A Gift Declaration Form Sample is a document used to officially record details of a gift given or received, ensuring transparency and compliance with legal or organizational policies. This form typically includes information such as the donor's and recipient's names, description of the gift, its value, and the date of transfer. Using a Gift Declaration Form Sample helps prevent conflicts of interest and supports proper record-keeping.

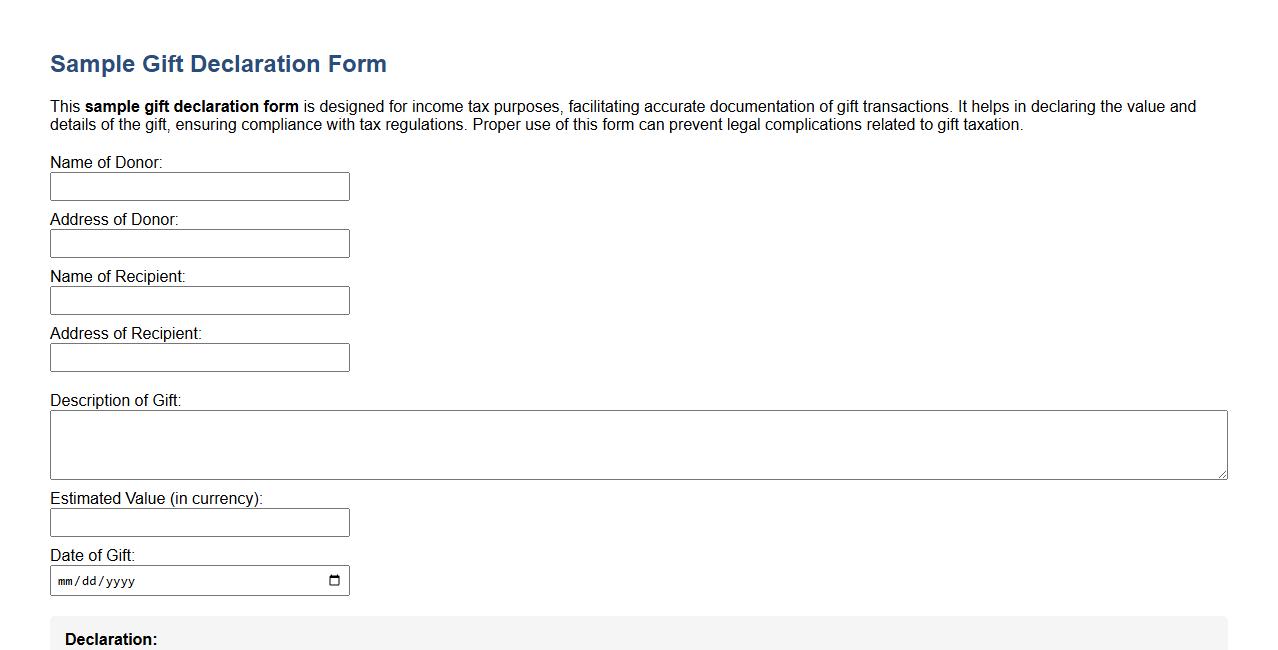

Sample gift declaration form for income tax purposes

This sample gift declaration form is designed for income tax purposes, facilitating accurate documentation of gift transactions. It helps in declaring the value and details of the gift, ensuring compliance with tax regulations. Proper use of this form can prevent legal complications related to gift taxation.

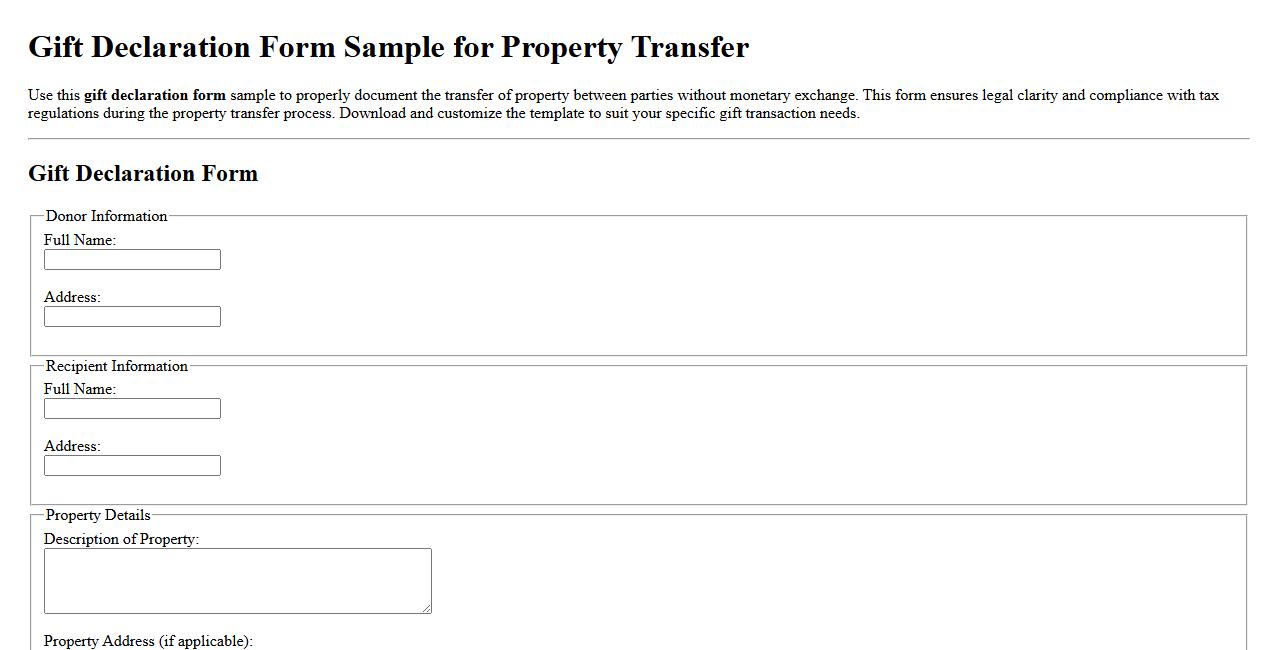

Gift declaration form sample for property transfer

Use this gift declaration form sample to properly document the transfer of property between parties without monetary exchange. This form ensures legal clarity and compliance with tax regulations during the property transfer process. Download and customize the template to suit your specific gift transaction needs.

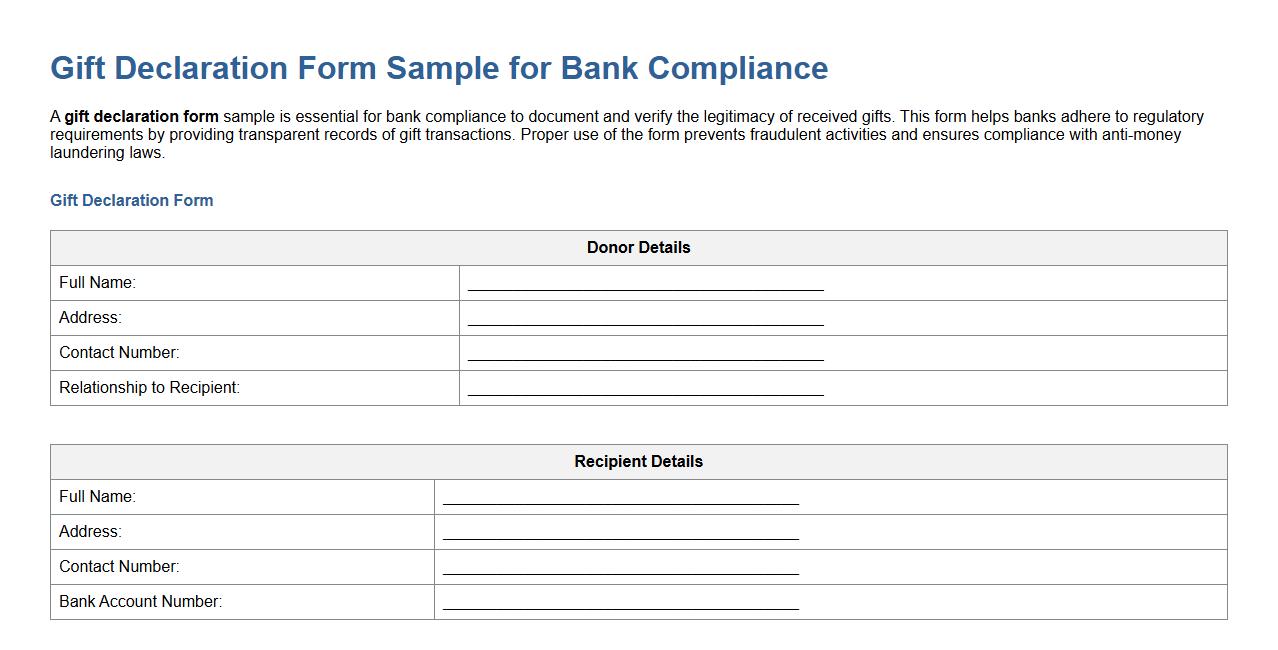

Gift declaration form sample for bank compliance

A gift declaration form sample is essential for bank compliance to document and verify the legitimacy of received gifts. This form helps banks adhere to regulatory requirements by providing transparent records of gift transactions. Proper use of the form prevents fraudulent activities and ensures compliance with anti-money laundering laws.

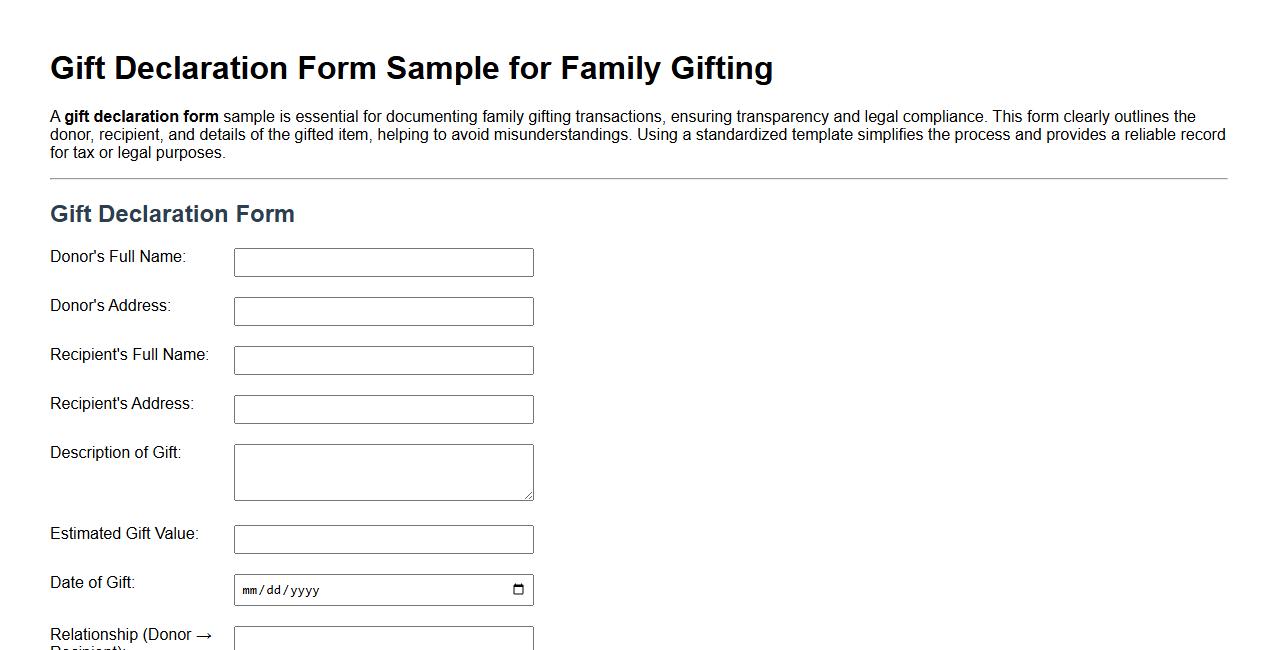

Gift declaration form sample for family gifting

A gift declaration form sample is essential for documenting family gifting transactions, ensuring transparency and legal compliance. This form clearly outlines the donor, recipient, and details of the gifted item, helping to avoid misunderstandings. Using a standardized template simplifies the process and provides a reliable record for tax or legal purposes.

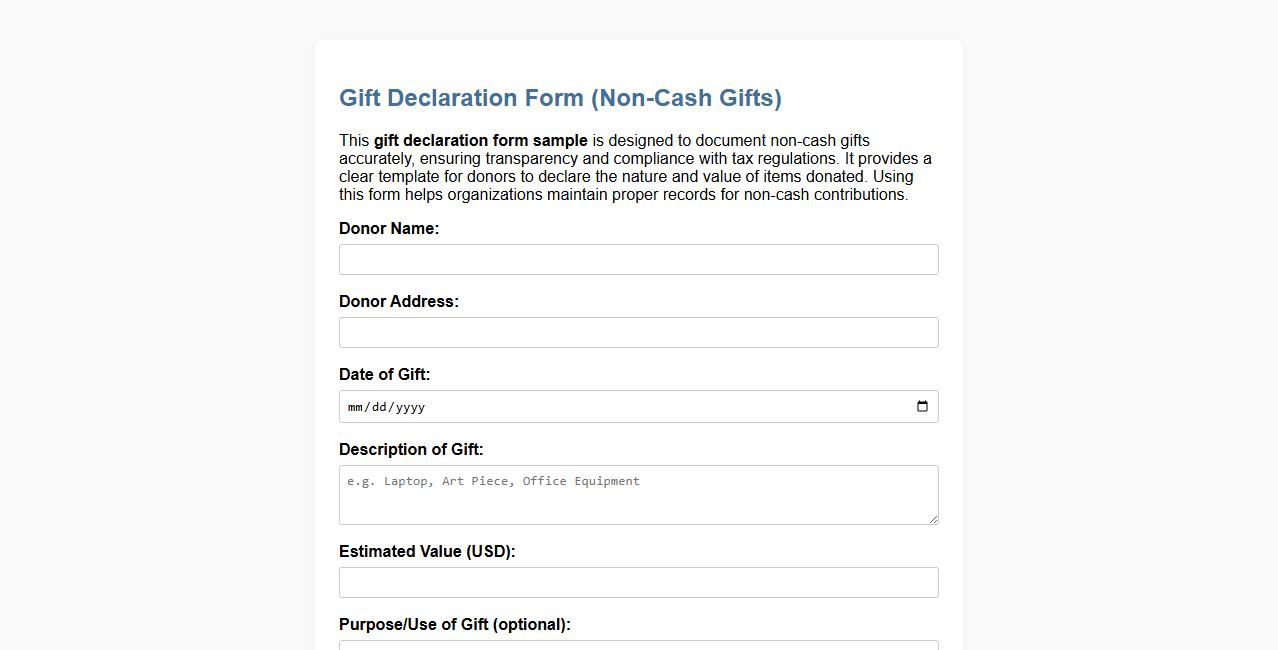

Gift declaration form sample for non-cash gifts

This gift declaration form sample is designed to document non-cash gifts accurately, ensuring transparency and compliance with tax regulations. It provides a clear template for donors to declare the nature and value of items donated. Using this form helps organizations maintain proper records for non-cash contributions.

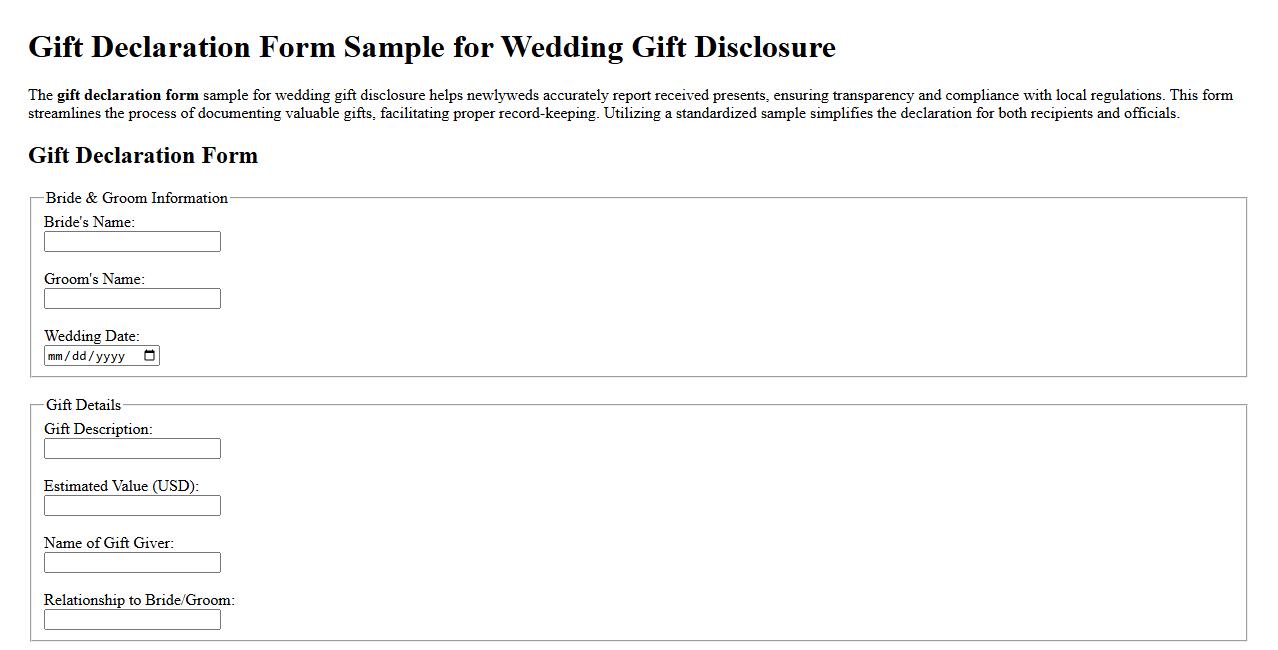

Gift declaration form sample for wedding gift disclosure

The gift declaration form sample for wedding gift disclosure helps newlyweds accurately report received presents, ensuring transparency and compliance with local regulations. This form streamlines the process of documenting valuable gifts, facilitating proper record-keeping. Utilizing a standardized sample simplifies the declaration for both recipients and officials.

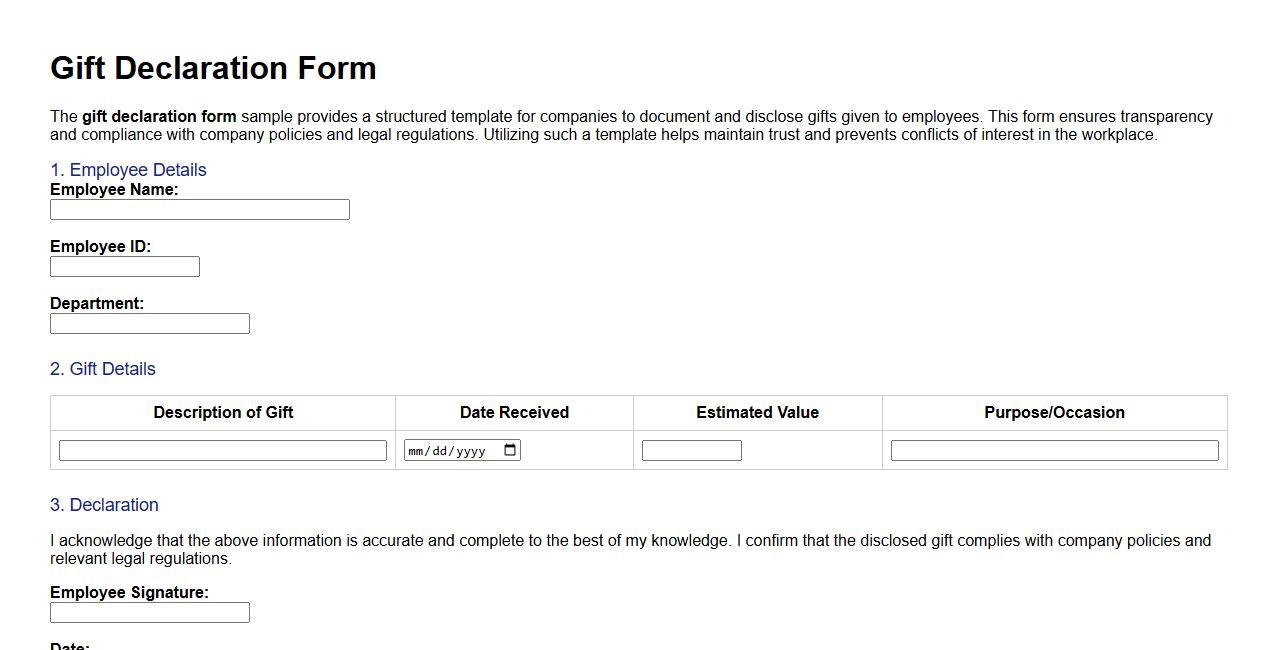

Gift declaration form sample for company gifts to employees

The gift declaration form sample provides a structured template for companies to document and disclose gifts given to employees. This form ensures transparency and compliance with company policies and legal regulations. Utilizing such a template helps maintain trust and prevents conflicts of interest in the workplace.

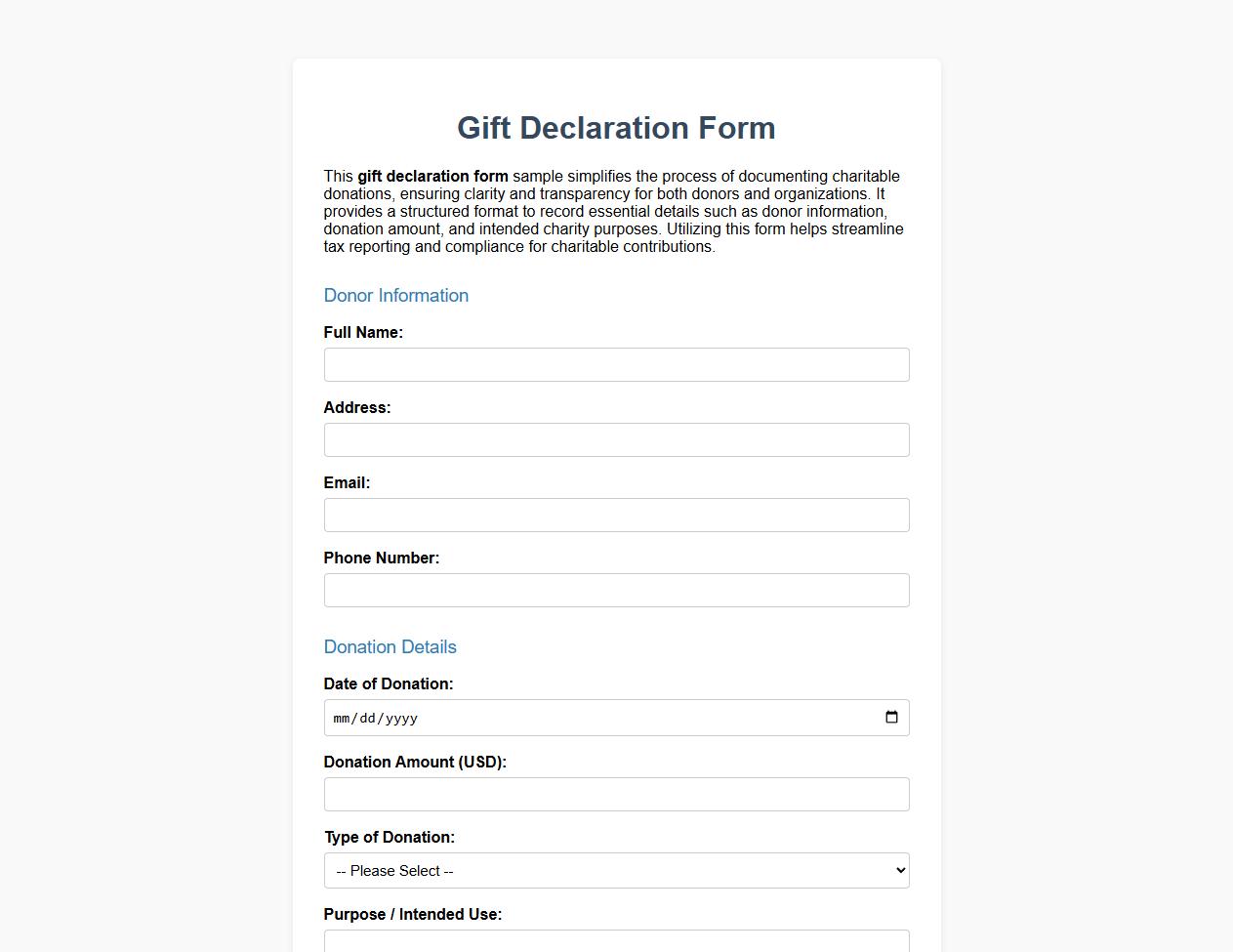

Gift declaration form sample for charitable donations

This gift declaration form sample simplifies the process of documenting charitable donations, ensuring clarity and transparency for both donors and organizations. It provides a structured format to record essential details such as donor information, donation amount, and intended charity purposes. Utilizing this form helps streamline tax reporting and compliance for charitable contributions.

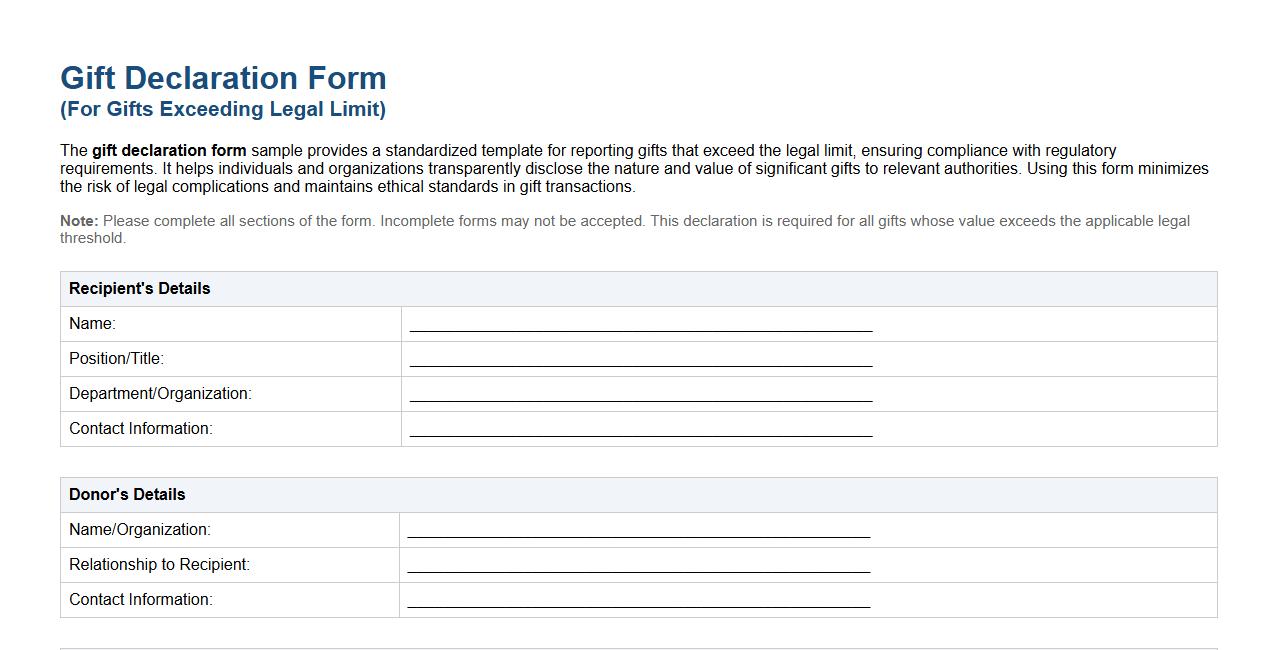

Gift declaration form sample for gifts exceeding legal limit

The gift declaration form sample provides a standardized template for reporting gifts that exceed the legal limit, ensuring compliance with regulatory requirements. It helps individuals and organizations transparently disclose the nature and value of significant gifts to relevant authorities. Using this form minimizes the risk of legal complications and maintains ethical standards in gift transactions.

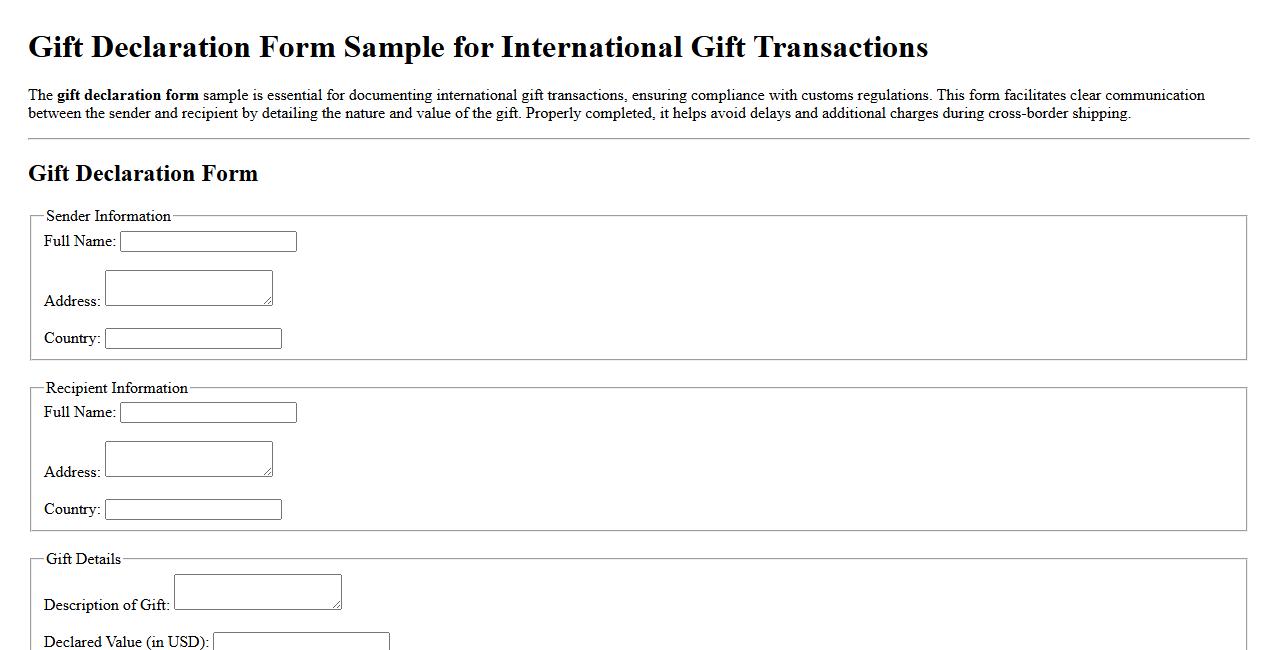

Gift declaration form sample for international gift transactions

The gift declaration form sample is essential for documenting international gift transactions, ensuring compliance with customs regulations. This form facilitates clear communication between the sender and recipient by detailing the nature and value of the gift. Properly completed, it helps avoid delays and additional charges during cross-border shipping.

What information is legally required in a Gift Declaration Form?

A Gift Declaration Form must include the full names and addresses of both the giver and the recipient. It should clearly describe the gifted item or amount, including its estimated value at the time of transfer. Additionally, the form requires the date of the gift and signatures of both parties to validate the declaration.

How does a Gift Declaration Form impact tax liabilities for both giver and recipient?

The Gift Declaration Form helps establish the legality of the gift, affecting tax reporting obligations for both parties. It can determine whether the gift is subject to gift tax or exemptions under relevant laws. Proper documentation ensures accurate assessment, potentially reducing unexpected tax liabilities for the giver and recipient.

Can a Gift Declaration Form be used for international transfers of assets?

Yes, a Gift Declaration Form can be used for international asset transfers, but it may require compliance with local laws in both jurisdictions. Additional documentation or notarization might be necessary to validate the gift across borders. This helps in avoiding legal issues or misunderstandings during the transfer process.

What are common mistakes to avoid when completing a Gift Declaration Form?

Common errors include omitting important details like the accurate gift value or incomplete identification of parties involved. Failing to obtain signatures or incorrectly dating the form can invalidate the document. Ensuring clarity and completeness is crucial for the legal validity of the gift declaration.

How long should a signed Gift Declaration Form be retained for record-keeping?

It is recommended to retain the Gift Declaration Form for at least seven years to comply with tax and legal requirements. This period covers statute of limitations for potential audits or disputes. Keeping the document safe ensures easy access if proof of the gift is needed later.