A Payment Authorization Form Sample serves as a template allowing businesses to obtain customer consent for processing payments securely. This form details payment information, authorization scope, and terms to ensure transparent and compliant transactions. Using a clear Payment Authorization Form Sample helps streamline payment approvals and reduce disputes.

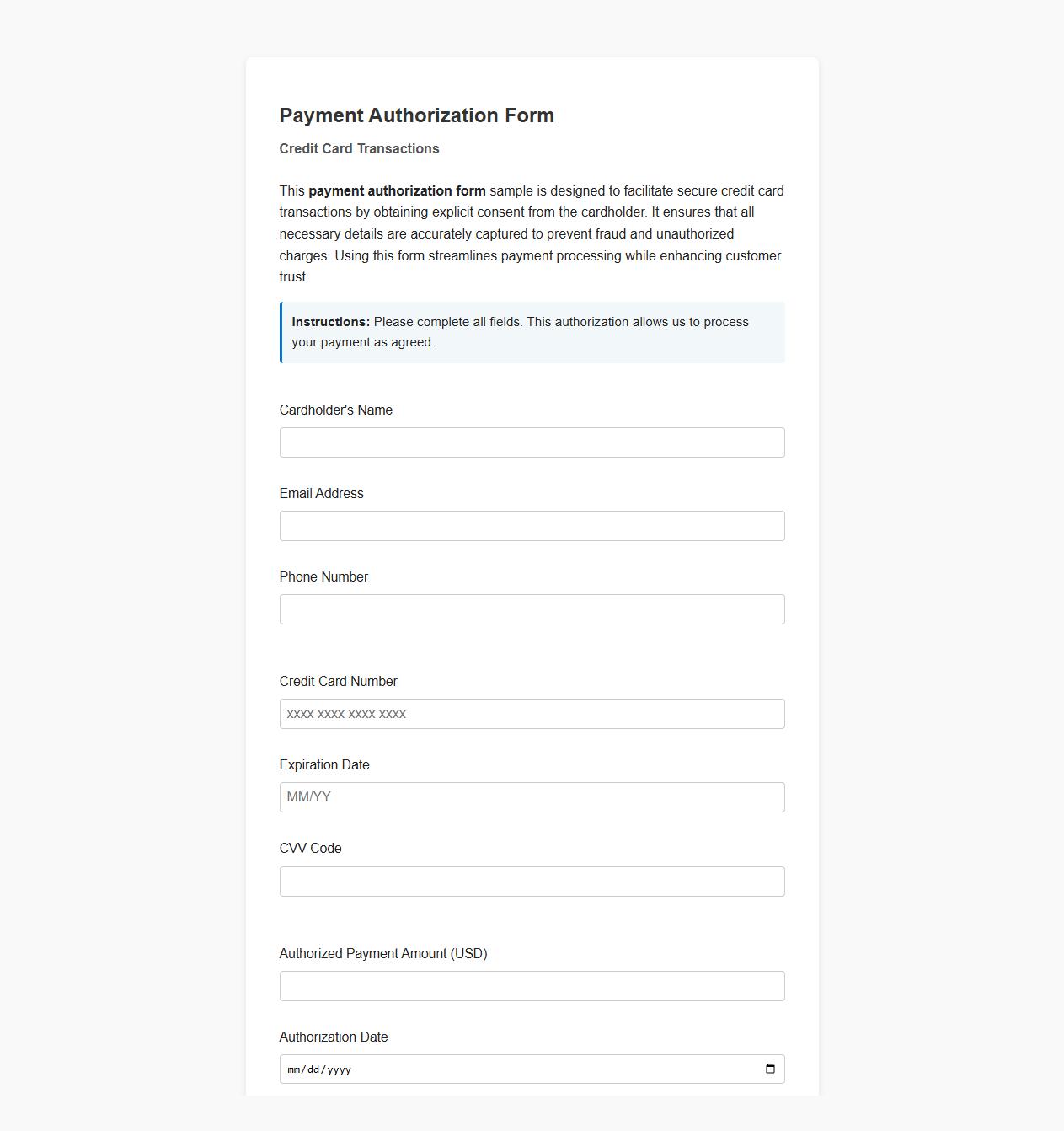

Payment authorization form sample for credit card transactions

This payment authorization form sample is designed to facilitate secure credit card transactions by obtaining explicit consent from the cardholder. It ensures that all necessary details are accurately captured to prevent fraud and unauthorized charges. Using this form streamlines payment processing while enhancing customer trust.

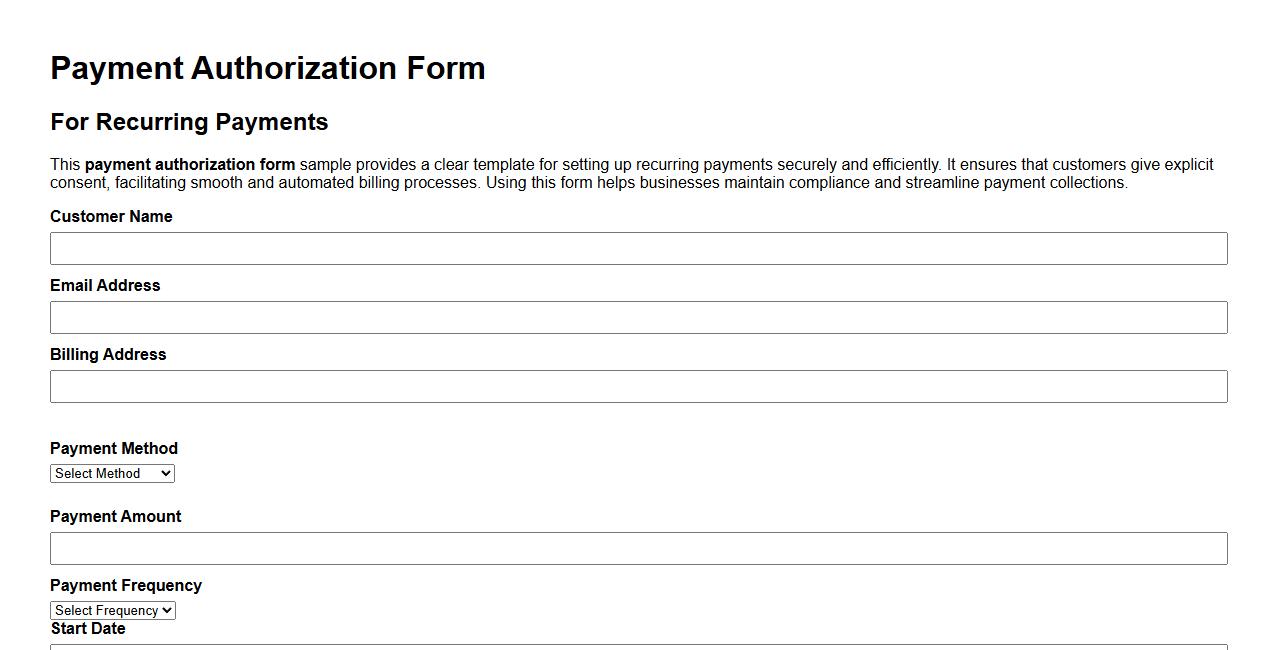

Payment authorization form sample for recurring payments

This payment authorization form sample provides a clear template for setting up recurring payments securely and efficiently. It ensures that customers give explicit consent, facilitating smooth and automated billing processes. Using this form helps businesses maintain compliance and streamline payment collections.

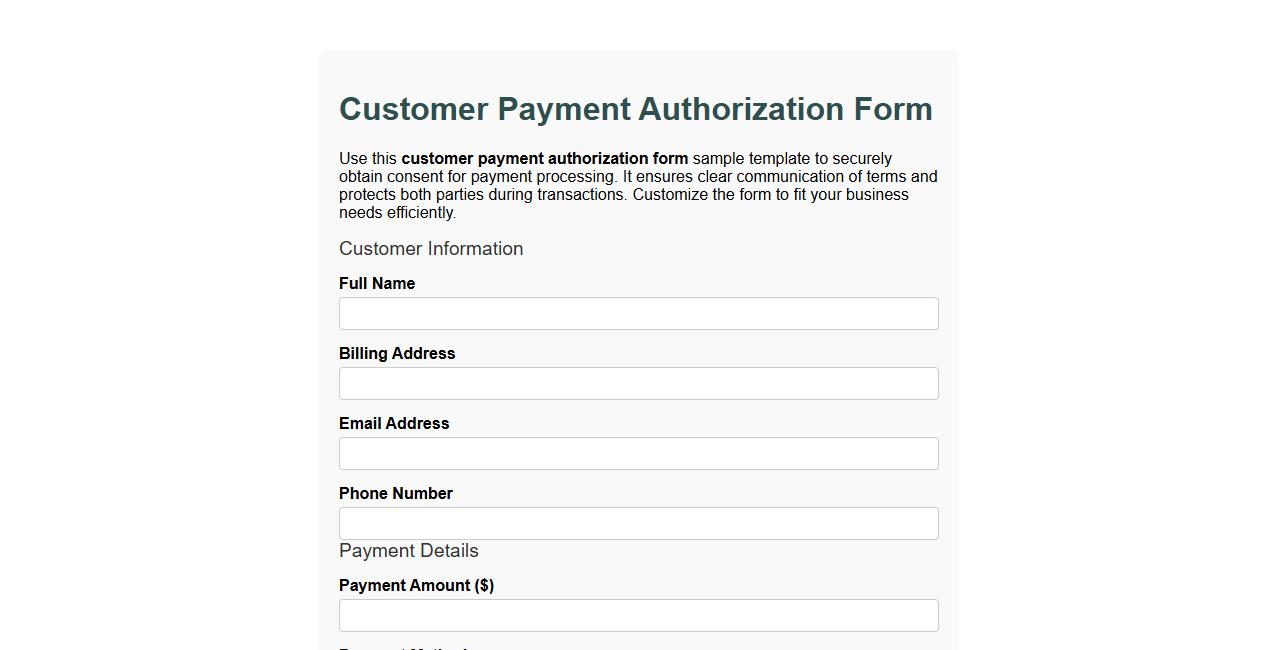

Customer payment authorization form sample template

Use this customer payment authorization form sample template to securely obtain consent for payment processing. It ensures clear communication of terms and protects both parties during transactions. Customize the form to fit your business needs efficiently.

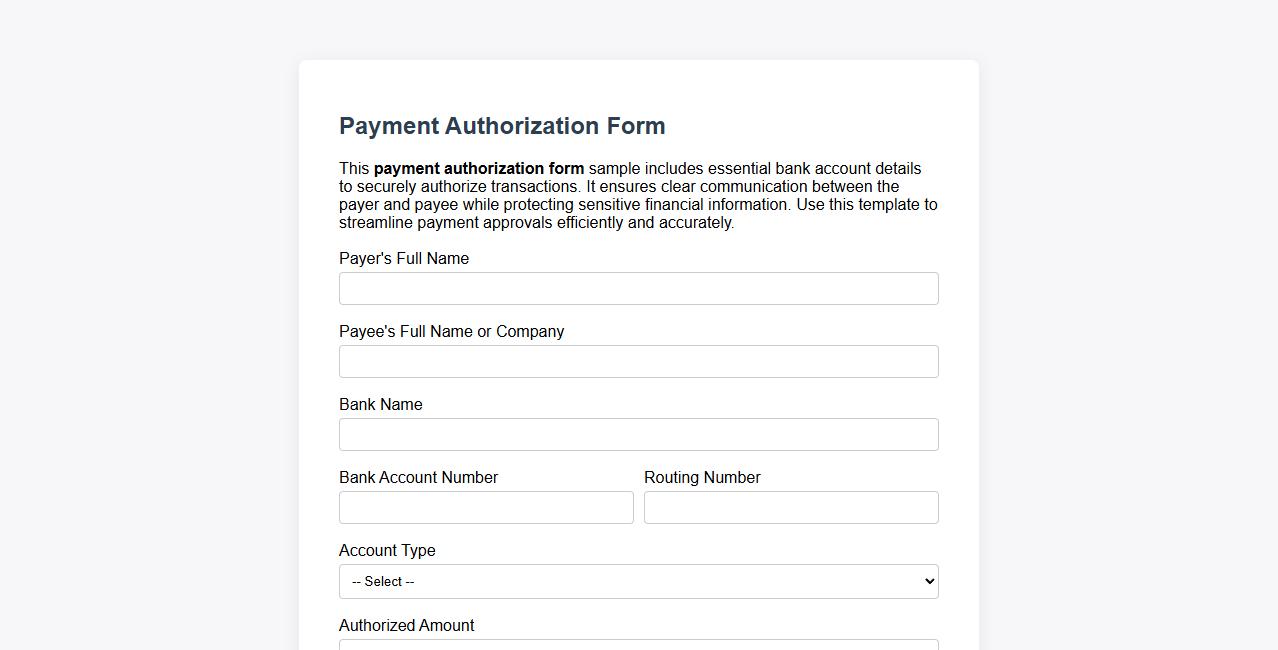

Payment authorization form sample with bank account details

This payment authorization form sample includes essential bank account details to securely authorize transactions. It ensures clear communication between the payer and payee while protecting sensitive financial information. Use this template to streamline payment approvals efficiently and accurately.

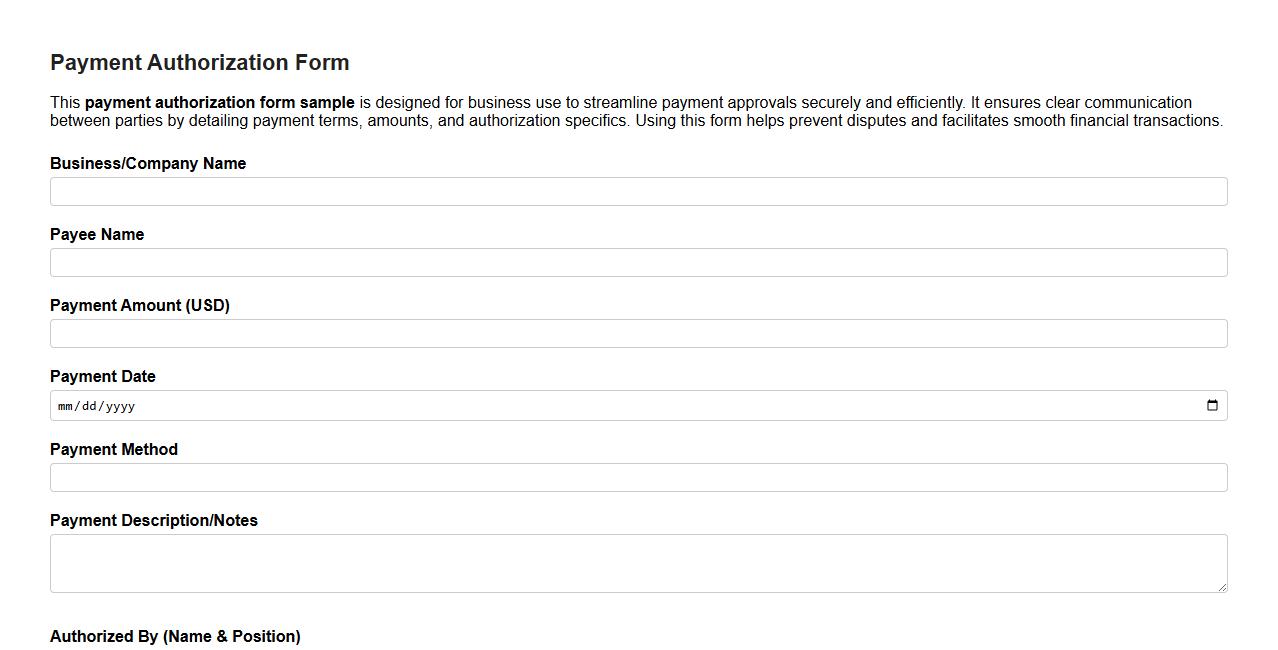

Payment authorization form sample for business use

This payment authorization form sample is designed for business use to streamline payment approvals securely and efficiently. It ensures clear communication between parties by detailing payment terms, amounts, and authorization specifics. Using this form helps prevent disputes and facilitates smooth financial transactions.

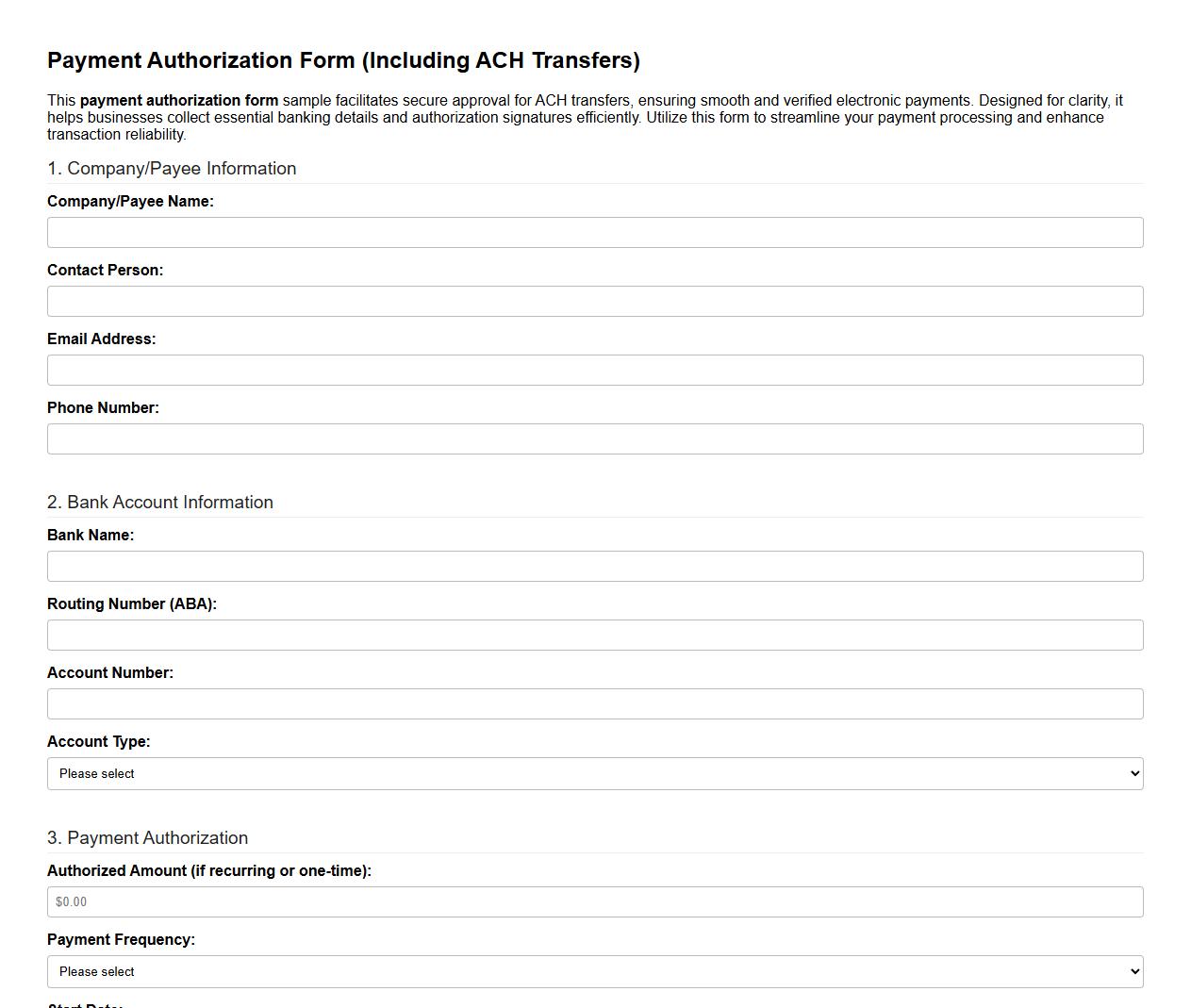

Payment authorization form sample including ACH transfers

This payment authorization form sample facilitates secure approval for ACH transfers, ensuring smooth and verified electronic payments. Designed for clarity, it helps businesses collect essential banking details and authorization signatures efficiently. Utilize this form to streamline your payment processing and enhance transaction reliability.

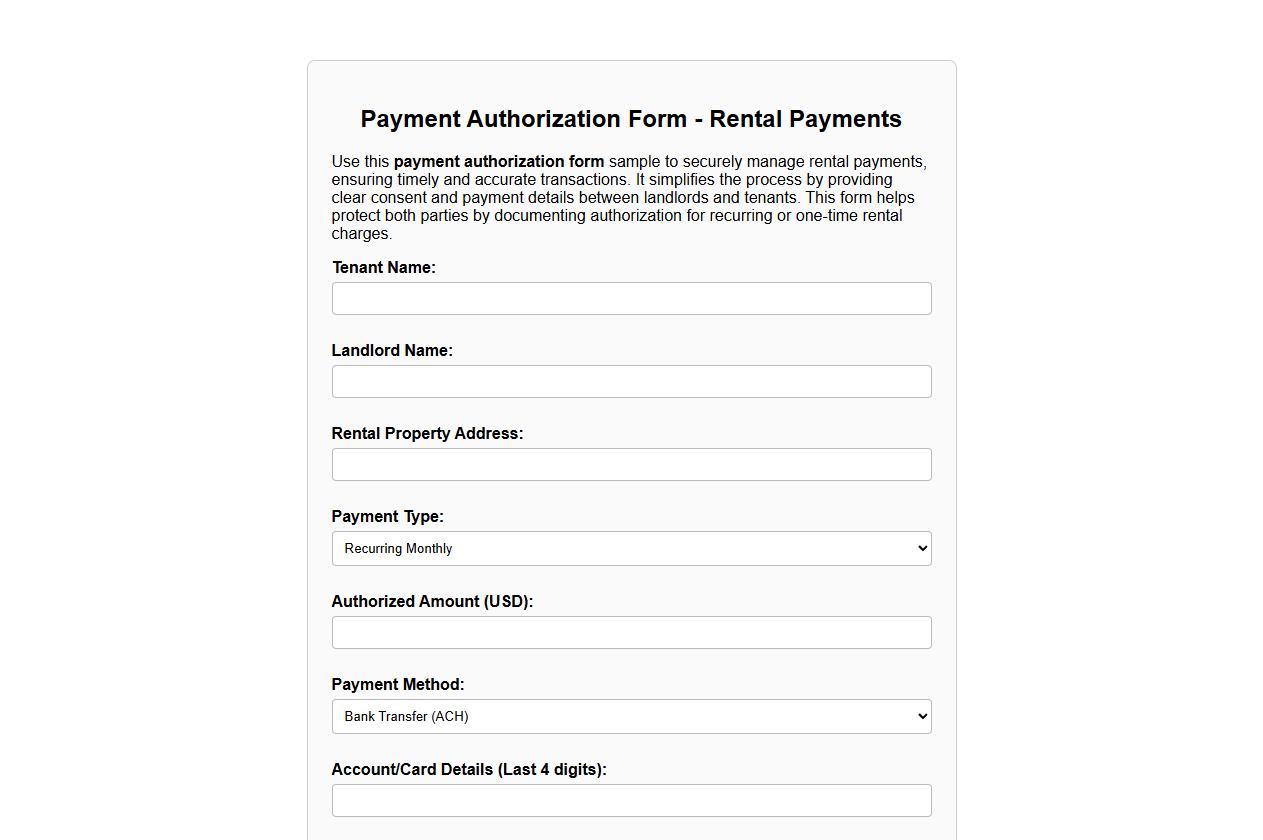

Payment authorization form sample for rental payments

Use this payment authorization form sample to securely manage rental payments, ensuring timely and accurate transactions. It simplifies the process by providing clear consent and payment details between landlords and tenants. This form helps protect both parties by documenting authorization for recurring or one-time rental charges.

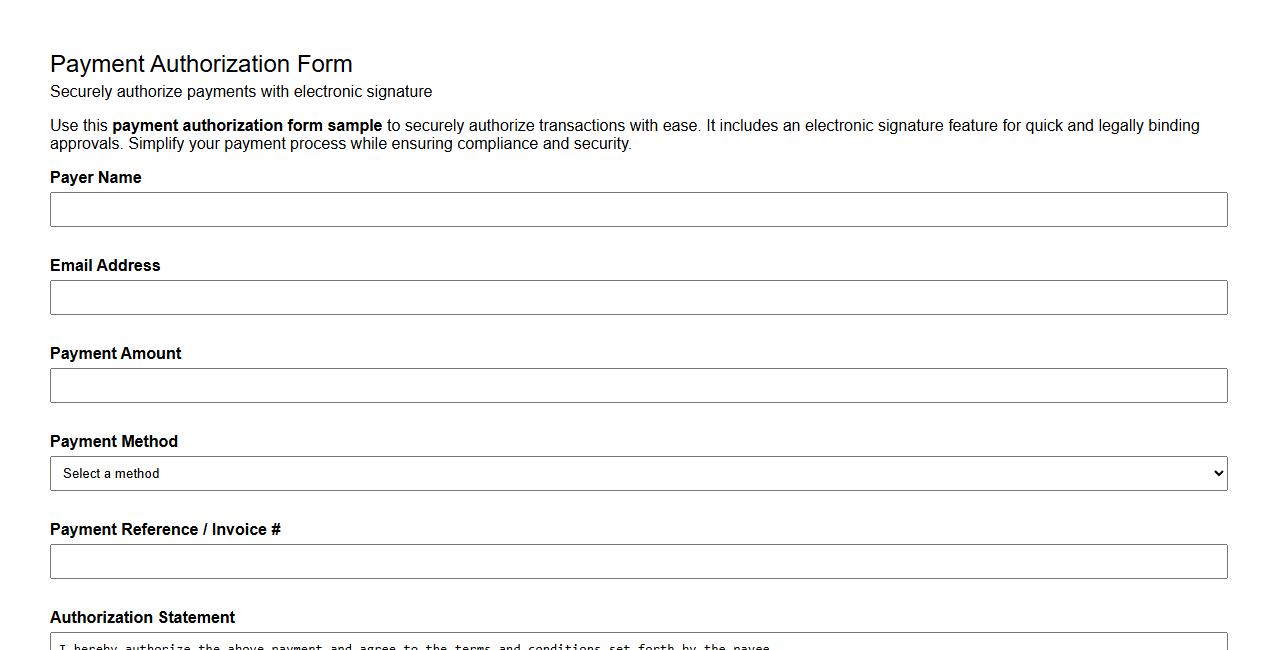

Payment authorization form sample with electronic signature

Use this payment authorization form sample to securely authorize transactions with ease. It includes an electronic signature feature for quick and legally binding approvals. Simplify your payment process while ensuring compliance and security.

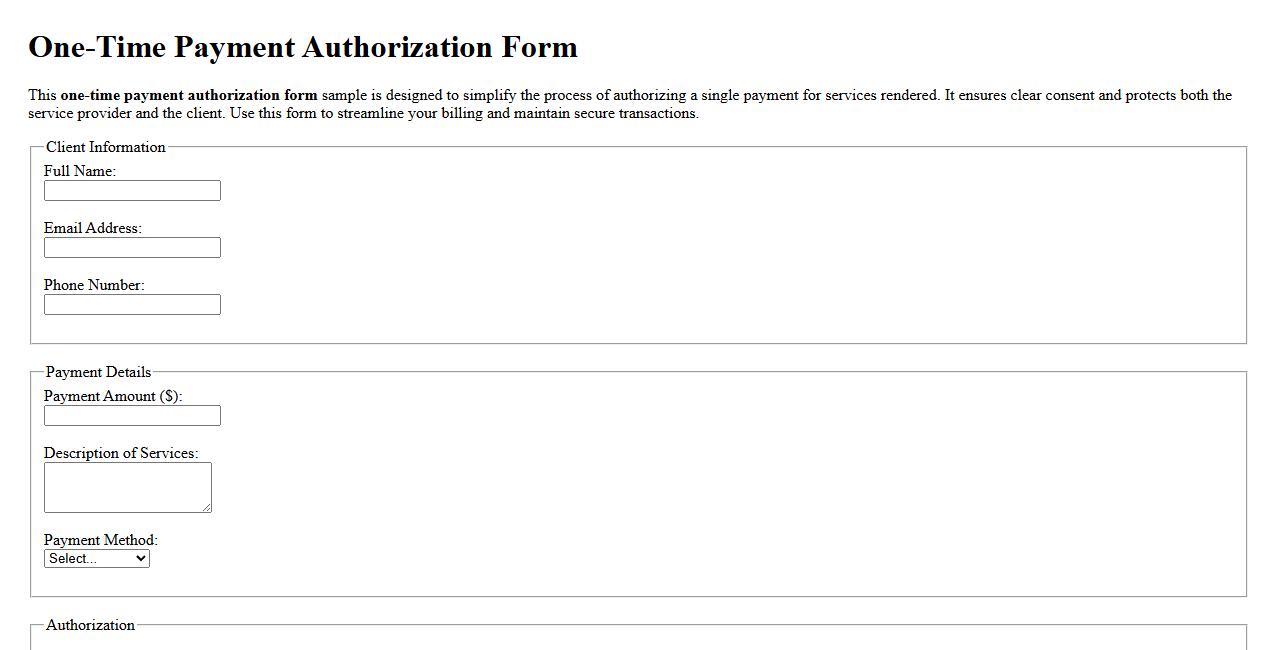

One-time payment authorization form sample for services

This one-time payment authorization form sample is designed to simplify the process of authorizing a single payment for services rendered. It ensures clear consent and protects both the service provider and the client. Use this form to streamline your billing and maintain secure transactions.

What specific information must be included in a Payment Authorization Form for recurring transactions?

A Payment Authorization Form for recurring transactions must include the customer's full name, billing address, and contact details. It should clearly specify the payment amount, frequency, and duration of the recurring charges. Additionally, the form requires explicit consent from the customer authorizing the automated charges to their payment method.

How does a Payment Authorization Form ensure compliance with PCI DSS requirements?

The form ensures PCI DSS compliance by capturing only the necessary payment information and protecting it through encryption. It mandates secure storage and restricted access to sensitive cardholder data to prevent unauthorized use. Regular audits and validation processes are also integrated to maintain compliance throughout the transaction lifecycle.

What digital signature methods are accepted for online Payment Authorization Forms?

Electronic signatures such as typed names, scanned handwritten signatures, or signatures drawn on touchscreen devices are commonly accepted. Advanced methods like digital certificates or multi-factor authentication provide higher security and legal validity. Compliance with e-signature laws, such as ESIGN and eIDAS, further legitimizes these digital signatures.

How long should Payment Authorization Forms be securely stored after processing?

Retention periods typically range from 2 to 7 years, depending on legal and regulatory requirements. Secure storage methods include encrypted databases and restricted physical access to prevent data breaches. Maintaining these records is essential for audits, chargebacks, and dispute resolution procedures.

What are the legal implications if a Payment Authorization Form is incomplete or unsigned?

An incomplete or unsigned form can nullify the authorization, resulting in denied transactions and potential legal disputes. Businesses may face penalties, chargebacks, or claims of unauthorized billing from customers. It is critical to obtain fully executed forms to ensure enforceability and protect against financial and reputational risks.