A Vehicle Mileage Log Form Sample helps track the distance traveled by a vehicle for business or personal use, ensuring accurate record-keeping for reimbursements or tax deductions. This form typically includes fields for date, starting and ending odometer readings, trip purpose, and total miles driven. Proper documentation using a mileage log enhances expense reporting and supports compliance with financial regulations.

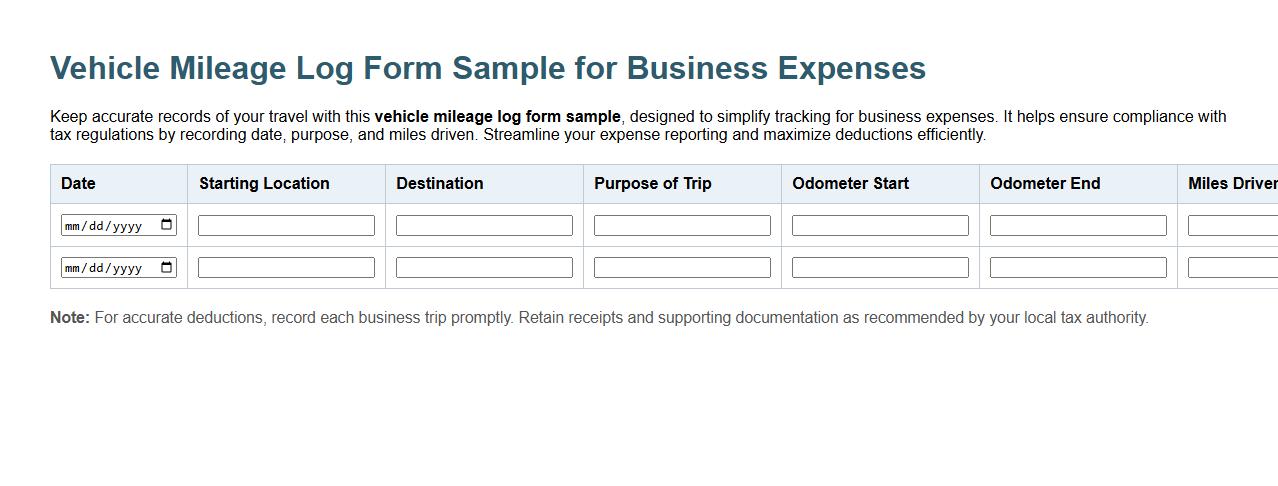

Vehicle mileage log form sample for business expenses

Keep accurate records of your travel with this vehicle mileage log form sample, designed to simplify tracking for business expenses. It helps ensure compliance with tax regulations by recording date, purpose, and miles driven. Streamline your expense reporting and maximize deductions efficiently.

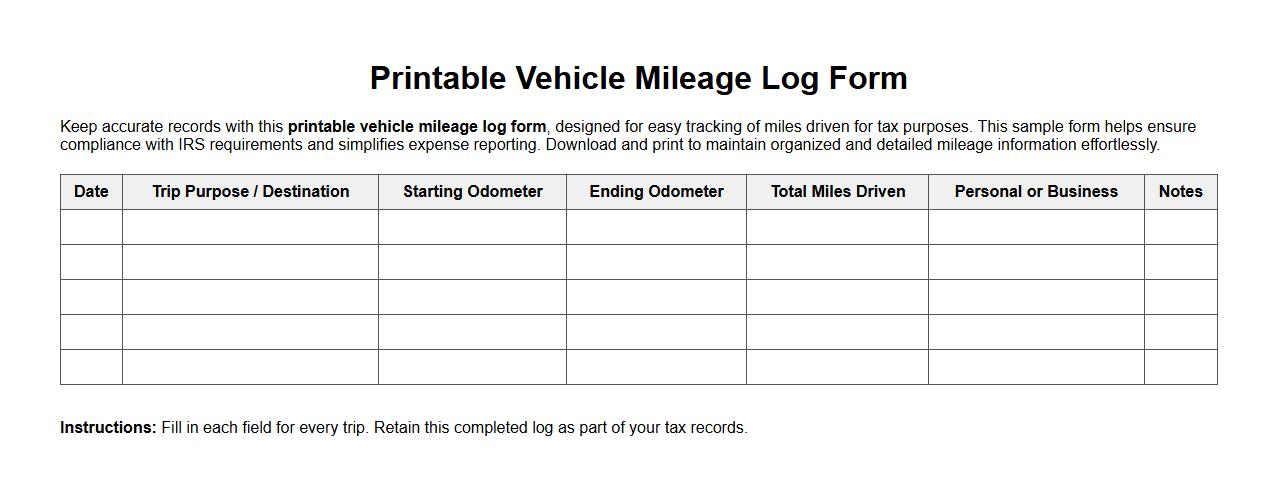

Printable vehicle mileage log form sample for tax purposes

Keep accurate records with this printable vehicle mileage log form, designed for easy tracking of miles driven for tax purposes. This sample form helps ensure compliance with IRS requirements and simplifies expense reporting. Download and print to maintain organized and detailed mileage information effortlessly.

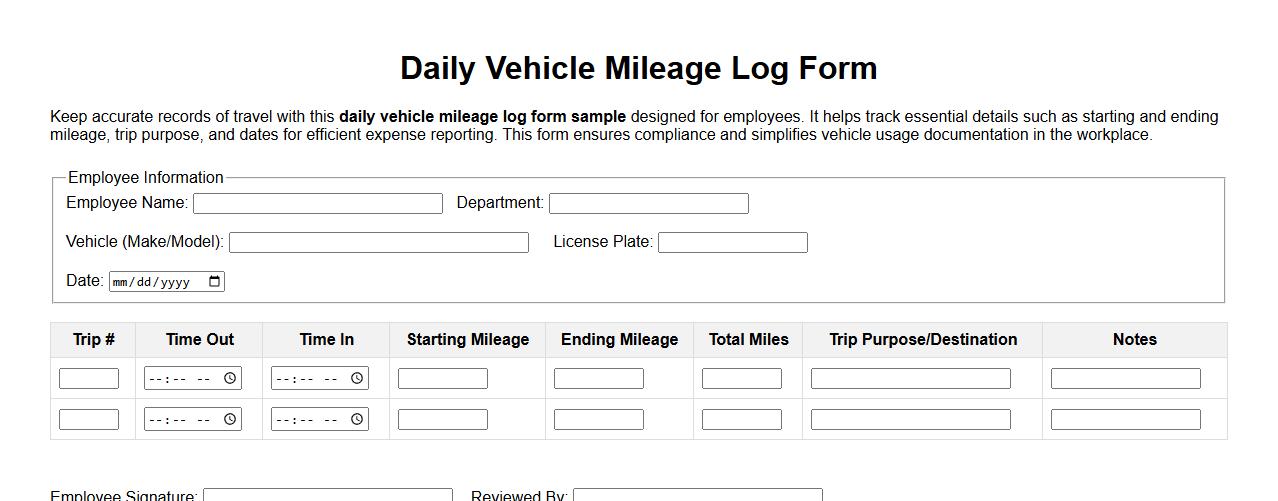

Daily vehicle mileage log form sample for employees

Keep accurate records of travel with this daily vehicle mileage log form sample designed for employees. It helps track essential details such as starting and ending mileage, trip purpose, and dates for efficient expense reporting. This form ensures compliance and simplifies vehicle usage documentation in the workplace.

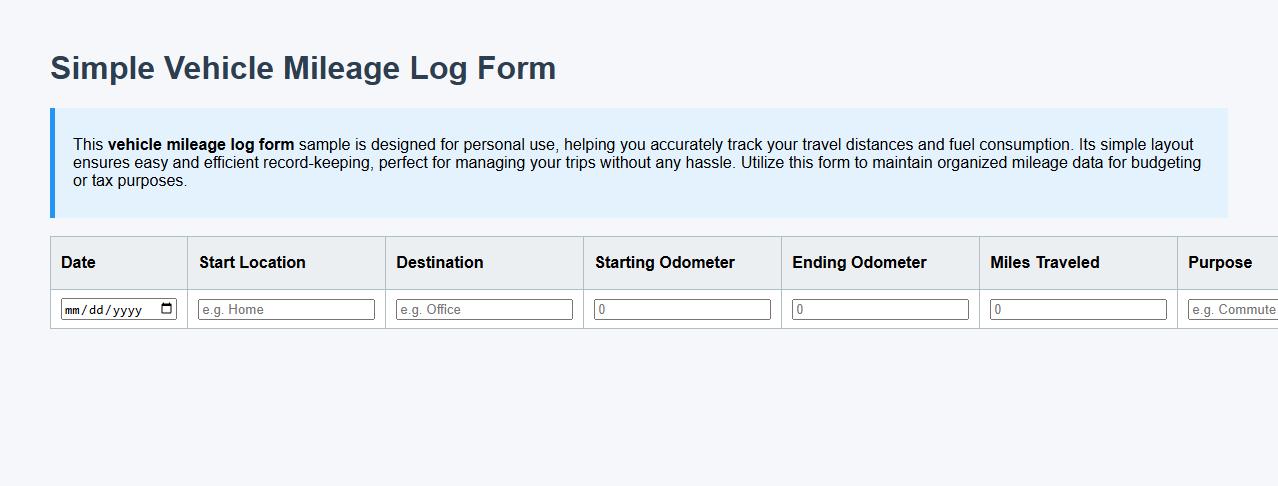

Simple vehicle mileage log form sample for personal use

This vehicle mileage log form sample is designed for personal use, helping you accurately track your travel distances and fuel consumption. Its simple layout ensures easy and efficient record-keeping, perfect for managing your trips without any hassle. Utilize this form to maintain organized mileage data for budgeting or tax purposes.

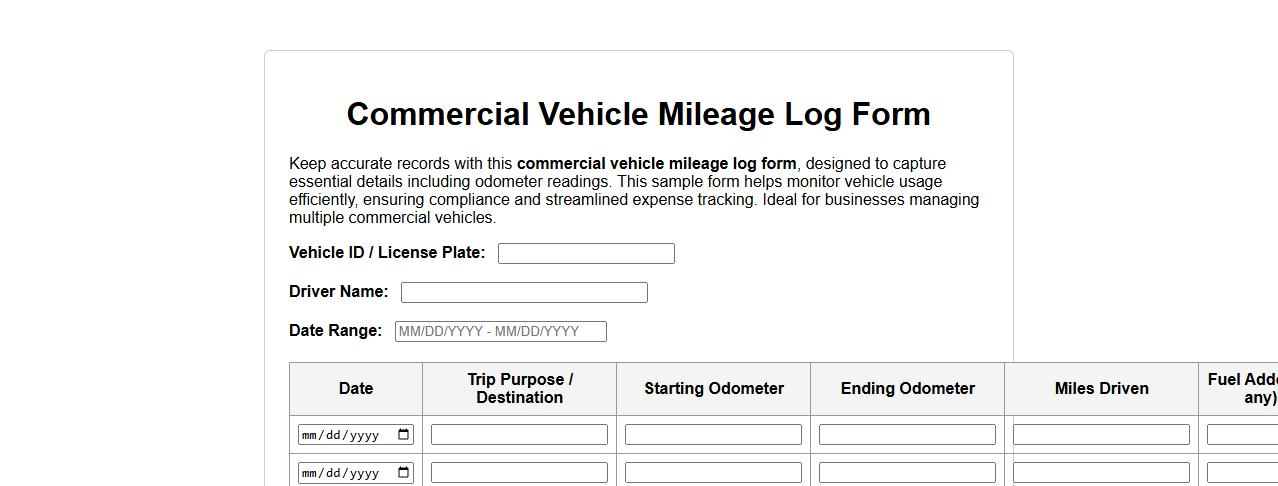

Commercial vehicle mileage log form sample with odometer reading

Keep accurate records with this commercial vehicle mileage log form, designed to capture essential details including odometer readings. This sample form helps monitor vehicle usage efficiently, ensuring compliance and streamlined expense tracking. Ideal for businesses managing multiple commercial vehicles.

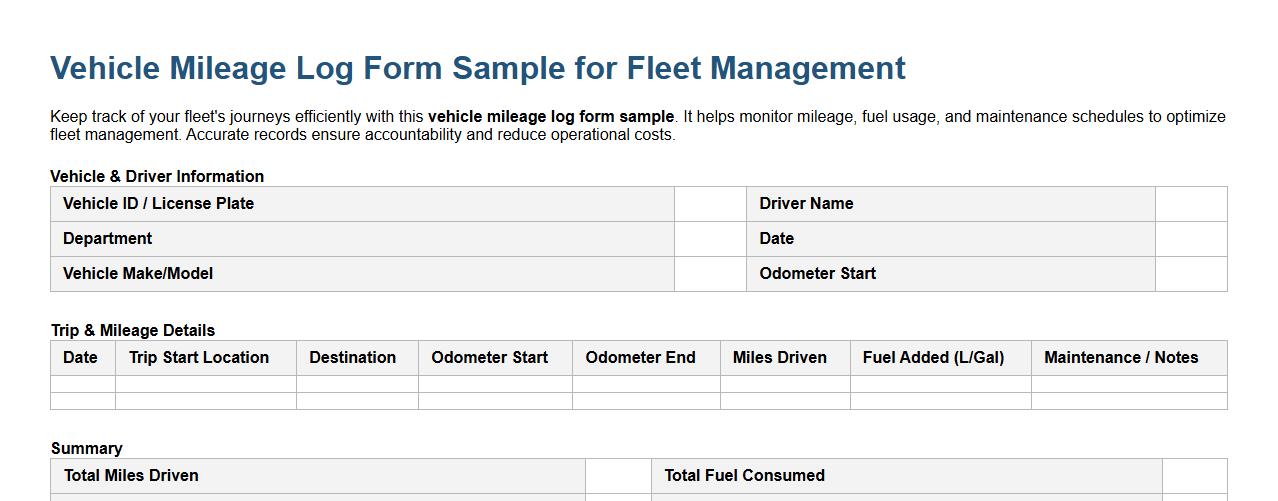

Vehicle mileage log form sample for fleet management

Keep track of your fleet's journeys efficiently with this vehicle mileage log form sample. It helps monitor mileage, fuel usage, and maintenance schedules to optimize fleet management. Accurate records ensure accountability and reduce operational costs.

Detailed vehicle mileage log form sample with fuel tracking

This vehicle mileage log form sample provides a comprehensive way to record daily travel distances and monitor fuel consumption efficiently. It helps drivers maintain accurate records for expense tracking and fuel usage analysis. Utilizing this form ensures better vehicle management and cost control.

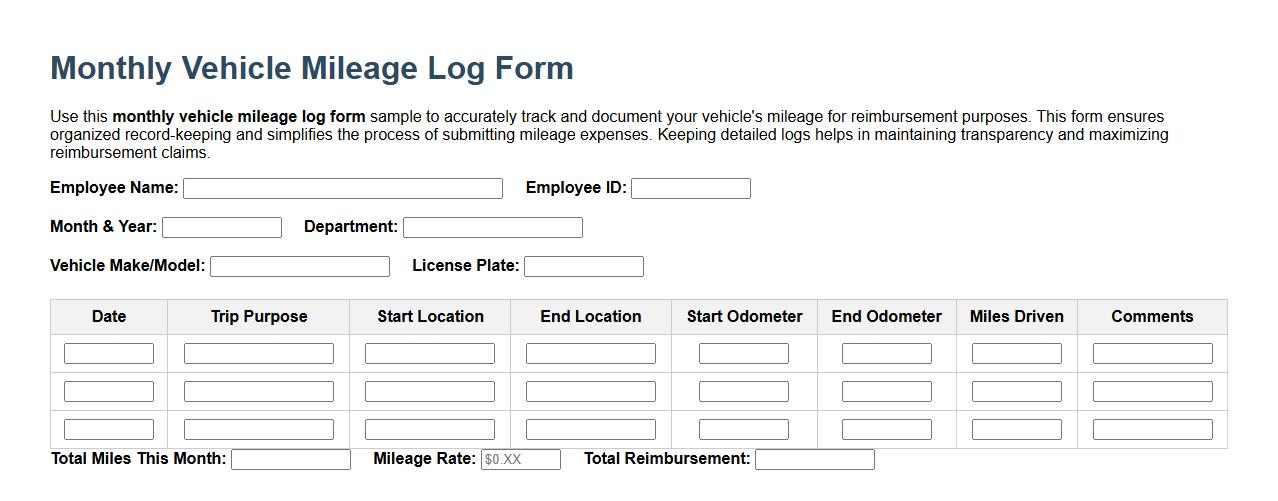

Monthly vehicle mileage log form sample for reimbursement

Use this monthly vehicle mileage log form sample to accurately track and document your vehicle's mileage for reimbursement purposes. This form ensures organized record-keeping and simplifies the process of submitting mileage expenses. Keeping detailed logs helps in maintaining transparency and maximizing reimbursement claims.

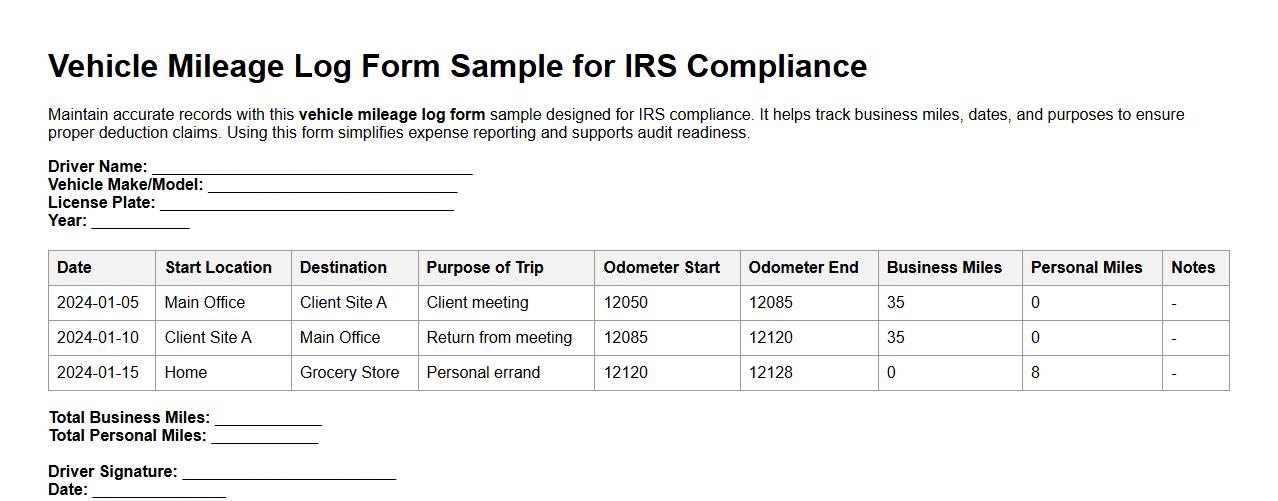

Vehicle mileage log form sample for IRS compliance

Maintain accurate records with this vehicle mileage log form sample designed for IRS compliance. It helps track business miles, dates, and purposes to ensure proper deduction claims. Using this form simplifies expense reporting and supports audit readiness.

What details are required in the odometer start and end sections?

The odometer start section records the vehicle's mileage at the beginning of the trip. The odometer end section captures the mileage at the trip's conclusion. These entries enable accurate calculation of total distance traveled.

How does the Vehicle Mileage Log Form track business versus personal use?

The form includes designated fields to differentiate business and personal mileage. Users input the miles driven for each category separately. This distinction ensures precise record-keeping for tax and reimbursement purposes.

Are there fields for multiple drivers on the same log form?

Many Vehicle Mileage Log Forms provide spaces for recording details from multiple drivers. This feature allows tracking of trips taken by different individuals using the same vehicle. It helps maintain an organized and comprehensive mileage record.

Does the form accommodate digital signature or approval fields?

Modern forms often include sections for digital signatures or approvals. This capability supports remote validation and authorization. It enhances the form's authenticity and compliance with corporate policies.

How is trip purpose categorized or detailed within the log?

The form offers a field for specifying the trip purpose, such as client meetings or deliveries. Users provide a brief description to clarify the reason for travel. Proper categorization aids in audit readiness and expense justification.