The Audit Preparation Checklist ensures all necessary documents and records are organized before an audit. It helps identify compliance gaps and streamline communication with auditors. Utilizing this checklist reduces the risk of delays and enhances overall audit efficiency.

Audit preparation checklist for small businesses

Ensure your small business is ready for financial review with this audit preparation checklist. It covers essential steps to organize documents, verify compliance, and streamline the auditing process. Proper preparation helps minimize stress and maximizes accuracy during your audit.

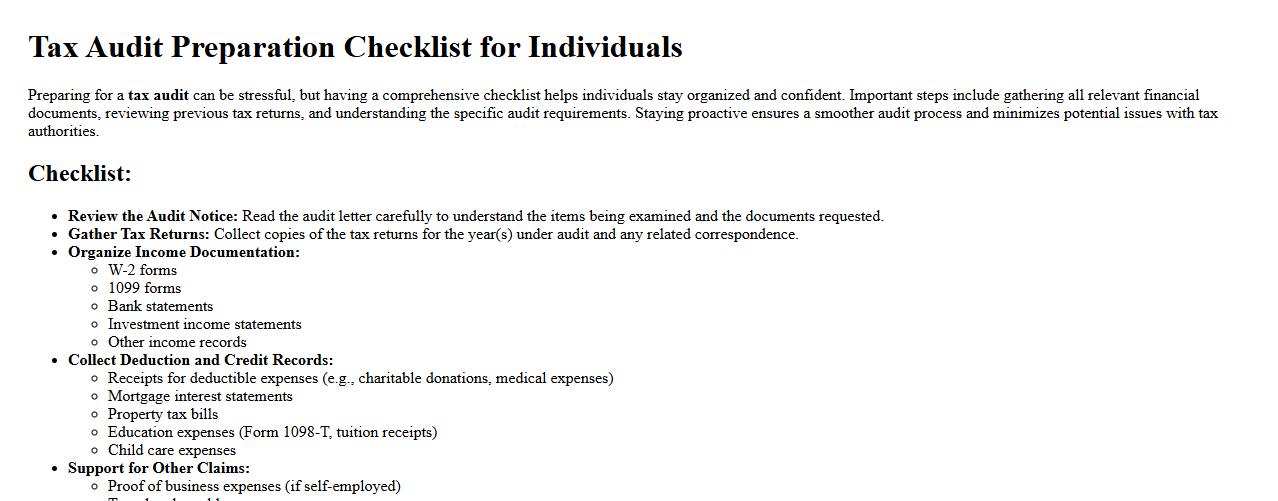

Tax audit preparation checklist for individuals

Preparing for a tax audit can be stressful, but having a comprehensive checklist helps individuals stay organized and confident. Important steps include gathering all relevant financial documents, reviewing previous tax returns, and understanding the specific audit requirements. Staying proactive ensures a smoother audit process and minimizes potential issues with tax authorities.

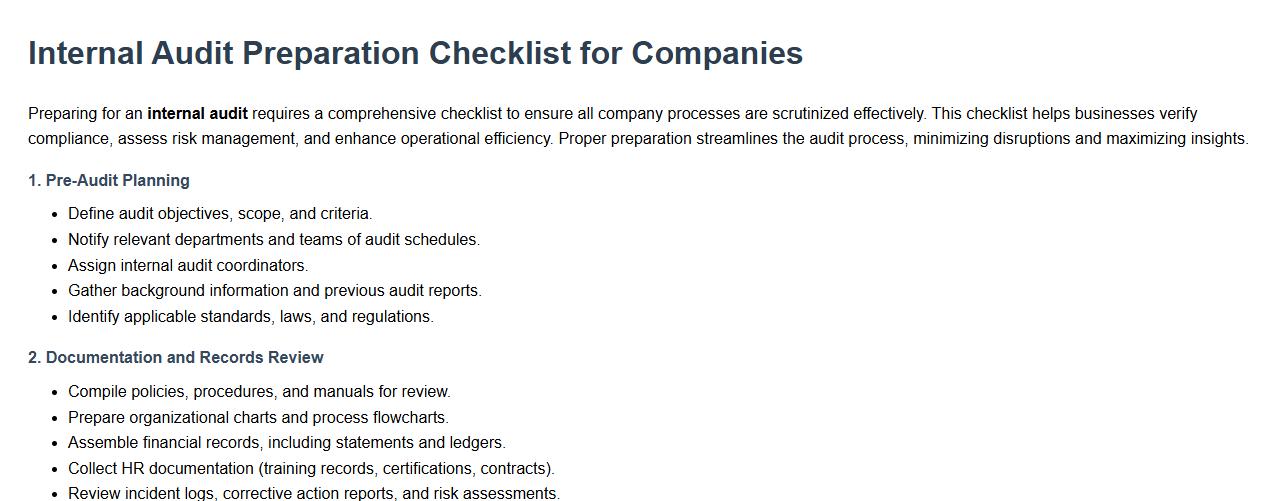

Internal audit preparation checklist for companies

Preparing for an internal audit requires a comprehensive checklist to ensure all company processes are scrutinized effectively. This checklist helps businesses verify compliance, assess risk management, and enhance operational efficiency. Proper preparation streamlines the audit process, minimizing disruptions and maximizing insights.

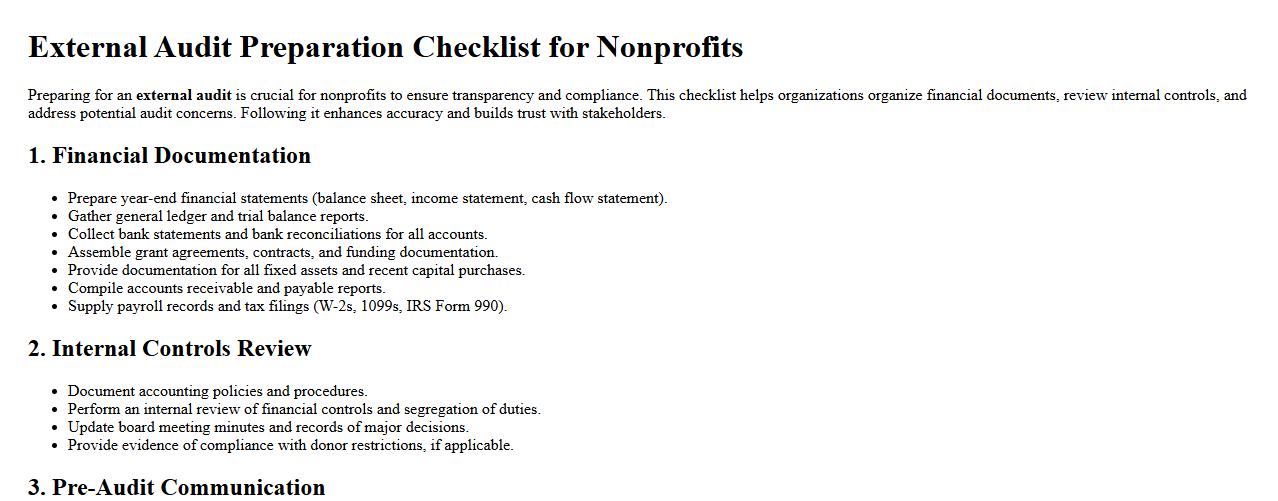

External audit preparation checklist for nonprofits

Preparing for an external audit is crucial for nonprofits to ensure transparency and compliance. This checklist helps organizations organize financial documents, review internal controls, and address potential audit concerns. Following it enhances accuracy and builds trust with stakeholders.

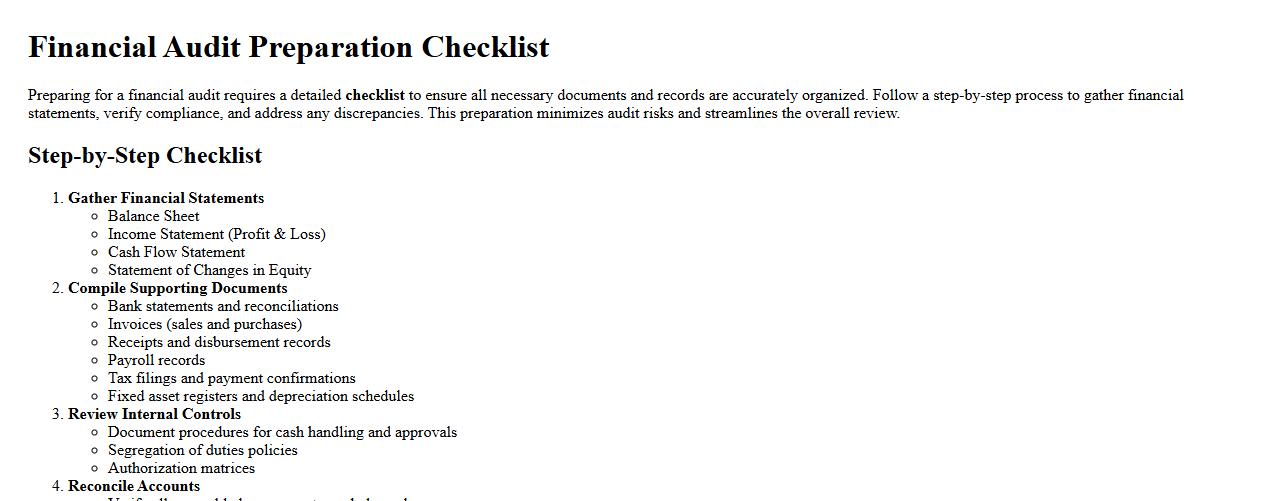

Financial audit preparation checklist step by step

Preparing for a financial audit requires a detailed checklist to ensure all necessary documents and records are accurately organized. Follow a step-by-step process to gather financial statements, verify compliance, and address any discrepancies. This preparation minimizes audit risks and streamlines the overall review.

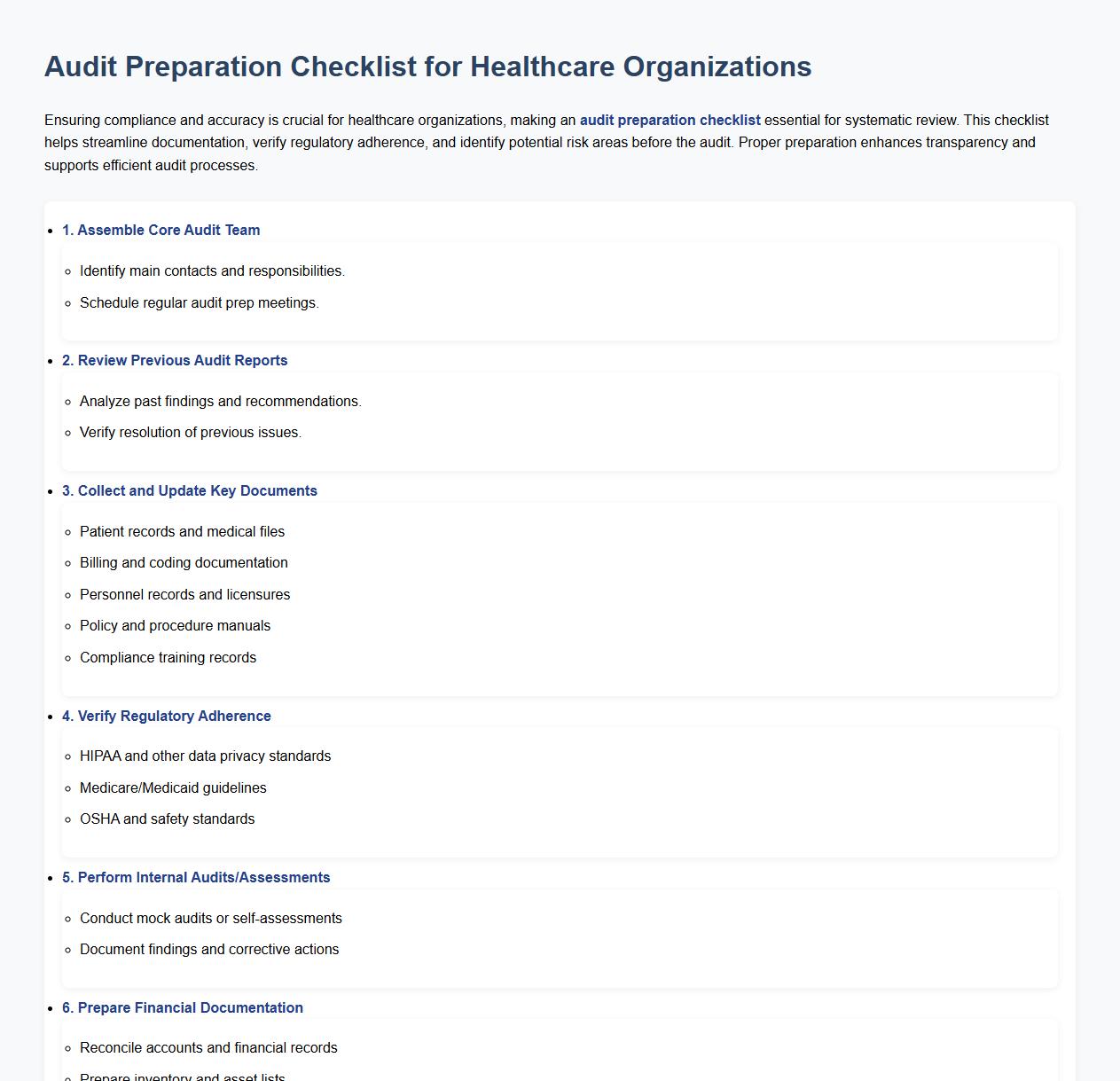

Audit preparation checklist for healthcare organizations

Ensuring compliance and accuracy is crucial for healthcare organizations, making an audit preparation checklist essential for systematic review. This checklist helps streamline documentation, verify regulatory adherence, and identify potential risk areas before the audit. Proper preparation enhances transparency and supports efficient audit processes.

Annual audit preparation checklist for schools

Preparing for an annual audit in schools requires a comprehensive checklist to ensure all financial records, compliance documents, and operational procedures are accurate and up-to-date. This checklist aids administrators in organizing vital information, facilitating a smooth audit process, and maintaining transparency. Proper annual audit preparation safeguards the school's financial integrity and regulatory compliance.

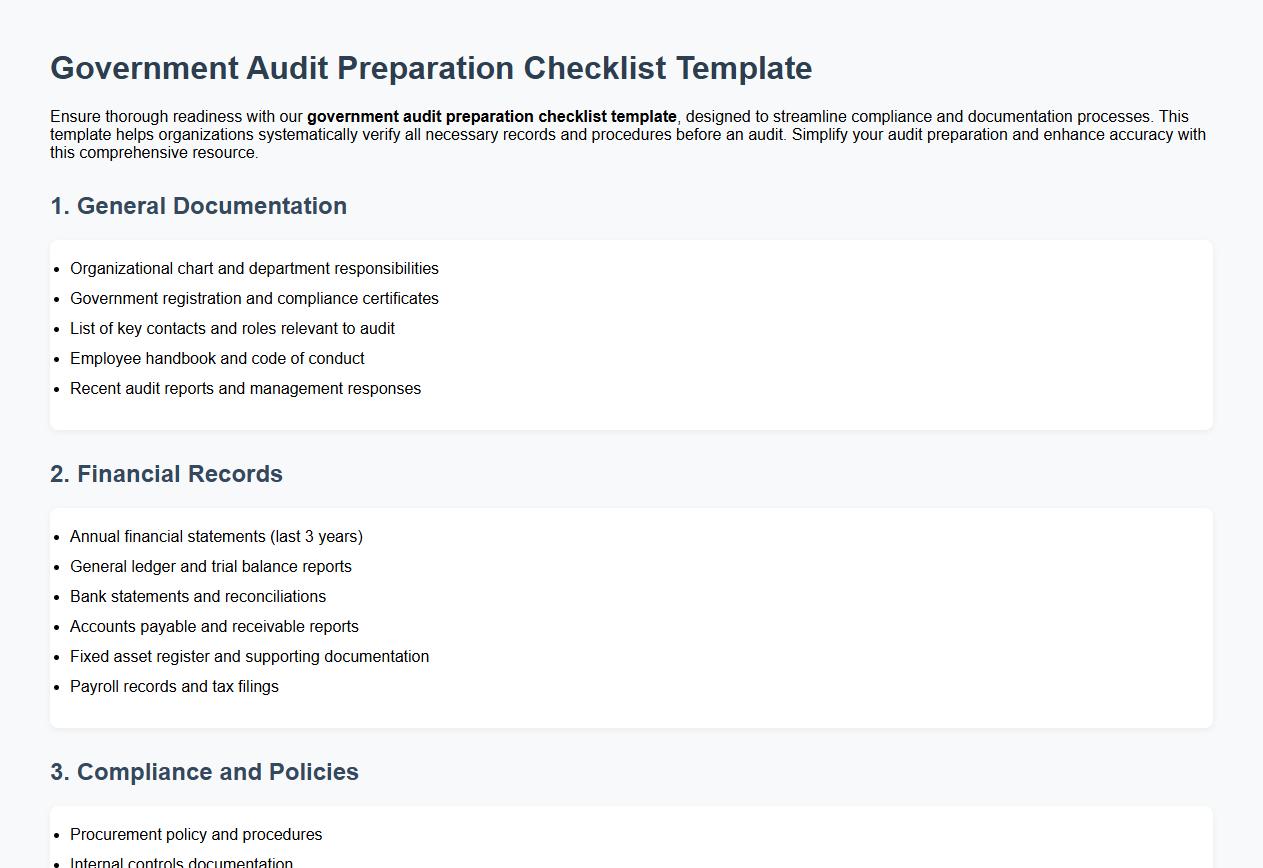

Government audit preparation checklist template

Ensure thorough readiness with our government audit preparation checklist template, designed to streamline compliance and documentation processes. This template helps organizations systematically verify all necessary records and procedures before an audit. Simplify your audit preparation and enhance accuracy with this comprehensive resource.

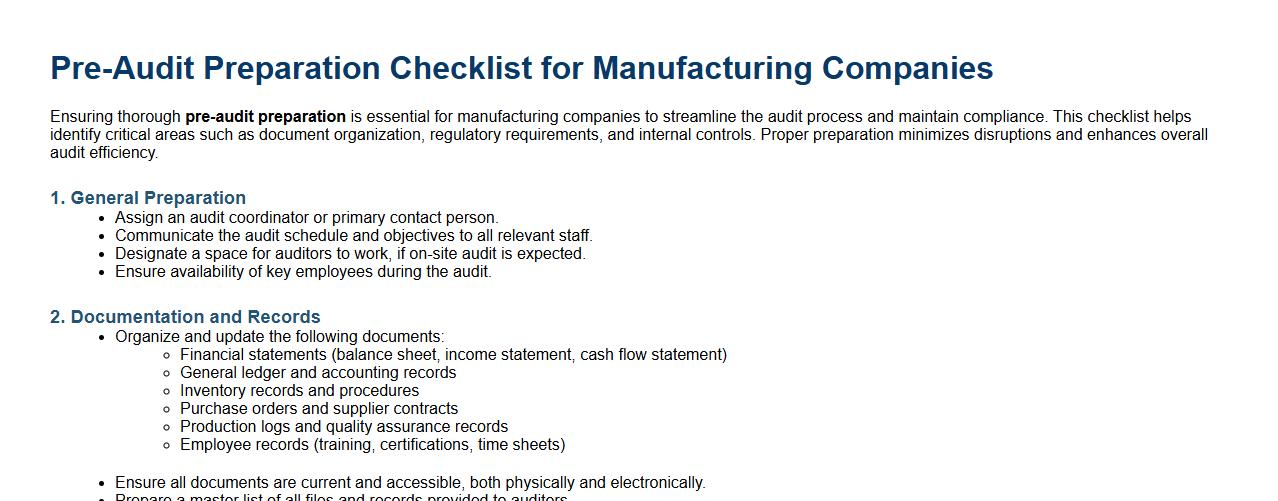

Pre-audit preparation checklist for manufacturing companies

Ensuring thorough pre-audit preparation is essential for manufacturing companies to streamline the audit process and maintain compliance. This checklist helps identify critical areas such as document organization, regulatory requirements, and internal controls. Proper preparation minimizes disruptions and enhances overall audit efficiency.

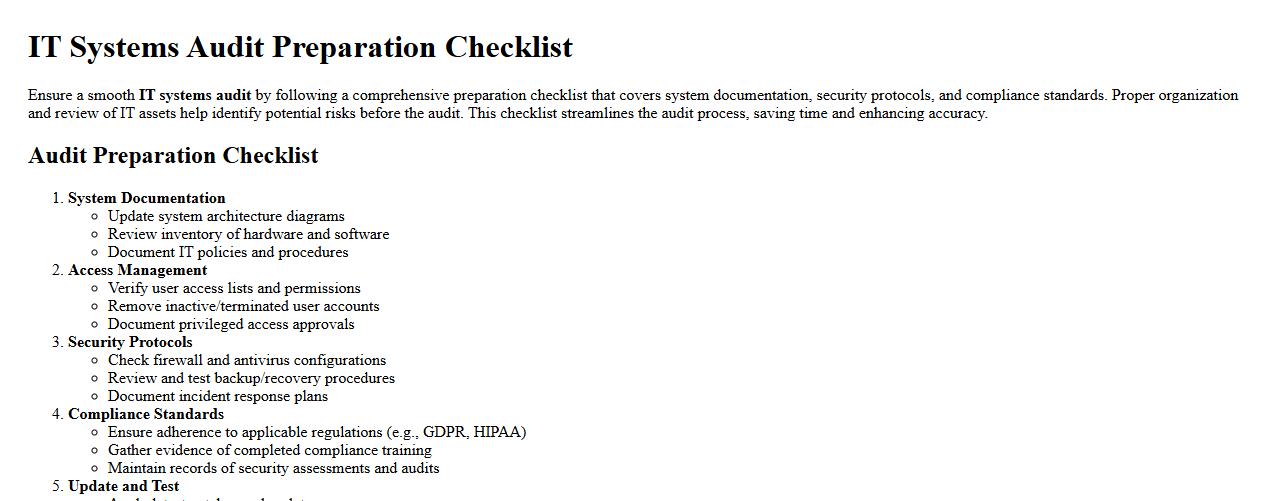

IT systems audit preparation checklist

Ensure a smooth IT systems audit by following a comprehensive preparation checklist that covers system documentation, security protocols, and compliance standards. Proper organization and review of IT assets help identify potential risks before the audit. This checklist streamlines the audit process, saving time and enhancing accuracy.

What supporting documents are required for each item on the audit preparation checklist?

Each item on the audit preparation checklist requires specific supporting documents to ensure thorough verification. Financial statements, transaction records, and compliance reports are commonly needed. Proper documentation serves as evidence to validate the accuracy and completeness of audit items.

How should digital and physical files be organized for auditor review?

Both digital and physical files should be systematically categorized and labeled for easy retrieval during the audit. Digital files must be stored in secure, organized folders with clear naming conventions, while physical files should be arranged in chronological or categorical order. This organized approach facilitates an efficient and smooth auditor review process.

Which internal controls must be documented in the checklist?

The checklist should include documentation of critical internal controls such as segregation of duties, authorization processes, and access controls. Recording these controls ensures compliance with organizational policies and regulatory requirements. Comprehensive documentation helps identify potential weaknesses for improvement.

Are previous audit findings addressed in this year's checklist documentation?

Yes, previous audit findings must be reviewed and addressed within the current year's checklist documentation. This ensures that any noted discrepancies or recommendations are resolved or mitigated. Tracking these findings promotes continuous improvement and accountability.

How frequently should the audit preparation checklist be updated or reviewed?

The audit preparation checklist should be reviewed and updated at least annually to reflect changes in regulations, organizational processes, and previous audit outcomes. Regular updates guarantee that the checklist remains relevant and effective for audit readiness. Periodic revisions enhance the accuracy and completeness of the audit process.