A Tax Declaration Form Sample provides a clear example of how to accurately report income, deductions, and tax liabilities. This sample helps individuals and businesses understand the necessary fields and required information for proper tax filing. Reviewing a Tax Declaration Form Sample ensures compliance with tax regulations and reduces the risk of errors.

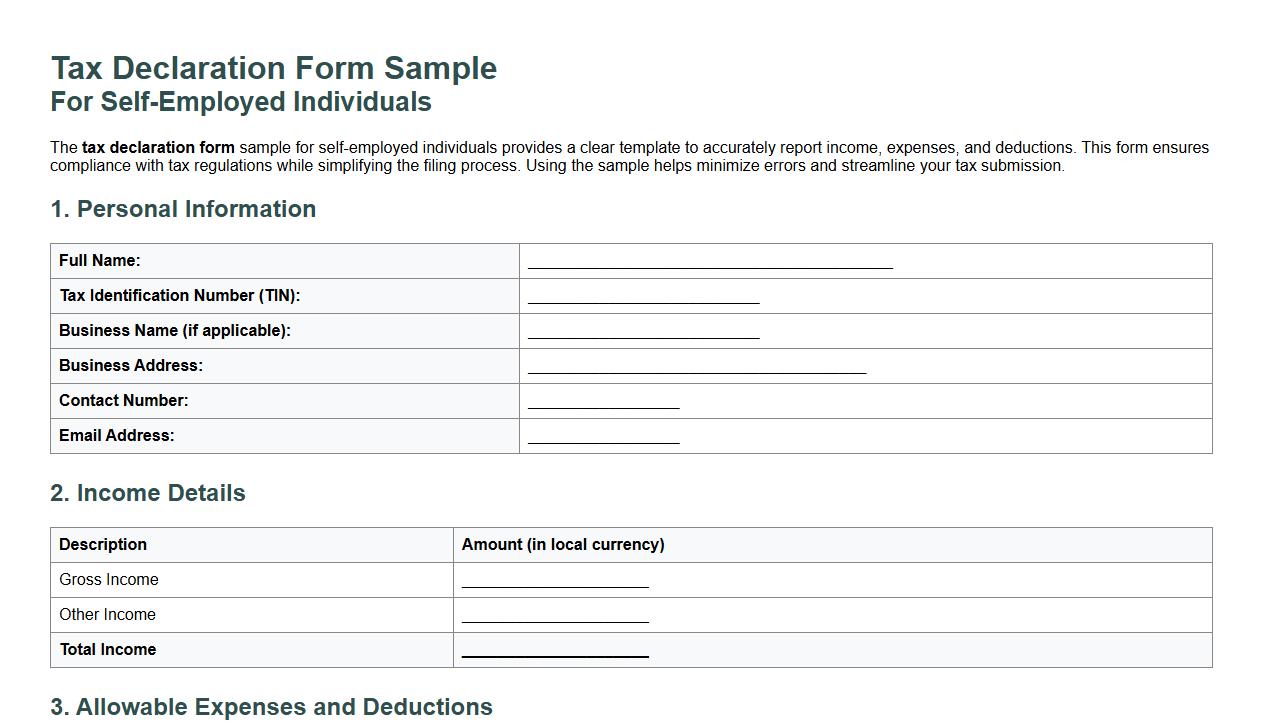

Tax declaration form sample for self-employed individuals

The tax declaration form sample for self-employed individuals provides a clear template to accurately report income, expenses, and deductions. This form ensures compliance with tax regulations while simplifying the filing process. Using the sample helps minimize errors and streamline your tax submission.

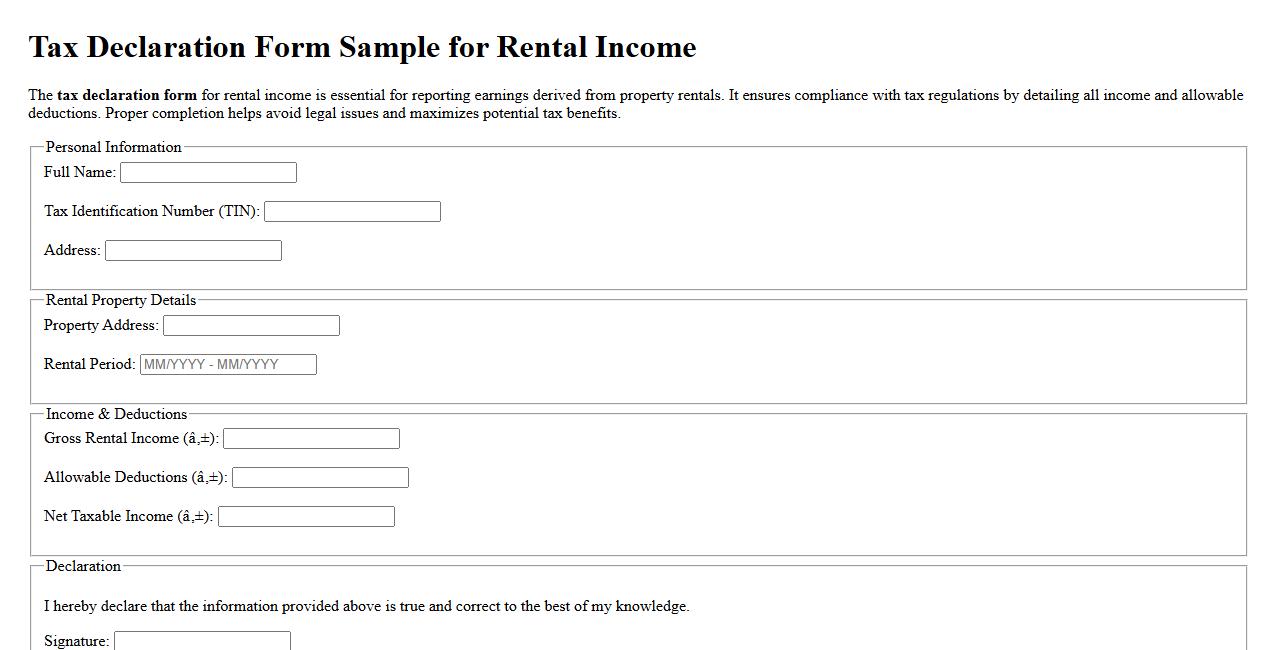

Tax declaration form sample for rental income

The tax declaration form for rental income is essential for reporting earnings derived from property rentals. It ensures compliance with tax regulations by detailing all income and allowable deductions. Proper completion helps avoid legal issues and maximizes potential tax benefits.

Tax declaration form sample for small business owners

The tax declaration form sample for small business owners provides a clear and concise template to report earnings and expenses accurately. It ensures compliance with tax regulations while simplifying the filing process. Using this form helps small businesses maintain organized financial records.

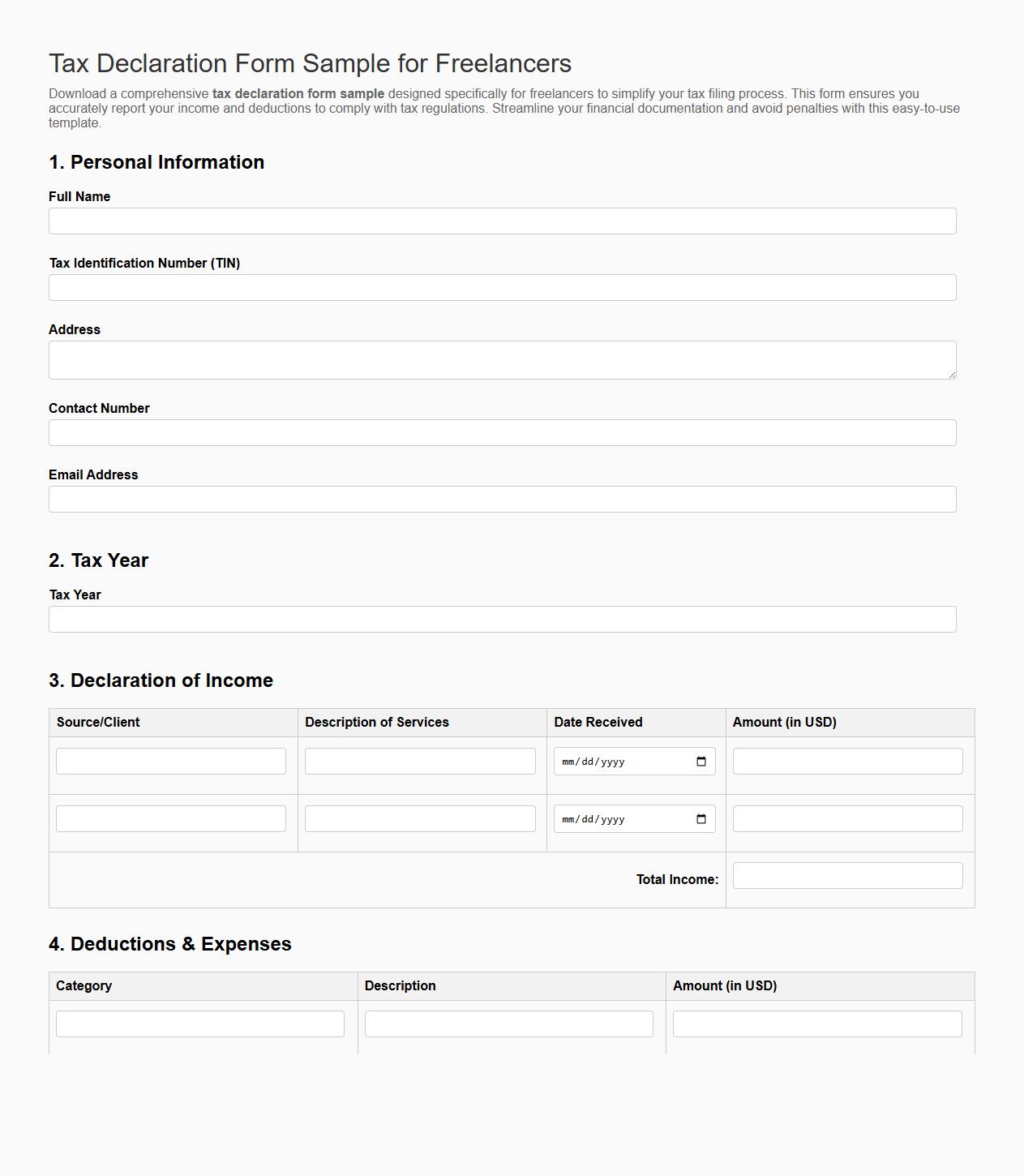

Tax declaration form sample for freelancers

Download a comprehensive tax declaration form sample designed specifically for freelancers to simplify your tax filing process. This form ensures you accurately report your income and deductions to comply with tax regulations. Streamline your financial documentation and avoid penalties with this easy-to-use template.

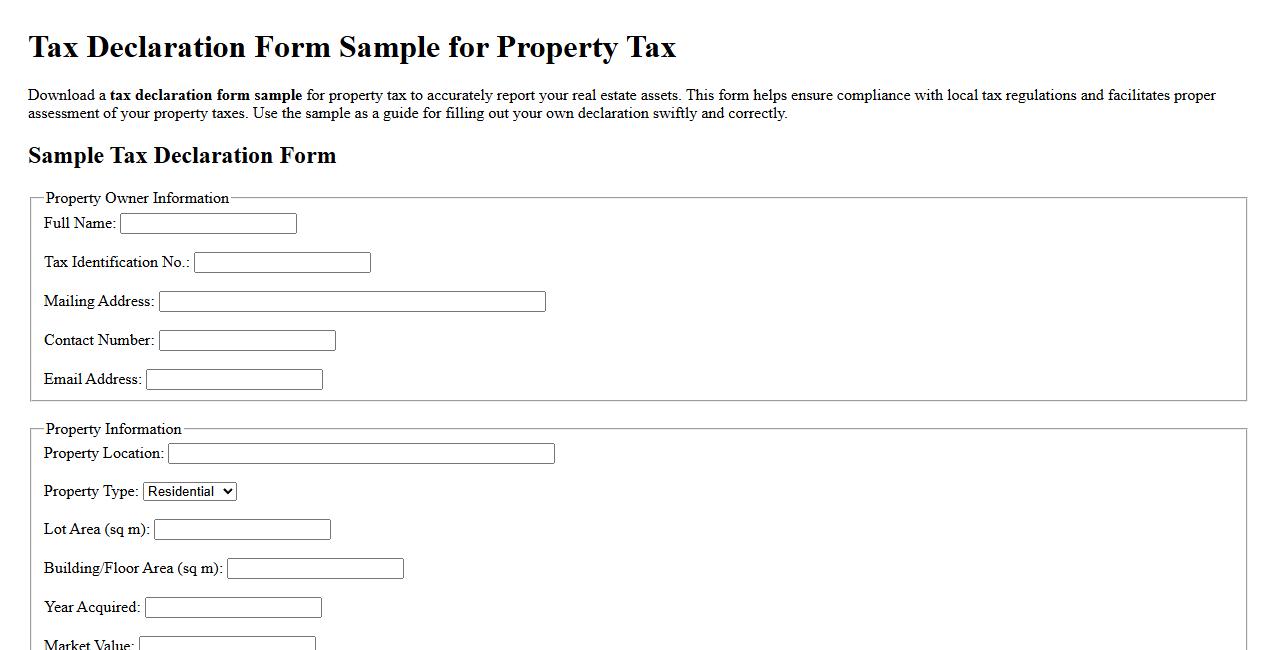

Tax declaration form sample for property tax

Download a tax declaration form sample for property tax to accurately report your real estate assets. This form helps ensure compliance with local tax regulations and facilitates proper assessment of your property taxes. Use the sample as a guide for filling out your own declaration swiftly and correctly.

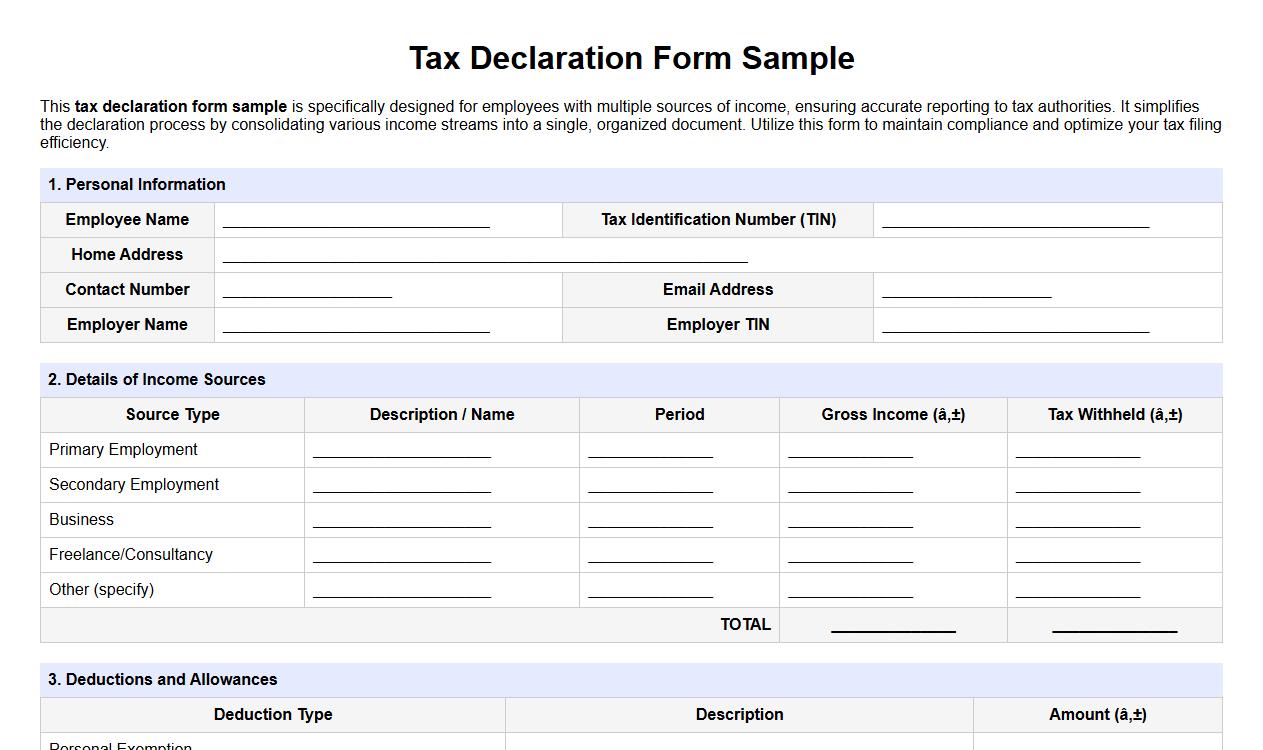

Tax declaration form sample for employees with multiple incomes

This tax declaration form sample is specifically designed for employees with multiple sources of income, ensuring accurate reporting to tax authorities. It simplifies the declaration process by consolidating various income streams into a single, organized document. Utilize this form to maintain compliance and optimize your tax filing efficiency.

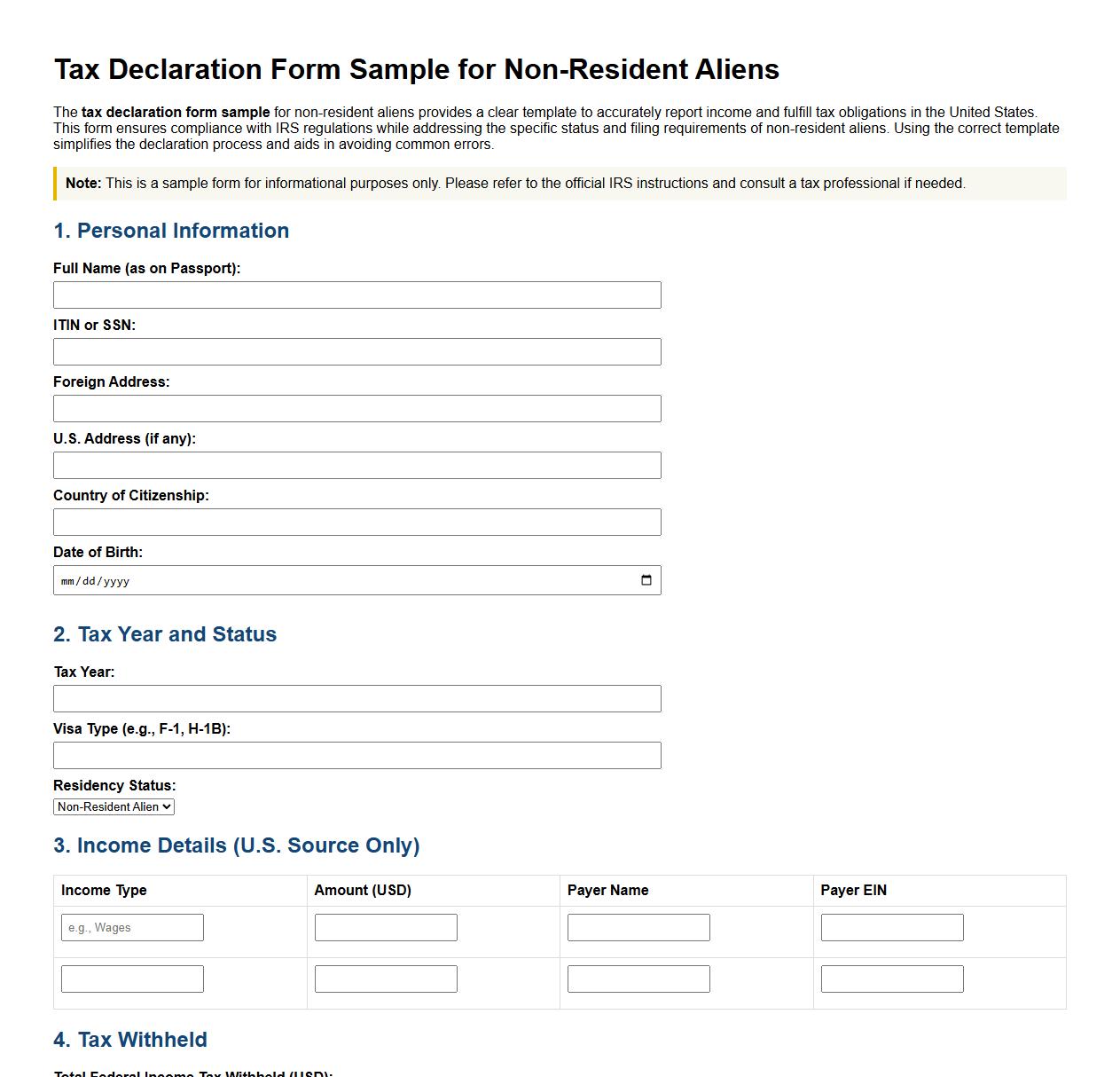

Tax declaration form sample for non-resident aliens

The tax declaration form sample for non-resident aliens provides a clear template to accurately report income and fulfill tax obligations in the United States. This form ensures compliance with IRS regulations while addressing the specific status and filing requirements of non-resident aliens. Using the correct template simplifies the declaration process and aids in avoiding common errors.

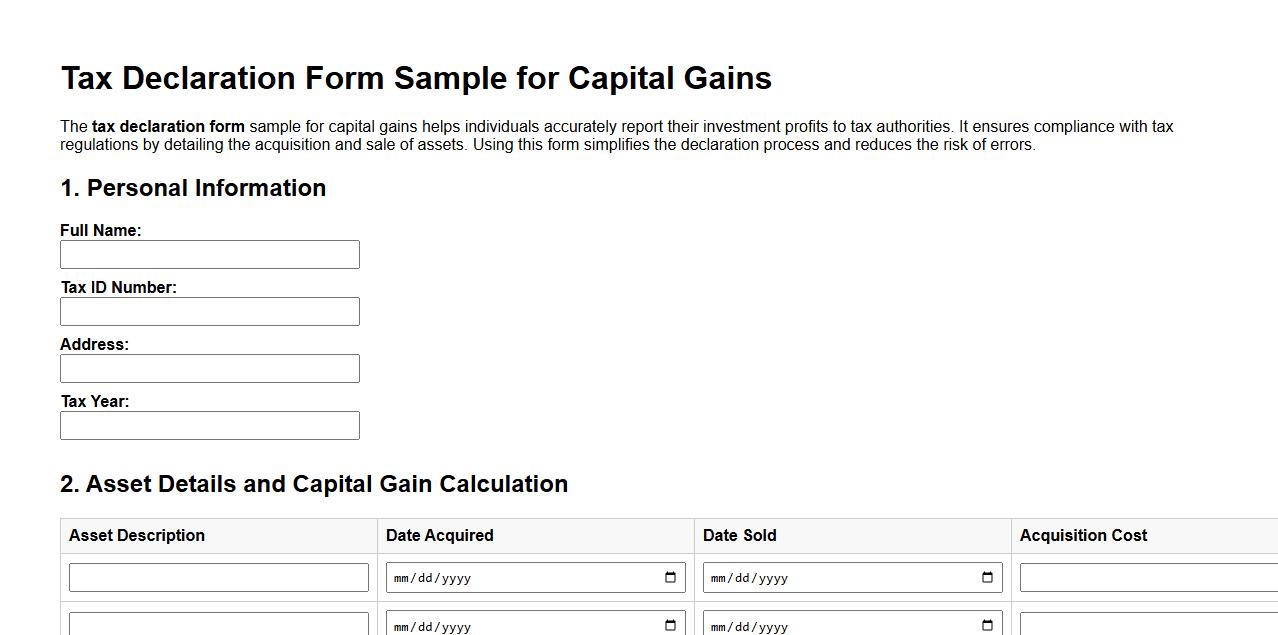

Tax declaration form sample for capital gains

The tax declaration form sample for capital gains helps individuals accurately report their investment profits to tax authorities. It ensures compliance with tax regulations by detailing the acquisition and sale of assets. Using this form simplifies the declaration process and reduces the risk of errors.

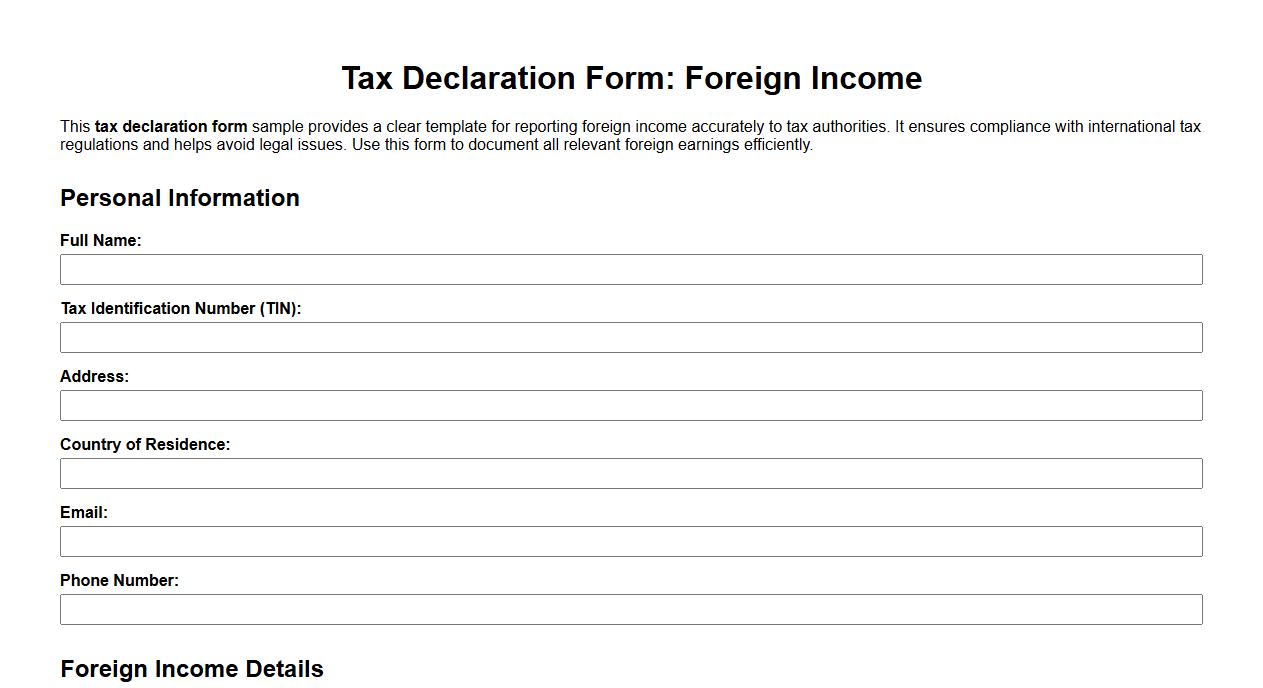

Tax declaration form sample for foreign income

This tax declaration form sample provides a clear template for reporting foreign income accurately to tax authorities. It ensures compliance with international tax regulations and helps avoid legal issues. Use this form to document all relevant foreign earnings efficiently.

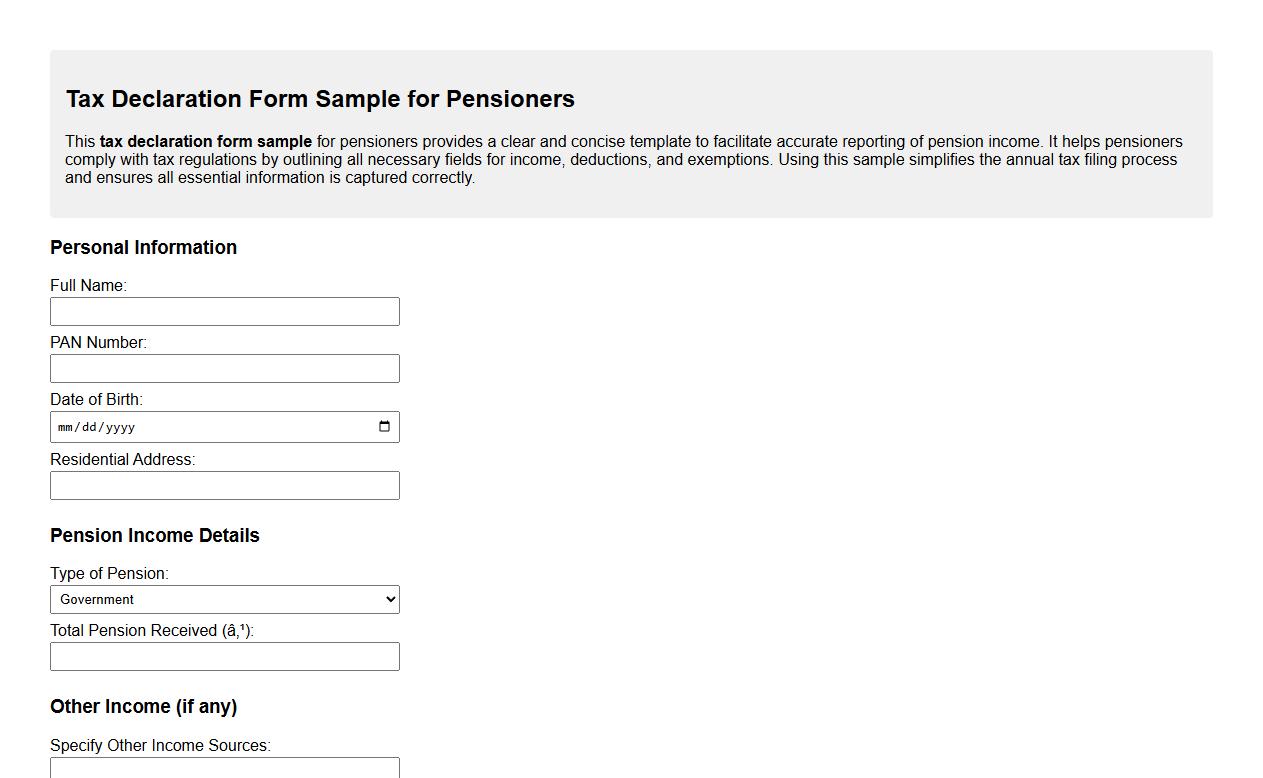

Tax declaration form sample for pensioners

This tax declaration form sample for pensioners provides a clear and concise template to facilitate accurate reporting of pension income. It helps pensioners comply with tax regulations by outlining all necessary fields for income, deductions, and exemptions. Using this sample simplifies the annual tax filing process and ensures all essential information is captured correctly.

What mandatory attachments are required for the Tax Declaration Form submission?

When submitting the Tax Declaration Form, you must include all relevant supporting documents. These attachments typically include income statements, proof of deductions, and any applicable tax credits. Ensuring these mandatory attachments are complete helps facilitate accurate processing and compliance.

Which sections on the Tax Declaration Form pertain specifically to foreign income?

The foreign income information is usually requested in dedicated sections of the Tax Declaration Form. These sections require detailing the amount, source, and tax paid abroad. Proper disclosure ensures correct taxation and avoids double taxation through applicable treaties.

How do I correct an error on a previously submitted Tax Declaration Form?

To correct an error on a previously submitted form, you must file an amended Tax Declaration Form. This process involves clearly marking the changes and providing an explanation for the correction. Timely submission of the amended form helps prevent penalties and ensures accurate tax records.

Are there digital signature provisions for the Tax Declaration Form?

Many tax authorities now accept digital signatures on the Tax Declaration Form for enhanced security and convenience. Digital signatures must comply with local regulations to be valid. Utilizing this option speeds up processing and reduces paperwork.

What deadlines apply to amendments made on the Tax Declaration Form?

Amendments to the Tax Declaration Form must generally be submitted within the prescribed deadline set by the tax authority, often within 30 to 90 days after the original filing. Missing these deadlines may result in penalties or disallowance of corrections. It is crucial to verify the specific timelines applicable in your jurisdiction.