The Expense Claim Record Form Sample is designed to streamline the process of documenting and submitting business-related expenses for reimbursement. It includes fields for date, description, amount, and approval signatures to ensure accurate record-keeping and accountability. Using this form helps maintain organized financial records and supports efficient expense tracking for both employees and employers.

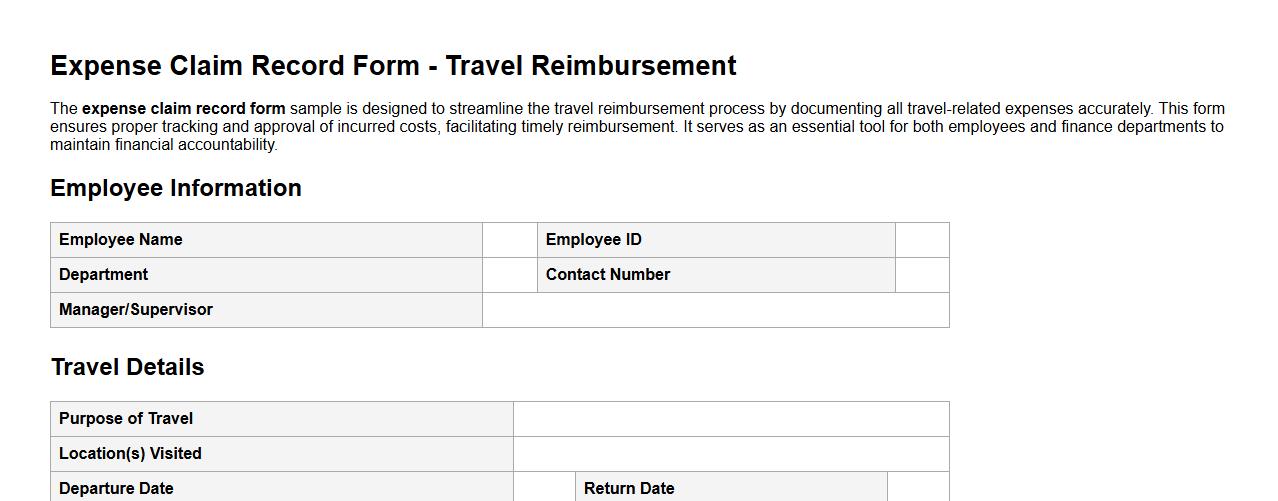

Expense claim record form sample for travel reimbursement

The expense claim record form sample is designed to streamline the travel reimbursement process by documenting all travel-related expenses accurately. This form ensures proper tracking and approval of incurred costs, facilitating timely reimbursement. It serves as an essential tool for both employees and finance departments to maintain financial accountability.

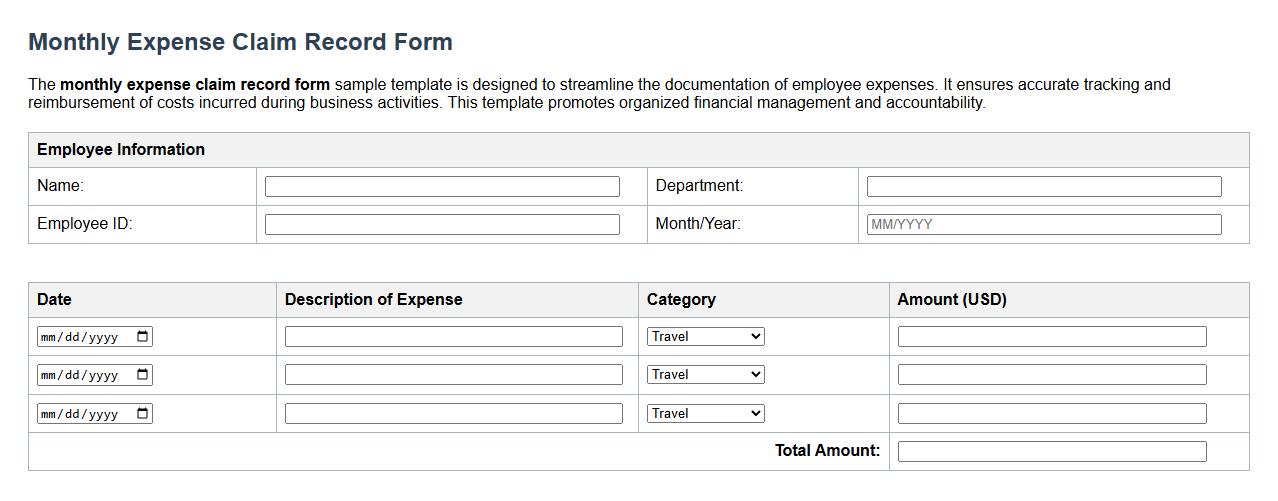

Monthly expense claim record form sample template

The monthly expense claim record form sample template is designed to streamline the documentation of employee expenses. It ensures accurate tracking and reimbursement of costs incurred during business activities. This template promotes organized financial management and accountability.

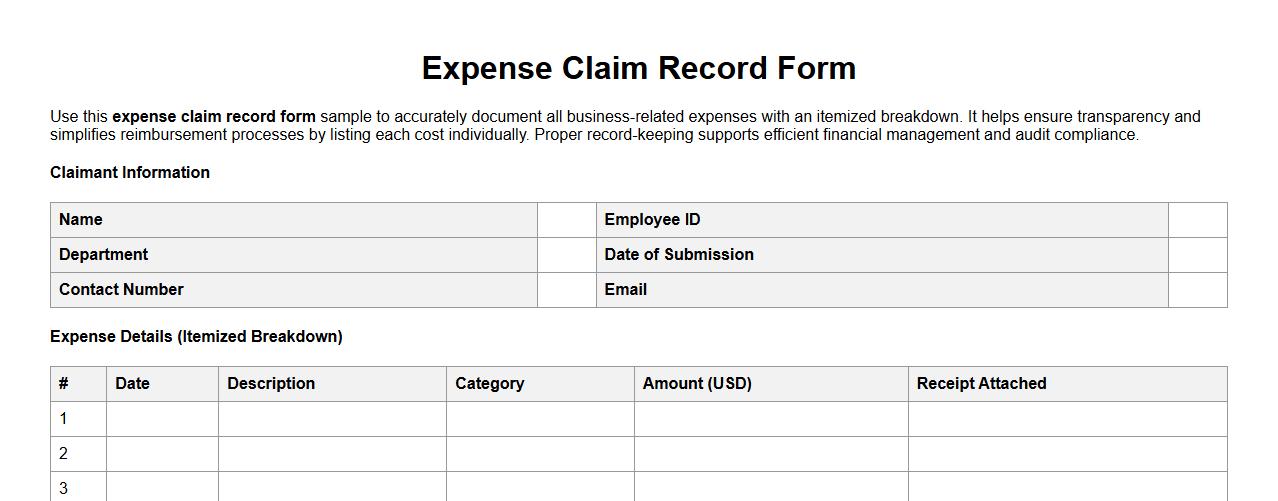

Expense claim record form sample with itemized breakdown

Use this expense claim record form sample to accurately document all business-related expenses with an itemized breakdown. It helps ensure transparency and simplifies reimbursement processes by listing each cost individually. Proper record-keeping supports efficient financial management and audit compliance.

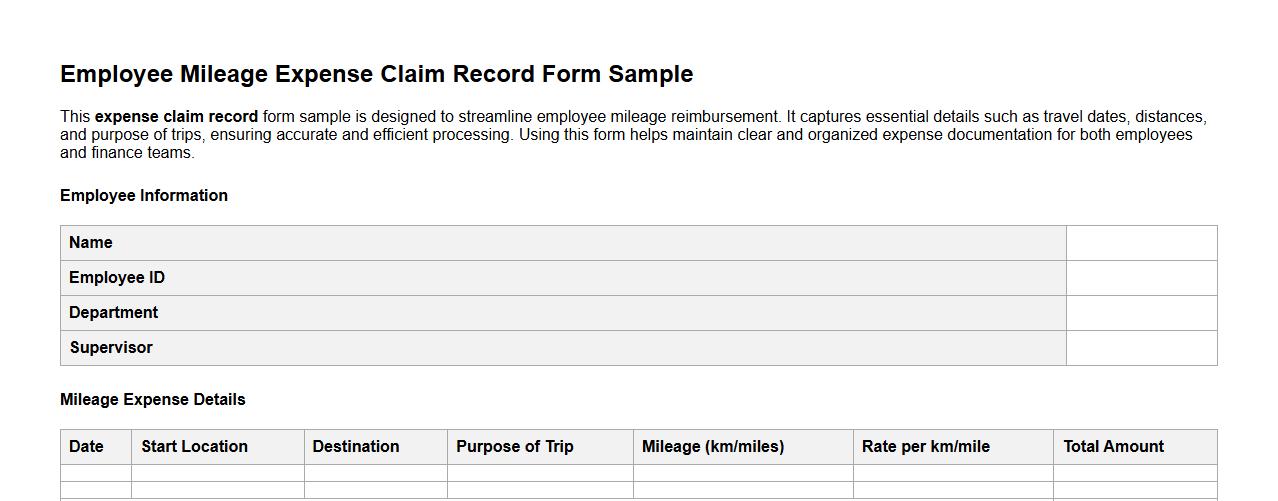

Expense claim record form sample for employee mileage

This expense claim record form sample is designed to streamline employee mileage reimbursement. It captures essential details such as travel dates, distances, and purpose of trips, ensuring accurate and efficient processing. Using this form helps maintain clear and organized expense documentation for both employees and finance teams.

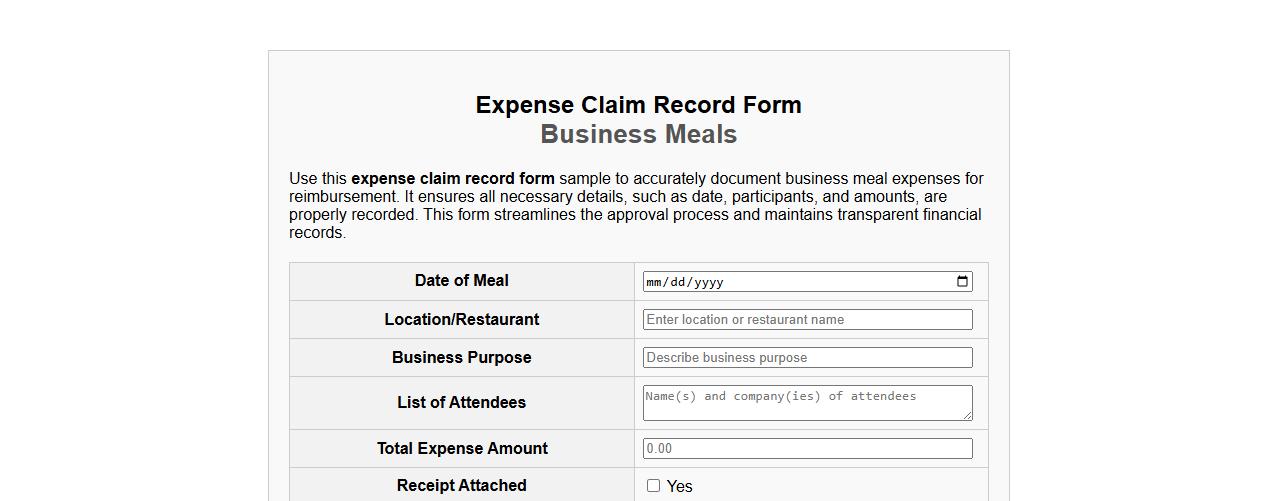

Expense claim record form sample for business meals

Use this expense claim record form sample to accurately document business meal expenses for reimbursement. It ensures all necessary details, such as date, participants, and amounts, are properly recorded. This form streamlines the approval process and maintains transparent financial records.

Downloadable expense claim record form sample pdf

Download our expense claim record form sample PDF to efficiently track and document your business expenditures. This easy-to-use template helps ensure accurate financial reporting and reimbursement. Ideal for professionals seeking organized and printable expense records.

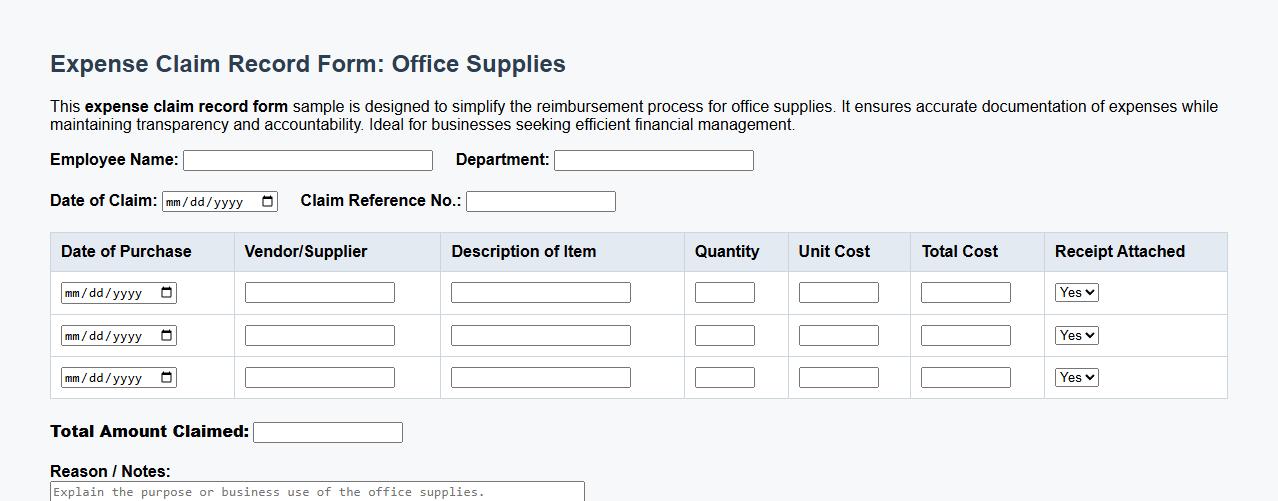

Expense claim record form sample for office supplies

This expense claim record form sample is designed to simplify the reimbursement process for office supplies. It ensures accurate documentation of expenses while maintaining transparency and accountability. Ideal for businesses seeking efficient financial management.

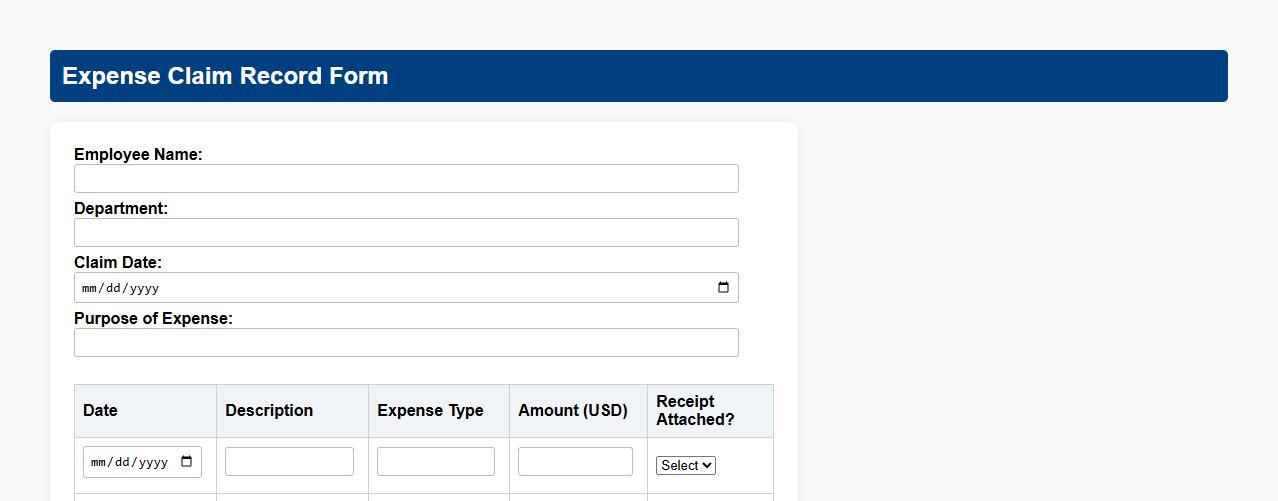

Expense claim record form sample with approval section

This expense claim record form sample provides a structured way to document and track expenses efficiently. It includes an approval section to ensure proper authorization before reimbursement. This form enhances transparency and accountability in expense management.

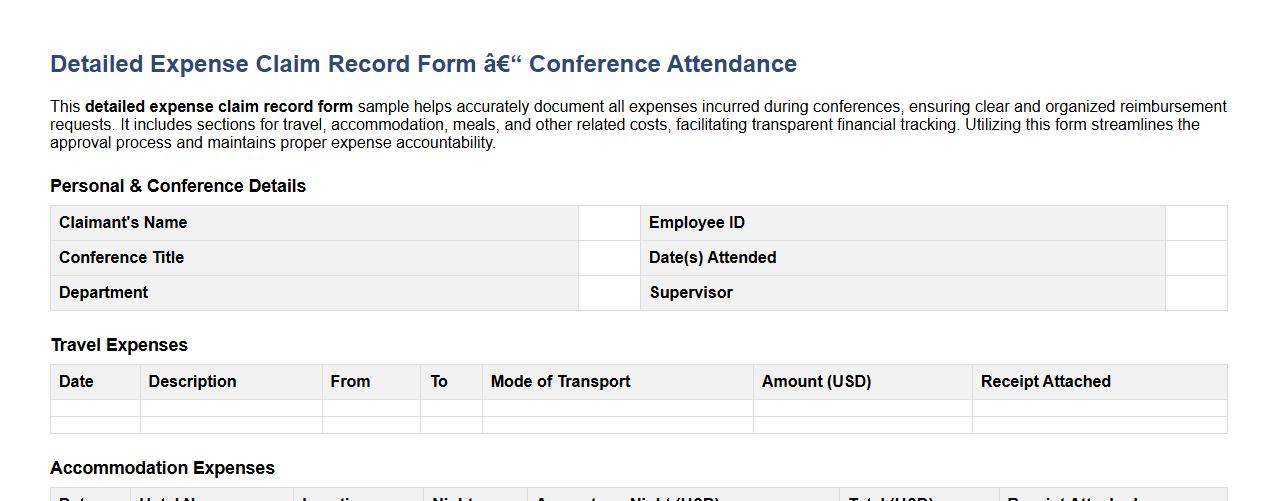

Detailed expense claim record form sample for conferences

This detailed expense claim record form sample helps accurately document all expenses incurred during conferences, ensuring clear and organized reimbursement requests. It includes sections for travel, accommodation, meals, and other related costs, facilitating transparent financial tracking. Utilizing this form streamlines the approval process and maintains proper expense accountability.

What supporting receipts are required for each expense category on the Expense Claim Record Form?

Each expense category on the form must be accompanied by corresponding original receipts. These supporting documents validate the claimed amounts and ensure compliance with company policies. Common required receipts include hotel bills, meal invoices, and transportation tickets.

How should mileage claims be documented within the form?

Mileage claims need to include detailed travel logs specifying the date, origin, destination, and total distance traveled. Entries must be accurate and supported by odometer readings or GPS data when available. Clear documentation facilitates proper reimbursement and audit transparency.

Are per diem allowances recorded separately or itemized in the form?

Per diem allowances are typically recorded separately from actual expenses to simplify the claim process. The form often includes a designated section for per diem rates based on location and duration. Itemizing is generally not required unless specific receipts accompany the allowance.

What approval signatures are mandatory for form submission?

The form must have mandatory approval signatures from both the employee's immediate supervisor and the finance department. These signatures confirm the legitimacy and accuracy of the claim before processing. Some organizations may require additional authorizations for high-value expenses.

How are currency conversions detailed for international expenses on the form?

International expenses must be reported with original amounts and their currency conversions into the company's base currency. The form should specify the exchange rate used and the date it was applied. Accurate conversions ensure correct reimbursement and compliance with accounting standards.