A Loan Agreement Form Sample serves as a legal document outlining the terms and conditions between a lender and borrower. It specifies the loan amount, interest rate, repayment schedule, and obligations of both parties. Using this form helps ensure clear communication and protects the rights of each party throughout the loan process.

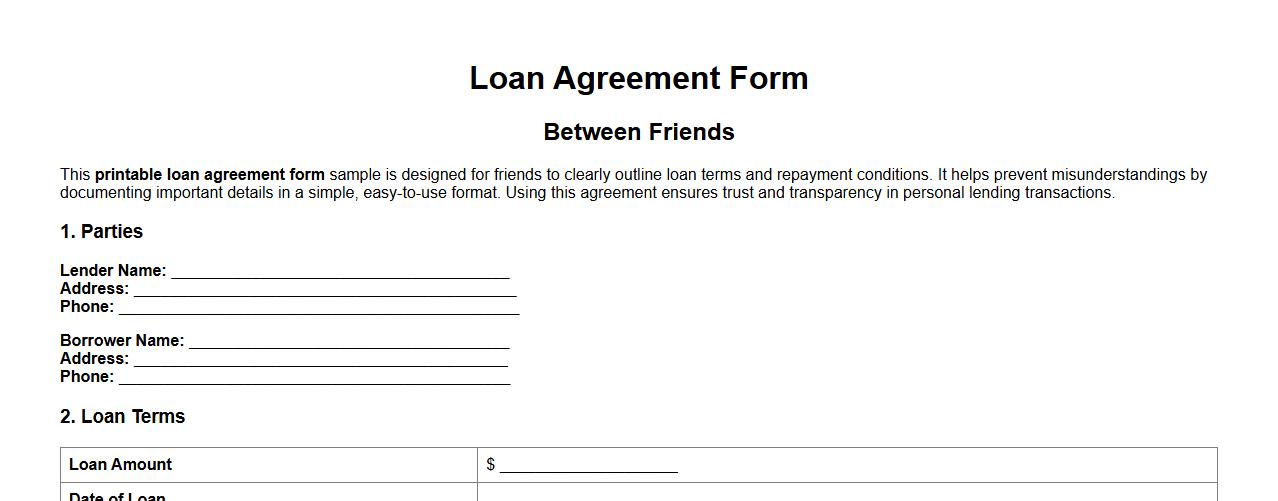

Printable loan agreement form sample between friends

This printable loan agreement form sample is designed for friends to clearly outline loan terms and repayment conditions. It helps prevent misunderstandings by documenting important details in a simple, easy-to-use format. Using this agreement ensures trust and transparency in personal lending transactions.

Simple loan agreement form sample PDF download

Download a simple loan agreement form sample PDF to easily outline the terms and conditions between borrower and lender. This template provides a clear and legally sound framework to ensure mutual understanding. Access it now for hassle-free loan documentation.

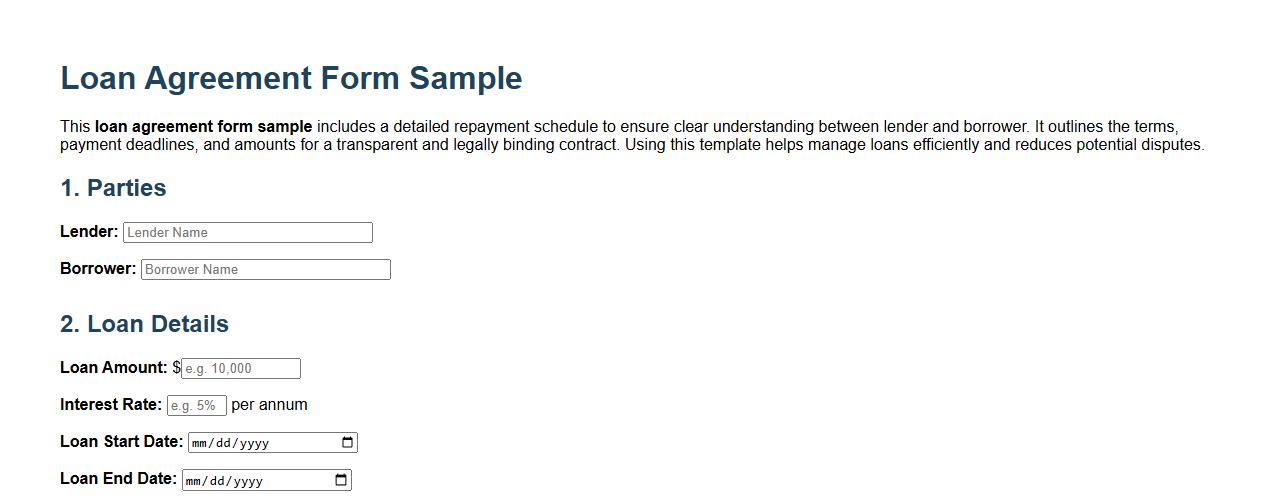

Loan agreement form sample with repayment schedule

This loan agreement form sample includes a detailed repayment schedule to ensure clear understanding between lender and borrower. It outlines the terms, payment deadlines, and amounts for a transparent and legally binding contract. Using this template helps manage loans efficiently and reduces potential disputes.

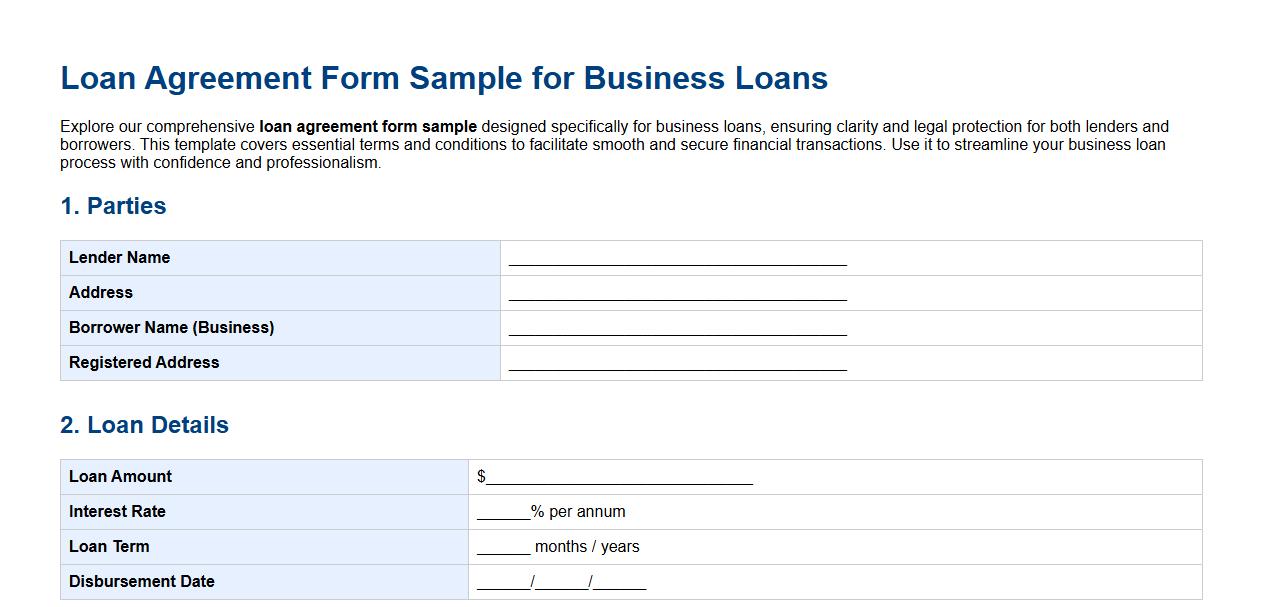

Loan agreement form sample for business loans

Explore our comprehensive loan agreement form sample designed specifically for business loans, ensuring clarity and legal protection for both lenders and borrowers. This template covers essential terms and conditions to facilitate smooth and secure financial transactions. Use it to streamline your business loan process with confidence and professionalism.

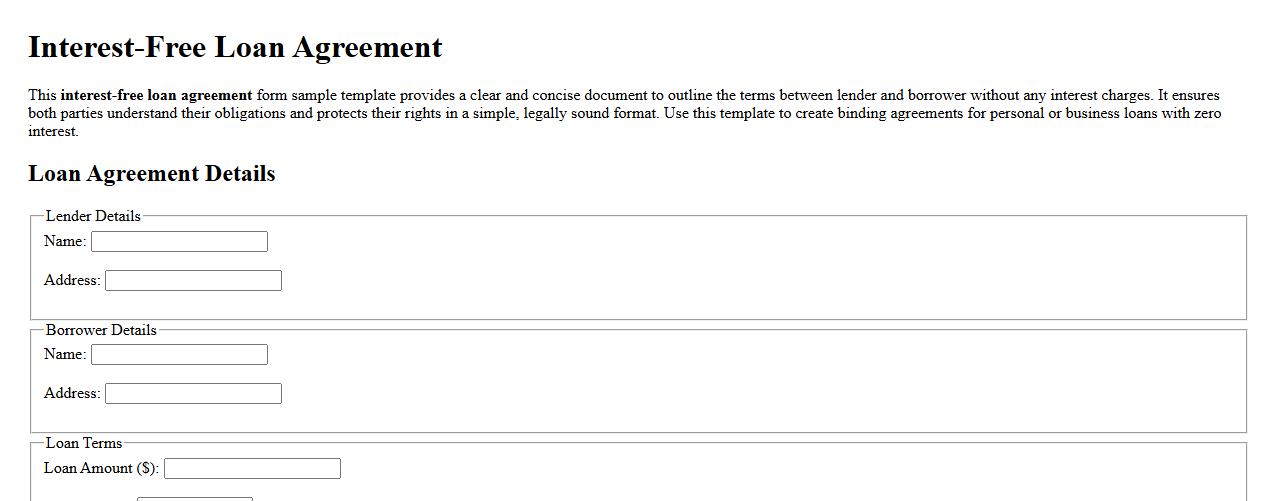

Interest-free loan agreement form sample template

This interest-free loan agreement form sample template provides a clear and concise document to outline the terms between lender and borrower without any interest charges. It ensures both parties understand their obligations and protects their rights in a simple, legally sound format. Use this template to create binding agreements for personal or business loans with zero interest.

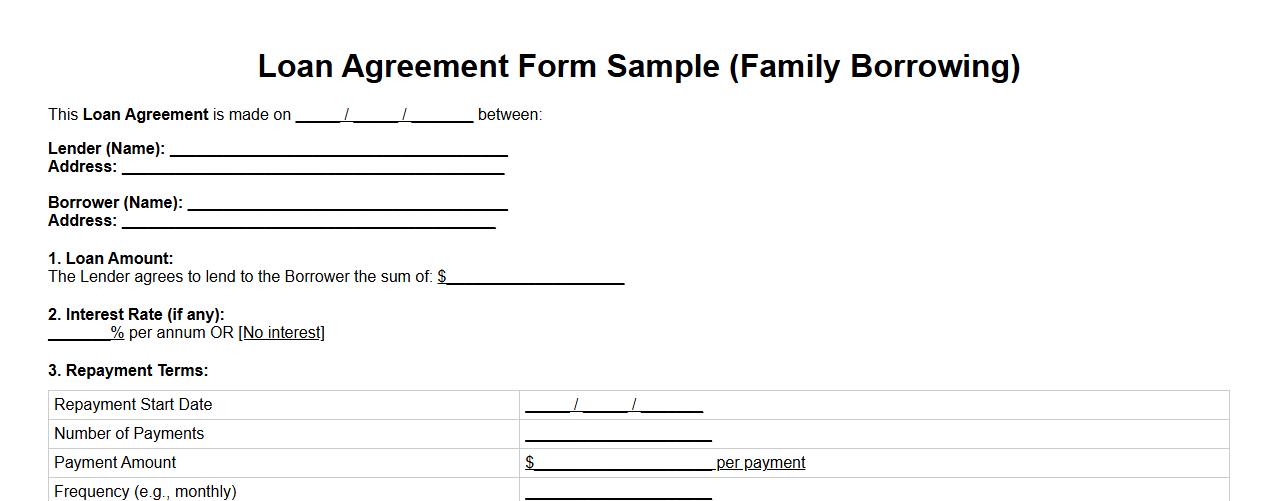

Loan agreement form sample for family borrowing

A loan agreement form sample for family borrowing provides a clear and legally binding document to outline the terms and conditions of money lent between relatives. This ensures transparency and helps prevent misunderstandings by detailing repayment schedules, interest rates, and responsibilities. Using a proper form protects both parties and promotes trust within family financial arrangements.

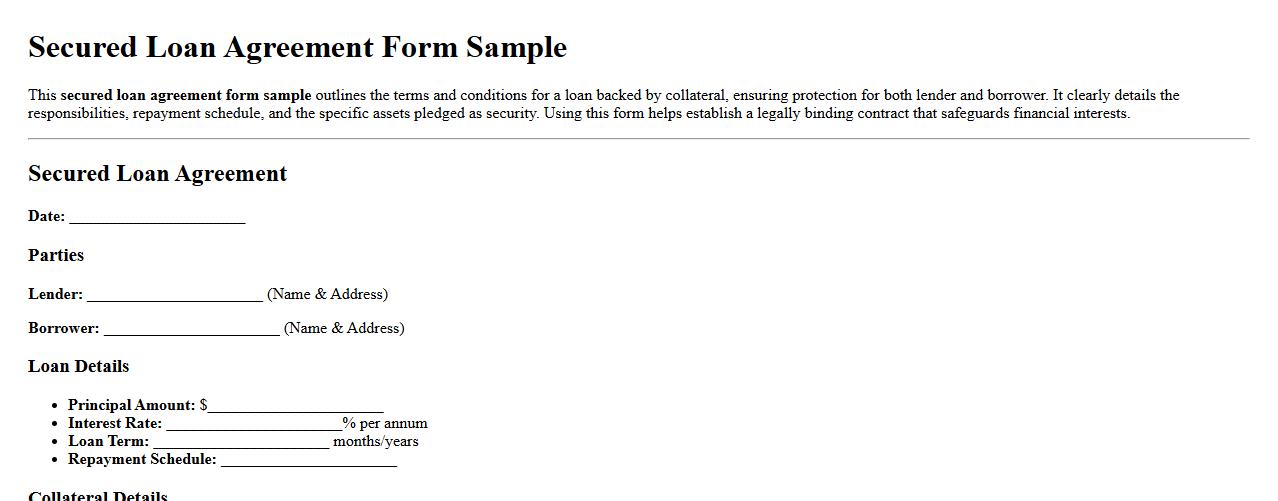

Secured loan agreement form sample with collateral

This secured loan agreement form sample outlines the terms and conditions for a loan backed by collateral, ensuring protection for both lender and borrower. It clearly details the responsibilities, repayment schedule, and the specific assets pledged as security. Using this form helps establish a legally binding contract that safeguards financial interests.

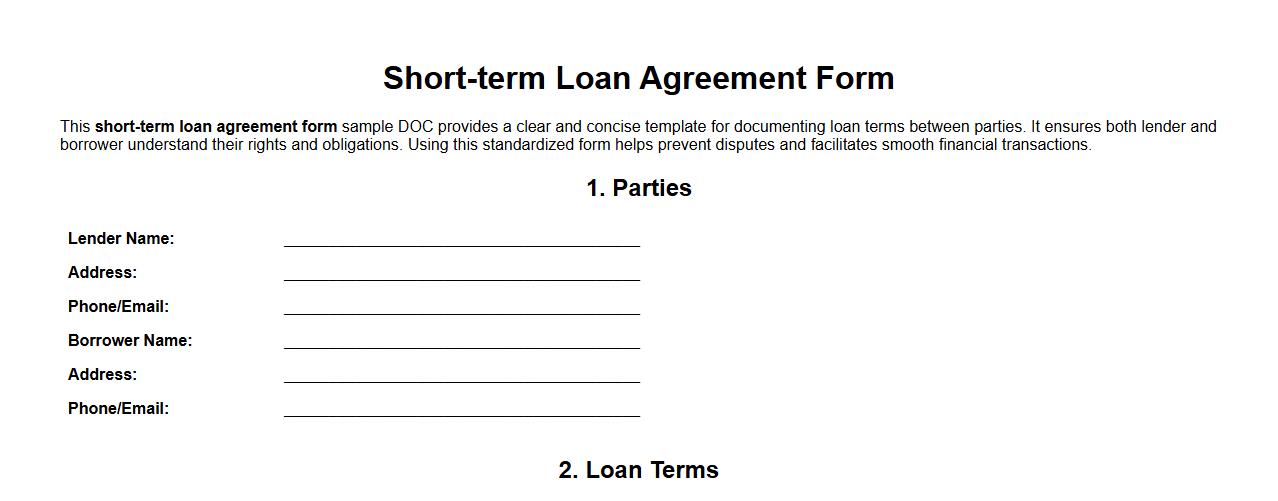

Short-term loan agreement form sample DOC

This short-term loan agreement form sample DOC provides a clear and concise template for documenting loan terms between parties. It ensures both lender and borrower understand their rights and obligations. Using this standardized form helps prevent disputes and facilitates smooth financial transactions.

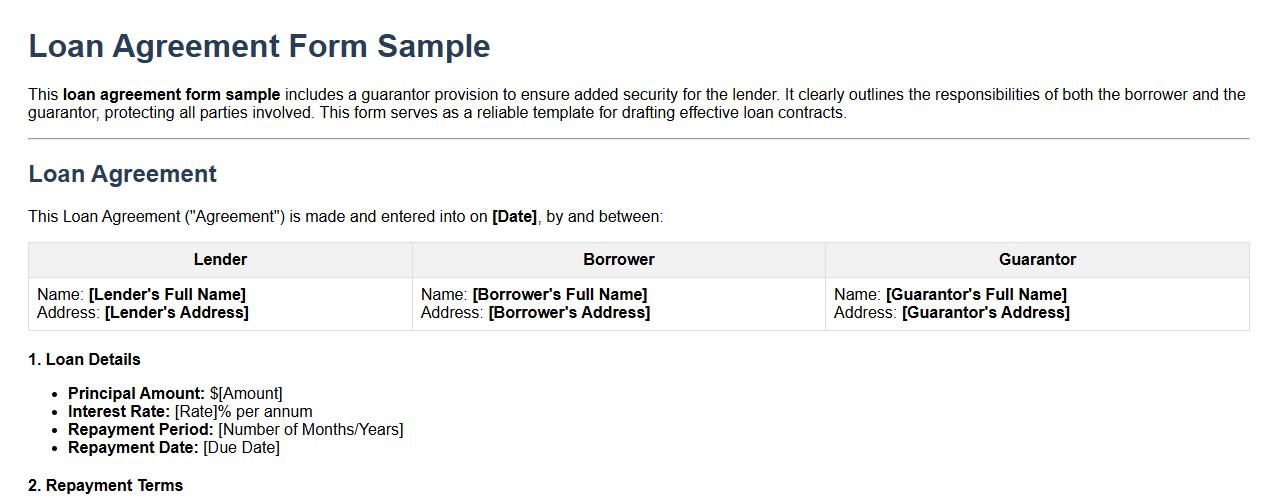

Loan agreement form sample with guarantor provision

This loan agreement form sample includes a guarantor provision to ensure added security for the lender. It clearly outlines the responsibilities of both the borrower and the guarantor, protecting all parties involved. This form serves as a reliable template for drafting effective loan contracts.

What clauses address early repayment penalties in the Loan Agreement Form?

The Loan Agreement Form includes a specific clause detailing early repayment penalties to protect the lender's interests. This clause outlines the conditions under which a borrower may repay the loan before the scheduled term. It also specifies the percentage or fixed amount that will be charged as a penalty for early repayment, ensuring transparency and fairness.

How is collateral detailed and verified within the document?

The document provides a comprehensive section for the description and valuation of collateral securing the loan. Collateral details include the type, location, and value assessment to guarantee adequate coverage. Verification procedures are also outlined to authenticate ownership and condition, safeguarding the lender's collateral rights.

Are co-signers' obligations clearly defined in the form?

The Loan Agreement explicitly defines the responsibilities and liabilities of co-signers to ensure legal clarity. It states that co-signers are equally responsible for repayment if the primary borrower defaults. Additionally, the form specifies the scope of their joint and several liabilities under the loan terms.

What default events are specifically outlined in the agreement?

The agreement lists precise default events that trigger remedies for the lender, like missed payments or insolvency. Each default condition is clearly articulated to prevent ambiguity in enforcement. The form also covers the consequences and lender rights upon occurrence of such events.

How does the Loan Agreement handle jurisdiction and dispute resolution?

The Loan Agreement specifies the jurisdiction governing the contract, typically linked to the lender's location or agreed venue. It includes dispute resolution mechanisms such as mediation or arbitration to handle conflicts efficiently. This ensures both parties understand the legal framework for resolving disputes.