A Loan Application Form Sample serves as a template that outlines the necessary information borrowers need to provide when applying for a loan. It typically includes fields for personal details, financial information, employment history, and loan amount requested. Using this sample ensures accuracy and completeness, streamlining the approval process for lenders.

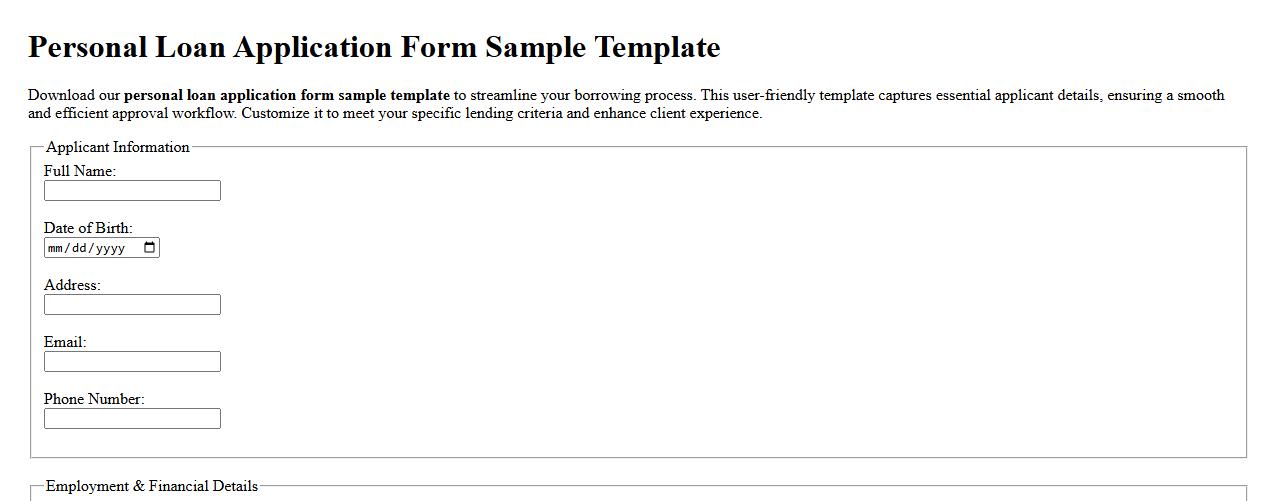

Personal loan application form sample template

Download our personal loan application form sample template to streamline your borrowing process. This user-friendly template captures essential applicant details, ensuring a smooth and efficient approval workflow. Customize it to meet your specific lending criteria and enhance client experience.

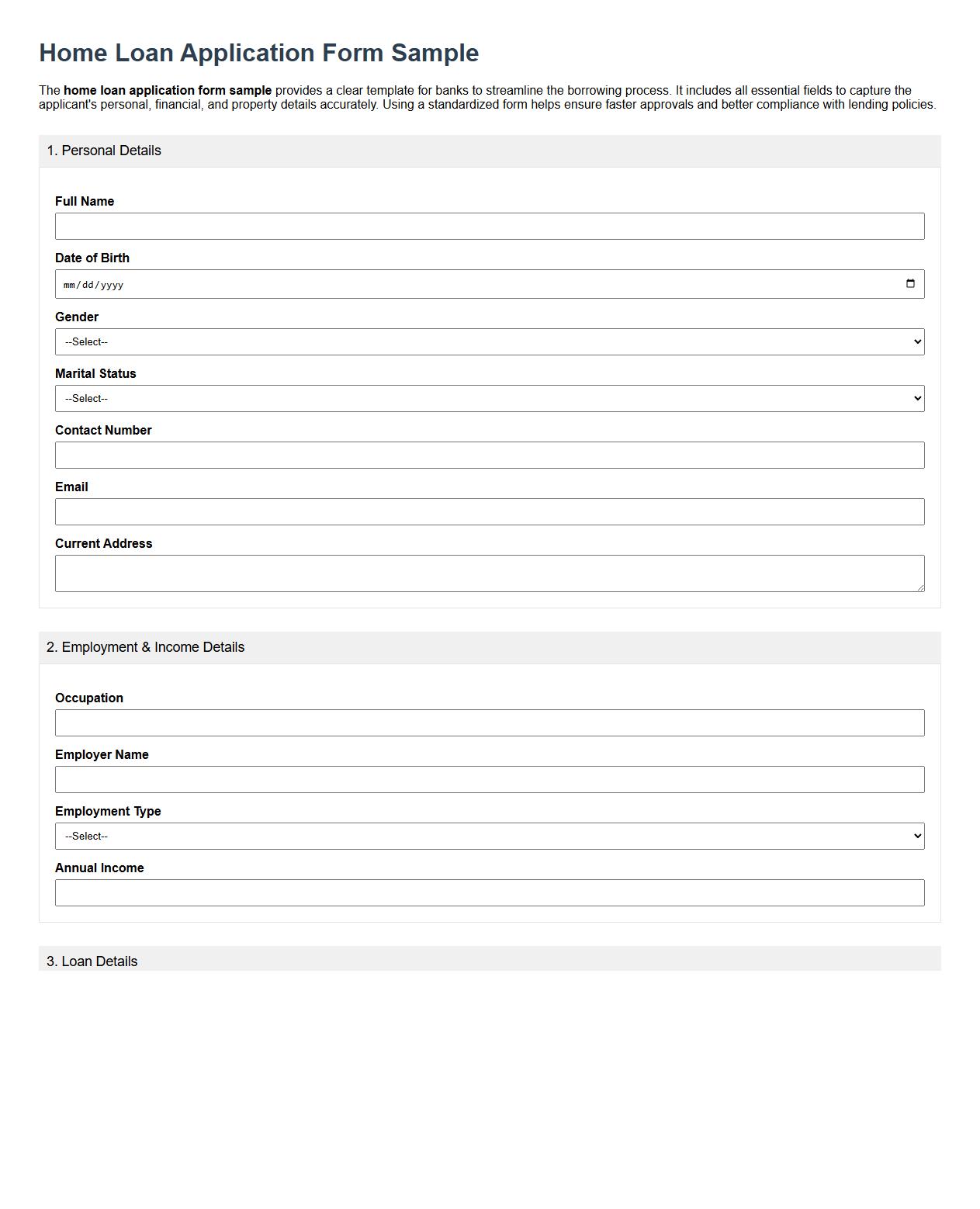

Home loan application form sample for banks

The home loan application form sample provides a clear template for banks to streamline the borrowing process. It includes all essential fields to capture the applicant's personal, financial, and property details accurately. Using a standardized form helps ensure faster approvals and better compliance with lending policies.

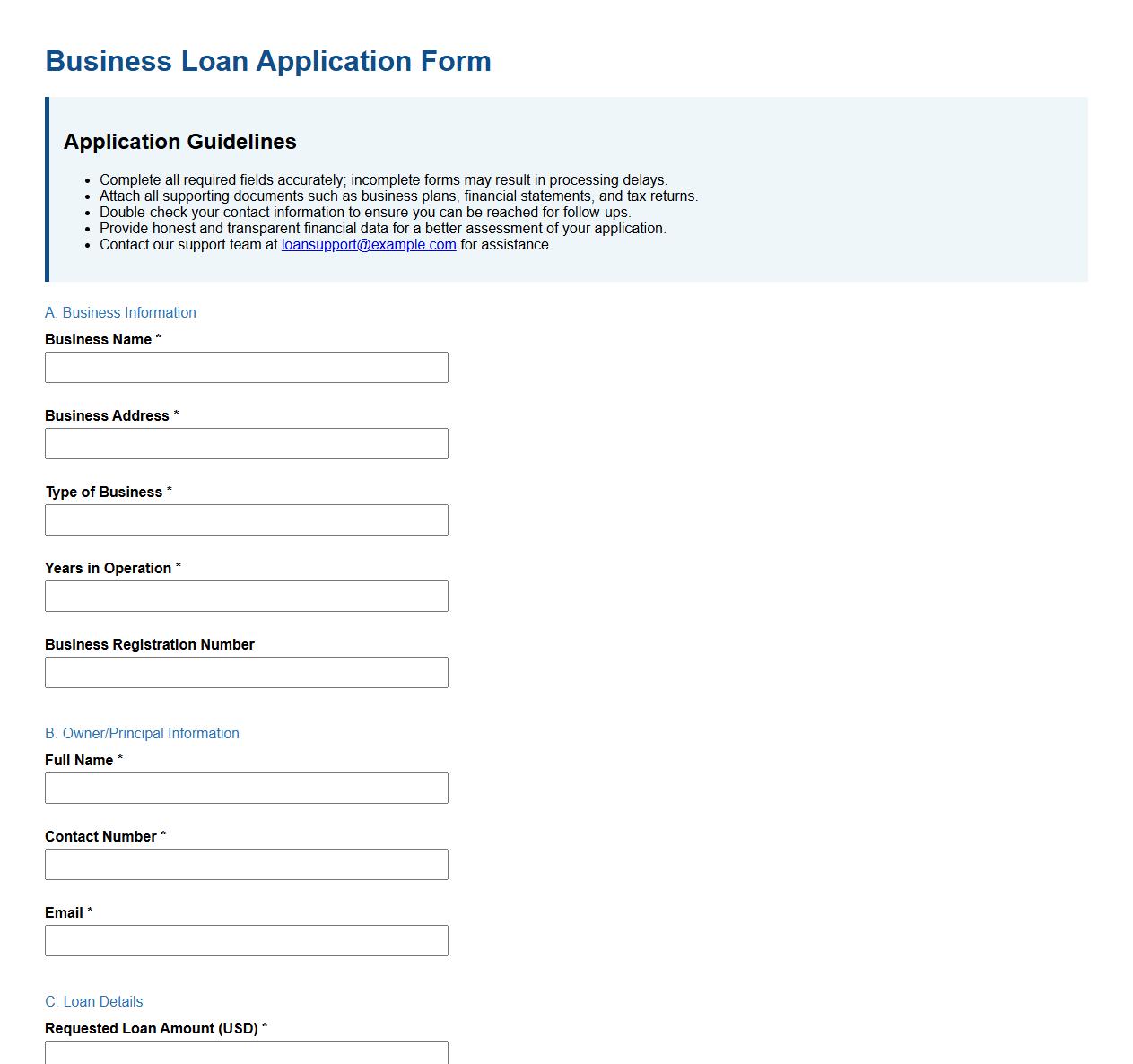

Business loan application form sample with guidelines

Use this business loan application form sample to streamline your loan request process efficiently. The form includes clear guidelines to ensure accurate and complete submissions, helping businesses secure necessary funding. Follow the step-by-step instructions to enhance your application success rate.

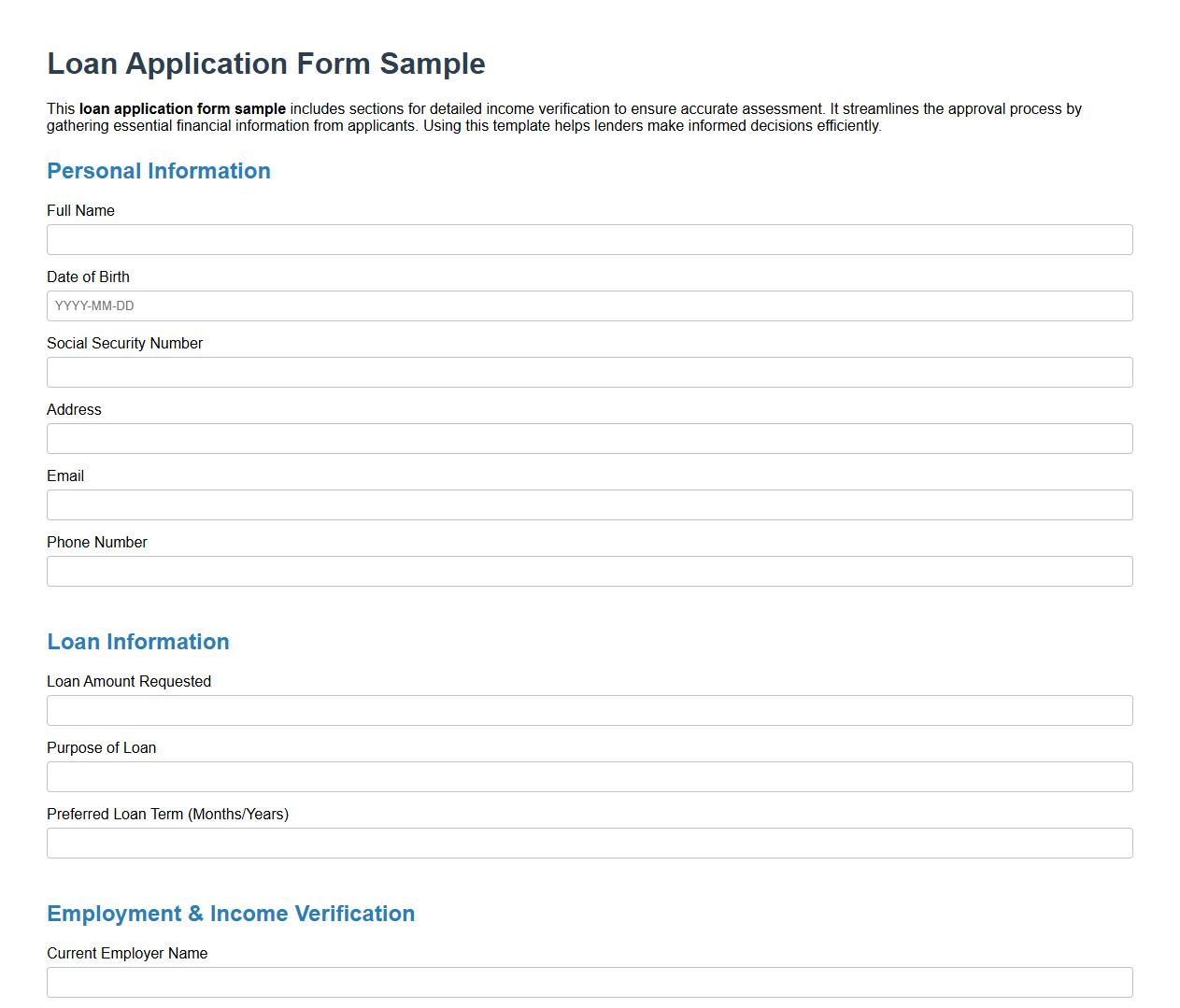

Loan application form sample with income verification

This loan application form sample includes sections for detailed income verification to ensure accurate assessment. It streamlines the approval process by gathering essential financial information from applicants. Using this template helps lenders make informed decisions efficiently.

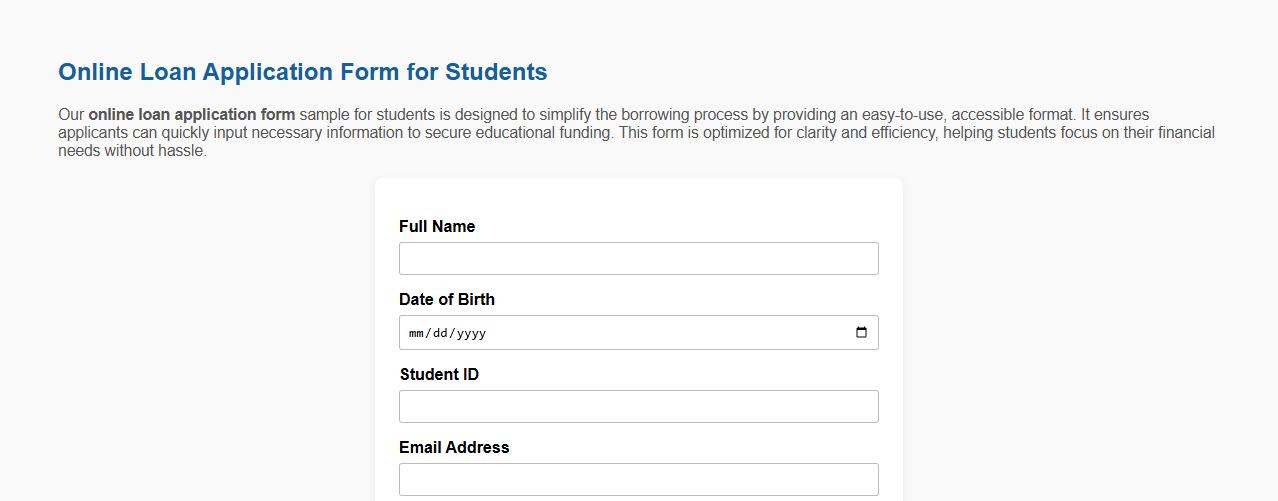

Online loan application form sample for students

Our online loan application form sample for students is designed to simplify the borrowing process by providing an easy-to-use, accessible format. It ensures applicants can quickly input necessary information to secure educational funding. This form is optimized for clarity and efficiency, helping students focus on their financial needs without hassle.

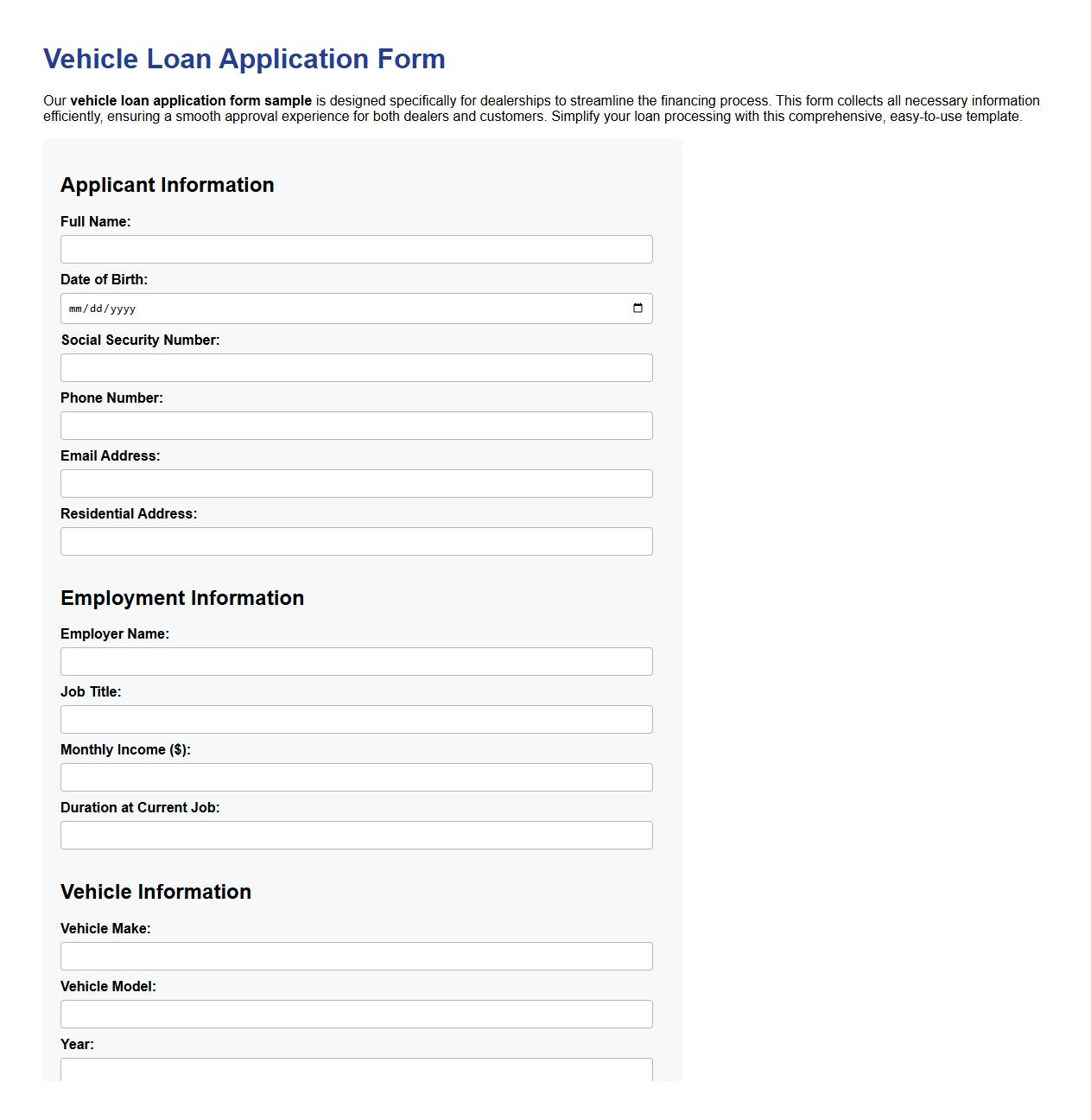

Vehicle loan application form sample for dealership

Our vehicle loan application form sample is designed specifically for dealerships to streamline the financing process. This form collects all necessary information efficiently, ensuring a smooth approval experience for both dealers and customers. Simplify your loan processing with this comprehensive, easy-to-use template.

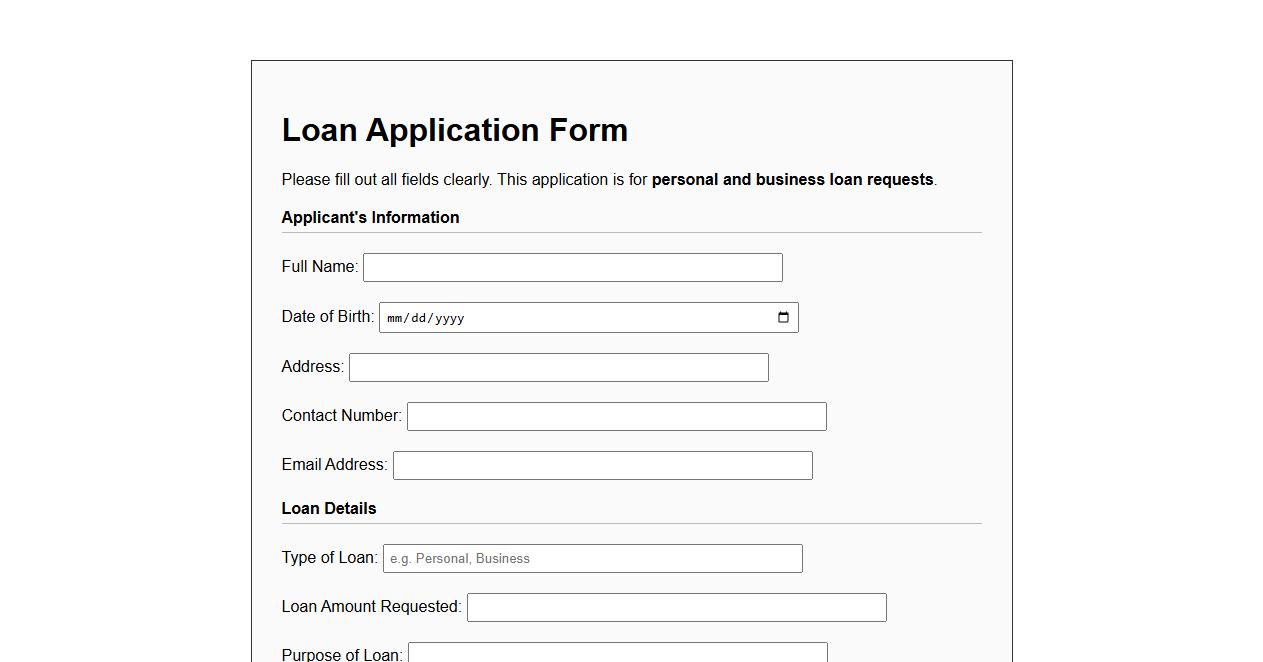

Printable loan application form sample with signature

Download a printable loan application form sample with signature space to facilitate a seamless borrowing process. This template ensures all necessary details are captured accurately for faster approval. Ideal for both personal and business loan applications.

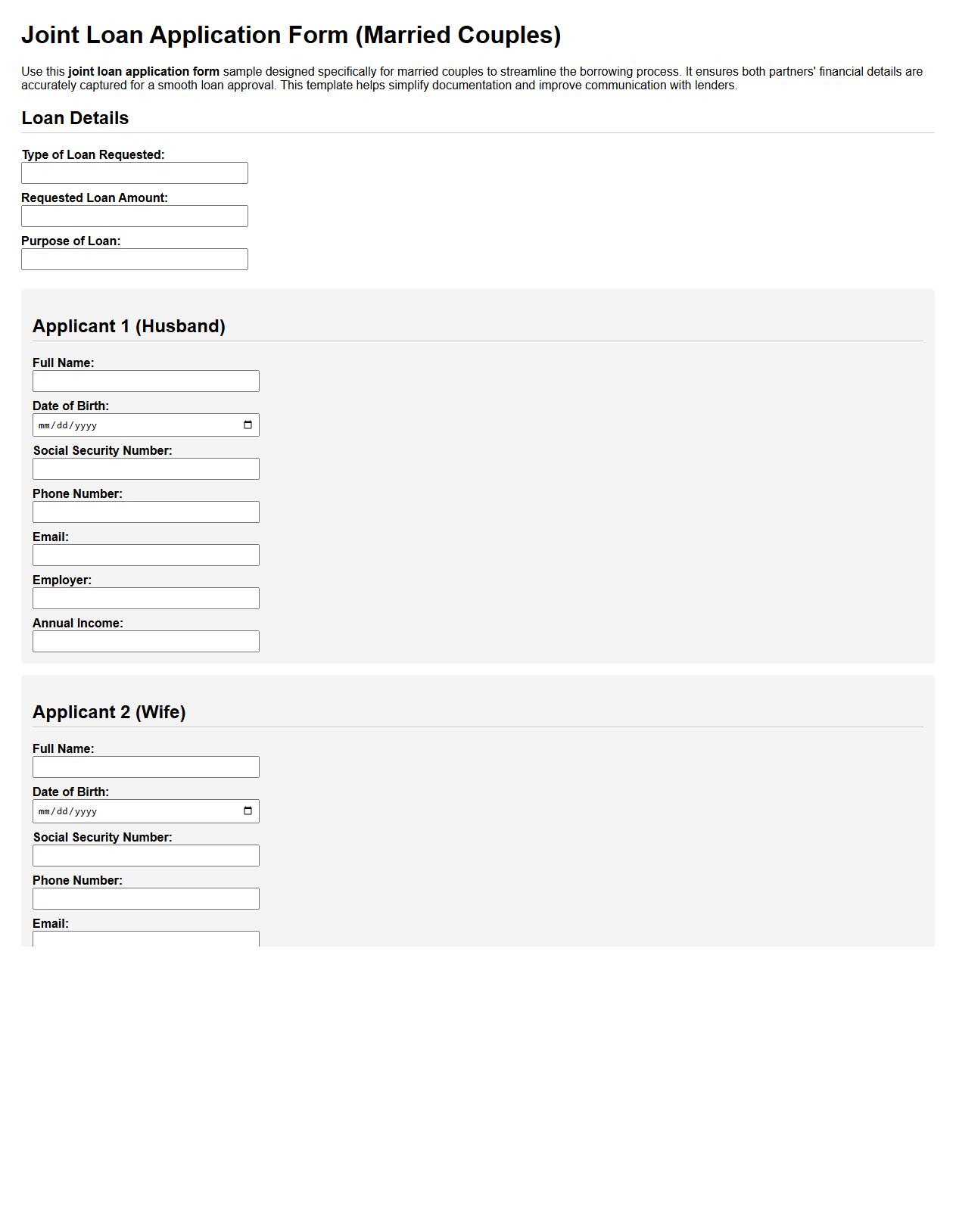

Joint loan application form sample for married couples

Use this joint loan application form sample designed specifically for married couples to streamline the borrowing process. It ensures both partners' financial details are accurately captured for a smooth loan approval. This template helps simplify documentation and improve communication with lenders.

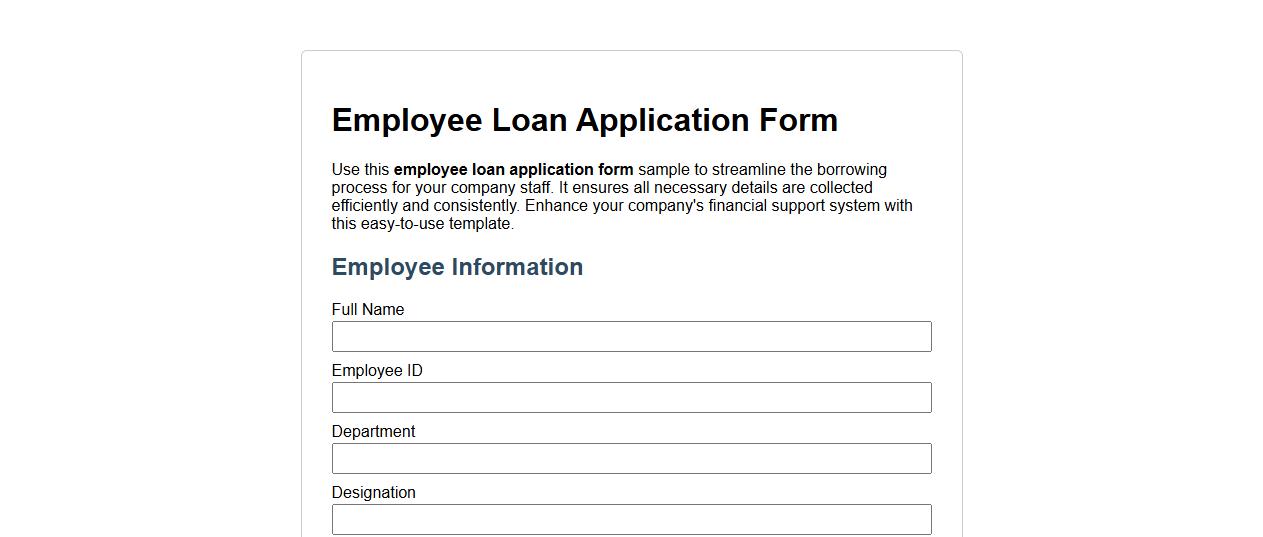

Employee loan application form sample for companies

Use this employee loan application form sample to streamline the borrowing process for your company staff. It ensures all necessary details are collected efficiently and consistently. Enhance your company's financial support system with this easy-to-use template.

What supporting documents are mandatory for the loan application form?

Essential supporting documents for a loan application include a valid identification card, proof of income, and recent bank statements. Lenders also typically require employment verification letters and credit reports to assess creditworthiness. Providing these documents promptly helps streamline the loan approval process.

How is applicant income verified in the loan application letter?

Applicant income is verified through submission of pay stubs, tax returns, and bank statements. Employers may also be contacted directly to confirm salary details and employment status. Accurate income verification ensures the borrower meets the lender's criteria for loan approval.

What are common errors found in loan application letters?

Common errors in loan application letters include incomplete information, incorrect contact details, and missing supporting documents. Another frequent mistake is failing to sign or date the application, which can cause delays. Ensuring all sections are fully and accurately completed is critical for a smooth process.

How is collateral information represented in the loan form?

Collateral information is detailed in a designated section of the loan form, describing the asset offered as security. This includes the asset's value, type, and ownership details to verify its legitimacy. Proper documentation of collateral is vital to safeguard lender interests.

Which sections require notarization in a formal loan application letter?

Sections that often require notarization include the borrower's signature and any legal declarations certifying the truthfulness of the information provided. Notarization serves as an official validation of the borrower's identity and consent. This step enhances the document's authenticity in the loan process.