The Income Tax Declaration Form Sample serves as a template to guide individuals in accurately reporting their income and tax details. This form assists taxpayers in declaring various sources of income, deductions, and exemptions to ensure compliance with tax regulations. Proper completion of the form helps in accurate calculation and timely submission of income tax returns.

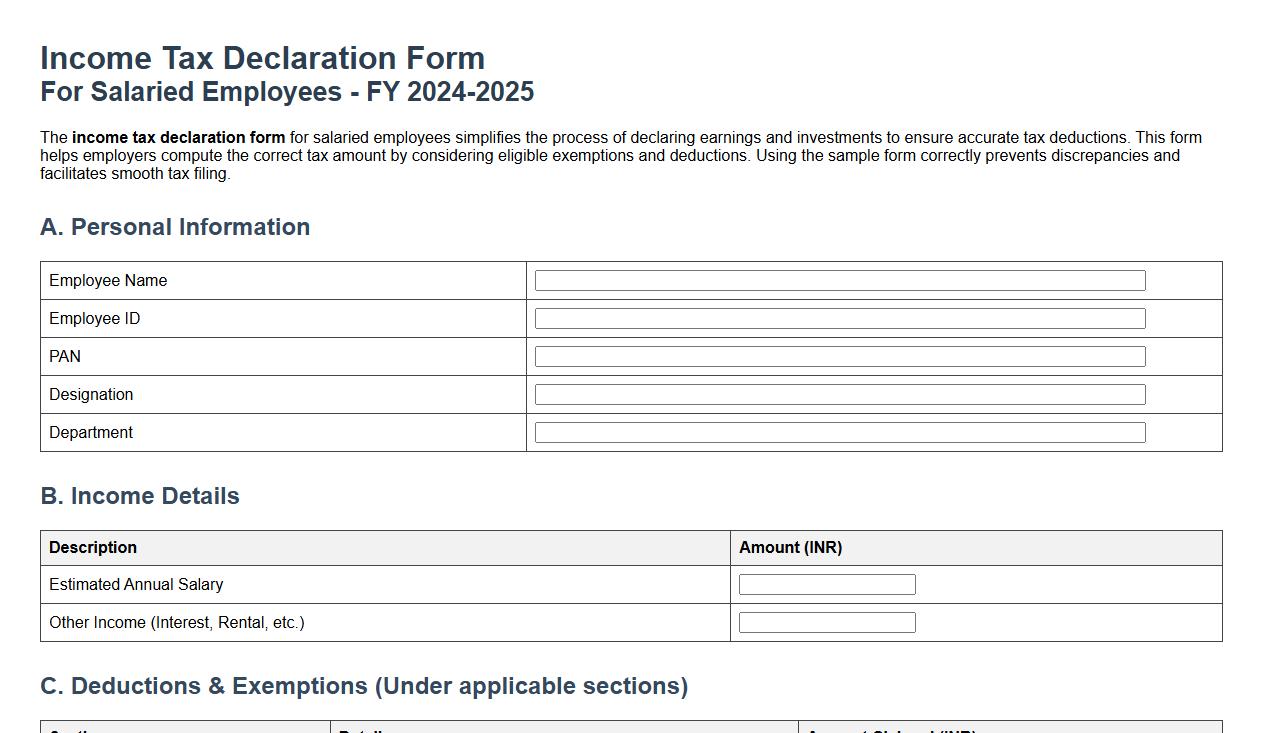

Income tax declaration form sample for salaried employees

The income tax declaration form for salaried employees simplifies the process of declaring earnings and investments to ensure accurate tax deductions. This form helps employers compute the correct tax amount by considering eligible exemptions and deductions. Using the sample form correctly prevents discrepancies and facilitates smooth tax filing.

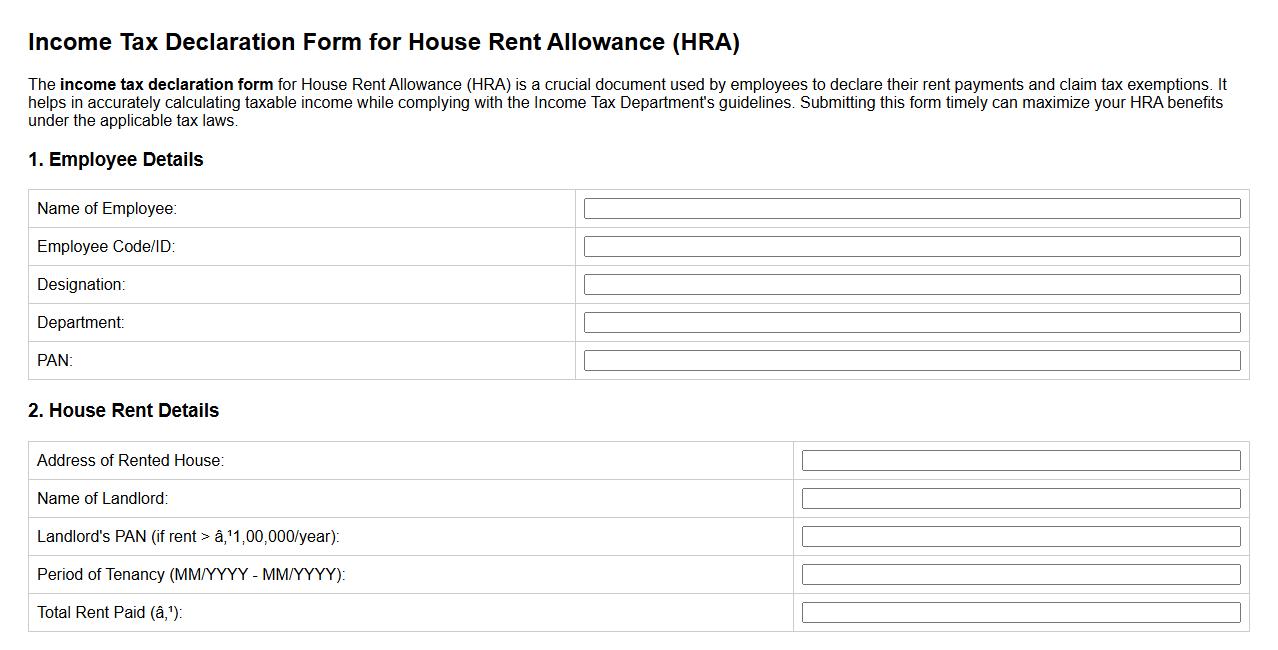

Income tax declaration form sample for house rent allowance

The income tax declaration form for House Rent Allowance (HRA) is a crucial document used by employees to declare their rent payments and claim tax exemptions. It helps in accurately calculating taxable income while complying with the Income Tax Department's guidelines. Submitting this form timely can maximize your HRA benefits under the applicable tax laws.

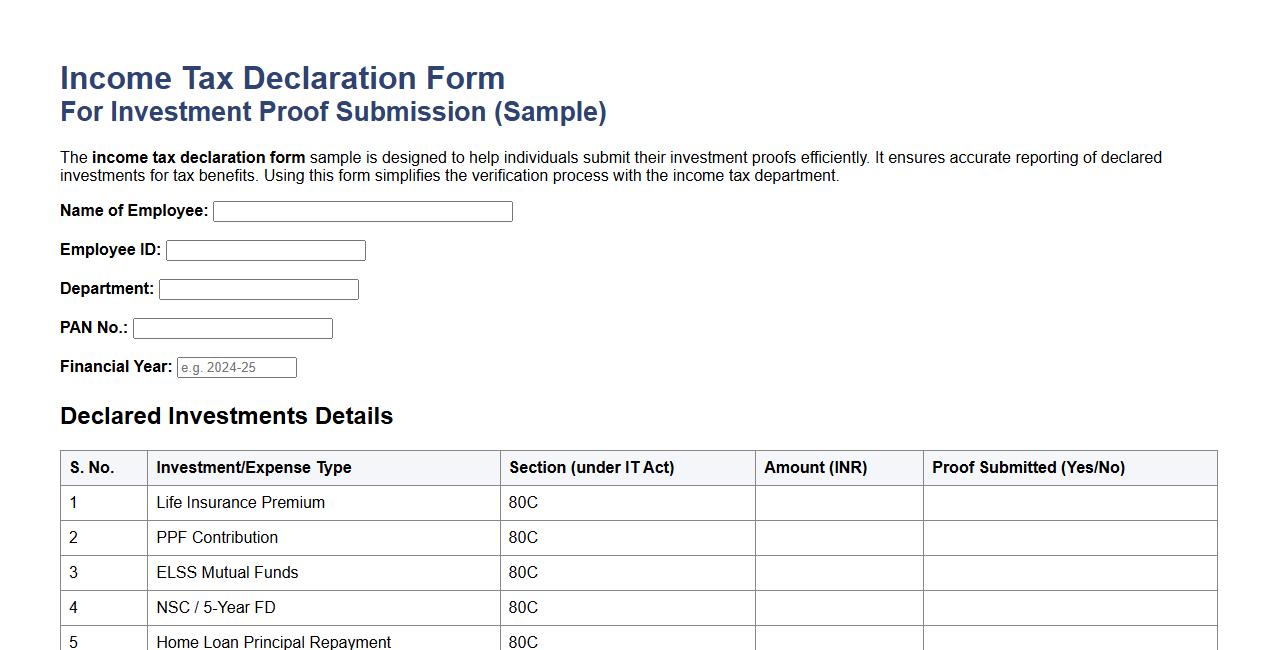

Income tax declaration form sample for investment proof submission

The income tax declaration form sample is designed to help individuals submit their investment proofs efficiently. It ensures accurate reporting of declared investments for tax benefits. Using this form simplifies the verification process with the income tax department.

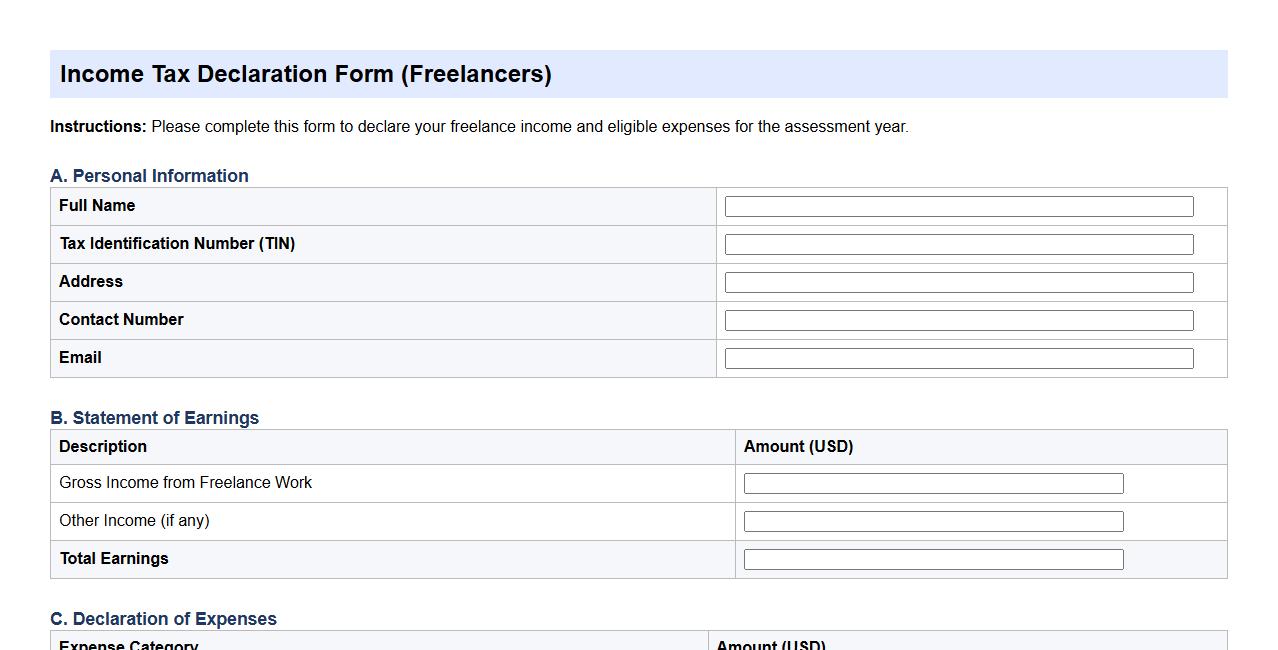

Income tax declaration form sample for freelancers

The income tax declaration form sample for freelancers provides a clear template to report earnings and expenses accurately. It simplifies the filing process by outlining essential financial details required by tax authorities. Freelancers can use this form to ensure compliance and optimize their tax submissions efficiently.

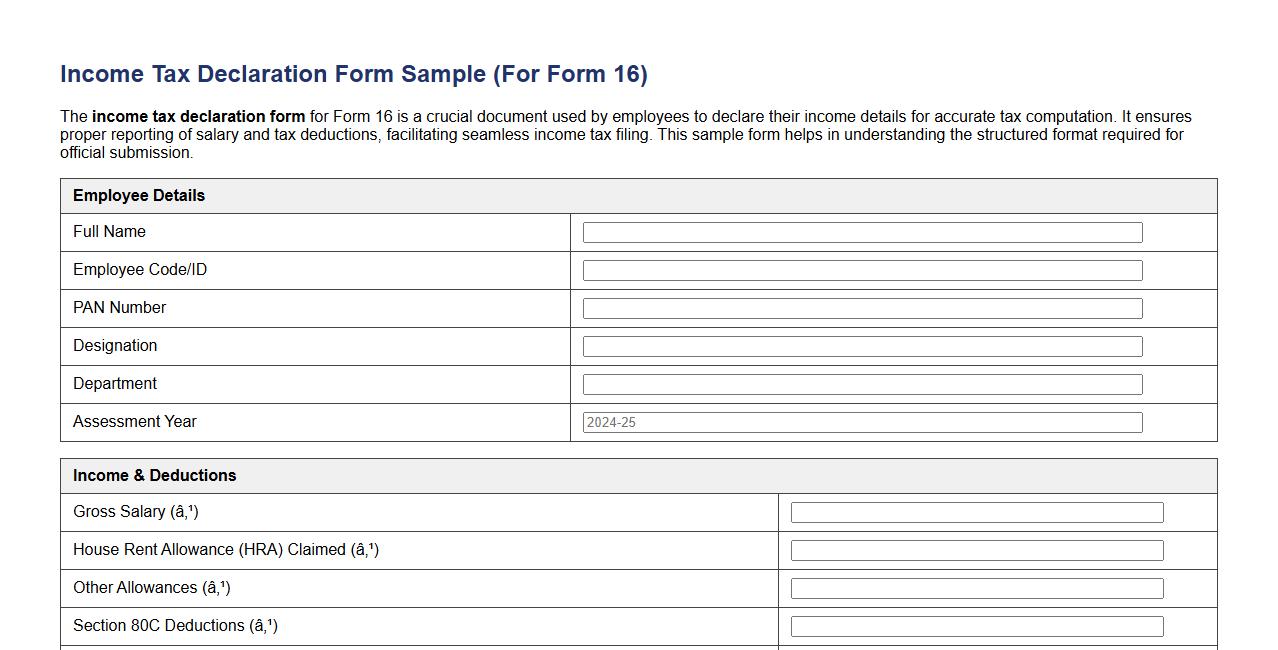

Income tax declaration form sample for form 16

The income tax declaration form for Form 16 is a crucial document used by employees to declare their income details for accurate tax computation. It ensures proper reporting of salary and tax deductions, facilitating seamless income tax filing. This sample form helps in understanding the structured format required for official submission.

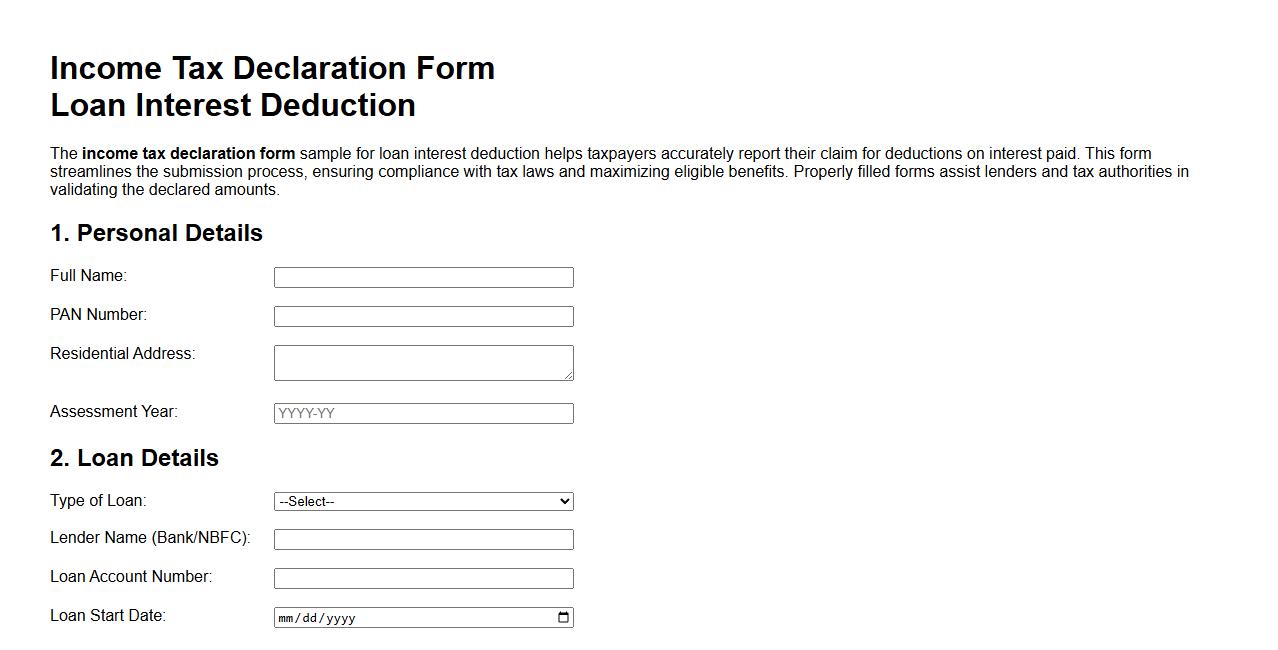

Income tax declaration form sample for loan interest deduction

The income tax declaration form sample for loan interest deduction helps taxpayers accurately report their claim for deductions on interest paid. This form streamlines the submission process, ensuring compliance with tax laws and maximizing eligible benefits. Properly filled forms assist lenders and tax authorities in validating the declared amounts.

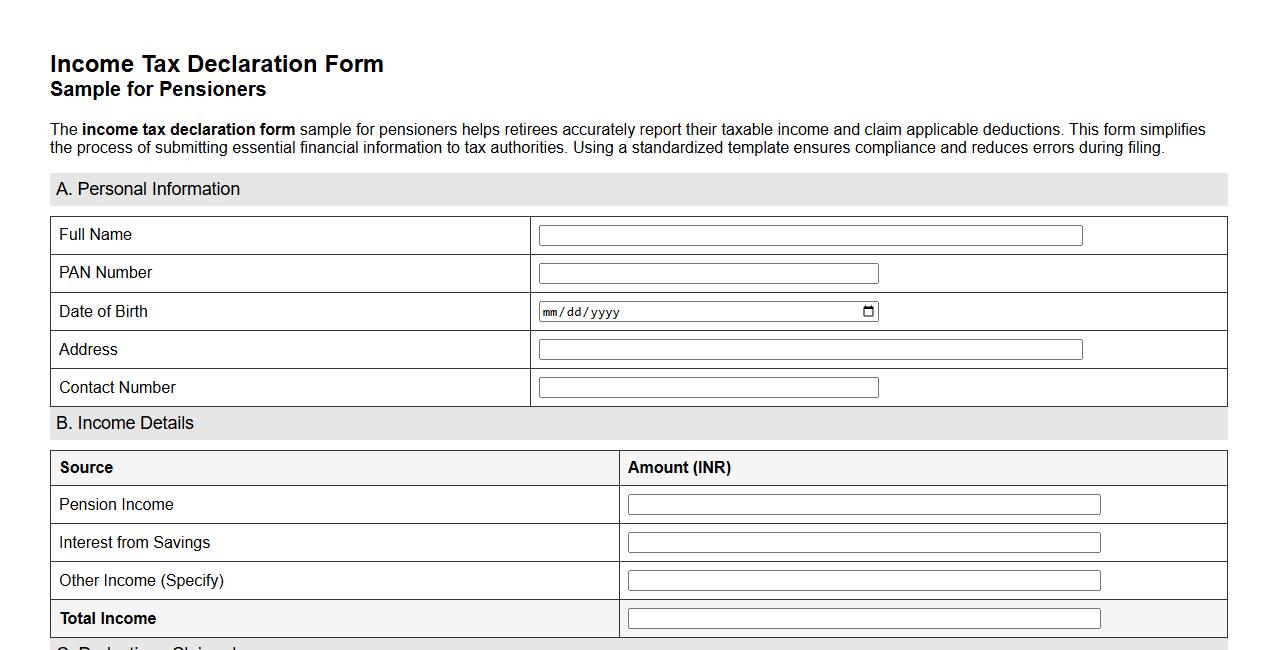

Income tax declaration form sample for pensioners

The income tax declaration form sample for pensioners helps retirees accurately report their taxable income and claim applicable deductions. This form simplifies the process of submitting essential financial information to tax authorities. Using a standardized template ensures compliance and reduces errors during filing.

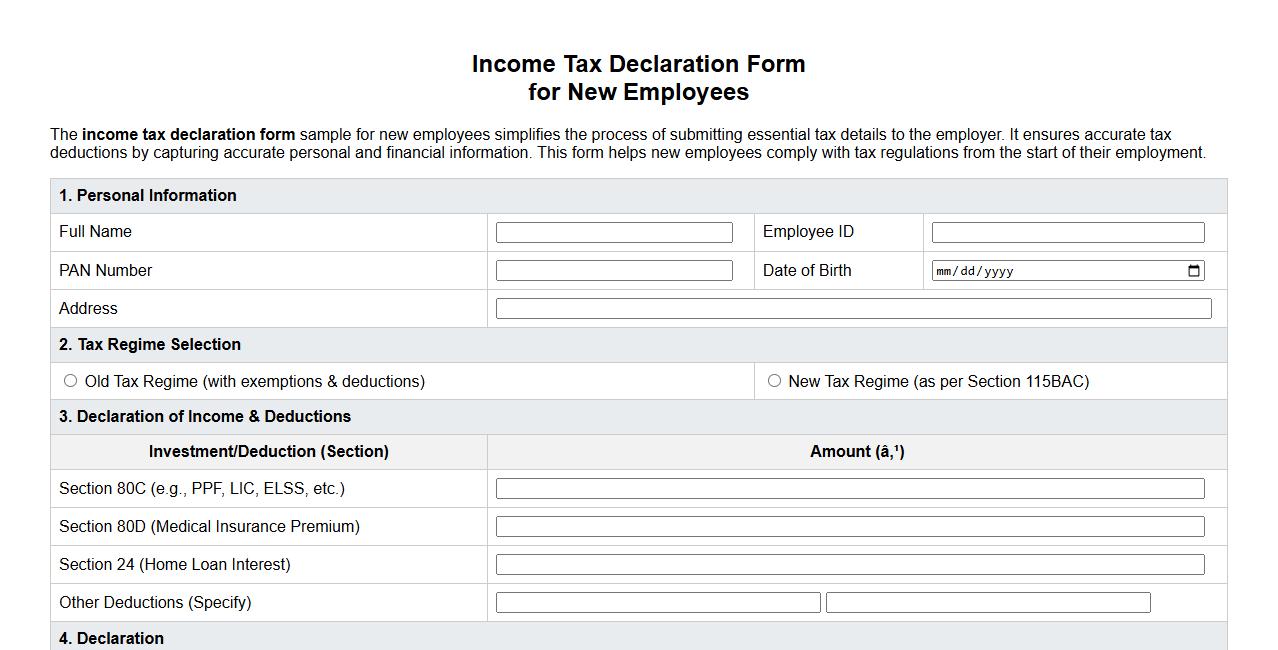

Income tax declaration form sample for new employees

The income tax declaration form sample for new employees simplifies the process of submitting essential tax details to the employer. It ensures accurate tax deductions by capturing accurate personal and financial information. This form helps new employees comply with tax regulations from the start of their employment.

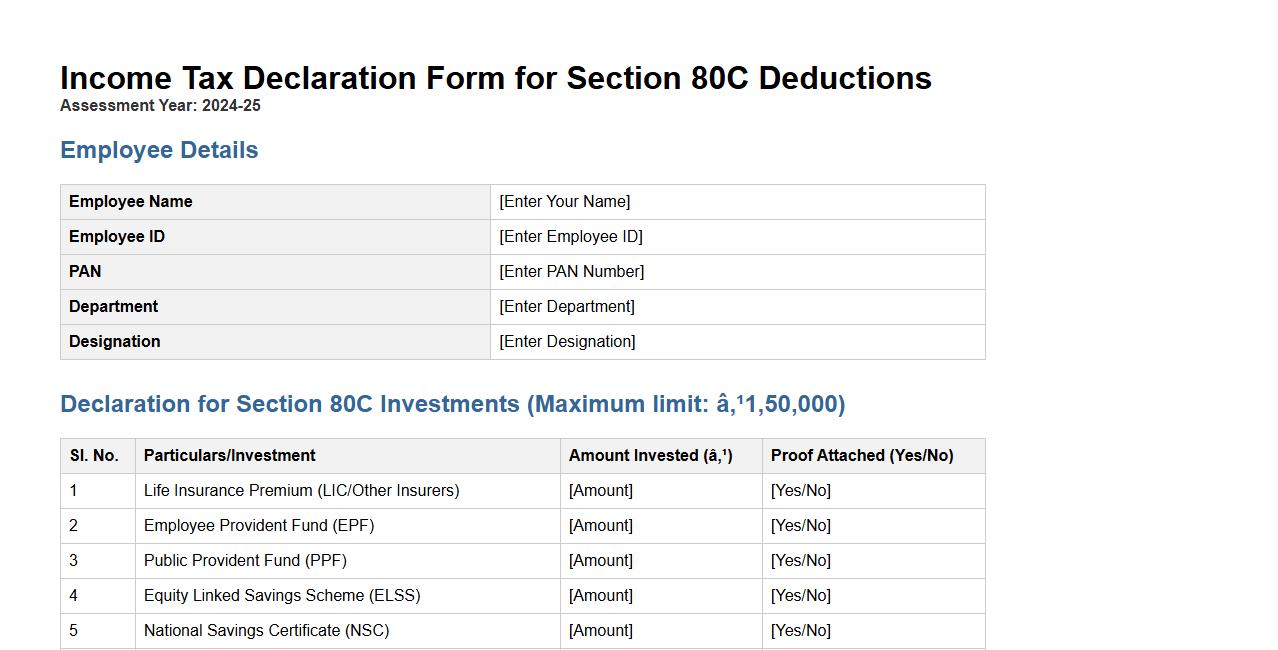

Income tax declaration form sample for section 80c deductions

The income tax declaration form sample for Section 80C deductions helps taxpayers accurately declare their eligible investments and expenses to claim tax benefits. It ensures compliance with tax laws while maximizing savings under Section 80C. Using this form simplifies the process of submitting proofs for deductions like LIC, PPF, and ELSS.

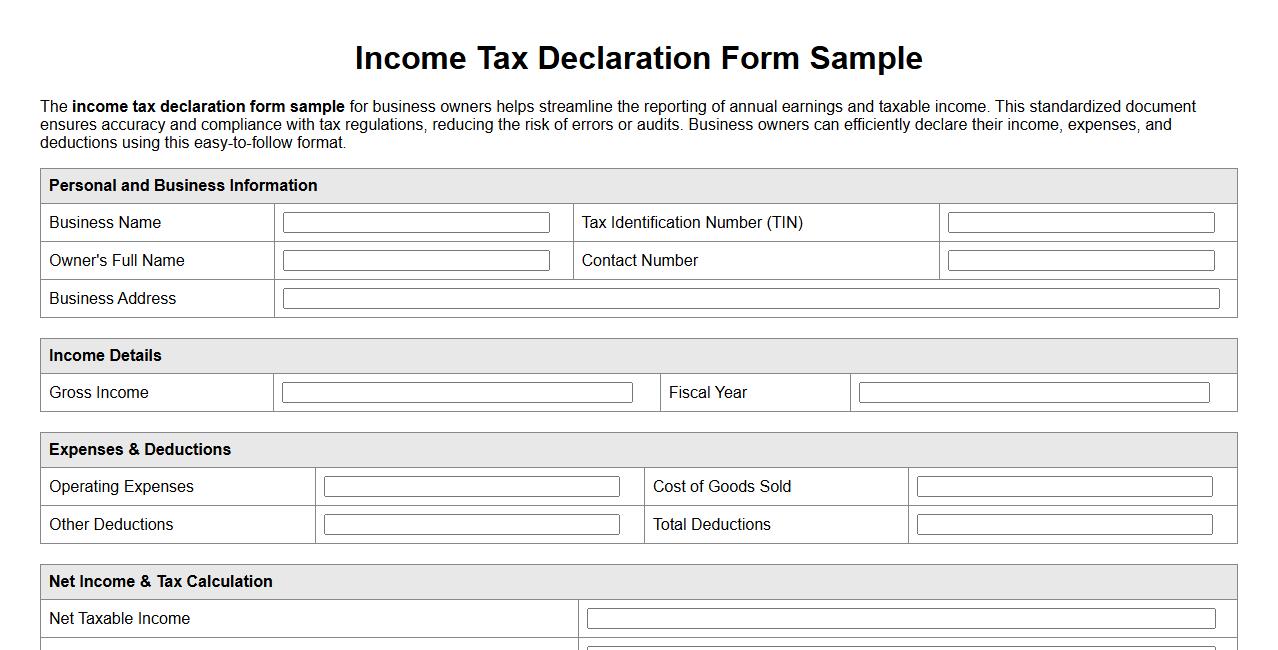

Income tax declaration form sample for business owners

The income tax declaration form sample for business owners helps streamline the reporting of annual earnings and taxable income. This standardized document ensures accuracy and compliance with tax regulations, reducing the risk of errors or audits. Business owners can efficiently declare their income, expenses, and deductions using this easy-to-follow format.

Which supporting documents are required for the Income Tax Declaration Form submission?

The supporting documents required for the Income Tax Declaration Form submission typically include salary slips, Form 16, and investment proofs. These documents validate your income and eligible tax deductions claimed. Proper documentation ensures the accuracy and smooth processing of your tax declaration.

What are common errors while filling out the Income Tax Declaration Form?

Common errors include incorrect personal details, mismatched income information, and missing or invalid document attachments. Failing to declare all income sources or claiming ineligible deductions also leads to errors. Reviewing the form for accuracy before submission helps avoid rejection and penalties.

How do I declare multiple sources of income in the form?

To declare multiple sources of income, list each income separately under the respective sections provided in the form. Include salary, business income, rental income, and other earnings with relevant supporting documents. Accurate declaration of all income streams ensures correct tax liability calculations.

Is digital signature mandatory on the Income Tax Declaration Form?

The requirement for a digital signature depends on the jurisdiction and the submission mode of the form. Many tax authorities allow manual signatures for offline forms but mandate digital signatures for online submissions. Using a digital signature enhances security and authenticity of the declaration.

How does the form impact year-end tax liability calculations?

The Income Tax Declaration Form directly influences your year-end tax liability by declaring income sources and claiming eligible deductions. Accurate details enable correct estimation and adjustment of tax deductions at source (TDS). This reduces the risk of underpayment or excess tax during the annual tax return filing.