A Expense Form Sample provides a clear template for employees to document business-related costs efficiently. This form typically includes fields for date, expense category, amount, and purpose, ensuring accurate tracking and reimbursement. Using a standardized Expense Form Sample helps streamline financial processes and maintain organized records.

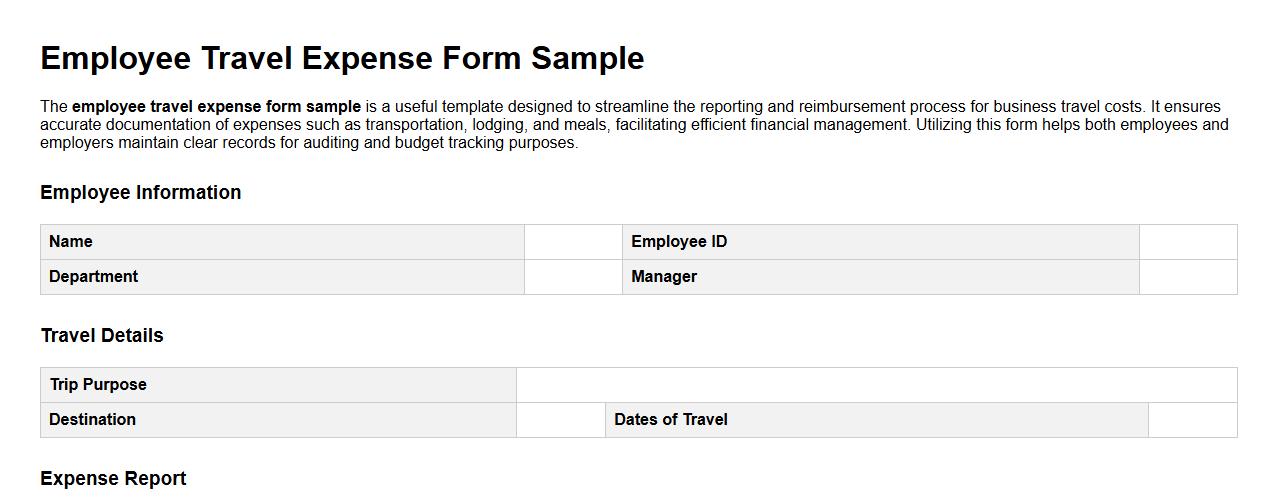

Employee travel expense form sample

The employee travel expense form sample is a useful template designed to streamline the reporting and reimbursement process for business travel costs. It ensures accurate documentation of expenses such as transportation, lodging, and meals, facilitating efficient financial management. Utilizing this form helps both employees and employers maintain clear records for auditing and budget tracking purposes.

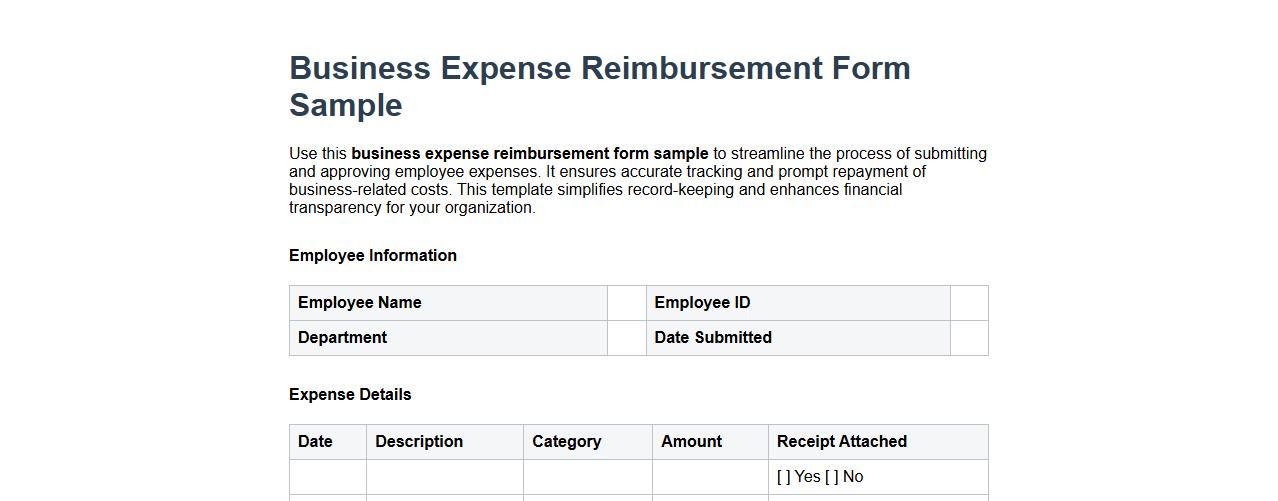

Business expense reimbursement form sample

Use this business expense reimbursement form sample to streamline the process of submitting and approving employee expenses. It ensures accurate tracking and prompt repayment of business-related costs. This template simplifies record-keeping and enhances financial transparency for your organization.

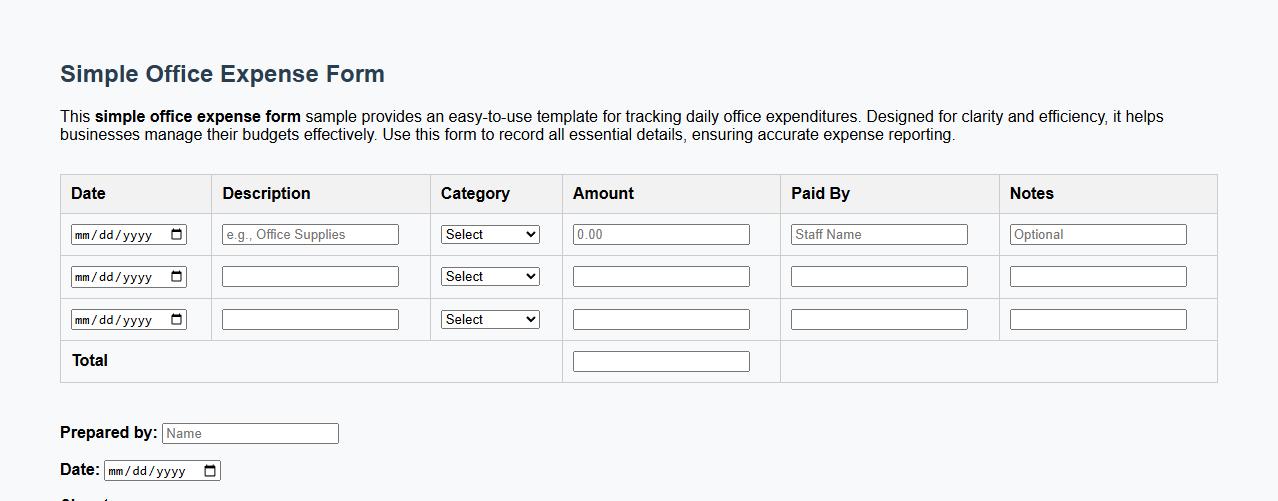

Simple office expense form sample

This simple office expense form sample provides an easy-to-use template for tracking daily office expenditures. Designed for clarity and efficiency, it helps businesses manage their budgets effectively. Use this form to record all essential details, ensuring accurate expense reporting.

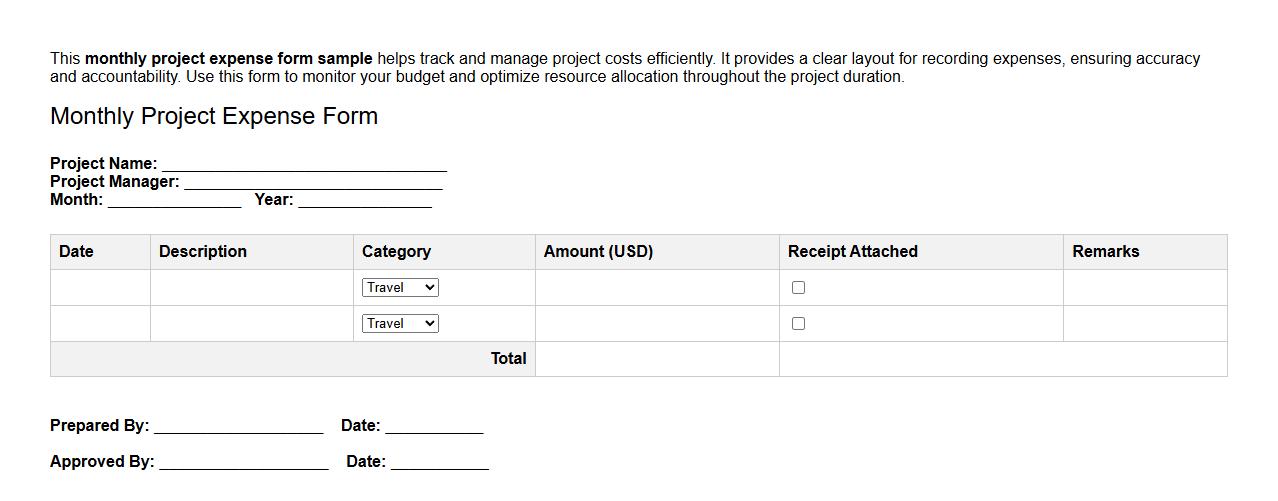

Monthly project expense form sample

This monthly project expense form sample helps track and manage project costs efficiently. It provides a clear layout for recording expenses, ensuring accuracy and accountability. Use this form to monitor your budget and optimize resource allocation throughout the project duration.

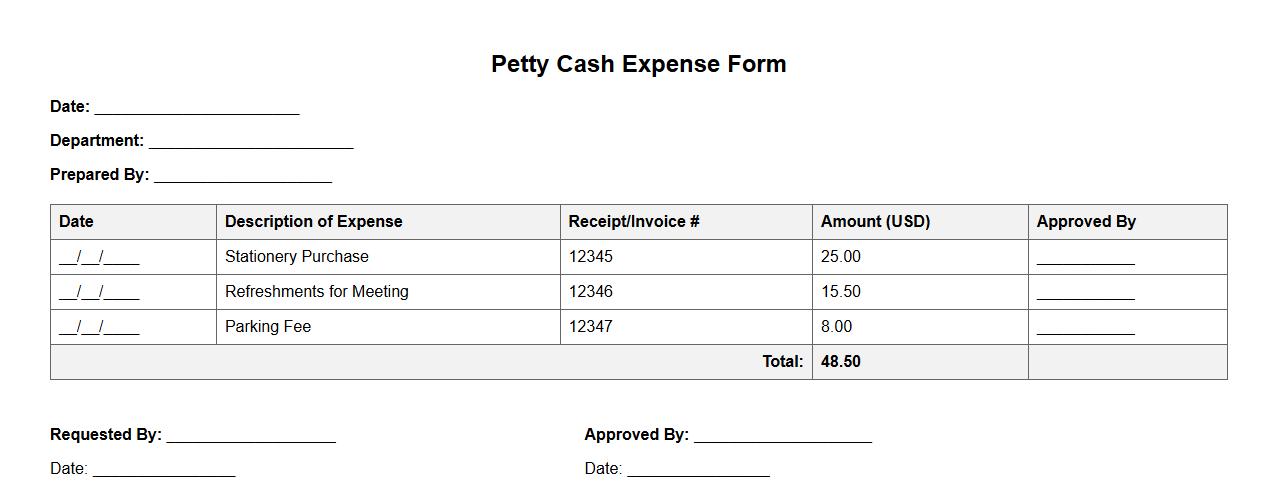

Petty cash expense form sample

The petty cash expense form sample is a vital tool for tracking small, day-to-day business expenditures accurately. It simplifies the reimbursement process by recording essential details such as date, amount, and purpose of each expense. Using this form ensures transparency and efficient management of petty cash funds.

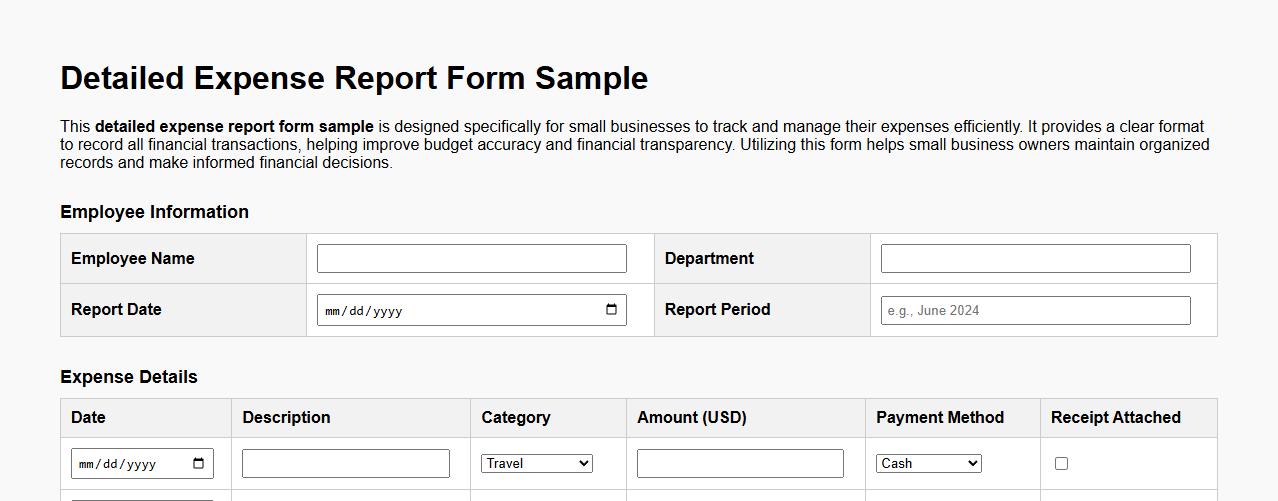

Detailed expense report form sample for small business

This detailed expense report form sample is designed specifically for small businesses to track and manage their expenses efficiently. It provides a clear format to record all financial transactions, helping improve budget accuracy and financial transparency. Utilizing this form helps small business owners maintain organized records and make informed financial decisions.

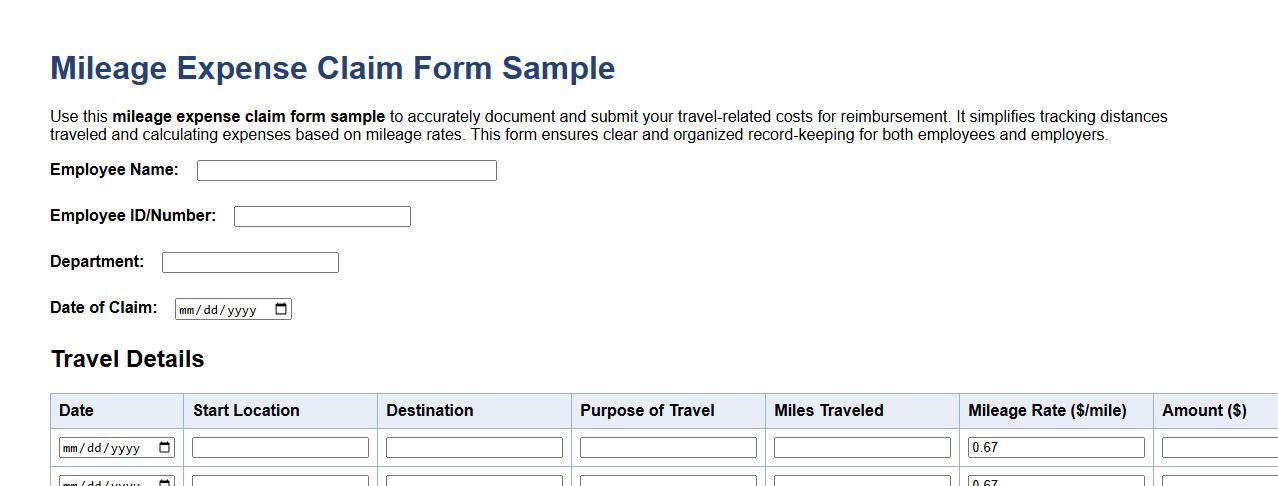

Mileage expense claim form sample

Use this mileage expense claim form sample to accurately document and submit your travel-related costs for reimbursement. It simplifies tracking distances traveled and calculating expenses based on mileage rates. This form ensures clear and organized record-keeping for both employees and employers.

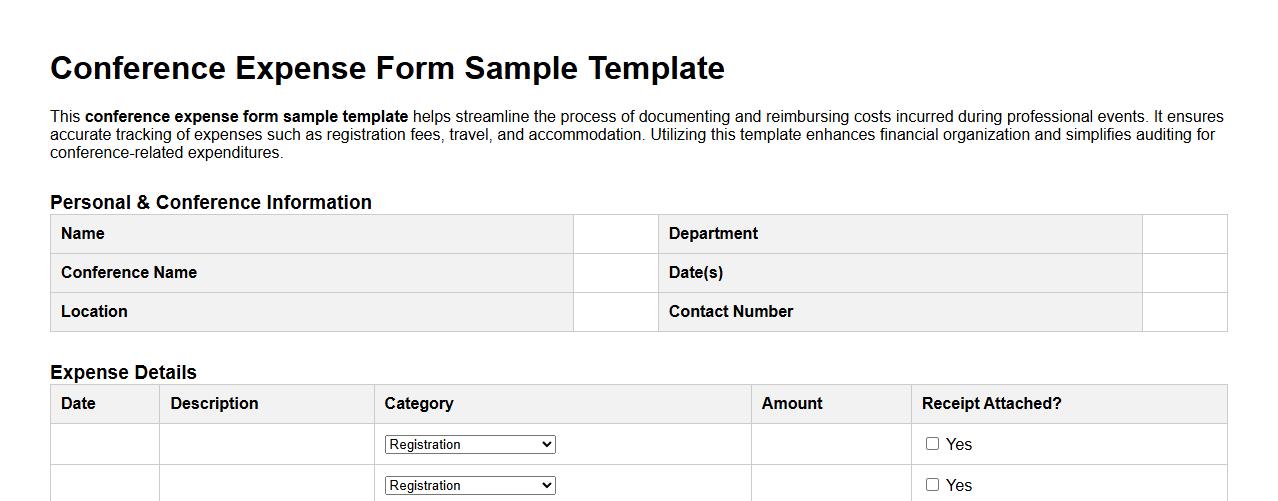

Conference expense form sample template

This conference expense form sample template helps streamline the process of documenting and reimbursing costs incurred during professional events. It ensures accurate tracking of expenses such as registration fees, travel, and accommodation. Utilizing this template enhances financial organization and simplifies auditing for conference-related expenditures.

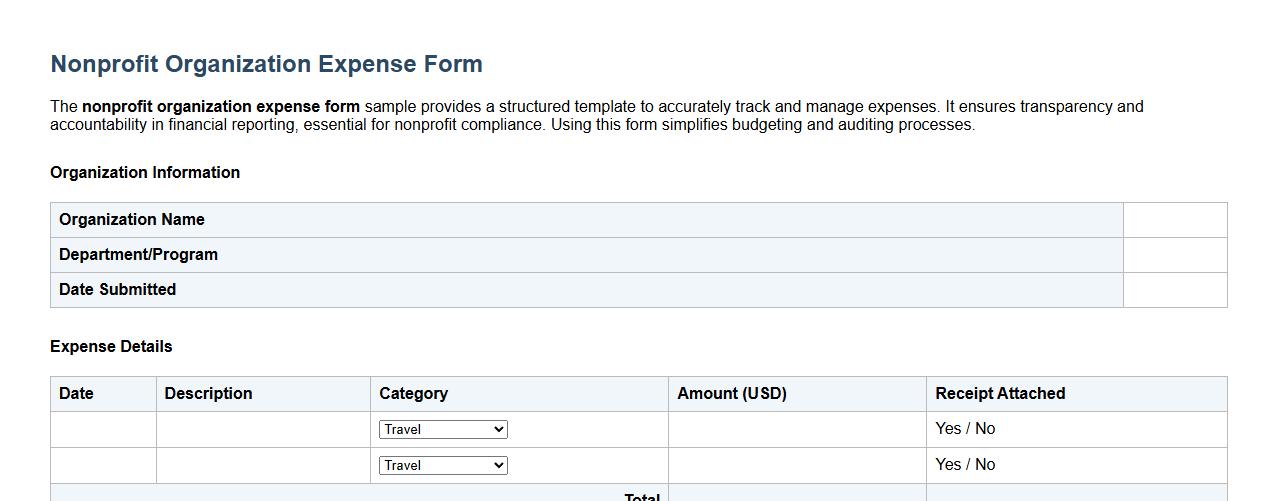

Nonprofit organization expense form sample

The nonprofit organization expense form sample provides a structured template to accurately track and manage expenses. It ensures transparency and accountability in financial reporting, essential for nonprofit compliance. Using this form simplifies budgeting and auditing processes.

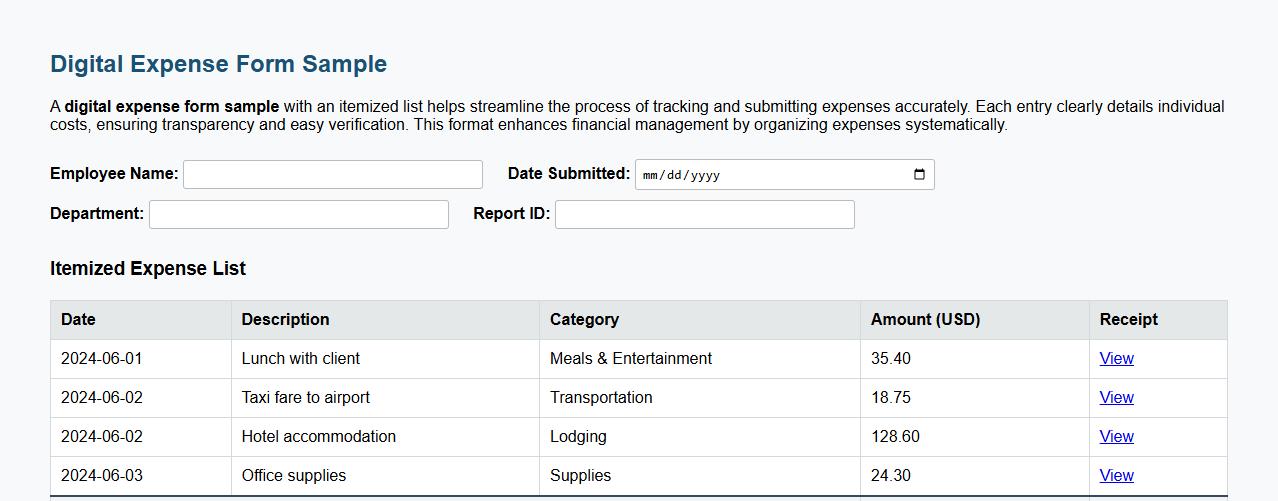

Digital expense form sample with itemized list

A digital expense form sample with an itemized list helps streamline the process of tracking and submitting expenses accurately. Each entry clearly details individual costs, ensuring transparency and easy verification. This format enhances financial management by organizing expenses systematically.

What receipts are required to accompany the Expense Form submission?

All original receipts must be submitted along with the Expense Form to validate the claimed expenses. These receipts should clearly show the date, vendor details, and the amount paid. Electronic receipts are acceptable if they contain all necessary information.

How should multi-currency expenses be documented in the Expense Form?

Multi-currency expenses must be documented by converting amounts to the company's base currency using the exchange rate on the date the expense was incurred. The Expense Form should include the original currency amount, exchange rate applied, and the converted amount. This ensures accurate reimbursement and accounting compliance.

Which expense categories are reimbursable as per the Expense Form policy?

The Expense Form policy covers travel, meals, accommodation, and office supplies as reimbursable categories. Each category must align with the company's spending limits and comply with policy guidelines. Expenses outside these categories require prior approval to be considered.

What is the deadline for submitting the Expense Form after incurring expenses?

Expense Forms must be submitted within 30 days of the expense date to qualify for reimbursement. Timely submission ensures quicker processing and reduces the risk of claim rejection. Late submissions might require managerial approval and additional documentation.

Who must approve the completed Expense Form before reimbursement processing?

The completed Expense Form must be approved by the employee's direct manager or designated supervisor. This approval confirms that the expenses are valid and comply with company policies. Without this authorization, reimbursement will be delayed or denied.