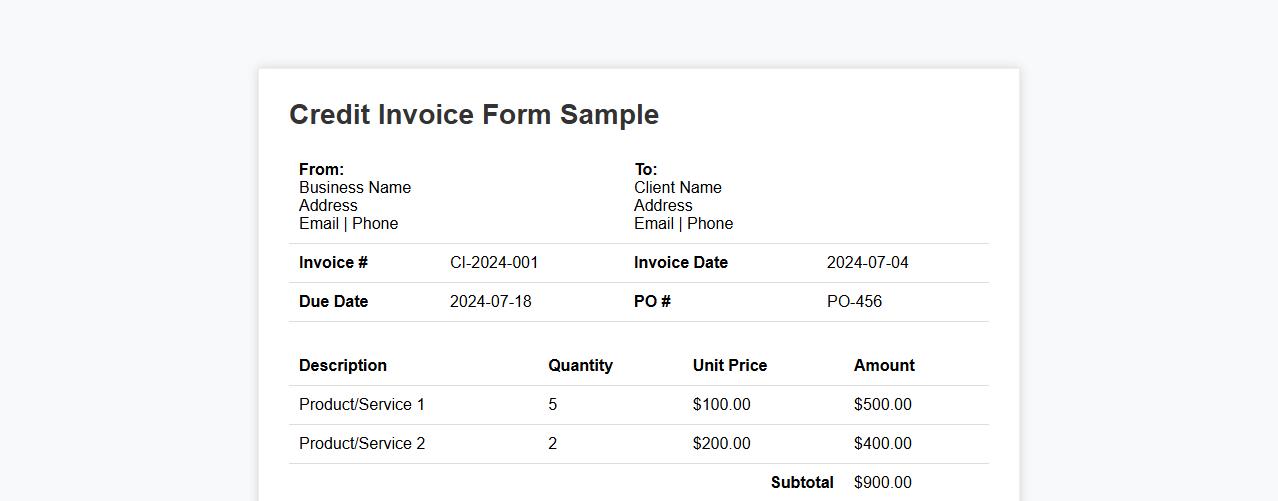

A Credit Invoice Form Sample is a pre-designed document used to record credit transactions between a seller and a buyer, detailing returned goods or adjustments to previously issued invoices. This form typically includes fields for item descriptions, quantities, credit amounts, and customer information, ensuring accurate financial tracking and communication. Utilizing a well-structured Credit Invoice Form Sample helps streamline accounting processes and maintain transparent records.

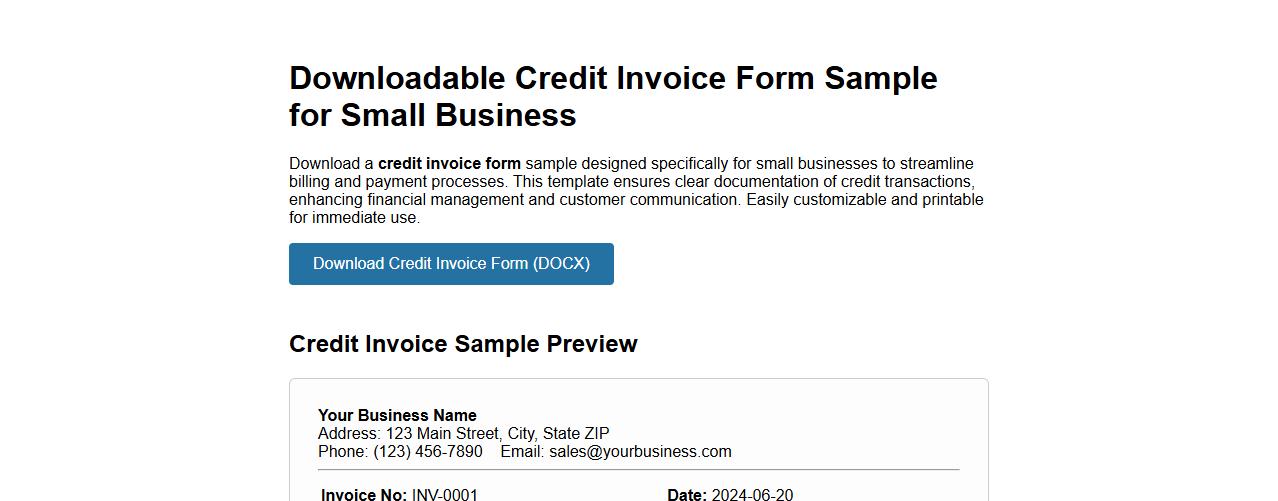

Downloadable credit invoice form sample for small business

Download a credit invoice form sample designed specifically for small businesses to streamline billing and payment processes. This template ensures clear documentation of credit transactions, enhancing financial management and customer communication. Easily customizable and printable for immediate use.

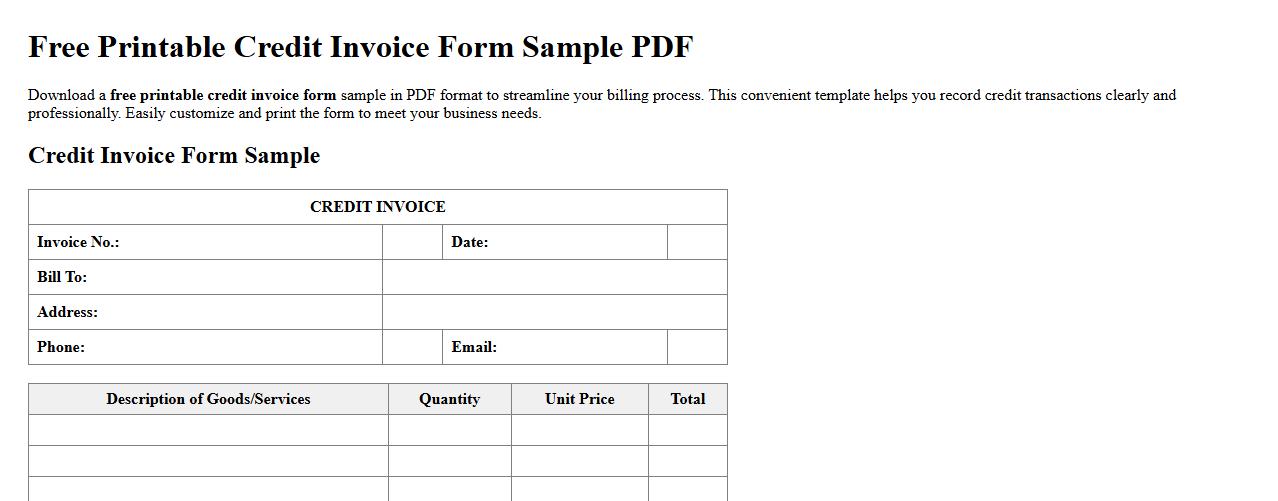

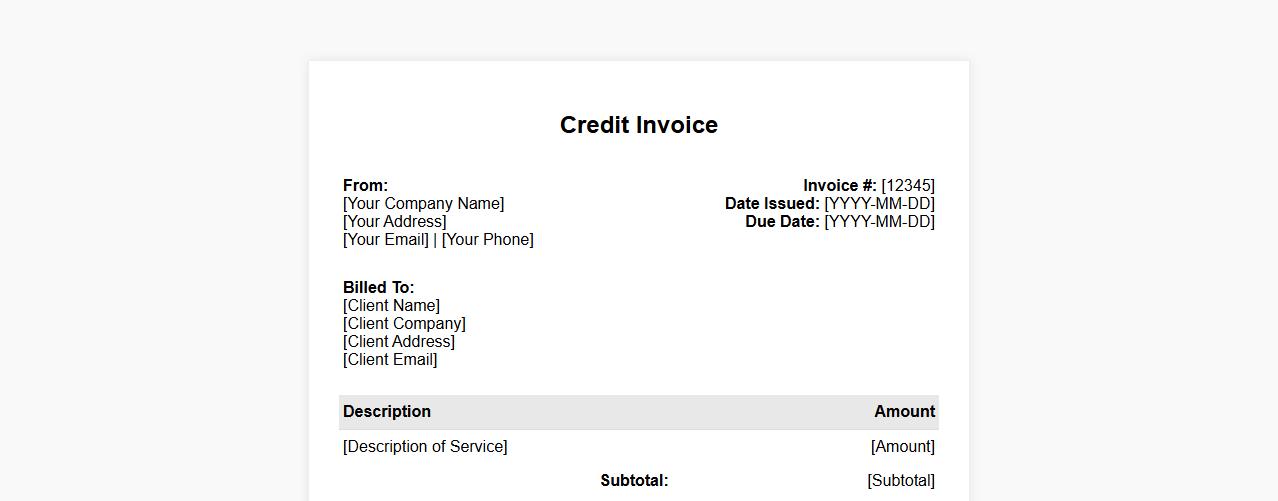

Free printable credit invoice form sample PDF

Download a free printable credit invoice form sample in PDF format to streamline your billing process. This convenient template helps you record credit transactions clearly and professionally. Easily customize and print the form to meet your business needs.

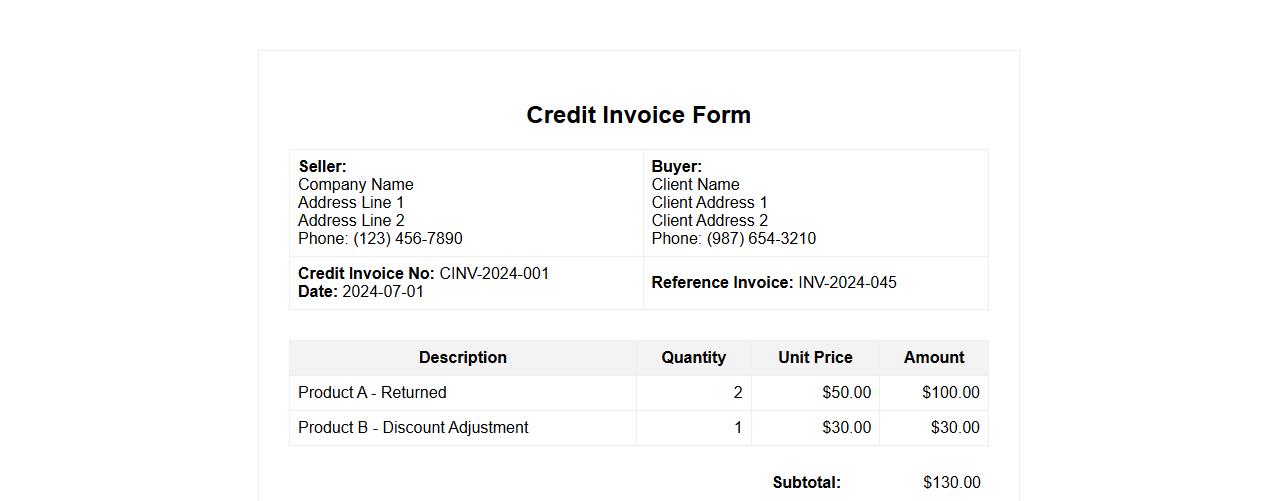

Credit invoice form sample with tax calculation

The credit invoice form sample with tax calculation simplifies financial transactions by clearly detailing credits and applicable taxes. It ensures accurate accounting and seamless record-keeping for both sellers and buyers. This template enhances transparency and compliance in invoicing processes.

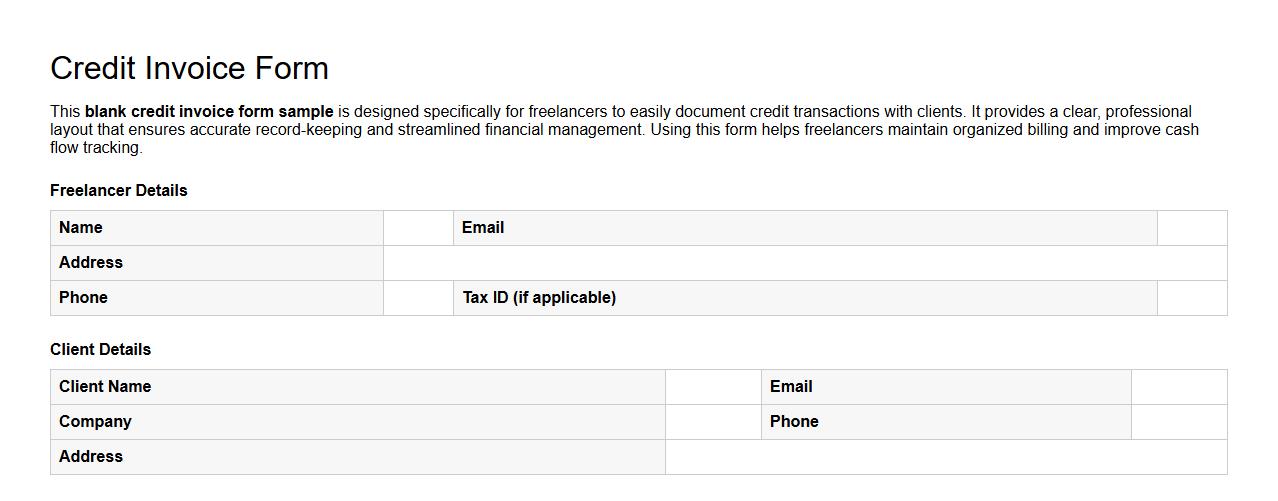

Blank credit invoice form sample for freelancers

This blank credit invoice form sample is designed specifically for freelancers to easily document credit transactions with clients. It provides a clear, professional layout that ensures accurate record-keeping and streamlined financial management. Using this form helps freelancers maintain organized billing and improve cash flow tracking.

Credit invoice form sample including payment terms

A credit invoice form sample provides a clear layout for documenting credit transactions between businesses, detailing the amounts owed and payment deadlines. It typically includes essential payment terms such as due dates, interest rates on late payments, and acceptable payment methods. Utilizing this form ensures transparent communication and helps maintain smooth financial operations.

Simple credit invoice form sample for services rendered

This simple credit invoice form sample is designed for services rendered, providing a clear and professional layout. It allows easy tracking of client payments and outstanding balances, ensuring smooth financial transactions. Ideal for freelancers and small businesses, this template simplifies billing processes.

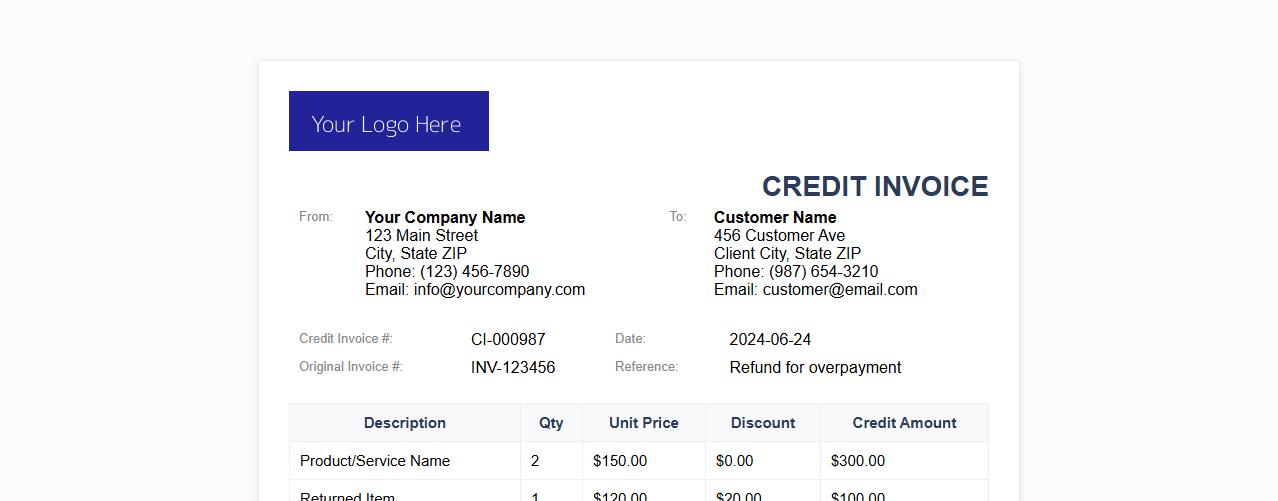

Credit invoice form sample with company logo

Enhance your billing process with this credit invoice form sample featuring a customizable company logo for professional branding. It provides a clear layout to detail transaction credits efficiently. Easily adaptable for any business to streamline financial documentation.

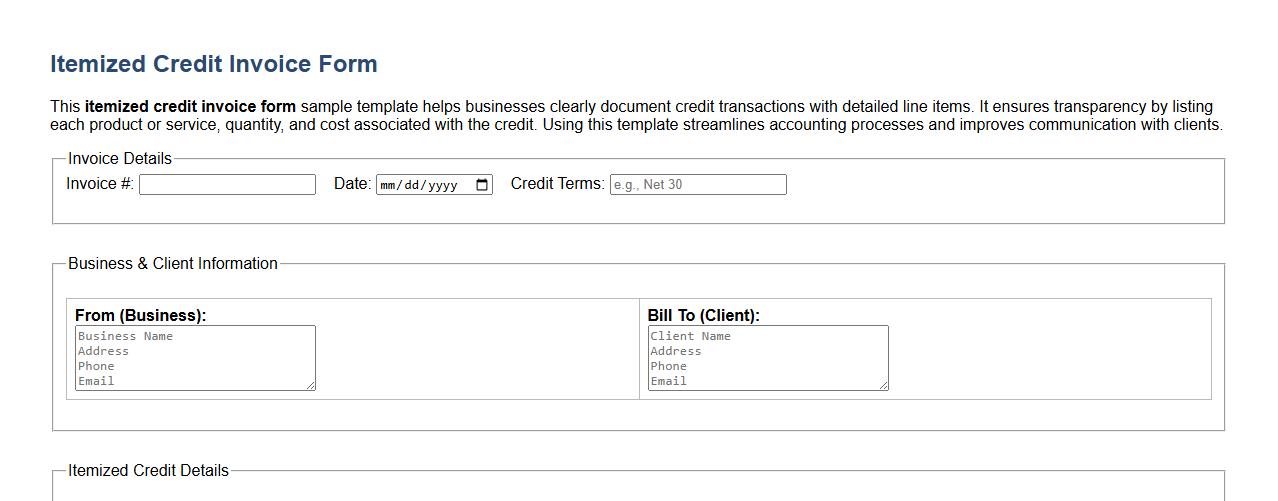

Itemized credit invoice form sample template

This itemized credit invoice form sample template helps businesses clearly document credit transactions with detailed line items. It ensures transparency by listing each product or service, quantity, and cost associated with the credit. Using this template streamlines accounting processes and improves communication with clients.

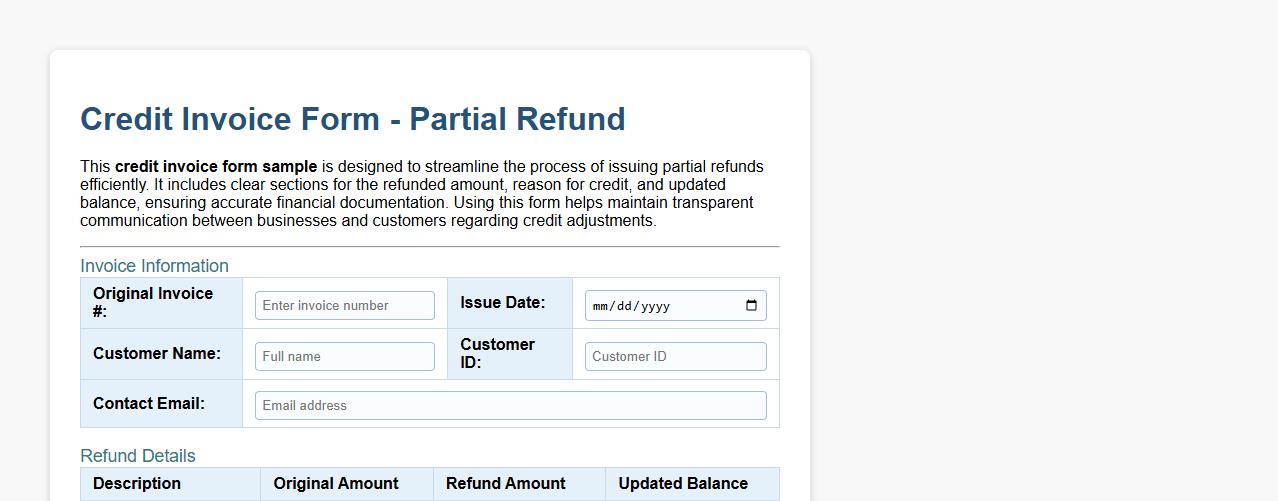

Credit invoice form sample for partial refunds

This credit invoice form sample is designed to streamline the process of issuing partial refunds efficiently. It includes clear sections for the refunded amount, reason for credit, and updated balance, ensuring accurate financial documentation. Using this form helps maintain transparent communication between businesses and customers regarding credit adjustments.

What mandatory fields must be included in a credit invoice form?

A credit invoice form must include mandatory fields such as the credit invoice number, date of issue, and details of the supplier and customer. It should also clearly state the original invoice number being credited and the reasons for the credit. Additionally, the form must include the description of goods or services, the amount credited, and applicable tax details.

How should tax adjustments be reflected in a credit invoice?

Tax adjustments on a credit invoice must be accurately reflected by specifying the original tax amount and the adjusted tax value. The credit invoice should display the tax rate applied and the total tax adjustment as a negative amount. This ensures transparency and compliance with tax regulations for both the issuer and recipient.

Which supporting documents are typically required with a credit invoice submission?

Supporting documents usually required include copies of the original invoice, a detailed explanation or authorization for the credit, and any related correspondence. Proof of returned goods or cancelled services may also be necessary to validate the credit. These documents help in verifying the authenticity of the credit transaction and facilitate proper accounting.

How is the reference to the original invoice documented in a credit invoice form?

The credit invoice must reference the original invoice by including its unique invoice number and date. This cross-reference creates a clear link between the two documents, ensuring traceability and accurate financial records. Proper documentation helps both parties reconcile transactions effectively.

What are the legal compliance requirements for credit invoice forms in cross-border transactions?

Credit invoices in cross-border transactions must comply with the tax laws and invoicing regulations of both the supplier's and customer's countries. This includes correct application of international VAT/GST rules, currency specifications, and language requirements. Ensuring legal compliance reduces the risk of disputes and penalties during international trade.