A Tax Refund Claim Form Sample provides a clear template to help taxpayers accurately complete their refund applications. It includes essential sections such as personal information, income details, and reasons for overpayment. Using this sample ensures all necessary data is submitted to expedite the refund process.

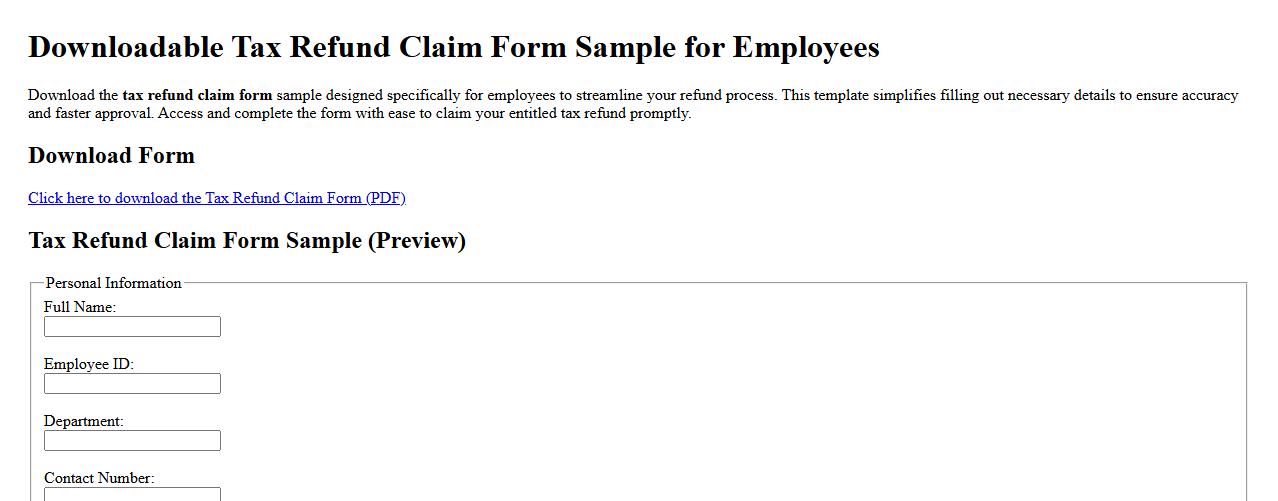

Downloadable tax refund claim form sample for employees

Download the tax refund claim form sample designed specifically for employees to streamline your refund process. This template simplifies filling out necessary details to ensure accuracy and faster approval. Access and complete the form with ease to claim your entitled tax refund promptly.

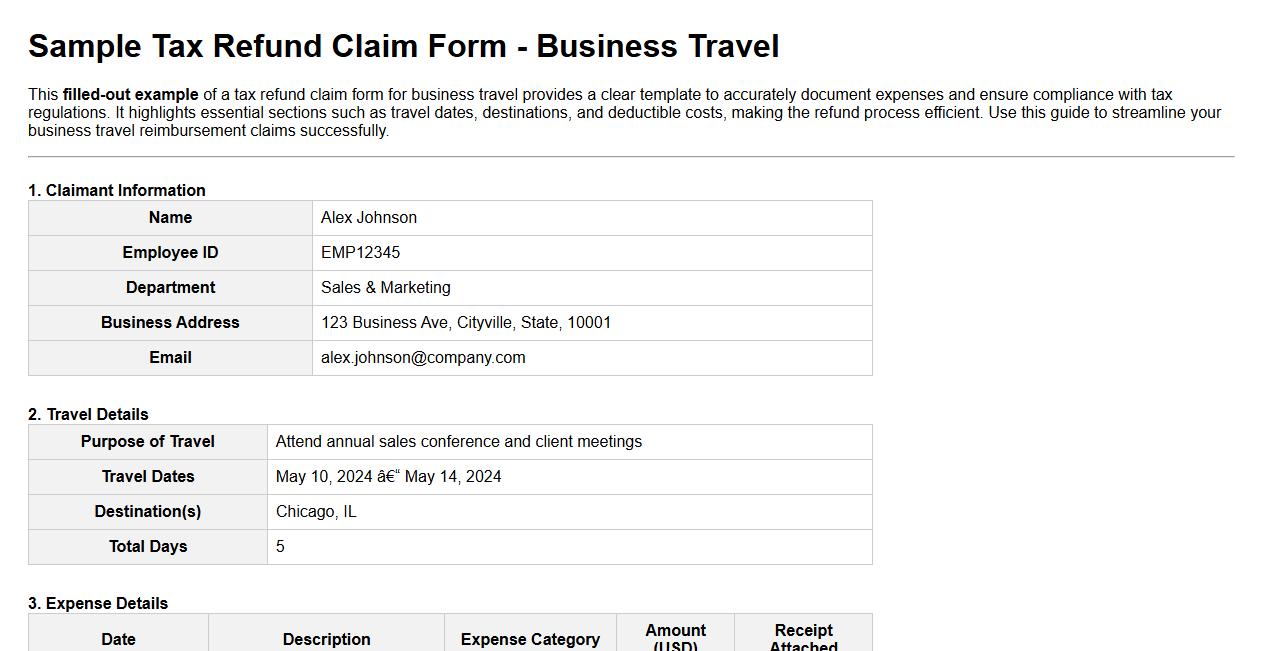

Filled-out example of tax refund claim form for business travel

This filled-out example of a tax refund claim form for business travel provides a clear template to accurately document expenses and ensure compliance with tax regulations. It highlights essential sections such as travel dates, destinations, and deductible costs, making the refund process efficient. Use this guide to streamline your business travel reimbursement claims successfully.

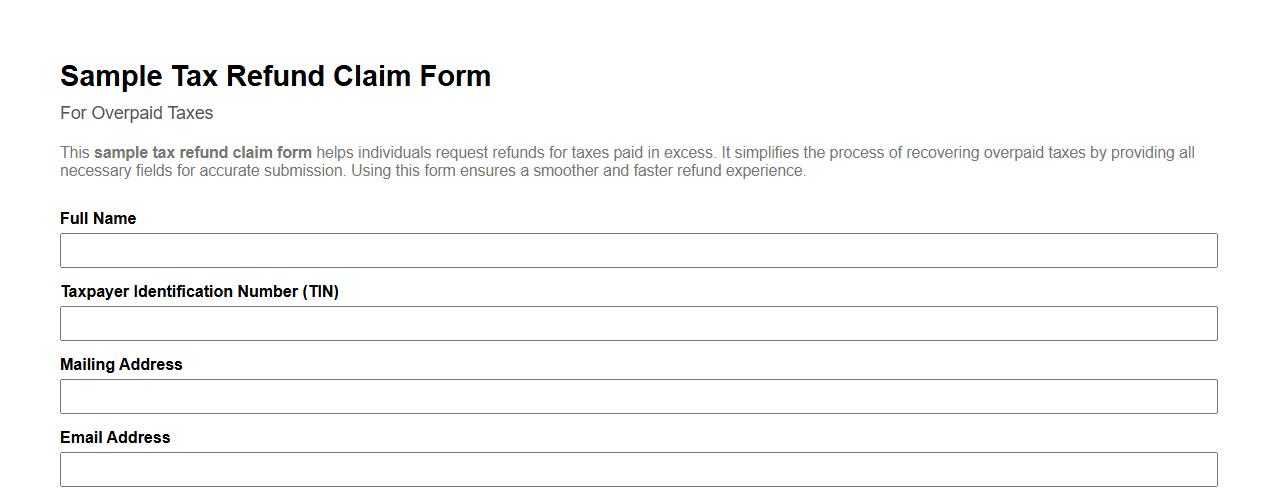

Sample tax refund claim form for overpaid taxes

This sample tax refund claim form helps individuals request refunds for taxes paid in excess. It simplifies the process of recovering overpaid taxes by providing all necessary fields for accurate submission. Using this form ensures a smoother and faster refund experience.

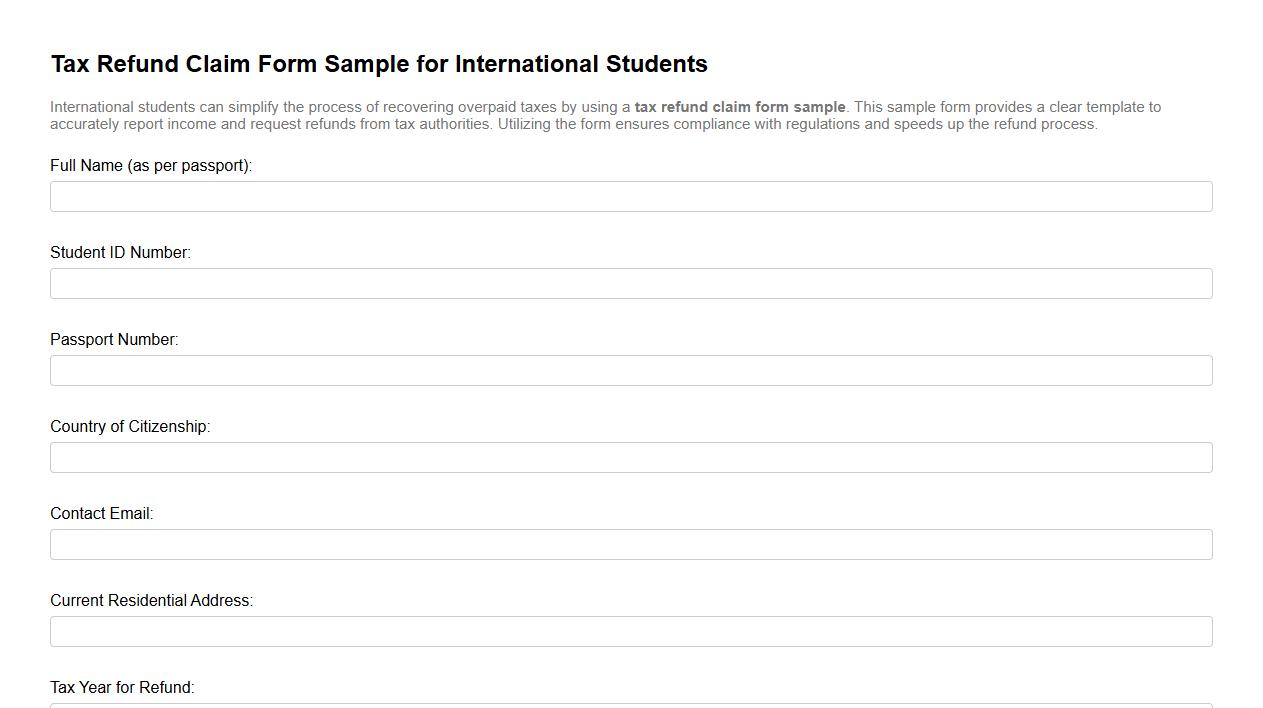

Tax refund claim form sample for international students

International students can simplify the process of recovering overpaid taxes by using a tax refund claim form sample. This sample form provides a clear template to accurately report income and request refunds from tax authorities. Utilizing the form ensures compliance with regulations and speeds up the refund process.

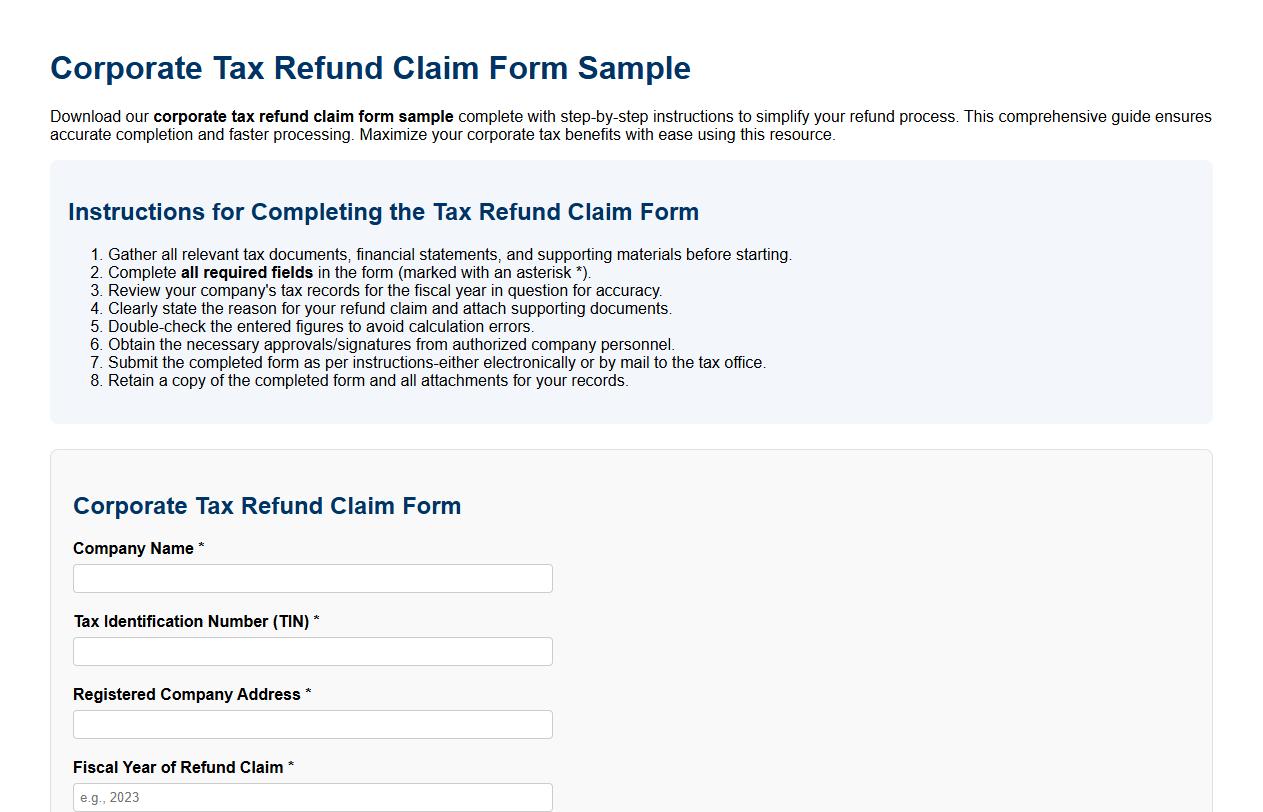

Corporate tax refund claim form sample with instructions

Download our corporate tax refund claim form sample complete with step-by-step instructions to simplify your refund process. This comprehensive guide ensures accurate completion and faster processing. Maximize your corporate tax benefits with ease using this resource.

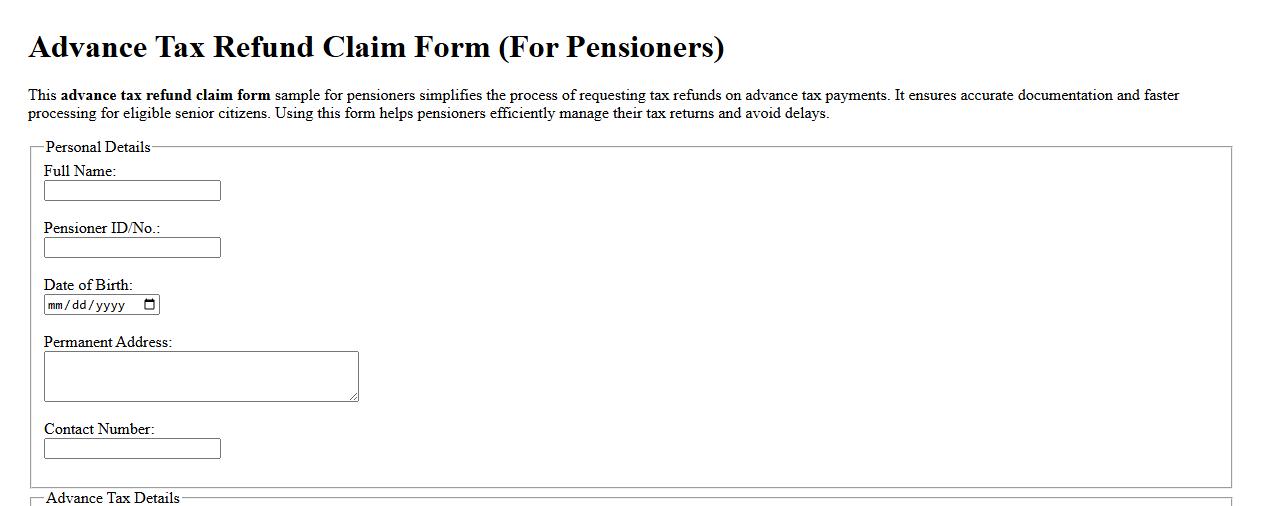

Advance tax refund claim form sample for pensioners

This advance tax refund claim form sample for pensioners simplifies the process of requesting tax refunds on advance tax payments. It ensures accurate documentation and faster processing for eligible senior citizens. Using this form helps pensioners efficiently manage their tax returns and avoid delays.

Step-by-step guide tax refund claim form sample for freelancers

Discover a comprehensive step-by-step guide to completing the tax refund claim form tailored specifically for freelancers. This detailed sample helps you navigate each section with ease, ensuring accuracy and maximizing your refund. Simplify your tax process and confidently submit your claim with expert guidance.

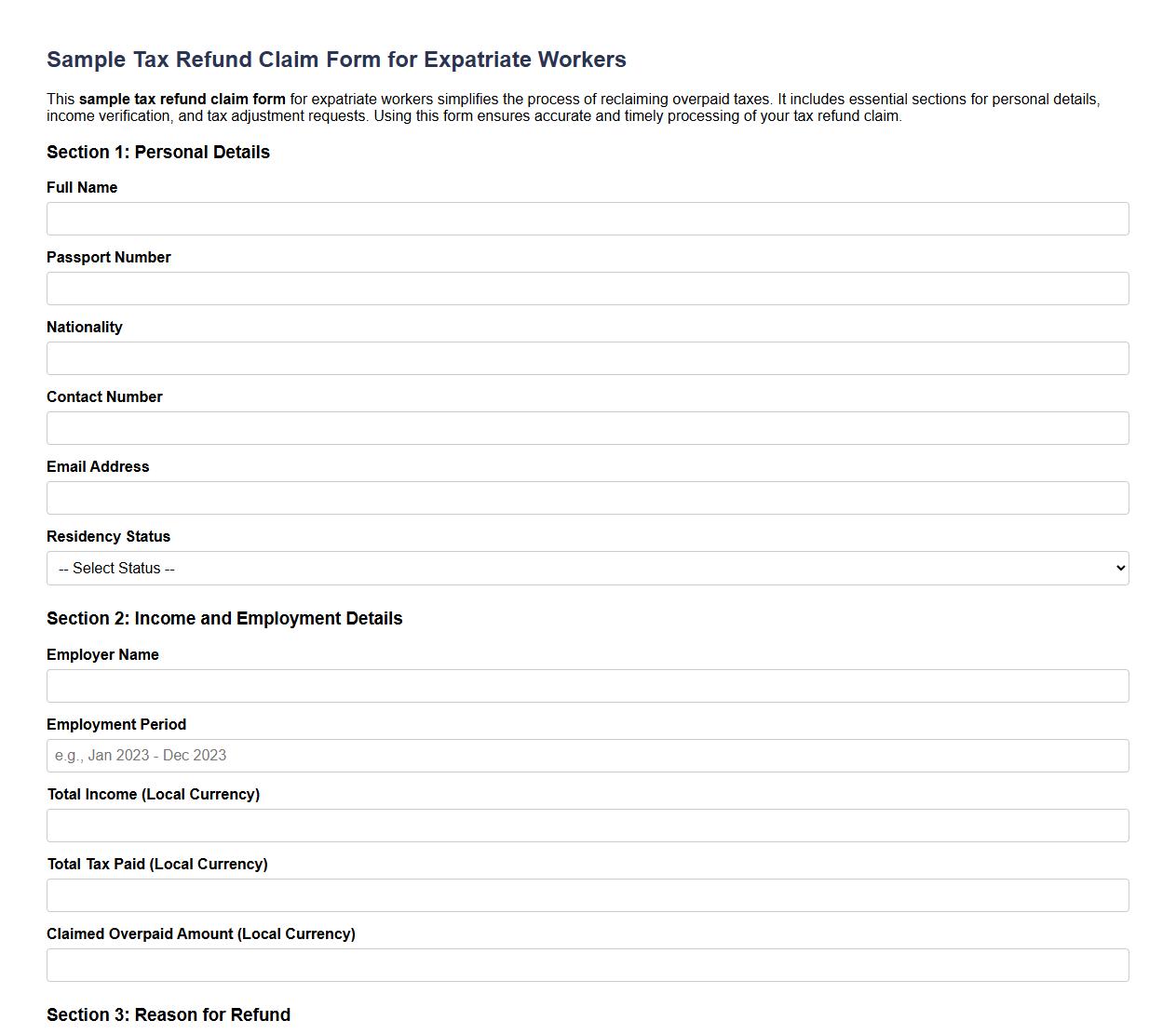

Sample tax refund claim form for expatriate workers

This sample tax refund claim form for expatriate workers simplifies the process of reclaiming overpaid taxes. It includes essential sections for personal details, income verification, and tax adjustment requests. Using this form ensures accurate and timely processing of your tax refund claim.

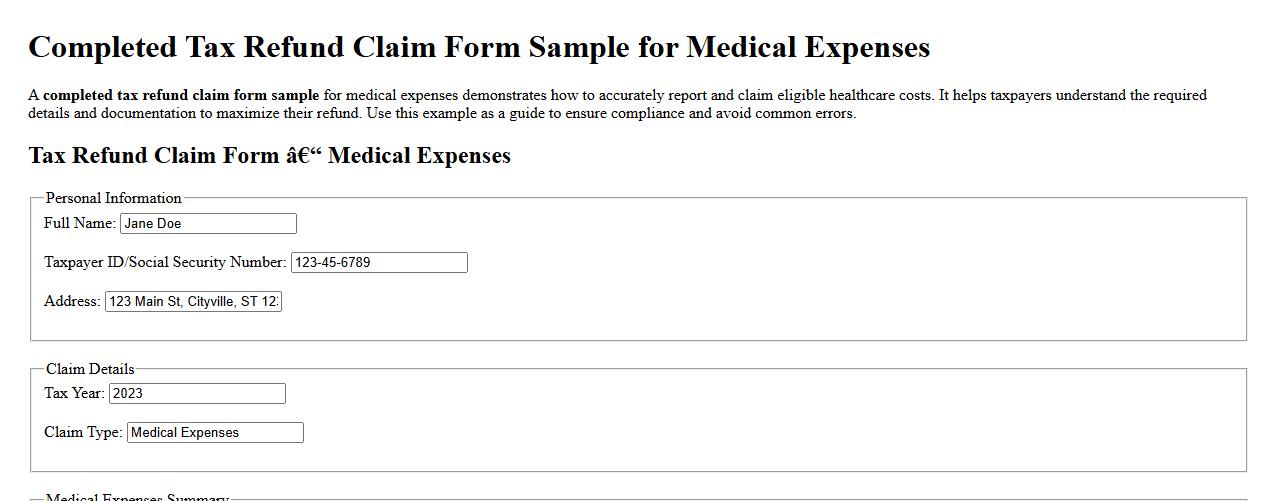

Completed tax refund claim form sample for medical expenses

A completed tax refund claim form sample for medical expenses demonstrates how to accurately report and claim eligible healthcare costs. It helps taxpayers understand the required details and documentation to maximize their refund. Use this example as a guide to ensure compliance and avoid common errors.

Required Supporting Documents for a Tax Refund Claim Form

To successfully file a tax refund claim, you must include proof of income such as payslips or tax statements. Additionally, providing receipts for taxes already paid is crucial to validate your claim. Supporting documents like identification and previous tax returns can further strengthen your application.

Deadline for Submitting a Tax Refund Claim Letter

The deadline for submitting a tax refund claim letter varies by jurisdiction, but typically it must be filed within three years from the end of the tax year in question. Missing this deadline usually results in the forfeiture of refund eligibility. It's essential to check local tax authority rules to ensure timely submission.

Common Errors to Avoid in a Tax Refund Claim Letter

Common mistakes include providing incorrect personal information and failing to attach required supporting documents. Another frequent error is submitting the claim after the official deadline, causing automatic rejection. Always double-check your letter for clarity and completeness before sending.

How to Track the Status of a Submitted Tax Refund Claim

Most tax authorities offer an online portal where you can check the status of your refund claim using a reference number. Alternatively, you can contact the tax office directly by phone or email for updates. Regularly tracking your claim ensures timely follow-up if additional information is requested.

Specific Wording Needed for Justifying a Tax Refund Claim

Your claim letter should clearly state the reason for overpayment or incorrect tax deduction. Use formal language such as "I am writing to request a refund due to excess tax withheld in the fiscal year." Including precise amounts and referencing relevant tax laws strengthens your justification.