A Expense Report Form Sample helps employees document and submit their business expenditures for reimbursement efficiently. This form typically includes fields for date, description of the expense, amount, and category, ensuring accurate financial tracking and compliance. Using a well-designed sample streamlines the approval process and maintains organized records for accounting purposes.

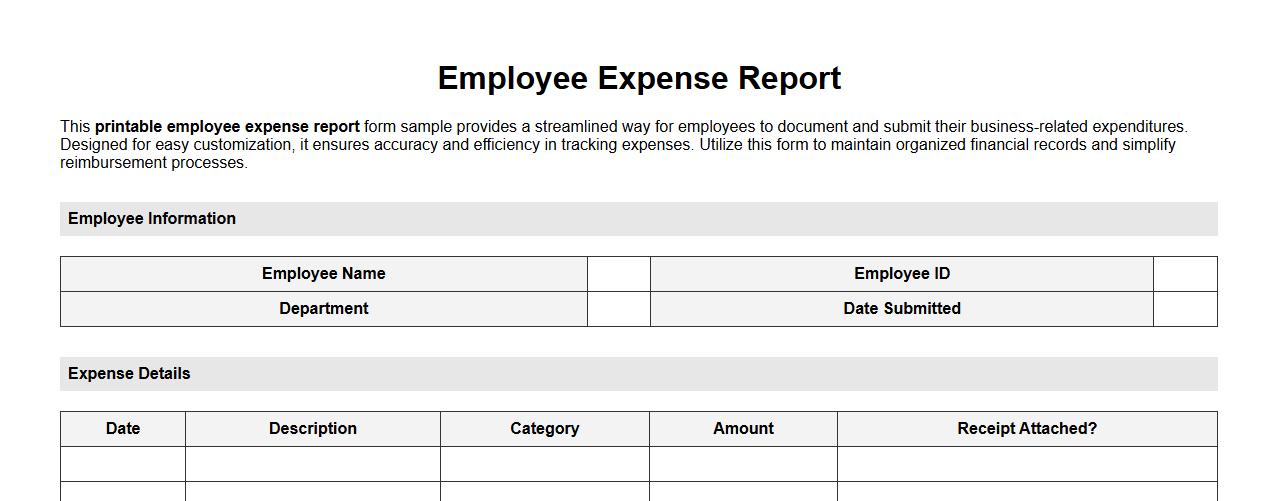

Printable employee expense report form sample

This printable employee expense report form sample provides a streamlined way for employees to document and submit their business-related expenditures. Designed for easy customization, it ensures accuracy and efficiency in tracking expenses. Utilize this form to maintain organized financial records and simplify reimbursement processes.

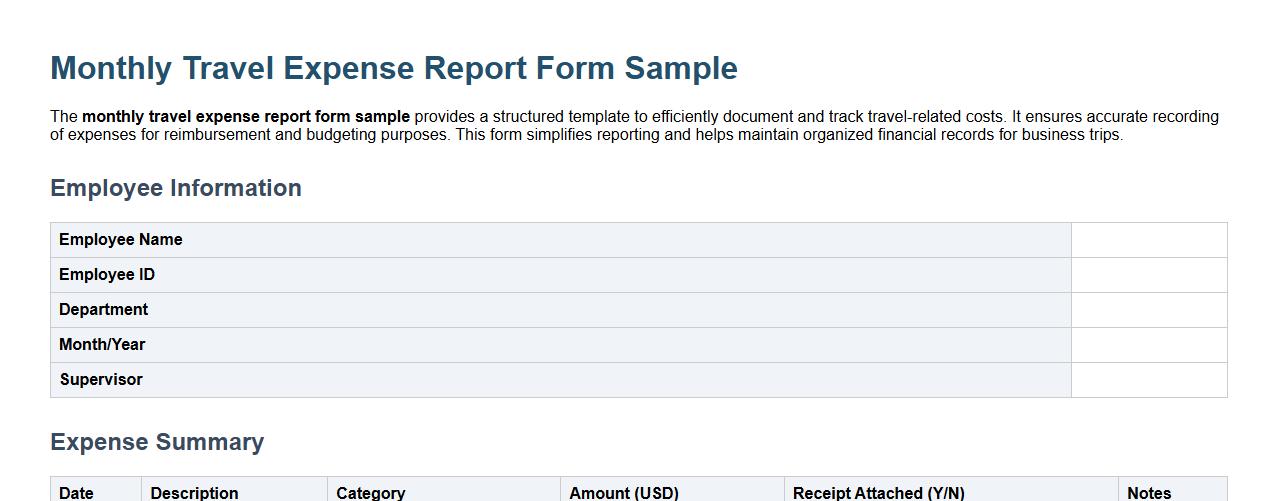

Monthly travel expense report form sample

The monthly travel expense report form sample provides a structured template to efficiently document and track travel-related costs. It ensures accurate recording of expenses for reimbursement and budgeting purposes. This form simplifies reporting and helps maintain organized financial records for business trips.

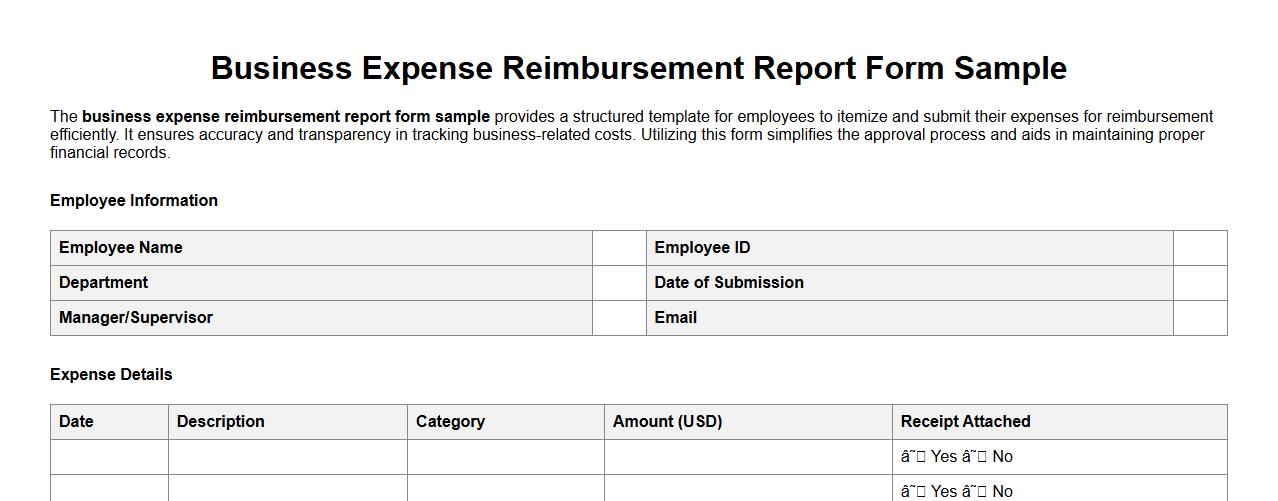

Business expense reimbursement report form sample

The business expense reimbursement report form sample provides a structured template for employees to itemize and submit their expenses for reimbursement efficiently. It ensures accuracy and transparency in tracking business-related costs. Utilizing this form simplifies the approval process and aids in maintaining proper financial records.

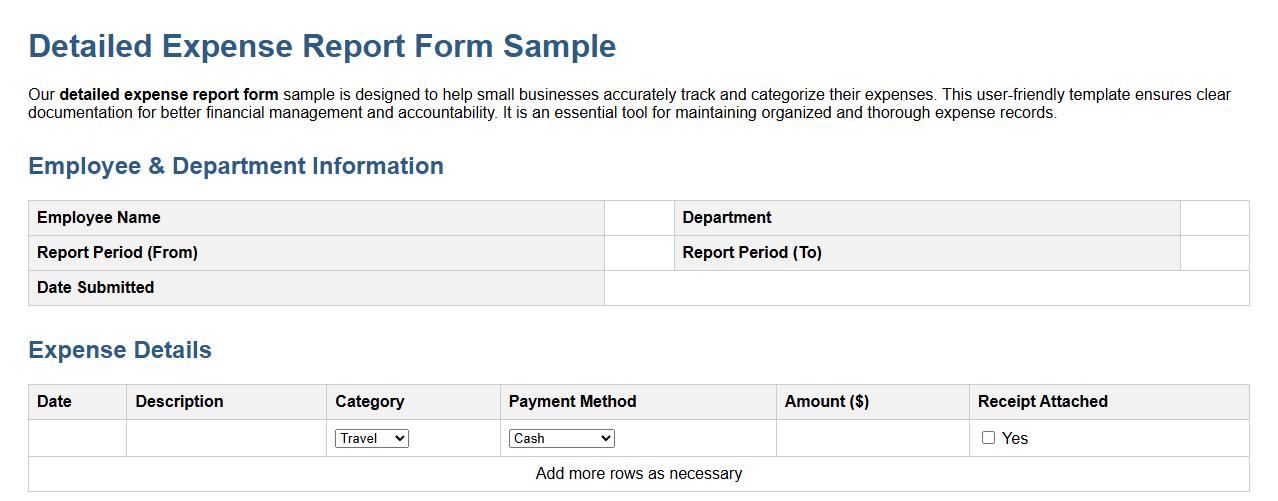

Detailed expense report form sample for small business

Our detailed expense report form sample is designed to help small businesses accurately track and categorize their expenses. This user-friendly template ensures clear documentation for better financial management and accountability. It is an essential tool for maintaining organized and thorough expense records.

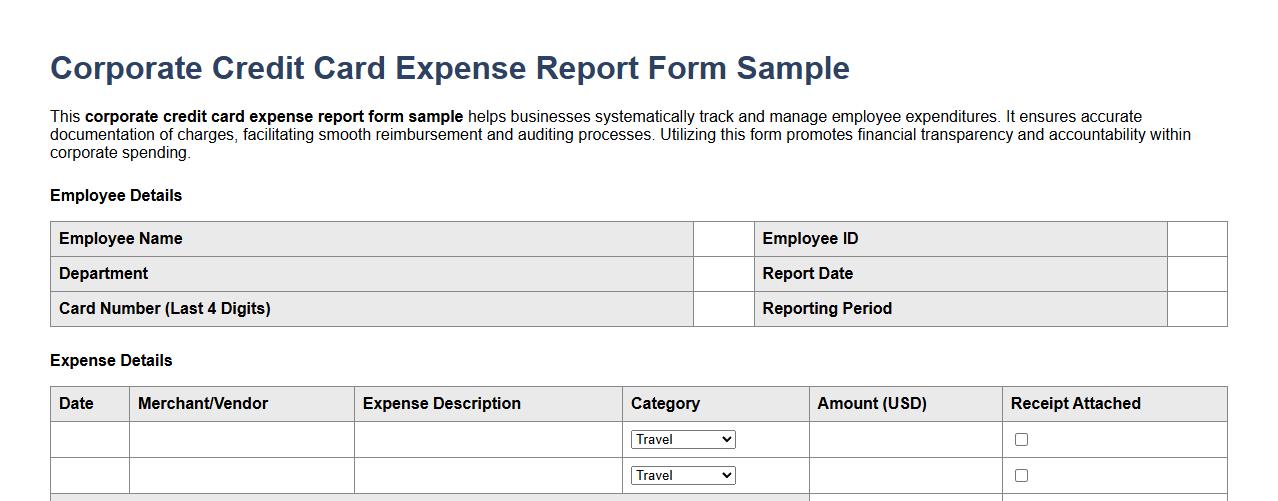

Corporate credit card expense report form sample

This corporate credit card expense report form sample helps businesses systematically track and manage employee expenditures. It ensures accurate documentation of charges, facilitating smooth reimbursement and auditing processes. Utilizing this form promotes financial transparency and accountability within corporate spending.

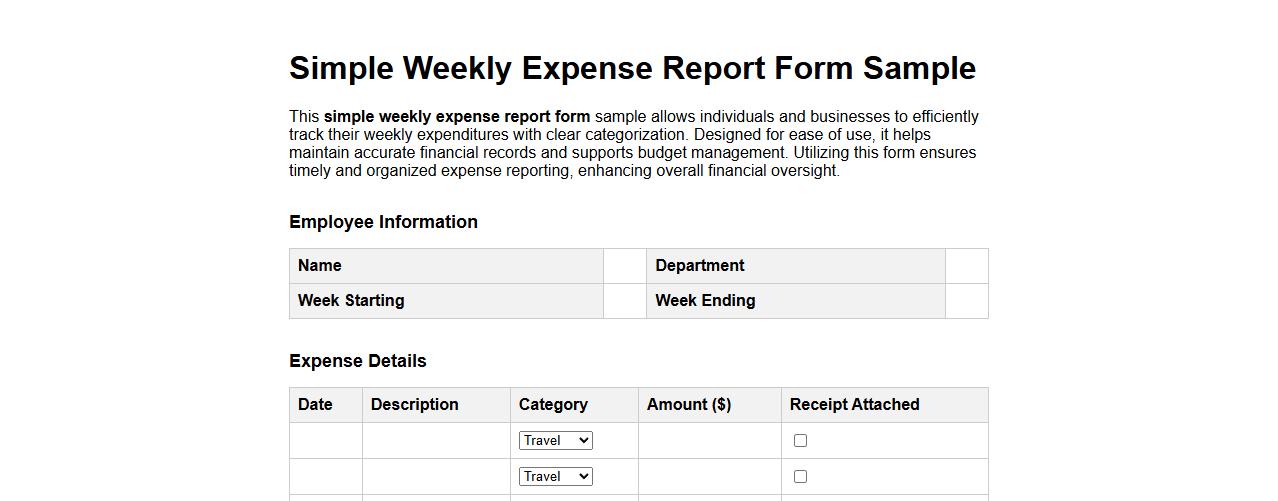

Simple weekly expense report form sample

This simple weekly expense report form sample allows individuals and businesses to efficiently track their weekly expenditures with clear categorization. Designed for ease of use, it helps maintain accurate financial records and supports budget management. Utilizing this form ensures timely and organized expense reporting, enhancing overall financial oversight.

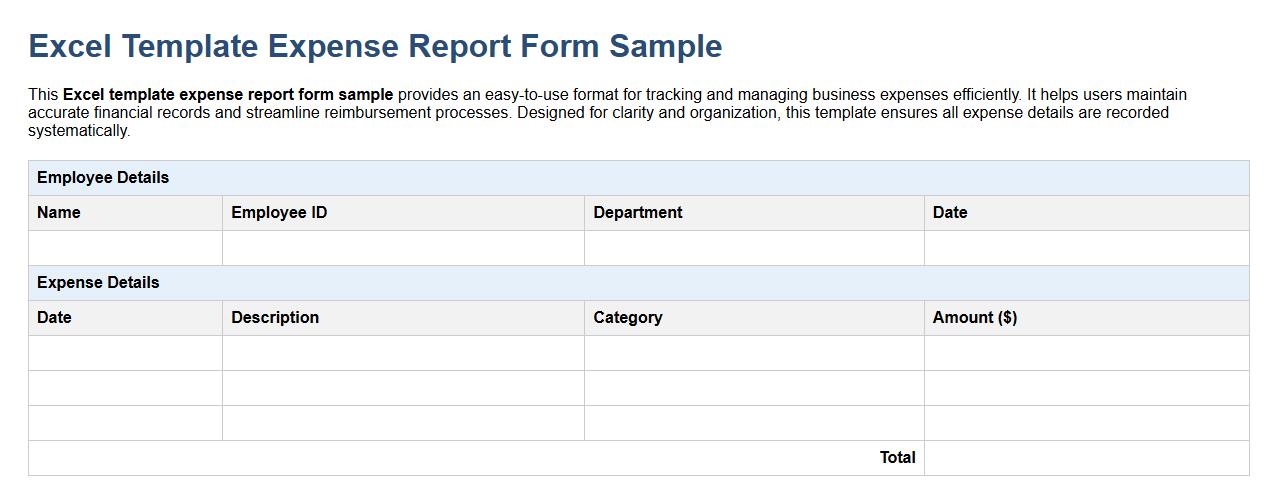

Excel template expense report form sample

This Excel template expense report form sample provides an easy-to-use format for tracking and managing business expenses efficiently. It helps users maintain accurate financial records and streamline reimbursement processes. Designed for clarity and organization, this template ensures all expense details are recorded systematically.

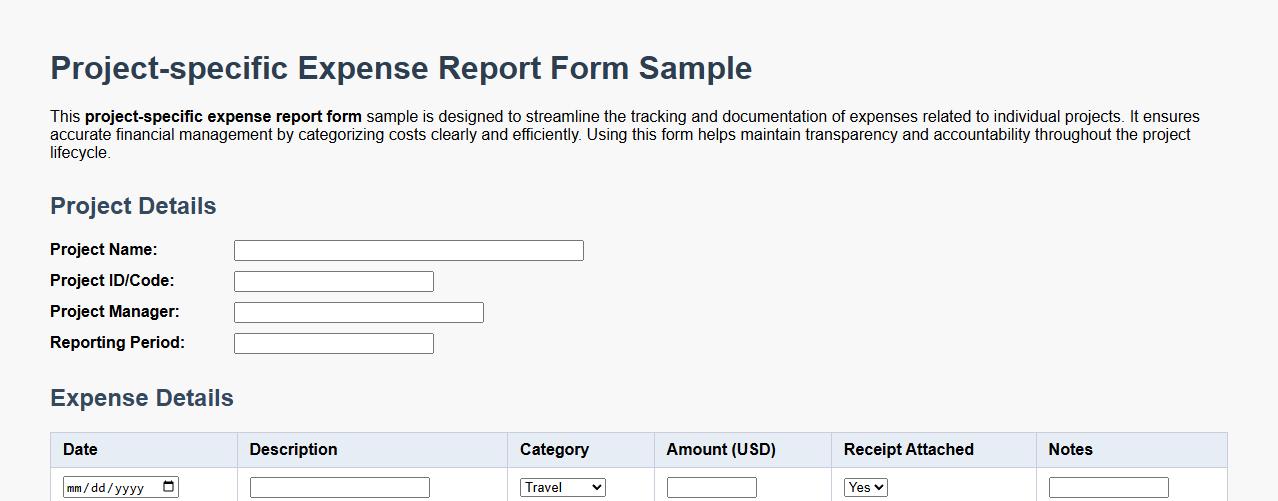

Project-specific expense report form sample

This project-specific expense report form sample is designed to streamline the tracking and documentation of expenses related to individual projects. It ensures accurate financial management by categorizing costs clearly and efficiently. Using this form helps maintain transparency and accountability throughout the project lifecycle.

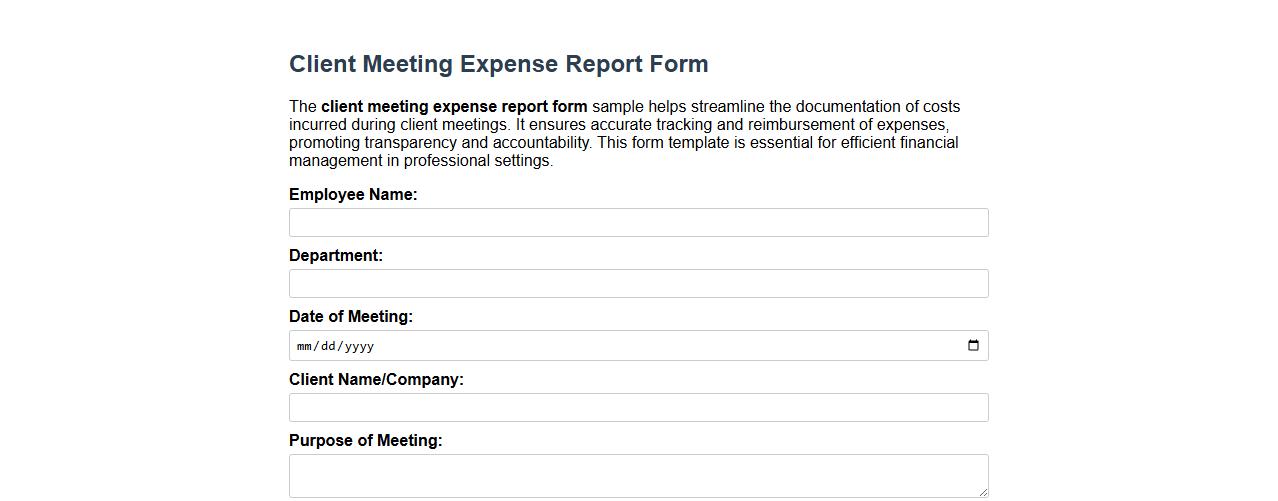

Client meeting expense report form sample

The client meeting expense report form sample helps streamline the documentation of costs incurred during client meetings. It ensures accurate tracking and reimbursement of expenses, promoting transparency and accountability. This form template is essential for efficient financial management in professional settings.

What supporting receipts are mandatory for each expense category?

Each expense category requires specific supporting receipts to validate the claim. For travel expenses, airlines and hotel invoices must be submitted. Receipts for meals, transportation, and office supplies should clearly indicate the date and amount.

How should meal expenses be itemized on the form?

Meal expenses must be itemized with details including the date, location, and names of attendees. The form requires separating food and beverage costs clearly. This ensures transparency and compliance with company policies.

Is there a section for mileage reimbursement on the document?

The form includes a dedicated section for mileage reimbursement where employees can log their travel distances. Users must enter the starting point, destination, and total miles traveled. This section calculates the reimbursement based on the current mileage rate.

Are currency conversions required for international expenses?

Yes, currency conversions are mandatory for all international expenses to maintain consistency. The form requires the original currency amount and the equivalent in the company's base currency. Exchange rates should be documented for verification purposes.

Does the form require manager approval signatures?

The form mandates a manager approval signature before processing the reimbursement. This step ensures the expenses are reviewed and authorized. Without the signature, the reimbursement request will be considered incomplete.