A Business Insurance Claim Form Sample provides a structured template to report losses or damages to an insurance provider. This form typically includes sections for policyholder details, incident description, and financial estimates of the claim. Using a well-designed sample ensures accurate and complete submission, facilitating a smoother claims process.

Downloadable business insurance claim form sample PDF

Download a business insurance claim form sample PDF to simplify the filing process and ensure all necessary information is accurately captured. This template provides a clear, professional layout tailored for business insurance claims. Easily customize and print the form to meet your specific business needs.

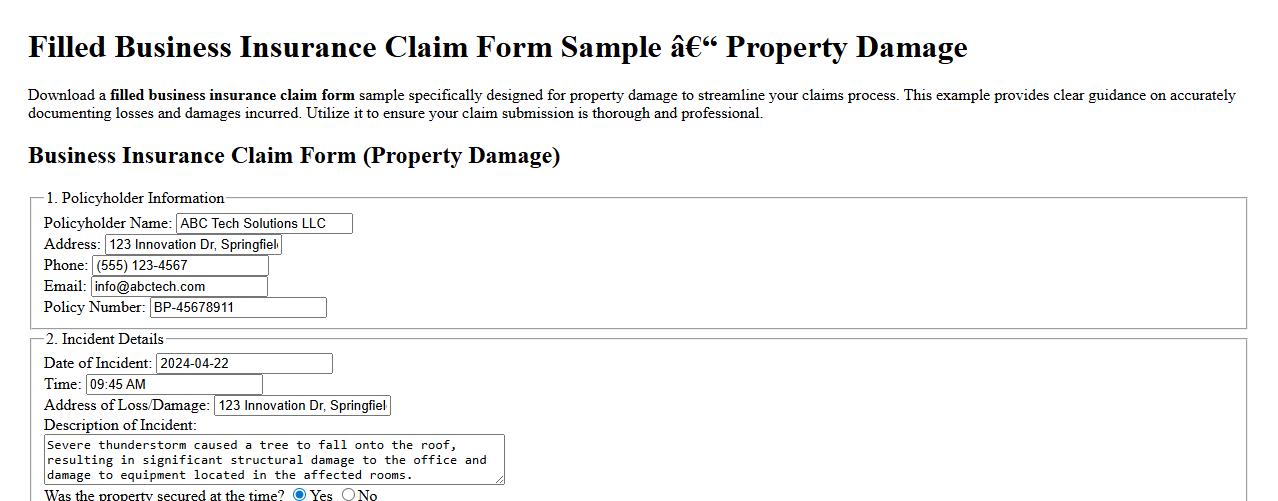

Filled business insurance claim form sample for property damage

Download a filled business insurance claim form sample specifically designed for property damage to streamline your claims process. This example provides clear guidance on accurately documenting losses and damages incurred. Utilize it to ensure your claim submission is thorough and professional.

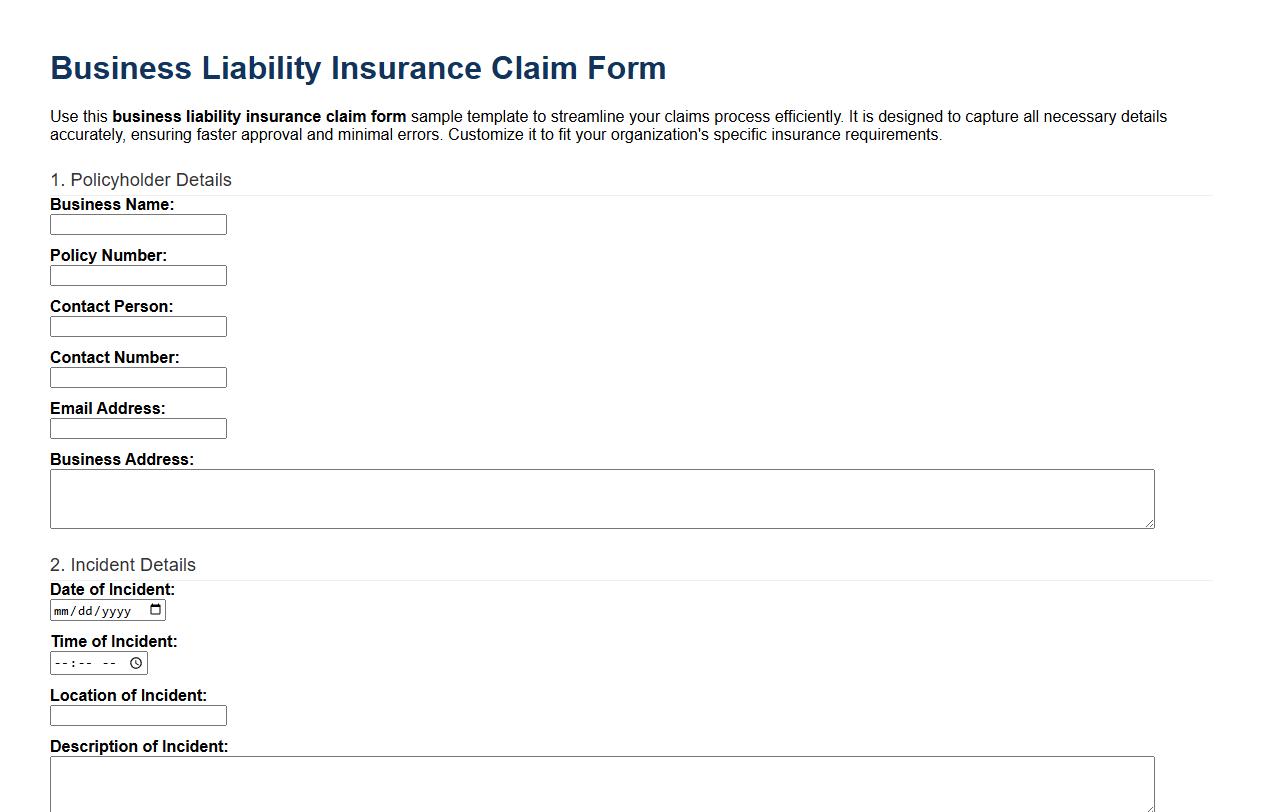

Business liability insurance claim form sample template

Use this business liability insurance claim form sample template to streamline your claims process efficiently. It is designed to capture all necessary details accurately, ensuring faster approval and minimal errors. Customize it to fit your organization's specific insurance requirements.

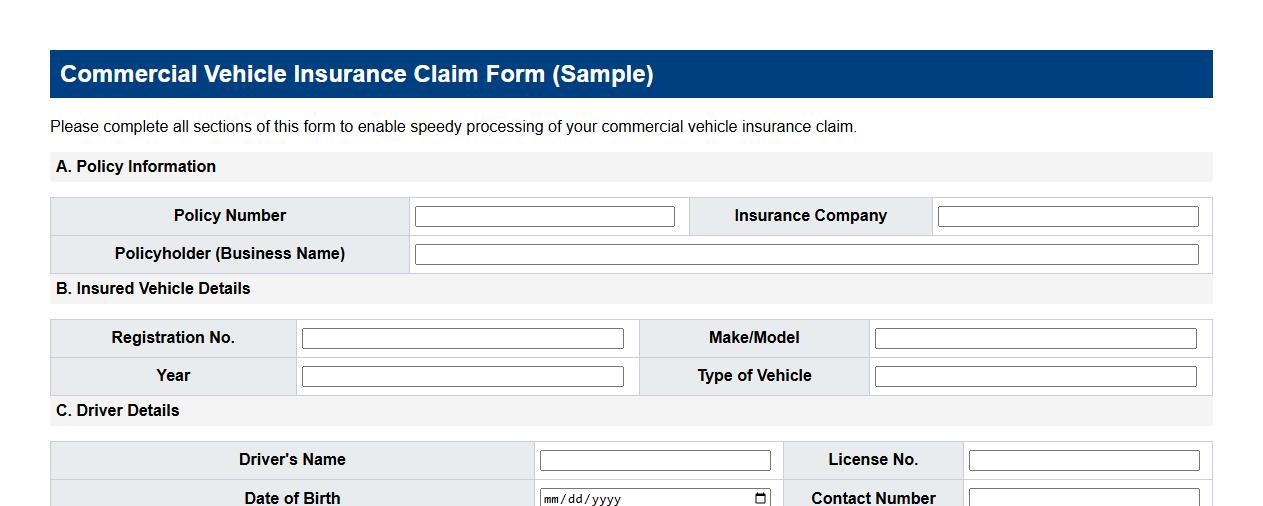

Commercial vehicle insurance claim form sample for businesses

A commercial vehicle insurance claim form sample for businesses provides a structured template to report incidents involving company vehicles. It ensures accurate documentation of damages, driver details, and accident circumstances to facilitate efficient claim processing. Using a standardized form helps businesses streamline their insurance claims and minimize delays.

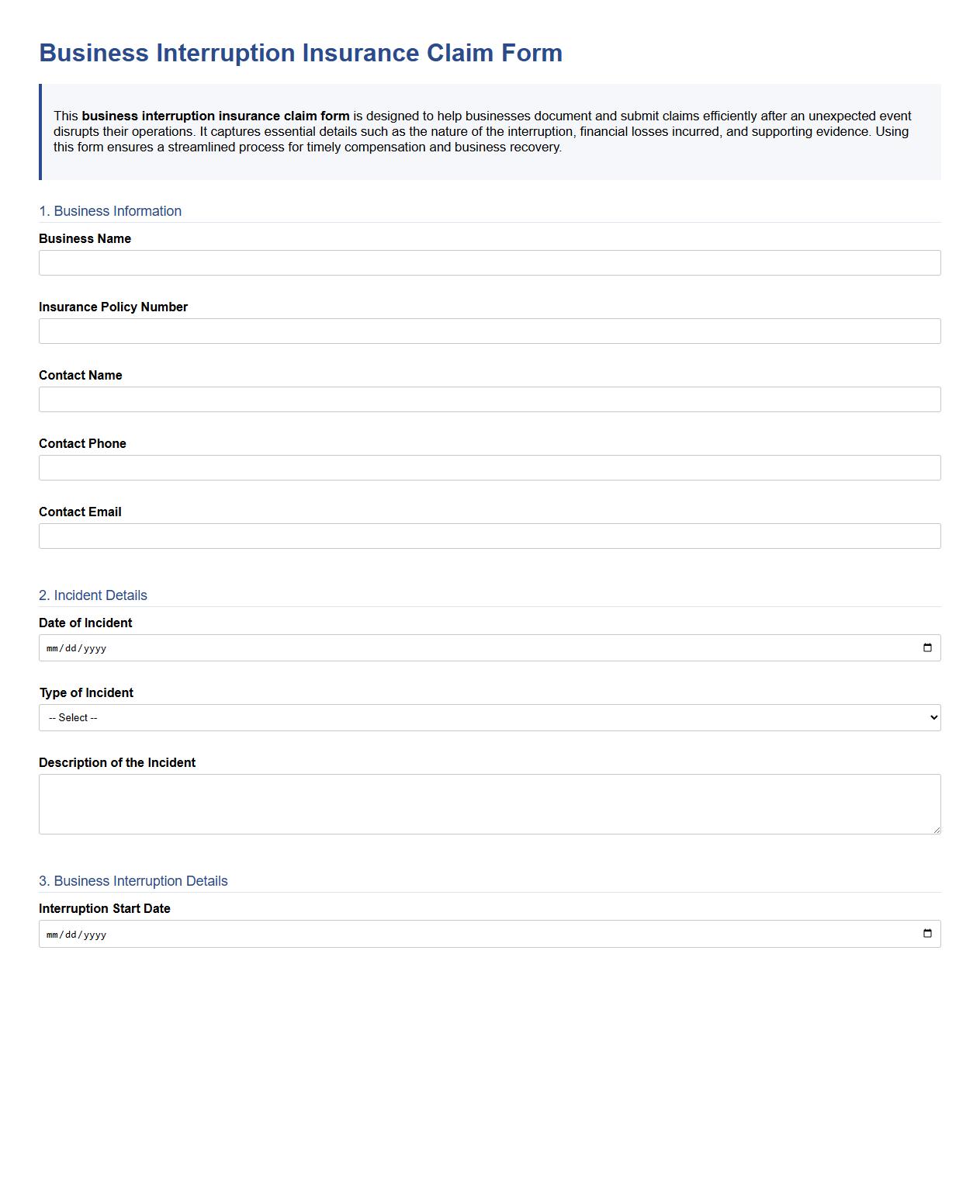

Sample business interruption insurance claim form

This business interruption insurance claim form is designed to help businesses document and submit claims efficiently after an unexpected event disrupts their operations. It captures essential details such as the nature of the interruption, financial losses incurred, and supporting evidence. Using this form ensures a streamlined process for timely compensation and business recovery.

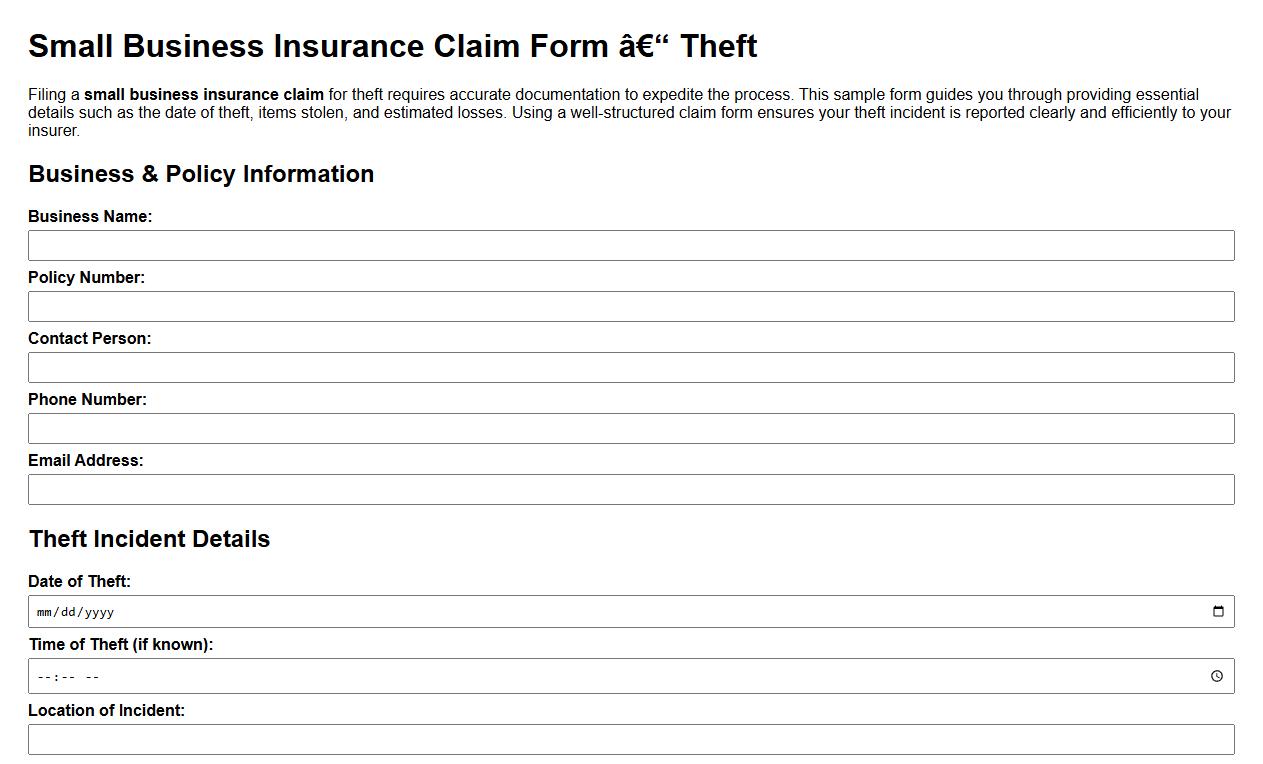

Small business insurance claim form sample for theft

Filing a small business insurance claim for theft requires accurate documentation to expedite the process. This sample form guides you through providing essential details such as the date of theft, items stolen, and estimated losses. Using a well-structured claim form ensures your theft incident is reported clearly and efficiently to your insurer.

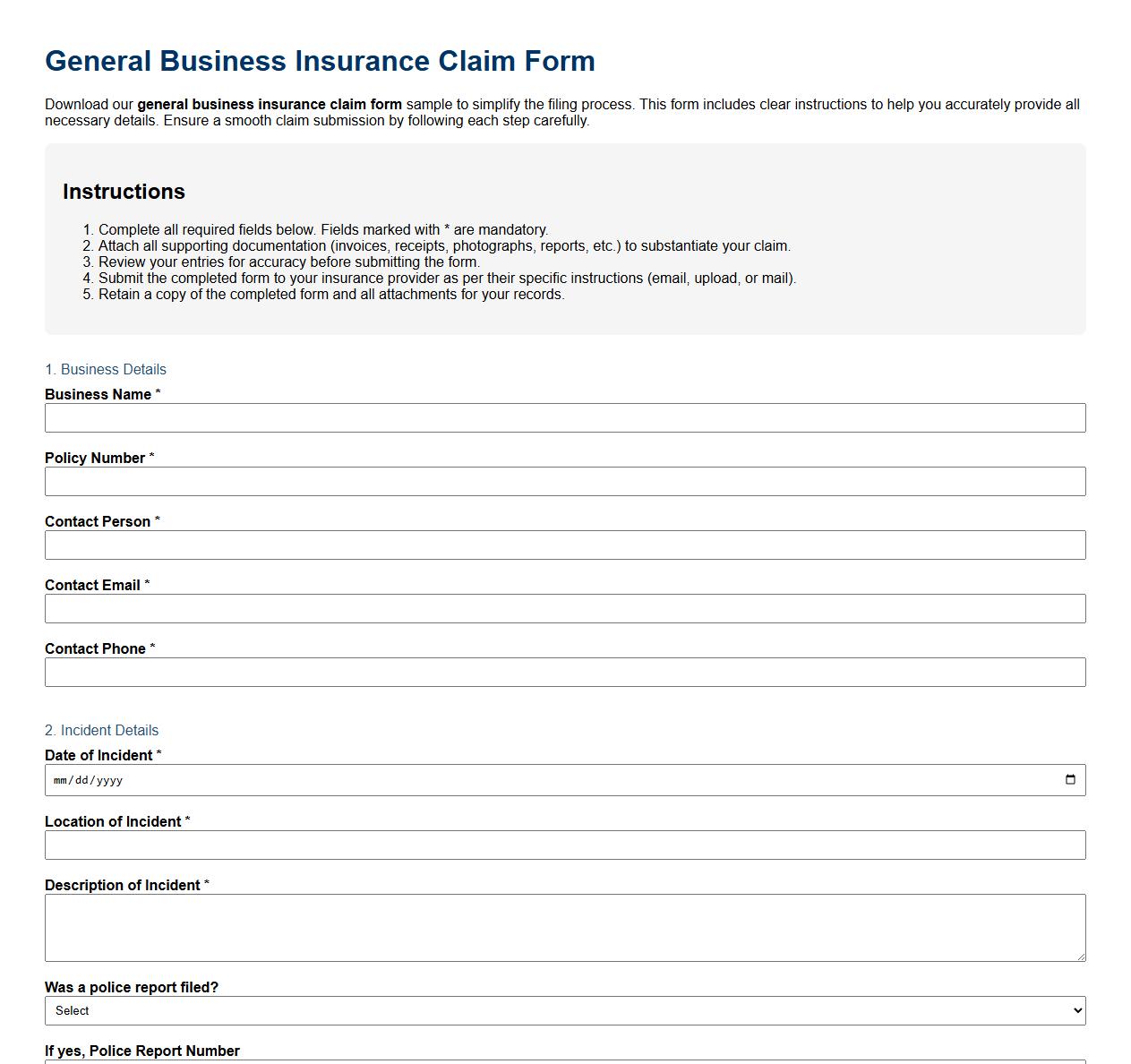

General business insurance claim form sample with instructions

Download our general business insurance claim form sample to simplify the filing process. This form includes clear instructions to help you accurately provide all necessary details. Ensure a smooth claim submission by following each step carefully.

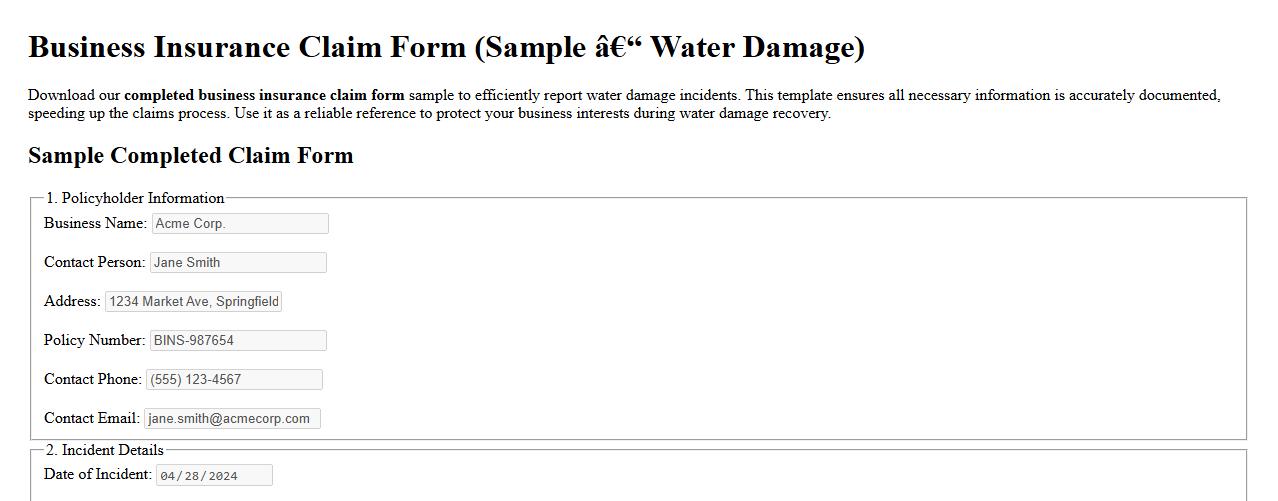

Completed business insurance claim form sample for water damage

Download our completed business insurance claim form sample to efficiently report water damage incidents. This template ensures all necessary information is accurately documented, speeding up the claims process. Use it as a reliable reference to protect your business interests during water damage recovery.

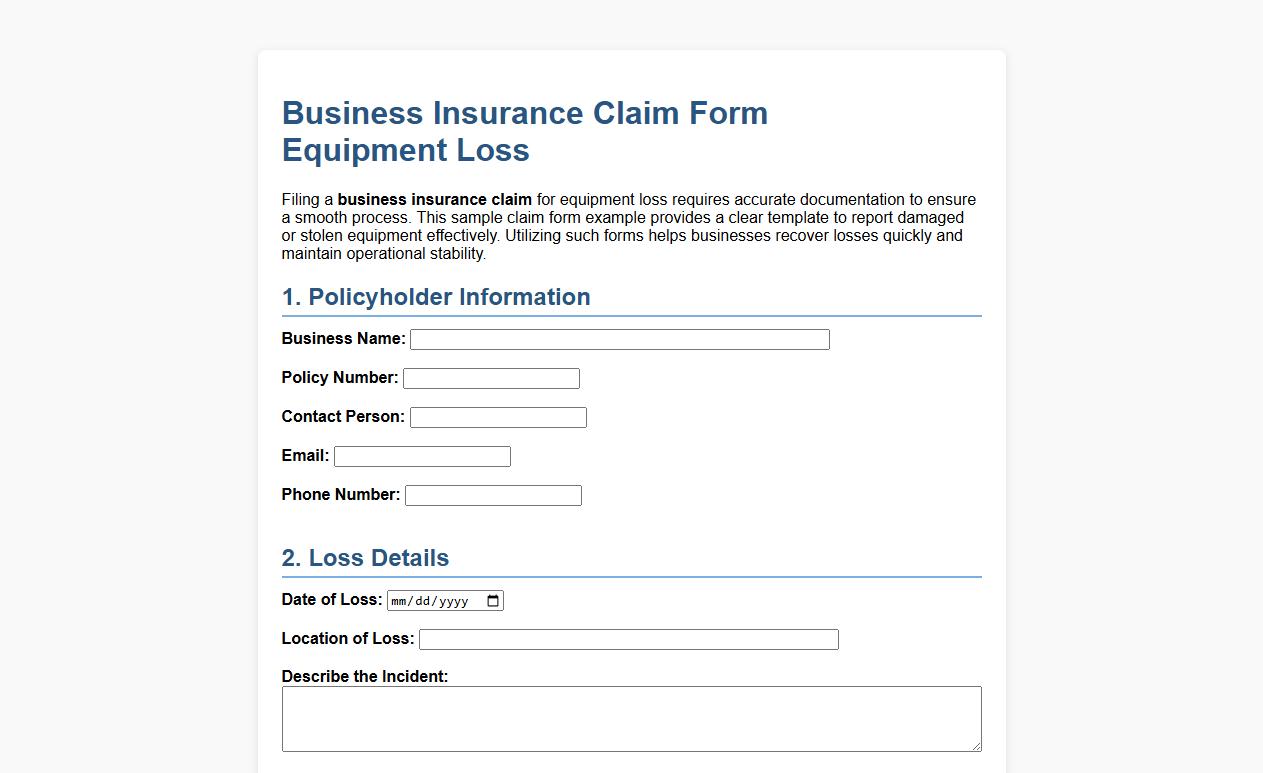

Business insurance claim form sample example for equipment loss

Filing a business insurance claim for equipment loss requires accurate documentation to ensure a smooth process. This sample claim form example provides a clear template to report damaged or stolen equipment effectively. Utilizing such forms helps businesses recover losses quickly and maintain operational stability.

Required supporting documents for Business Insurance Claim Form submission?

When submitting a Business Insurance Claim Form, it is essential to include all relevant supporting documents. These typically include the insurance policy copy, proof of loss or damage, and detailed receipts or invoices. Accurate and complete documentation ensures the claim is processed without unnecessary delays.

Common reasons for Business Insurance Claim Form rejection?

Claims are often rejected due to incomplete or incorrect information on the form. Missing signatures, lack of supporting documents, or submission past the policy's claim period are common errors. Ensuring compliance with policy terms helps avoid claim rejection.

Steps to correct errors on a Business Insurance Claim Form?

To correct errors, first review the form thoroughly to identify inaccuracies or omissions. Contact the insurance provider to understand the required corrections and submit an updated form promptly. Timely correction is critical to advance the claims process smoothly.

Timeframe for processing a Business Insurance Claim Form?

The processing time for a Business Insurance Claim Form varies by insurer but typically ranges from 2 to 6 weeks. Factors influencing the timeframe include the complexity of the claim and prompt submission of supporting documents. Staying informed about the processing timeframe helps manage expectations effectively.

Who is authorized to sign a Business Insurance Claim Form?

The claim form must be signed by an individual with legal authority within the business, such as the owner or a designated officer. This signature verifies the authenticity and approval of the claim submission. Proper authorization is crucial for the validity of the claim.