A Travel Expense Reimbursement Form Sample helps employees document and submit their travel-related costs for reimbursement efficiently. This form typically includes fields for itemizing expenses such as transportation, lodging, meals, and incidentals with corresponding receipts. Organizations use these samples to streamline the approval process and ensure accurate financial tracking.

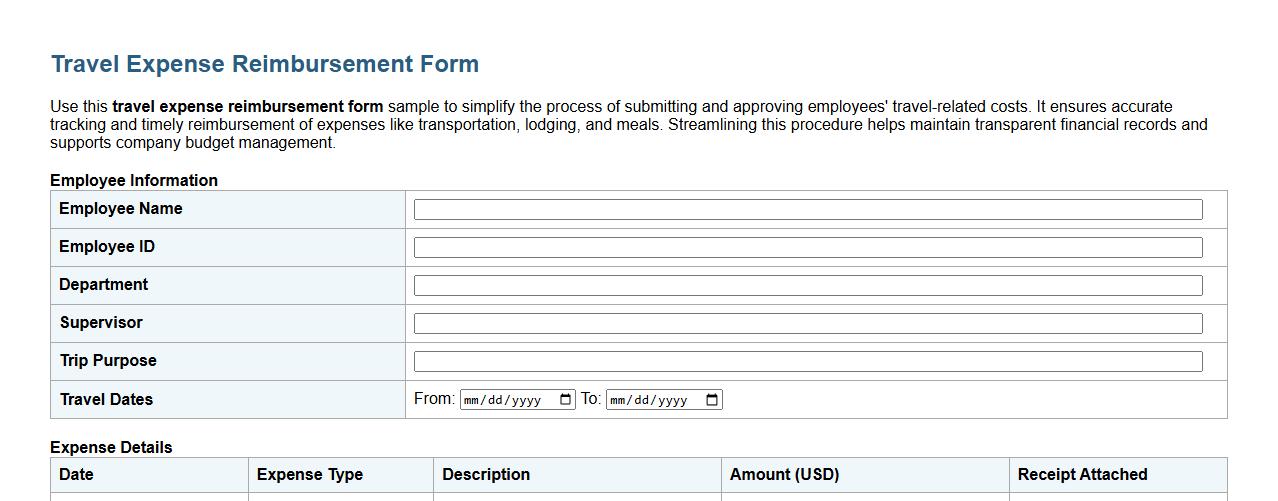

Travel expense reimbursement form sample for employees

Use this travel expense reimbursement form sample to simplify the process of submitting and approving employees' travel-related costs. It ensures accurate tracking and timely reimbursement of expenses like transportation, lodging, and meals. Streamlining this procedure helps maintain transparent financial records and supports company budget management.

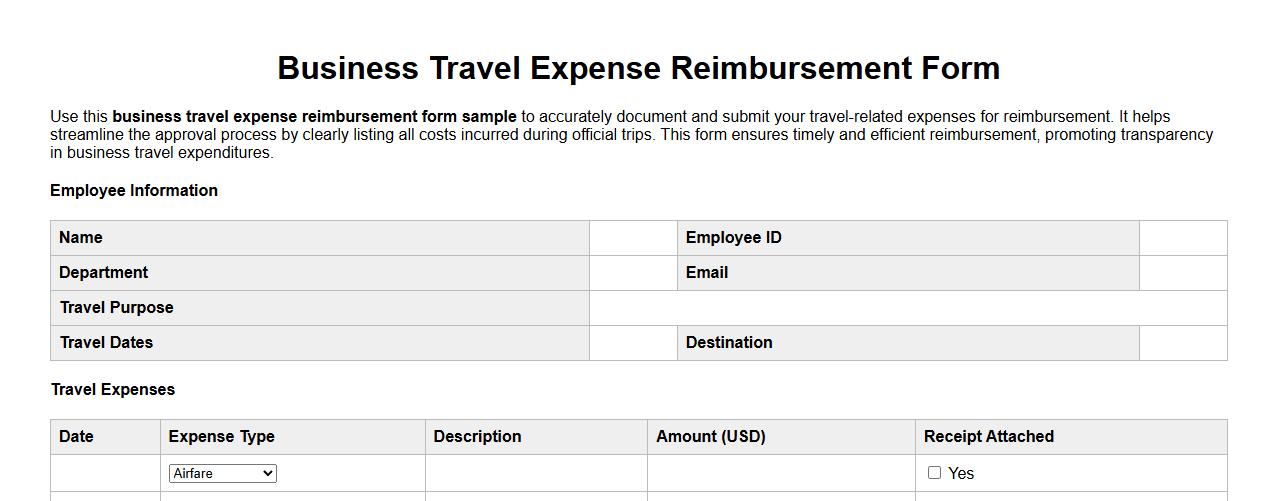

Business travel expense reimbursement form sample

Use this business travel expense reimbursement form sample to accurately document and submit your travel-related expenses for reimbursement. It helps streamline the approval process by clearly listing all costs incurred during official trips. This form ensures timely and efficient reimbursement, promoting transparency in business travel expenditures.

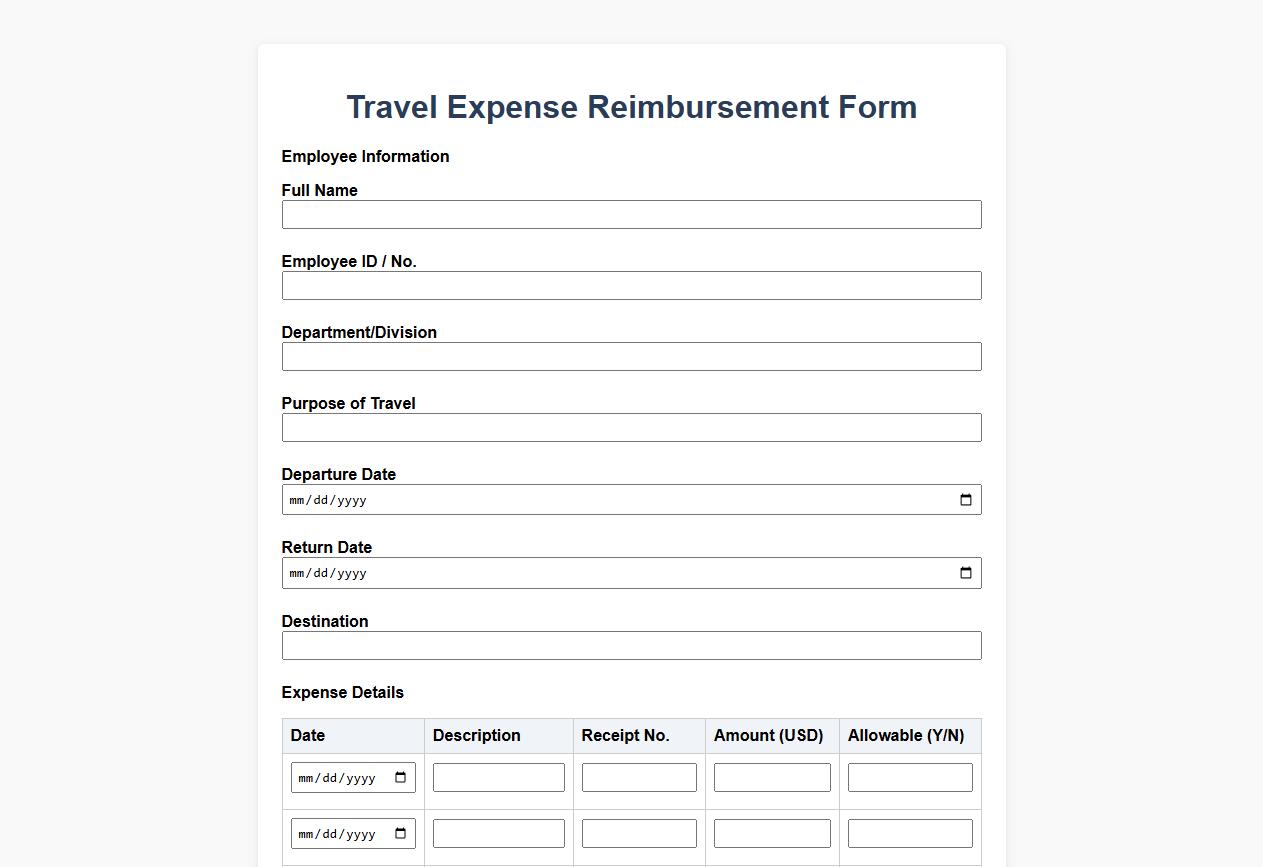

Travel expense reimbursement form sample for government employees

This travel expense reimbursement form sample is designed specifically for government employees to accurately document and claim allowable travel costs. It ensures compliance with official policies while streamlining the approval process. Utilizing this form helps maintain transparency and accountability in government travel expenditures.

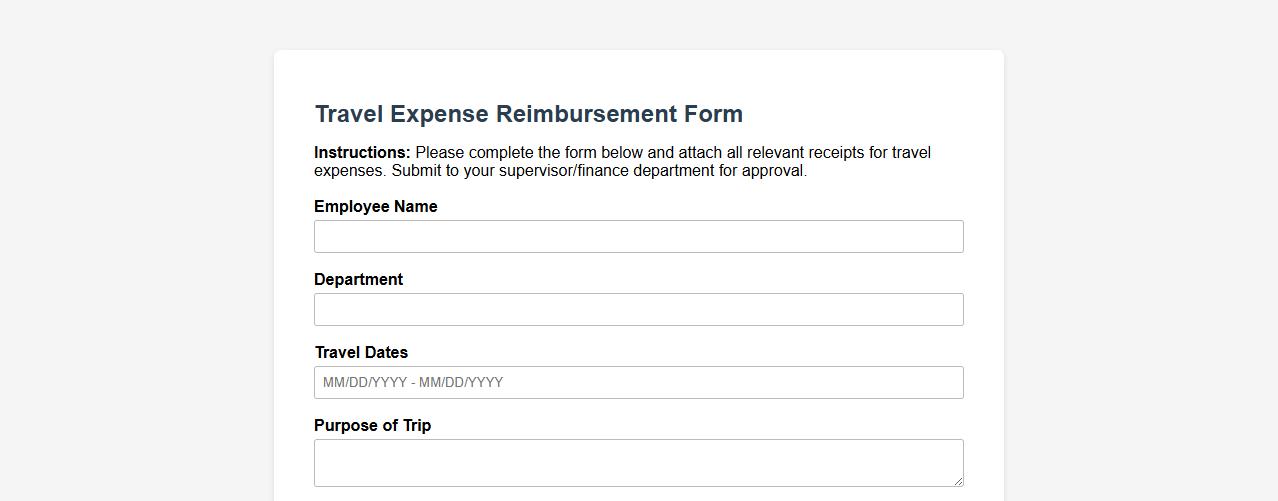

Simple travel expense reimbursement form sample

This travel expense reimbursement form sample provides a straightforward template to track and submit travel-related costs for reimbursement. Designed for ease of use, it helps ensure accurate documentation and approval of expenses. Ideal for businesses and individuals managing travel budgets efficiently.

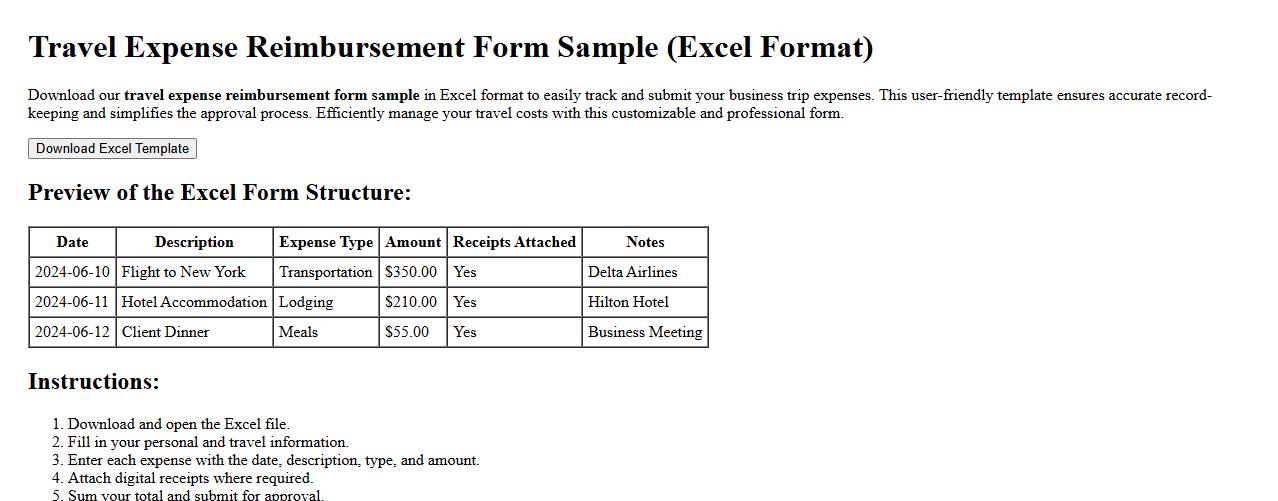

Travel expense reimbursement form sample in excel format

Download our travel expense reimbursement form sample in Excel format to easily track and submit your business trip expenses. This user-friendly template ensures accurate record-keeping and simplifies the approval process. Efficiently manage your travel costs with this customizable and professional form.

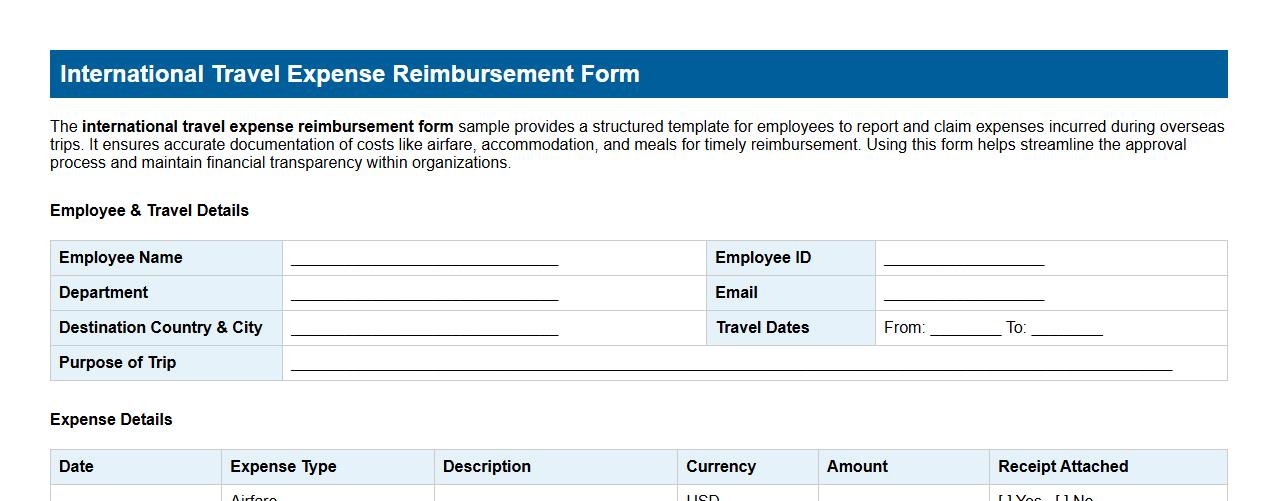

International travel expense reimbursement form sample

The international travel expense reimbursement form sample provides a structured template for employees to report and claim expenses incurred during overseas trips. It ensures accurate documentation of costs like airfare, accommodation, and meals for timely reimbursement. Using this form helps streamline the approval process and maintain financial transparency within organizations.

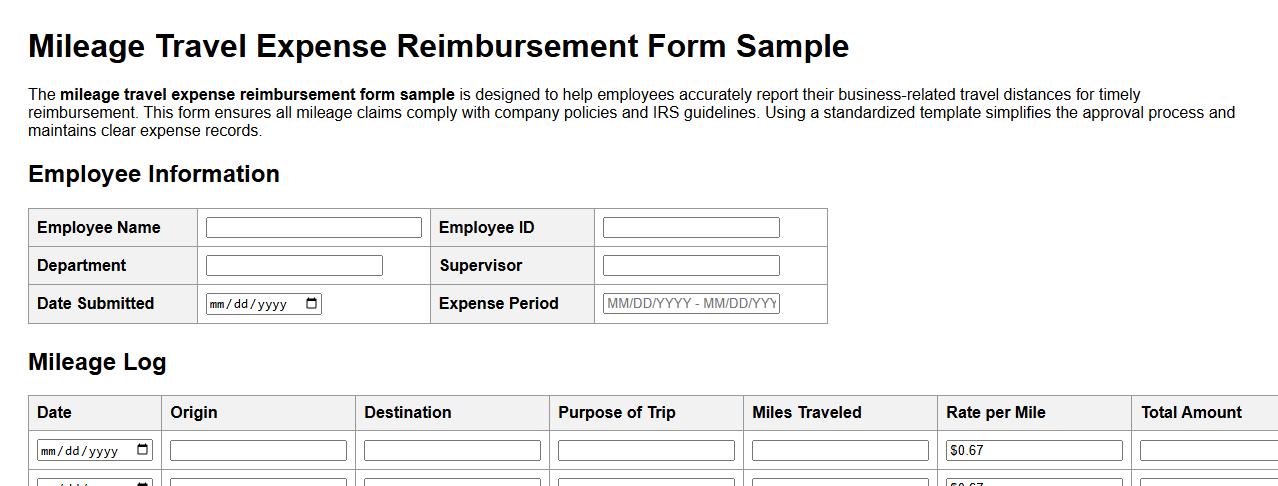

Mileage travel expense reimbursement form sample

The mileage travel expense reimbursement form sample is designed to help employees accurately report their business-related travel distances for timely reimbursement. This form ensures all mileage claims comply with company policies and IRS guidelines. Using a standardized template simplifies the approval process and maintains clear expense records.

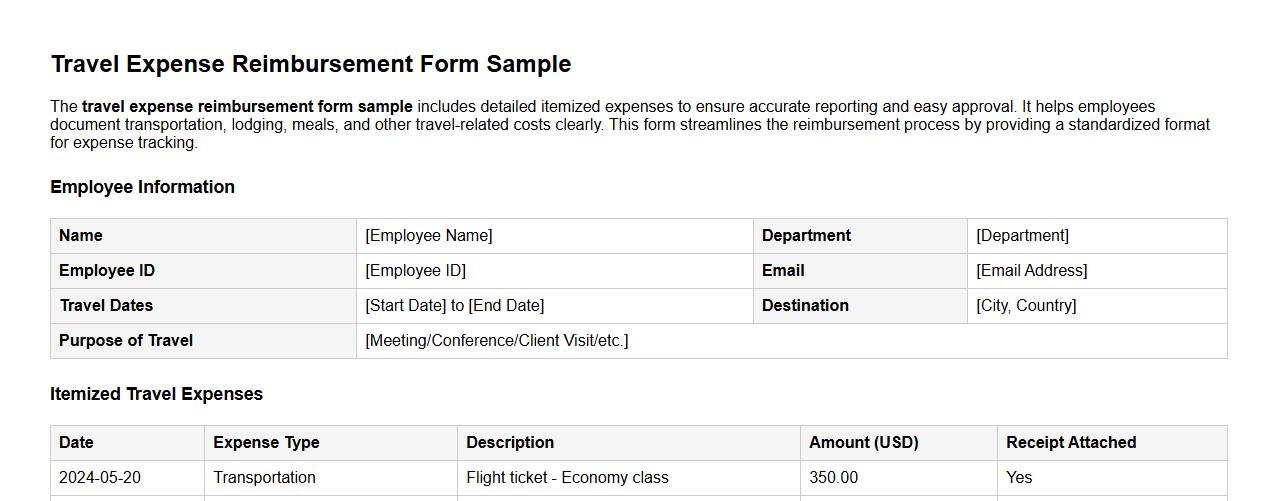

Travel expense reimbursement form sample with itemized expenses

The travel expense reimbursement form sample includes detailed itemized expenses to ensure accurate reporting and easy approval. It helps employees document transportation, lodging, meals, and other travel-related costs clearly. This form streamlines the reimbursement process by providing a standardized format for expense tracking.

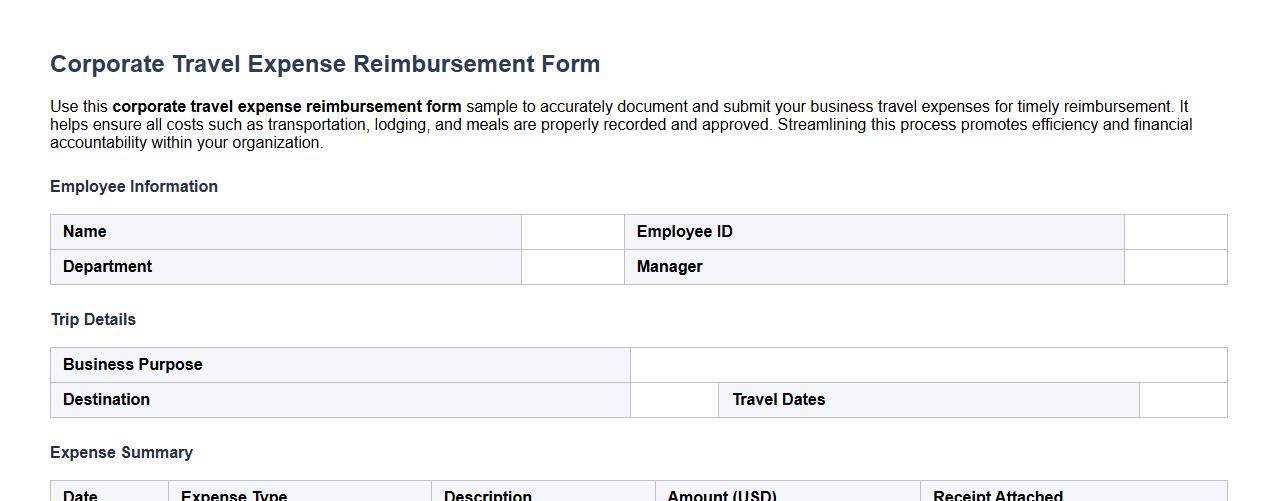

Corporate travel expense reimbursement form sample

Use this corporate travel expense reimbursement form sample to accurately document and submit your business travel expenses for timely reimbursement. It helps ensure all costs such as transportation, lodging, and meals are properly recorded and approved. Streamlining this process promotes efficiency and financial accountability within your organization.

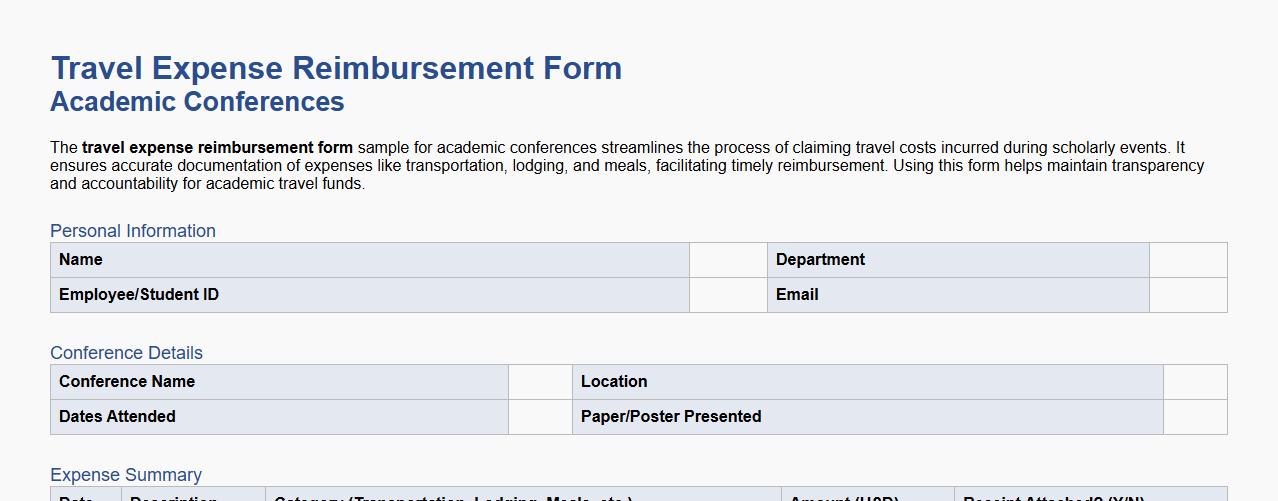

Travel expense reimbursement form sample for academic conferences

The travel expense reimbursement form sample for academic conferences streamlines the process of claiming travel costs incurred during scholarly events. It ensures accurate documentation of expenses like transportation, lodging, and meals, facilitating timely reimbursement. Using this form helps maintain transparency and accountability for academic travel funds.

What supporting receipts are required for lodging on the Travel Expense Reimbursement Form?

Receipts for lodging must be attached to the Travel Expense Reimbursement Form to validate the expenses claimed. These receipts should clearly show the hotel name, dates of stay, and the total amount paid. Without proper documentation, lodging expenses may not be reimbursed.

How should international currency expenses be reported in the form?

International currency expenses must be converted to the official currency using the exchange rate on the date of the transaction. The form requires entering both the original amount and the converted amount in the designated fields. Accurate currency reporting ensures compliance with financial policies.

Are per diem meal allowances automatically calculated or manually entered?

The per diem meal allowances are typically automatically calculated based on the destination and duration of travel. Travelers do not need to enter meal expenses manually if they opt for the per diem method. This automation simplifies the reimbursement process.

What project code section should be filled for grant-funded travel?

For grant-funded travel, the form must include the specific project code or grant number in the designated section. This ensures that expenses are charged to the correct funding source. Providing the correct project code is crucial for accurate financial tracking.

How does the form address expenses incurred before formal travel approval?

The form requires that all expenses incurred before formal travel approval be clearly indicated and may require additional justification. Some organizations may disallow reimbursement for costs incurred prior to approval. It's important to review policies to avoid non-reimbursable expenses.