A Payroll Record Form Sample is a template used to systematically document employee payment details, including wages, deductions, and tax information. This form ensures accurate tracking of payroll data for compliance with legal and financial regulations. Employers rely on these records for efficient payroll management and auditing purposes.

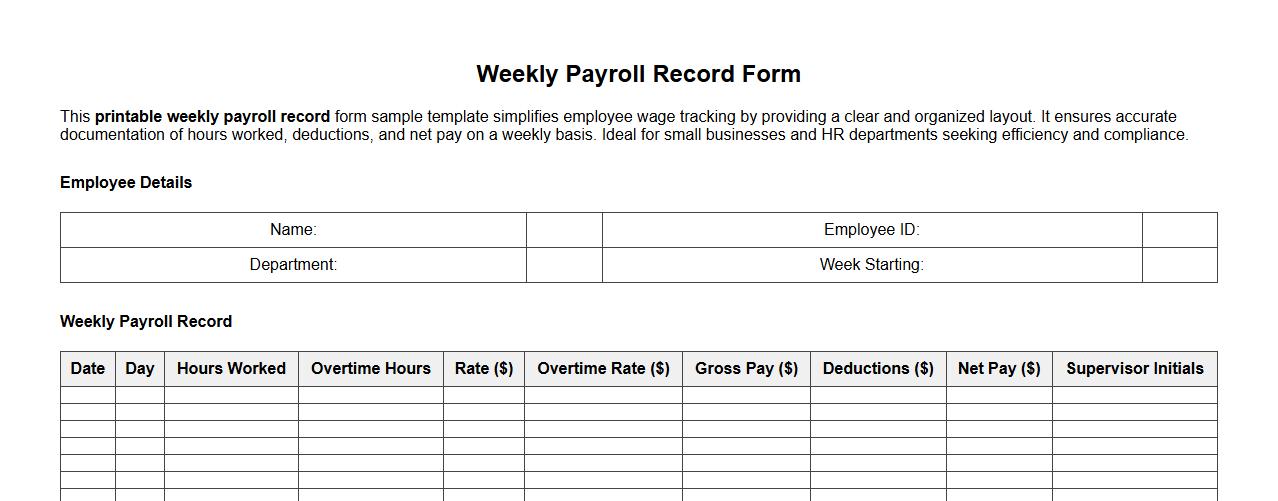

Printable weekly payroll record form sample template

This printable weekly payroll record form sample template simplifies employee wage tracking by providing a clear and organized layout. It ensures accurate documentation of hours worked, deductions, and net pay on a weekly basis. Ideal for small businesses and HR departments seeking efficiency and compliance.

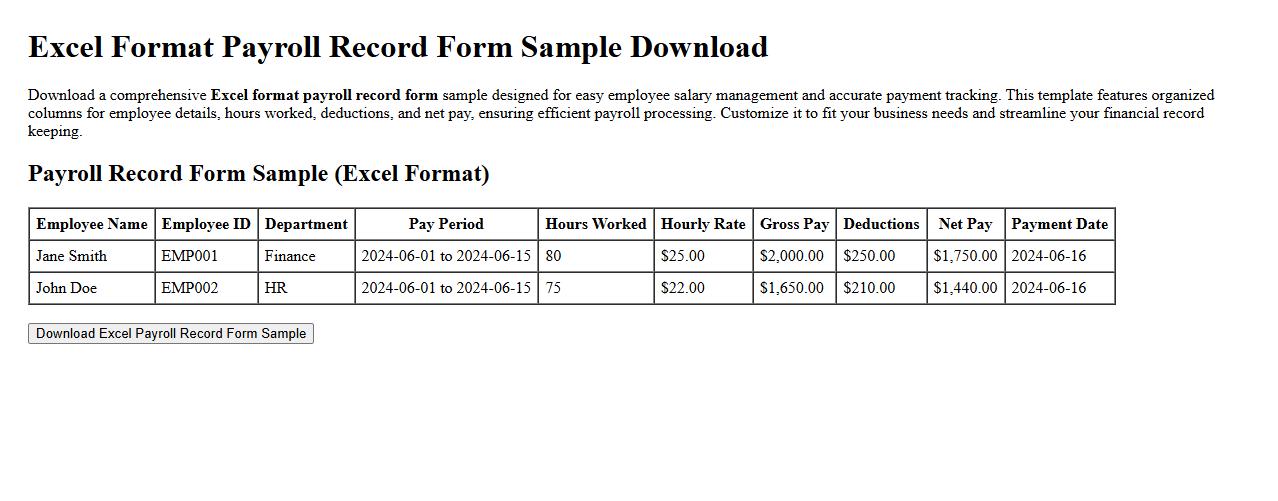

Excel format payroll record form sample download

Download a comprehensive Excel format payroll record form sample designed for easy employee salary management and accurate payment tracking. This template features organized columns for employee details, hours worked, deductions, and net pay, ensuring efficient payroll processing. Customize it to fit your business needs and streamline your financial record keeping.

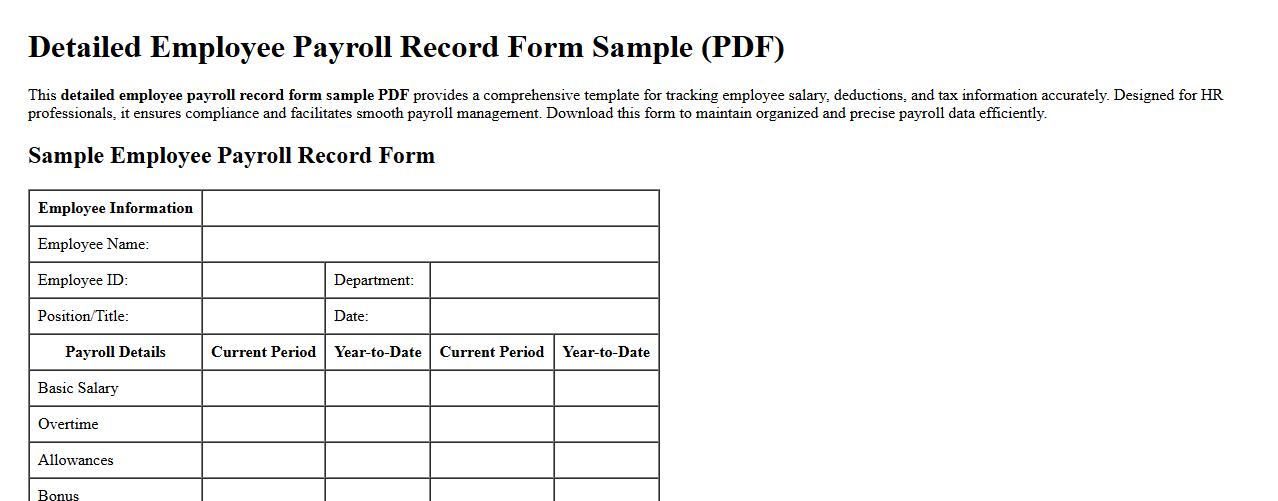

Detailed employee payroll record form sample PDF

This detailed employee payroll record form sample PDF provides a comprehensive template for tracking employee salary, deductions, and tax information accurately. Designed for HR professionals, it ensures compliance and facilitates smooth payroll management. Download this form to maintain organized and precise payroll data efficiently.

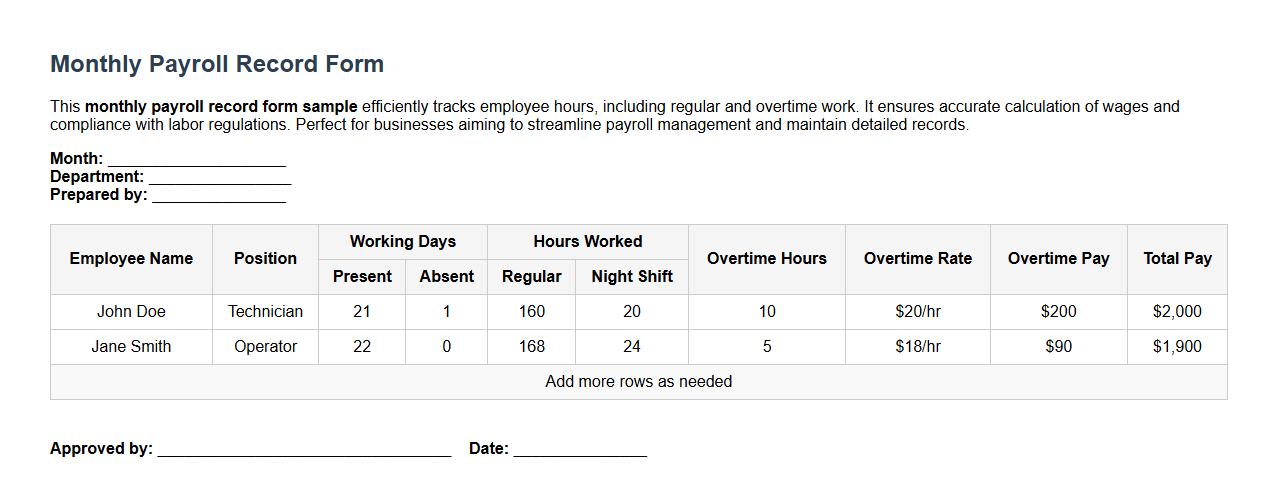

Monthly payroll record form sample with overtime

This monthly payroll record form sample efficiently tracks employee hours, including regular and overtime work. It ensures accurate calculation of wages and compliance with labor regulations. Perfect for businesses aiming to streamline payroll management and maintain detailed records.

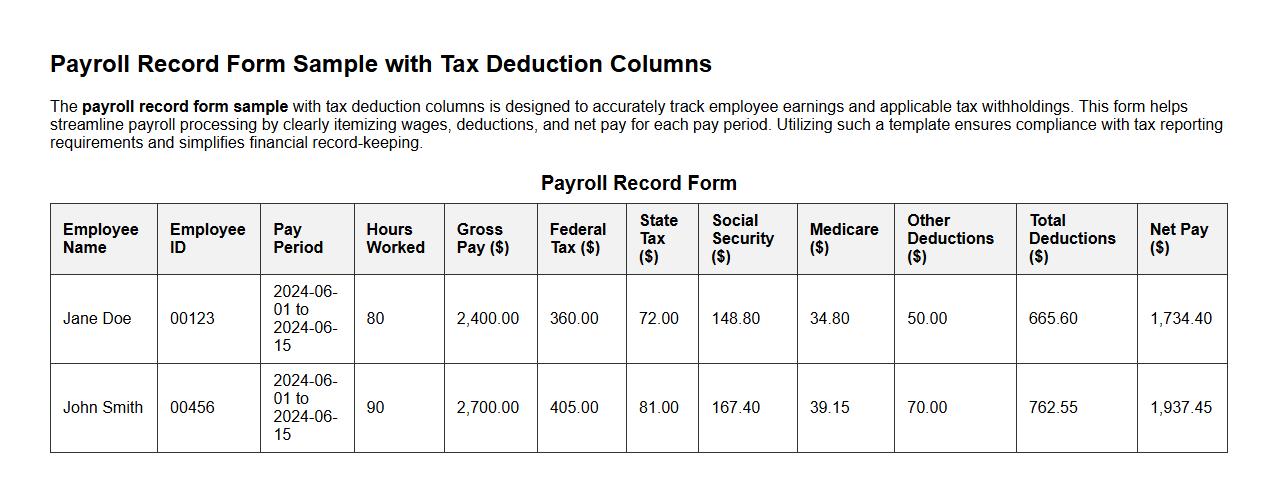

Payroll record form sample with tax deduction columns

The payroll record form sample with tax deduction columns is designed to accurately track employee earnings and applicable tax withholdings. This form helps streamline payroll processing by clearly itemizing wages, deductions, and net pay for each pay period. Utilizing such a template ensures compliance with tax reporting requirements and simplifies financial record-keeping.

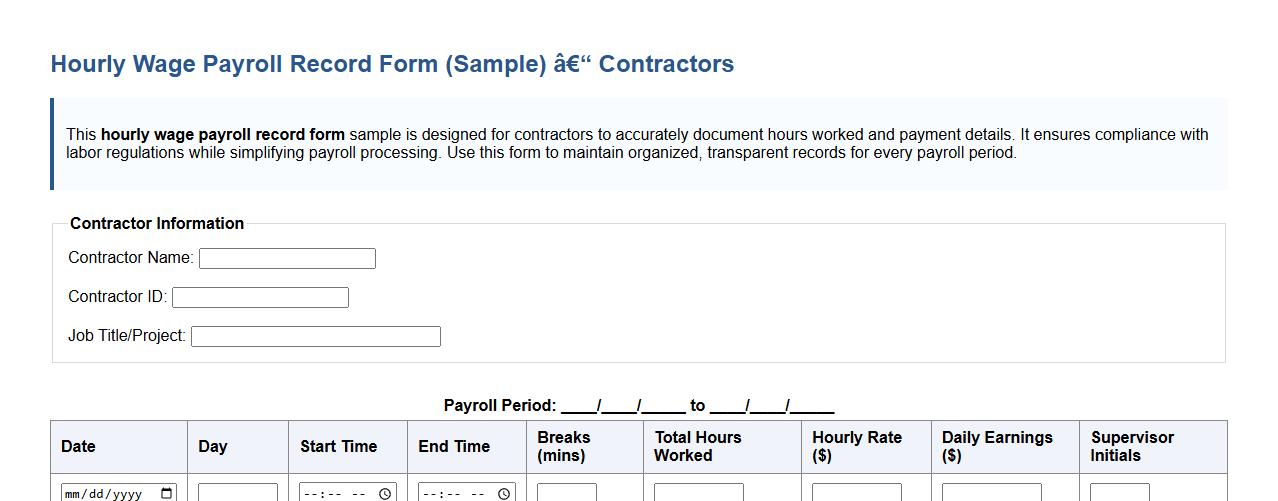

Hourly wage payroll record form sample for contractors

This hourly wage payroll record form sample is designed for contractors to accurately document hours worked and payment details. It ensures compliance with labor regulations while simplifying payroll processing. Use this form to maintain organized, transparent records for every payroll period.

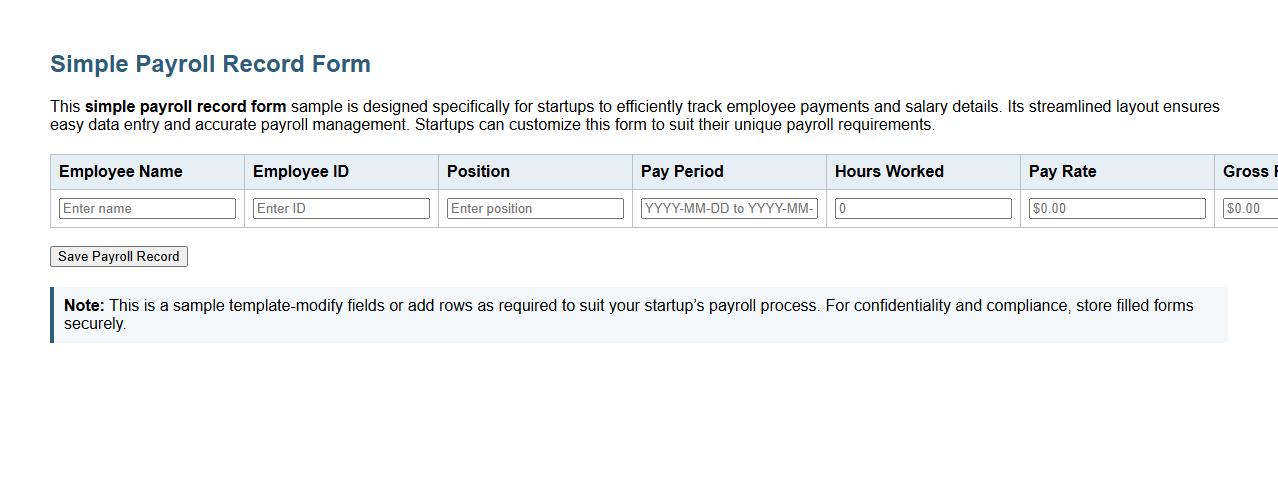

Simple payroll record form sample for startups

This simple payroll record form sample is designed specifically for startups to efficiently track employee payments and salary details. Its streamlined layout ensures easy data entry and accurate payroll management. Startups can customize this form to suit their unique payroll requirements.

Payroll record form sample including benefits tracking

The payroll record form sample efficiently manages employee salary details and benefits tracking. This form ensures accurate documentation of wages, deductions, and additional benefits for seamless payroll processing. It is an essential tool for streamlined HR and finance operations.

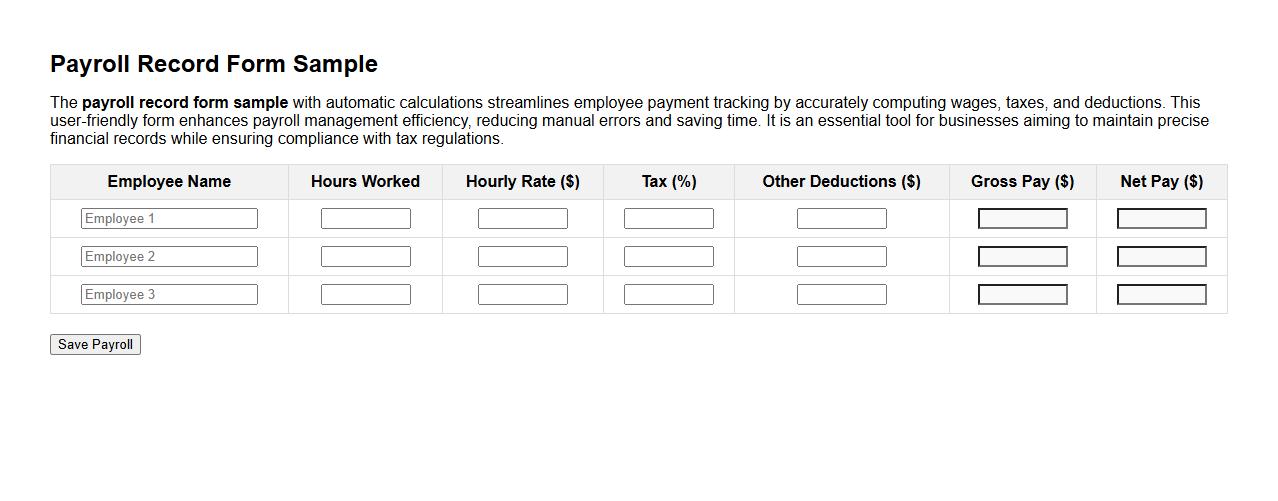

Payroll record form sample with automatic calculations

The payroll record form sample with automatic calculations streamlines employee payment tracking by accurately computing wages, taxes, and deductions. This user-friendly form enhances payroll management efficiency, reducing manual errors and saving time. It is an essential tool for businesses aiming to maintain precise financial records while ensuring compliance with tax regulations.

What legal retention period applies to payroll record forms?

The legal retention period for payroll record forms typically ranges from 3 to 7 years, depending on jurisdiction. Employers must comply with local labor laws and tax regulations when retaining payroll records. Maintaining these records ensures legal compliance and facilitates audits or dispute resolutions.

Which employee data fields are mandatory on a payroll record form?

A payroll record form must include mandatory employee data fields such as full name, social security number, and employment dates. Salary details, tax withholding information, and hours worked are also essential for compliance. Accurate data collection supports proper payroll processing and tax reporting.

How is confidentiality maintained when sharing payroll forms internally?

Confidentiality is maintained by limiting access to payroll forms to authorized personnel only. Using secure communication channels and encrypted storage helps prevent unauthorized disclosure. Regular training on data privacy further reinforces internal confidentiality policies.

Are digital signatures acceptable on payroll record documents?

Digital signatures are widely accepted on payroll record documents, provided they meet legal standards for authenticity. Many jurisdictions recognize e-signatures as valid for record-keeping and verification purposes. Using compliant digital signature tools enhances efficiency and security in payroll management.

How should corrections be documented on submitted payroll record forms?

Corrections on payroll record forms must be clearly documented and authorized to preserve record integrity. Employers should use amendment logs or addendums that specify the nature and date of changes. Transparent correction procedures help avoid discrepancies during audits or reviews.