The Insurance Declaration Form Sample provides a clear template outlining the essential details required for insurance coverage verification. It includes sections for personal information, policy specifics, and coverage limits to ensure accurate and efficient processing. This sample form serves as a practical guide for both insurers and policyholders to standardize documentation.

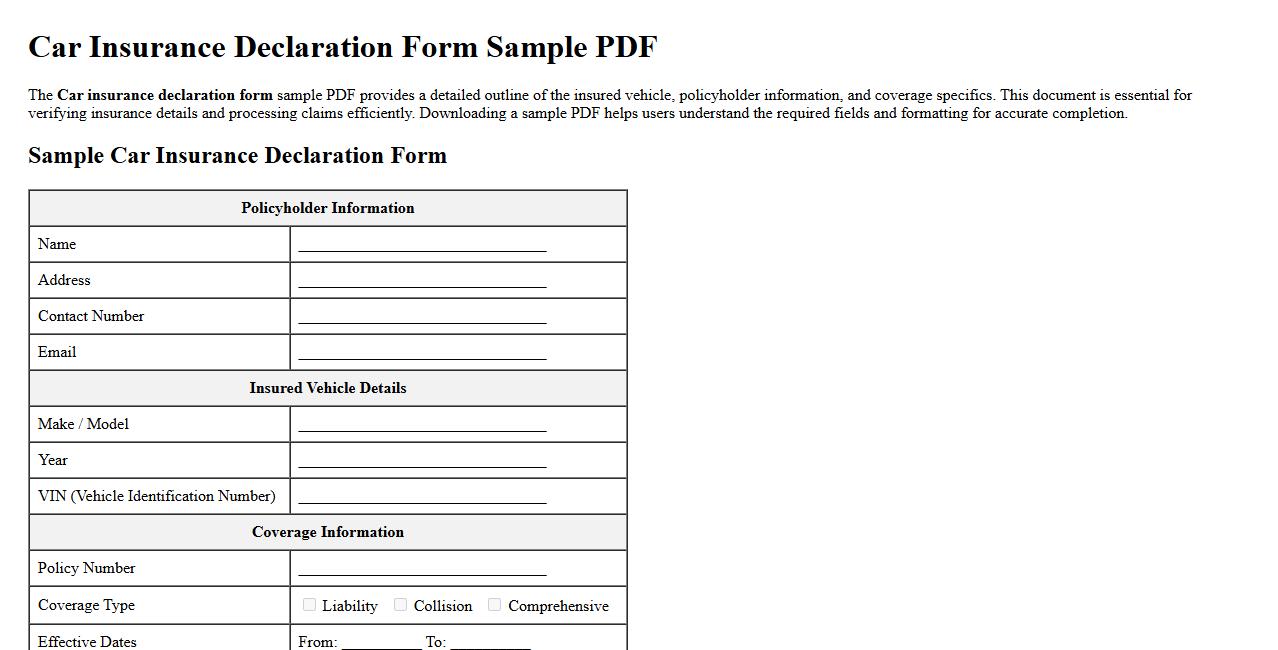

Car insurance declaration form sample PDF

The Car insurance declaration form sample PDF provides a detailed outline of the insured vehicle, policyholder information, and coverage specifics. This document is essential for verifying insurance details and processing claims efficiently. Downloading a sample PDF helps users understand the required fields and formatting for accurate completion.

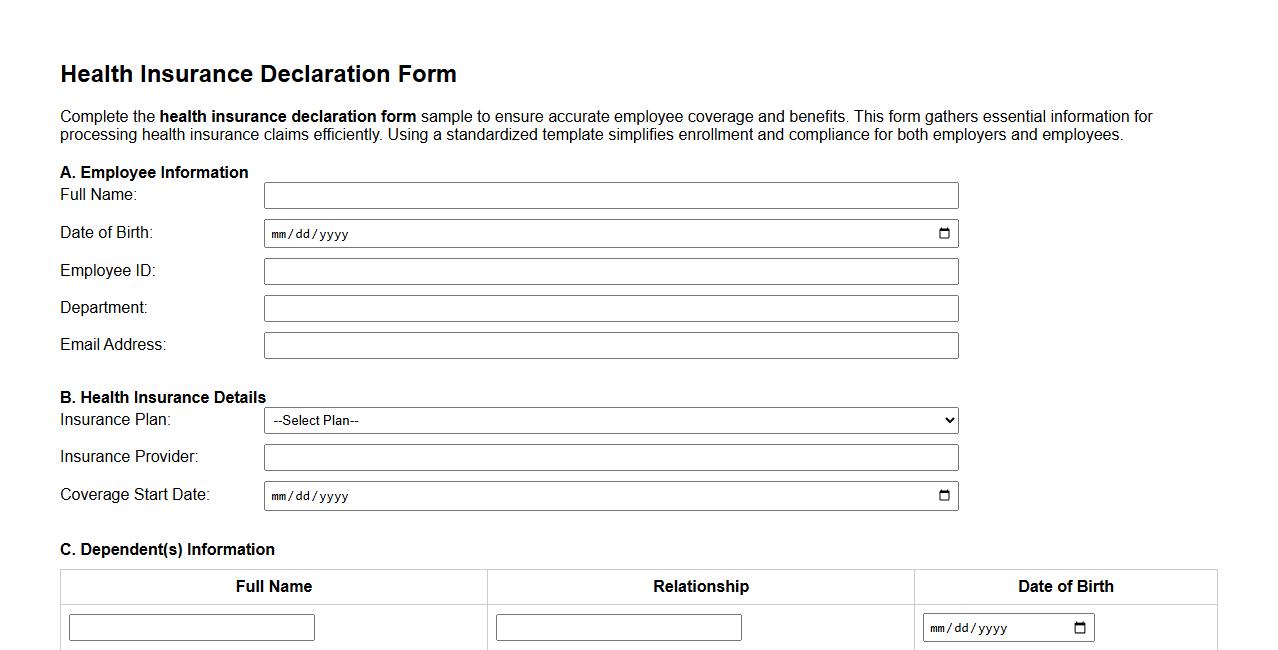

Health insurance declaration form sample for employees

Complete the health insurance declaration form sample to ensure accurate employee coverage and benefits. This form gathers essential information for processing health insurance claims efficiently. Using a standardized template simplifies enrollment and compliance for both employers and employees.

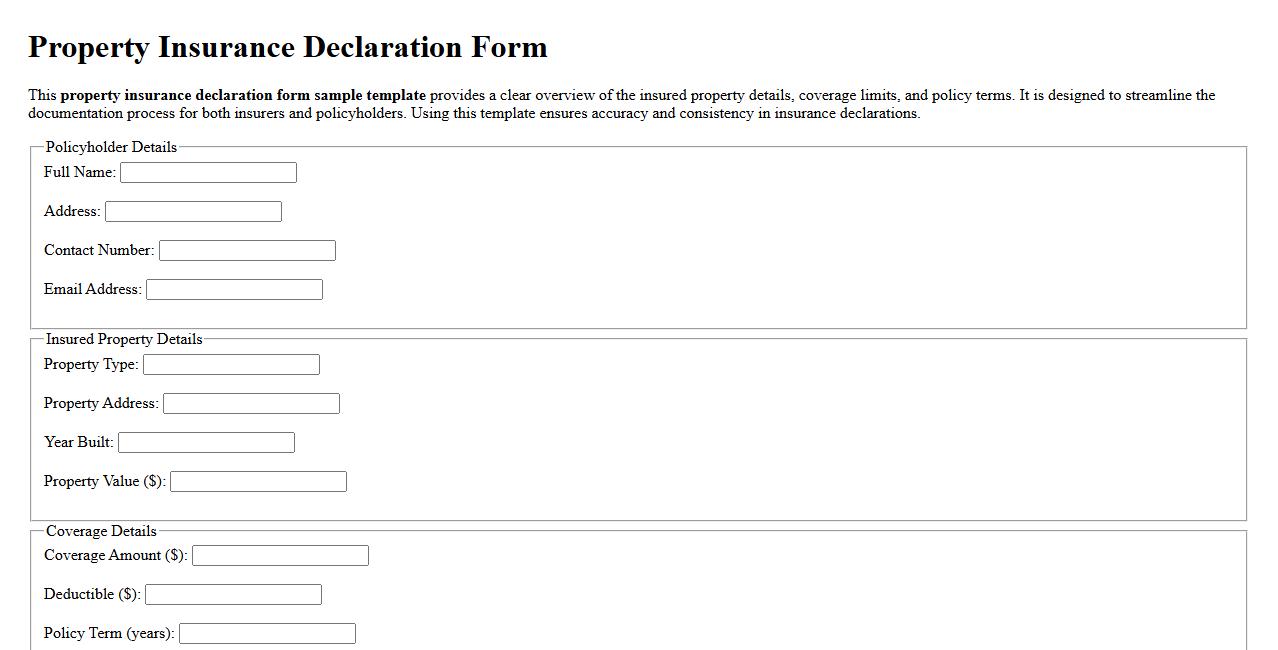

Property insurance declaration form sample template

This property insurance declaration form sample template provides a clear overview of the insured property details, coverage limits, and policy terms. It is designed to streamline the documentation process for both insurers and policyholders. Using this template ensures accuracy and consistency in insurance declarations.

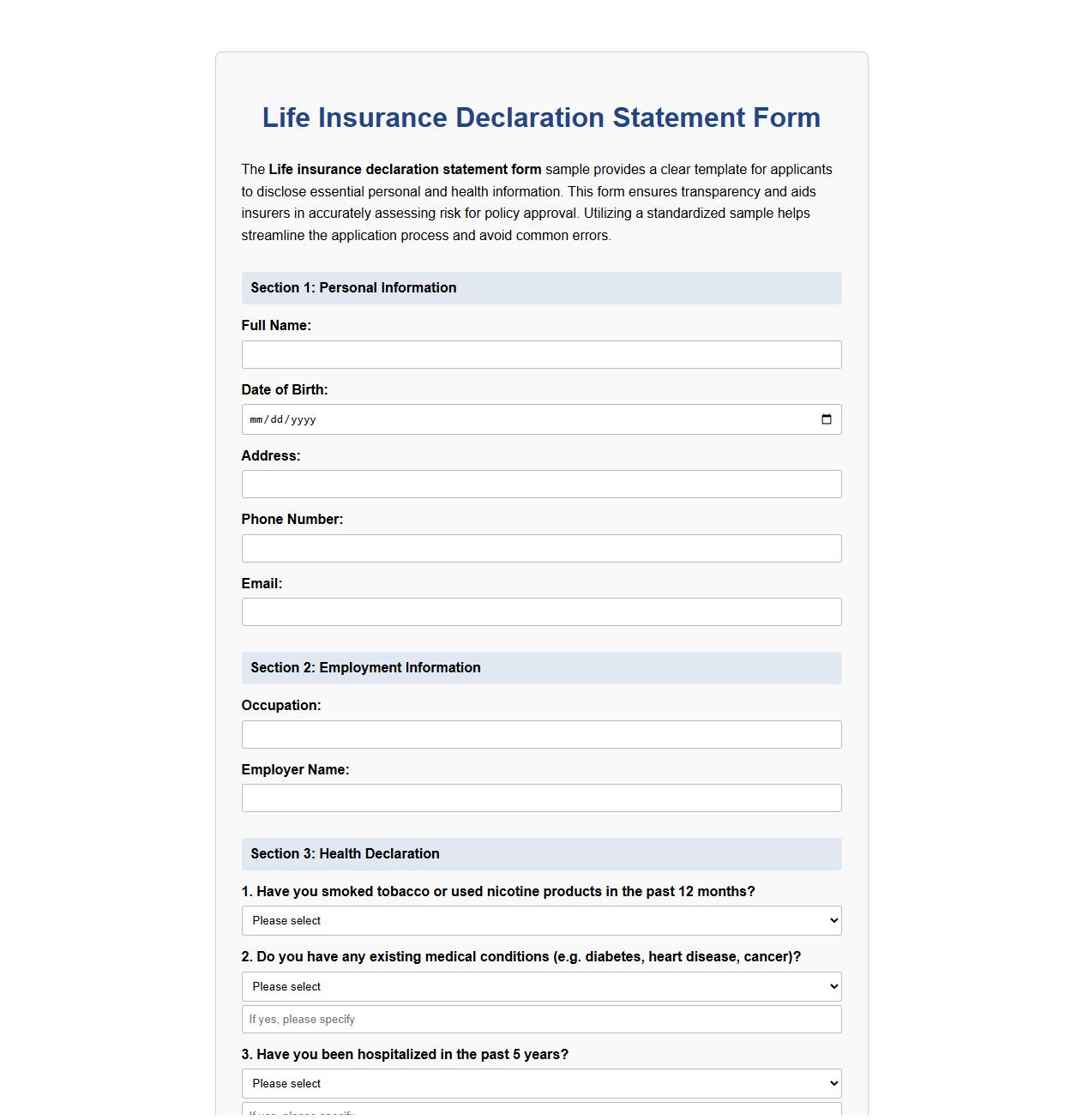

Life insurance declaration statement form sample

The Life insurance declaration statement form sample provides a clear template for applicants to disclose essential personal and health information. This form ensures transparency and aids insurers in accurately assessing risk for policy approval. Utilizing a standardized sample helps streamline the application process and avoid common errors.

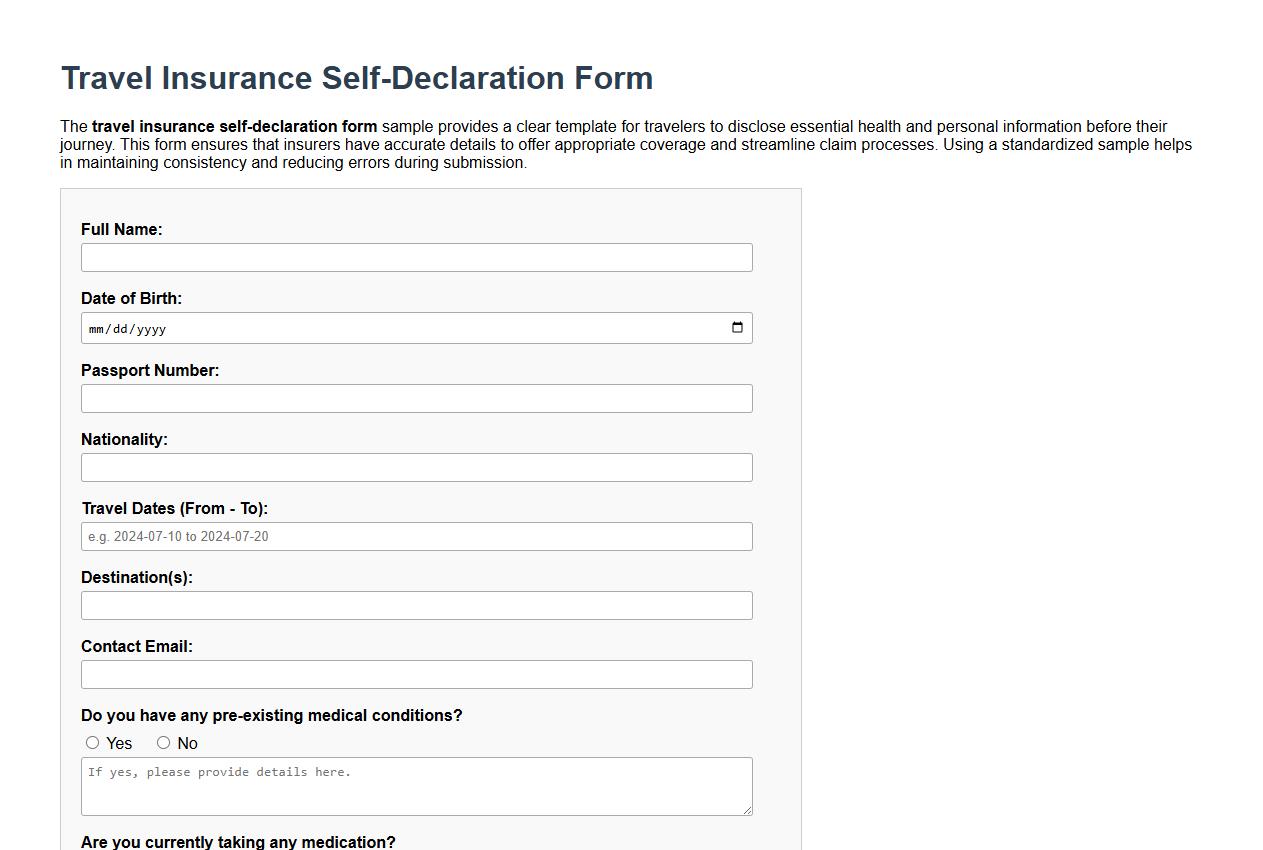

Travel insurance self-declaration form sample

The travel insurance self-declaration form sample provides a clear template for travelers to disclose essential health and personal information before their journey. This form ensures that insurers have accurate details to offer appropriate coverage and streamline claim processes. Using a standardized sample helps in maintaining consistency and reducing errors during submission.

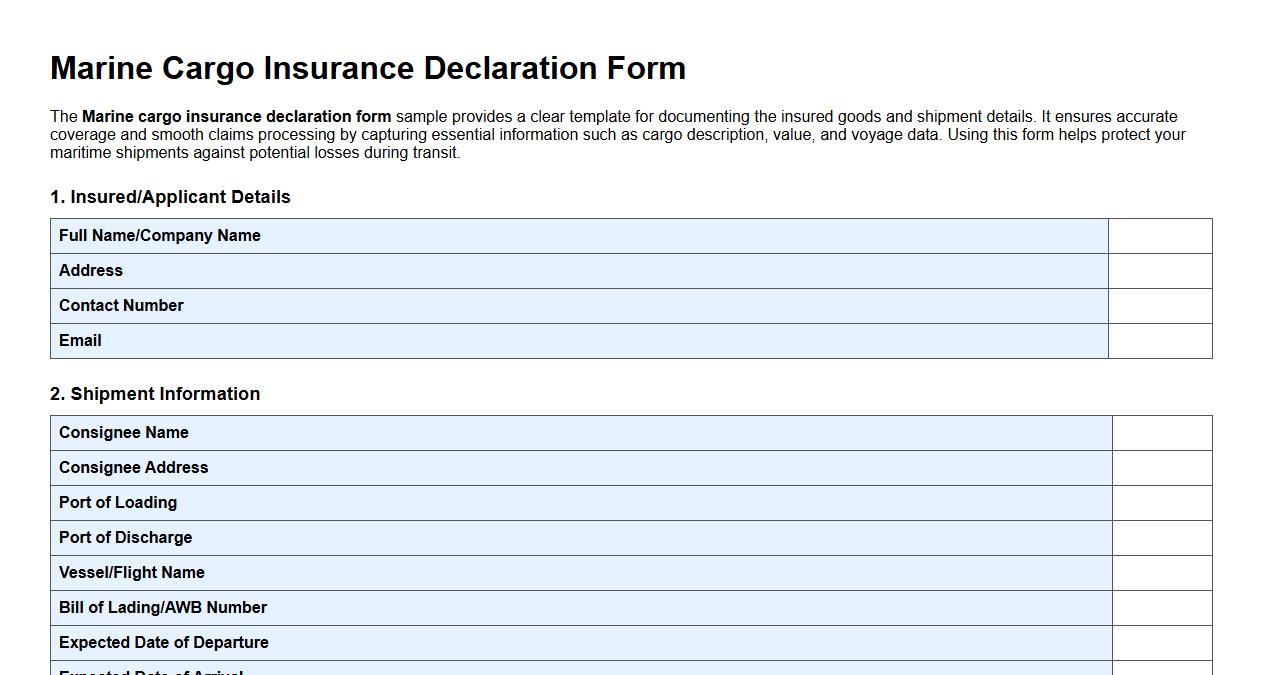

Marine cargo insurance declaration form sample

The Marine cargo insurance declaration form sample provides a clear template for documenting the insured goods and shipment details. It ensures accurate coverage and smooth claims processing by capturing essential information such as cargo description, value, and voyage data. Using this form helps protect your maritime shipments against potential losses during transit.

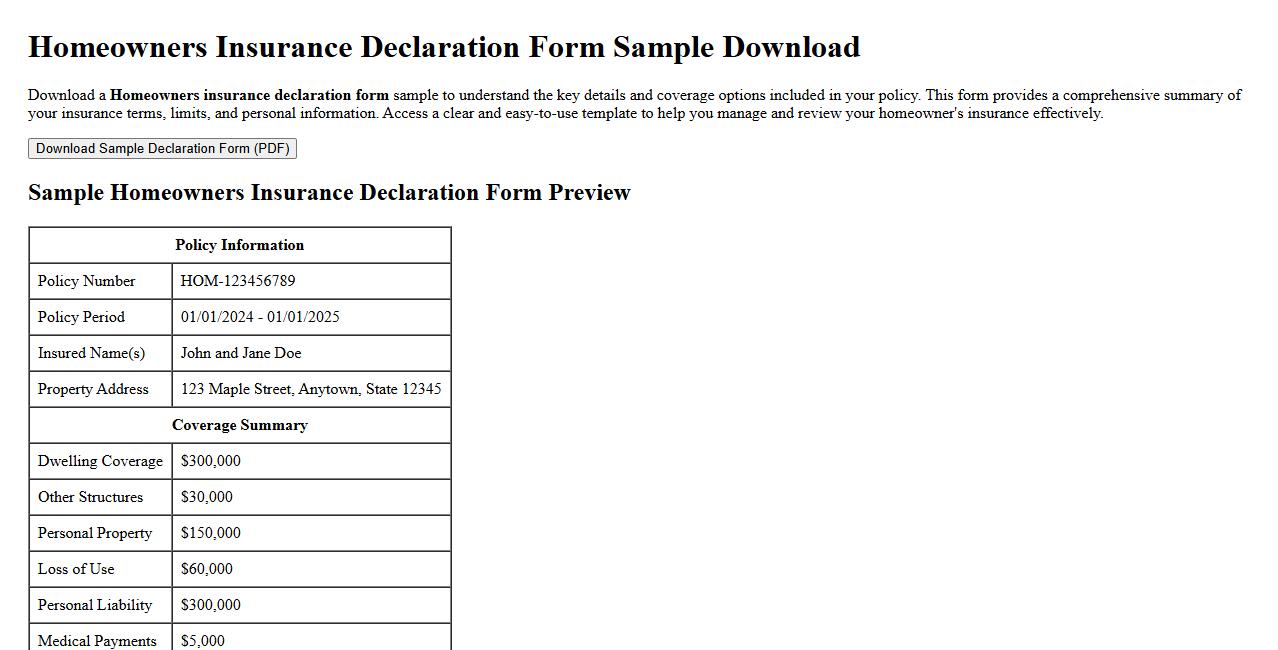

Homeowners insurance declaration form sample download

Download a Homeowners insurance declaration form sample to understand the key details and coverage options included in your policy. This form provides a comprehensive summary of your insurance terms, limits, and personal information. Access a clear and easy-to-use template to help you manage and review your homeowner's insurance effectively.

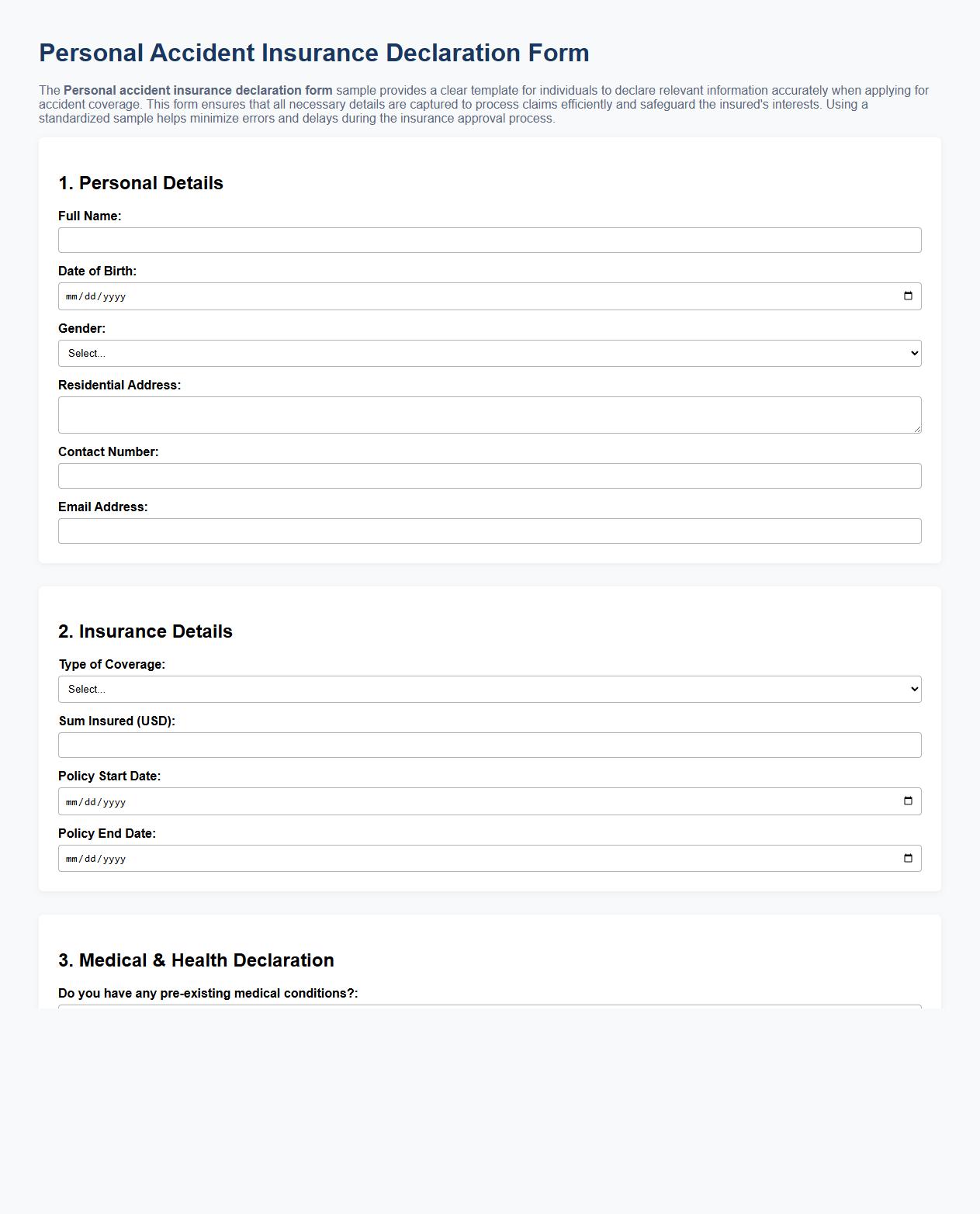

Personal accident insurance declaration form sample

The Personal accident insurance declaration form sample provides a clear template for individuals to declare relevant information accurately when applying for accident coverage. This form ensures that all necessary details are captured to process claims efficiently and safeguard the insured's interests. Using a standardized sample helps minimize errors and delays during the insurance approval process.

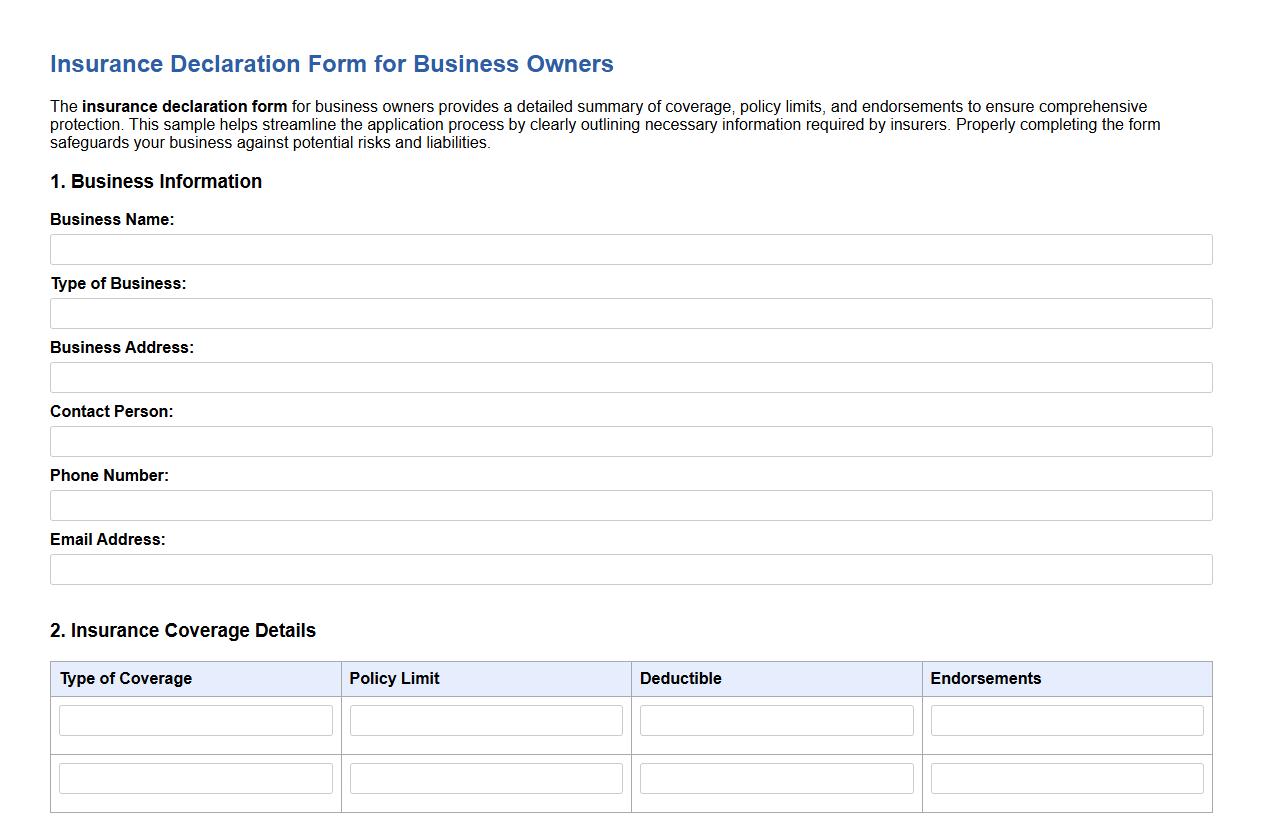

Insurance declaration form sample for business owners

The insurance declaration form for business owners provides a detailed summary of coverage, policy limits, and endorsements to ensure comprehensive protection. This sample helps streamline the application process by clearly outlining necessary information required by insurers. Properly completing the form safeguards your business against potential risks and liabilities.

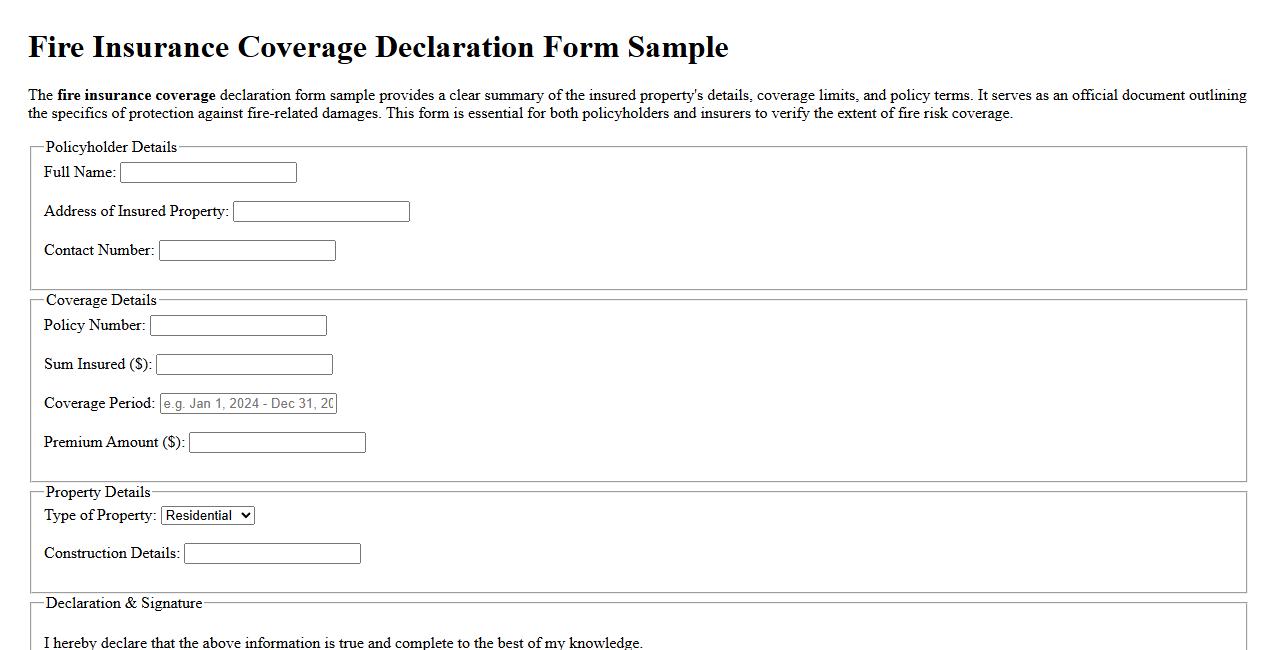

Fire insurance coverage declaration form sample

The fire insurance coverage declaration form sample provides a clear summary of the insured property's details, coverage limits, and policy terms. It serves as an official document outlining the specifics of protection against fire-related damages. This form is essential for both policyholders and insurers to verify the extent of fire risk coverage.

What specific coverage details are required in the Insurance Declaration Form?

The Insurance Declaration Form must include the insured item's description, coverage limits, and the policy period. Detailed information about the risks covered and any deductibles applied is essential. Accurate and complete coverage details ensure proper validation and claims processing.

How should discrepancies in declared asset values be reported on the form?

Any discrepancies in asset values should be clearly noted in the remarks section of the form. It is critical to provide an explanation along with supporting documentation reflecting the corrected values. Transparent reporting of discrepancies prevents future disputes and improves claim accuracy.

Which supporting documents must accompany the filled declaration form?

The form must be submitted with proof of ownership documents, such as bills of sale or purchase receipts. Additionally, appraisals or valuation certificates may be required to verify asset values. These documents collectively substantiate the information declared and strengthen the insurance application.

Are there unique declaration requirements for commercial vs. personal insurance policies?

Yes, commercial insurance policies often require detailed financial statements and business operation descriptions. In contrast, personal policies focus more on individual assets and personal information. Understanding these unique requirements ensures the correct and complete submission of the declaration form.

What are the common errors that lead to rejection of an Insurance Declaration Form?

Common errors include incomplete information, lack of supporting documents, and inaccurate asset valuations. Failure to disclose material changes or discrepancies can also lead to form rejection. Ensuring accuracy and completeness is key to a successful insurance declaration process.