A Direct Deposit Authorization Form Sample provides a template for employees to authorize their employer to deposit wages directly into their bank account. This form typically includes essential details such as bank account number, routing number, and authorization signature for seamless electronic transfer. Using a standardized sample ensures accuracy and simplifies the payroll process for both employers and employees.

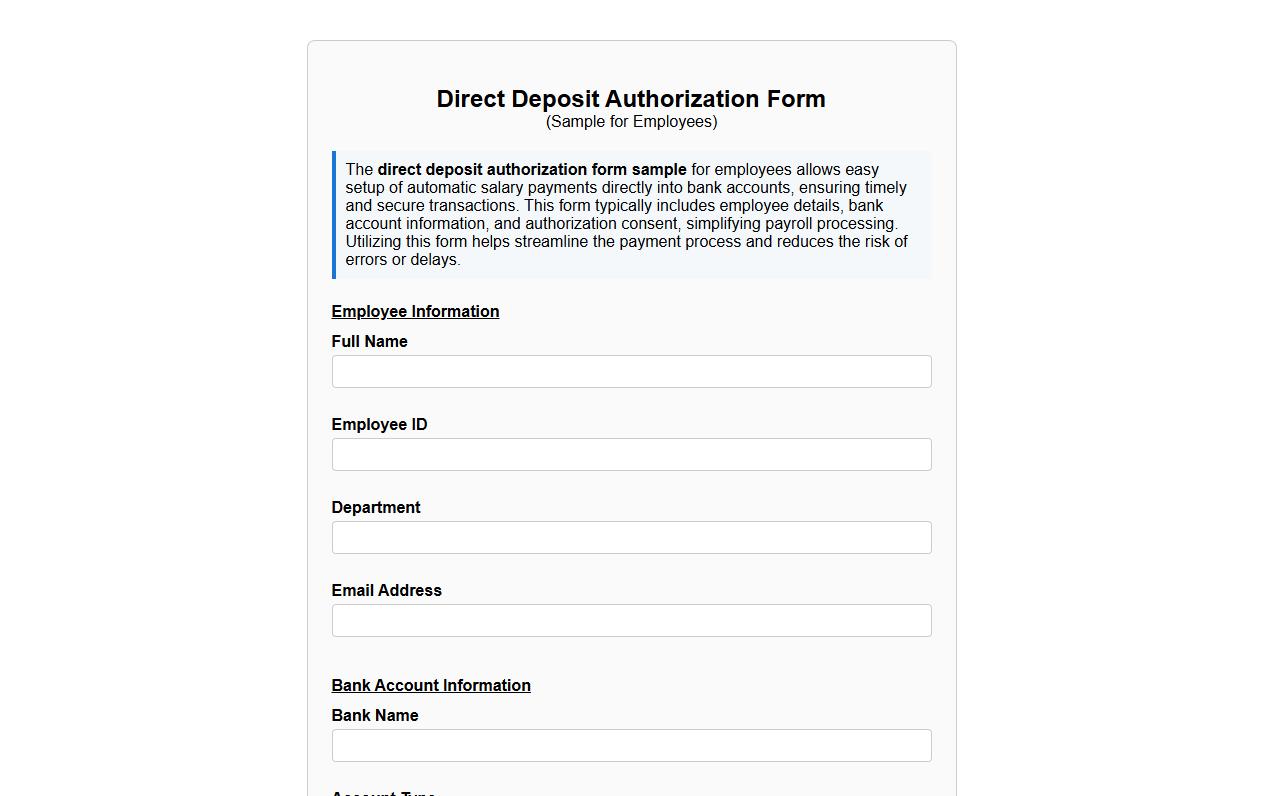

Direct deposit authorization form sample for employees

The direct deposit authorization form sample for employees allows easy setup of automatic salary payments directly into bank accounts, ensuring timely and secure transactions. This form typically includes employee details, bank account information, and authorization consent, simplifying payroll processing. Utilizing this form helps streamline the payment process and reduces the risk of errors or delays.

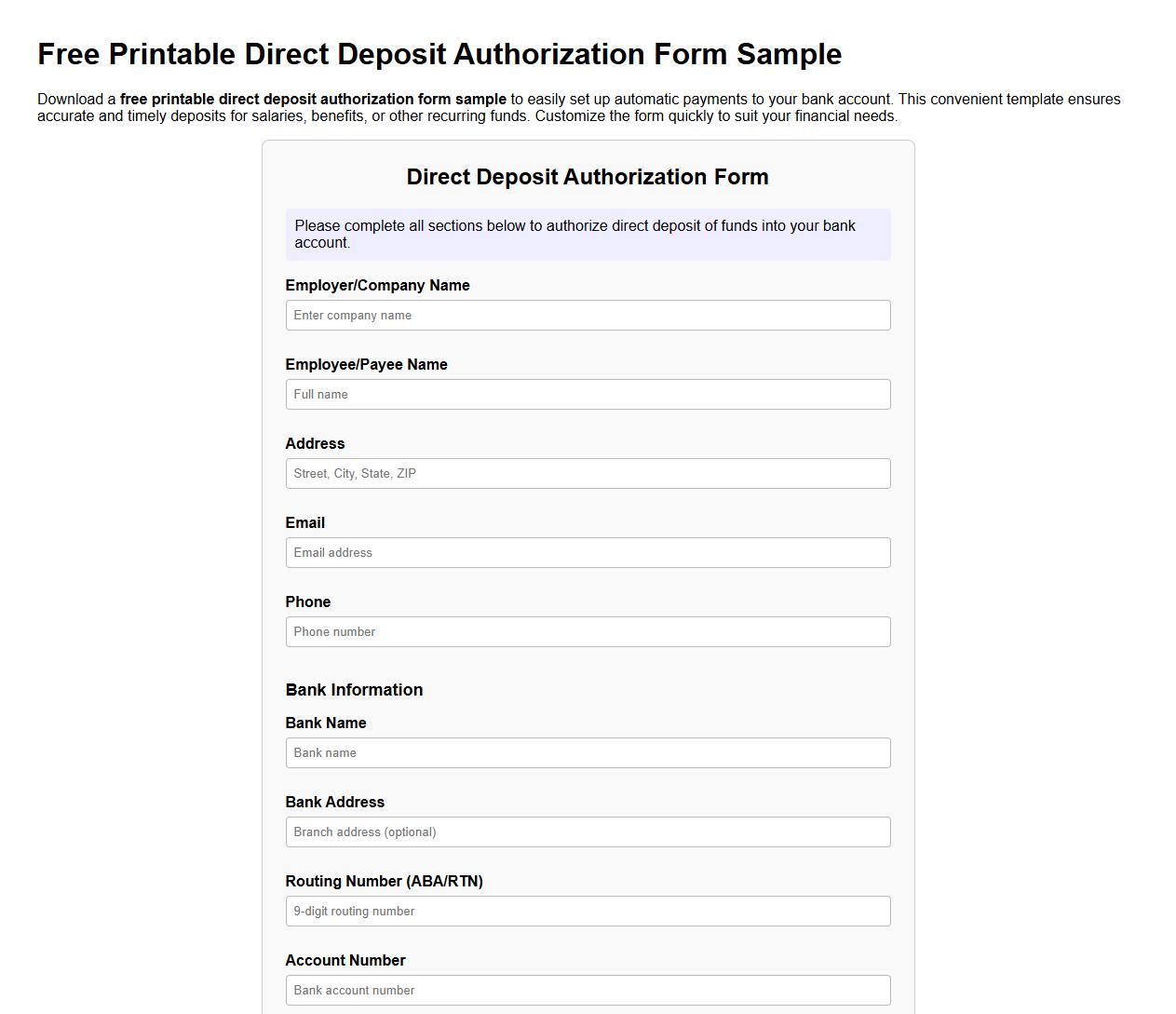

Free printable direct deposit authorization form sample

Download a free printable direct deposit authorization form sample to easily set up automatic payments to your bank account. This convenient template ensures accurate and timely deposits for salaries, benefits, or other recurring funds. Customize the form quickly to suit your financial needs.

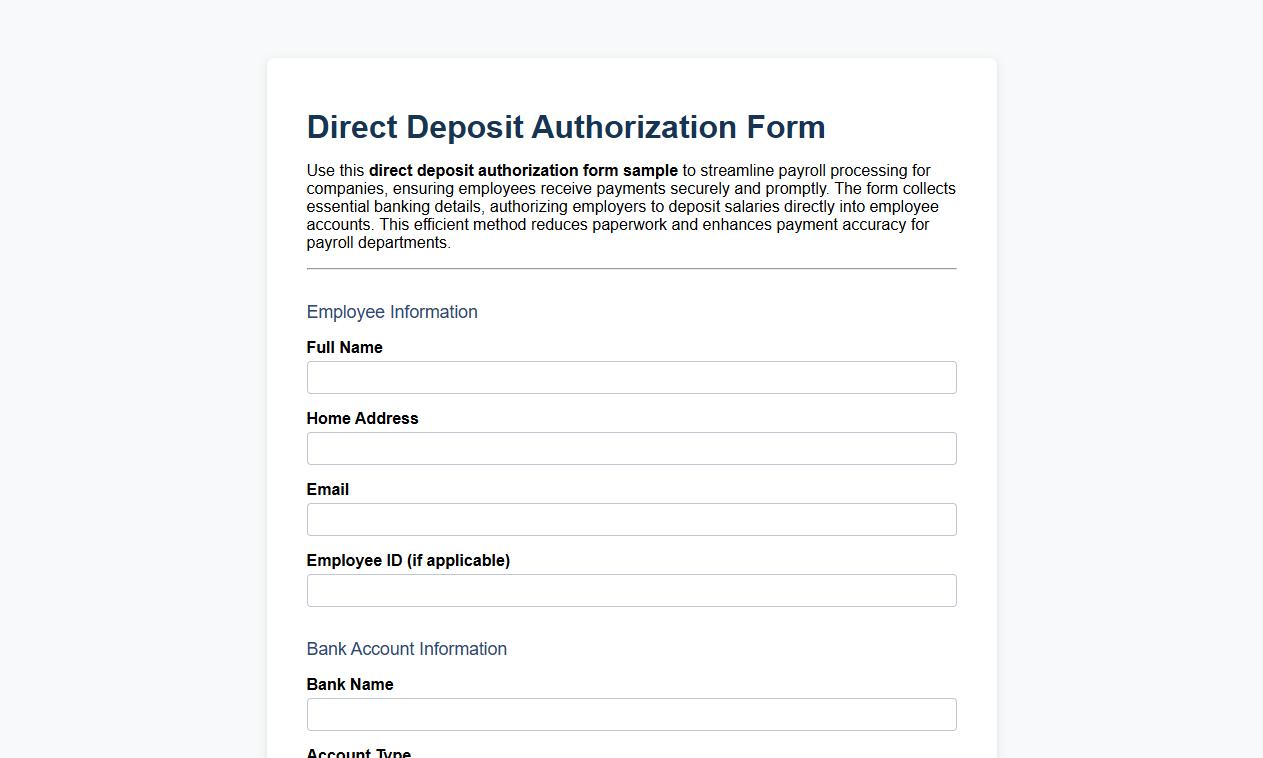

Direct deposit authorization form sample for payroll companies

Use this direct deposit authorization form sample to streamline payroll processing for companies, ensuring employees receive payments securely and promptly. The form collects essential banking details, authorizing employers to deposit salaries directly into employee accounts. This efficient method reduces paperwork and enhances payment accuracy for payroll departments.

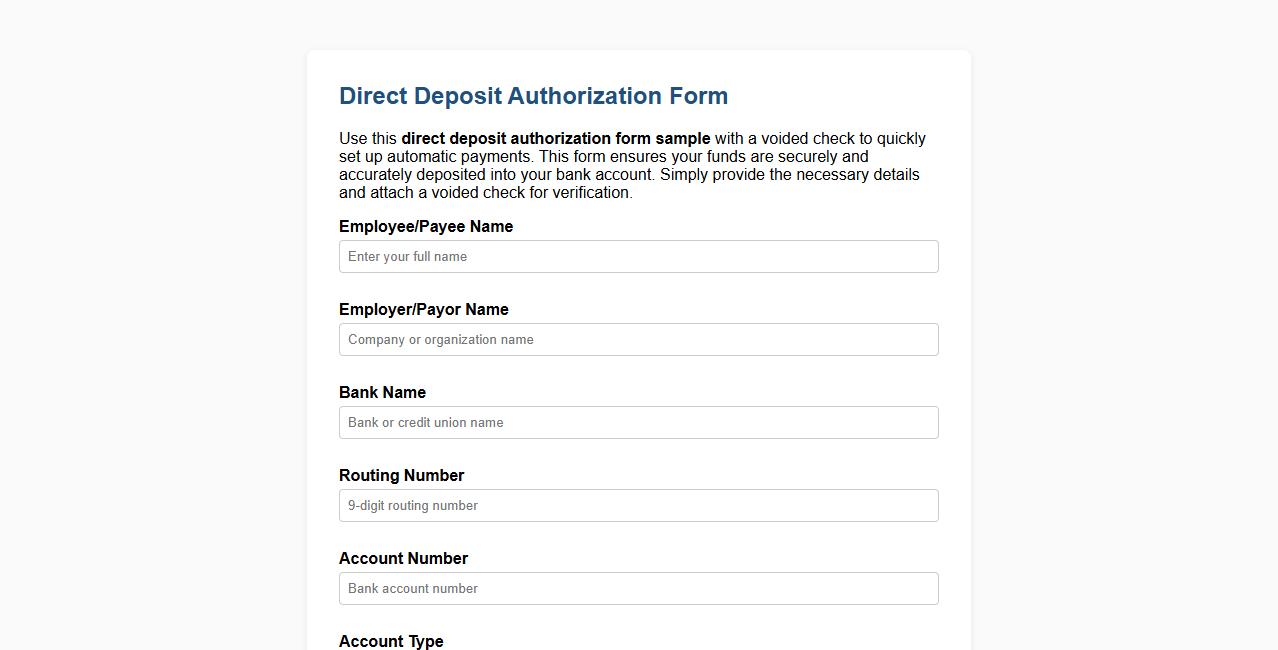

Direct deposit authorization form sample with voided check

Use this direct deposit authorization form sample with a voided check to quickly set up automatic payments. This form ensures your funds are securely and accurately deposited into your bank account. Simply provide the necessary details and attach a voided check for verification.

Direct deposit authorization form sample pdf download

Download our direct deposit authorization form sample in PDF to easily set up automatic payments. This secure and convenient form ensures your funds are deposited directly into your bank account without any hassle. Save time and avoid delays with our straightforward template available for instant download.

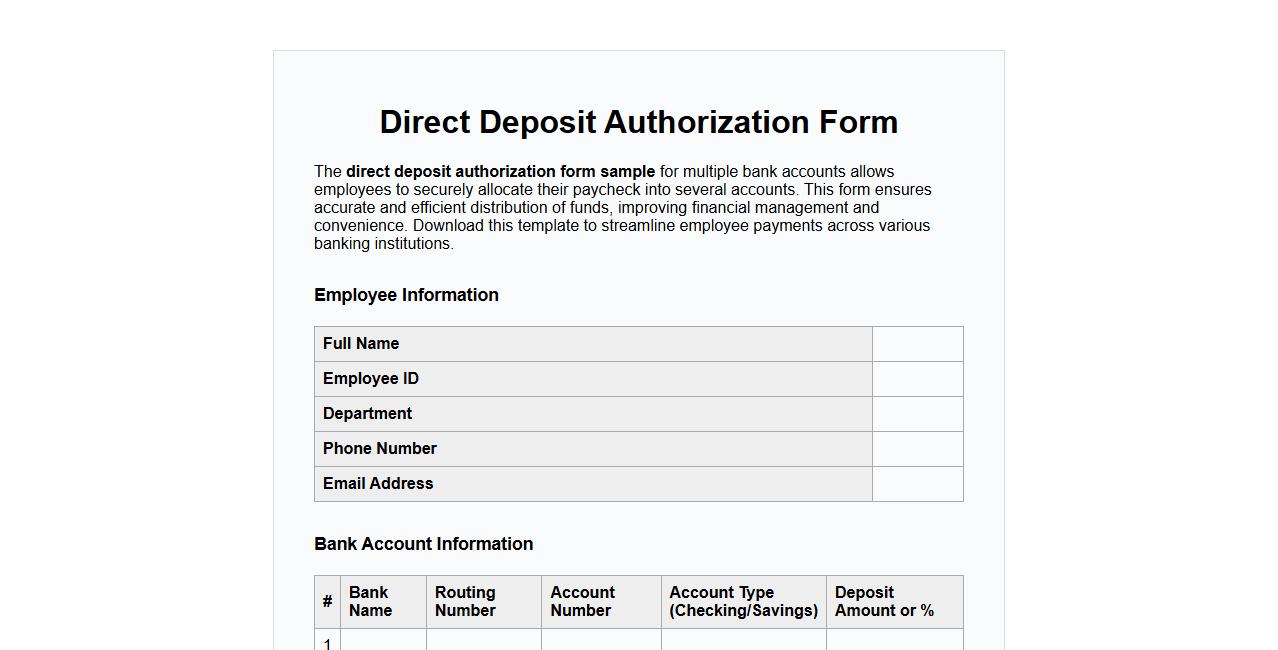

Direct deposit authorization form sample for multiple bank accounts

The direct deposit authorization form sample for multiple bank accounts allows employees to securely allocate their paycheck into several accounts. This form ensures accurate and efficient distribution of funds, improving financial management and convenience. Download this template to streamline employee payments across various banking institutions.

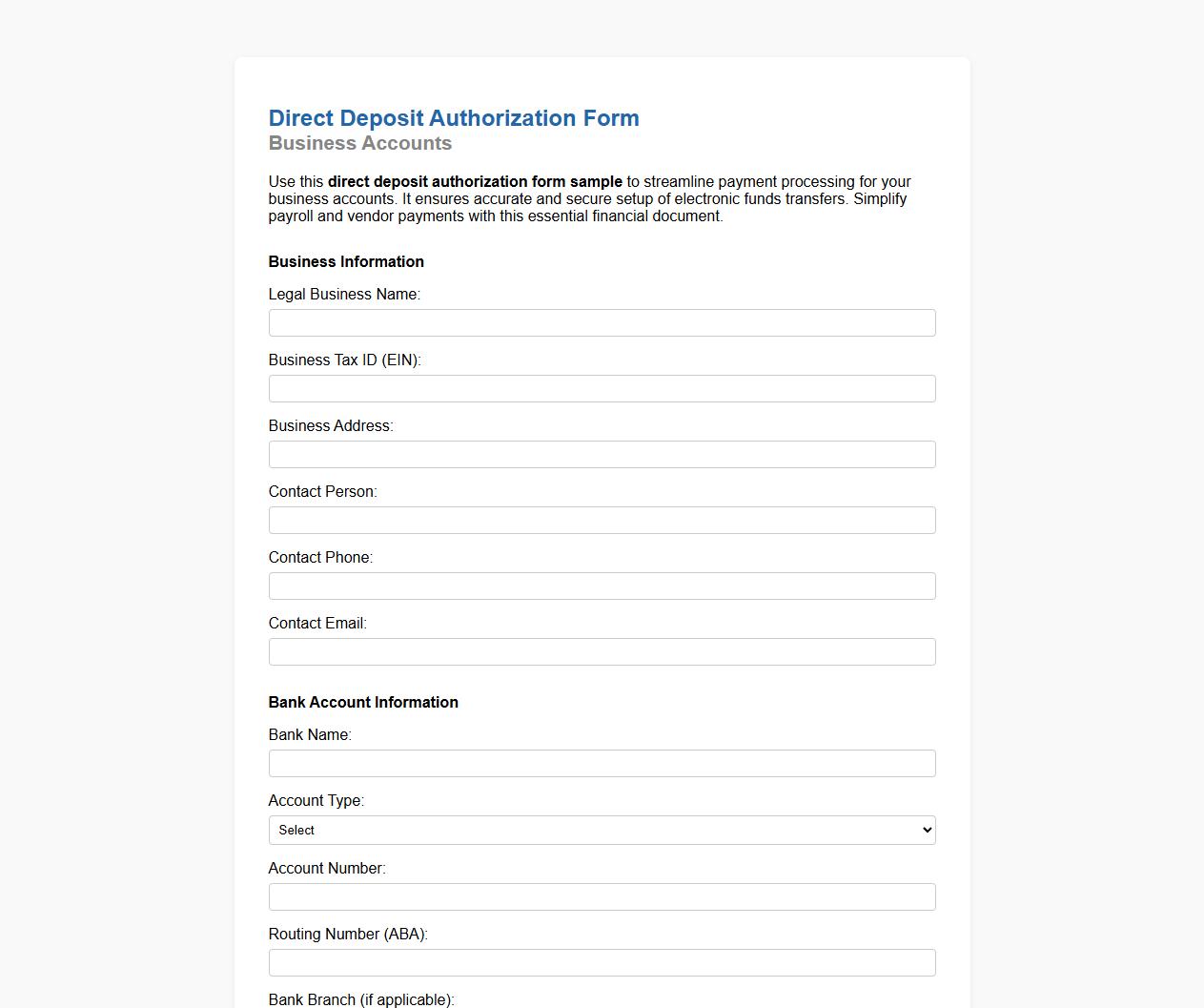

Direct deposit authorization form sample for business accounts

Use this direct deposit authorization form sample to streamline payment processing for your business accounts. It ensures accurate and secure setup of electronic funds transfers. Simplify payroll and vendor payments with this essential financial document.

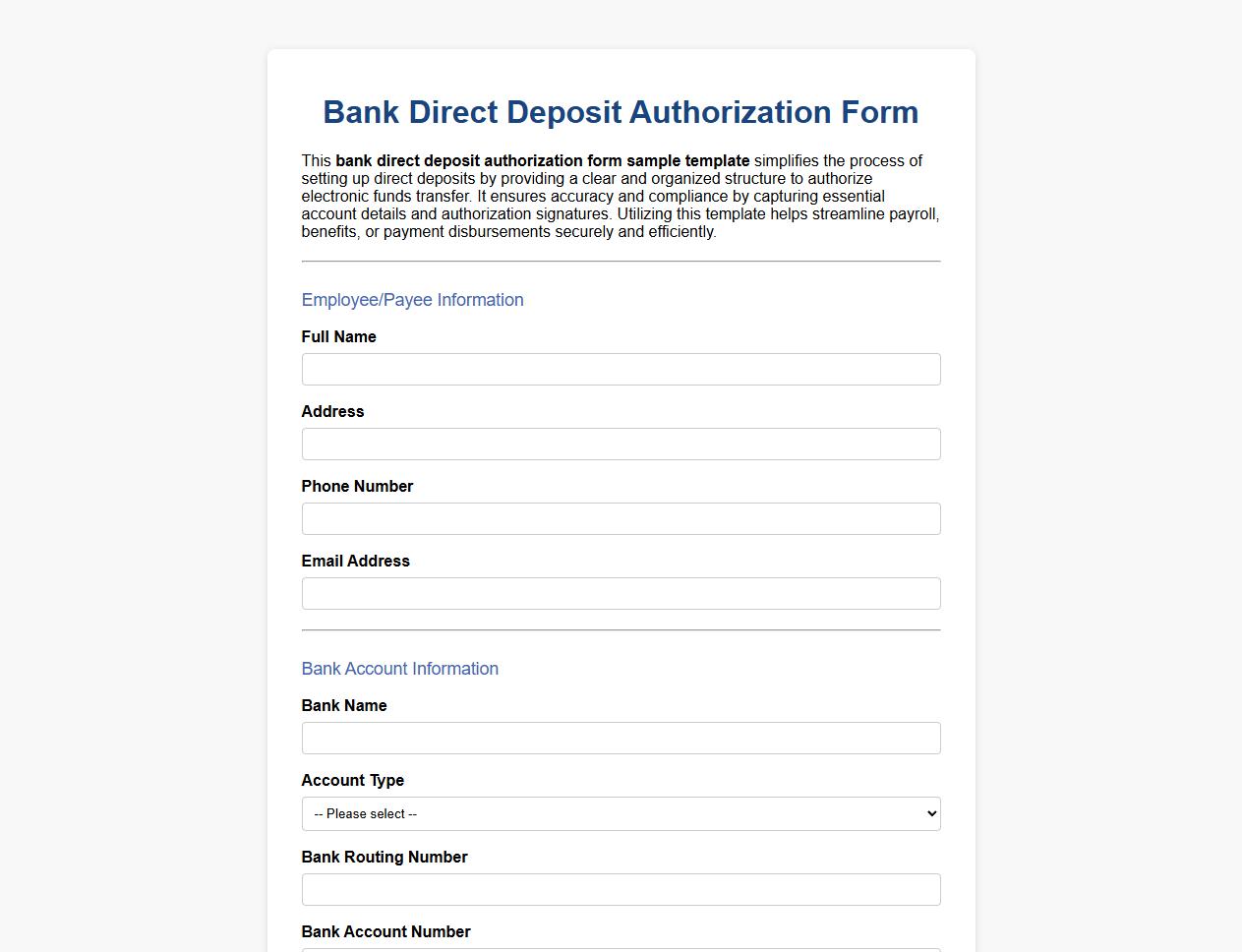

Bank direct deposit authorization form sample template

This bank direct deposit authorization form sample template simplifies the process of setting up direct deposits by providing a clear and organized structure to authorize electronic funds transfer. It ensures accuracy and compliance by capturing essential account details and authorization signatures. Utilizing this template helps streamline payroll, benefits, or payment disbursements securely and efficiently.

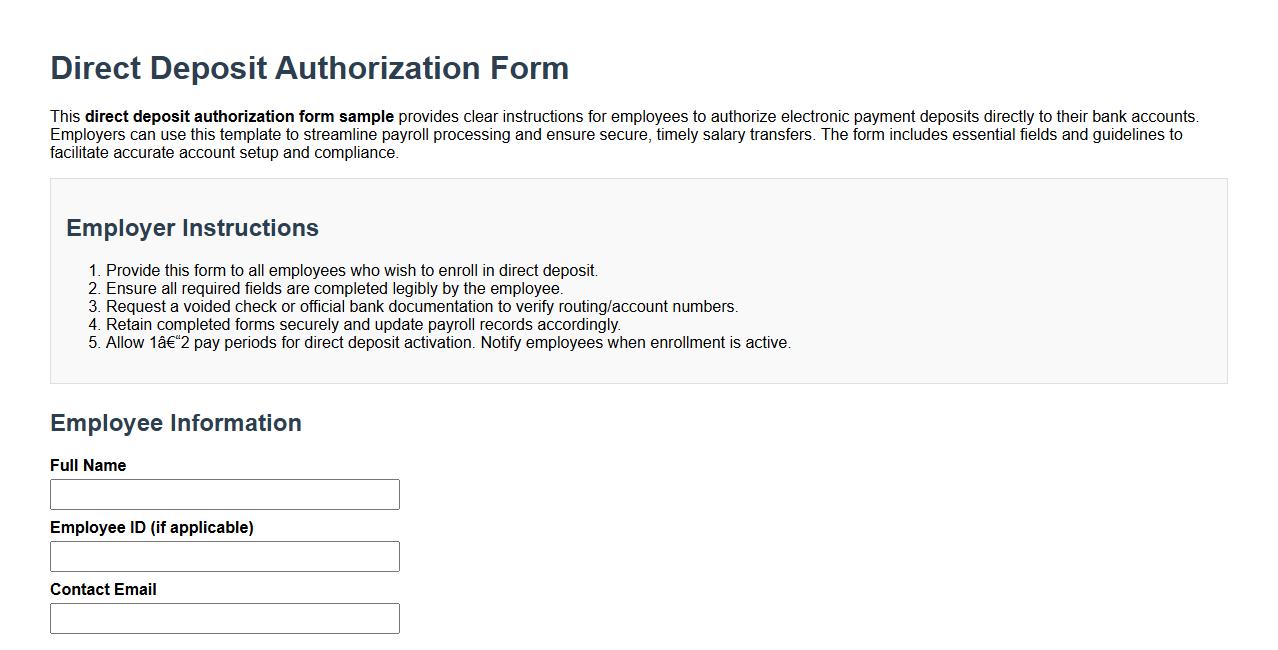

Direct deposit authorization form sample with employer instructions

This direct deposit authorization form sample provides clear instructions for employees to authorize electronic payment deposits directly to their bank accounts. Employers can use this template to streamline payroll processing and ensure secure, timely salary transfers. The form includes essential fields and guidelines to facilitate accurate account setup and compliance.

What security measures protect sensitive data on a Direct Deposit Authorization Form?

The security of sensitive data on a Direct Deposit Authorization Form is ensured through encryption during electronic submission and storage. Access to the form is typically restricted to authorized personnel within the payroll or HR department. Additionally, compliance with data protection regulations such as GDPR or HIPAA ensures that personal banking information is safeguarded at all times.

Which bank account types are eligible for direct deposit authorization?

Direct deposit authorization commonly supports both checking and savings accounts. Some institutions may also accept prepaid debit cards linked to a bank account. It is important to verify with the employer or financial institution to ensure the specific account type is eligible for direct deposit.

How can an employee revoke or update a Direct Deposit Authorization Form?

An employee can revoke or update their direct deposit details by submitting a new Direct Deposit Authorization Form to the payroll department. Typically, written notification or an official form must be completed to reflect any changes in bank account information. Employers often require a reasonable processing time to implement such updates, ensuring payroll accuracy.

Are digital signatures legally accepted on Direct Deposit Authorization Forms?

Yes, digital signatures are generally accepted on Direct Deposit Authorization Forms, provided they meet legal standards for electronic signatures. Laws like the ESIGN Act in the United States validate electronic signatures for payroll-related documents. Employers should use secure platforms that verify signature authenticity and maintain compliance with relevant regulations.

What supporting documents are required alongside the Direct Deposit Authorization Form?

Supporting documents often required with a Direct Deposit Authorization Form include a voided check or a bank statement. These documents help verify the accuracy of bank account details provided by the employee. Some employers may also request a government-issued ID to confirm the identity of the account holder.