The Annual Financial Report provides a comprehensive overview of a company's financial performance and position over the fiscal year. It includes key statements such as the balance sheet, income statement, and cash flow statement, offering stakeholders essential data for evaluating business health. This report is crucial for investors, regulators, and management to make informed decisions.

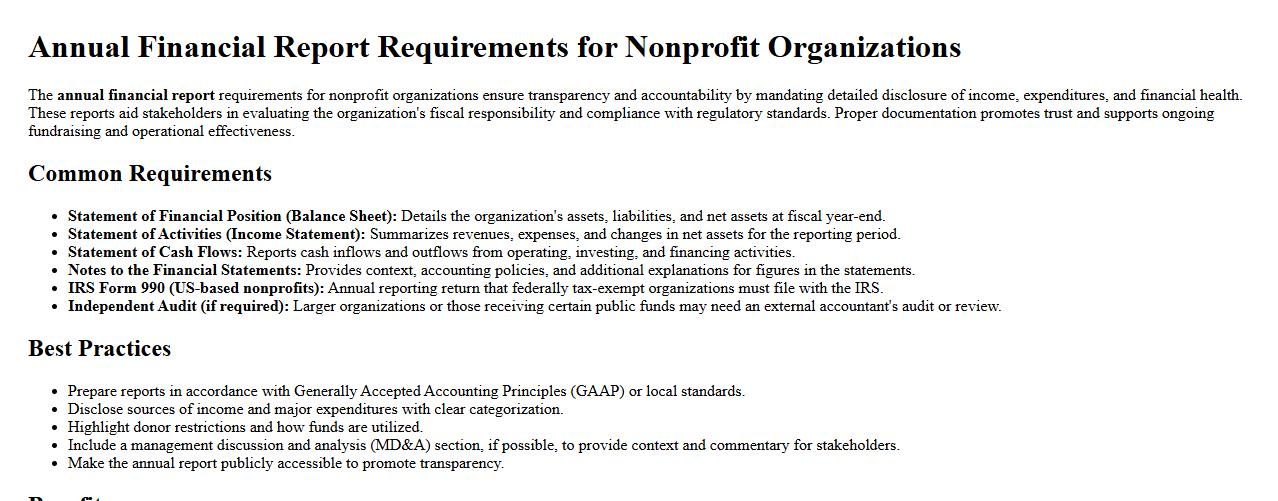

Annual financial report requirements for non profit organizations

The annual financial report requirements for nonprofit organizations ensure transparency and accountability by mandating detailed disclosure of income, expenditures, and financial health. These reports aid stakeholders in evaluating the organization's fiscal responsibility and compliance with regulatory standards. Proper documentation promotes trust and supports ongoing fundraising and operational effectiveness.

How to prepare an annual financial report for small businesses

Preparing an annual financial report for small businesses involves compiling accurate financial statements, including the income statement, balance sheet, and cash flow statement, to provide a clear overview of the company's financial health. It is essential to ensure all transactions are properly recorded and reviewed to maintain compliance with accounting standards. This report aids in informed decision-making and facilitates transparency with stakeholders.

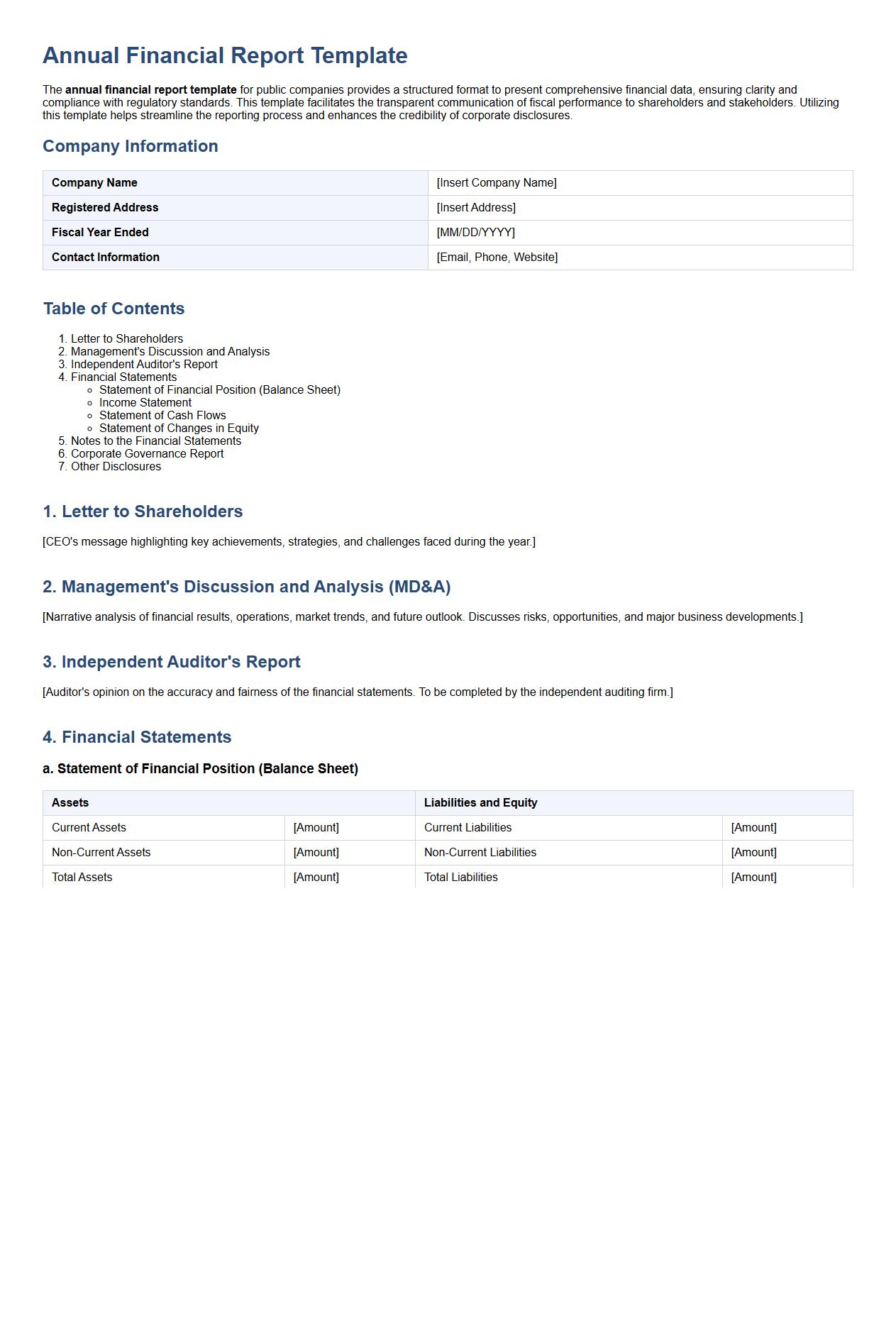

Annual financial report template for public companies

The annual financial report template for public companies provides a structured format to present comprehensive financial data, ensuring clarity and compliance with regulatory standards. This template facilitates the transparent communication of fiscal performance to shareholders and stakeholders. Utilizing this template helps streamline the reporting process and enhances the credibility of corporate disclosures.

SEC annual financial report filing guidelines

The SEC annual financial report filing guidelines provide a comprehensive framework for public companies to report their financial performance accurately and transparently. These guidelines ensure consistent disclosure, helping investors make informed decisions based on standardized financial data. Adhering to these regulations is essential for maintaining market integrity and regulatory compliance.

Annual financial report components and sections

The annual financial report consists of several key components, including the balance sheet, income statement, cash flow statement, and notes to the financial statements. Each section provides essential insights into a company's financial health, performance, and cash management over the fiscal year. Together, these sections ensure transparency and aid stakeholders in making informed decisions.

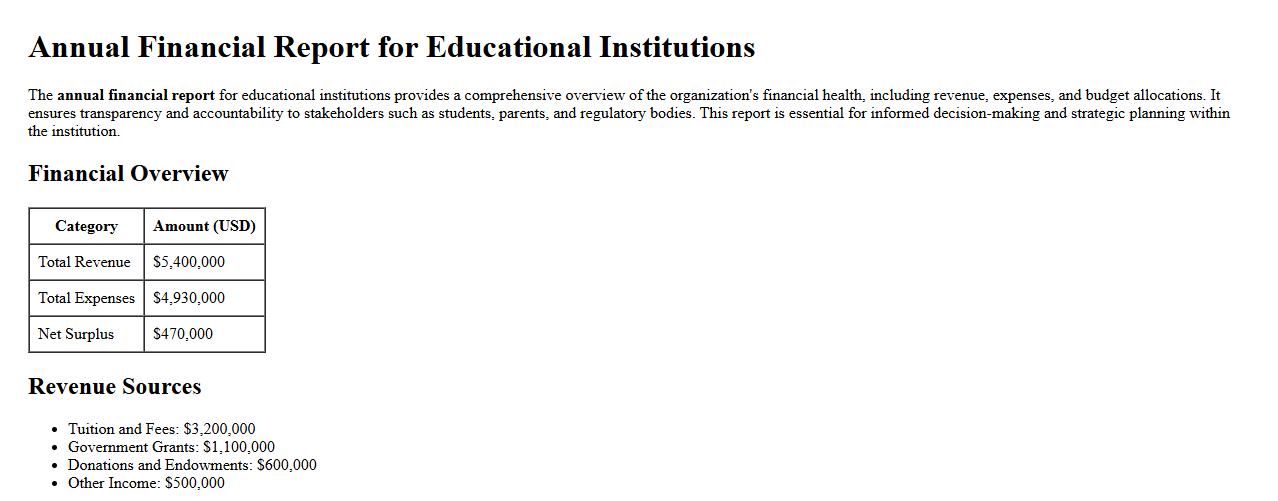

Annual financial report for educational institutions

The annual financial report for educational institutions provides a comprehensive overview of the organization's financial health, including revenue, expenses, and budget allocations. It ensures transparency and accountability to stakeholders such as students, parents, and regulatory bodies. This report is essential for informed decision-making and strategic planning within the institution.

International standards for annual financial report disclosure

International standards for annual financial report disclosure ensure transparency, consistency, and comparability of financial information across global markets. These standards guide companies in presenting accurate and comprehensive financial statements to stakeholders. Adhering to such criteria fosters investor confidence and supports informed decision-making worldwide.

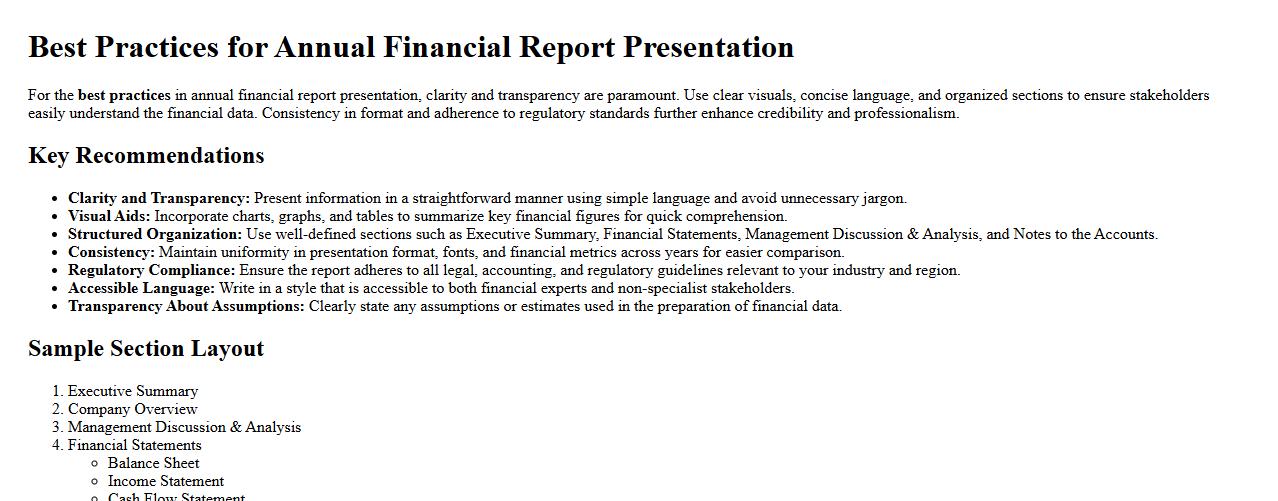

Best practices for annual financial report presentation

For the best practices in annual financial report presentation, clarity and transparency are paramount. Use clear visuals, concise language, and organized sections to ensure stakeholders easily understand the financial data. Consistency in format and adherence to regulatory standards further enhance credibility and professionalism.

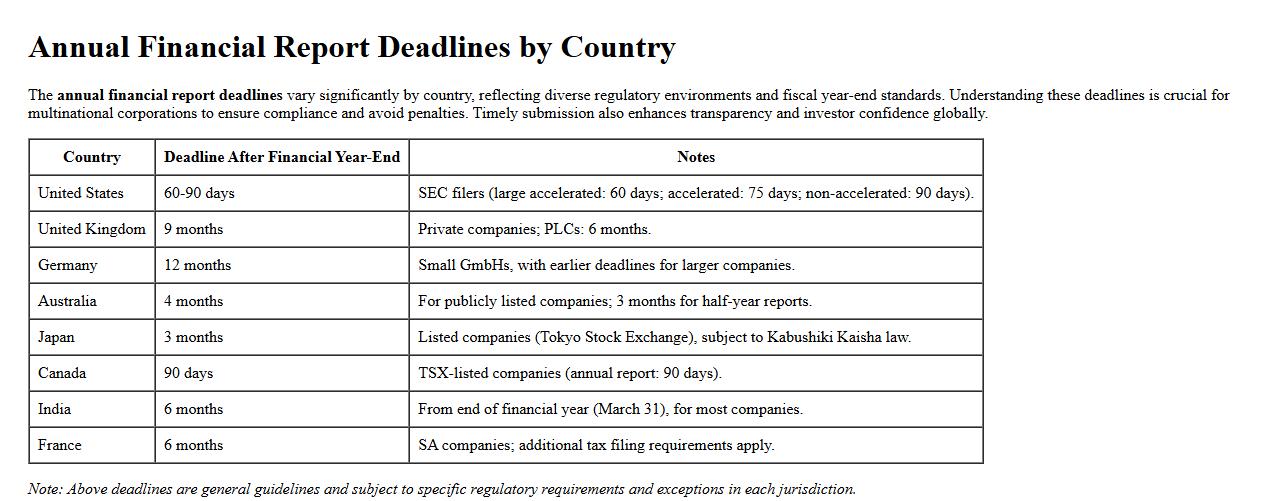

Annual financial report deadlines by country

The annual financial report deadlines vary significantly by country, reflecting diverse regulatory environments and fiscal year-end standards. Understanding these deadlines is crucial for multinational corporations to ensure compliance and avoid penalties. Timely submission also enhances transparency and investor confidence globally.

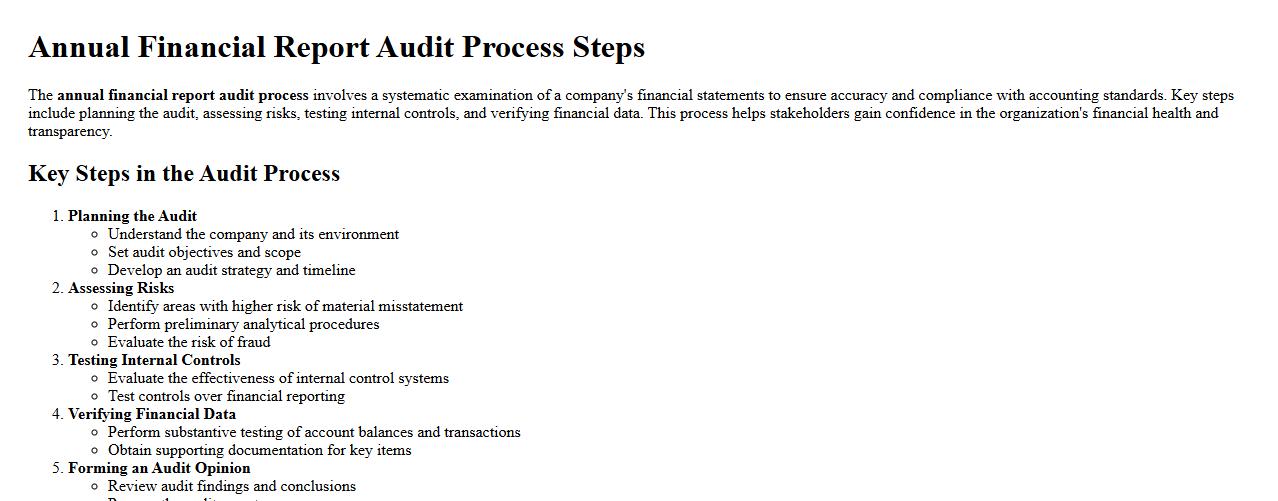

Annual financial report audit process steps

The annual financial report audit process involves a systematic examination of a company's financial statements to ensure accuracy and compliance with accounting standards. Key steps include planning the audit, assessing risks, testing internal controls, and verifying financial data. This process helps stakeholders gain confidence in the organization's financial health and transparency.

What are the key variances highlighted in the annual financial report's management discussion section?

The management discussion section emphasizes significant variances in revenue and expenses compared to the previous year. Key drivers include changes in market demand, operational efficiencies, and cost management initiatives. This section provides a clear narrative on the financial performance and underlying factors impacting results.

How does the annual report address changes in accounting policies compared to the previous year?

The report clearly outlines any changes in accounting policies and their impact on financial statements. Comparative figures are restated to maintain consistency and transparency for stakeholders. Explanations are provided to justify the adoption of new standards or revisions.

Which specific footnotes detail contingent liabilities in the financial statements?

Contingent liabilities are typically disclosed in the footnotes dedicated to legal matters or risk management. These notes describe potential financial obligations that depend on the outcome of uncertain future events. The detailed disclosures help users understand the possible impact on the company's financial position.

How is sustainability or ESG (Environmental, Social, Governance) performance disclosed in this year's report?

The annual report includes a dedicated sustainability or ESG section covering environmental initiatives, social responsibility programs, and governance practices. Performance metrics and goals are presented to demonstrate commitment and progress. This disclosure enhances transparency and aligns with stakeholder expectations.

What internal controls are described regarding financial data accuracy in the annual financial report?

The report details the internal controls implemented to ensure the accuracy and reliability of financial data. These controls include regular audits, segregation of duties, and automated system checks. Management emphasizes the robustness of these measures in maintaining strong financial governance.