A Purchase Invoice Format serves as a standardized template used by businesses to record the details of goods or services purchased. It typically includes key information such as supplier details, invoice number, date, item descriptions, quantities, prices, and total amount payable. Maintaining a clear and accurate Purchase Invoice Format ensures efficient financial tracking and simplifies accounting processes.

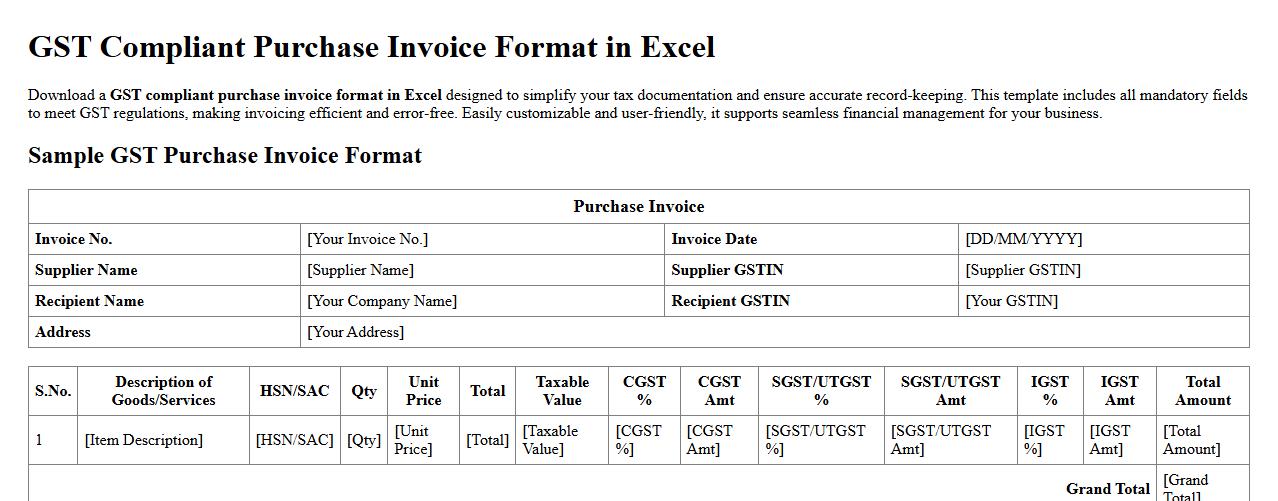

GST compliant purchase invoice format in Excel

Download a GST compliant purchase invoice format in Excel designed to simplify your tax documentation and ensure accurate record-keeping. This template includes all mandatory fields to meet GST regulations, making invoicing efficient and error-free. Easily customizable and user-friendly, it supports seamless financial management for your business.

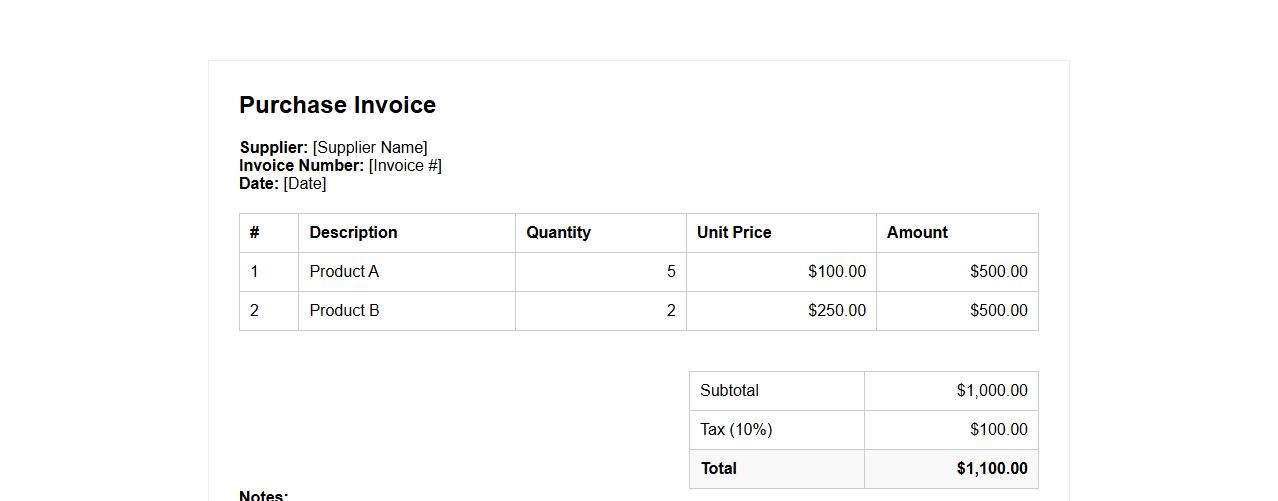

Purchase invoice format with tax calculation

Our purchase invoice format with tax calculation simplifies financial documentation by automatically computing applicable taxes. This format ensures accuracy and compliance with tax regulations, streamlining your accounting process. Easily customize and use it for efficient record-keeping and auditing purposes.

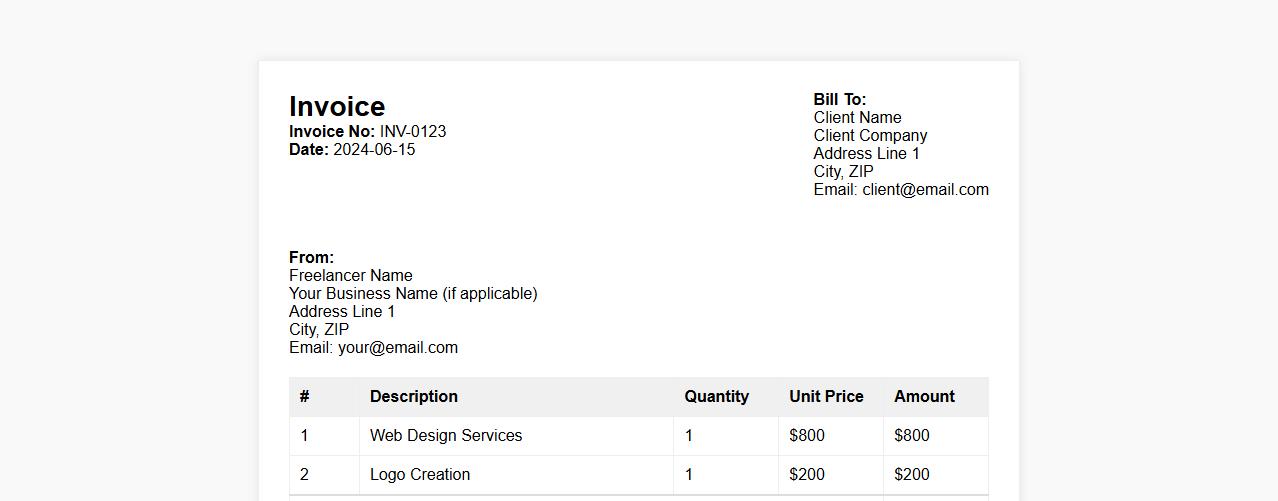

Simple purchase invoice format for freelancers

Our simple purchase invoice format is designed specifically for freelancers to streamline their billing process. It includes all essential details like client information, services rendered, and payment terms for easy and professional invoicing. This format ensures quick customization and efficient record-keeping for freelance projects.

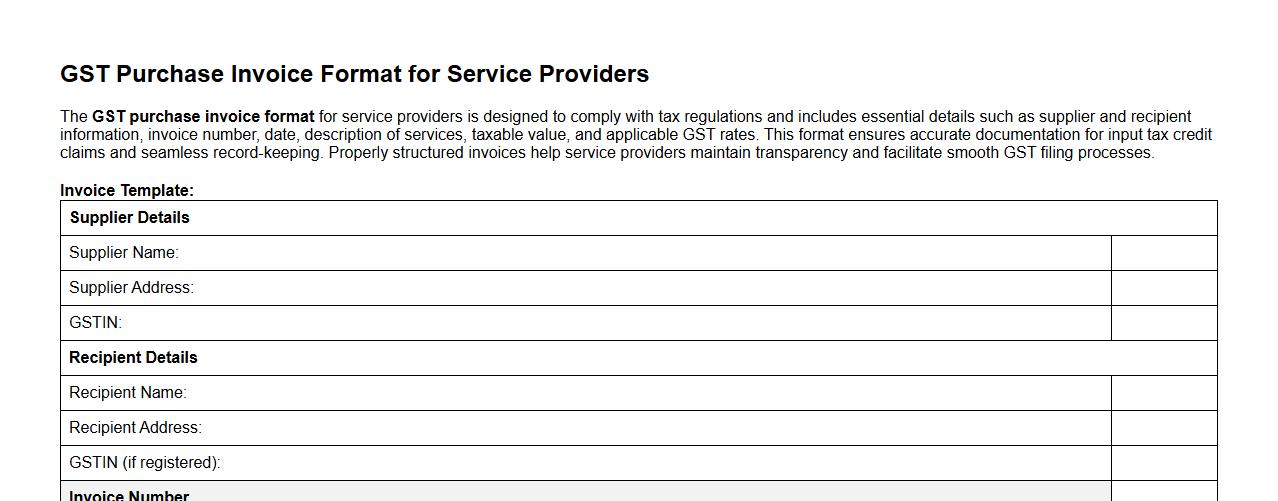

GST purchase invoice format for service providers

The GST purchase invoice format for service providers is designed to comply with tax regulations and includes essential details such as supplier and recipient information, invoice number, date, description of services, taxable value, and applicable GST rates. This format ensures accurate documentation for input tax credit claims and seamless record-keeping. Properly structured invoices help service providers maintain transparency and facilitate smooth GST filing processes.

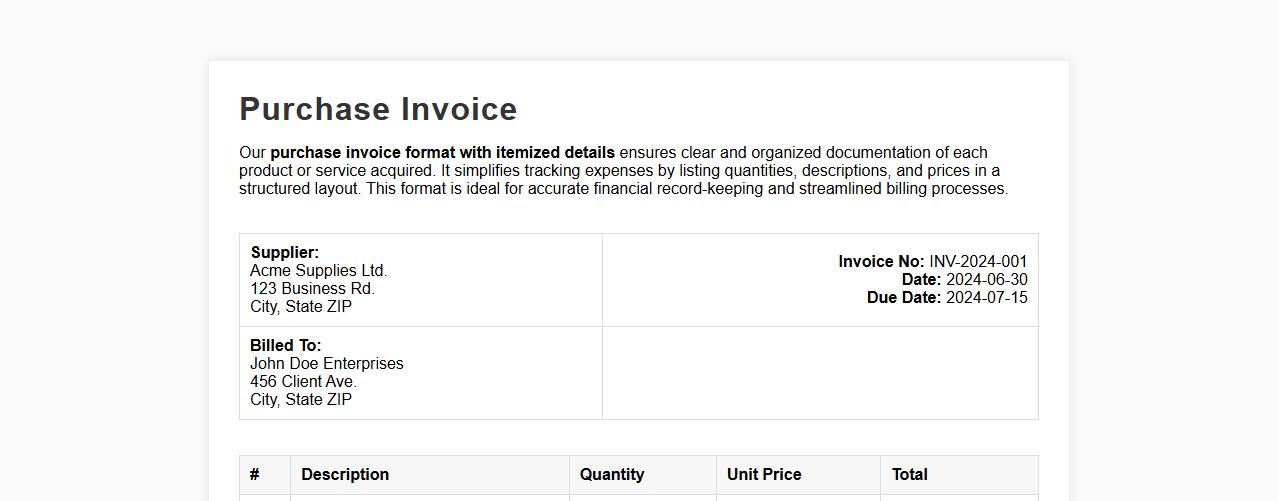

Purchase invoice format with itemized details

Our purchase invoice format with itemized details ensures clear and organized documentation of each product or service acquired. It simplifies tracking expenses by listing quantities, descriptions, and prices in a structured layout. This format is ideal for accurate financial record-keeping and streamlined billing processes.

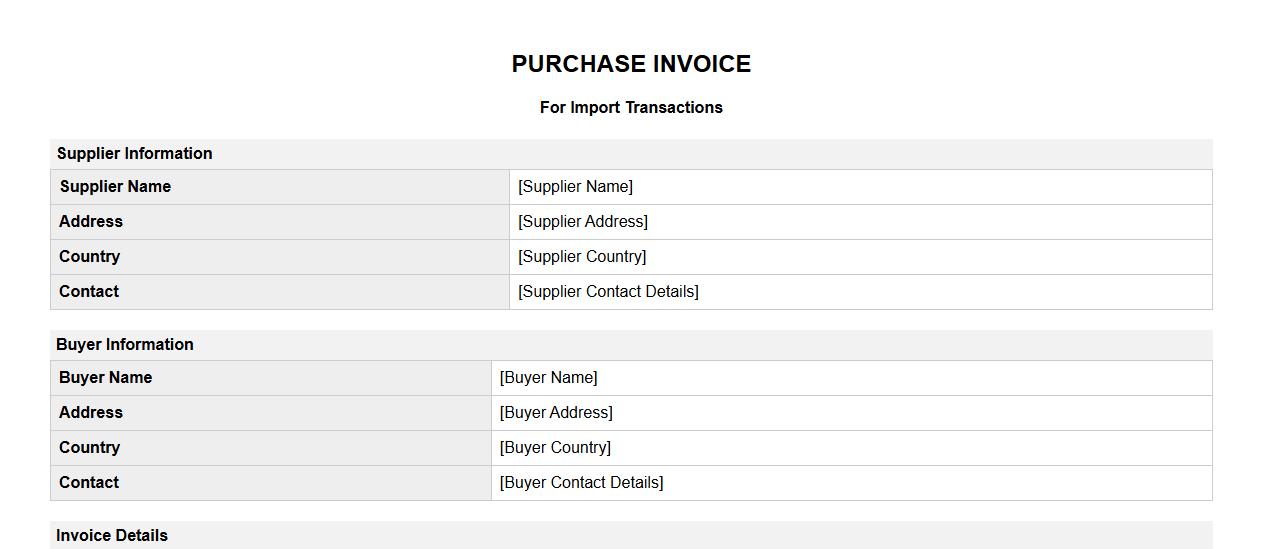

Purchase invoice format for import transactions

Our purchase invoice format for import transactions is designed to streamline documentation and ensure compliance with international trade regulations. This format includes all essential details such as supplier information, item descriptions, quantities, prices, and import duties. Utilizing this template helps businesses maintain accurate records and facilitates smooth customs clearance.

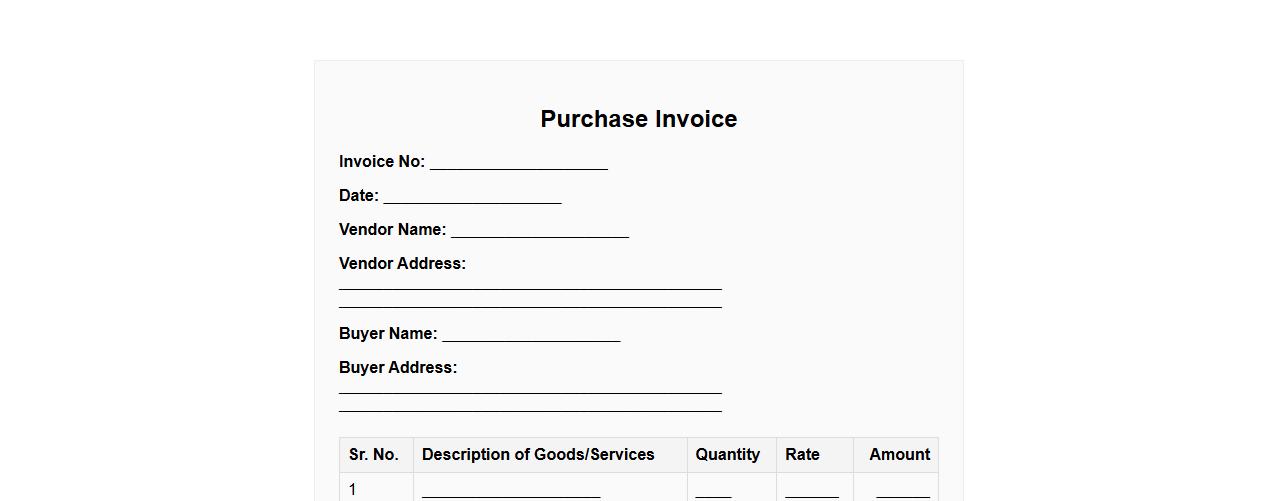

Purchase invoice format without GST

A purchase invoice format without GST is a simplified billing template used for transactions exempt from Goods and Services Tax. It includes essential details such as vendor information, item descriptions, quantities, and total amounts. This format ensures clear and accurate documentation while complying with tax regulations when GST is not applicable.

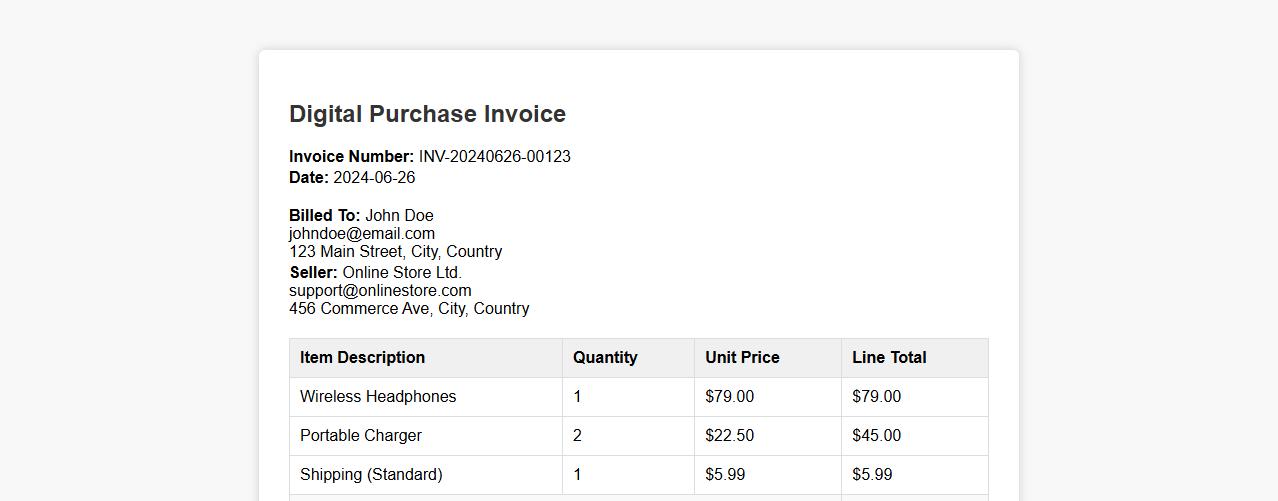

Digital purchase invoice format for online purchases

The digital purchase invoice format streamlines record-keeping for online transactions by providing a clear, organized layout of purchase details. It ensures all necessary information, such as item descriptions, quantities, prices, and payment methods, is easily accessible. This format enhances transparency and simplifies financial management for both buyers and sellers.

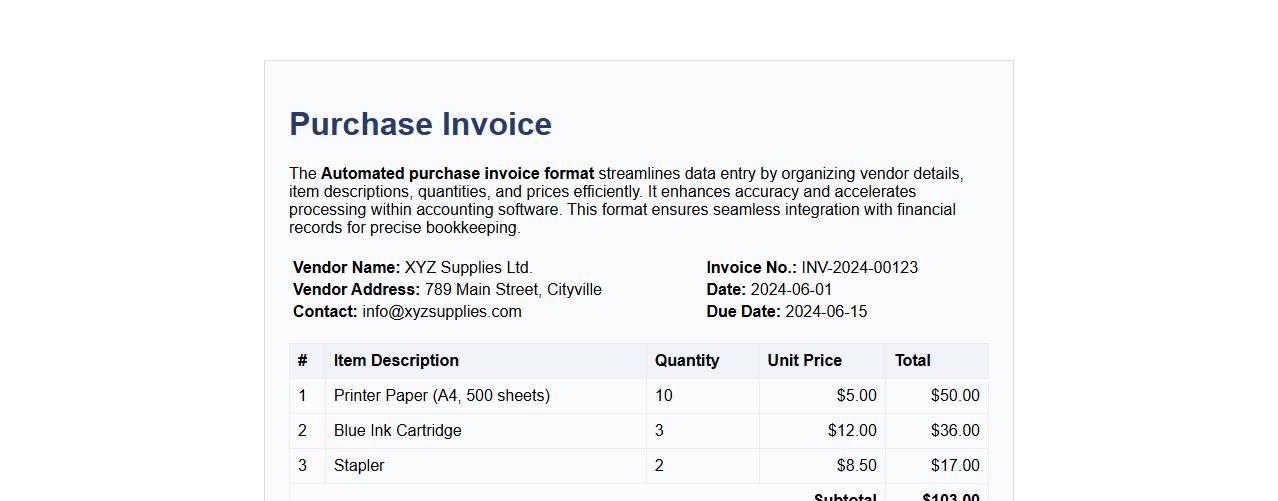

Automated purchase invoice format for accounting software

The Automated purchase invoice format streamlines data entry by organizing vendor details, item descriptions, quantities, and prices efficiently. It enhances accuracy and accelerates processing within accounting software. This format ensures seamless integration with financial records for precise bookkeeping.

Mandatory Fields in a GST-Compliant Purchase Invoice Format

A GST-compliant purchase invoice must include the supplier's name, address, and GSTIN (Goods and Services Tax Identification Number). The invoice should also clearly mention the buyer's GSTIN and a unique invoice number for tracking. Additionally, the taxable value, applicable GST rates, and total tax amount are crucial fields for compliance.

Structuring Payment Terms in a Standardized Purchase Invoice Template

Payment terms in a standardized purchase invoice template should specify the due date and acceptable payment methods such as bank transfer, cheque, or digital wallets. Clear mention of penalties for late payments helps avoid disputes. Moreover, including terms like early payment discounts can encourage timely settlements.

Accepted Digital Signature Options on Electronic Purchase Invoices

Electronic purchase invoices accept digital signatures through certificates issued by authorized certification authorities for authenticity. Common formats include Aadhaar-based, DSC (Digital Signature Certificate), and eSign signatures. These ensure the invoice's integrity and legal validity in electronic transactions.

Software Tools Offering Customizable Purchase Invoice Format Downloads

Popular software tools like Zoho Invoice, QuickBooks, and Tally ERP offer customizable purchase invoice format downloads with user-friendly interfaces. These platforms provide templates compliant with GST regulations, enabling businesses to adjust fields as per needs. Cloud-based options also ensure easy access and real-time updates.

Differentiating Between a Purchase Order and a Purchase Invoice Format

A purchase order is a buyer-generated document indicating intent to purchase products or services, while a purchase invoice is seller-generated billing after delivery. Purchase orders focus on quantity and price, whereas invoices detail tax, payment terms, and total amount due. Understanding this distinction helps streamline procurement and accounting processes.