A Payroll Checklist ensures accurate and timely processing of employee payments by systematically tracking essential payroll tasks. It includes verifying employee hours, calculating wages, deducting taxes, and reviewing compliance with labor laws. Utilizing a comprehensive Payroll Checklist minimizes errors and enhances payroll efficiency.

Year-end payroll checklist for small businesses

Stay organized with this comprehensive year-end payroll checklist designed specifically for small businesses. It ensures all payroll tasks are completed accurately and on time, helping to avoid penalties and streamline tax filing. Use this guide to review employee wages, update tax forms, and prepare for the new fiscal year seamlessly.

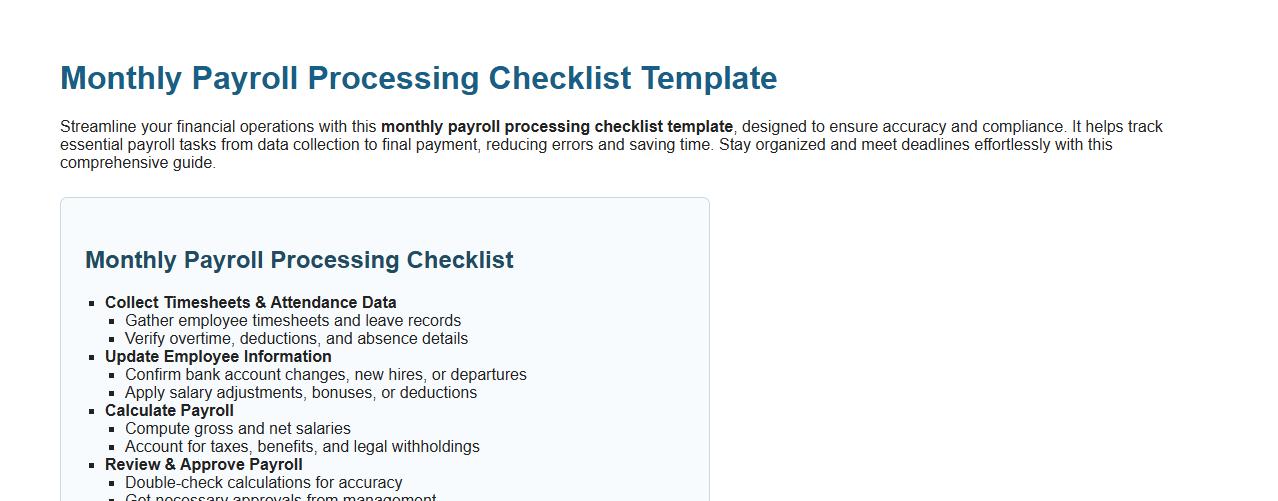

Monthly payroll processing checklist template

Streamline your financial operations with this monthly payroll processing checklist template, designed to ensure accuracy and compliance. It helps track essential payroll tasks from data collection to final payment, reducing errors and saving time. Stay organized and meet deadlines effortlessly with this comprehensive guide.

Payroll checklist for new employee onboarding

A payroll checklist for new employee onboarding ensures accurate and timely processing of salaries by verifying essential information such as tax forms, bank details, and employment agreements. This organized approach helps streamline payroll setup and avoids delays in compensation. Implementing a comprehensive checklist enhances compliance and employee satisfaction from day one.

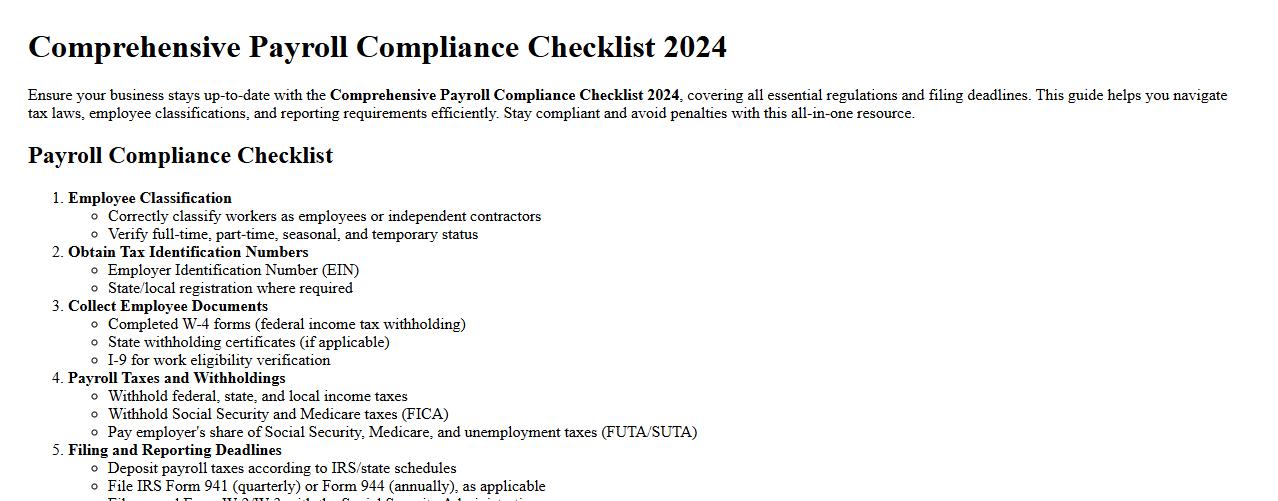

Comprehensive payroll compliance checklist 2024

Ensure your business stays up-to-date with the Comprehensive Payroll Compliance Checklist 2024, covering all essential regulations and filing deadlines. This guide helps you navigate tax laws, employee classifications, and reporting requirements efficiently. Stay compliant and avoid penalties with this all-in-one resource.

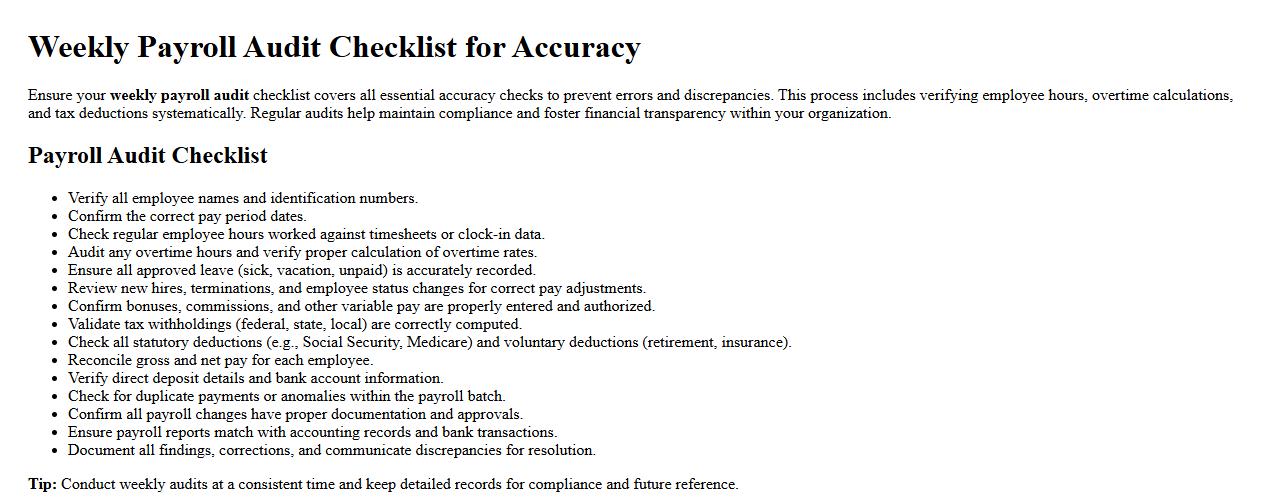

Weekly payroll audit checklist for accuracy

Ensure your weekly payroll audit checklist covers all essential accuracy checks to prevent errors and discrepancies. This process includes verifying employee hours, overtime calculations, and tax deductions systematically. Regular audits help maintain compliance and foster financial transparency within your organization.

Payroll tax filing checklist for employers

Employers must follow a comprehensive payroll tax filing checklist to ensure timely and accurate submission of all required tax documents. This checklist includes gathering employee information, calculating tax withholdings, and submitting federal, state, and local payroll taxes. Proper adherence helps avoid penalties and keeps payroll operations compliant with tax regulations.

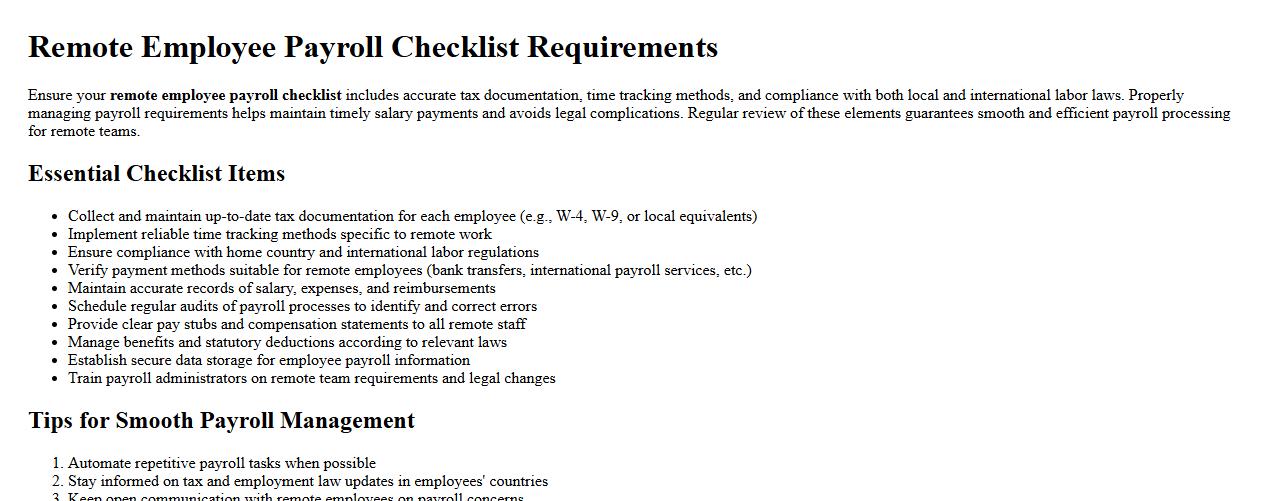

Remote employee payroll checklist requirements

Ensure your remote employee payroll checklist includes accurate tax documentation, time tracking methods, and compliance with both local and international labor laws. Properly managing payroll requirements helps maintain timely salary payments and avoids legal complications. Regular review of these elements guarantees smooth and efficient payroll processing for remote teams.

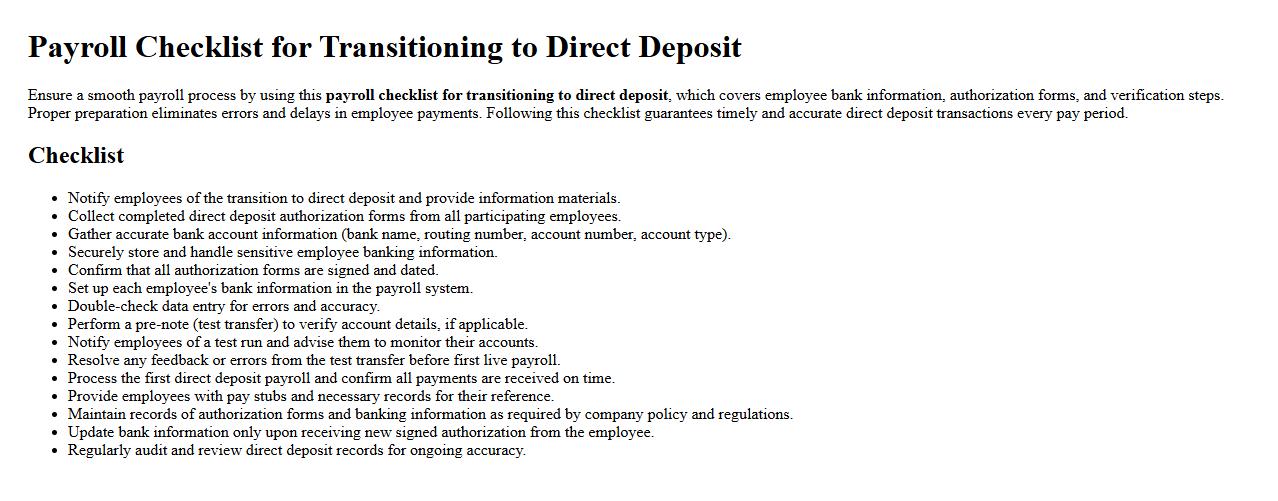

Payroll checklist for transitioning to direct deposit

Ensure a smooth payroll process by using this payroll checklist for transitioning to direct deposit, which covers employee bank information, authorization forms, and verification steps. Proper preparation eliminates errors and delays in employee payments. Following this checklist guarantees timely and accurate direct deposit transactions every pay period.

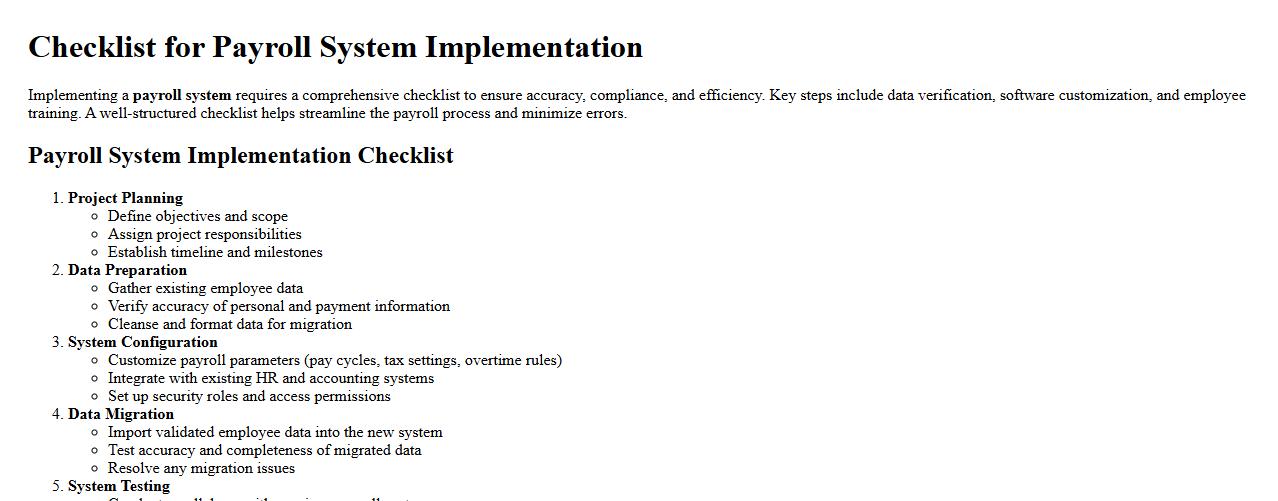

Checklist for payroll system implementation

Implementing a payroll system requires a comprehensive checklist to ensure accuracy, compliance, and efficiency. Key steps include data verification, software customization, and employee training. A well-structured checklist helps streamline the payroll process and minimize errors.

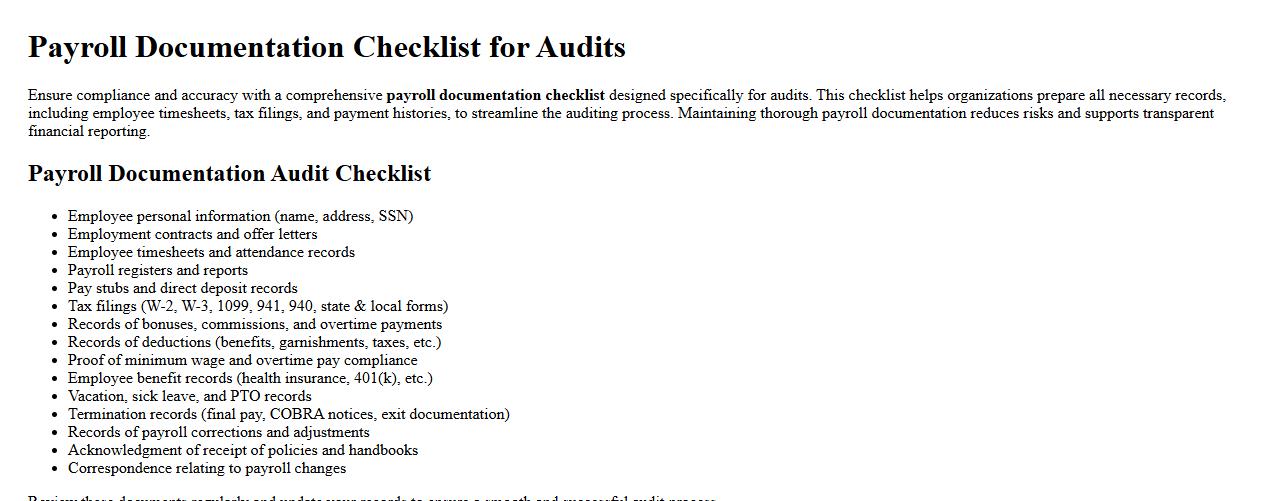

Payroll documentation checklist for audits

Ensure compliance and accuracy with a comprehensive payroll documentation checklist designed specifically for audits. This checklist helps organizations prepare all necessary records, including employee timesheets, tax filings, and payment histories, to streamline the auditing process. Maintaining thorough payroll documentation reduces risks and supports transparent financial reporting.

What essential items must a payroll checklist letter include for compliance?

A payroll checklist letter must include employee details such as names, identification numbers, and pay rates to ensure accurate payroll processing. It should also list all deductions, including taxes, benefits, and garnishments, reflecting current legal requirements. Additionally, the letter must specify payment dates and methods to maintain transparency and compliance with labor laws.

How should discrepancies be documented in a payroll checklist letter?

Discrepancies should be clearly identified with a detailed description of the issue, including the affected employees and affected amounts. The letter must outline steps taken to resolve the discrepancy and proposed timelines for correction. Maintaining a professional, factual tone while highlighting the importance of accurate payroll helps ensure clarity and accountability.

What signatures are required on a payroll checklist authorization letter?

A payroll checklist authorization letter typically requires signatures from the payroll manager or officer and the human resources representative. Additionally, authorization from a senior executive such as the finance director or company CEO adds a level of official approval. These signatures confirm that the payroll details have been reviewed and authorized for processing, ensuring compliance and accountability.

How can digital payroll checklist letters ensure data security?

Digital payroll checklist letters can ensure data security by utilizing encryption during transmission and storage to protect sensitive employee information. Access controls and authentication measures restrict unauthorized viewing or editing of payroll data. Regular audits and compliance with data privacy regulations further enhance the security of digital payroll communications.

What audit trail details are necessary in a payroll checklist communication?

An effective audit trail must include timestamps showing when the payroll checklist was created, reviewed, and approved. It should document changes made, identifying who made them and the reasons behind adjustments to ensure transparency. Recording these details supports compliance with regulatory standards and facilitates easier payroll audits.