A Statement of Assets and Liabilities Form Sample provides a clear template for reporting financial position by listing owned assets and outstanding liabilities. This form helps individuals and businesses organize and disclose their financial status accurately for legal, tax, or loan purposes. Using a standardized sample ensures consistency and completeness in financial documentation.

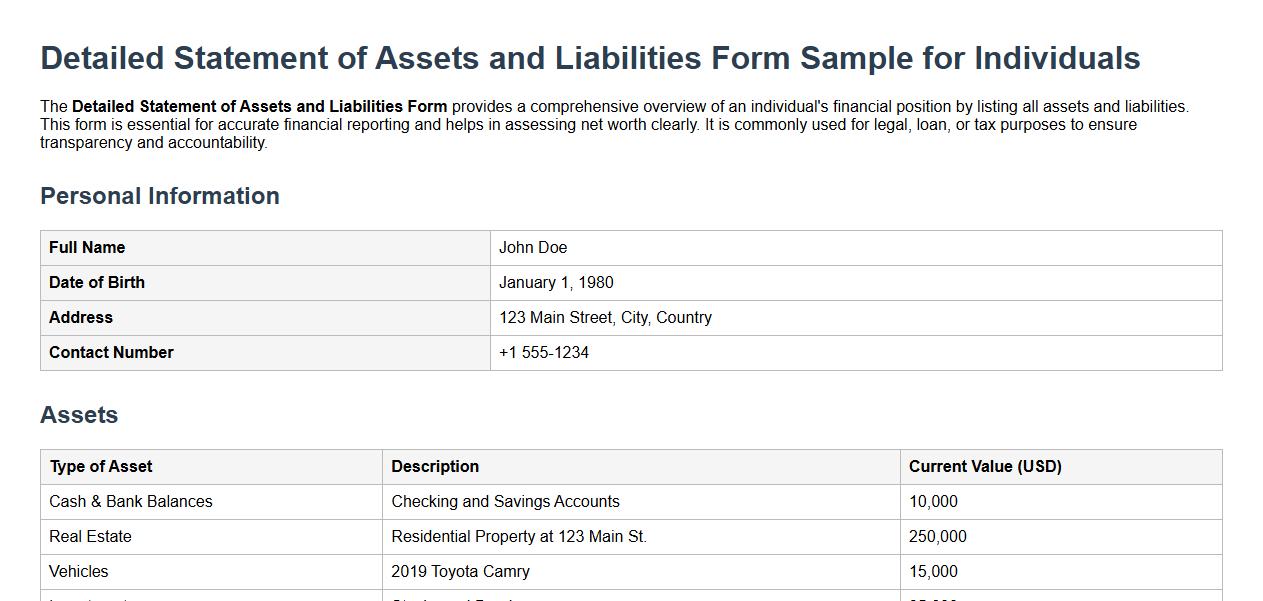

Detailed Statement of Assets and Liabilities Form Sample for Individuals

The Detailed Statement of Assets and Liabilities Form provides a comprehensive overview of an individual's financial position by listing all assets and liabilities. This form is essential for accurate financial reporting and helps in assessing net worth clearly. It is commonly used for legal, loan, or tax purposes to ensure transparency and accountability.

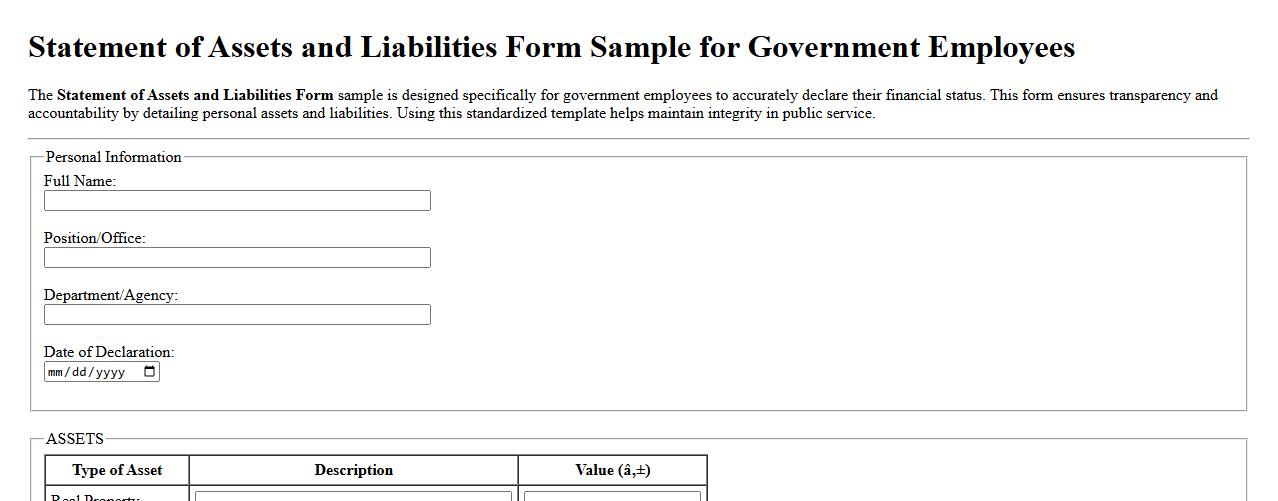

Statement of Assets and Liabilities Form Sample for Government Employees

The Statement of Assets and Liabilities Form sample is designed specifically for government employees to accurately declare their financial status. This form ensures transparency and accountability by detailing personal assets and liabilities. Using this standardized template helps maintain integrity in public service.

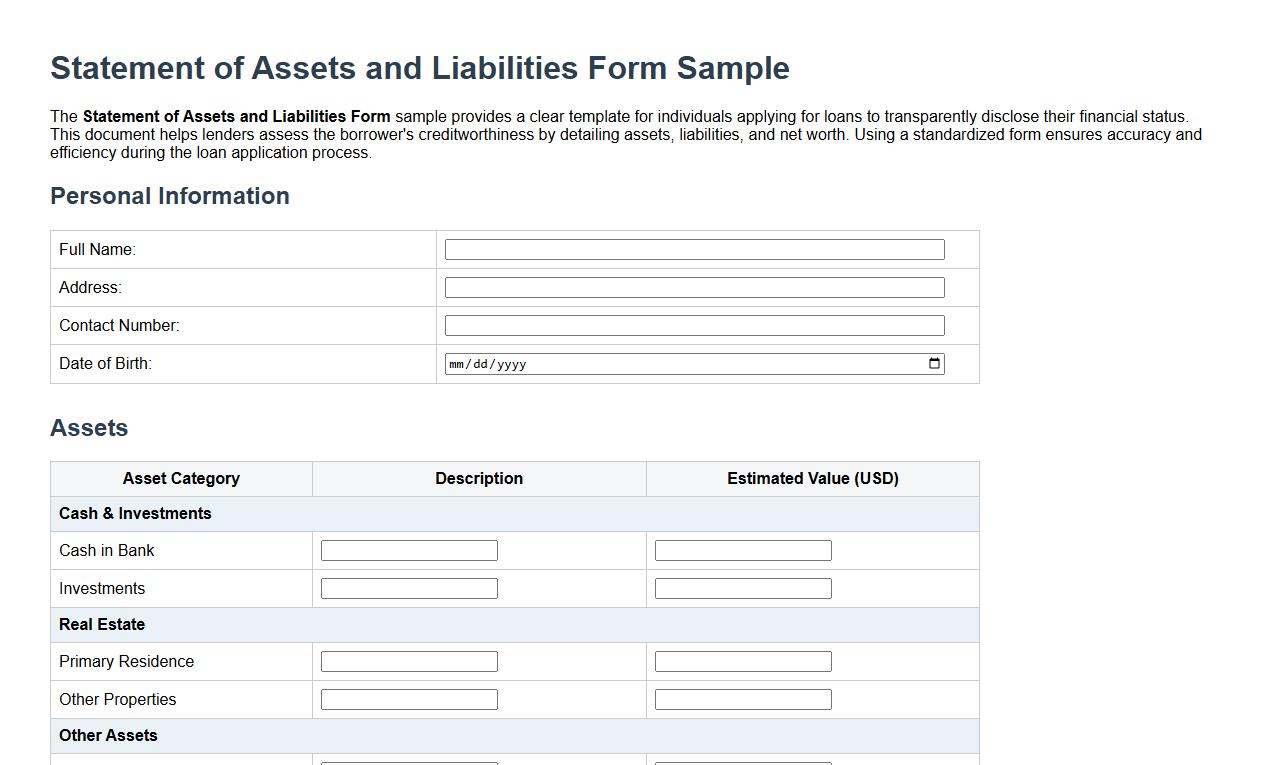

Statement of Assets and Liabilities Form Sample for Loan Application

The Statement of Assets and Liabilities Form sample provides a clear template for individuals applying for loans to transparently disclose their financial status. This document helps lenders assess the borrower's creditworthiness by detailing assets, liabilities, and net worth. Using a standardized form ensures accuracy and efficiency during the loan application process.

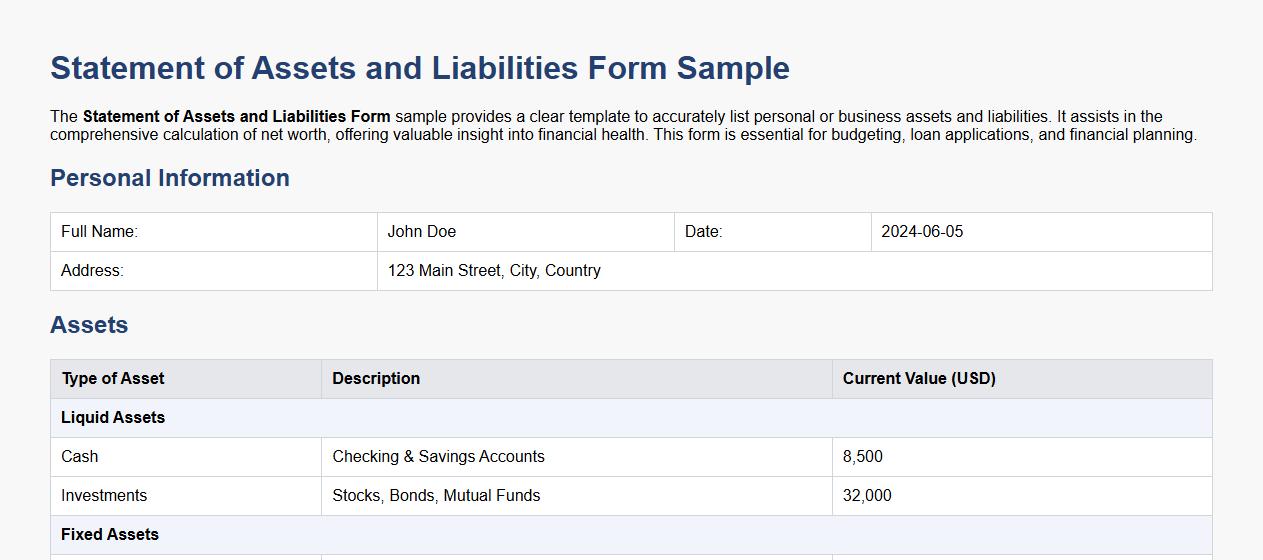

Statement of Assets and Liabilities Form Sample with Net Worth Calculation

The Statement of Assets and Liabilities Form sample provides a clear template to accurately list personal or business assets and liabilities. It assists in the comprehensive calculation of net worth, offering valuable insight into financial health. This form is essential for budgeting, loan applications, and financial planning.

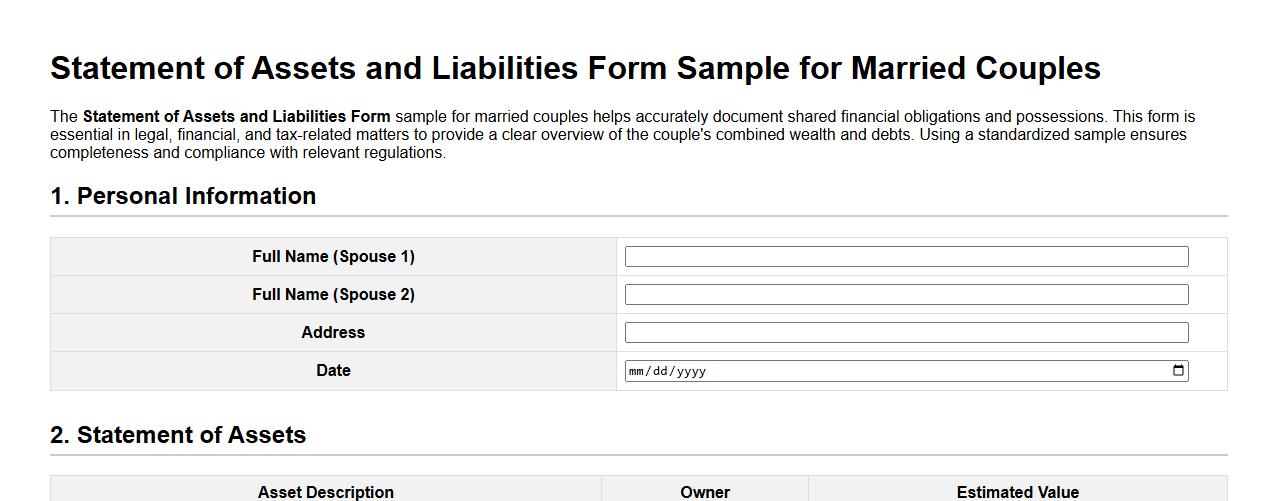

Statement of Assets and Liabilities Form Sample for Married Couples

The Statement of Assets and Liabilities Form sample for married couples helps accurately document shared financial obligations and possessions. This form is essential in legal, financial, and tax-related matters to provide a clear overview of the couple's combined wealth and debts. Using a standardized sample ensures completeness and compliance with relevant regulations.

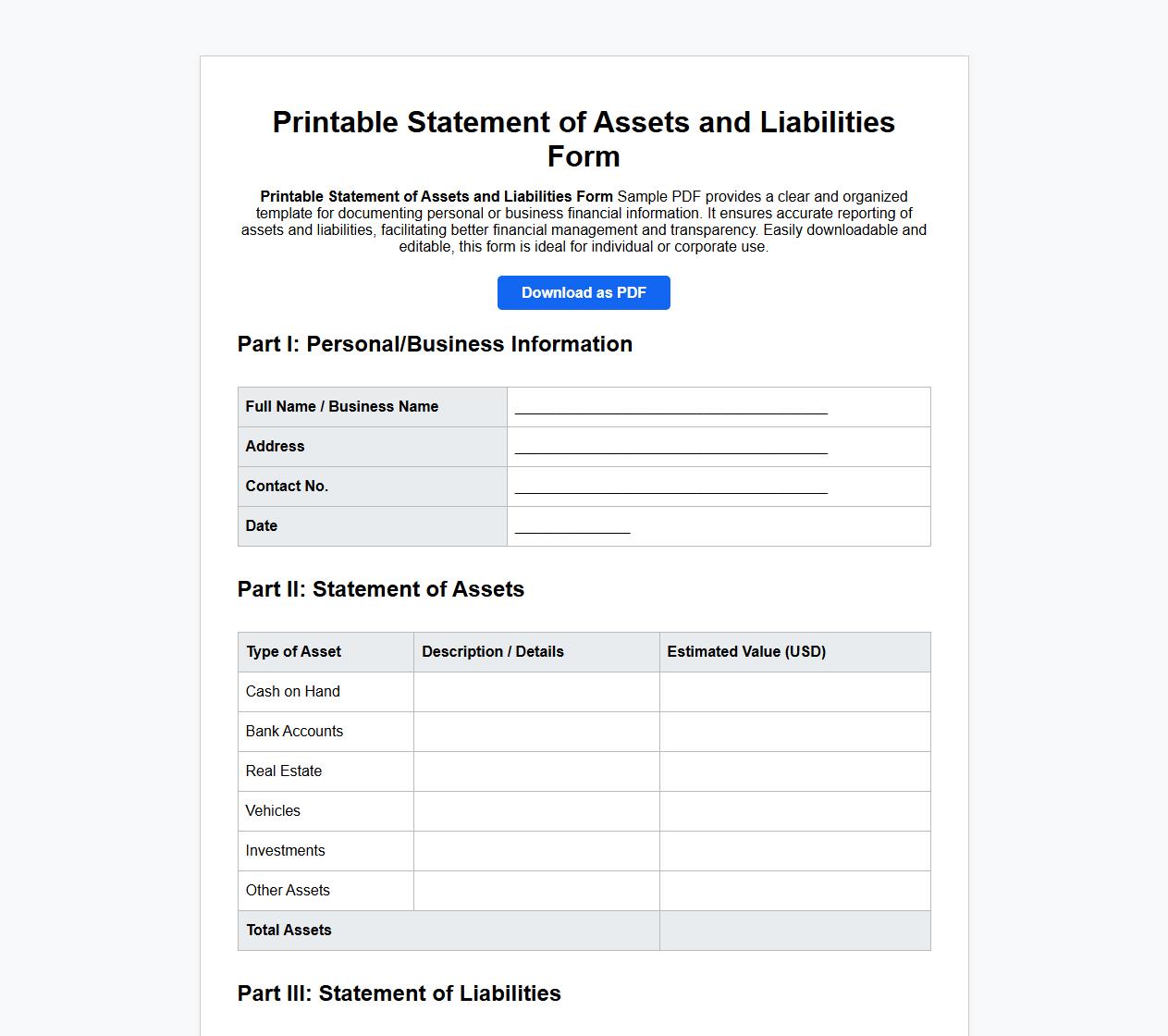

Printable Statement of Assets and Liabilities Form Sample PDF

This Printable Statement of Assets and Liabilities Form Sample PDF provides a clear and organized template for documenting personal or business financial information. It ensures accurate reporting of assets and liabilities, facilitating better financial management and transparency. Easily downloadable and editable, this form is ideal for individual or corporate use.

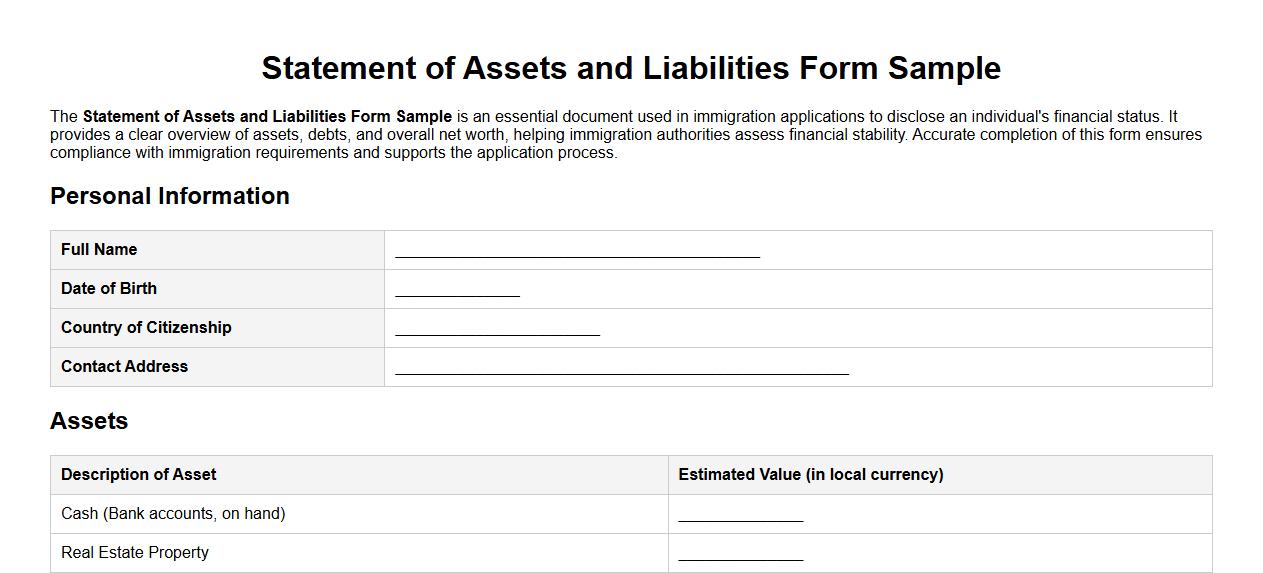

Statement of Assets and Liabilities Form Sample for Immigration Purposes

The Statement of Assets and Liabilities Form Sample is an essential document used in immigration applications to disclose an individual's financial status. It provides a clear overview of assets, debts, and overall net worth, helping immigration authorities assess financial stability. Accurate completion of this form ensures compliance with immigration requirements and supports the application process.

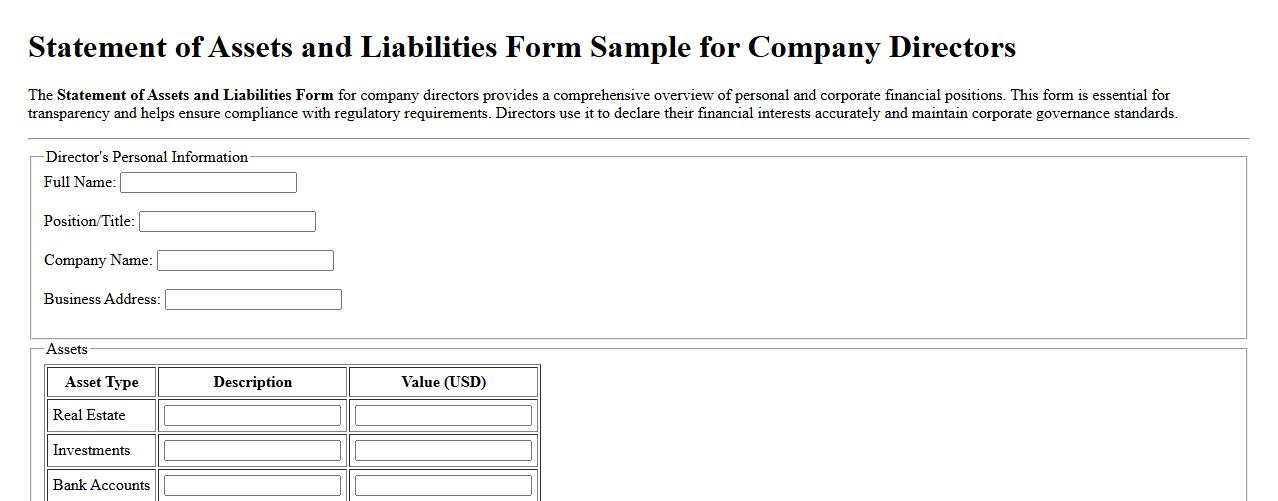

Statement of Assets and Liabilities Form Sample for Company Directors

The Statement of Assets and Liabilities Form for company directors provides a comprehensive overview of personal and corporate financial positions. This form is essential for transparency and helps ensure compliance with regulatory requirements. Directors use it to declare their financial interests accurately and maintain corporate governance standards.

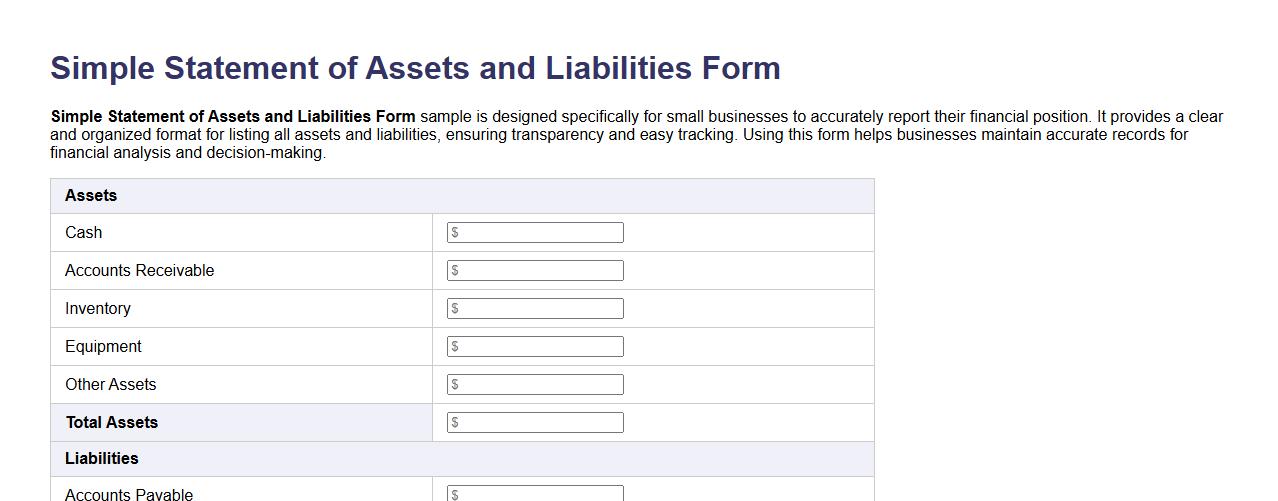

Simple Statement of Assets and Liabilities Form Sample for Small Business

This Simple Statement of Assets and Liabilities Form sample is designed specifically for small businesses to accurately report their financial position. It provides a clear and organized format for listing all assets and liabilities, ensuring transparency and easy tracking. Using this form helps businesses maintain accurate records for financial analysis and decision-making.

What supporting documents are required for verifying entries in the Statement of Assets and Liabilities Form?

Supporting documents for the Statement of Assets and Liabilities include bank statements, titles, deeds, and receipts. These documents must verify the ownership and valuation of each asset or liability declared. Proper documentation ensures accuracy and compliance with regulatory requirements.

How do you report jointly-owned assets in the Statement of Assets and Liabilities Form?

Jointly-owned assets must be reported based on your proportionate share of ownership in the Statement. Include only the portion legally attributed to you, not the total asset value. Proper disclosure prevents overstatement of assets and aligns with legal and tax standards.

What are the tax implications for assets declared on the Statement of Assets and Liabilities Form?

Declared assets on the Statement of Assets and Liabilities could impact capital gains tax and estate tax calculations. Accurate reporting can ensure proper taxation and avoid legal penalties. Consulting a tax advisor helps in understanding specific obligations tied to asset declarations.

How should foreign assets be disclosed in the Statement of Assets and Liabilities Form?

All foreign assets must be fully disclosed, including their location and valuation in local currency. Convert overseas valuations into the reporting currency using the prevailing exchange rate on the relevant date. Transparency regarding foreign assets supports global compliance and prevents tax evasion.

Which valuation date should be used when completing the Statement of Assets and Liabilities Form?

The valuation date for the Statement of Assets and Liabilities is typically the last day of the reporting period or fiscal year. Use the market values as of this specific date for all asset and liability entries. Consistency in valuation dates ensures accuracy and comparability of the financial position.