A Loan Contract Form Sample provides a structured template outlining the terms and conditions agreed upon by the lender and borrower. It includes crucial details such as loan amount, interest rate, repayment schedule, and default consequences. This document ensures clarity and legal protection for both parties throughout the loan process.

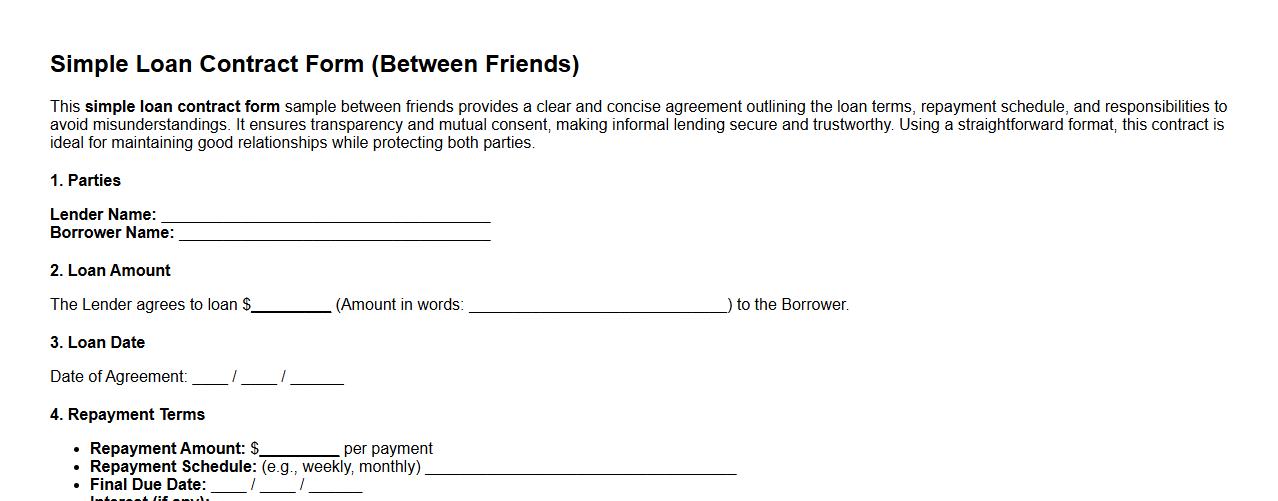

Simple loan contract form sample between friends

This simple loan contract form sample between friends provides a clear and concise agreement outlining the loan terms, repayment schedule, and responsibilities to avoid misunderstandings. It ensures transparency and mutual consent, making informal lending secure and trustworthy. Using a straightforward format, this contract is ideal for maintaining good relationships while protecting both parties.

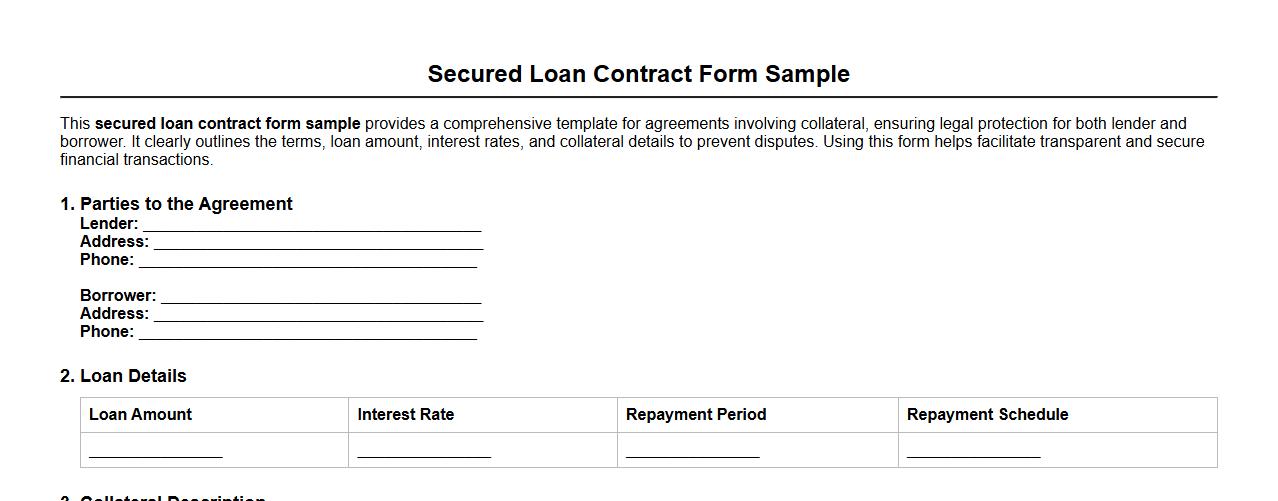

Secured loan contract form sample with collateral

This secured loan contract form sample provides a comprehensive template for agreements involving collateral, ensuring legal protection for both lender and borrower. It clearly outlines the terms, loan amount, interest rates, and collateral details to prevent disputes. Using this form helps facilitate transparent and secure financial transactions.

Business loan contract form sample PDF download

Download a business loan contract form sample PDF to streamline your loan agreement process. This document ensures clear terms and conditions for both lenders and borrowers. Access a professional template that simplifies contract creation and enhances legal clarity.

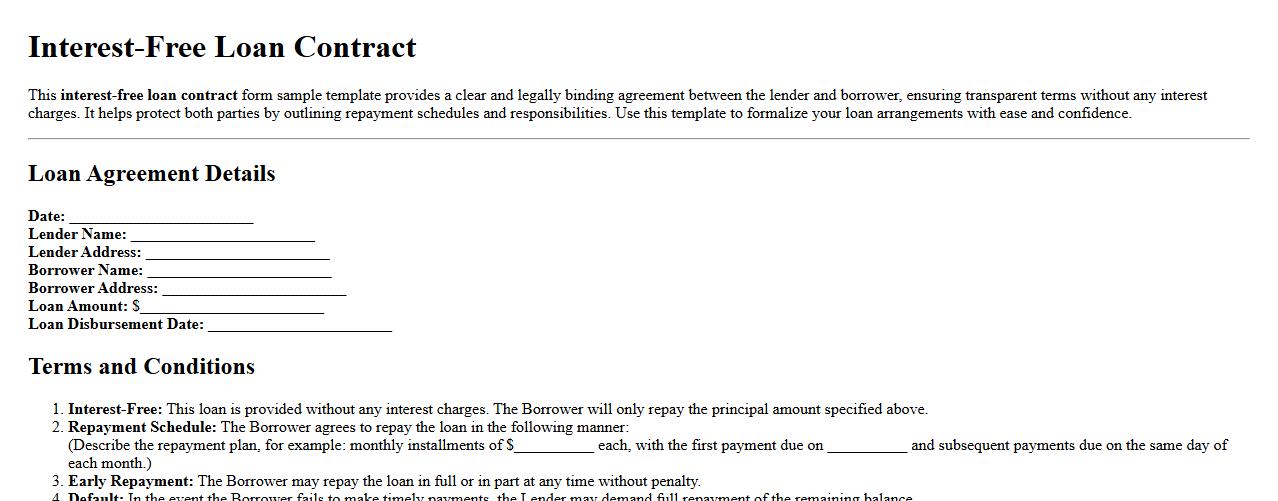

Interest-free loan contract form sample template

This interest-free loan contract form sample template provides a clear and legally binding agreement between the lender and borrower, ensuring transparent terms without any interest charges. It helps protect both parties by outlining repayment schedules and responsibilities. Use this template to formalize your loan arrangements with ease and confidence.

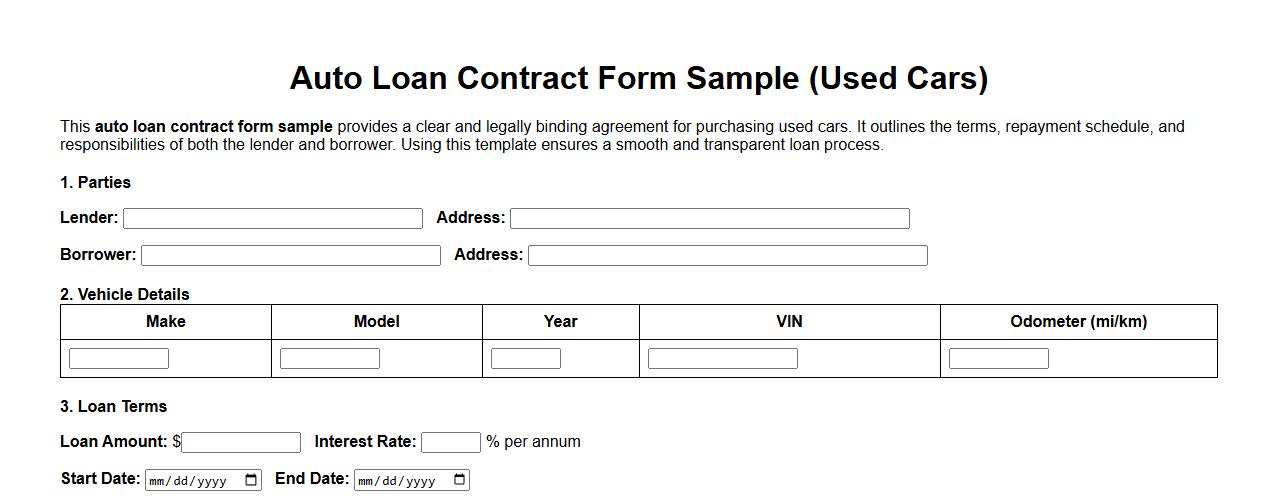

Auto loan contract form sample for used cars

This auto loan contract form sample provides a clear and legally binding agreement for purchasing used cars. It outlines the terms, repayment schedule, and responsibilities of both the lender and borrower. Using this template ensures a smooth and transparent loan process.

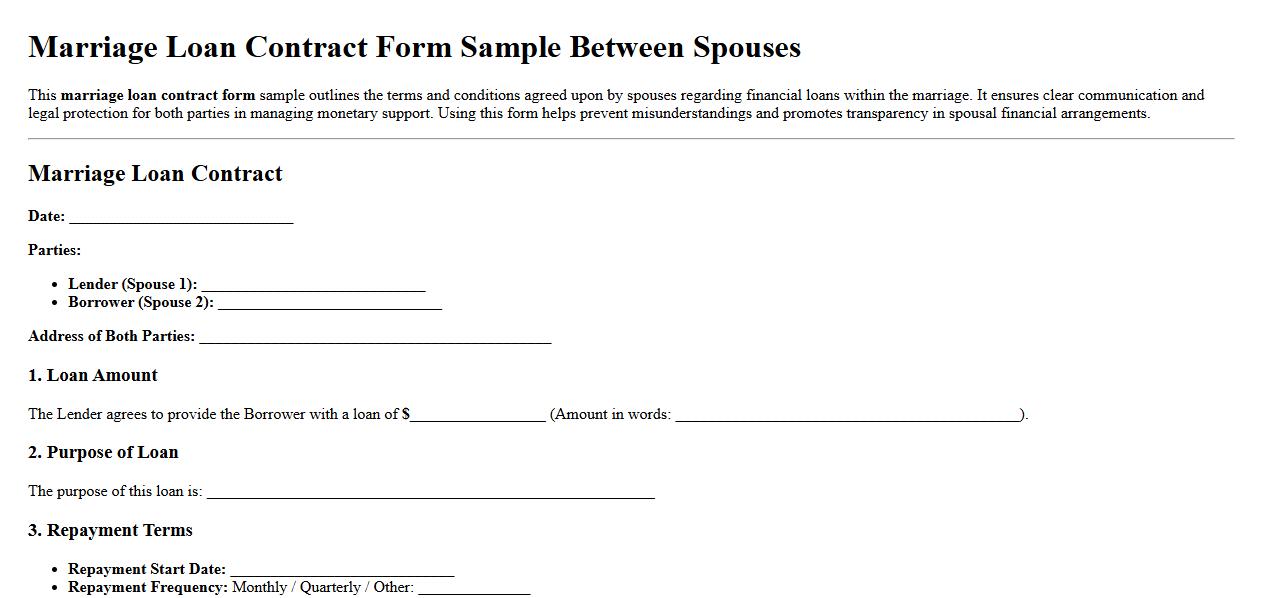

Marriage loan contract form sample between spouses

This marriage loan contract form sample outlines the terms and conditions agreed upon by spouses regarding financial loans within the marriage. It ensures clear communication and legal protection for both parties in managing monetary support. Using this form helps prevent misunderstandings and promotes transparency in spousal financial arrangements.

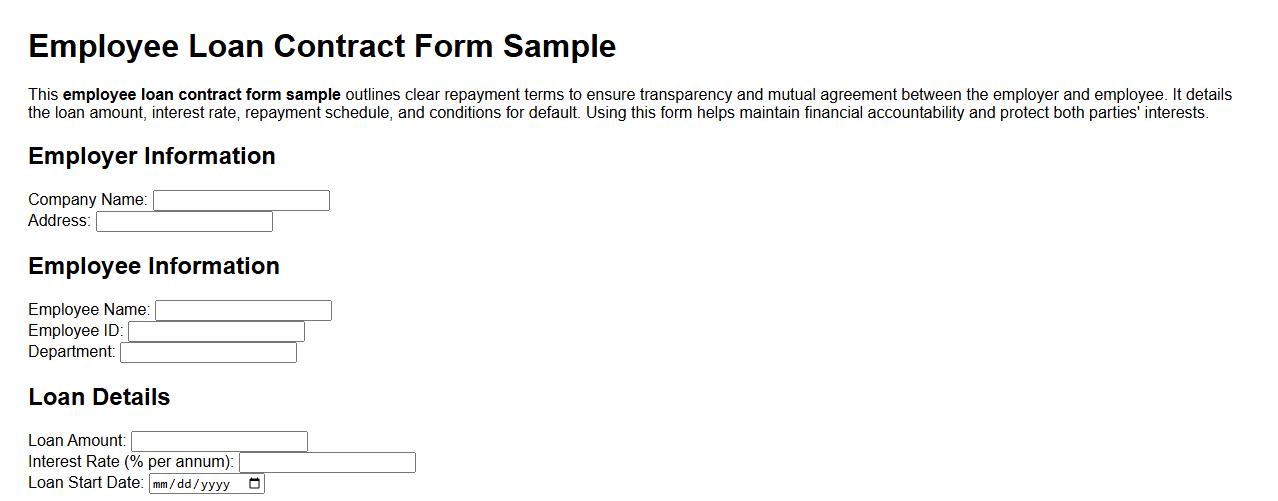

Employee loan contract form sample with repayment terms

This employee loan contract form sample outlines clear repayment terms to ensure transparency and mutual agreement between the employer and employee. It details the loan amount, interest rate, repayment schedule, and conditions for default. Using this form helps maintain financial accountability and protect both parties' interests.

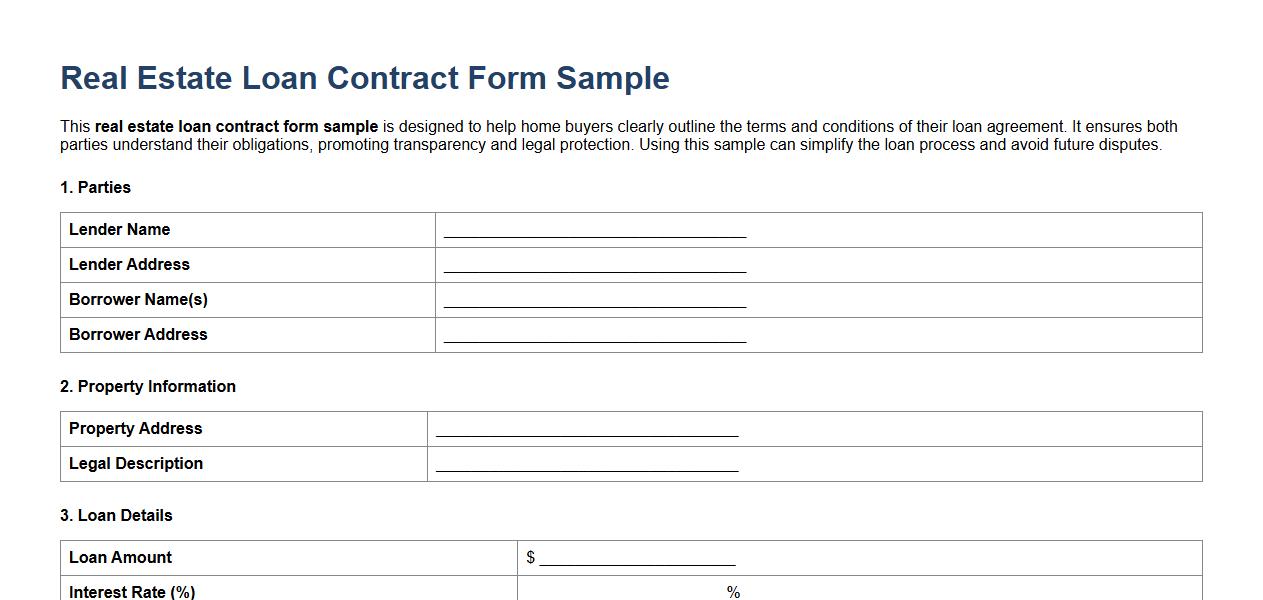

Real estate loan contract form sample for home buyers

This real estate loan contract form sample is designed to help home buyers clearly outline the terms and conditions of their loan agreement. It ensures both parties understand their obligations, promoting transparency and legal protection. Using this sample can simplify the loan process and avoid future disputes.

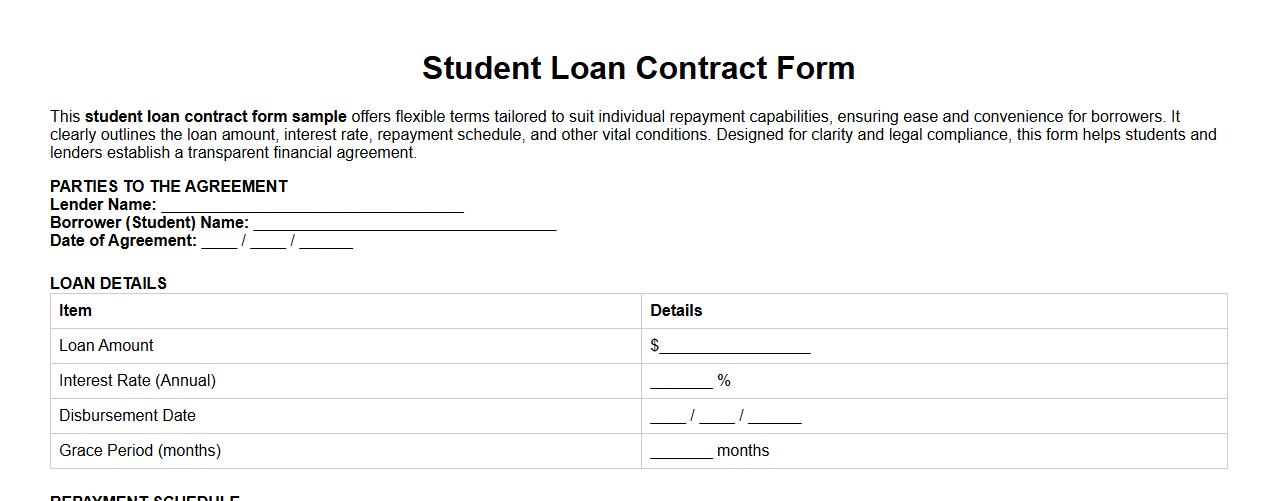

Student loan contract form sample with flexible terms

This student loan contract form sample offers flexible terms tailored to suit individual repayment capabilities, ensuring ease and convenience for borrowers. It clearly outlines the loan amount, interest rate, repayment schedule, and other vital conditions. Designed for clarity and legal compliance, this form helps students and lenders establish a transparent financial agreement.

What are the essential clauses required in a small business loan contract form?

A small business loan contract must include clauses regarding the loan amount, interest rate, and repayment schedule to define clear financial expectations. It should also specify the purpose of the loan and any collateral involved to protect both parties. Additionally, default and remedy clauses are critical to outline the consequences of non-payment and the lender's rights.

How does a co-signer affect the terms of a personal loan contract letter?

A co-signer guarantees the loan by agreeing to take responsibility if the primary borrower defaults, which reduces the lender's risk. This involvement generally leads to more favorable loan terms, like lower interest rates and higher loan amounts. However, the co-signer shares equal liability, making their credit equally impacted by the loan's performance.

Which state-specific regulations must be reflected in a mortgage loan contract form?

A mortgage loan contract must comply with state-specific laws such as usury limits and foreclosure processes to ensure legality. Disclosure requirements unique to the state, including property taxes and insurance obligations, must also be included. These regulations protect borrowers and lenders by providing transparency and legal clarity.

What documentation is needed to validate identity in a peer-to-peer loan contract?

Validating identity in a peer-to-peer loan contract requires government-issued photo identification, such as a driver's license or passport. Additionally, proof of address like utility bills may be necessary to confirm residence. These documents help prevent fraud and ensure the parties involved are legitimate.

How should late payment penalties be clearly stated in a student loan contract letter?

Late payment penalties must be explicitly defined, including the amount or percentage charged and the timeframe after which penalties apply. The contract should also explain the impact of late payments on credit scores and potential additional fees. Clear wording ensures borrowers understand the consequences of missing deadlines.