A Contractor Invoice Form Sample provides a standardized template for contractors to bill clients efficiently and accurately. This form typically includes sections for project details, labor hours, materials used, payment terms, and contact information to ensure clear communication. Using this sample helps streamline invoicing processes and improve financial record-keeping for both parties.

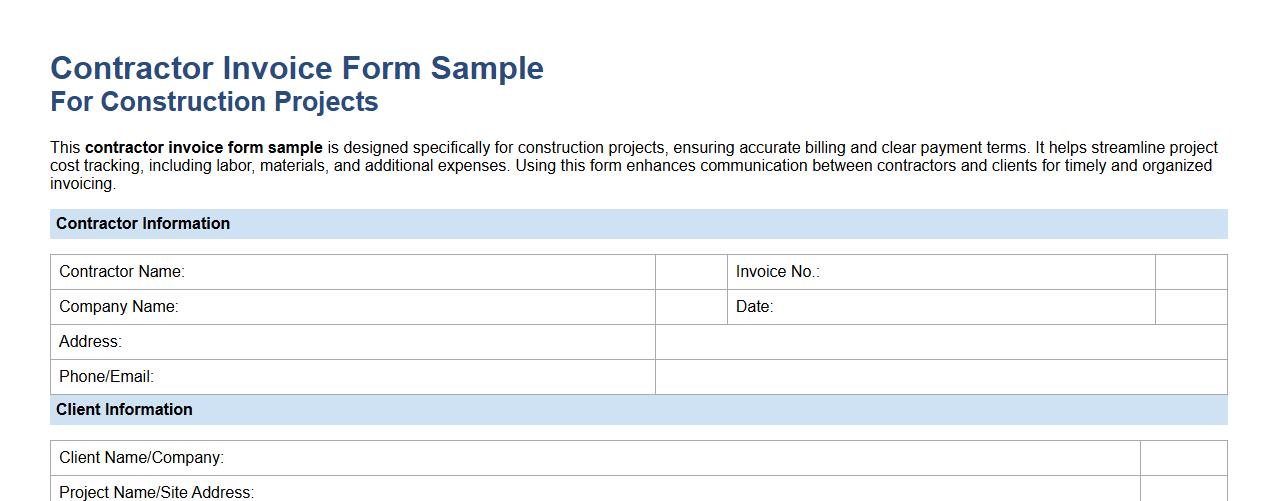

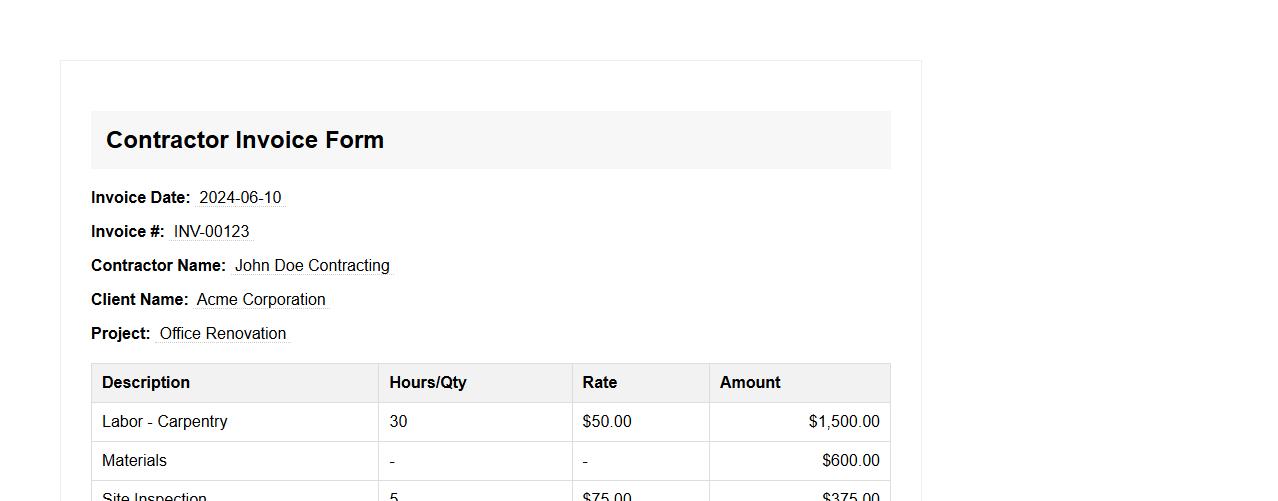

Contractor invoice form sample for construction projects

This contractor invoice form sample is designed specifically for construction projects, ensuring accurate billing and clear payment terms. It helps streamline project cost tracking, including labor, materials, and additional expenses. Using this form enhances communication between contractors and clients for timely and organized invoicing.

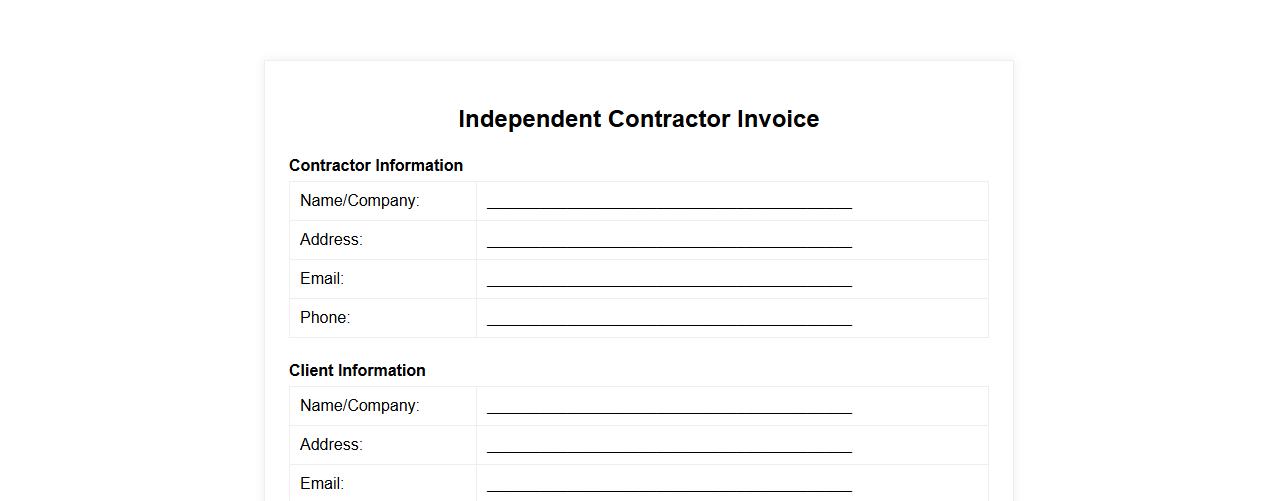

Independent contractor invoice form sample template

This independent contractor invoice form sample template provides a clear and professional format for billing clients efficiently. It includes sections for services rendered, payment terms, and contact information to streamline the invoicing process. Using this template ensures accurate and timely payments for freelance and contract work.

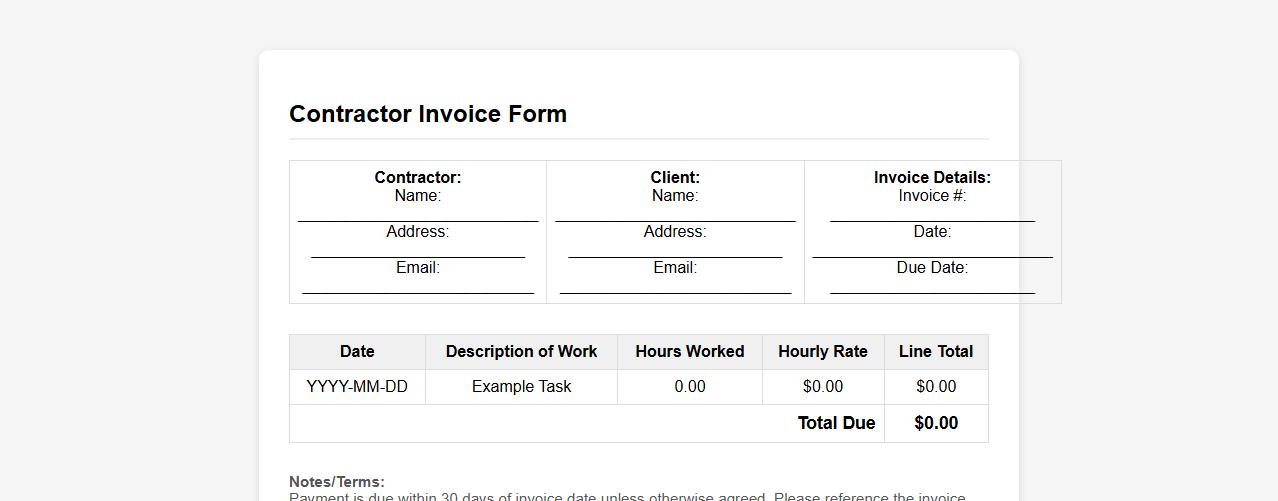

Contractor invoice form sample with hourly rates

This contractor invoice form sample with hourly rates streamlines billing by clearly itemizing hours worked and corresponding charges. It ensures transparent communication between contractors and clients, facilitating accurate payment processing. Using this template helps maintain professional and organized financial records for all contracted projects.

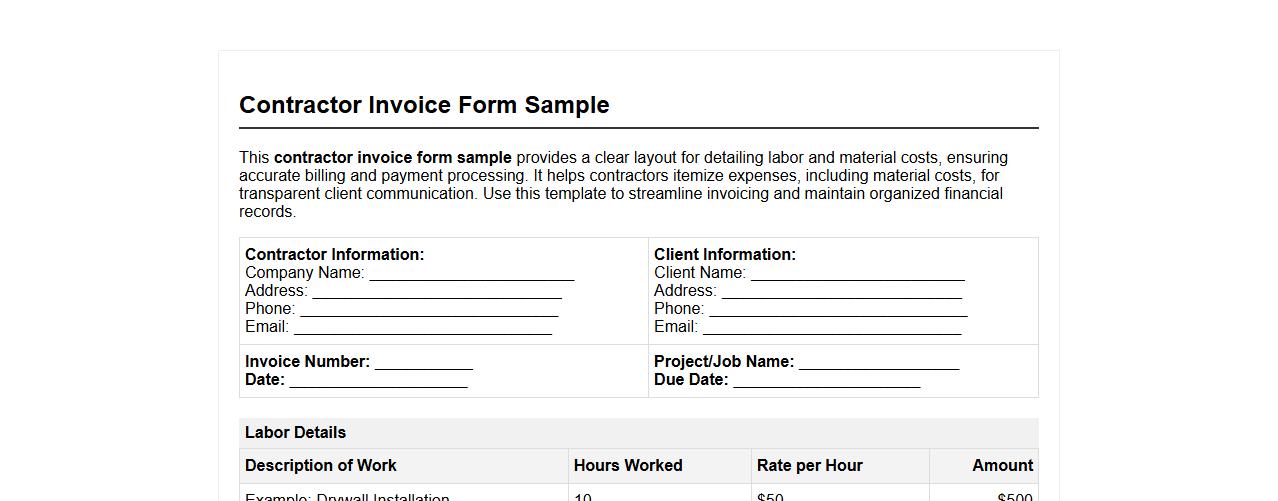

Contractor invoice form sample including material costs

This contractor invoice form sample provides a clear layout for detailing labor and material costs, ensuring accurate billing and payment processing. It helps contractors itemize expenses, including material costs, for transparent client communication. Use this template to streamline invoicing and maintain organized financial records.

Contractor invoice form sample with tax breakdown

This contractor invoice form sample includes a detailed tax breakdown to ensure accurate billing and compliance. It is designed to simplify the invoicing process by clearly itemizing charges and applicable taxes. Ideal for contractors seeking organized and transparent payment documentation.

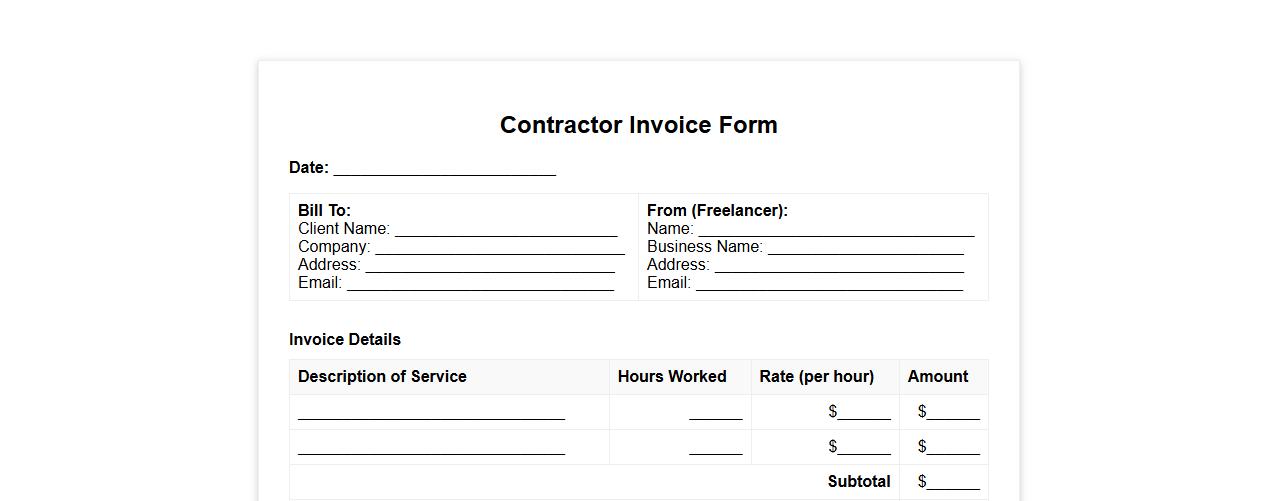

Contractor invoice form sample for freelance services

This contractor invoice form sample is designed specifically for freelance services, providing a clear and professional template for billing clients. It includes essential details such as service descriptions, hours worked, rates, and payment terms to ensure accurate and timely payments. Using this form helps freelancers maintain organized records and streamline their invoicing process.

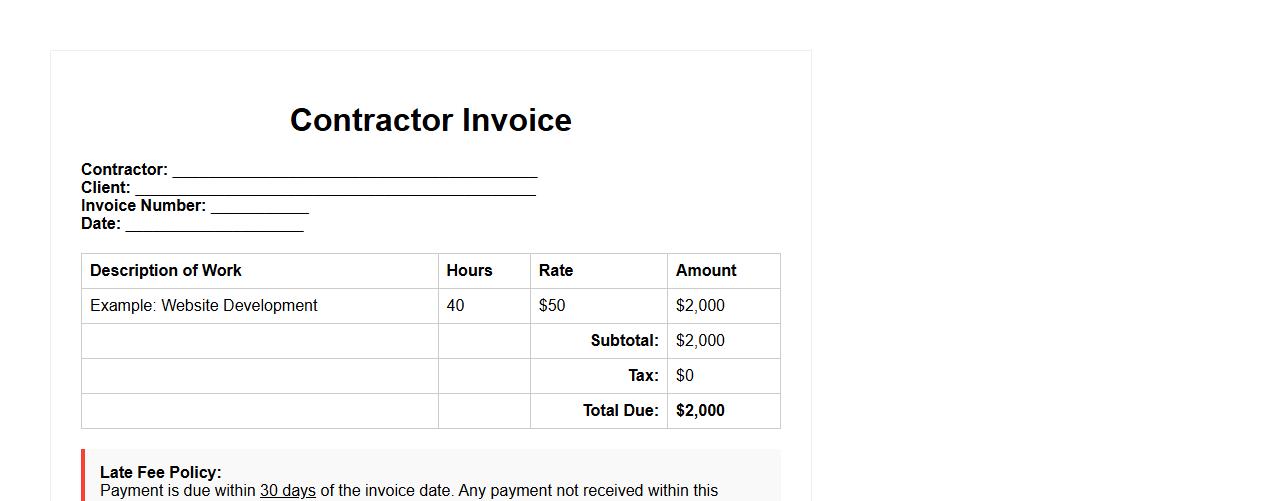

Contractor invoice form sample with late fee policy

This contractor invoice form sample provides a clear format for billing project costs and includes a detailed late fee policy to encourage timely payments. Designed to streamline contractor-client transactions, it helps avoid misunderstandings regarding payment deadlines. Utilizing this form ensures professional invoicing and efficient payment management.

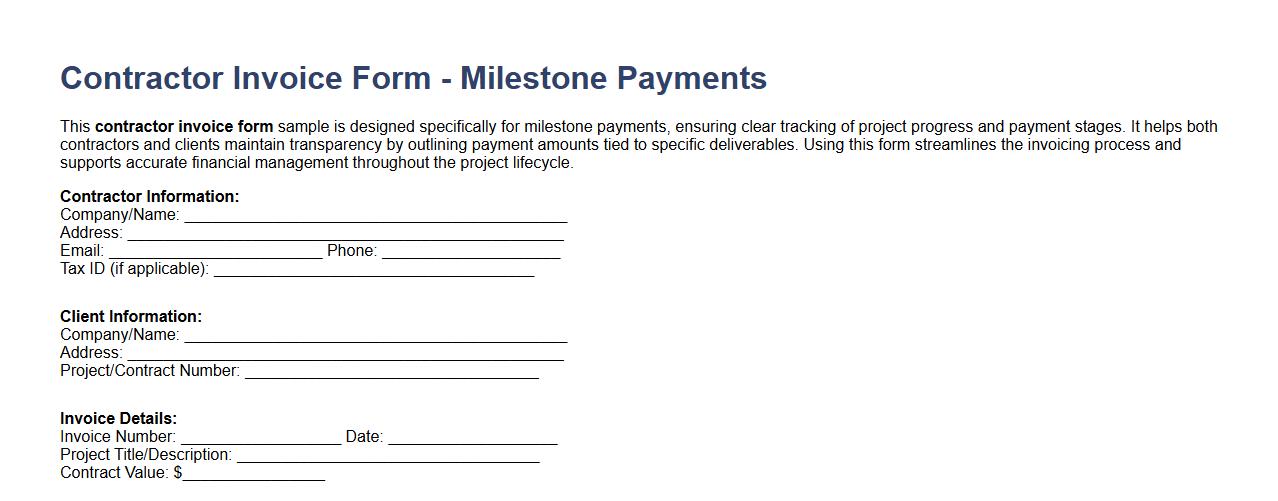

Contractor invoice form sample for milestone payments

This contractor invoice form sample is designed specifically for milestone payments, ensuring clear tracking of project progress and payment stages. It helps both contractors and clients maintain transparency by outlining payment amounts tied to specific deliverables. Using this form streamlines the invoicing process and supports accurate financial management throughout the project lifecycle.

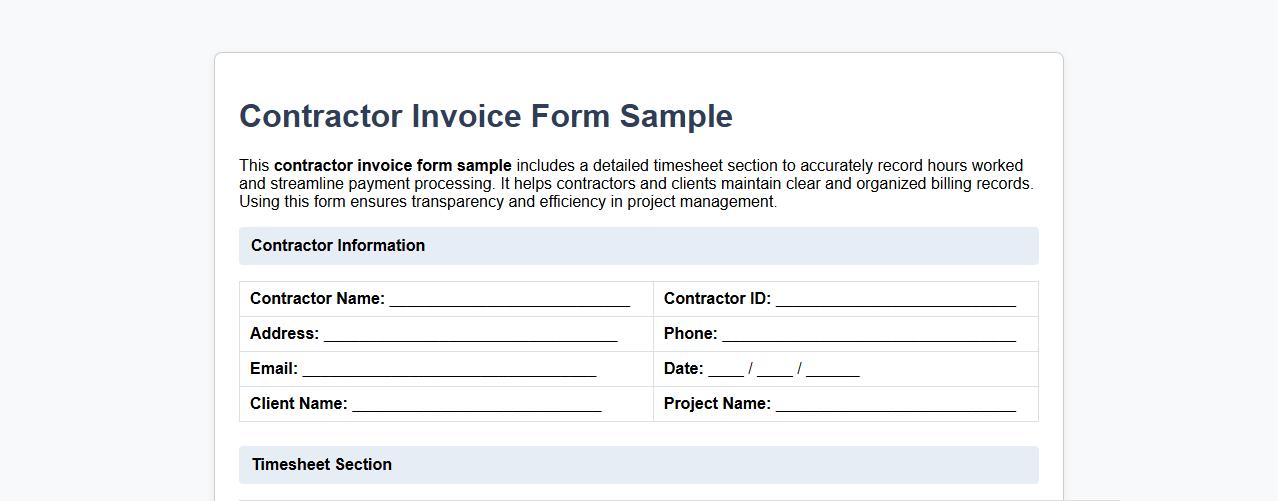

Contractor invoice form sample with timesheet section

This contractor invoice form sample includes a detailed timesheet section to accurately record hours worked and streamline payment processing. It helps contractors and clients maintain clear and organized billing records. Using this form ensures transparency and efficiency in project management.

What details must a Contractor Invoice Form include for compliance auditing?

A Contractor Invoice Form must include the contractor's name, invoice number, and date to ensure accurate tracking. It should also list detailed descriptions of services rendered or materials supplied along with corresponding costs. Including contract references and payment terms is essential for thorough compliance auditing.

How should change orders be documented within a Contractor Invoice Form?

Change orders must be clearly referenced within the invoice with a unique change order number and date. Descriptions of the changed work, along with approved cost adjustments, should be detailed precisely. Proper documentation of change orders supports transparency and prevents billing disputes.

Which signatures are legally required on a Contractor Invoice Form?

A contractor's signature is mandatory to verify the authenticity of the invoice. Additionally, an authorized representative from the hiring company should sign to confirm approval of the billed services or materials. These signatures provide legal validation and protect both parties in case of audits.

How are retainage amounts specified in a Contractor Invoice Form?

The invoice must clearly detail the retainage percentage withheld based on contract terms and the resulting deducted amount. It should show both the gross amount due and the net amount after retainage deductions. Specifying retainage ensures compliance with payment withholding regulations.

What backup documentation should accompany a Contractor Invoice Form submission?

Supporting documents such as timesheets, delivery receipts, and approved work orders must accompany the invoice submission. Photographic evidence or inspection reports may be included to substantiate completed work. Providing comprehensive backup documentation facilitates efficient auditing and payment processing.