A Rental Invoice Form Sample provides a structured template for documenting rental transactions, ensuring clear communication between landlords and tenants. This form typically includes details such as payment amount, due date, property information, and terms of rental. Using a well-designed invoice form helps maintain accurate financial records and simplifies the tracking of rental payments.

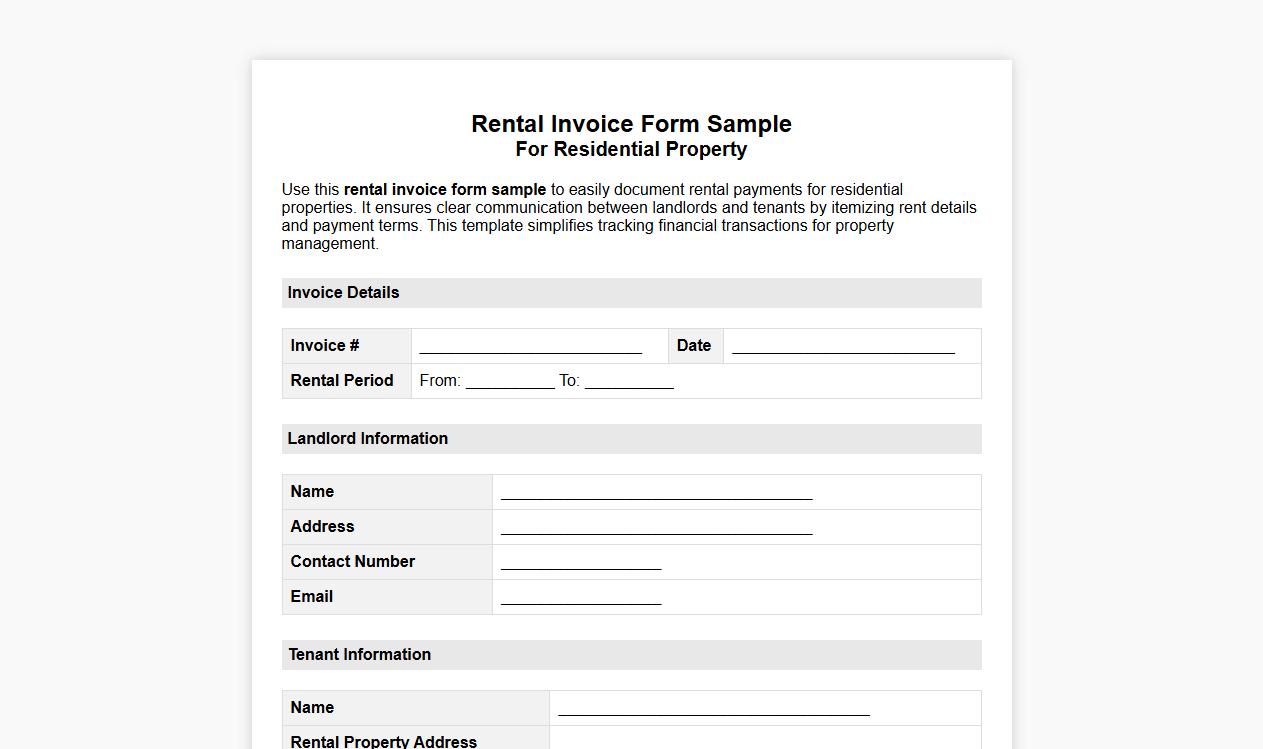

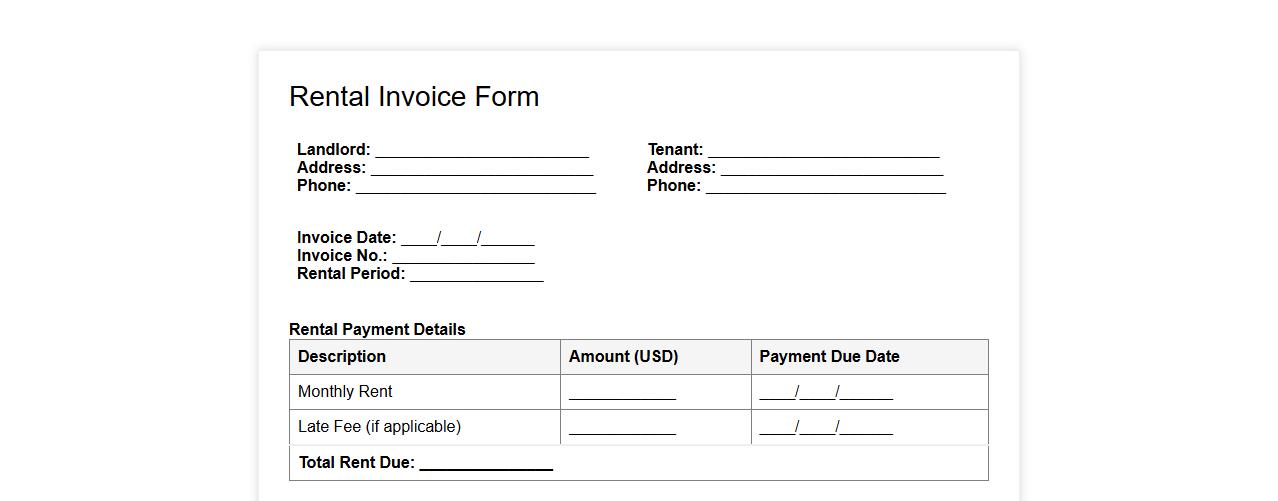

Rental invoice form sample for residential property

Use this rental invoice form sample to easily document rental payments for residential properties. It ensures clear communication between landlords and tenants by itemizing rent details and payment terms. This template simplifies tracking financial transactions for property management.

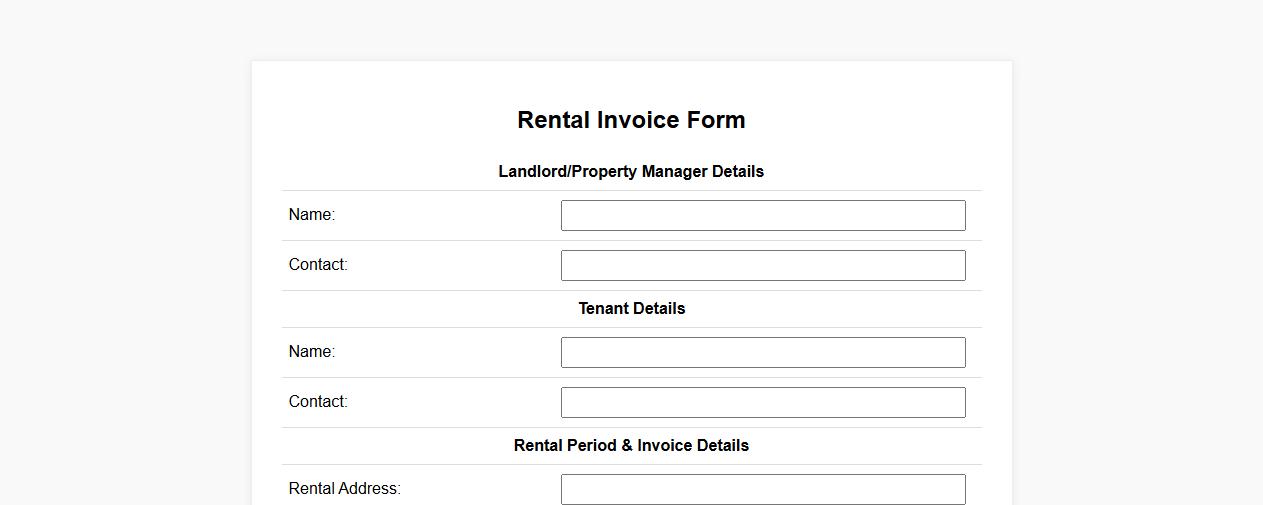

Rental invoice form sample with tax calculation

This rental invoice form sample includes a clear layout for capturing essential details and automatically calculates taxes to ensure accurate billing. Its user-friendly design helps landlords and property managers streamline payment processing while maintaining financial records. The form is customizable to fit various rental agreements and tax requirements.

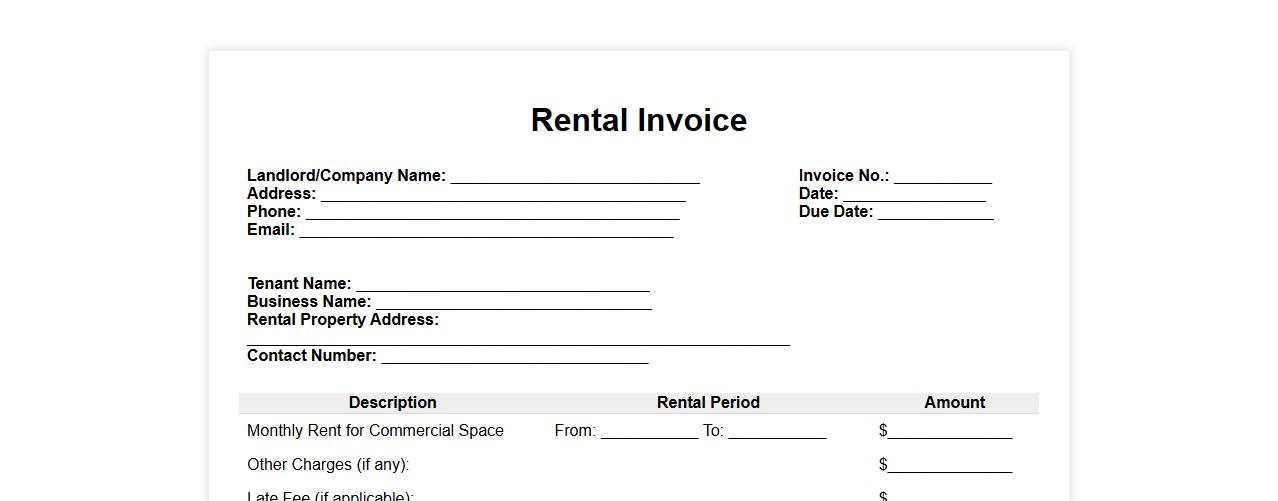

Rental invoice form sample for commercial space

This rental invoice form sample for commercial space provides a professional and organized template to document lease payments clearly. It includes essential details such as tenant information, rental period, and payment terms to ensure smooth transactions. Using this form simplifies record-keeping and enhances communication between landlords and tenants.

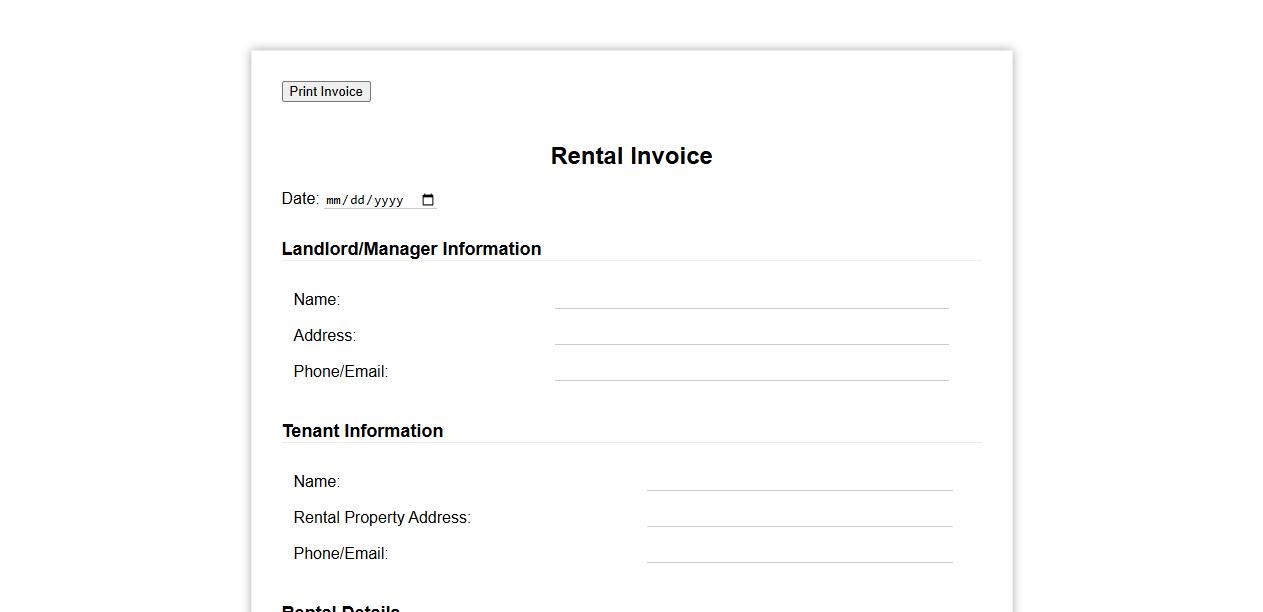

Printable rental invoice form sample with late fee

Download this printable rental invoice form sample to easily document rental payments and include any applicable late fees. This professionally designed template helps landlords track dues and ensure timely payments. It is perfect for maintaining clear financial records between tenants and property owners.

Rental invoice form sample with security deposit details

This rental invoice form sample includes detailed sections for rent amounts, payment dates, and a clear breakdown of the security deposit. Designed for landlords and tenants, it ensures transparent transaction records and protects both parties' interests. Using this form simplifies rent collection and deposit tracking efficiently.

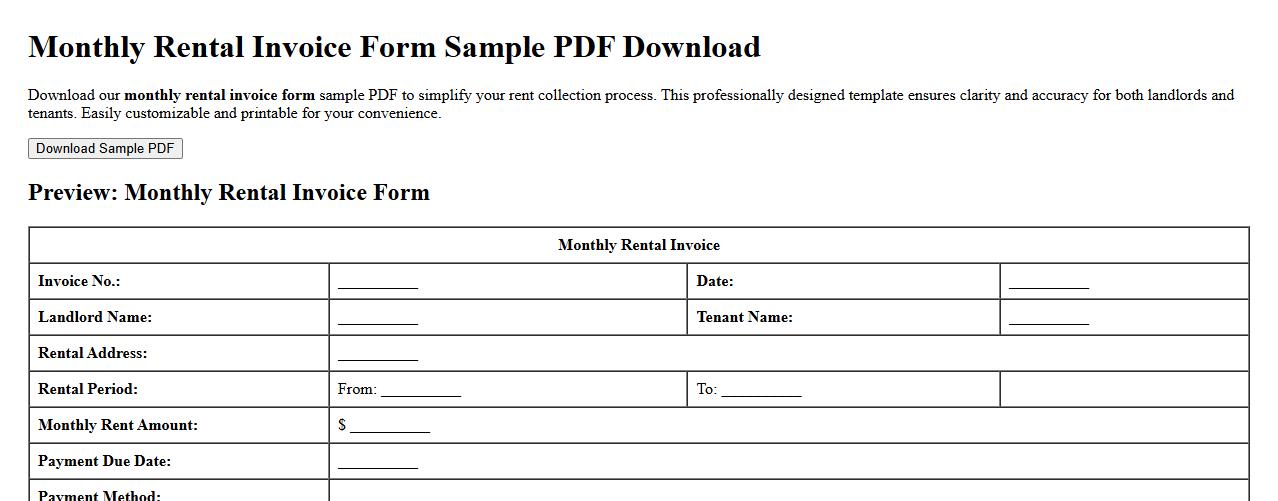

Monthly rental invoice form sample pdf download

Download our monthly rental invoice form sample PDF to simplify your rent collection process. This professionally designed template ensures clarity and accuracy for both landlords and tenants. Easily customizable and printable for your convenience.

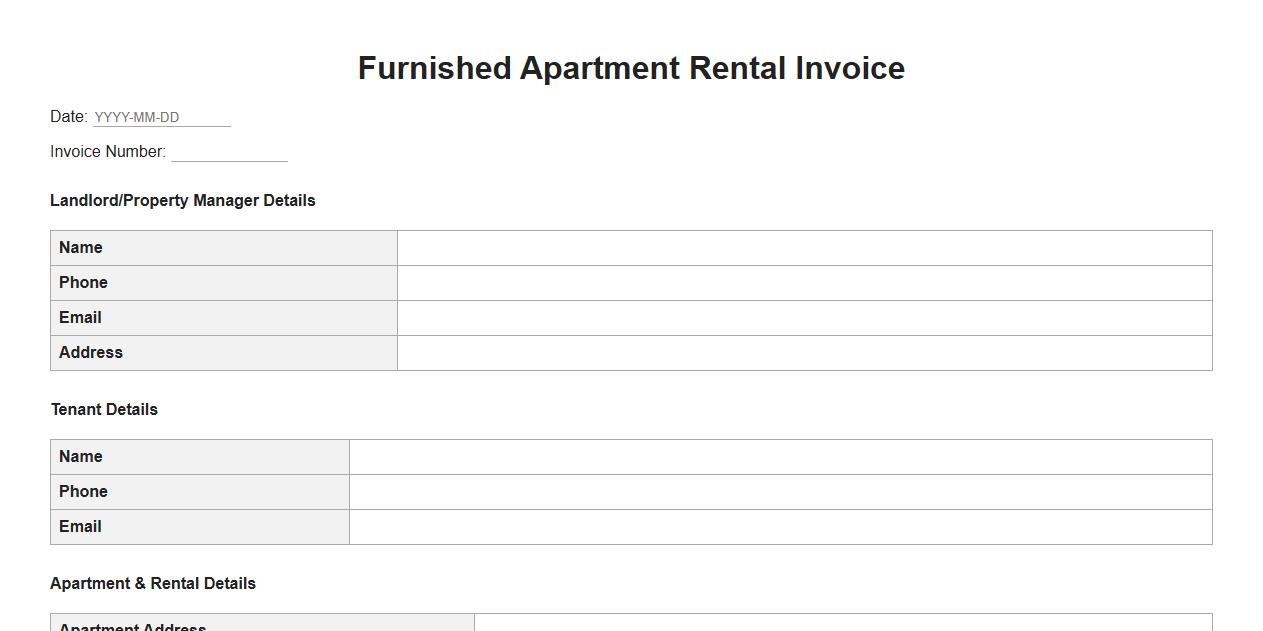

Furnished apartment rental invoice form sample

This furnished apartment rental invoice form sample provides a clear and professional template to document rental payments and details. It ensures transparent communication between landlords and tenants, outlining charges for furnished amenities. Utilizing this form helps streamline rental transactions and record-keeping efficiently.

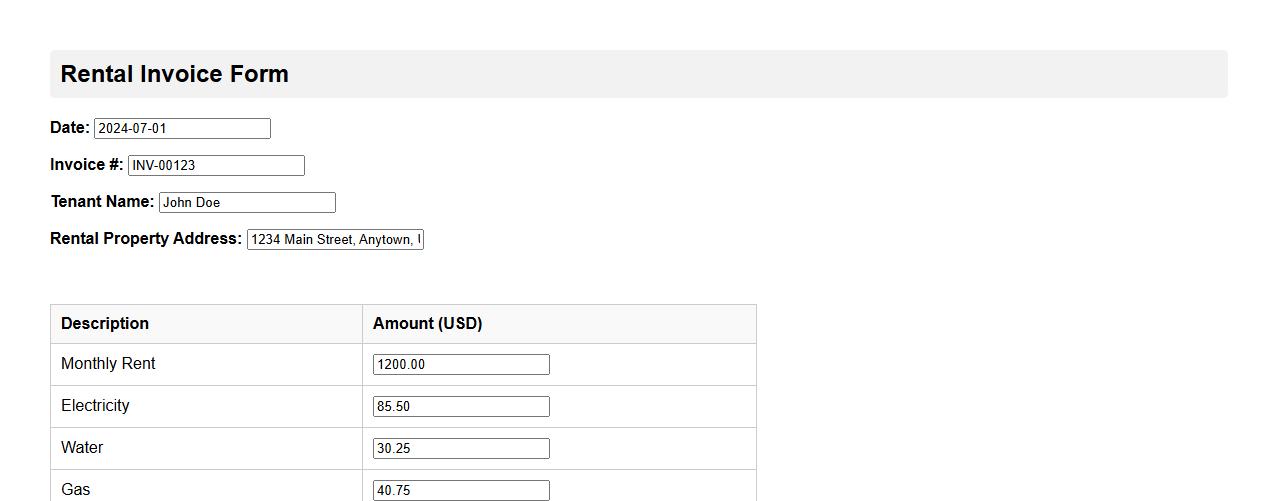

Rental invoice form sample with itemized utilities

This rental invoice form sample includes an itemized breakdown of utilities, making it easy for landlords and tenants to track monthly expenses clearly. It ensures transparency by listing each utility charge separately, such as electricity, water, and gas. This format helps avoid disputes and simplifies payment processing.

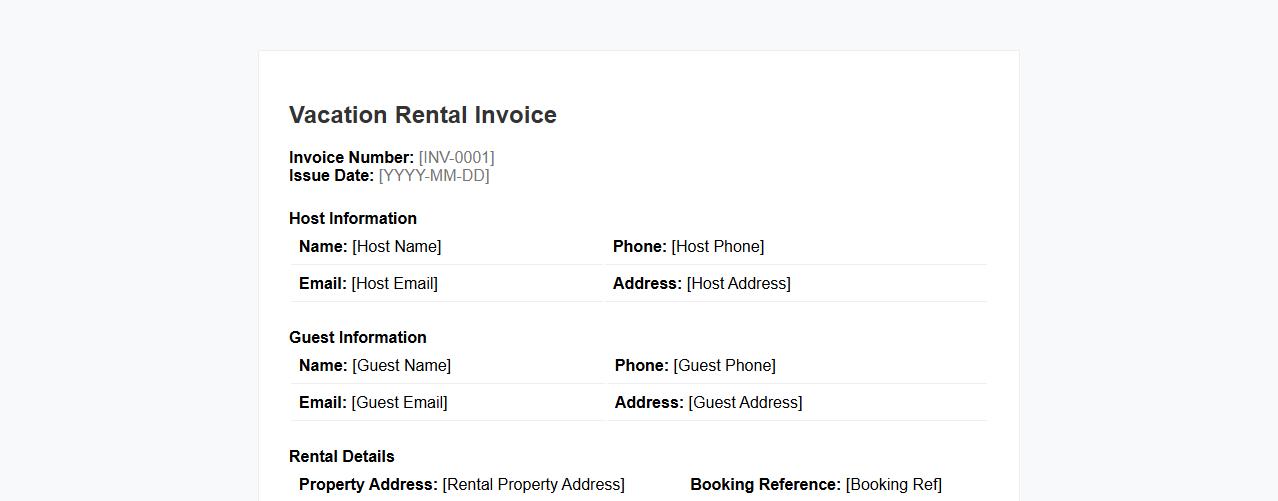

Rental invoice form sample for vacation rentals

Generate a professional rental invoice form sample designed specifically for vacation rentals to streamline your booking process. This invoice template ensures clear communication of charges and payment details between hosts and guests. Simplify your vacation rental management with an easy-to-use and accurate billing document.

What fields are required for a compliant rental invoice form?

A compliant rental invoice form must include the tenant's and landlord's full names and contact details. It should clearly state the rental period, payment due date, and the total amount due. Additionally, the invoice must show the breakdown of charges such as rent, taxes, and any other fees.

How should late payment penalties be detailed on a rental invoice?

Late payment penalties should be explicitly detailed with the penalty percentage or fixed fee and the date from which the penalty applies. The invoice must specify the grace period, if any, and consequences of non-payment. Clearly stating these terms ensures transparency and legal compliance.

Which tax identification numbers must appear for landlord and tenant?

The landlord's tax identification number (TIN) or equivalent must be included on the invoice for tax compliance. Likewise, when relevant, the tenant's tax ID or business number should be indicated, especially for business rentals. This information facilitates proper reporting and auditing by tax authorities.

How can digital signatures be incorporated into a rental invoice form?

Digital signatures can be added using e-signature software integrated into the rental invoice platform for secure validation. The signature field should clearly state signer identity and timestamp to ensure authenticity. This method legally binds the document and enhances convenience for both parties.

What format is preferred for itemizing utilities on a rental invoice?

Utilities should be itemized separately with clear descriptions such as electricity, water, gas, and internet charges. Each utility must display the usage period and corresponding amounts for transparency. Using a tabular format improves readability and reduces disputes over charges.