A Balance Sheet Statement Template provides a structured format to summarize a company's financial position at a specific point in time, listing assets, liabilities, and equity. It helps businesses maintain accuracy and consistency while preparing financial reports for stakeholders. This template is essential for clear financial analysis and decision-making.

Balance sheet statement template for small business

Use this balance sheet statement template to accurately track your small business's assets, liabilities, and equity. It helps maintain clear financial records and supports informed decision-making. Customize the template to suit your business needs and ensure compliance with accounting standards.

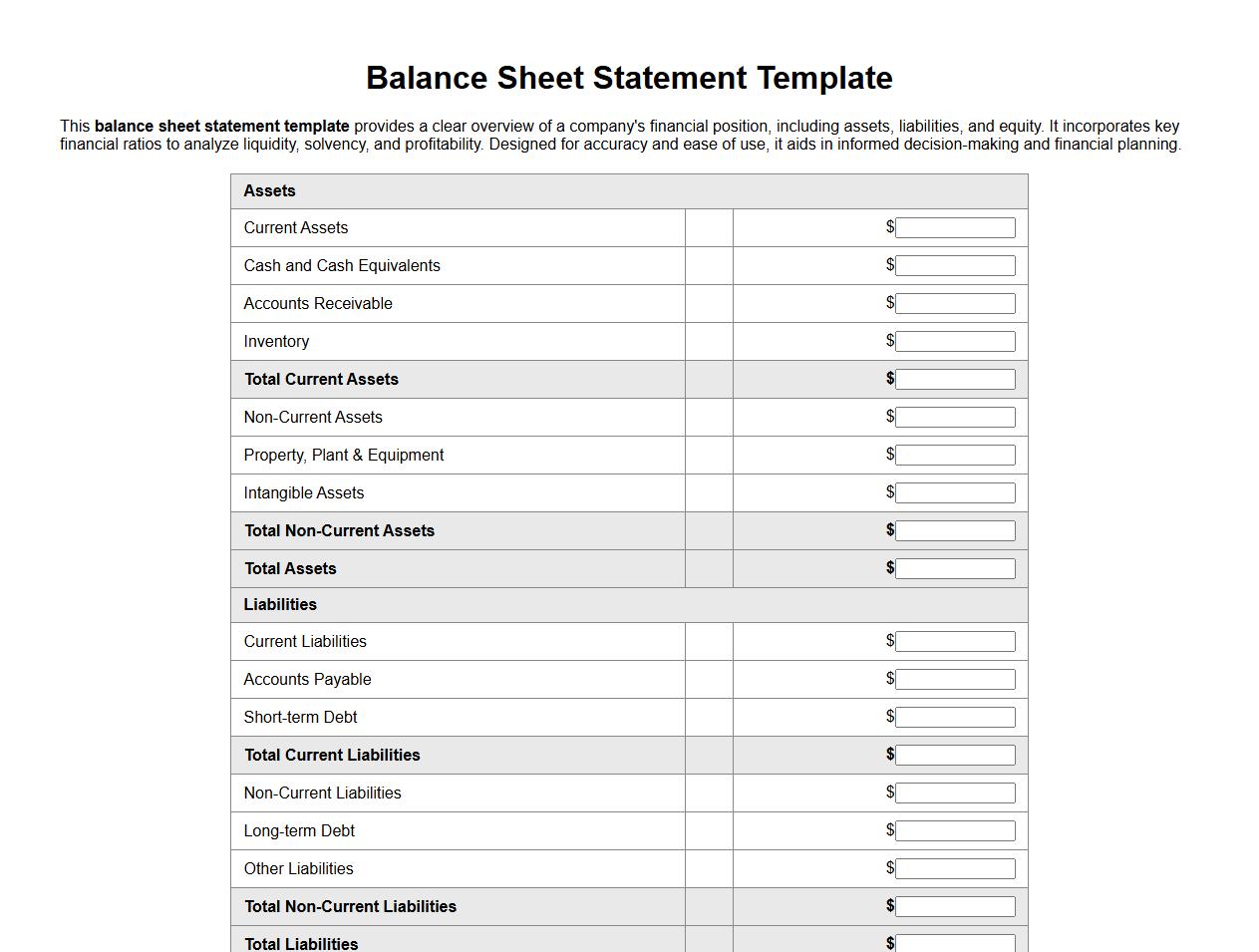

Balance sheet statement template with financial ratios

This balance sheet statement template provides a clear overview of a company's financial position, including assets, liabilities, and equity. It incorporates key financial ratios to analyze liquidity, solvency, and profitability. Designed for accuracy and ease of use, it aids in informed decision-making and financial planning.

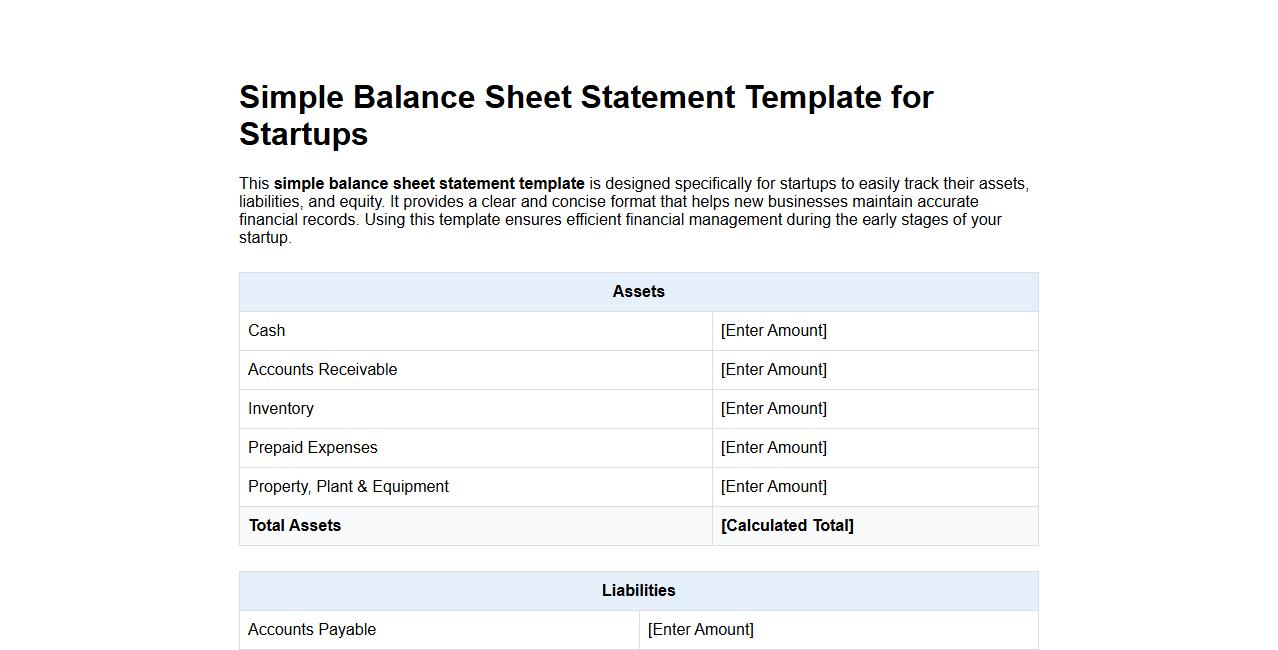

Simple balance sheet statement template for startups

This simple balance sheet statement template is designed specifically for startups to easily track their assets, liabilities, and equity. It provides a clear and concise format that helps new businesses maintain accurate financial records. Using this template ensures efficient financial management during the early stages of your startup.

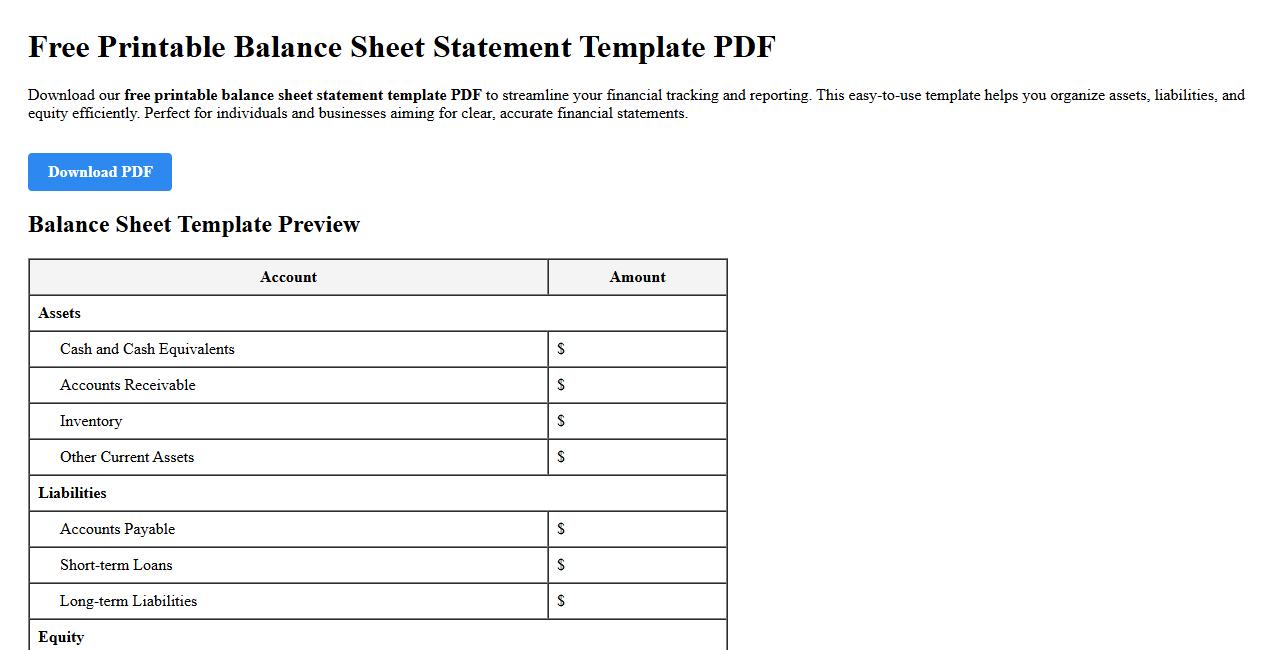

Free printable balance sheet statement template PDF

Download our free printable balance sheet statement template PDF to streamline your financial tracking and reporting. This easy-to-use template helps you organize assets, liabilities, and equity efficiently. Perfect for individuals and businesses aiming for clear, accurate financial statements.

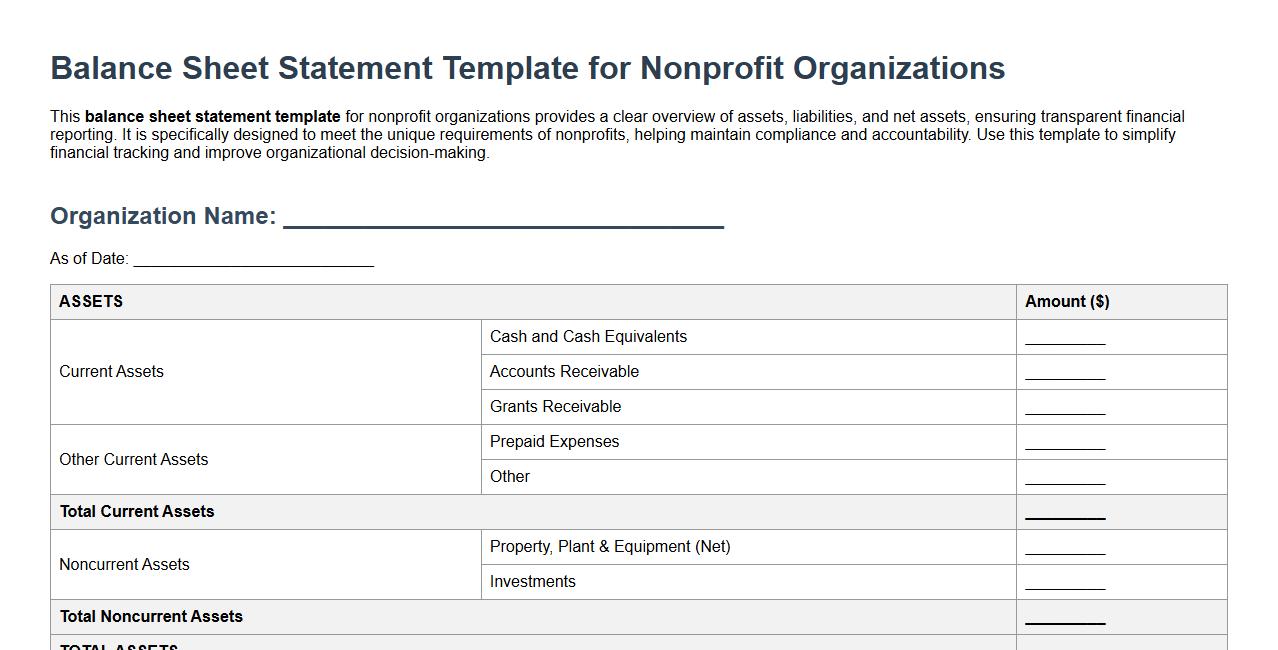

Balance sheet statement template for nonprofit organizations

This balance sheet statement template for nonprofit organizations provides a clear overview of assets, liabilities, and net assets, ensuring transparent financial reporting. It is specifically designed to meet the unique requirements of nonprofits, helping maintain compliance and accountability. Use this template to simplify financial tracking and improve organizational decision-making.

Year-end balance sheet statement template download

Download our year-end balance sheet statement template to simplify your financial reporting process. This easy-to-use template helps accurately summarize your company's assets, liabilities, and equity at fiscal year-end. Streamline your accounting tasks and ensure compliance with industry standards using this professional tool.

Balance sheet statement template with income statement

This balance sheet statement template integrates seamlessly with the income statement, providing a comprehensive overview of financial health. It allows for easy tracking of assets, liabilities, and equity alongside revenues and expenses. Ideal for accurate financial analysis and reporting.

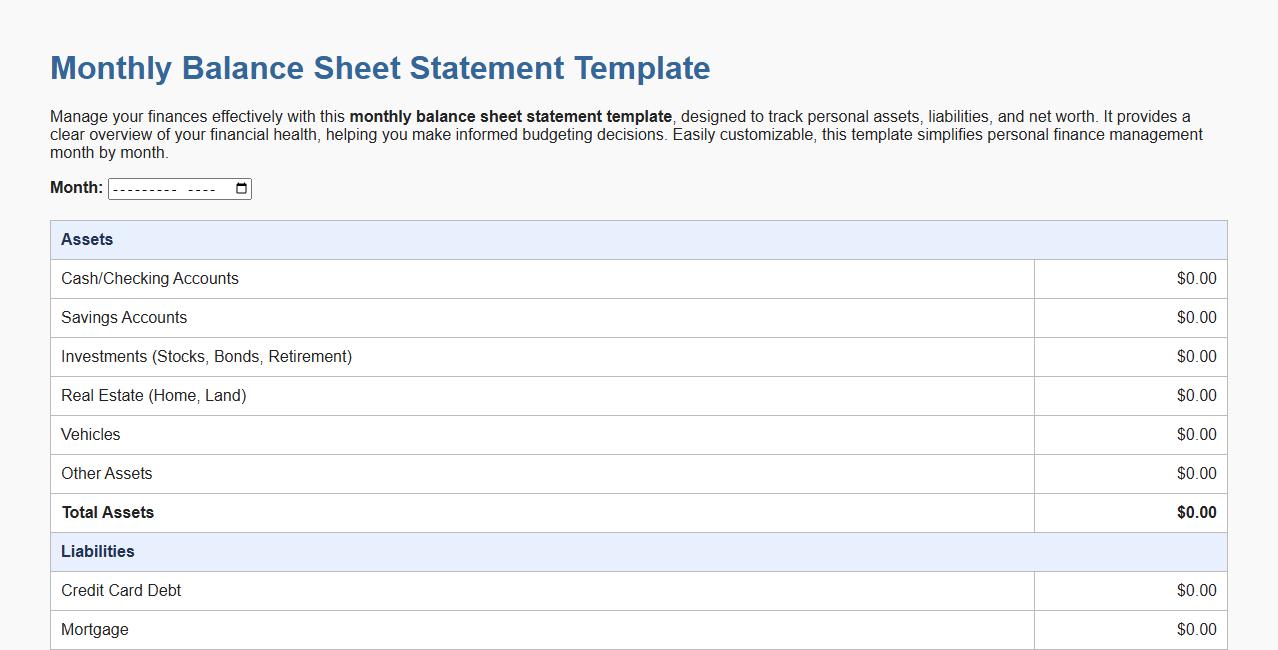

Monthly balance sheet statement template for personal finance

Manage your finances effectively with this monthly balance sheet statement template, designed to track personal assets, liabilities, and net worth. It provides a clear overview of your financial health, helping you make informed budgeting decisions. Easily customizable, this template simplifies personal finance management month by month.

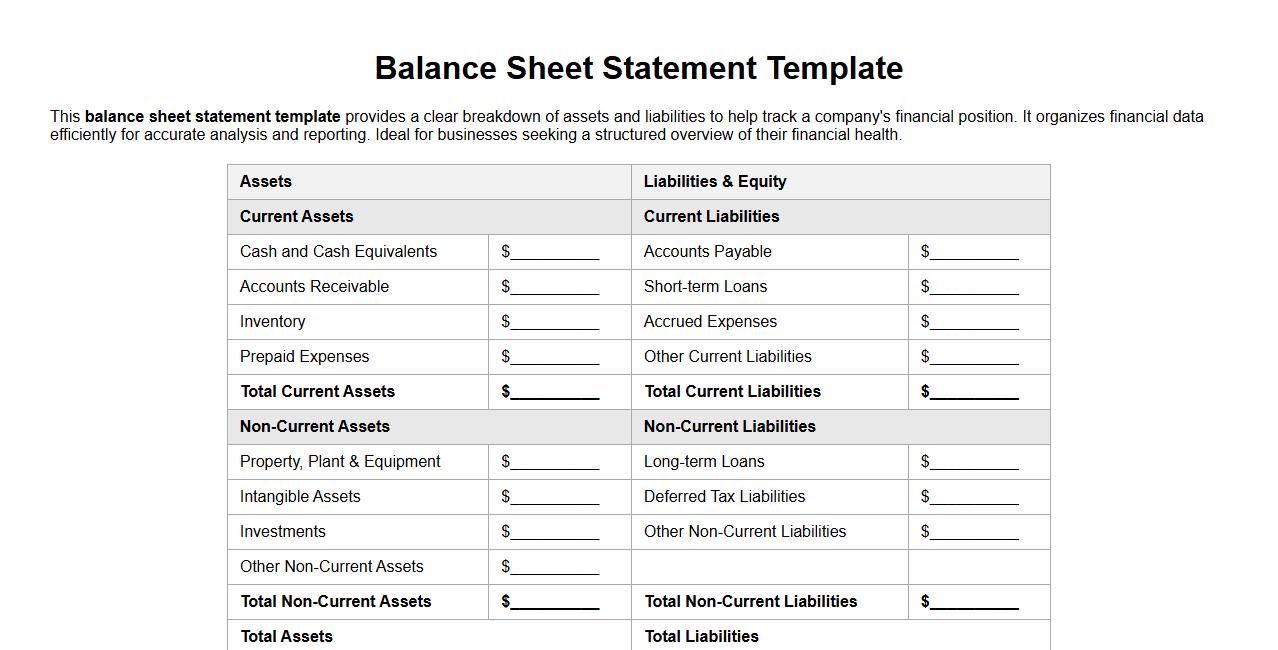

Balance sheet statement template including assets and liabilities breakdown

This balance sheet statement template provides a clear breakdown of assets and liabilities to help track a company's financial position. It organizes financial data efficiently for accurate analysis and reporting. Ideal for businesses seeking a structured overview of their financial health.

What supporting documents validate the figures in the Balance Sheet Statement?

The Balance Sheet Statement figures are validated through various supporting documents such as bank statements, invoices, and contracts. These documents provide evidence for assets, liabilities, and equity reported on the balance sheet. Auditors rely heavily on these records to ensure the financial data is accurate and compliant with accounting standards.

How are intangible assets classified and disclosed in the Balance Sheet?

Intangible assets on the balance sheet are classified as non-current assets and include items like patents, trademarks, and goodwill. They are disclosed separately from tangible assets to provide clarity on their nature and value. Proper disclosure includes the method of valuation, amortization, and any impairment losses.

What are the typical red flags in Balance Sheet notes indicating financial risk?

Red flags in balance sheet notes often include large amounts of contingent liabilities, significant related party transactions, and off-balance-sheet financing. These notes may reveal hidden risks not evident from the figures alone. Investors and analysts scrutinize such disclosures for warnings about potential financial instability.

How are intercompany loans reported on the Balance Sheet Statement?

Intercompany loans are recorded as either receivables or payables on the balance sheet depending on the reporting entity's perspective. They are typically listed under current or non-current assets/liabilities based on the loan maturity. Transparent reporting of these loans helps prevent financial statement manipulation within corporate groups.

What is the impact of post-balance-sheet events on Balance Sheet accuracy?

Post-balance-sheet events can significantly affect the accuracy of the financial statements if they provide additional insight into conditions existing at the balance sheet date. Such events require adjustments or disclosures to maintain the reliability of the balance sheet. Properly accounting for these events ensures stakeholders receive timely and truthful financial information.