The Expense Record Form Sample is a practical template designed to track daily business or personal expenses efficiently. It includes fields for date, description, amount, and category, ensuring accurate financial documentation. Using this form helps streamline budgeting and expense management processes.

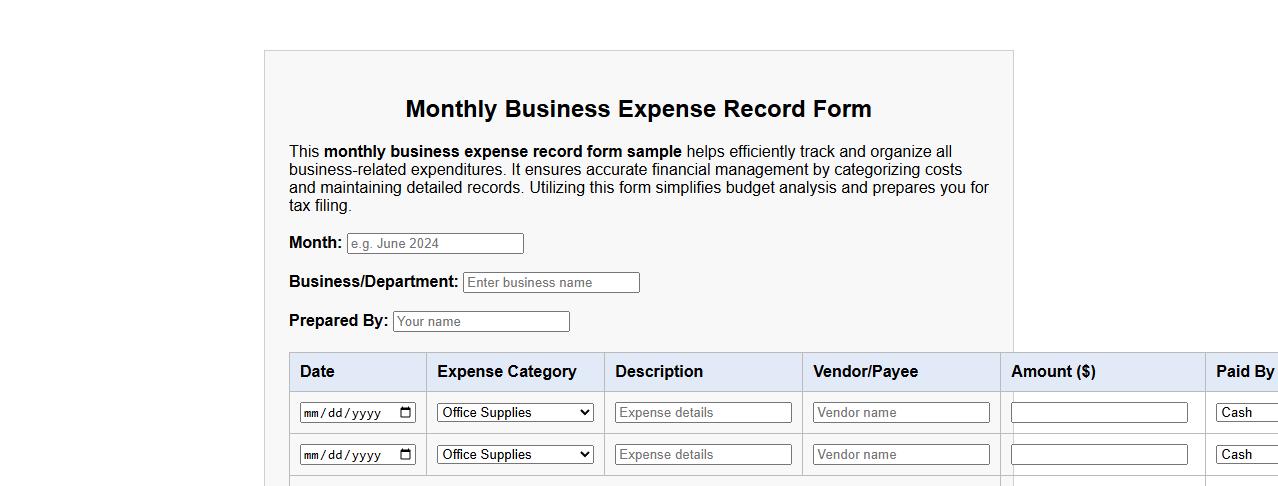

Monthly business expense record form sample

This monthly business expense record form sample helps efficiently track and organize all business-related expenditures. It ensures accurate financial management by categorizing costs and maintaining detailed records. Utilizing this form simplifies budget analysis and prepares you for tax filing.

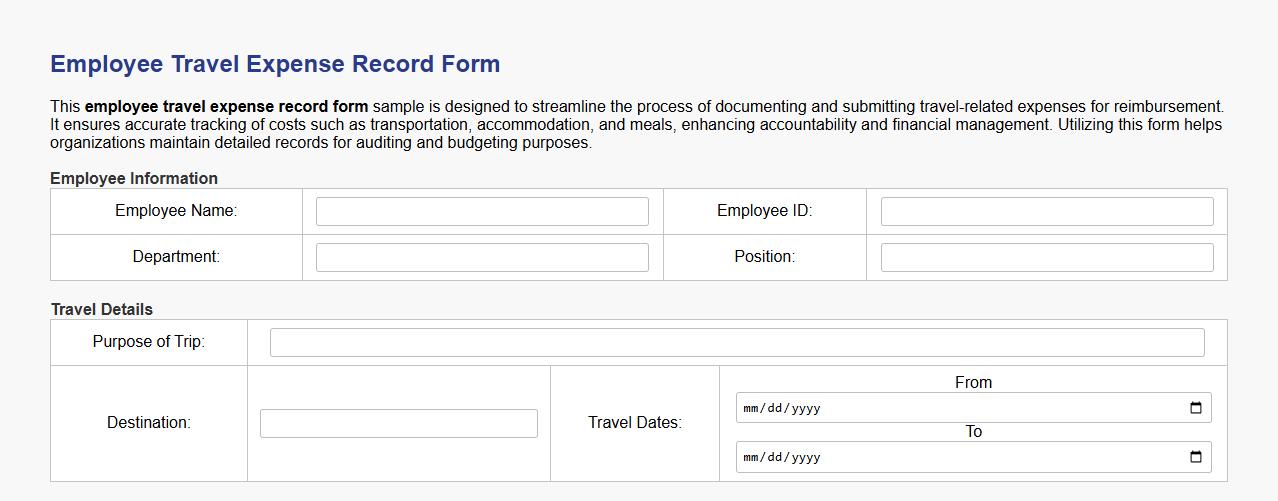

Employee travel expense record form sample

This employee travel expense record form sample provides a structured template to accurately document travel-related expenses incurred during business trips. It helps streamline reimbursement processes and ensures compliance with company policies. Using this form enhances transparency and accountability in managing employee travel costs.

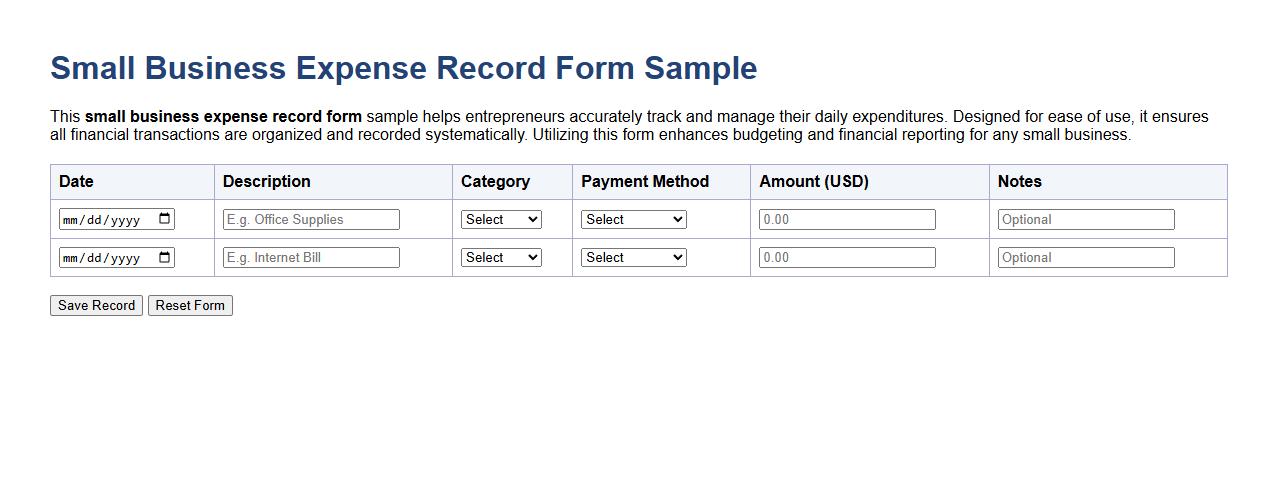

Small business expense record form sample

This small business expense record form sample helps entrepreneurs accurately track and manage their daily expenditures. Designed for ease of use, it ensures all financial transactions are organized and recorded systematically. Utilizing this form enhances budgeting and financial reporting for any small business.

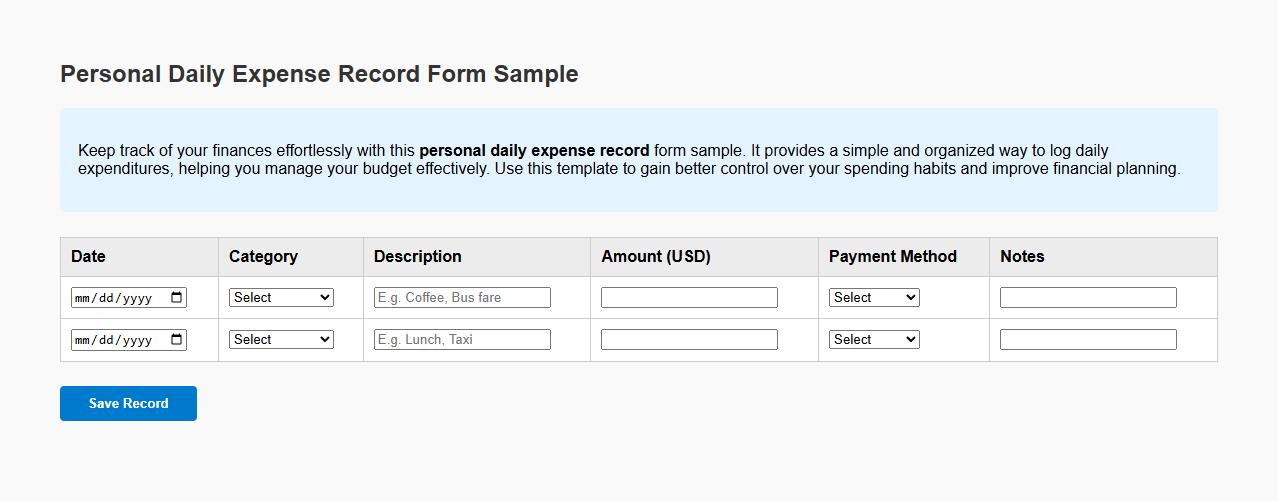

Personal daily expense record form sample

Keep track of your finances effortlessly with this personal daily expense record form sample. It provides a simple and organized way to log daily expenditures, helping you manage your budget effectively. Use this template to gain better control over your spending habits and improve financial planning.

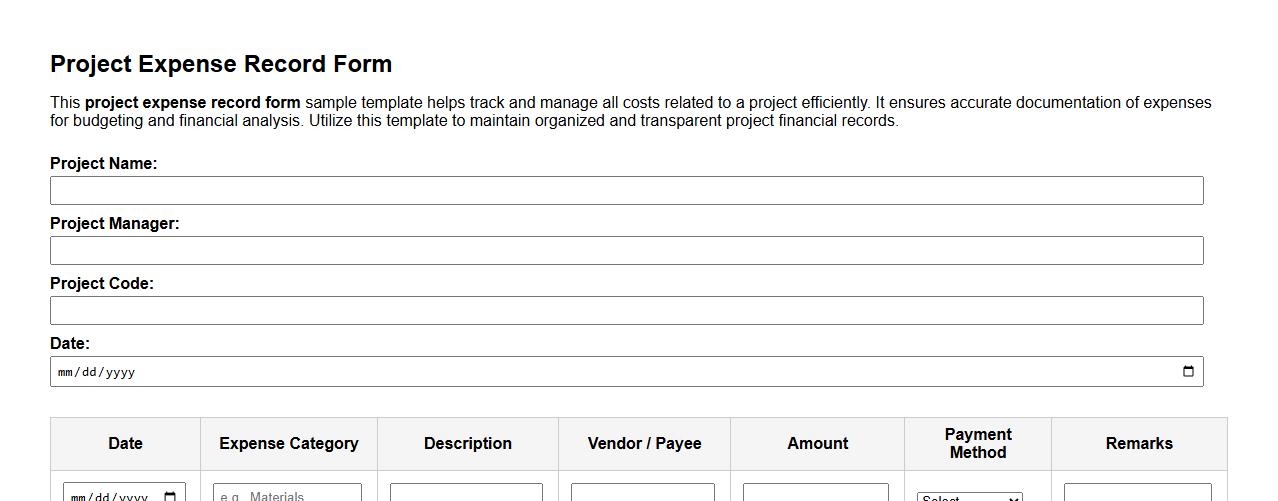

Project expense record form sample template

This project expense record form sample template helps track and manage all costs related to a project efficiently. It ensures accurate documentation of expenses for budgeting and financial analysis. Utilize this template to maintain organized and transparent project financial records.

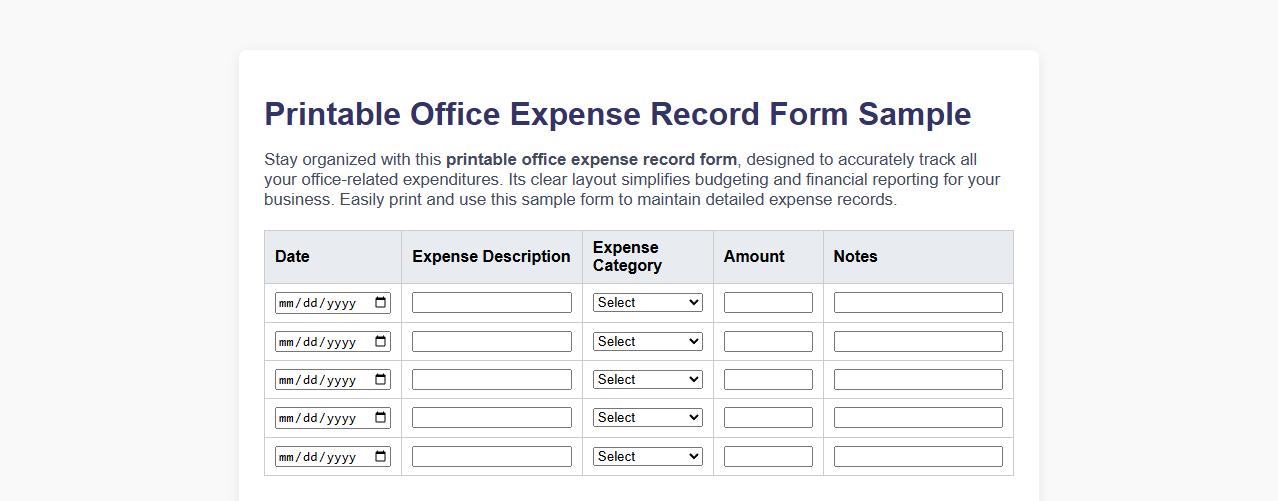

Printable office expense record form sample

Stay organized with this printable office expense record form, designed to accurately track all your office-related expenditures. Its clear layout simplifies budgeting and financial reporting for your business. Easily print and use this sample form to maintain detailed expense records.

Expense record form sample for tax purposes

This expense record form sample is designed to help individuals and businesses accurately track and document expenditures for tax purposes. Utilizing this form ensures organized financial records, making tax filing more efficient and compliant. Proper documentation can maximize deductions and simplify audits.

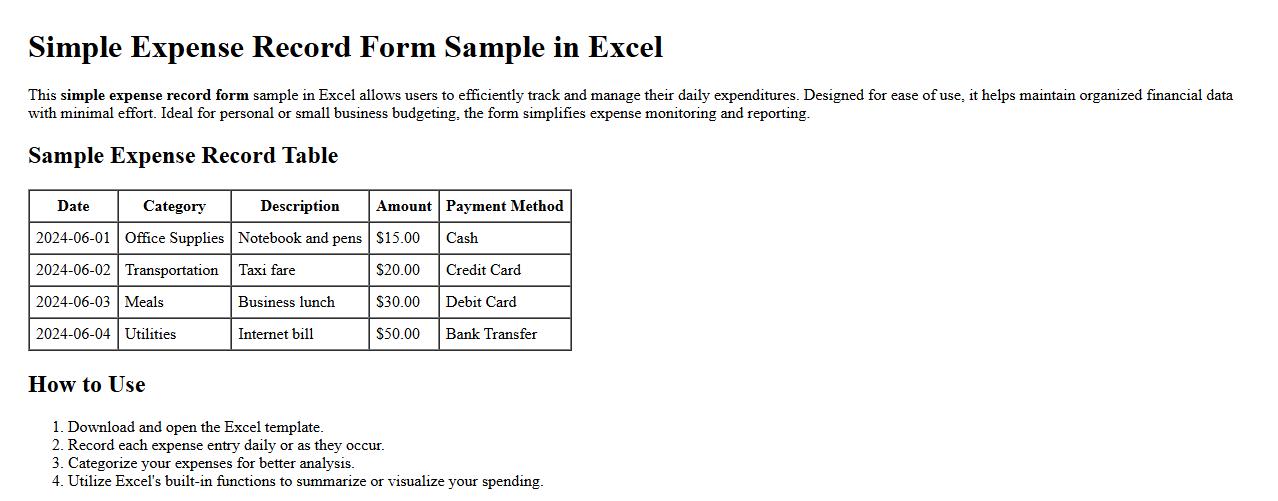

Simple expense record form sample in Excel

This simple expense record form sample in Excel allows users to efficiently track and manage their daily expenditures. Designed for ease of use, it helps maintain organized financial data with minimal effort. Ideal for personal or small business budgeting, the form simplifies expense monitoring and reporting.

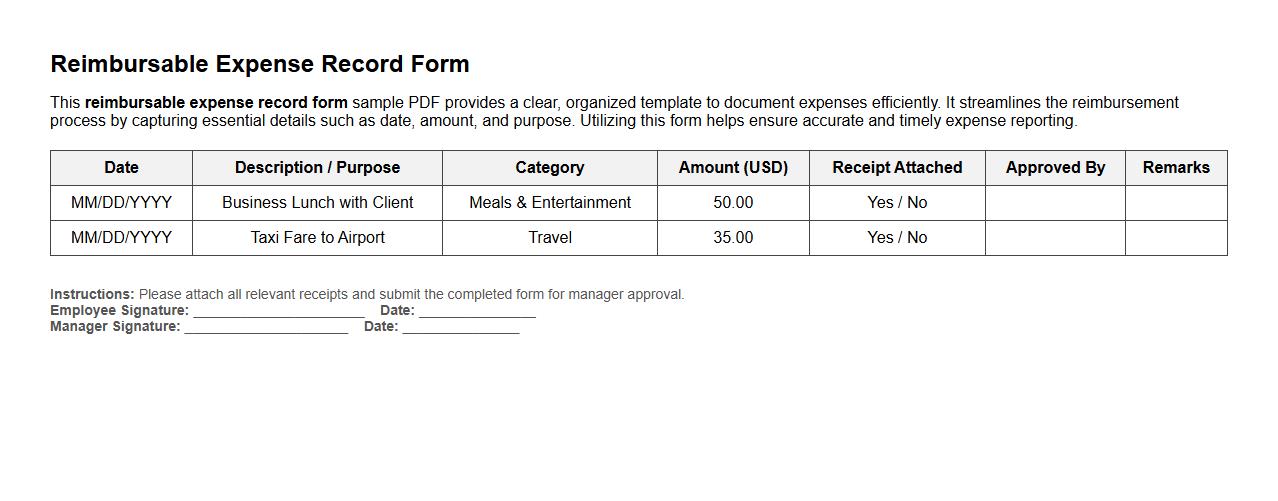

Reimbursable expense record form sample PDF

This reimbursable expense record form sample PDF provides a clear, organized template to document expenses efficiently. It streamlines the reimbursement process by capturing essential details such as date, amount, and purpose. Utilizing this form helps ensure accurate and timely expense reporting.

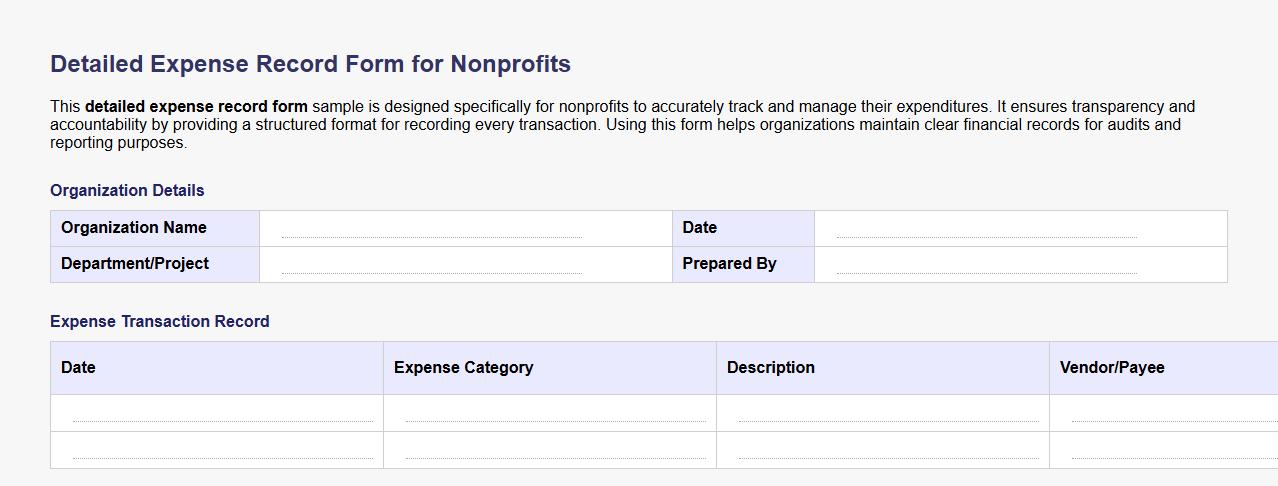

Detailed expense record form sample for nonprofits

This detailed expense record form sample is designed specifically for nonprofits to accurately track and manage their expenditures. It ensures transparency and accountability by providing a structured format for recording every transaction. Using this form helps organizations maintain clear financial records for audits and reporting purposes.

What approval hierarchy is required on the Expense Record Form?

The approval hierarchy on the Expense Record Form ensures that all expenses are reviewed by the appropriate managers. Typically, the form requires initial approval from the employee's direct supervisor. Following this, higher-level finance or department heads provide the final sign-off to maintain compliance and accountability.

Which specific expense categories are included in the form fields?

The Expense Record Form includes a variety of expense categories such as travel, meals, lodging, office supplies, and entertainment. These clearly defined fields make it easier for employees to categorize their expenses accurately. Including specific categories promotes consistent reporting and simplifies expense tracking for finance teams.

Is there a section for attaching digital receipts on the Expense Record Form?

Yes, the form contains a dedicated section for attaching digital receipts to support expense claims. This feature enables employees to upload scanned copies or photos of their receipts directly within the form. It enhances the submission process by providing immediate documentation and reducing the need for paper trails.

How is mileage reimbursement documented within the form?

Mileage reimbursement is documented by entering the total miles traveled, along with the date and purpose of the journey. The form calculates the reimbursement amount based on the standard company mileage rate. Clear instructions ensure that employees provide accurate and verifiable mileage data for reimbursement.

What audit trail features are integrated into the Expense Record Form?

The Expense Record Form includes built-in audit trail features that track all changes and approvals throughout the submission process. Each action is time-stamped and attributed to the user responsible, ensuring full transparency. These features support internal controls and simplify compliance audits by providing a detailed history of the expense report.