A Supplier Invoice Form Sample helps businesses accurately record and process payments for goods or services received from suppliers. This form typically includes details such as supplier information, invoice number, date, items supplied, quantities, prices, and total amount payable. Using a standardized Supplier Invoice Form Sample ensures consistency and streamlines financial record-keeping.

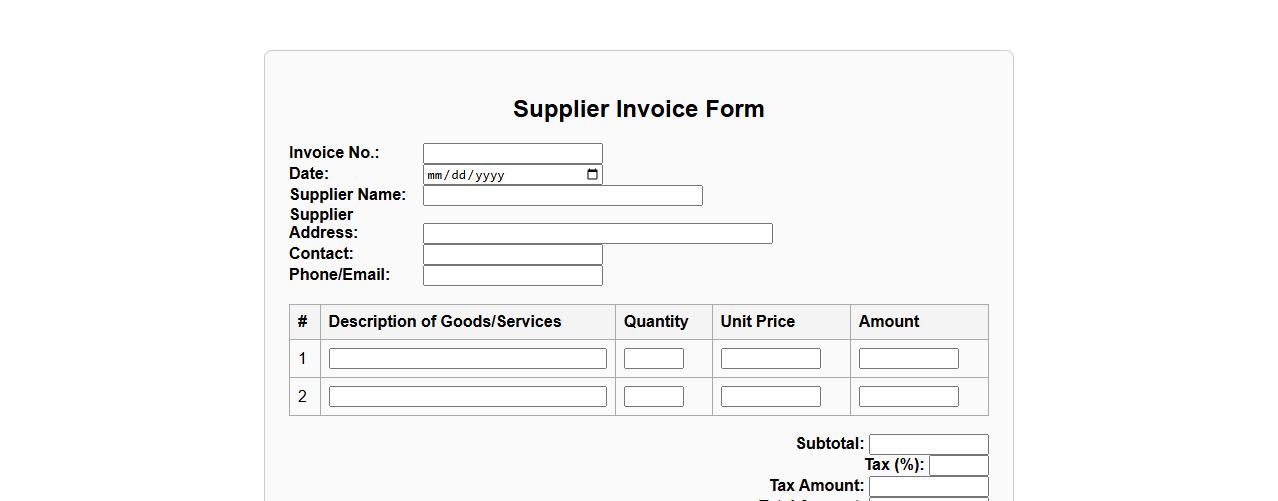

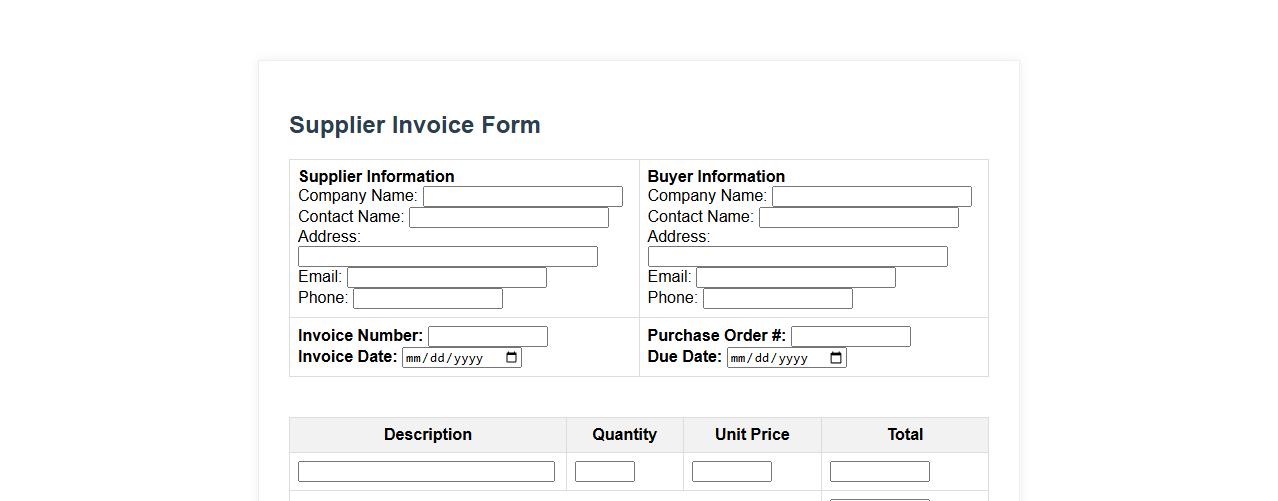

Supplier invoice form sample for small business

A supplier invoice form sample for small businesses helps streamline billing and payment processes by clearly outlining product details, costs, and payment terms. This template ensures accuracy and efficiency, reducing errors and improving supplier communication. Utilizing a standardized form supports smooth financial management and record-keeping for small enterprises.

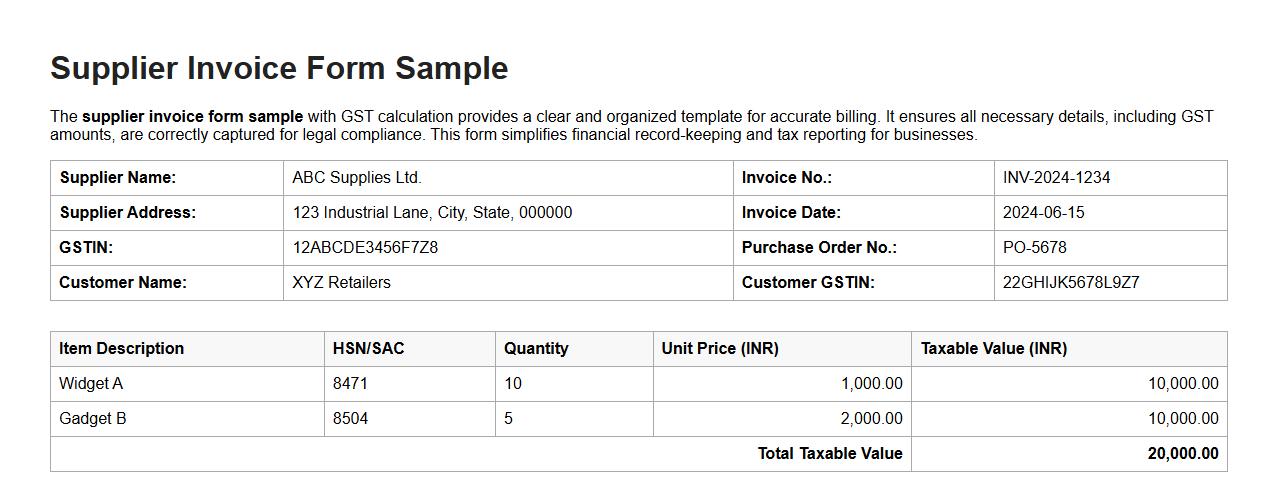

Supplier invoice form sample with GST calculation

The supplier invoice form sample with GST calculation provides a clear and organized template for accurate billing. It ensures all necessary details, including GST amounts, are correctly captured for legal compliance. This form simplifies financial record-keeping and tax reporting for businesses.

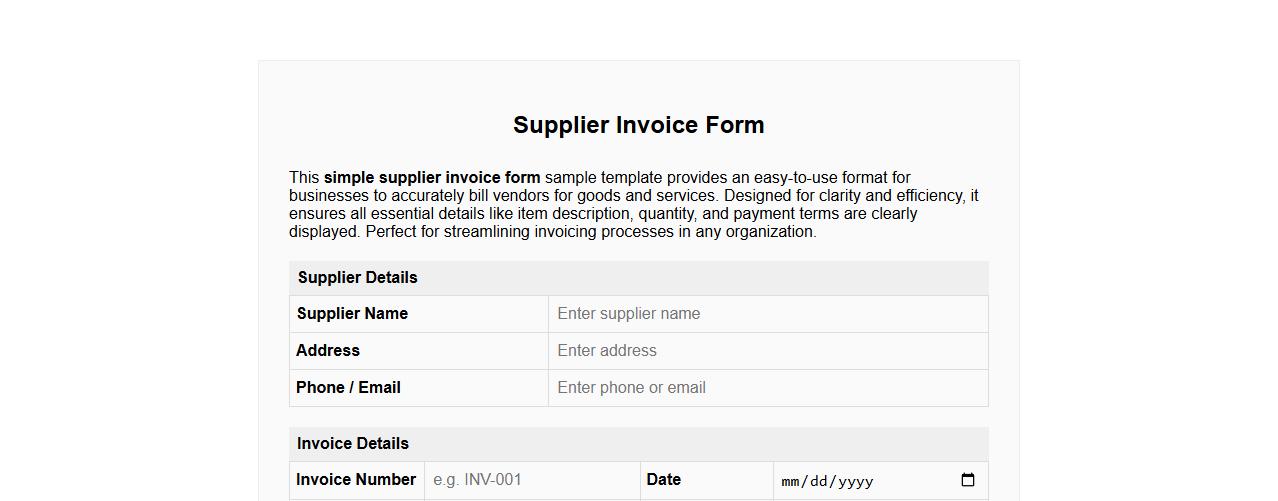

Simple supplier invoice form sample template

This simple supplier invoice form sample template provides an easy-to-use format for businesses to accurately bill vendors for goods and services. Designed for clarity and efficiency, it ensures all essential details like item description, quantity, and payment terms are clearly displayed. Perfect for streamlining invoicing processes in any organization.

Free supplier invoice form sample download

Download a free supplier invoice form sample to streamline your payment process and maintain accurate records. This customizable template helps you easily document purchase details and supplier information. Save time and enhance your business organization with this efficient invoice form.

Supplier invoice form sample with payment terms

This supplier invoice form sample includes detailed payment terms to ensure clear and effective communication between buyers and suppliers. Designed for easy customization, it helps streamline invoice processing and payment tracking. Use this template to maintain transparency and avoid payment delays.

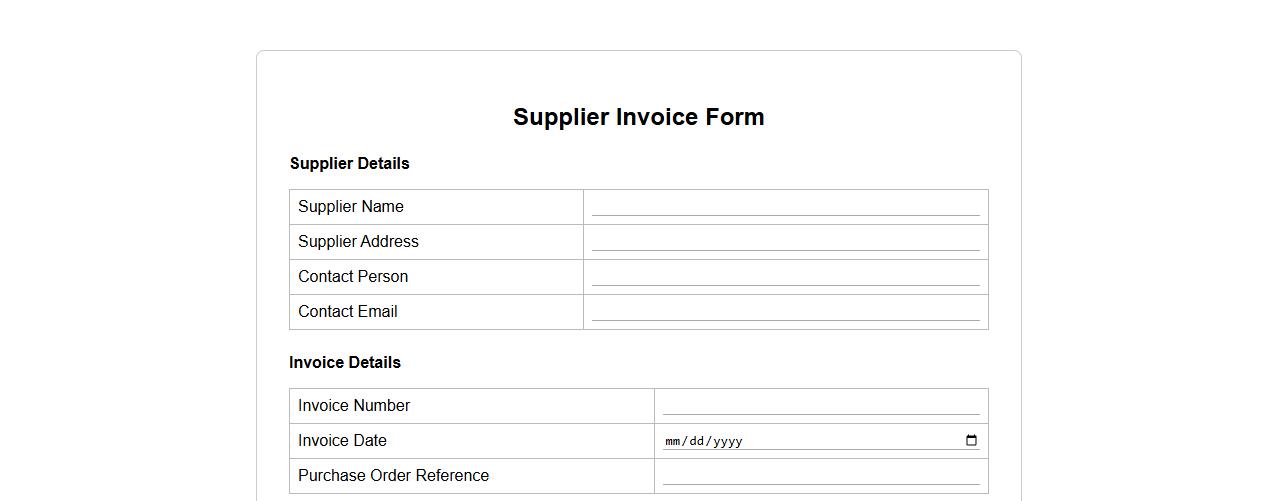

Supplier invoice form sample for purchase orders

The supplier invoice form sample for purchase orders ensures accurate billing and streamlined payment processing. It includes essential fields like supplier details, invoice number, purchase order reference, and itemized costs. Using this form helps maintain clear records and facilitates efficient financial management.

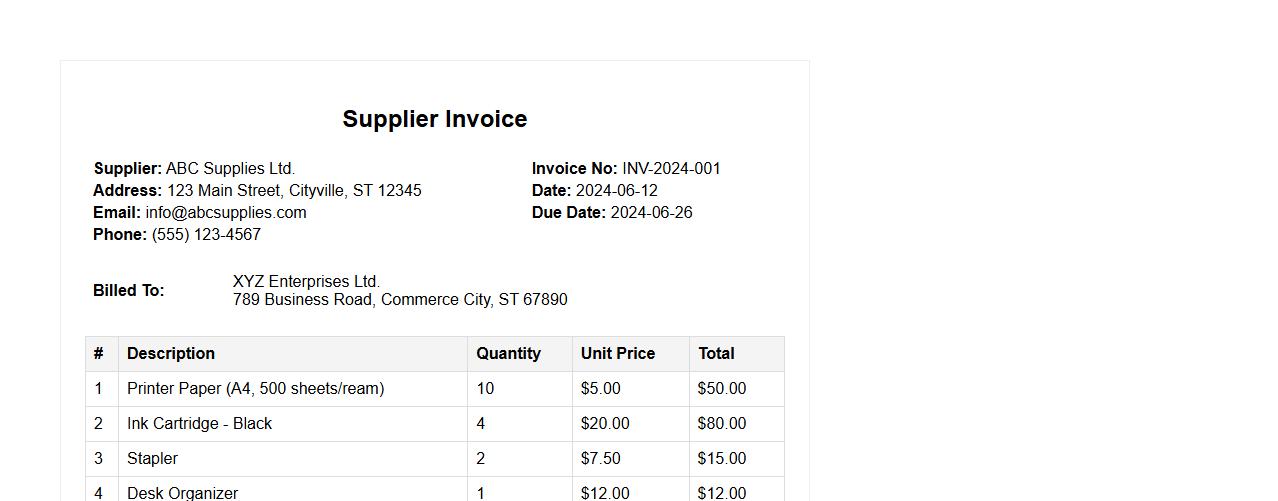

Supplier invoice form sample with itemized list

The supplier invoice form sample with itemized list provides a clear and organized way to detail each purchased item along with its cost, quantity, and description. This format ensures accurate billing and easier tracking for both suppliers and buyers. Using an itemized list helps in maintaining transparency and simplifies the payment process.

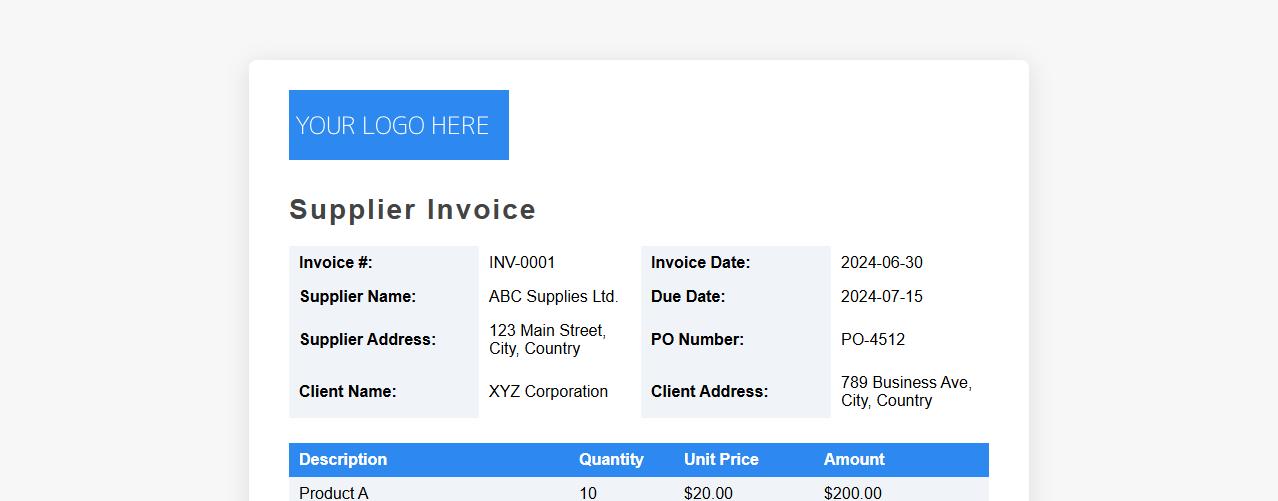

Supplier invoice form sample with company logo

Download our supplier invoice form sample designed to include your company logo for a professional appearance. This template ensures clear and efficient billing between suppliers and clients. Customize it easily to match your branding and streamline your invoicing process.

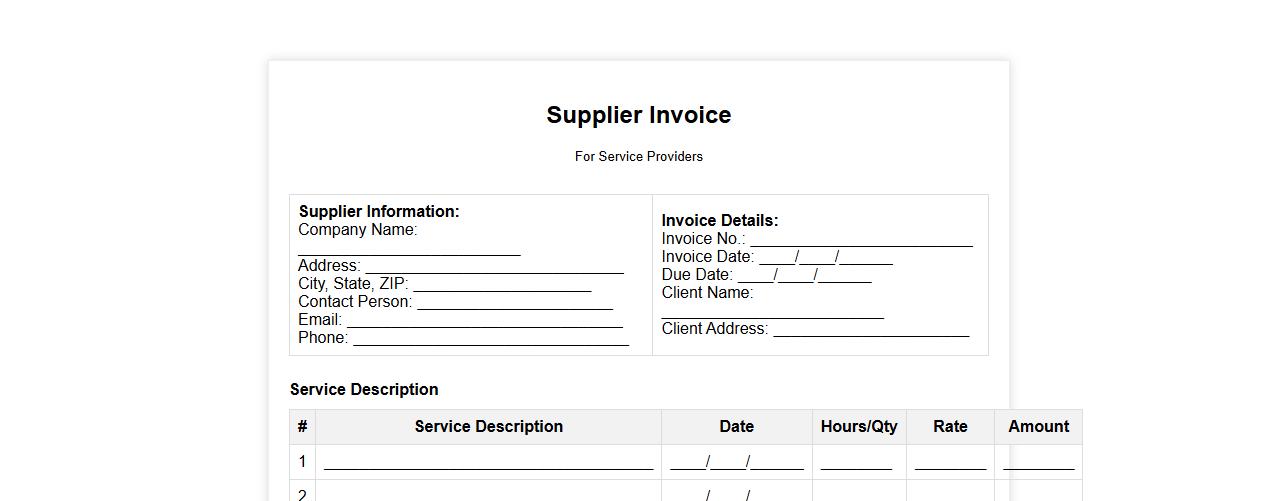

Supplier invoice form sample for service providers

This supplier invoice form sample is designed specifically for service providers to ensure accurate billing and payment processing. It includes essential sections such as service description, date, and payment terms, facilitating smooth financial transactions. Using this form helps maintain clear communication between suppliers and clients.

What fields are mandatory on the supplier invoice form for compliance?

The supplier invoice form must include the supplier's complete name and address. It is essential to have a unique invoice number and the invoice date for tracking purposes. Additionally, the form should list a detailed description of goods or services provided, along with the total amount payable.

How is tax (VAT/GST) breakdown recorded on the invoice form?

The tax breakdown section clearly separates the taxable amount and the tax rate applied, showing either VAT or GST. It includes the total tax amount calculated based on the applicable percentage. This helps ensure transparency and ease of verification for accounting and compliance audits.

Which approval signatures are required on a supplier invoice form?

The supplier invoice form requires approval from an authorized finance officer or accountant to validate payment. Additionally, a department head or a purchase manager's signature is often mandatory to confirm goods or services received. These signatures help maintain accountability and prevent fraudulent transactions.

How are multiple purchase orders referenced on a single supplier invoice form?

The invoice form can reference multiple purchase order numbers by listing each PO number clearly in a dedicated section. This ensures that all billed items correspond to valid orders, facilitating easier reconciliation. Proper referencing also streamlines internal auditing and payment processing.

What format is preferred for electronic submission of the supplier invoice form?

The preferred format for electronic submission is typically PDF or e-invoice XML, ensuring data integrity and readability. These formats support secure transmission and comply with electronic invoicing standards. Using standardized electronic formats accelerates processing and reduces errors.