The Asset Transfer Record Form Sample is a standardized document used to track the movement of assets between departments or individuals within an organization. This form ensures accurate documentation of asset details, transfer dates, and responsible parties to maintain accountability. Proper use of this form helps streamline asset management and prevent discrepancies in inventory records.

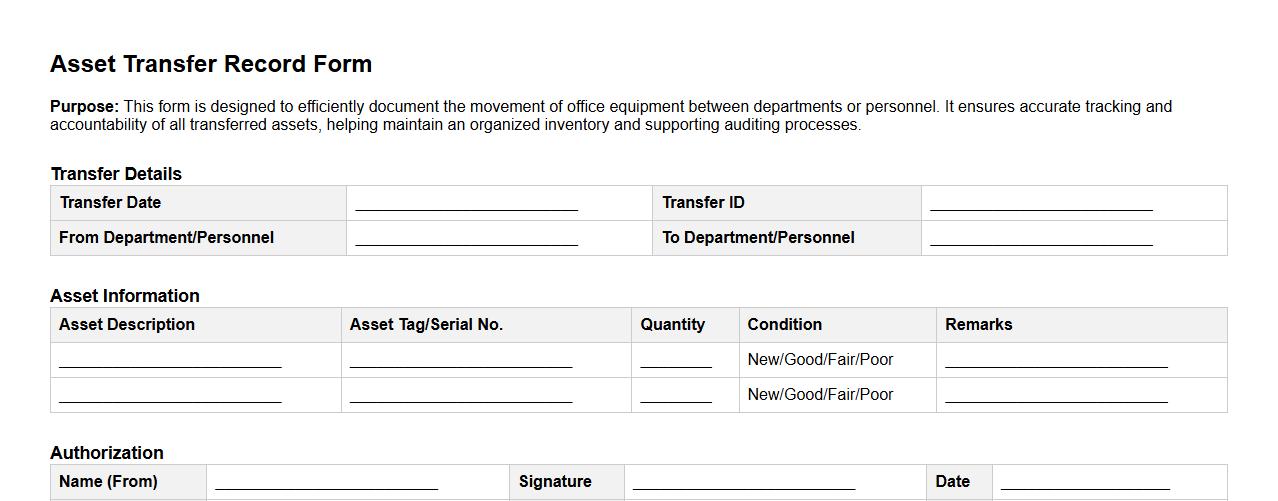

Asset Transfer Record Form sample for office equipment

The Asset Transfer Record Form sample is designed to efficiently document the movement of office equipment between departments or personnel. This form ensures accurate tracking and accountability of all transferred assets. It helps maintain an organized inventory and supports auditing processes.

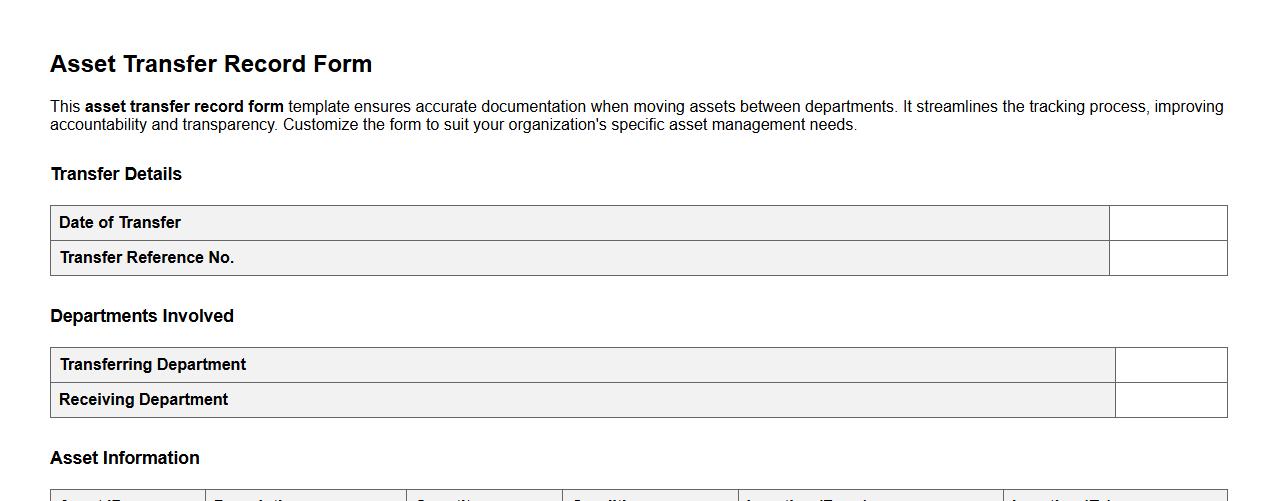

Sample template for asset transfer record form between departments

This asset transfer record form template ensures accurate documentation when moving assets between departments. It streamlines the tracking process, improving accountability and transparency. Customize the form to suit your organization's specific asset management needs.

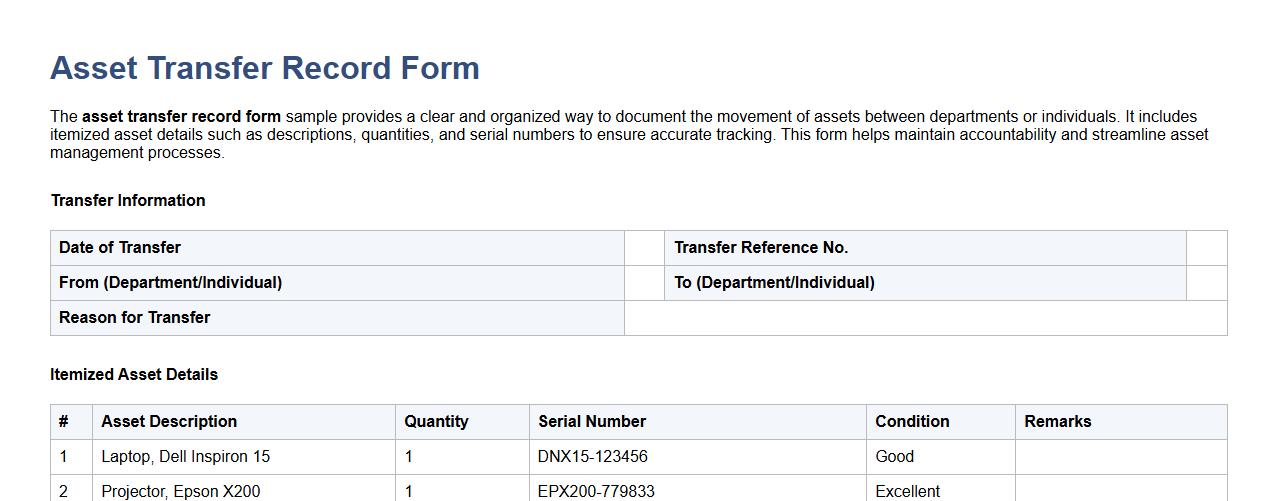

Asset transfer record form sample with itemized asset details

The asset transfer record form sample provides a clear and organized way to document the movement of assets between departments or individuals. It includes itemized asset details such as descriptions, quantities, and serial numbers to ensure accurate tracking. This form helps maintain accountability and streamline asset management processes.

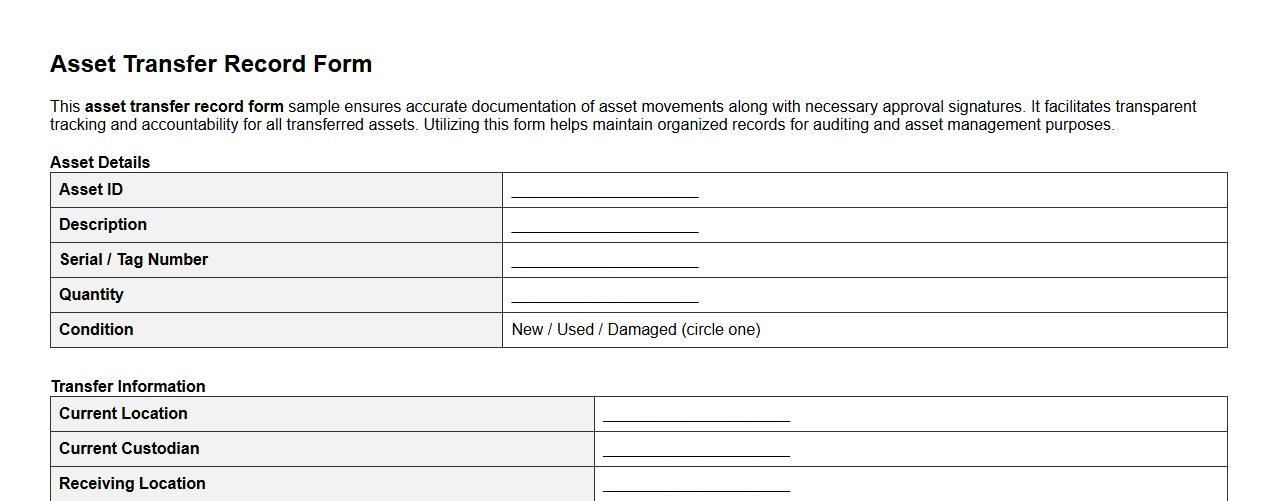

Asset transfer record form sample including approval signatures

This asset transfer record form sample ensures accurate documentation of asset movements along with necessary approval signatures. It facilitates transparent tracking and accountability for all transferred assets. Utilizing this form helps maintain organized records for auditing and asset management purposes.

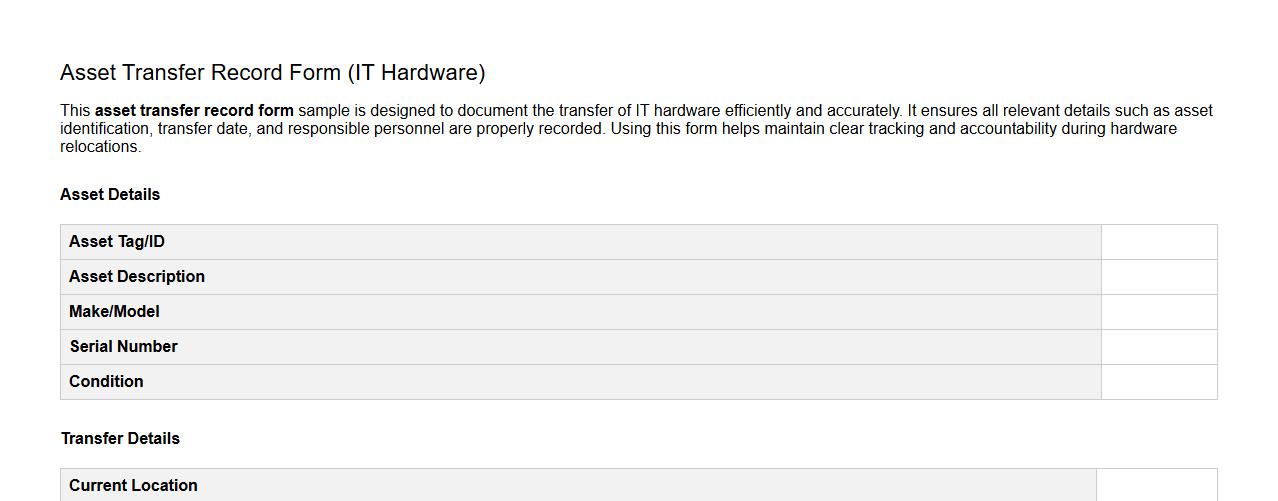

Asset transfer record form sample for IT hardware transfer

This asset transfer record form sample is designed to document the transfer of IT hardware efficiently and accurately. It ensures all relevant details such as asset identification, transfer date, and responsible personnel are properly recorded. Using this form helps maintain clear tracking and accountability during hardware relocations.

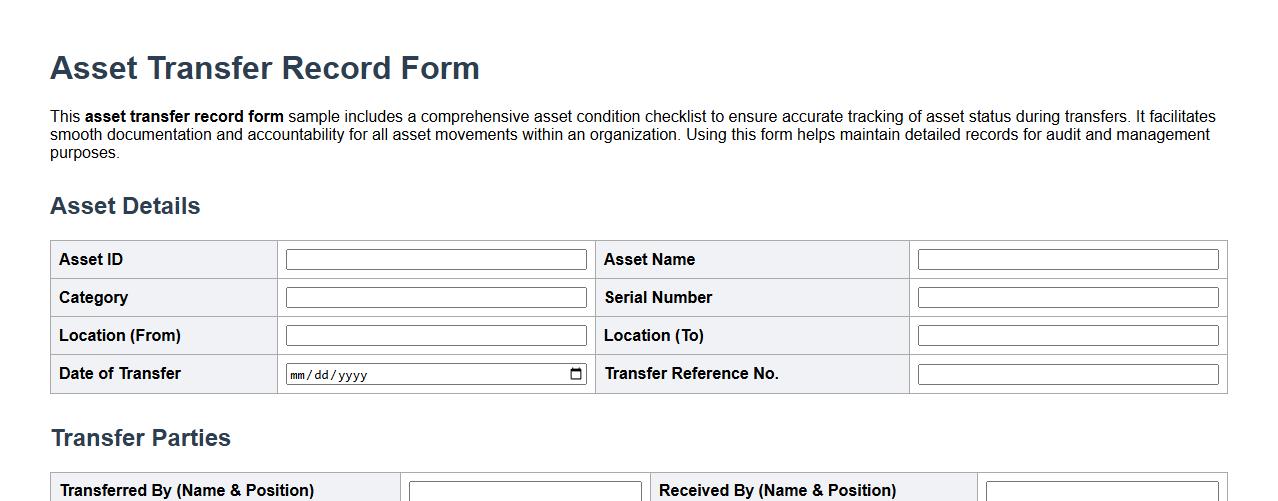

Asset transfer record form sample with asset condition checklist

This asset transfer record form sample includes a comprehensive asset condition checklist to ensure accurate tracking of asset status during transfers. It facilitates smooth documentation and accountability for all asset movements within an organization. Using this form helps maintain detailed records for audit and management purposes.

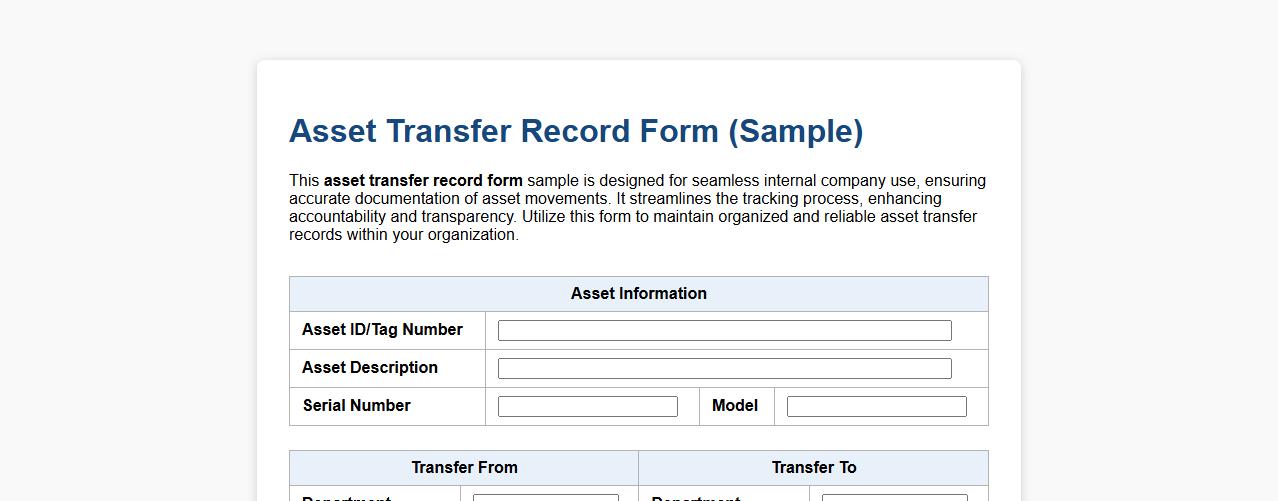

Asset transfer record form sample for internal company use

This asset transfer record form sample is designed for seamless internal company use, ensuring accurate documentation of asset movements. It streamlines the tracking process, enhancing accountability and transparency. Utilize this form to maintain organized and reliable asset transfer records within your organization.

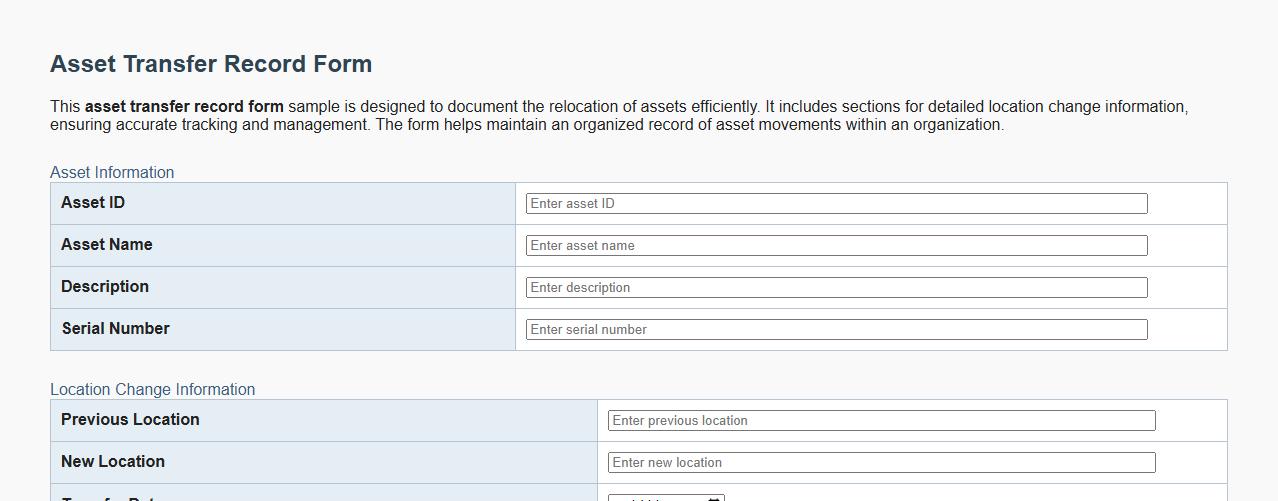

Asset transfer record form sample with location change information

This asset transfer record form sample is designed to document the relocation of assets efficiently. It includes sections for detailed location change information, ensuring accurate tracking and management. The form helps maintain an organized record of asset movements within an organization.

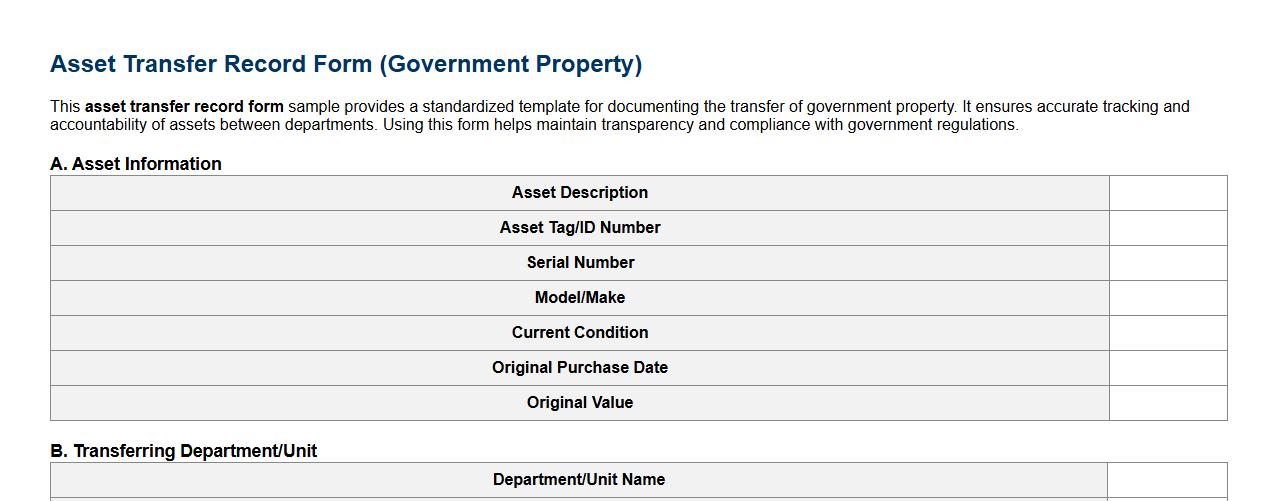

Asset transfer record form sample for government property

This asset transfer record form sample provides a standardized template for documenting the transfer of government property. It ensures accurate tracking and accountability of assets between departments. Using this form helps maintain transparency and compliance with government regulations.

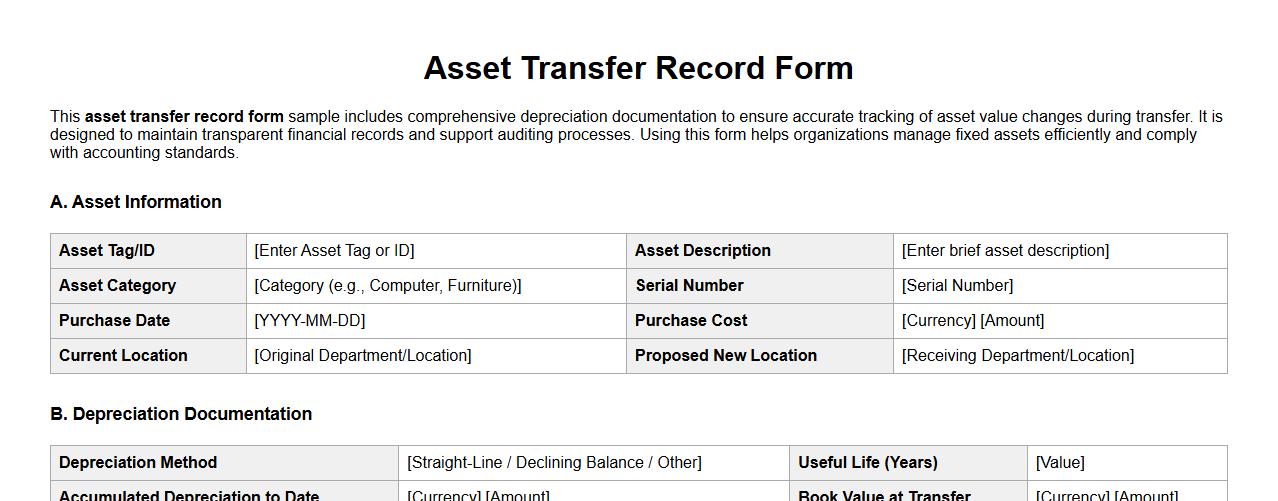

Asset transfer record form sample with depreciation documentation

This asset transfer record form sample includes comprehensive depreciation documentation to ensure accurate tracking of asset value changes during transfer. It is designed to maintain transparent financial records and support auditing processes. Using this form helps organizations manage fixed assets efficiently and comply with accounting standards.

What information is mandatory for the transferee section on an Asset Transfer Record Form?

The transferee's full name must be clearly stated to ensure accountability. Contact details such as phone number and email address are essential for follow-up communication. Additionally, the department or unit receiving the asset must be specified to track the transfer destination accurately.

How is asset depreciation documented during a transfer on this form?

The form includes a dedicated section to record the current depreciation value of the asset at the time of transfer. It requires the depreciation method used, such as straight-line or reducing balance, to maintain consistent accounting. This documentation ensures transparent financial reporting during the asset movement.

Which supporting documents must accompany the completed Asset Transfer Record Form?

Supporting documents such as the original purchase invoice validate the asset's acquisition details. A current asset valuation report may be required to confirm the asset's condition and worth. Additionally, any maintenance records provide context on asset reliability during the transfer process.

What approval signatures are required for validating an Asset Transfer Record Form?

The form must be signed by the transferee to acknowledge receipt of the asset accurately. An authorized supervisor or manager signature is mandatory to approve the transfer officially. Finally, the asset management or finance department must endorse the form to complete compliance and record-keeping.

How does the form capture unique asset identification numbers for traceability?

The form requires entry of the asset's unique identification number or barcode, ensuring precise traceability. This number links the asset to the central inventory management system for accurate tracking. Recording this data helps prevent asset misplacement and supports audit trails effectively.