A Budget Planning Checklist helps organize and prioritize financial goals by outlining income, expenses, savings, and debt management. It ensures accurate tracking of monthly spending to prevent overspending and promotes disciplined financial habits. Using this checklist supports effective money management and long-term financial stability.

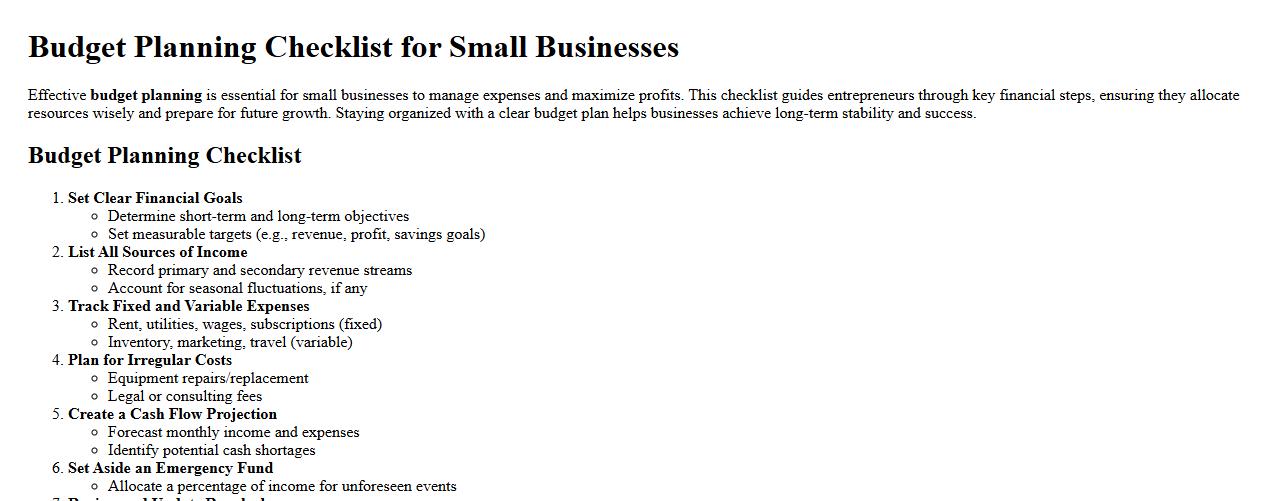

Budget planning checklist for small businesses

Effective budget planning is essential for small businesses to manage expenses and maximize profits. This checklist guides entrepreneurs through key financial steps, ensuring they allocate resources wisely and prepare for future growth. Staying organized with a clear budget plan helps businesses achieve long-term stability and success.

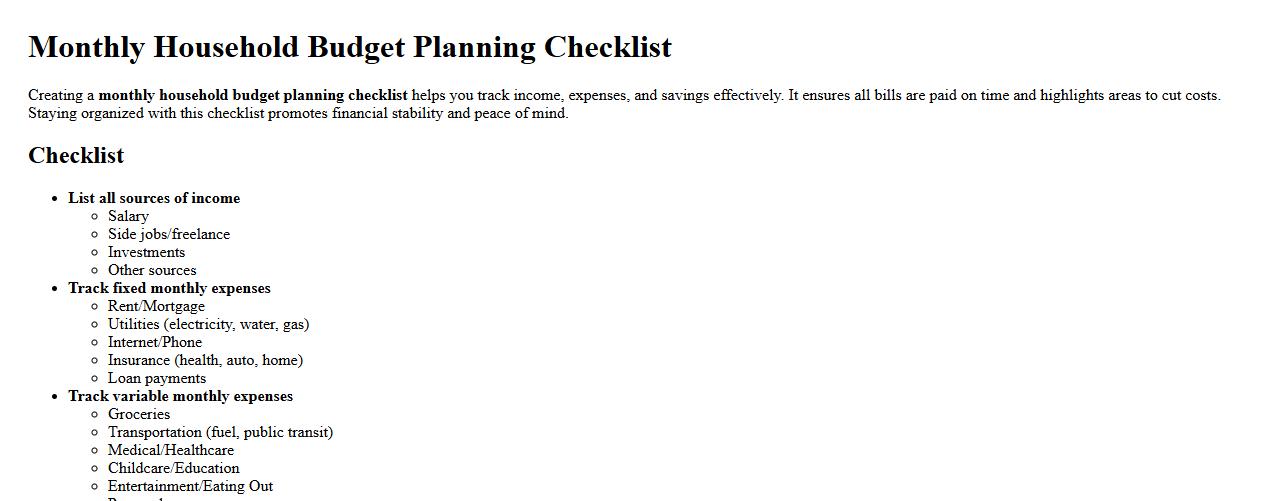

Monthly household budget planning checklist

Creating a monthly household budget planning checklist helps you track income, expenses, and savings effectively. It ensures all bills are paid on time and highlights areas to cut costs. Staying organized with this checklist promotes financial stability and peace of mind.

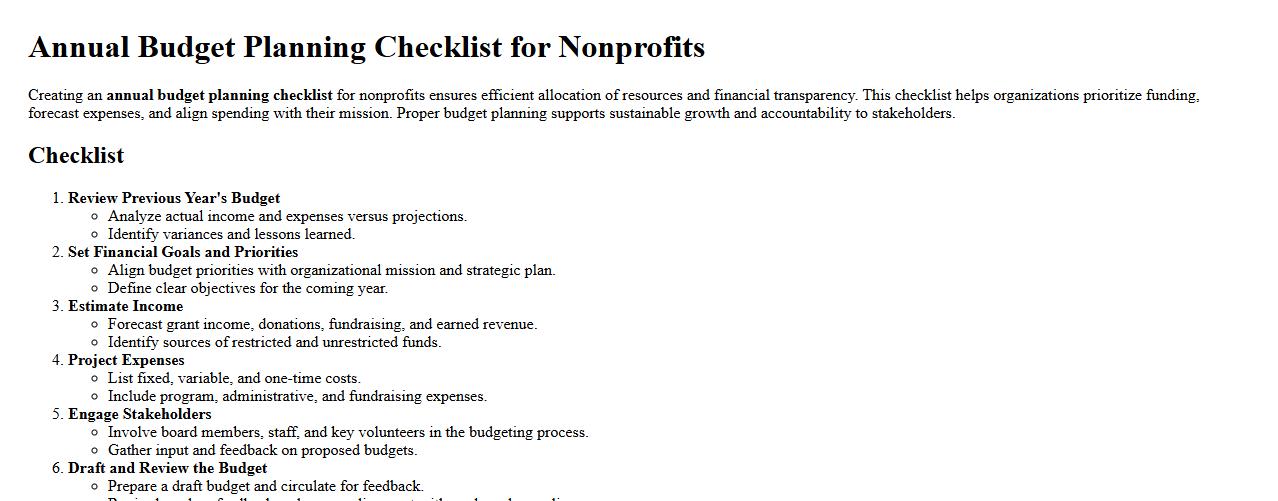

Annual budget planning checklist for nonprofits

Creating an annual budget planning checklist for nonprofits ensures efficient allocation of resources and financial transparency. This checklist helps organizations prioritize funding, forecast expenses, and align spending with their mission. Proper budget planning supports sustainable growth and accountability to stakeholders.

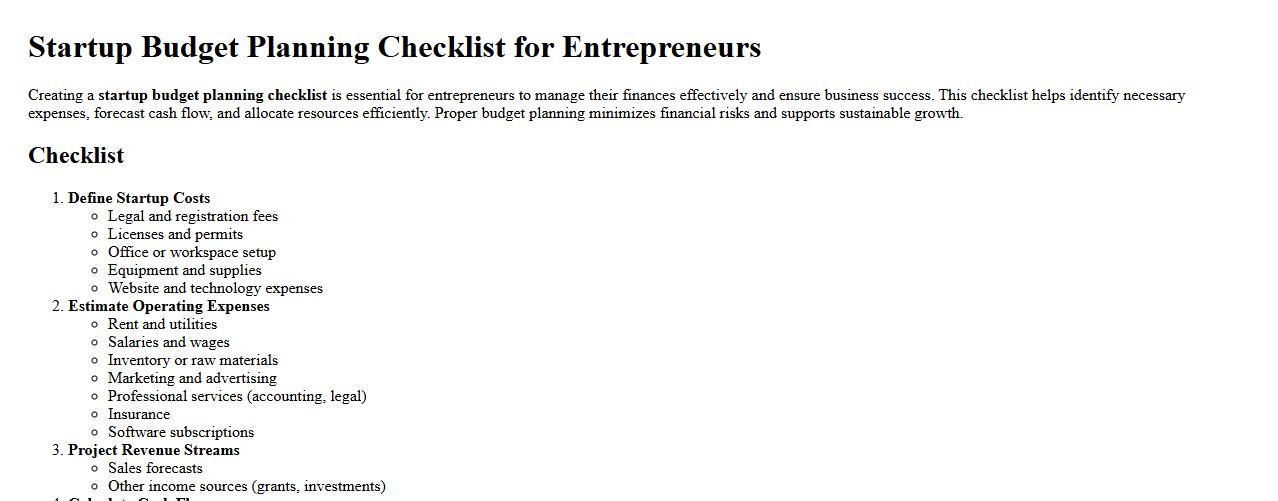

Startup budget planning checklist for entrepreneurs

Creating a startup budget planning checklist is essential for entrepreneurs to manage their finances effectively and ensure business success. This checklist helps identify necessary expenses, forecast cash flow, and allocate resources efficiently. Proper budget planning minimizes financial risks and supports sustainable growth.

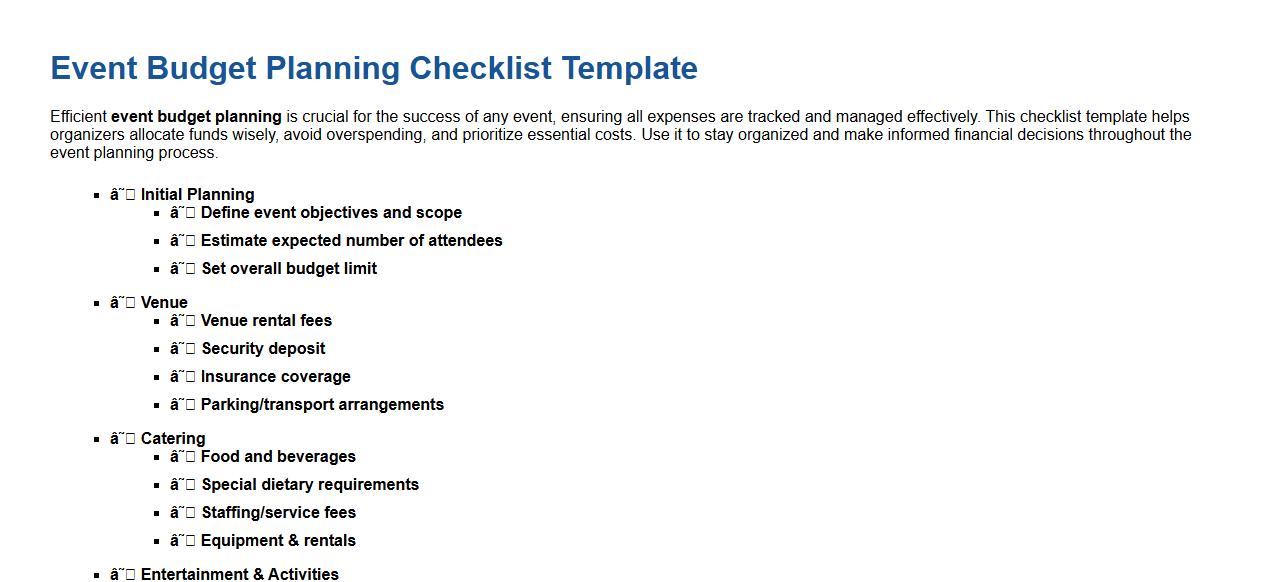

Event budget planning checklist template

Efficient event budget planning is crucial for the success of any event, ensuring all expenses are tracked and managed effectively. This checklist template helps organizers allocate funds wisely, avoid overspending, and prioritize essential costs. Use it to stay organized and make informed financial decisions throughout the event planning process.

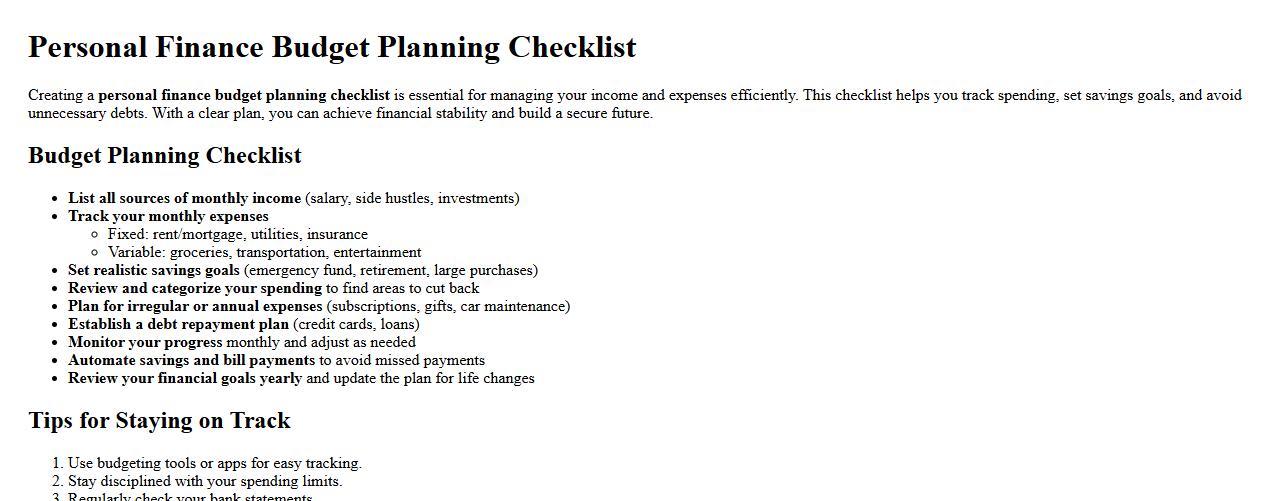

Personal finance budget planning checklist

Creating a personal finance budget planning checklist is essential for managing your income and expenses efficiently. This checklist helps you track spending, set savings goals, and avoid unnecessary debts. With a clear plan, you can achieve financial stability and build a secure future.

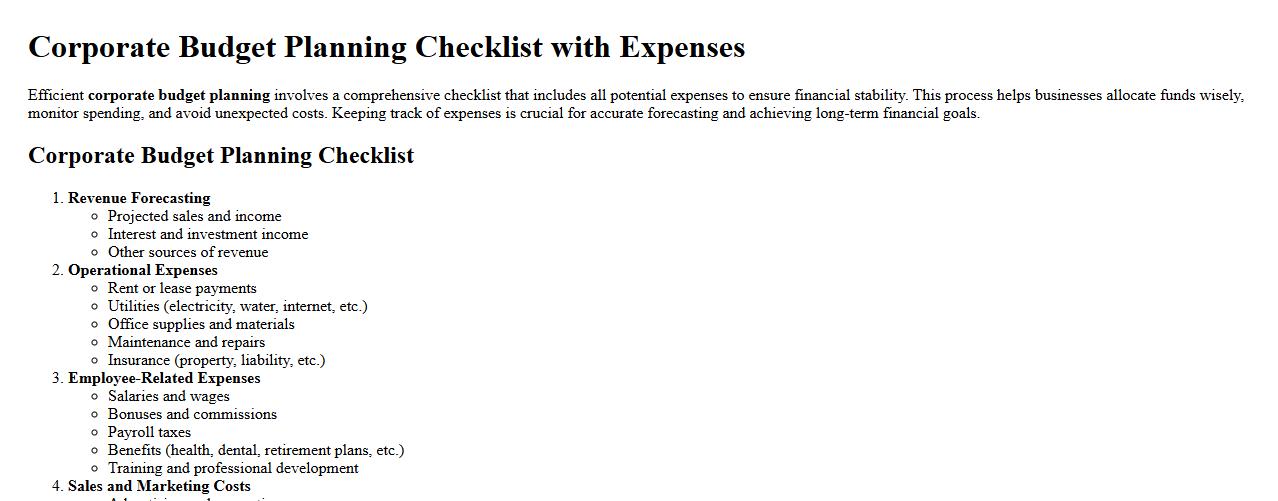

Corporate budget planning checklist with expenses

Efficient corporate budget planning involves a comprehensive checklist that includes all potential expenses to ensure financial stability. This process helps businesses allocate funds wisely, monitor spending, and avoid unexpected costs. Keeping track of expenses is crucial for accurate forecasting and achieving long-term financial goals.

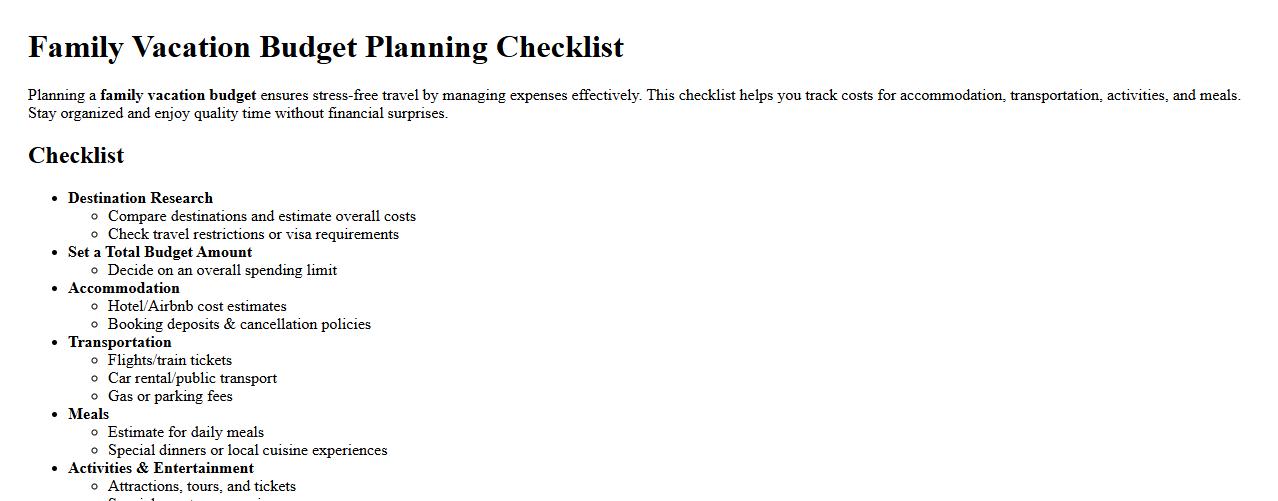

Family vacation budget planning checklist

Planning a family vacation budget ensures stress-free travel by managing expenses effectively. This checklist helps you track costs for accommodation, transportation, activities, and meals. Stay organized and enjoy quality time without financial surprises.

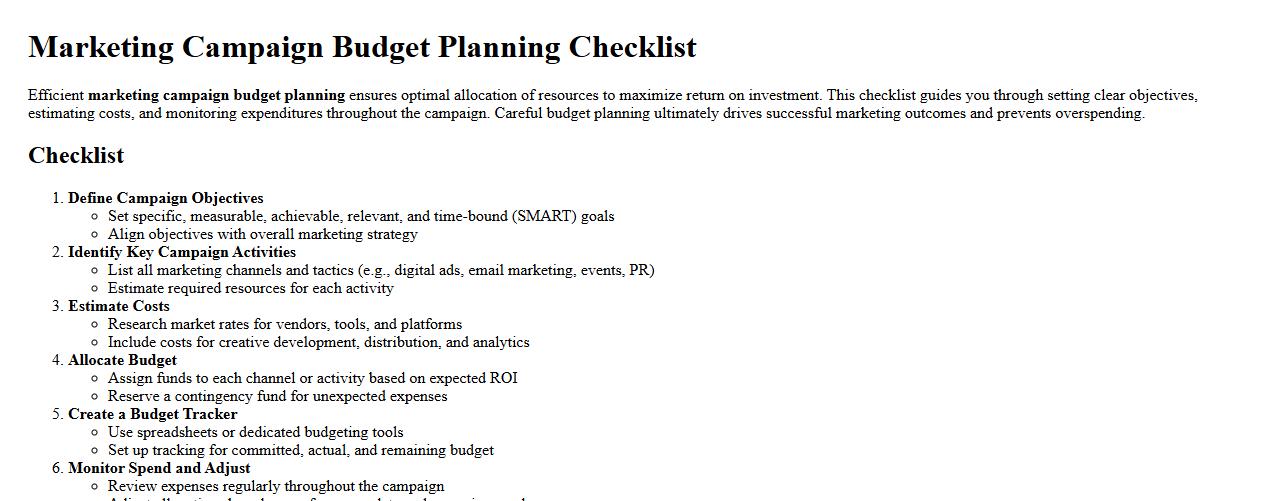

Marketing campaign budget planning checklist

Efficient marketing campaign budget planning ensures optimal allocation of resources to maximize return on investment. This checklist guides you through setting clear objectives, estimating costs, and monitoring expenditures throughout the campaign. Careful budget planning ultimately drives successful marketing outcomes and prevents overspending.

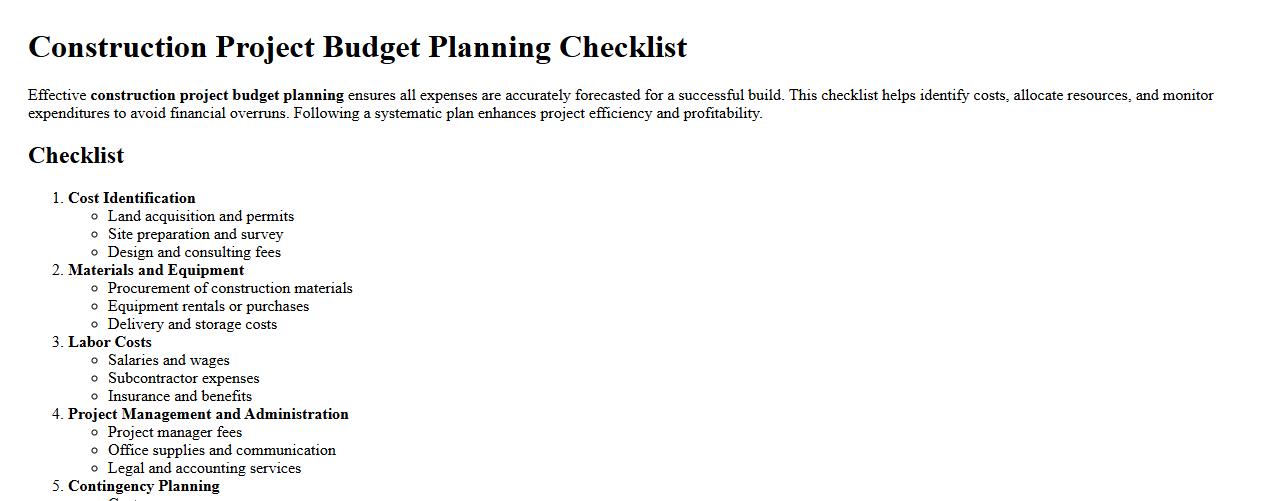

Construction project budget planning checklist

Effective construction project budget planning ensures all expenses are accurately forecasted for a successful build. This checklist helps identify costs, allocate resources, and monitor expenditures to avoid financial overruns. Following a systematic plan enhances project efficiency and profitability.

What supplemental documentation is required for each budget category?

Each budget category must be supported by detailed invoices, receipts, and contracts to ensure accuracy. These documents provide a clear audit trail and justify planned expenditures. Proper documentation facilitates transparent financial management and compliance with organizational policies.

How are variances between projected and actual expenses tracked in the checklist?

The checklist includes a section for recording variance analysis that compares budgeted amounts to actual expenses. Discrepancies are noted with explanations to identify the root causes of any deviations. This process supports ongoing budget monitoring and helps improve future forecasting accuracy.

Which approval signatures must be collected, and in what order, for finalizing the budget?

Approval signatures are required in a specific sequence starting with the department manager, followed by the finance director, and finally the chief executive officer. This hierarchical approval process ensures all stakeholders review and endorse the budget. Collecting signatures in order guarantees accountability and formal authorization.

Are contingency funds explicitly itemized or included within outlined budget totals?

Contingency funds are typically explicitly itemized as a separate line item to track reserved resources for unforeseen expenses. Including them within budget totals without specification can obscure financial risk management. Clear delineation supports prudent fiscal planning and transparency.

Does the checklist align with fiscal year reporting periods and auditing standards?

The checklist is designed to align precisely with the organization's fiscal year reporting calendar for consistency. It also complies with recognized auditing standards to facilitate thorough financial reviews. This alignment enhances the checklist's effectiveness for accurate financial reporting and audit readiness.