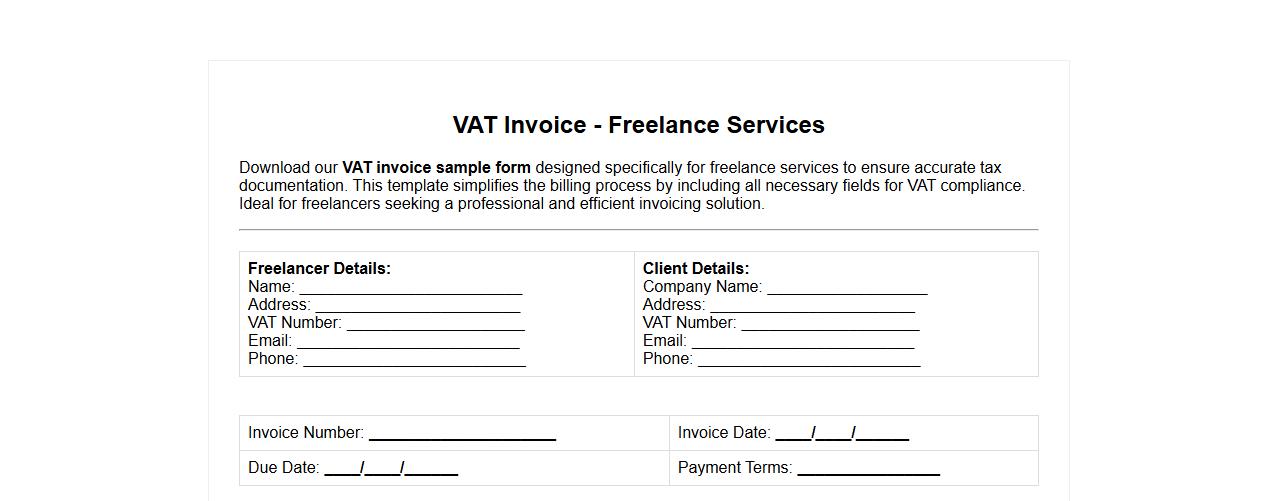

VAT invoice sample form for freelance services

Download our VAT invoice sample form designed specifically for freelance services to ensure accurate tax documentation. This template simplifies the billing process by including all necessary fields for VAT compliance. Ideal for freelancers seeking a professional and efficient invoicing solution.

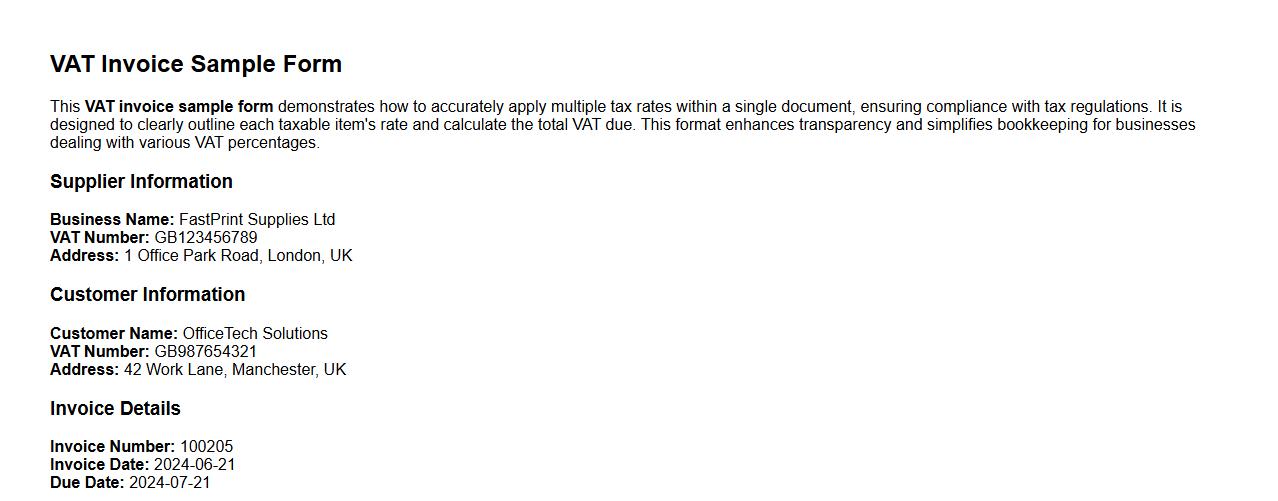

VAT invoice sample form with multiple tax rates

This VAT invoice sample form demonstrates how to accurately apply multiple tax rates within a single document, ensuring compliance with tax regulations. It is designed to clearly outline each taxable item's rate and calculate the total VAT due. This format enhances transparency and simplifies bookkeeping for businesses dealing with various VAT percentages.

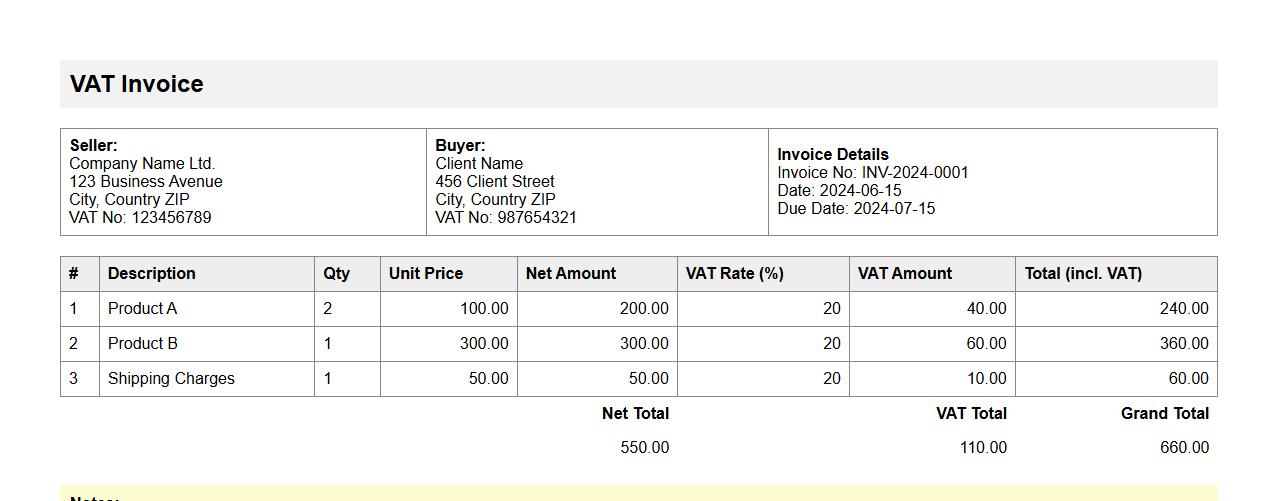

VAT invoice sample form including shipping charges

This VAT invoice sample form includes detailed sections for accurately listing products, prices, and applicable taxes, along with additional lines for shipping charges. It is designed to help businesses create compliant and professional invoices that reflect all transactional costs clearly. Using this template ensures transparency and simplifies tax reporting for both sellers and buyers.

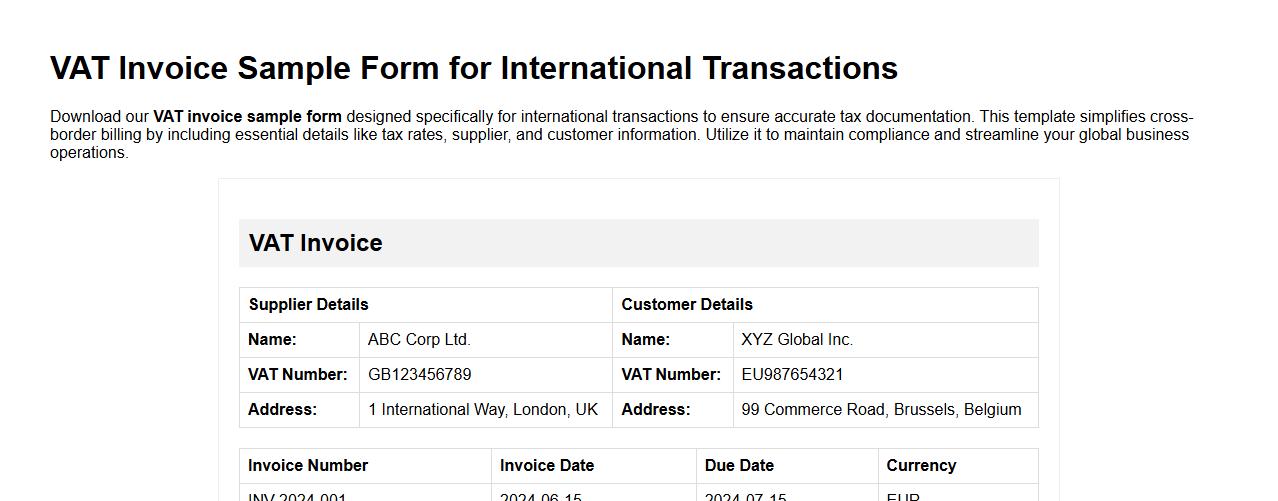

VAT invoice sample form for international transactions

Download our VAT invoice sample form designed specifically for international transactions to ensure accurate tax documentation. This template simplifies cross-border billing by including essential details like tax rates, supplier, and customer information. Utilize it to maintain compliance and streamline your global business operations.

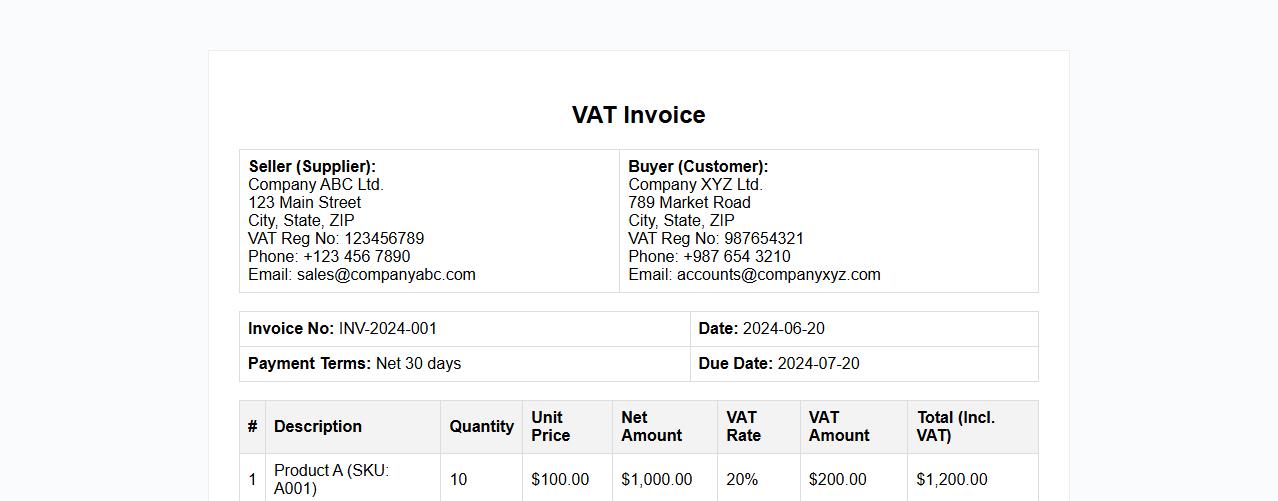

Detailed VAT invoice sample form with breakdown

This VAT invoice sample form provides a clear and detailed breakdown of all taxable items and corresponding VAT amounts, ensuring transparency for both buyers and sellers. It accurately displays essential information such as invoice number, date, seller and buyer details, product descriptions, quantities, unit prices, and VAT rates. This comprehensive format helps maintain compliance with tax regulations and facilitates smooth financial transactions.

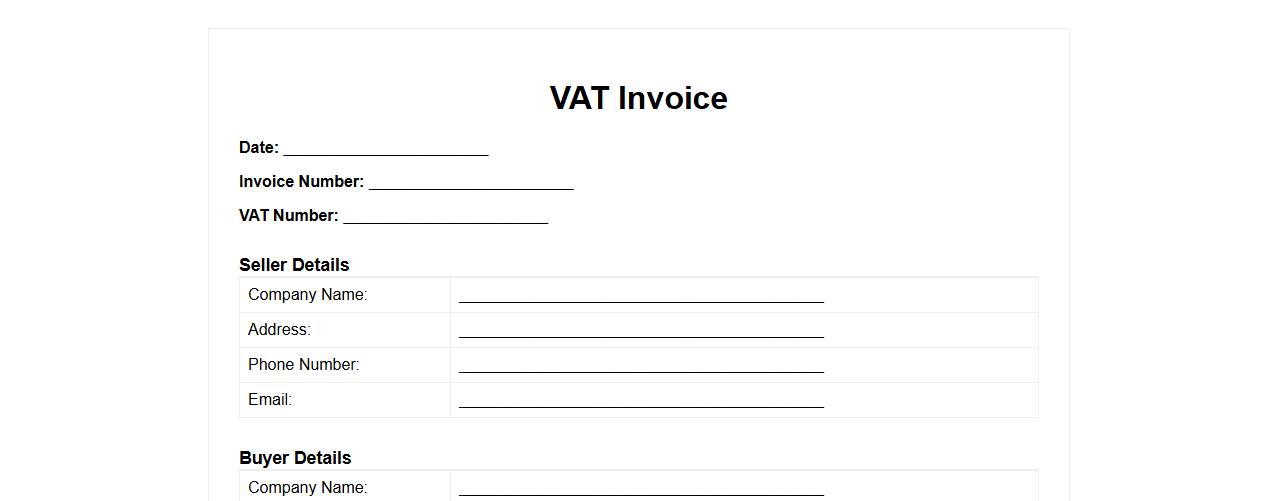

Blank VAT invoice sample form for printing

Download this blank VAT invoice sample form for easy printing and accurate record-keeping. This template is designed to streamline your billing process by providing a clear layout for VAT details and transaction information. Customize and print it to maintain professional and compliant invoicing.

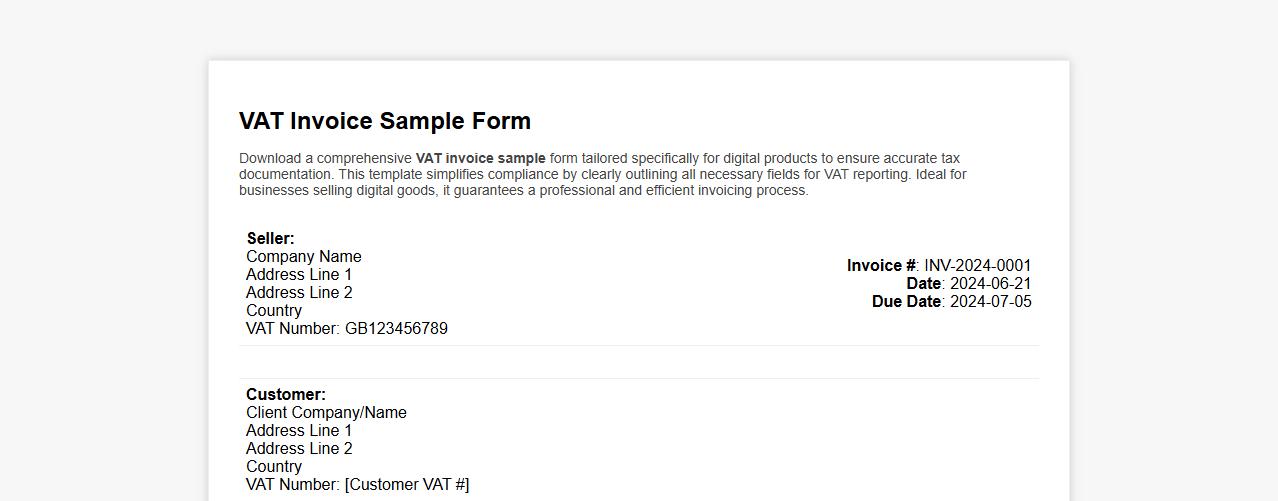

VAT invoice sample form for digital products

Download a comprehensive VAT invoice sample form tailored specifically for digital products to ensure accurate tax documentation. This template simplifies compliance by clearly outlining all necessary fields for VAT reporting. Ideal for businesses selling digital goods, it guarantees a professional and efficient invoicing process.

What specific details must be included in a VAT invoice form for cross-border transactions?

A VAT invoice for cross-border transactions must include the seller's and buyer's VAT identification numbers to ensure compliance with international tax regulations. It should also detail the transaction's description, quantity, and value of goods or services supplied. Additionally, the invoice must specify the applicable VAT rate and the amount charged, clearly indicating that the transaction is subject to reverse charge if applicable.

How should VAT exemption clauses be documented on the invoice form?

VAT exemption clauses must be clearly documented within the invoice to justify the non-application of VAT. The clause should cite the specific legal provision or regulation under which the exemption is granted. Furthermore, the invoice should explicitly state the reason for exemption, ensuring clarity and transparency for tax authorities.

What are the legal requirements for digital VAT invoice formats?

Legal requirements for digital VAT invoices mandate that the format must ensure authenticity, integrity, and readability throughout the invoicing process. Digital invoices should be generated or archived using trusted electronic signatures or secure electronic exchange systems. They must also comply with local tax laws regarding format, storage period, and accessibility for audit purposes.

How can a VAT invoice form accommodate multiple tax rates in a single transaction?

A VAT invoice form should list each item or service separately with its corresponding tax rate applied. It must provide a clear breakdown of taxable amounts, VAT rates, and the total VAT charged per rate. This structured representation helps in accurate tax calculation and compliance with tax authority requirements.

What supporting documents should be attached with a VAT invoice for zero-rated goods?

Supporting documents for zero-rated goods must prove that the goods qualify for zero-rating under tax law. These can include export declarations, customs documentation, and proof of transportation outside the VAT jurisdiction. Attaching these documents ensures validation of the zero-rating status and aids in smooth tax audits.