A Loan Authorization Form Sample serves as a template that allows borrowers to grant permission for a lender to access their financial information. This form streamlines the loan approval process by ensuring clear communication and consent between both parties. It typically includes details such as borrower identification, loan amount, and authorization terms.

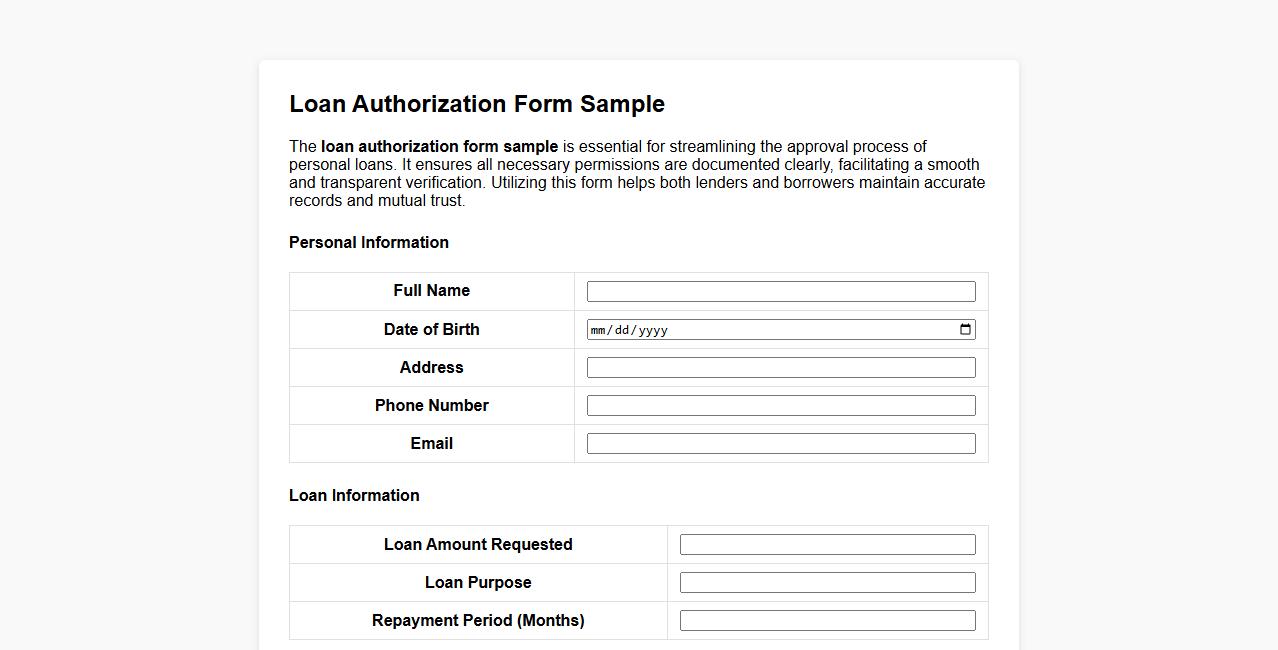

Loan authorization form sample for personal loan approval

The loan authorization form sample is essential for streamlining the approval process of personal loans. It ensures all necessary permissions are documented clearly, facilitating a smooth and transparent verification. Utilizing this form helps both lenders and borrowers maintain accurate records and mutual trust.

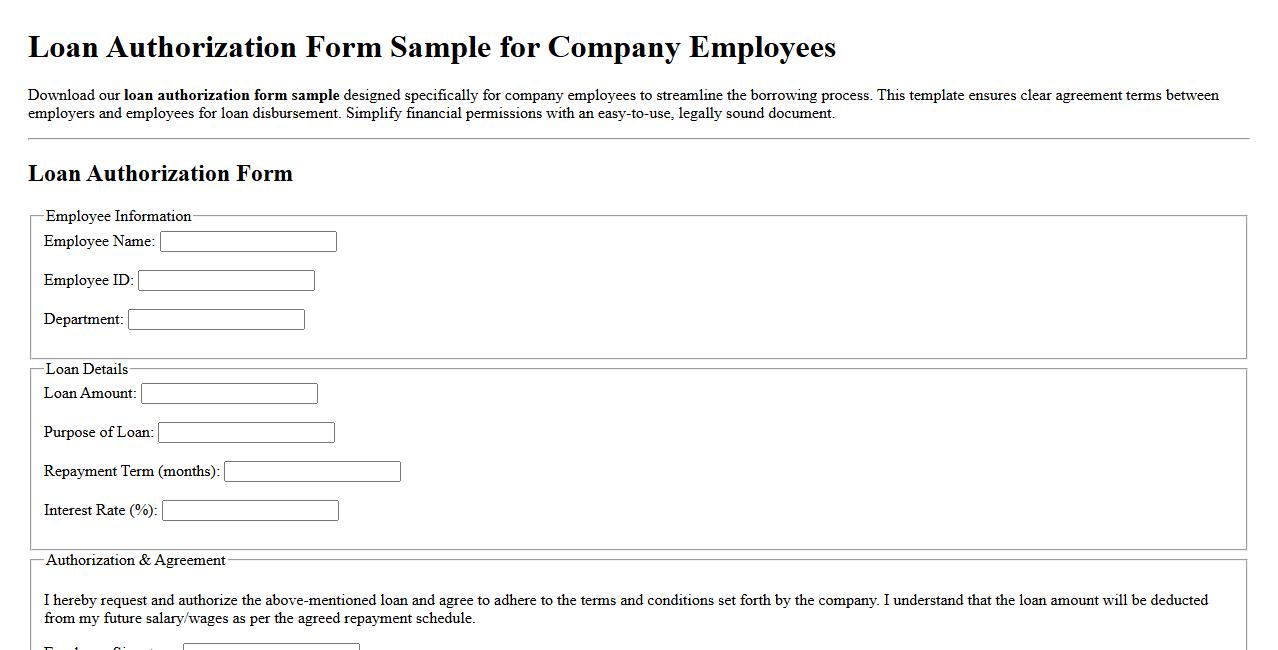

Loan authorization form sample for company employees

Download our loan authorization form sample designed specifically for company employees to streamline the borrowing process. This template ensures clear agreement terms between employers and employees for loan disbursement. Simplify financial permissions with an easy-to-use, legally sound document.

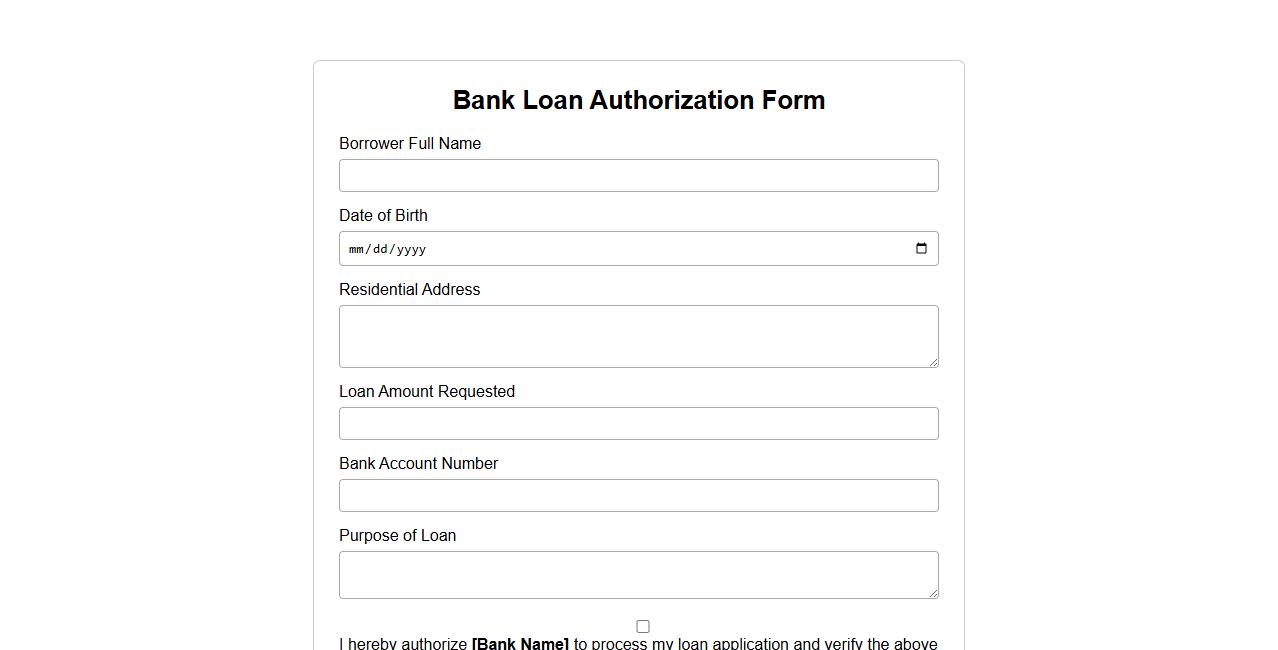

Bank loan authorization form sample with signature

This bank loan authorization form sample includes all necessary fields to grant permission for loan processing, ensuring compliance and security. It features a designated area for the borrower's signature to validate consent. Using this template helps streamline loan approvals efficiently and reliably.

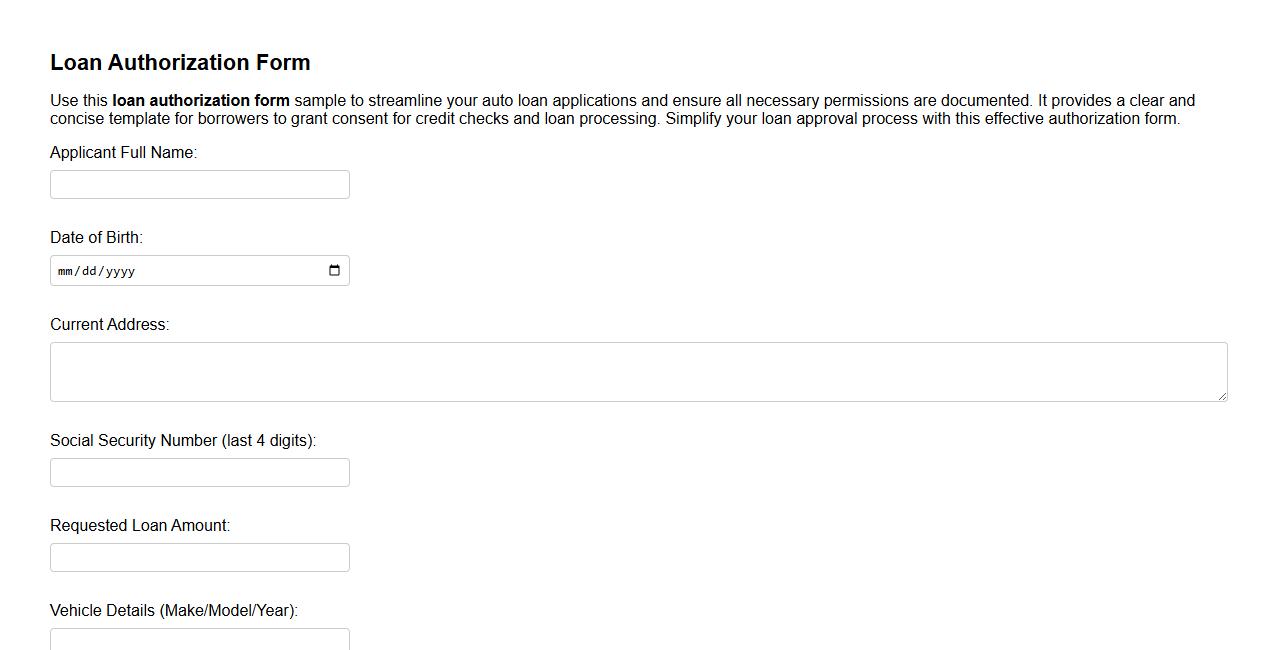

Loan authorization form sample for auto loan applications

Use this loan authorization form sample to streamline your auto loan applications and ensure all necessary permissions are documented. It provides a clear and concise template for borrowers to grant consent for credit checks and loan processing. Simplify your loan approval process with this effective authorization form.

Mortgage loan authorization form sample download

Download a mortgage loan authorization form sample to streamline the loan approval process. This form grants lenders permission to verify your financial information efficiently. Accessing a ready-made template ensures accuracy and saves time during the application.

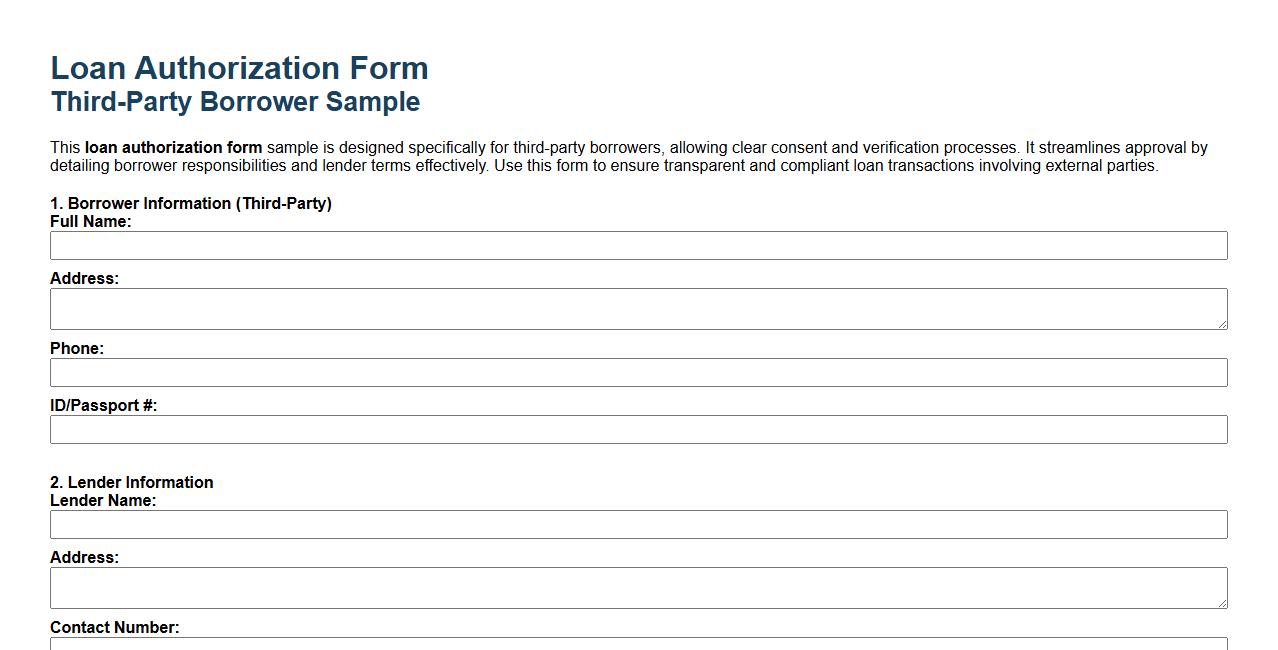

Loan authorization form sample for third-party borrowers

This loan authorization form sample is designed specifically for third-party borrowers, allowing clear consent and verification processes. It streamlines approval by detailing borrower responsibilities and lender terms effectively. Use this form to ensure transparent and compliant loan transactions involving external parties.

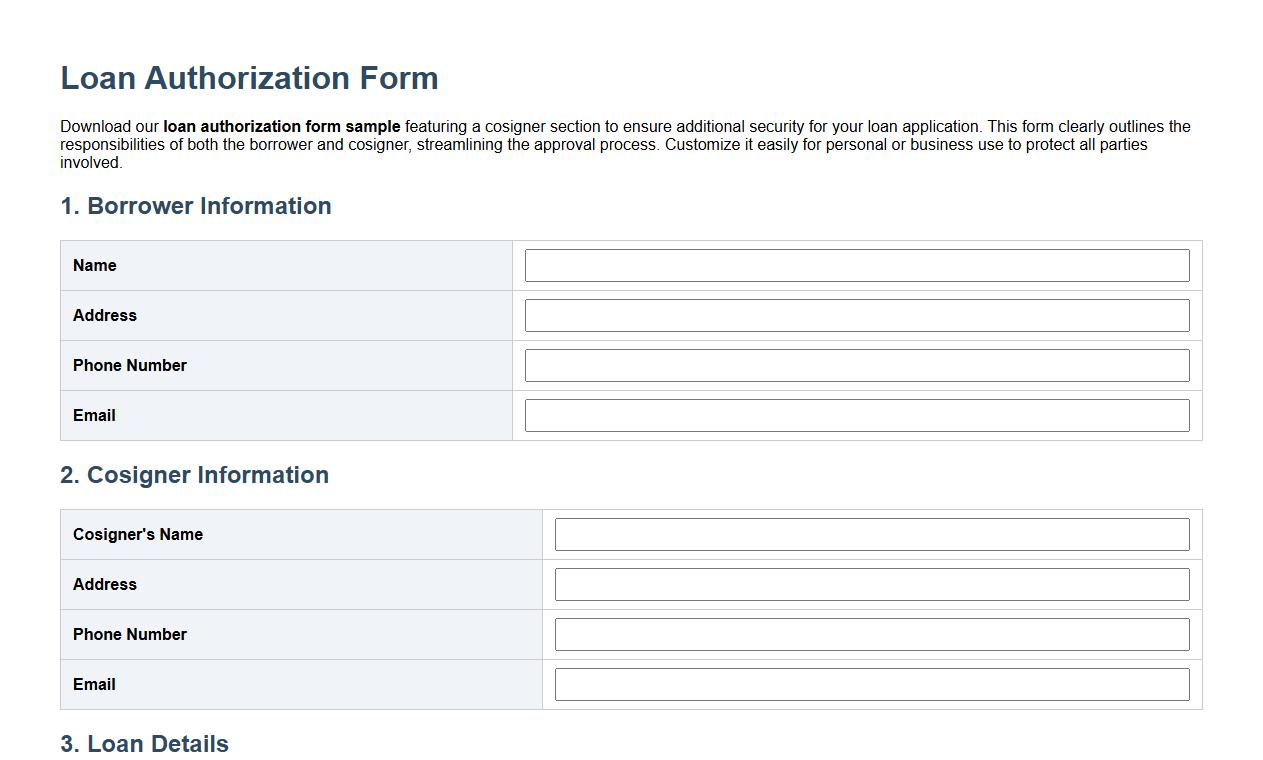

Loan authorization form sample with cosigner section

Download our loan authorization form sample featuring a cosigner section to ensure additional security for your loan application. This form clearly outlines the responsibilities of both the borrower and cosigner, streamlining the approval process. Customize it easily for personal or business use to protect all parties involved.

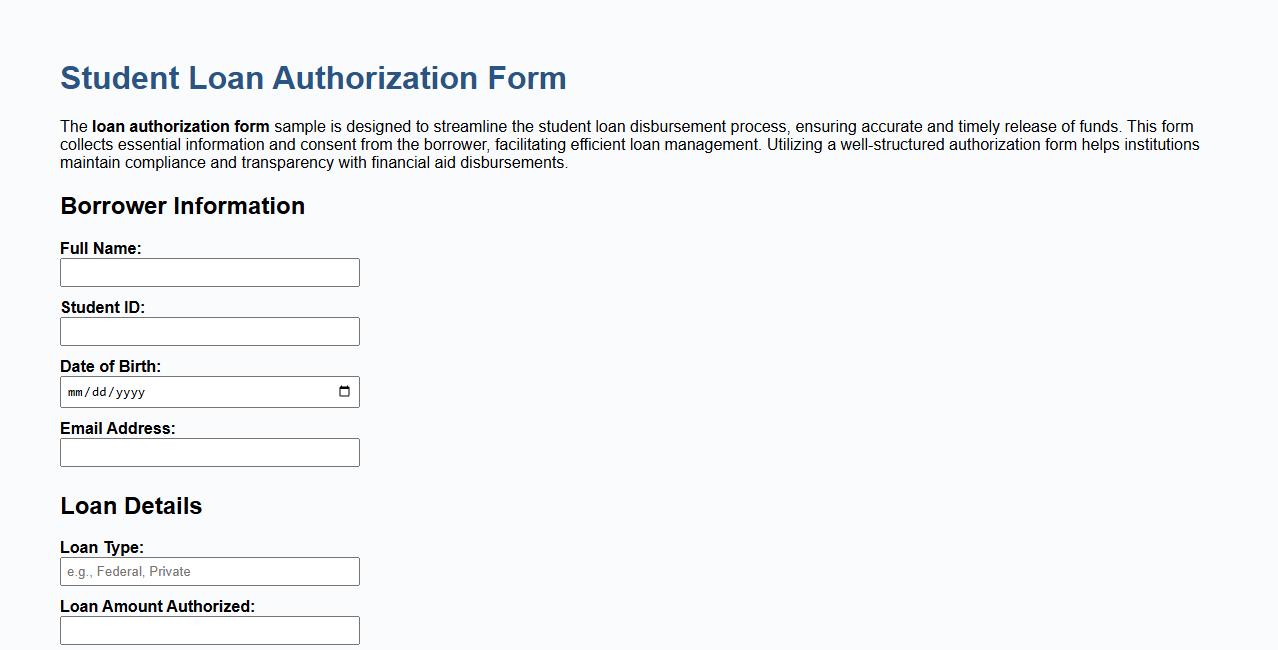

Loan authorization form sample for student loan disbursement

The loan authorization form sample is designed to streamline the student loan disbursement process, ensuring accurate and timely release of funds. This form collects essential information and consent from the borrower, facilitating efficient loan management. Utilizing a well-structured authorization form helps institutions maintain compliance and transparency with financial aid disbursements.

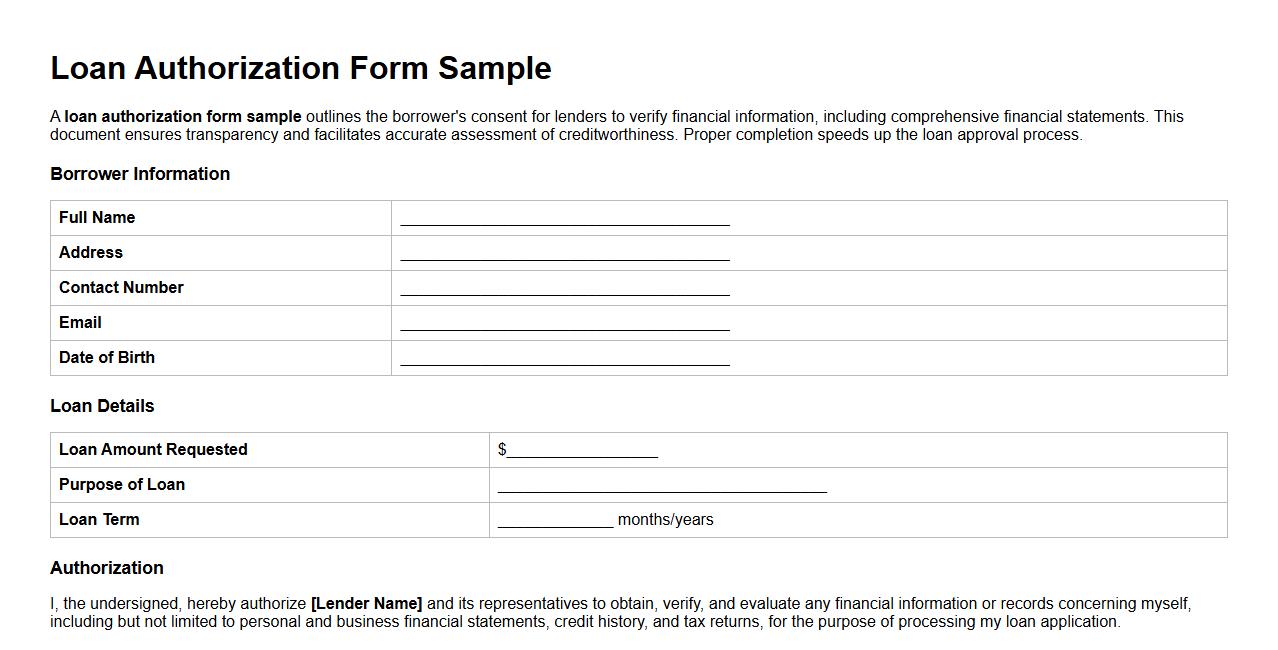

Loan authorization form sample including financial statements

A loan authorization form sample outlines the borrower's consent for lenders to verify financial information, including comprehensive financial statements. This document ensures transparency and facilitates accurate assessment of creditworthiness. Proper completion speeds up the loan approval process.

What specific collateral details must be included in the Loan Authorization Form?

The Loan Authorization Form must include detailed information about the collateral such as description, value, and location. It should clearly identify the type of asset being pledged to secure the loan. Providing accurate collateral details ensures proper assessment and validation by the lender.

How does the form address co-signer authorization and liability?

The form explicitly requires a co-signer's authorization with their personal details, signature, and agreement to the loan terms. It clearly states the liability of the co-signer for repayment obligations. This ensures legal accountability and protects the lender's interests.

Are digital signatures accepted or is a wet signature mandatory?

The form usually specifies whether digital signatures are accepted or if a wet signature is mandatory. Many lenders are now embracing electronic signatures for faster processing. However, certain cases may still require an original signature to comply with legal standards.

What are the document retention and validity periods for submitted forms?

The Loan Authorization Form outlines the document retention period for record-keeping compliance, typically several years. It also specifies the validity period within which the loan application remains active. These provisions help ensure regulatory adherence and timely loan processing.

Which sections require notarization before loan processing?

Notarization is generally required for critical sections such as borrower and co-signer signature blocks. This verifies the authenticity of the parties involved and their consent. Proper notarization is essential to ensure the legal enforceability of the loan agreement.