A Loan Assessment Form Sample helps financial institutions evaluate an applicant's creditworthiness by collecting essential personal, financial, and employment information. This form includes sections for income verification, existing debts, and loan purpose to ensure a thorough risk analysis. Proper use of a Loan Assessment Form Sample streamlines the approval process and supports informed lending decisions.

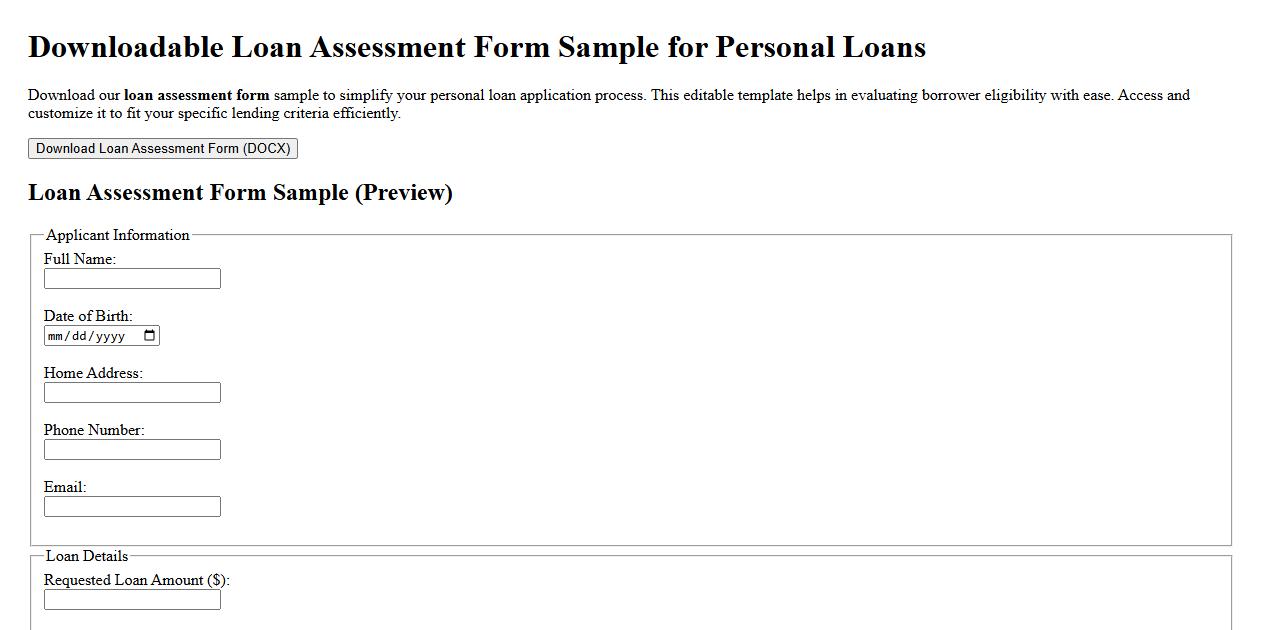

Downloadable loan assessment form sample for personal loans

Download our loan assessment form sample to simplify your personal loan application process. This editable template helps in evaluating borrower eligibility with ease. Access and customize it to fit your specific lending criteria efficiently.

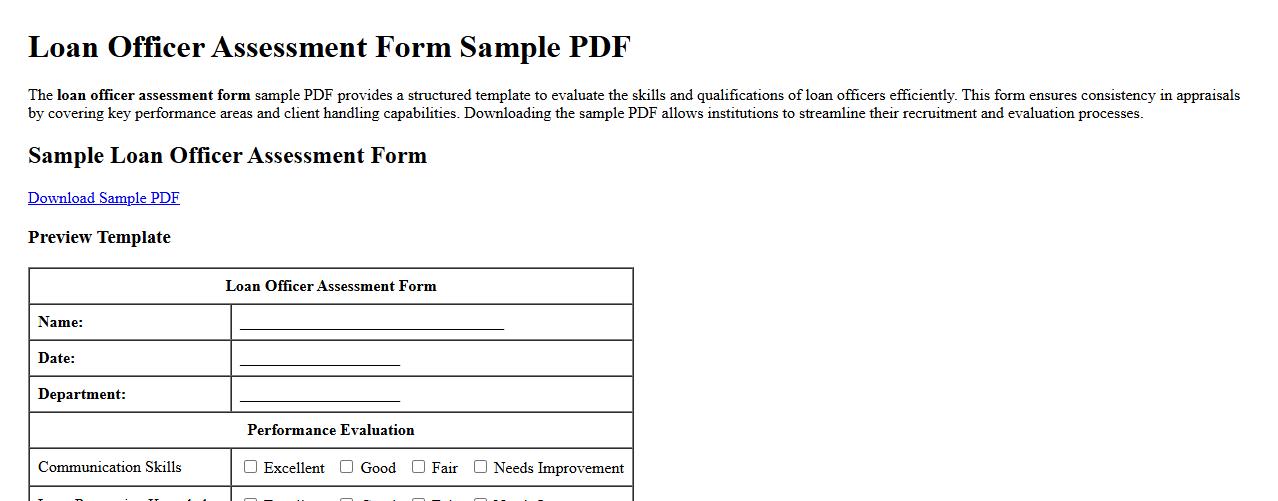

Loan officer assessment form sample PDF

The loan officer assessment form sample PDF provides a structured template to evaluate the skills and qualifications of loan officers efficiently. This form ensures consistency in appraisals by covering key performance areas and client handling capabilities. Downloading the sample PDF allows institutions to streamline their recruitment and evaluation processes.

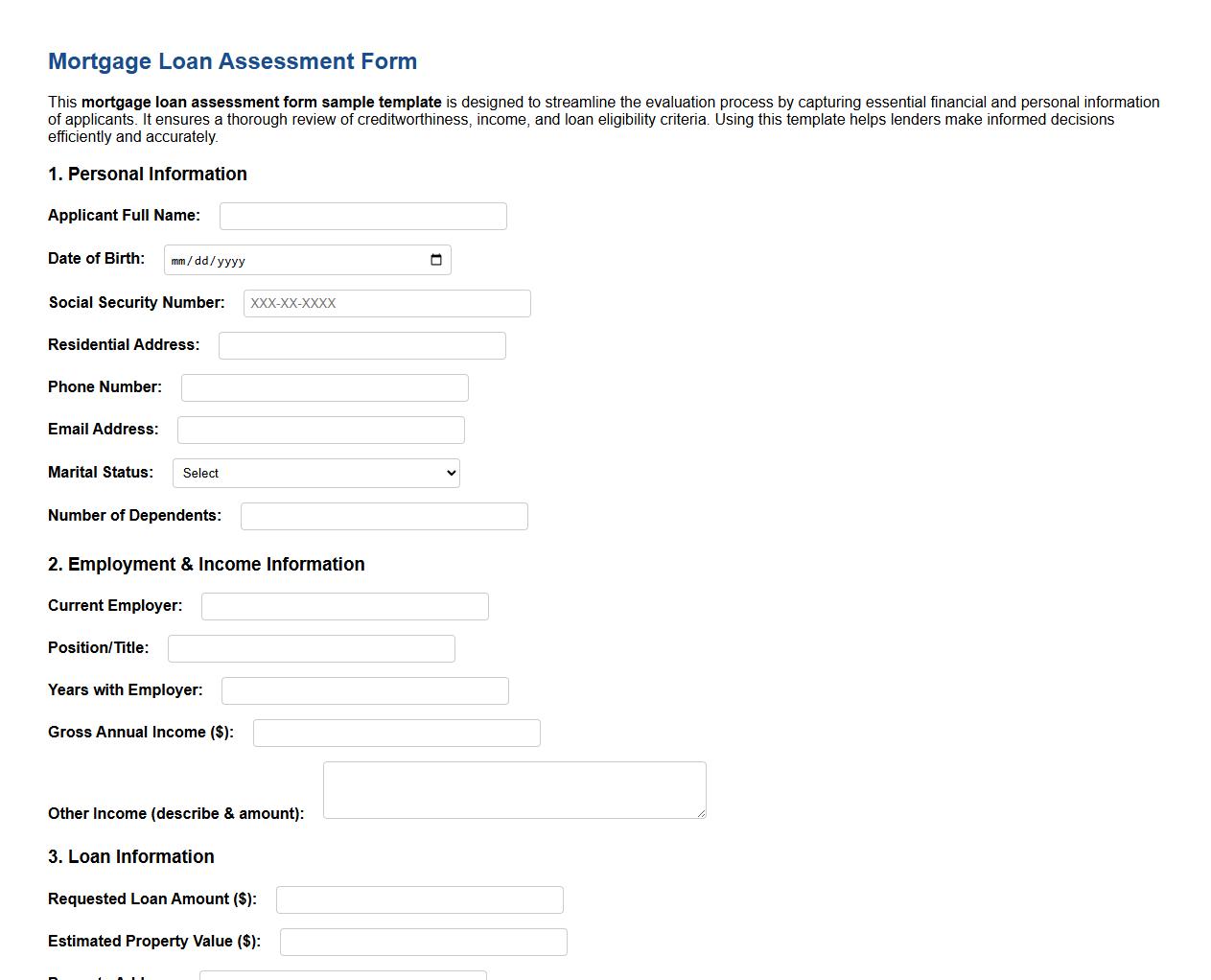

Mortgage loan assessment form sample template

This mortgage loan assessment form sample template is designed to streamline the evaluation process by capturing essential financial and personal information of applicants. It ensures a thorough review of creditworthiness, income, and loan eligibility criteria. Using this template helps lenders make informed decisions efficiently and accurately.

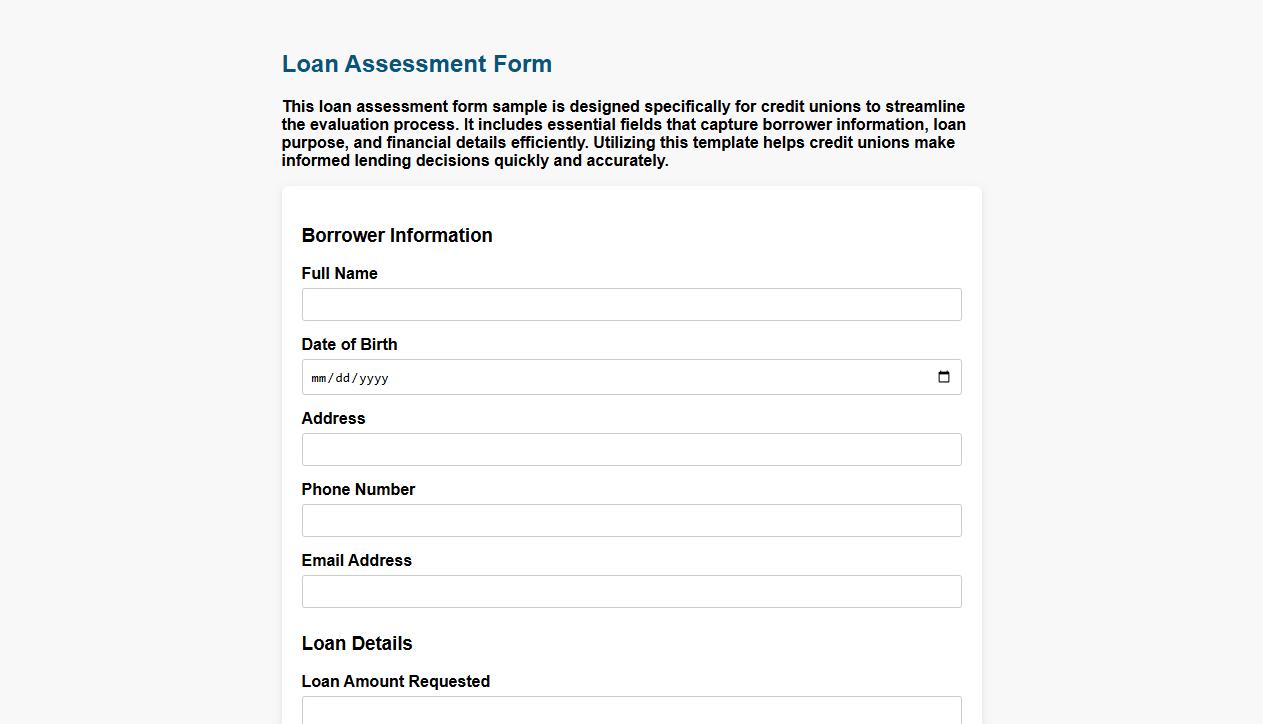

Simple loan assessment form sample for credit unions

This loan assessment form sample is designed specifically for credit unions to streamline the evaluation process. It includes essential fields that capture borrower information, loan purpose, and financial details efficiently. Utilizing this template helps credit unions make informed lending decisions quickly and accurately.

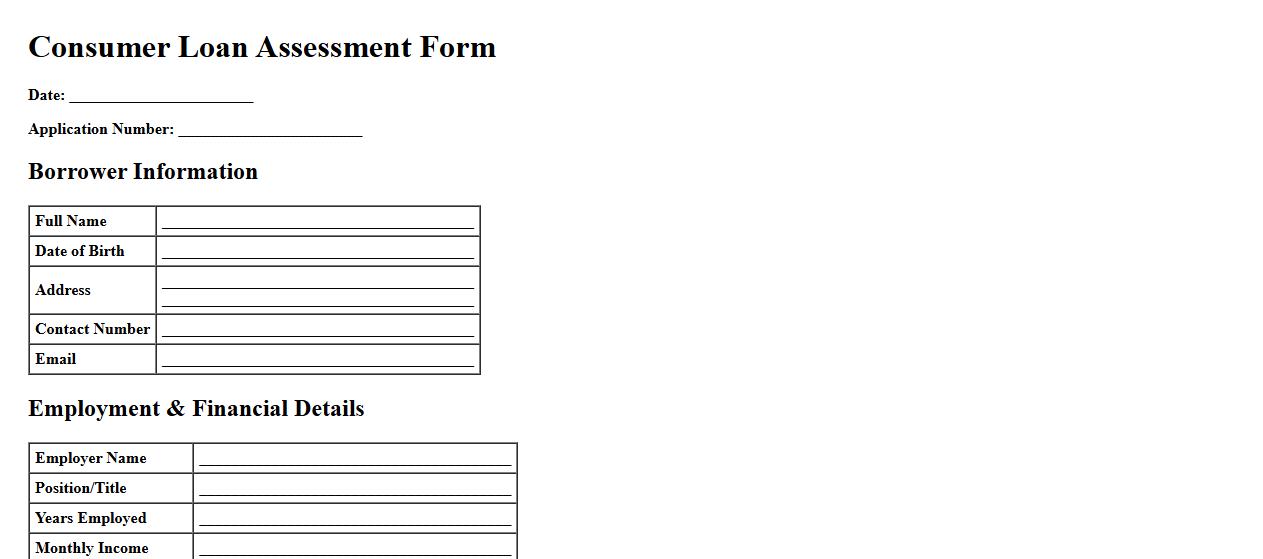

Consumer loan assessment form sample in Word

The consumer loan assessment form sample in Word provides a structured template to evaluate a borrower's financial status efficiently. It helps lenders gather essential information for making informed loan decisions while ensuring clarity and accuracy. This editable document is ideal for customizing specific loan criteria and requirements.

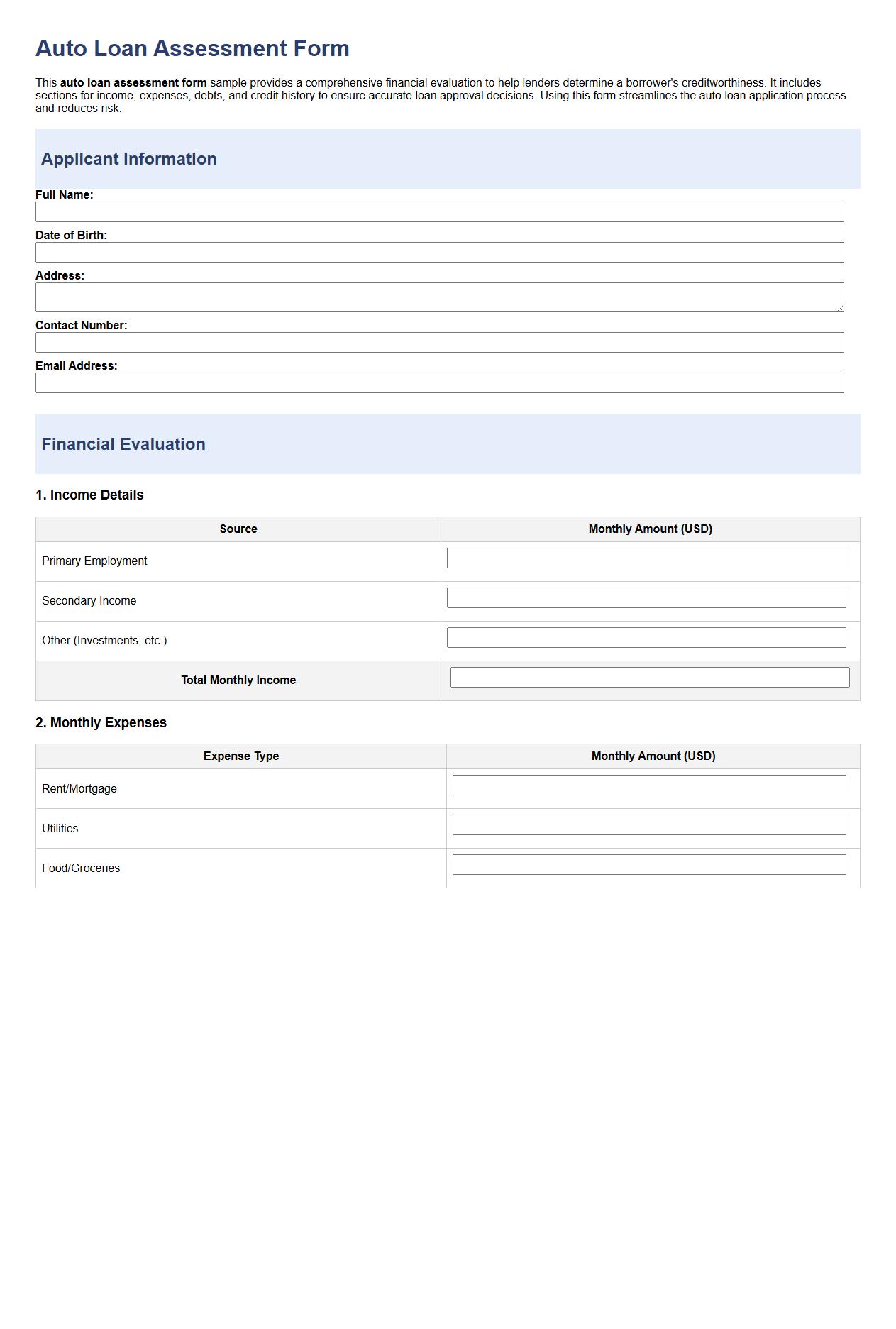

Auto loan assessment form sample with financial evaluation

This auto loan assessment form sample provides a comprehensive financial evaluation to help lenders determine a borrower's creditworthiness. It includes sections for income, expenses, debts, and credit history to ensure accurate loan approval decisions. Using this form streamlines the auto loan application process and reduces risk.

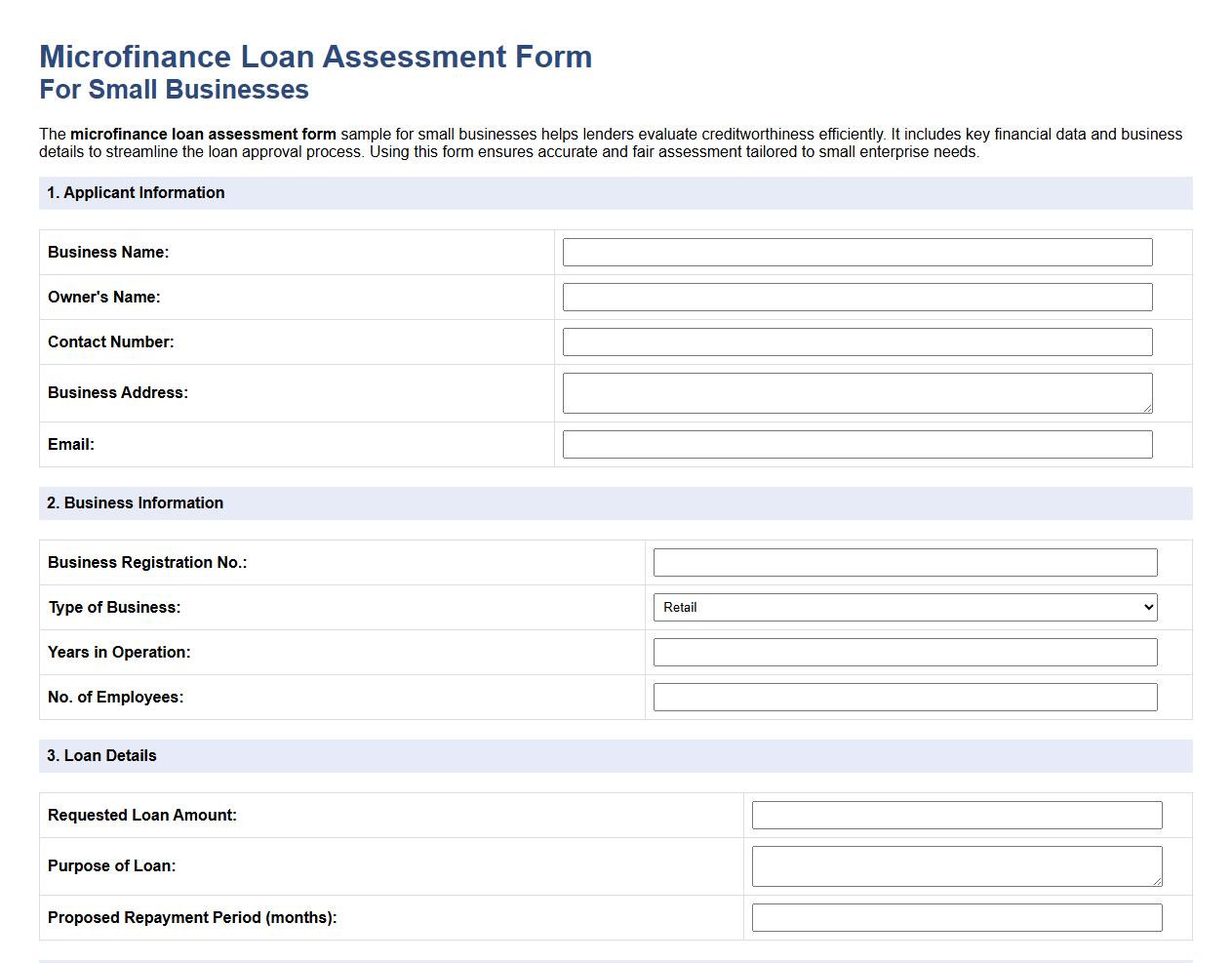

Microfinance loan assessment form sample for small businesses

The microfinance loan assessment form sample for small businesses helps lenders evaluate creditworthiness efficiently. It includes key financial data and business details to streamline the loan approval process. Using this form ensures accurate and fair assessment tailored to small enterprise needs.

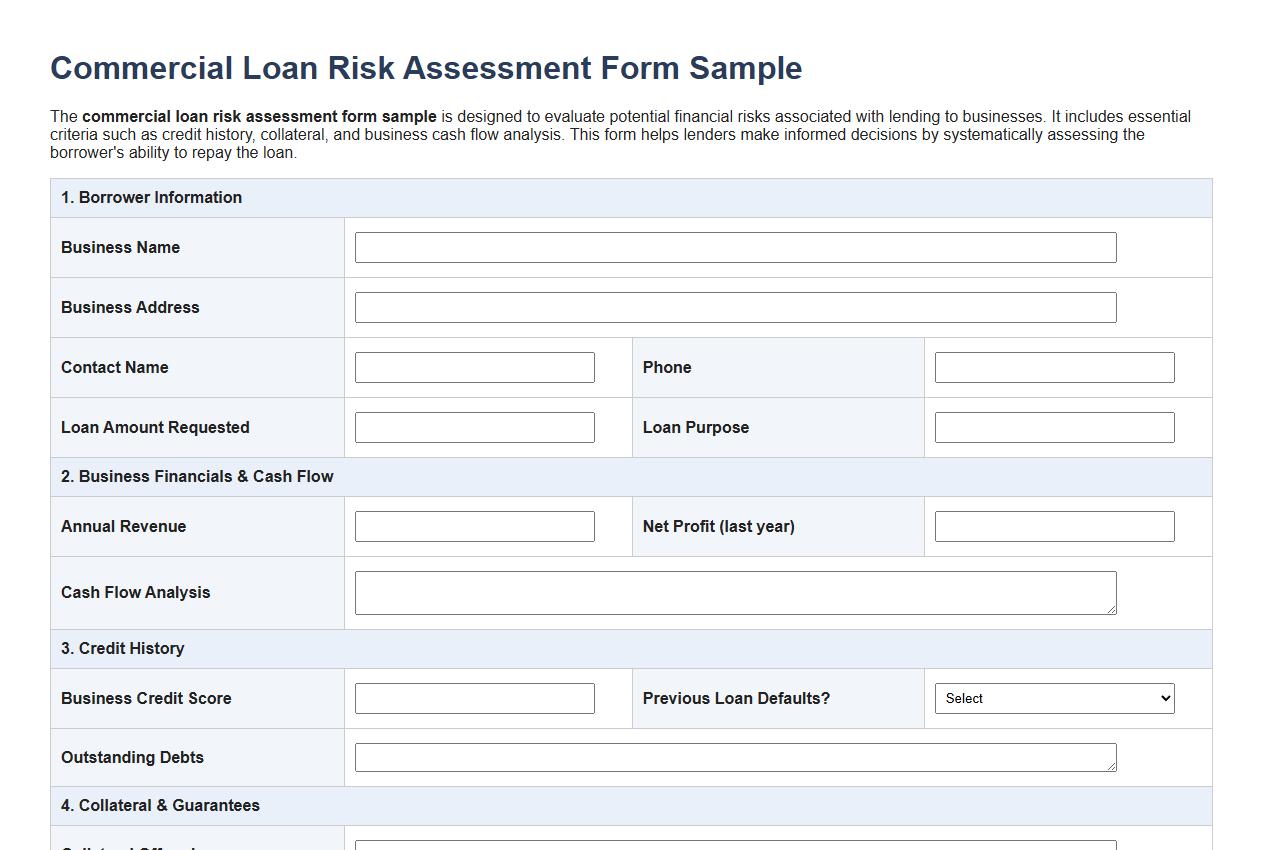

Commercial loan risk assessment form sample

The commercial loan risk assessment form sample is designed to evaluate potential financial risks associated with lending to businesses. It includes essential criteria such as credit history, collateral, and business cash flow analysis. This form helps lenders make informed decisions by systematically assessing the borrower's ability to repay the loan.

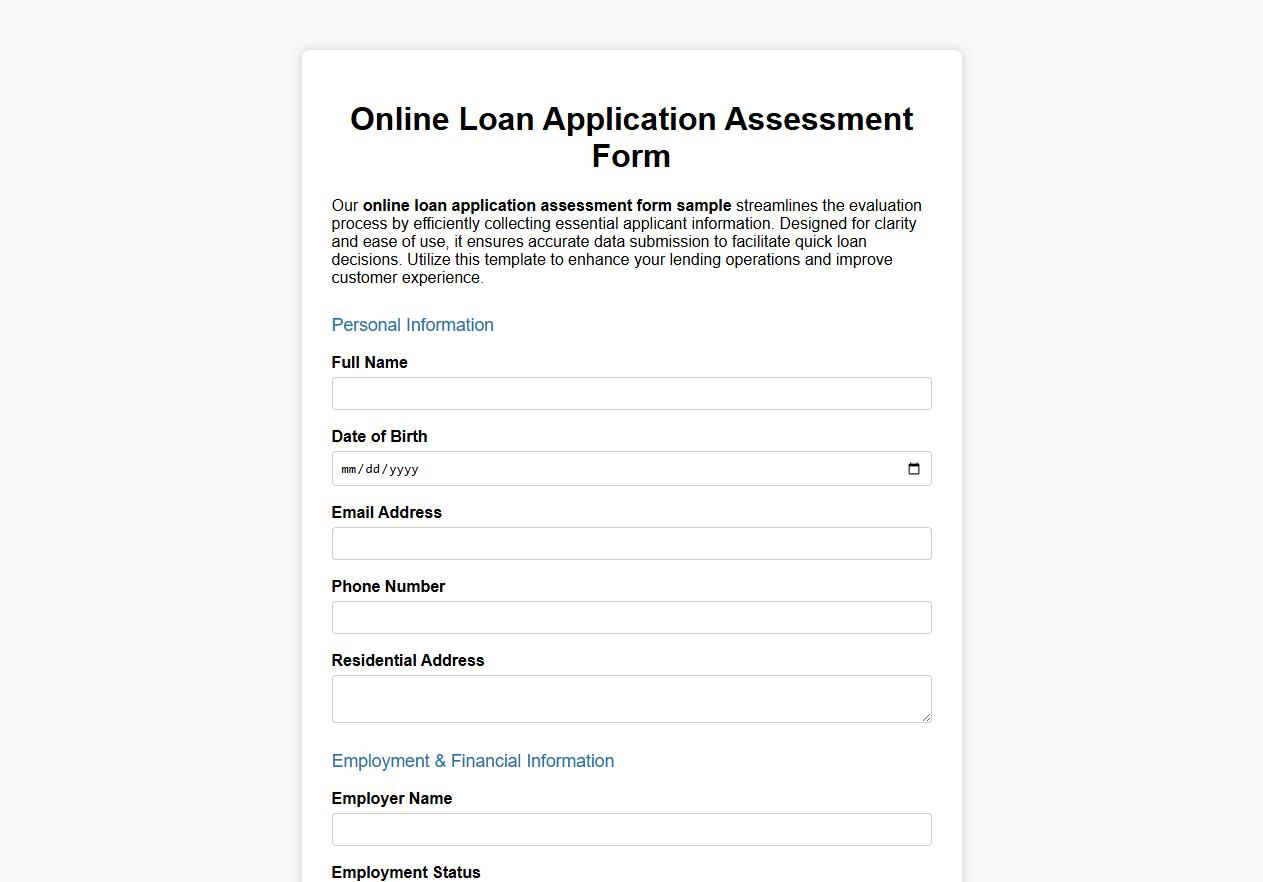

Online loan application assessment form sample

Our online loan application assessment form sample streamlines the evaluation process by efficiently collecting essential applicant information. Designed for clarity and ease of use, it ensures accurate data submission to facilitate quick loan decisions. Utilize this template to enhance your lending operations and improve customer experience.

What specific financial documents must accompany the Loan Assessment Form?

The Loan Assessment Form must be submitted with financial documents such as recent pay stubs, tax returns, and bank statements. These documents provide essential proof of the borrower's income and financial stability. Accurate and complete attachments help ensure a smooth loan evaluation process.

Are there designated sections for co-borrower details within the form?

Yes, the form includes designated sections specifically for co-borrower information. These sections capture personal details, income, and credit history of the co-borrower. Including this information is crucial for comprehensive loan assessment.

How is collateral information recorded on the Loan Assessment Form?

Collateral details are recorded in a dedicated section that requires specifics such as type, value, and ownership status of the asset. This ensures that the lender assesses the collateral value accurately. Proper documentation aids in minimizing loan risk.

What risk rating criteria are captured in the assessment section?

The assessment section captures risk rating criteria including credit score, repayment history, and debt-to-income ratio. These metrics help evaluate the borrower's creditworthiness and repayment capacity. Proper risk rating supports informed lending decisions.

Which fields address the loan applicant's income verification process?

The form contains specific fields for income verification such as employer details, monthly income, and employment status. It also requires supporting documents to validate the declared income. Accurate income verification is vital for loan approval.