A Payment Record Form Sample is a useful template designed to document financial transactions efficiently. It typically includes fields for payment date, amount, payer details, and payment method, ensuring accurate and organized record-keeping. This form helps businesses track expenses and maintain clear financial records for auditing and reporting purposes.

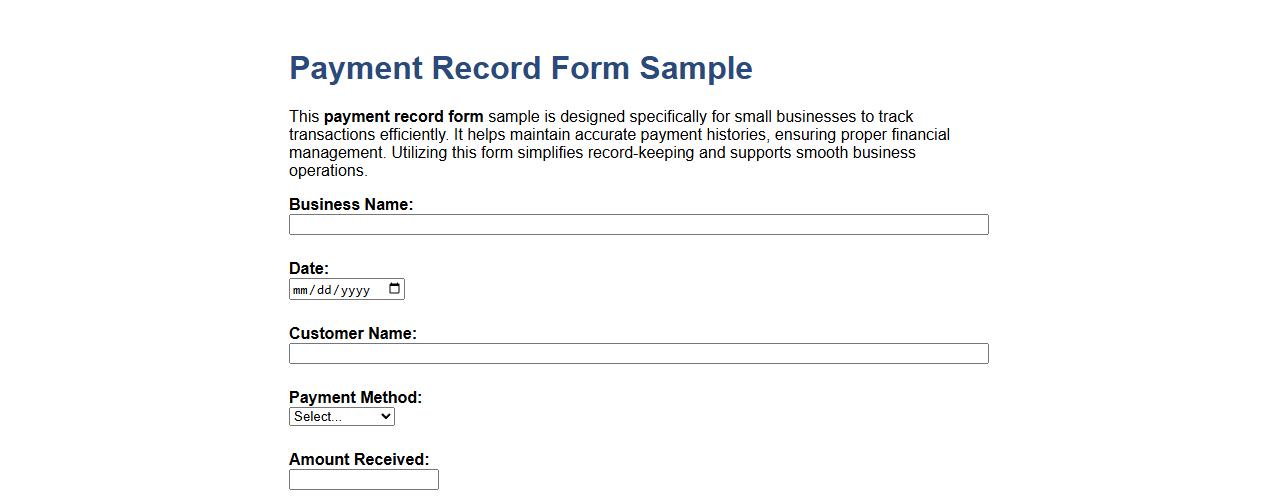

Payment record form sample for small businesses

This payment record form sample is designed specifically for small businesses to track transactions efficiently. It helps maintain accurate payment histories, ensuring proper financial management. Utilizing this form simplifies record-keeping and supports smooth business operations.

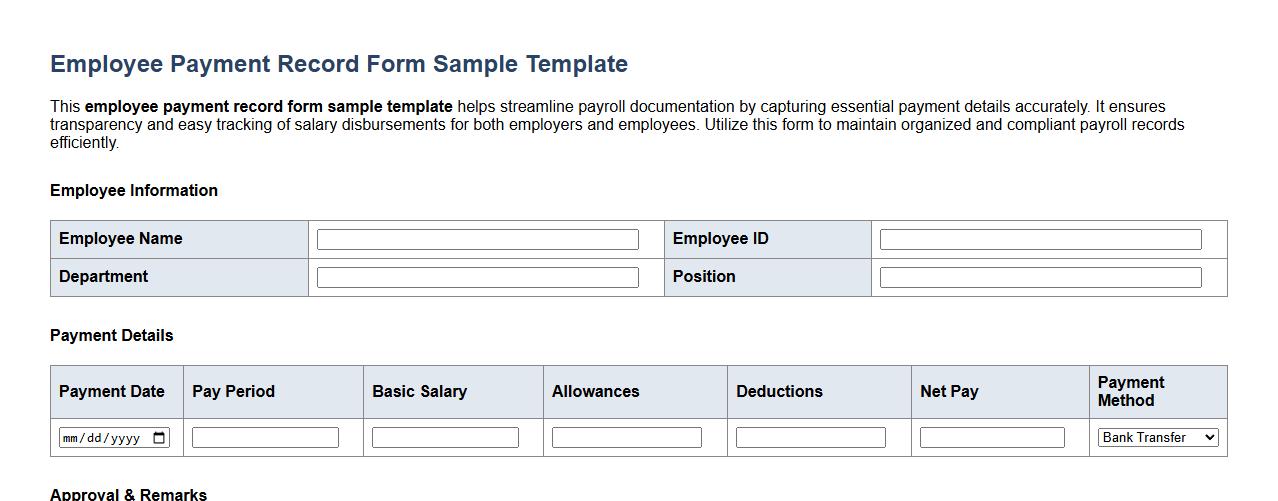

Employee payment record form sample template

This employee payment record form sample template helps streamline payroll documentation by capturing essential payment details accurately. It ensures transparency and easy tracking of salary disbursements for both employers and employees. Utilize this form to maintain organized and compliant payroll records efficiently.

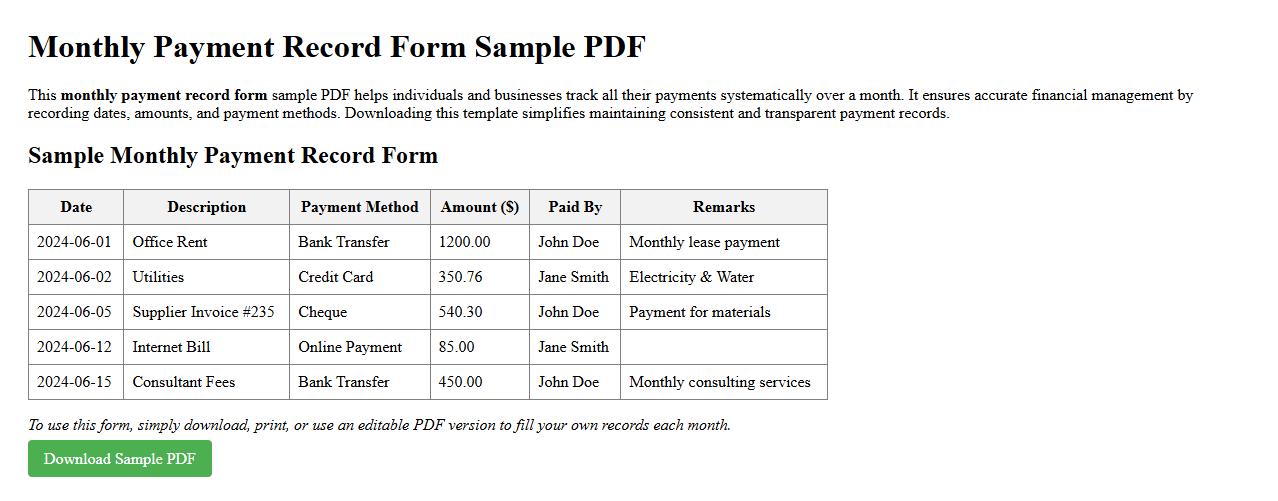

Monthly payment record form sample PDF

This monthly payment record form sample PDF helps individuals and businesses track all their payments systematically over a month. It ensures accurate financial management by recording dates, amounts, and payment methods. Downloading this template simplifies maintaining consistent and transparent payment records.

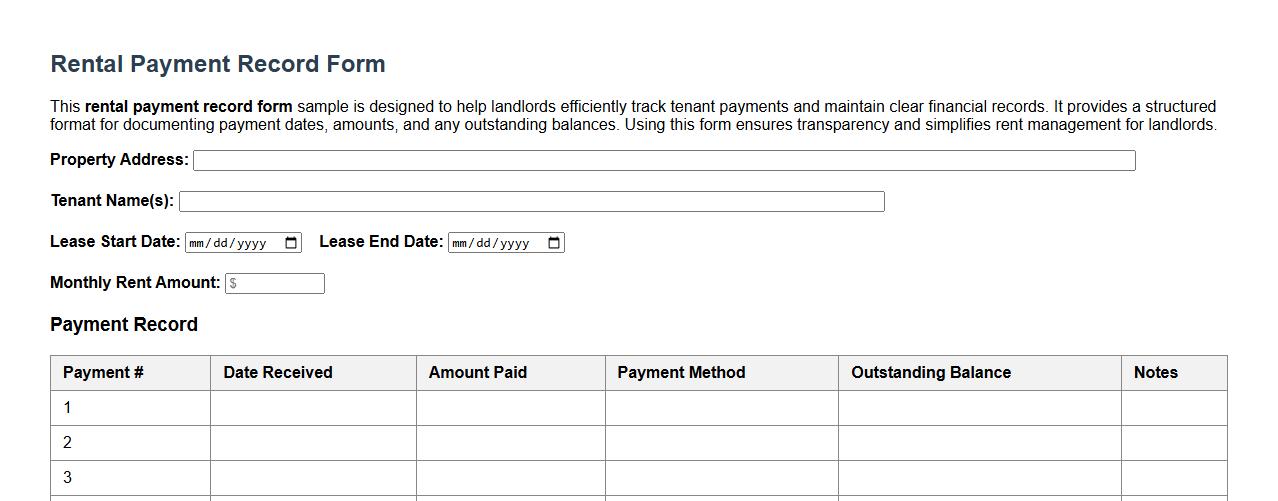

Rental payment record form sample for landlords

This rental payment record form sample is designed to help landlords efficiently track tenant payments and maintain clear financial records. It provides a structured format for documenting payment dates, amounts, and any outstanding balances. Using this form ensures transparency and simplifies rent management for landlords.

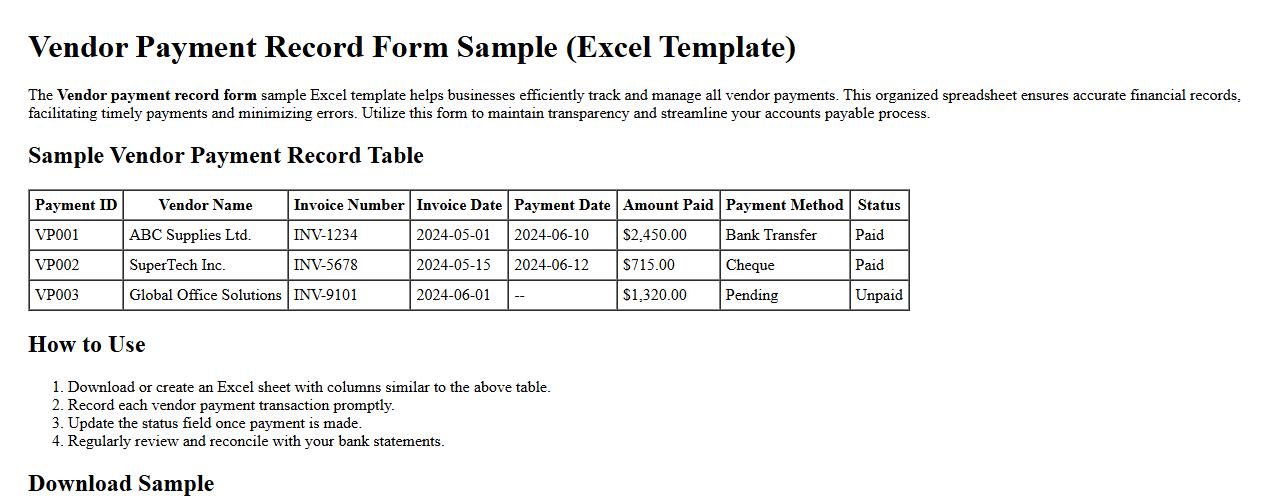

Vendor payment record form sample Excel

The Vendor payment record form sample Excel template helps businesses efficiently track and manage all vendor payments. This organized spreadsheet ensures accurate financial records, facilitating timely payments and minimizing errors. Utilize this form to maintain transparency and streamline your accounts payable process.

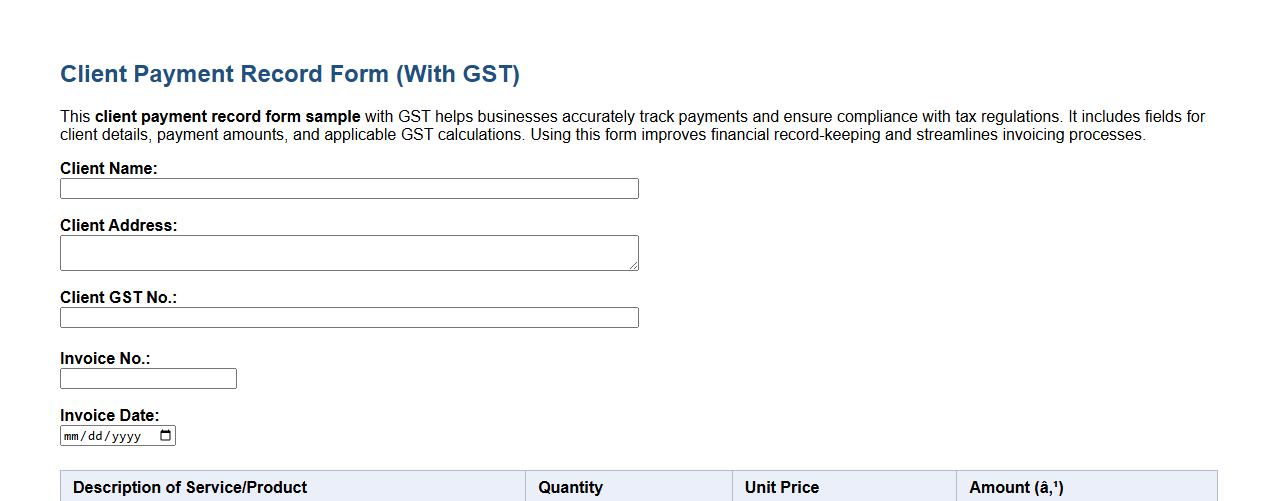

Client payment record form sample with GST

This client payment record form sample with GST helps businesses accurately track payments and ensure compliance with tax regulations. It includes fields for client details, payment amounts, and applicable GST calculations. Using this form improves financial record-keeping and streamlines invoicing processes.

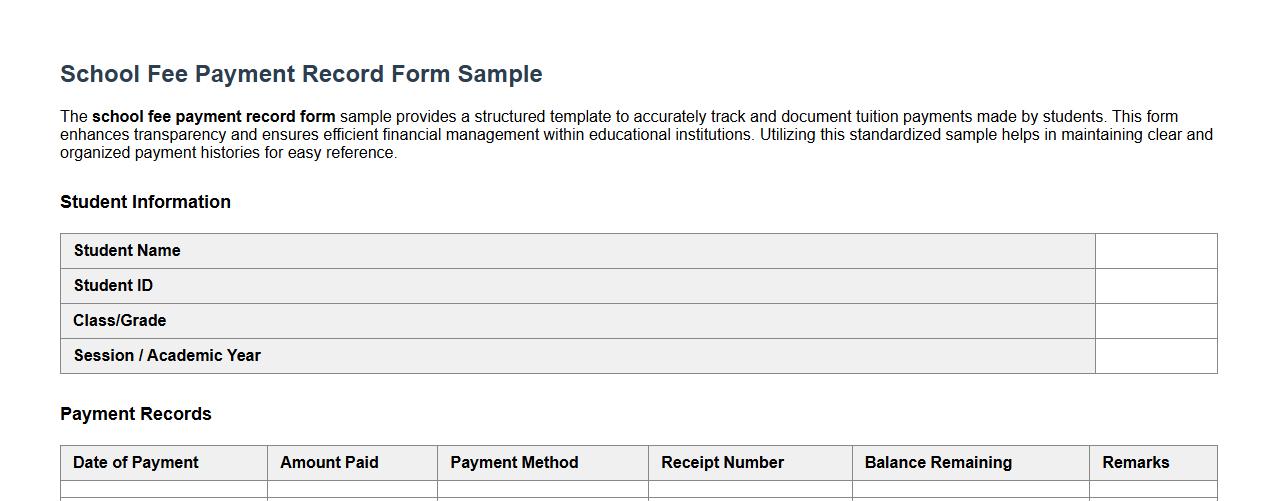

School fee payment record form sample

The school fee payment record form sample provides a structured template to accurately track and document tuition payments made by students. This form enhances transparency and ensures efficient financial management within educational institutions. Utilizing this standardized sample helps in maintaining clear and organized payment histories for easy reference.

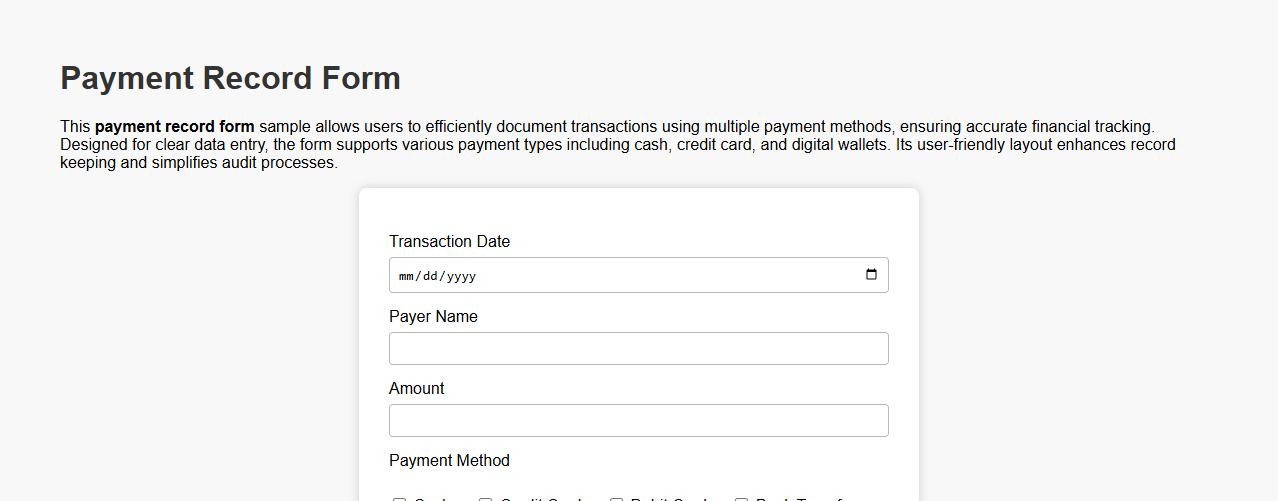

Payment record form sample with multiple payment methods

This payment record form sample allows users to efficiently document transactions using multiple payment methods, ensuring accurate financial tracking. Designed for clear data entry, the form supports various payment types including cash, credit card, and digital wallets. Its user-friendly layout enhances record keeping and simplifies audit processes.

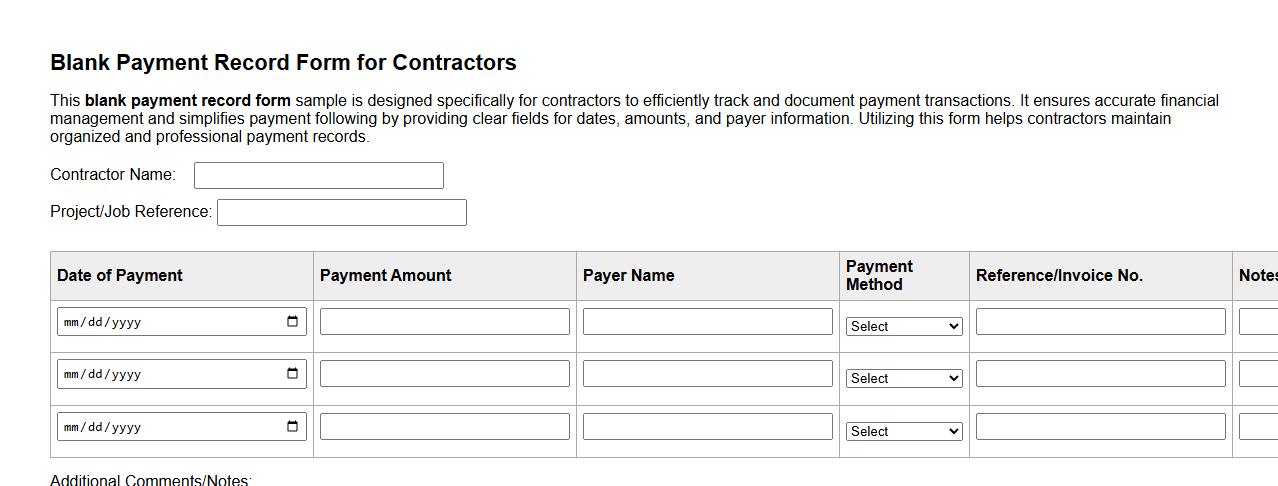

Blank payment record form sample for contractors

This blank payment record form sample is designed specifically for contractors to efficiently track and document payment transactions. It ensures accurate financial management and simplifies payment following by providing clear fields for dates, amounts, and payer information. Utilizing this form helps contractors maintain organized and professional payment records.

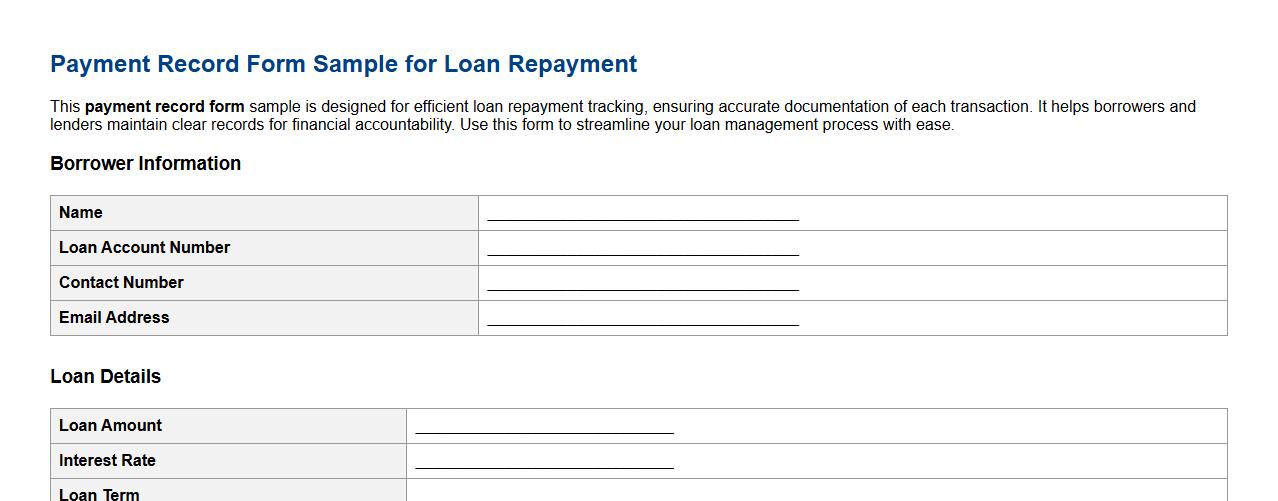

Payment record form sample for loan repayment

This payment record form sample is designed for efficient loan repayment tracking, ensuring accurate documentation of each transaction. It helps borrowers and lenders maintain clear records for financial accountability. Use this form to streamline your loan management process with ease.

How do you verify the authenticity of a Payment Record Form submission?

To verify the authenticity of a Payment Record Form submission, ensure the form is submitted by an authorized individual using secure login credentials or digital signatures. Cross-check the submitted data against internal records such as invoices or payment receipts for accuracy. Employ multi-factor authentication and timestamping to further validate the origin and timing of the submission.

What essential data fields must be included in a Payment Record Form for compliance?

A Payment Record Form must include critical data fields such as the payer and payee information, payment amount, date of transaction, and payment method to meet compliance requirements. Additional mandatory fields typically consist of invoice or reference numbers and authorization signatures. Including these essential data points ensures traceability and regulatory adherence.

How is confidential information protected when processing Payment Record Forms?

Confidential information in Payment Record Forms is safeguarded through encryption methods during transmission and storage to prevent unauthorized access. Access controls and user authentication protocols restrict form handling to authorized personnel only. Regular security audits and compliance with data protection regulations further enhance the protection of sensitive data.

What is the retention period for archived Payment Record Forms?

The retention period for archived Payment Record Forms varies by jurisdiction but typically spans a minimum of five to seven years to comply with financial regulations. Archiving must ensure the forms are stored securely and remain easily retrievable for audits or legal inquiries. Organizations should follow their internal policies aligned with legal requirements to manage document retention effectively.

How are discrepancies in a Payment Record Form reconciled during audits?

Discrepancies identified in a Payment Record Form during audits are addressed by conducting a thorough investigation to trace inconsistencies and verify supporting documentation. The finance team collaborates with relevant departments to correct errors and update records accordingly. Maintaining clear audit trails and documenting all reconciliation actions is vital for financial accuracy and compliance.