A Payroll Deduction Authorization Form Sample is a document that allows employees to authorize their employer to deduct specified amounts from their paycheck for various purposes such as loan repayments, union dues, or charitable contributions. This form ensures clear communication and legal compliance between the employee and employer regarding the deductions. Using a sample helps streamline the process by providing a standardized template for accurate and efficient completion.

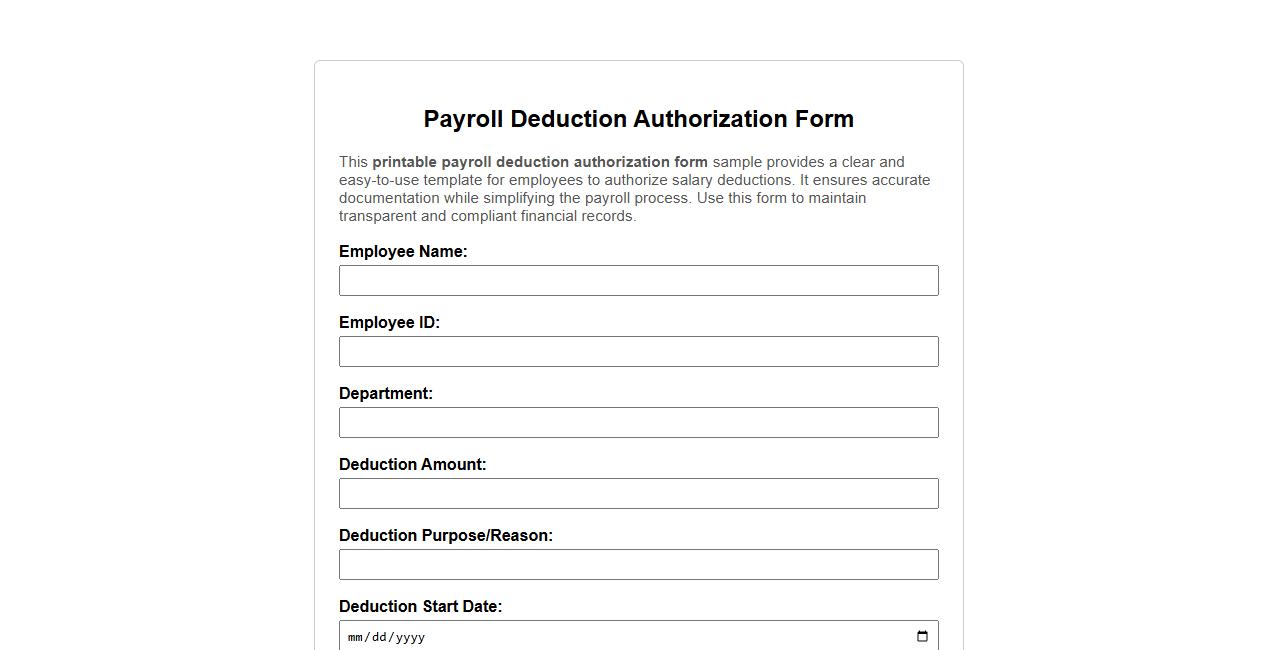

Printable payroll deduction authorization form sample

This printable payroll deduction authorization form sample provides a clear and easy-to-use template for employees to authorize salary deductions. It ensures accurate documentation while simplifying the payroll process. Use this form to maintain transparent and compliant financial records.

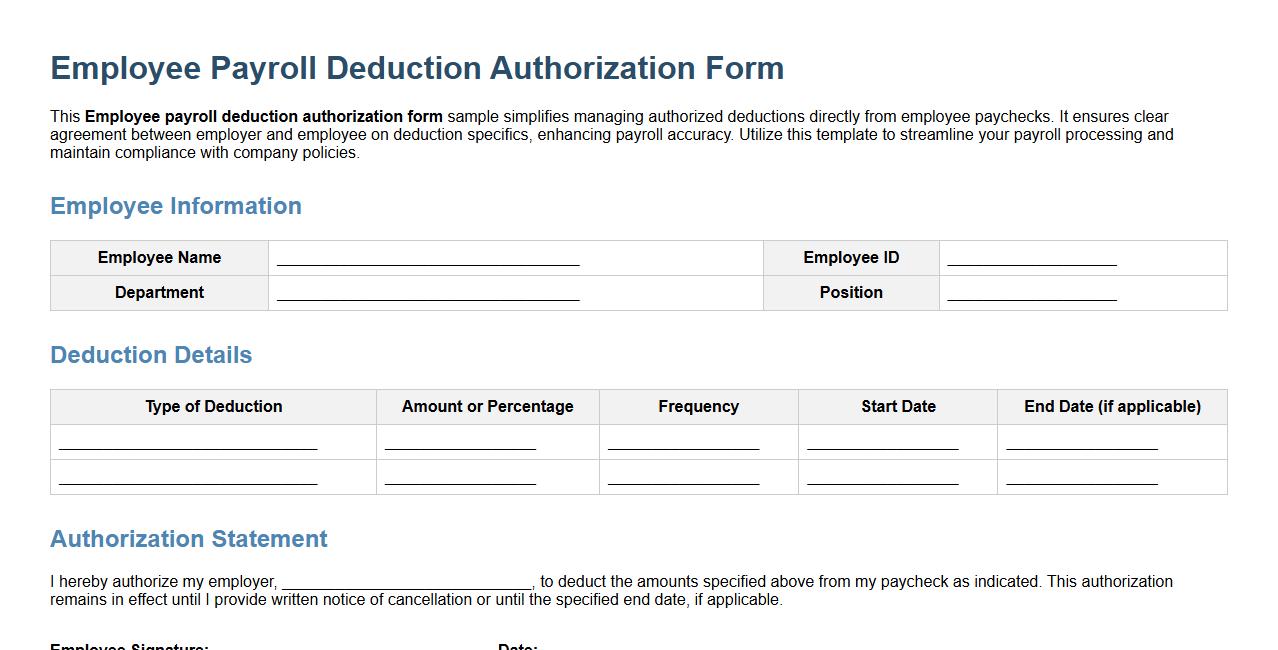

Employee payroll deduction authorization form sample

This Employee payroll deduction authorization form sample simplifies managing authorized deductions directly from employee paychecks. It ensures clear agreement between employer and employee on deduction specifics, enhancing payroll accuracy. Utilize this template to streamline your payroll processing and maintain compliance with company policies.

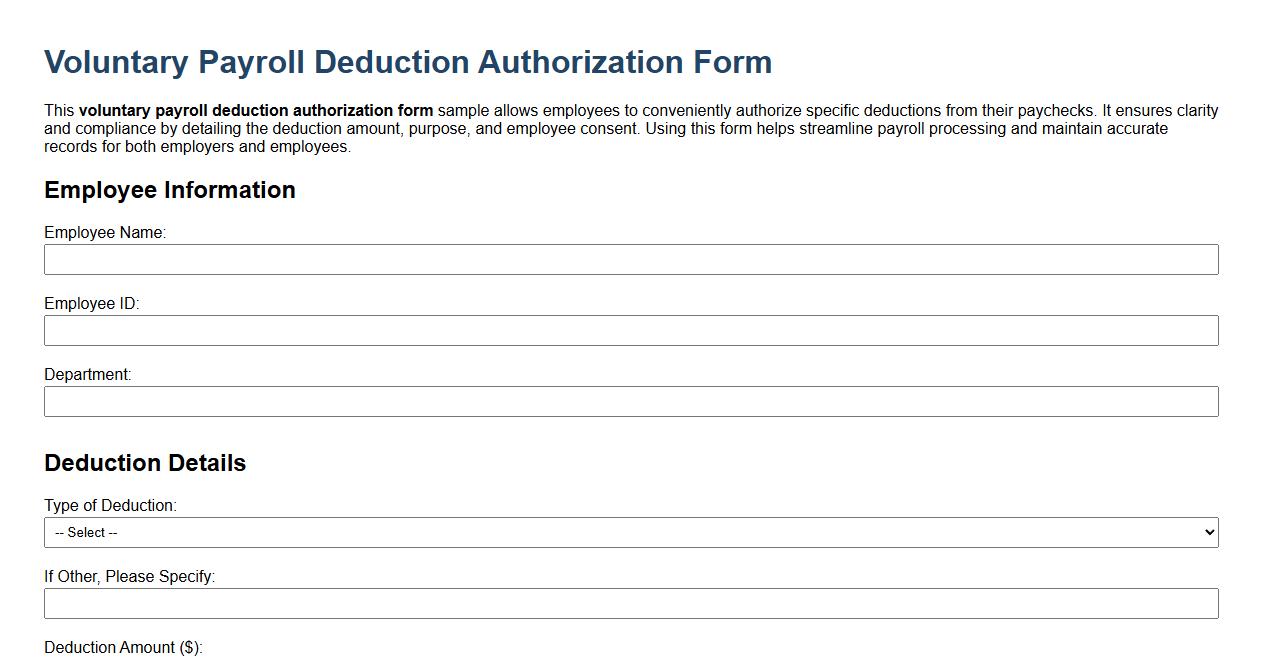

Voluntary payroll deduction authorization form sample

This voluntary payroll deduction authorization form sample allows employees to conveniently authorize specific deductions from their paychecks. It ensures clarity and compliance by detailing the deduction amount, purpose, and employee consent. Using this form helps streamline payroll processing and maintain accurate records for both employers and employees.

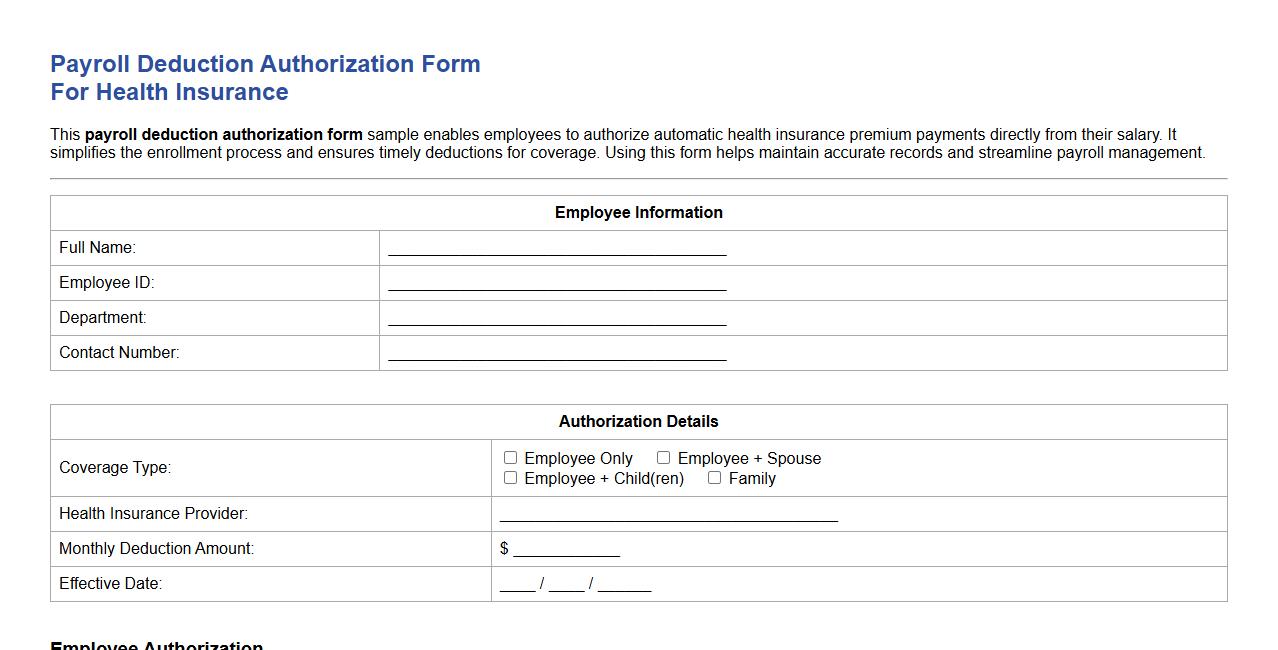

Payroll deduction authorization form sample for health insurance

This payroll deduction authorization form sample enables employees to authorize automatic health insurance premium payments directly from their salary. It simplifies the enrollment process and ensures timely deductions for coverage. Using this form helps maintain accurate records and streamline payroll management.

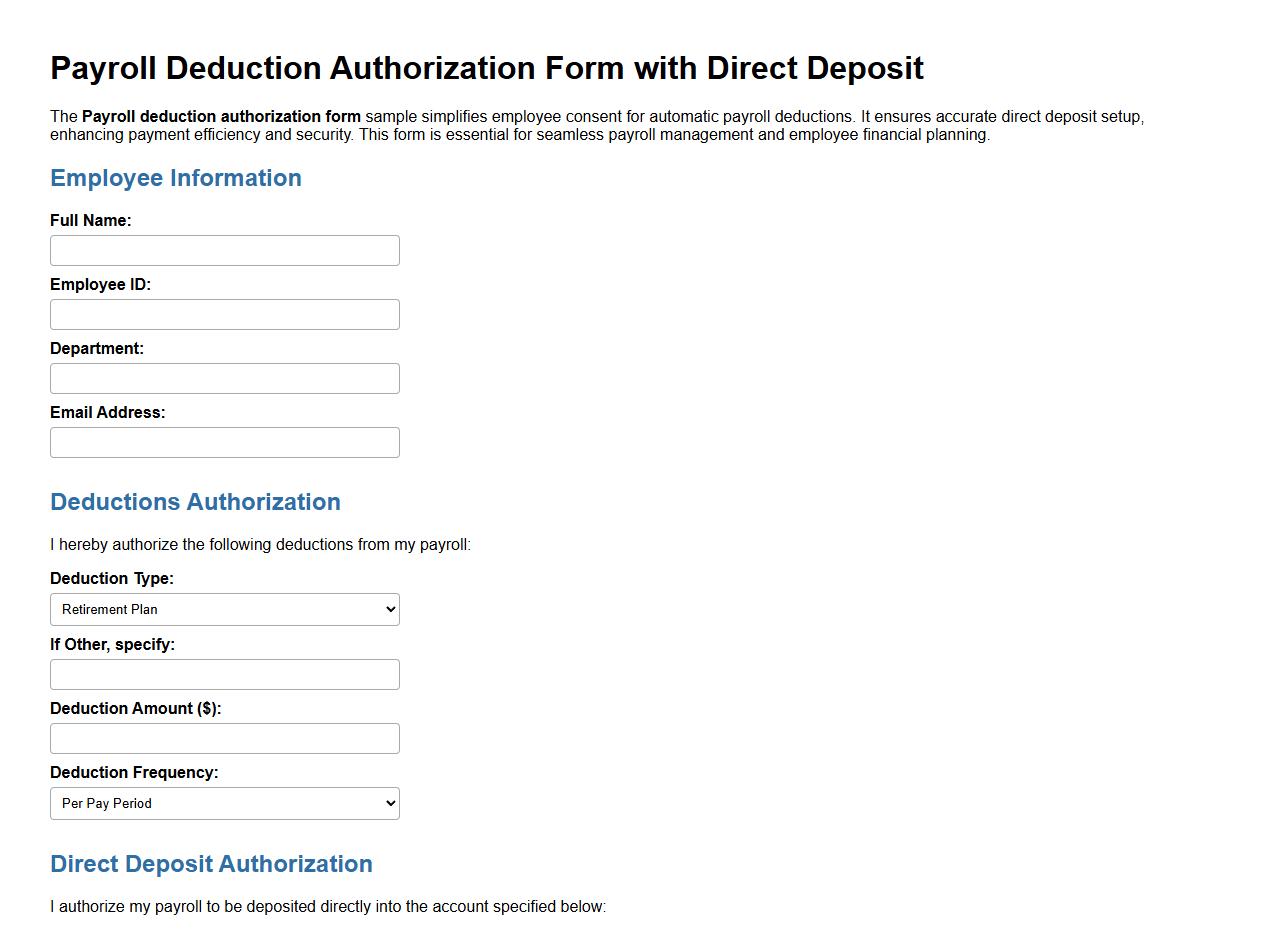

Payroll deduction authorization form sample with direct deposit

The Payroll deduction authorization form sample simplifies employee consent for automatic payroll deductions. It ensures accurate direct deposit setup, enhancing payment efficiency and security. This form is essential for seamless payroll management and employee financial planning.

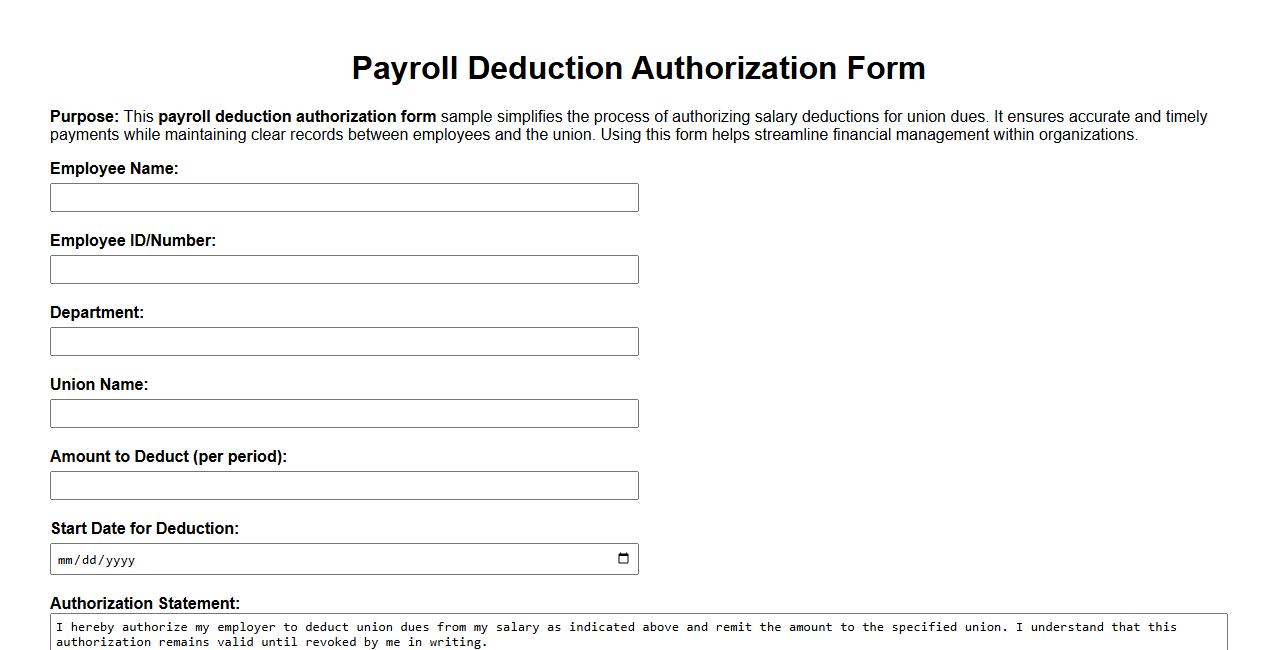

Payroll deduction authorization form sample for union dues

This payroll deduction authorization form sample simplifies the process of authorizing salary deductions for union dues. It ensures accurate and timely payments while maintaining clear records between employees and the union. Using this form helps streamline financial management within organizations.

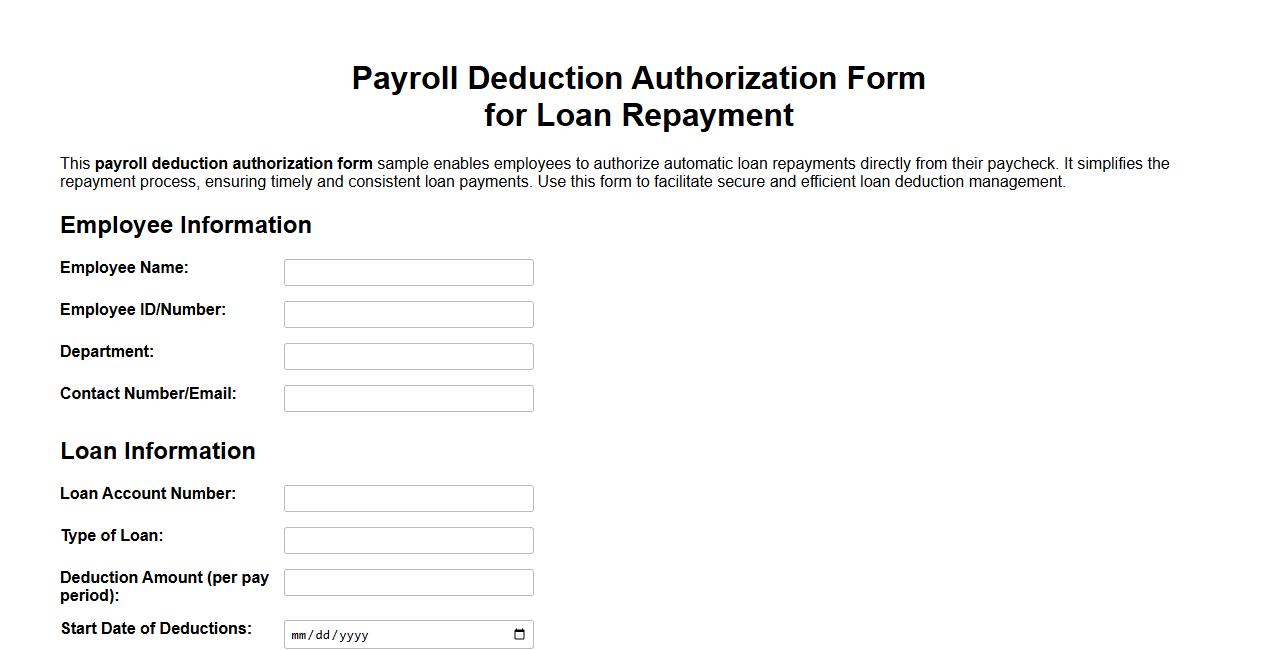

Payroll deduction authorization form sample for loan repayment

This payroll deduction authorization form sample enables employees to authorize automatic loan repayments directly from their paycheck. It simplifies the repayment process, ensuring timely and consistent loan payments. Use this form to facilitate secure and efficient loan deduction management.

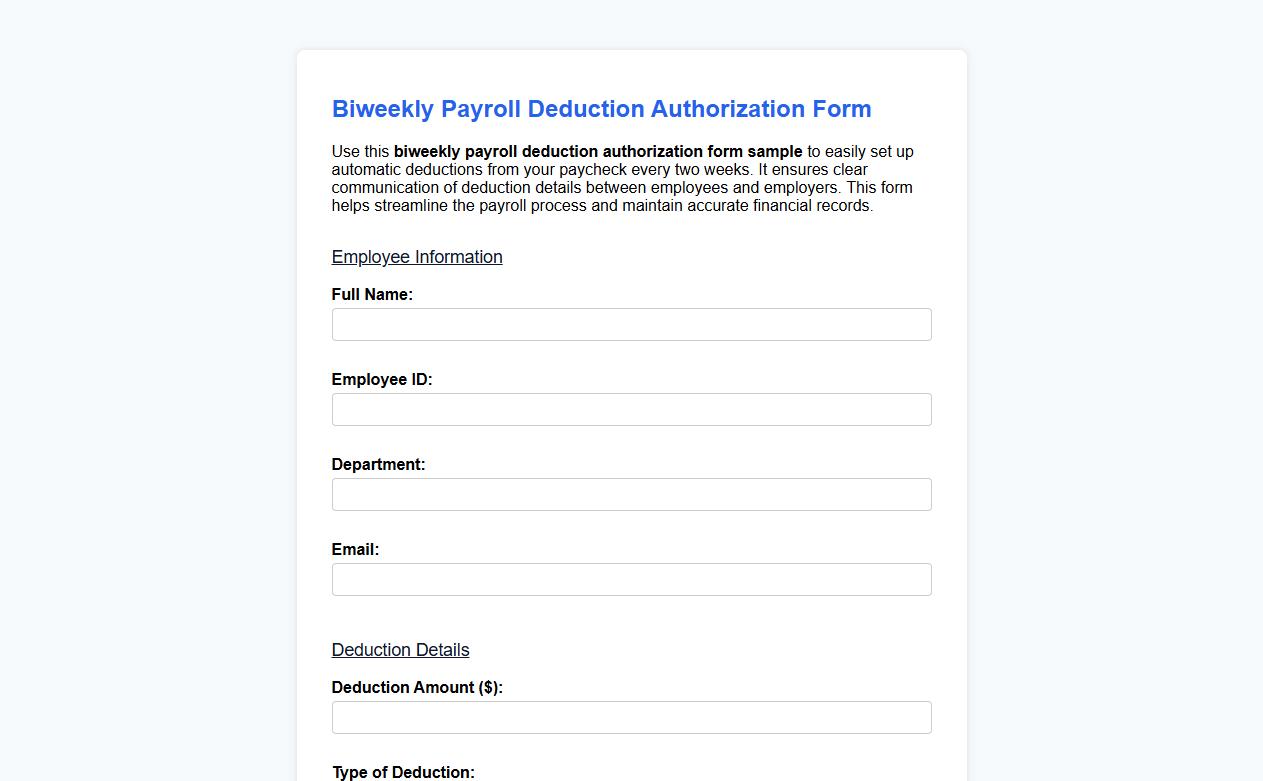

Biweekly payroll deduction authorization form sample

Use this biweekly payroll deduction authorization form sample to easily set up automatic deductions from your paycheck every two weeks. It ensures clear communication of deduction details between employees and employers. This form helps streamline the payroll process and maintain accurate financial records.

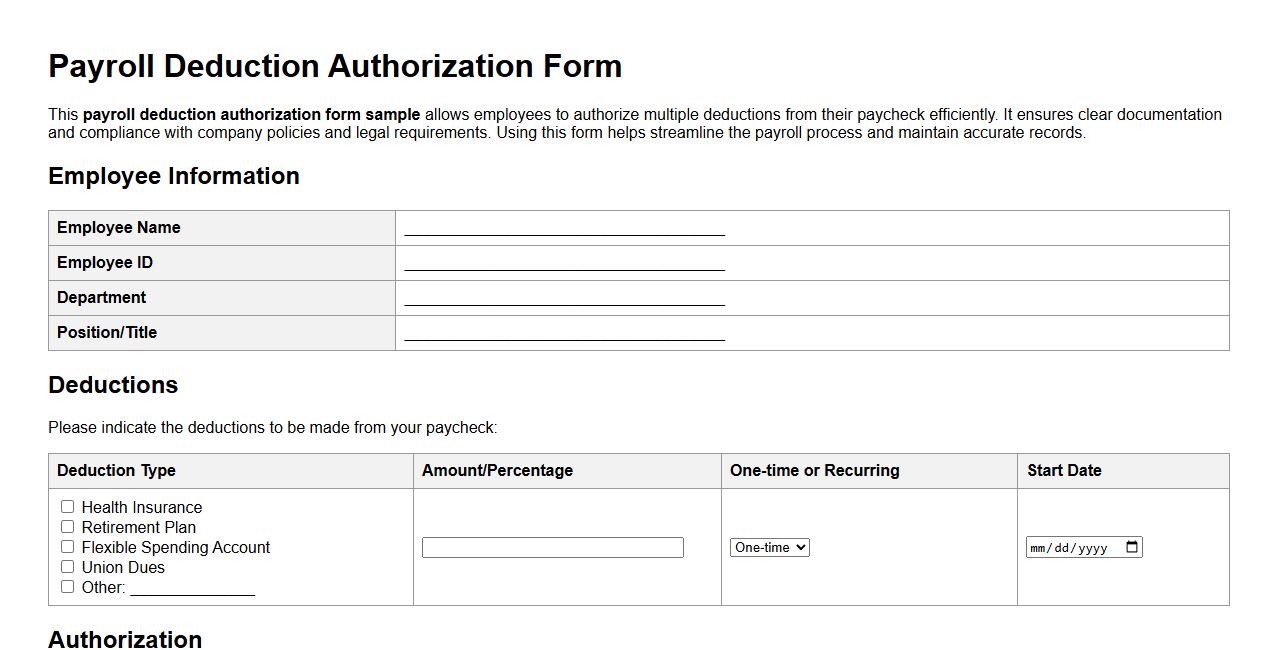

Payroll deduction authorization form sample with multiple deductions

This payroll deduction authorization form sample allows employees to authorize multiple deductions from their paycheck efficiently. It ensures clear documentation and compliance with company policies and legal requirements. Using this form helps streamline the payroll process and maintain accurate records.

What specific deductions can be authorized on the Payroll Deduction Authorization Form?

The Payroll Deduction Authorization Form allows employees to authorize various deductions such as health insurance premiums, retirement contributions, and union dues. Other common deductions include charitable donations and loan repayments. This form ensures that these deductions are systematically processed through the employee's payroll.

How can employees revoke or amend an existing Payroll Deduction Authorization Form?

Employees can revoke or amend their payroll deduction authorizations by submitting a new signed form or a written notice to the payroll or HR department. It is important that any changes are communicated in advance to ensure accurate payroll processing. Some organizations may require a specific notice period before changes take effect.

Are digital signatures accepted on Payroll Deduction Authorization Forms for compliance?

Many organizations now accept digital signatures on Payroll Deduction Authorization Forms to enhance convenience and compliance. Electronic signatures meet legal requirements when they comply with relevant e-signature laws and security standards. This also streamlines processing and maintains an audit trail for verification.

What is the effective date of payroll deductions after submitting the authorization form?

The effective date for payroll deductions typically depends on the payroll cycle and the time of form submission. Usually, deductions begin on the next payroll period after the authorization is processed by HR or payroll. Employees are encouraged to check with their payroll department for precise timing details.

How is sensitive employee data protected on the Payroll Deduction Authorization Form?

Organizations implement data protection measures such as encryption, secure storage, and restricted access to safeguard sensitive employee information. Compliance with data privacy regulations ensures that personal and financial data remain confidential. Additionally, secure digital systems reduce risks of unauthorized access or data breaches.