A Monthly Expense Report provides a detailed summary of all expenditures within a specific month, helping businesses and individuals track their spending patterns effectively. This report categorizes expenses, allowing for better budget management and financial forecasting. Regularly reviewing a Monthly Expense Report ensures transparency and supports informed decision-making.

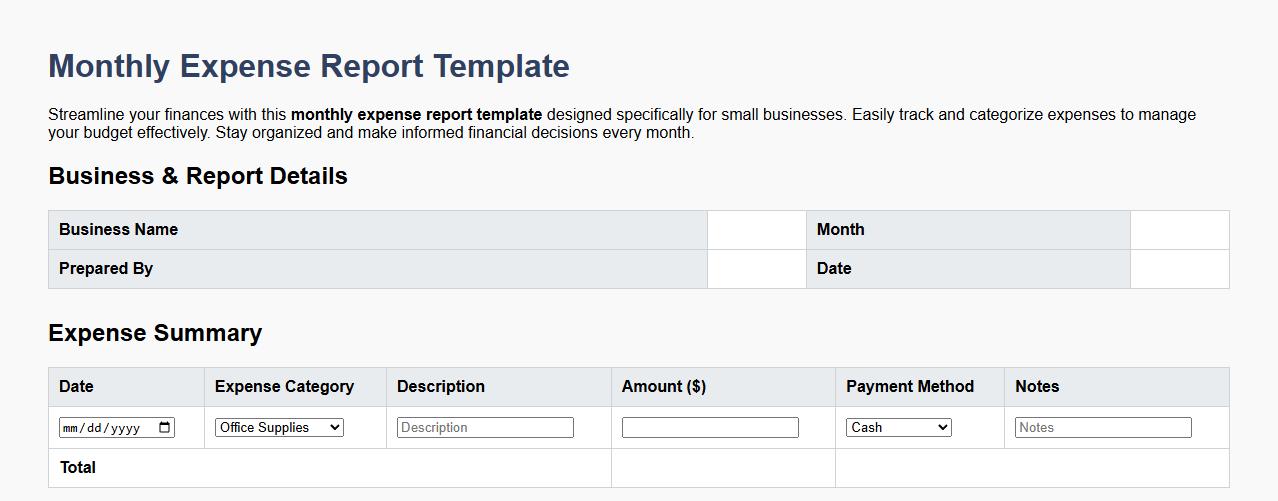

Monthly expense report template for small business

Streamline your finances with this monthly expense report template designed specifically for small businesses. Easily track and categorize expenses to manage your budget effectively. Stay organized and make informed financial decisions every month.

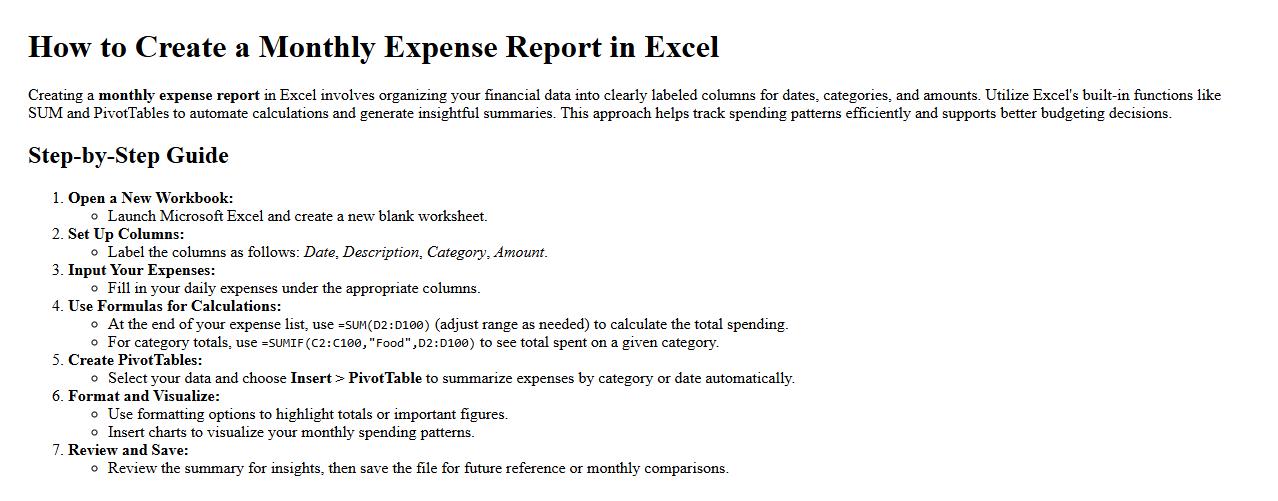

How to create a monthly expense report in Excel

Creating a monthly expense report in Excel involves organizing your financial data into clearly labeled columns for dates, categories, and amounts. Utilize Excel's built-in functions like SUM and PivotTables to automate calculations and generate insightful summaries. This approach helps track spending patterns efficiently and supports better budgeting decisions.

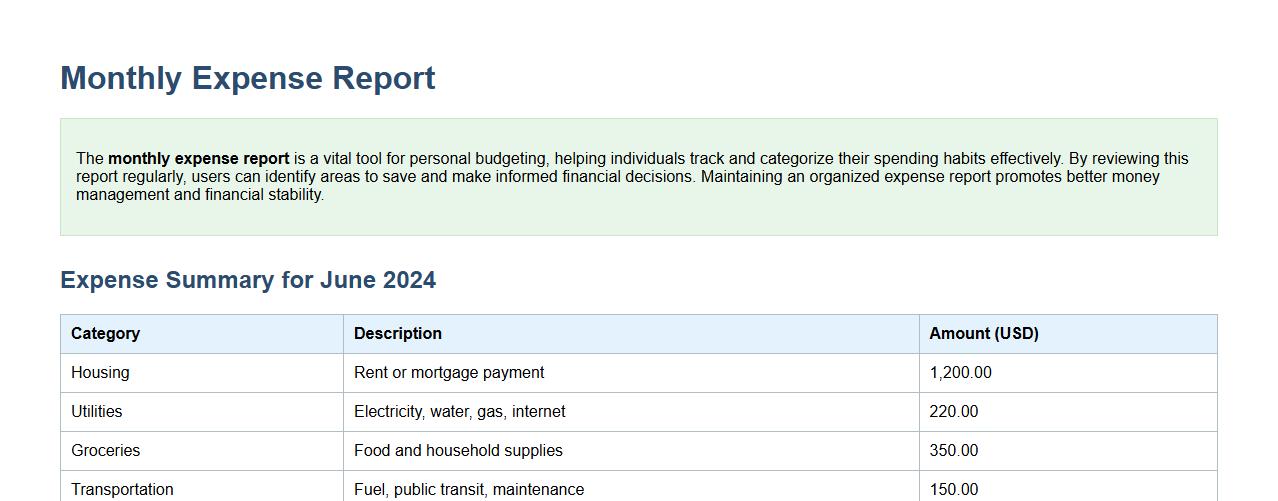

Monthly expense report for personal budgeting

The monthly expense report is a vital tool for personal budgeting, helping individuals track and categorize their spending habits effectively. By reviewing this report regularly, users can identify areas to save and make informed financial decisions. Maintaining an organized expense report promotes better money management and financial stability.

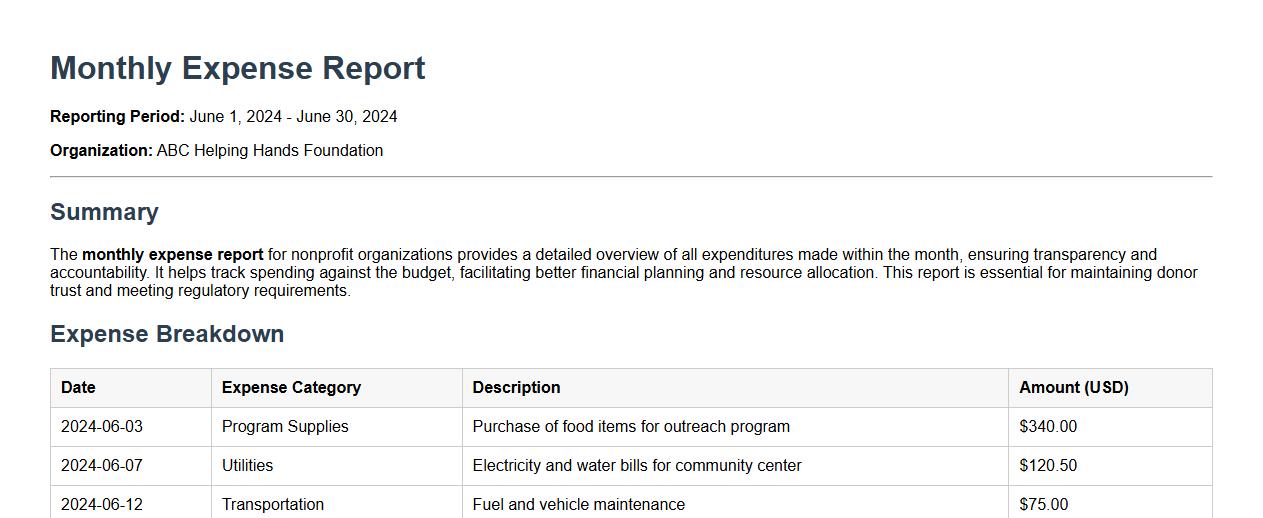

Monthly expense report for nonprofit organizations

The monthly expense report for nonprofit organizations provides a detailed overview of all expenditures made within the month, ensuring transparency and accountability. It helps track spending against the budget, facilitating better financial planning and resource allocation. This report is essential for maintaining donor trust and meeting regulatory requirements.

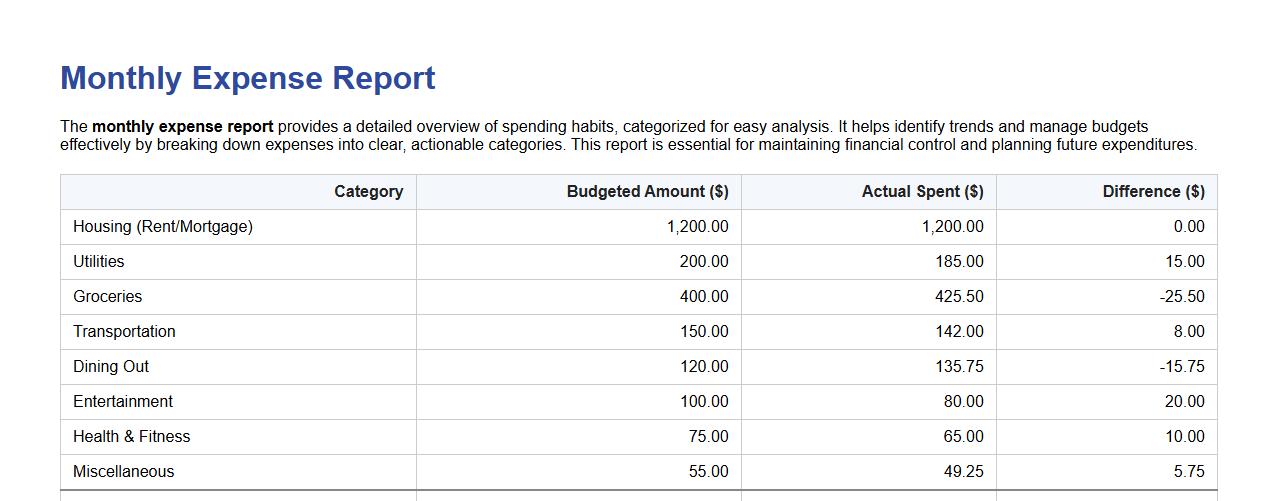

Monthly expense report with category breakdown

The monthly expense report provides a detailed overview of spending habits, categorized for easy analysis. It helps identify trends and manage budgets effectively by breaking down expenses into clear, actionable categories. This report is essential for maintaining financial control and planning future expenditures.

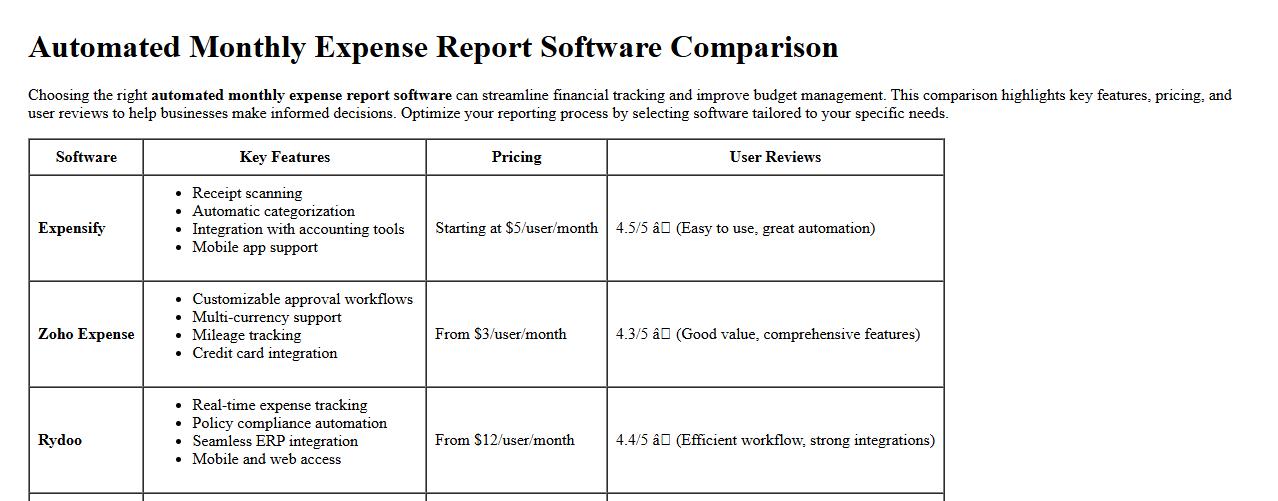

Automated monthly expense report software comparison

Choosing the right automated monthly expense report software can streamline financial tracking and improve budget management. This comparison highlights key features, pricing, and user reviews to help businesses make informed decisions. Optimize your reporting process by selecting software tailored to your specific needs.

Monthly expense report for travel expenses

The monthly expense report for travel expenses provides a detailed summary of all costs incurred during business trips, including transportation, accommodation, and meals. This report helps in tracking spending patterns and ensuring compliance with company budgets. Regular analysis of travel expenses enables better financial planning and cost control.

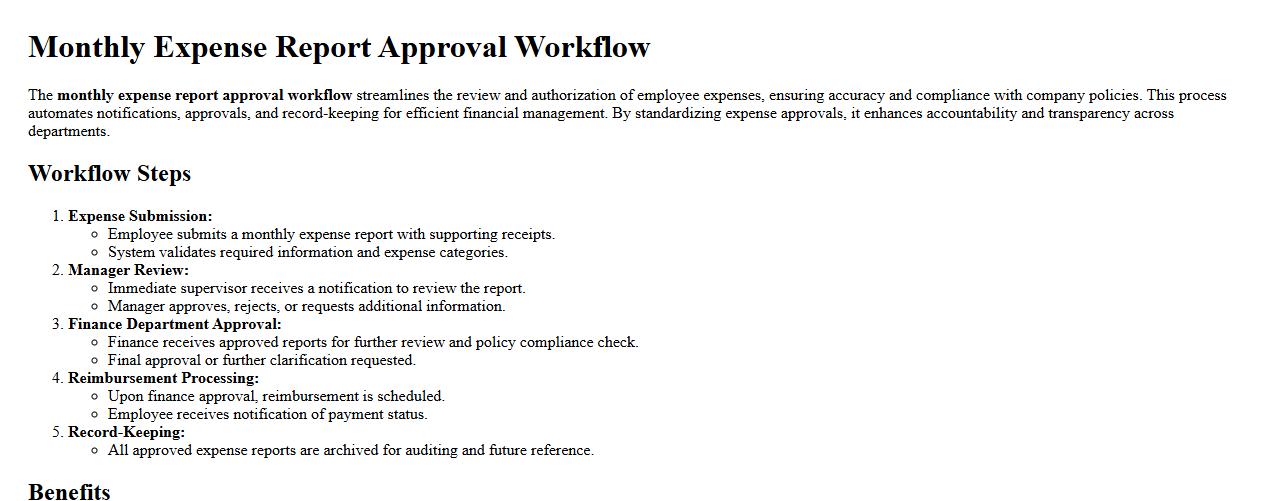

Monthly expense report approval workflow

The monthly expense report approval workflow streamlines the review and authorization of employee expenses, ensuring accuracy and compliance with company policies. This process automates notifications, approvals, and record-keeping for efficient financial management. By standardizing expense approvals, it enhances accountability and transparency across departments.

Monthly expense report for project management

The monthly expense report is an essential tool for project management, providing a detailed overview of all costs incurred during the month. It helps ensure budget adherence and facilitates informed decision-making. Regularly reviewing this report enhances financial transparency and project accountability.

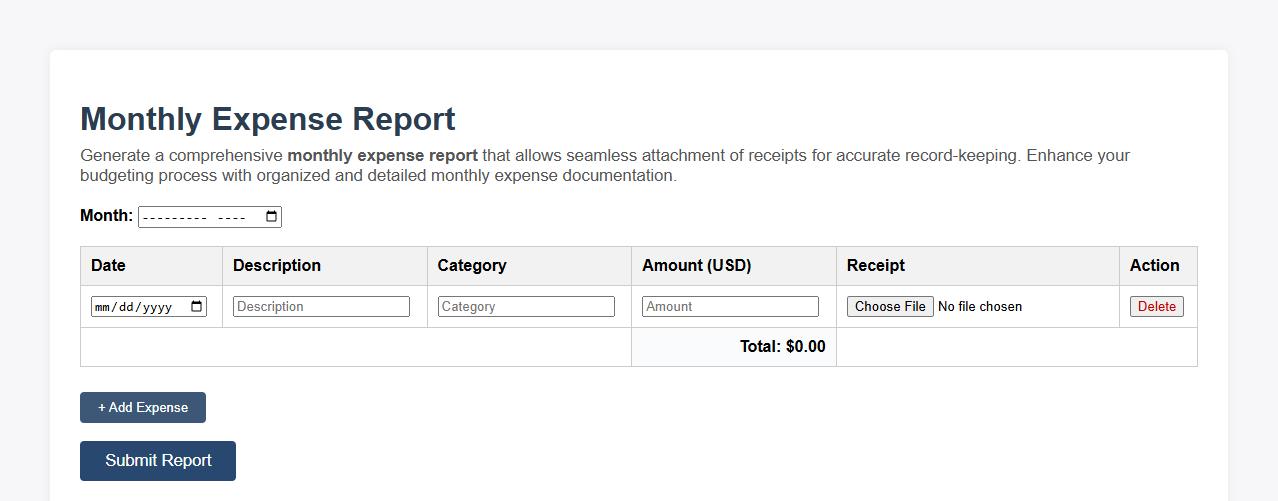

Monthly expense report with receipts attachment option

Generate a comprehensive monthly expense report that allows seamless attachment of receipts for accurate record-keeping. This feature simplifies tracking and auditing expenses by consolidating financial data alongside visual proof of transactions. Enhance your budgeting process with organized and detailed monthly expense documentation.

What supporting receipts are mandatory for a monthly expense report submission?

For a monthly expense report, receipts for all business-related expenses must be submitted to ensure accuracy and compliance. This includes invoices, payment confirmations, and detailed bills that reflect the date and amount spent. Proper documentation helps in auditing and validating each claim within the report.

Which expense categories require manager pre-approval in the monthly report?

Manager pre-approval is typically required for high-cost categories such as travel, accommodation, and equipment purchases. Expenses related to client entertainment or gifts often also need prior authorization. This practice ensures that expenditures align with company policies and budget constraints.

How is mileage reimbursement calculated and documented in the monthly expense report?

Mileage reimbursement is calculated based on a fixed rate per mile set by the company or government guidelines. Employees must accurately log the total miles driven for business purposes along with dates and destinations. Supporting documentation, such as a mileage log or map printout, should accompany the calculation.

What is the protocol for reporting late expenses on a monthly basis?

Late expense submissions must be reported with a valid reason and in compliance with the company's late submission policy. Often, employees need to notify their manager and submit the expenses within an extended deadline for approval. Failure to comply may result in the expense being disallowed or delayed reimbursement.

Which software or template is standard for compiling monthly expense reports?

The standard practice involves using dedicated expense management software like Concur, Expensify, or SAP that integrates seamlessly with accounting systems. Some companies also provide customized Excel or Google Sheets templates that follow a strict format for consistency. These tools enhance accuracy, streamline approval workflows, and maintain organized financial records.