The Employee Expense Claim Form Sample serves as a standardized template for employees to report and request reimbursement for work-related expenses. It typically includes fields for date, description, amount, and receipts, ensuring accurate and transparent documentation. Using this form streamlines the approval process and helps maintain organized financial records.

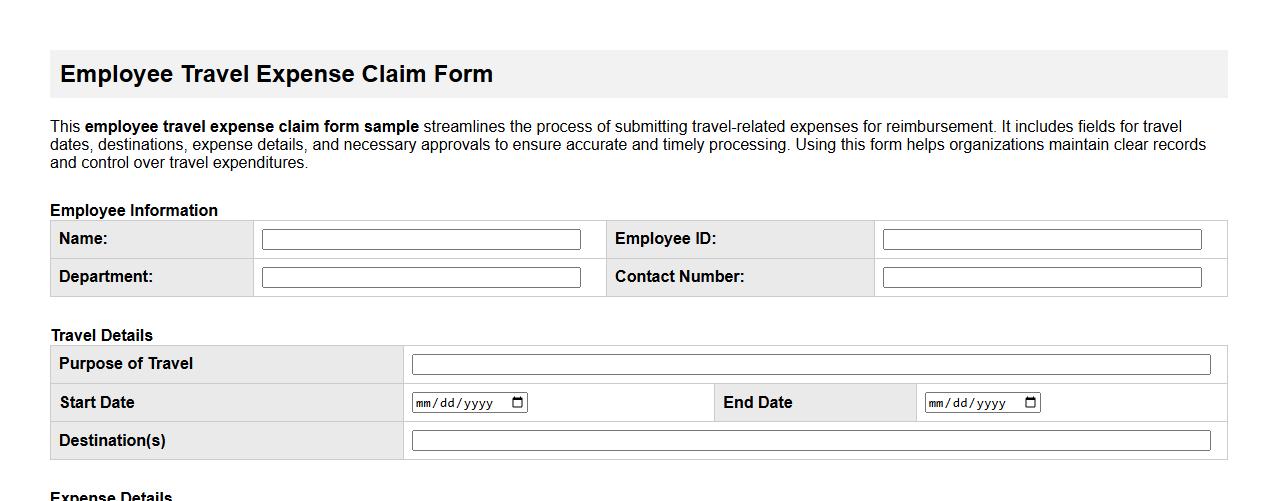

Employee travel expense claim form sample

This employee travel expense claim form sample streamlines the process of submitting travel-related expenses for reimbursement. It includes fields for travel dates, destinations, expense details, and necessary approvals to ensure accurate and timely processing. Using this form helps organizations maintain clear records and control over travel expenditures.

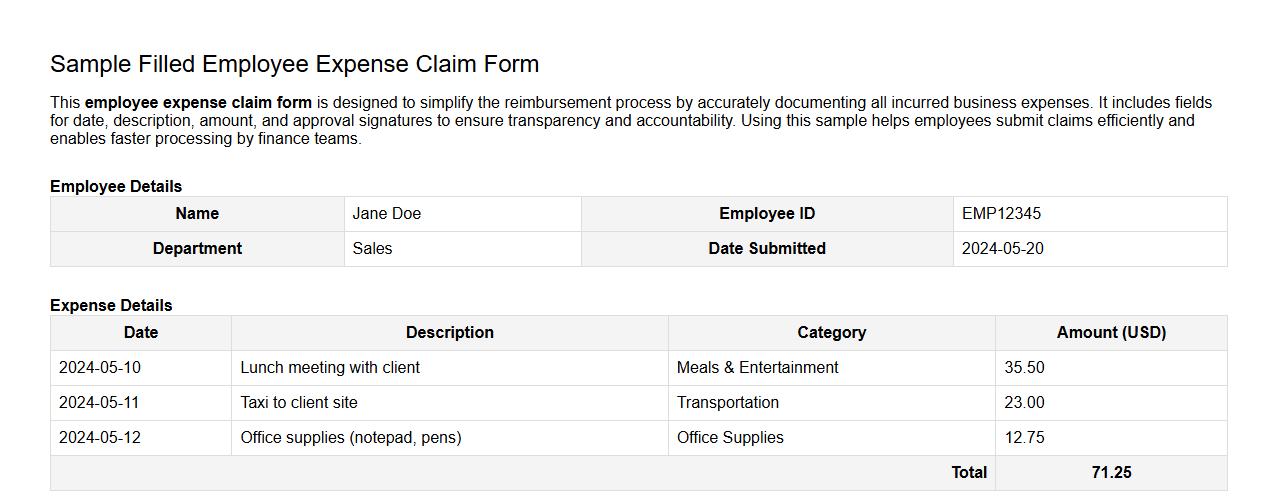

Sample filled employee expense claim form

This employee expense claim form is designed to simplify the reimbursement process by accurately documenting all incurred business expenses. It includes fields for date, description, amount, and approval signatures to ensure transparency and accountability. Using this sample helps employees submit claims efficiently and enables faster processing by finance teams.

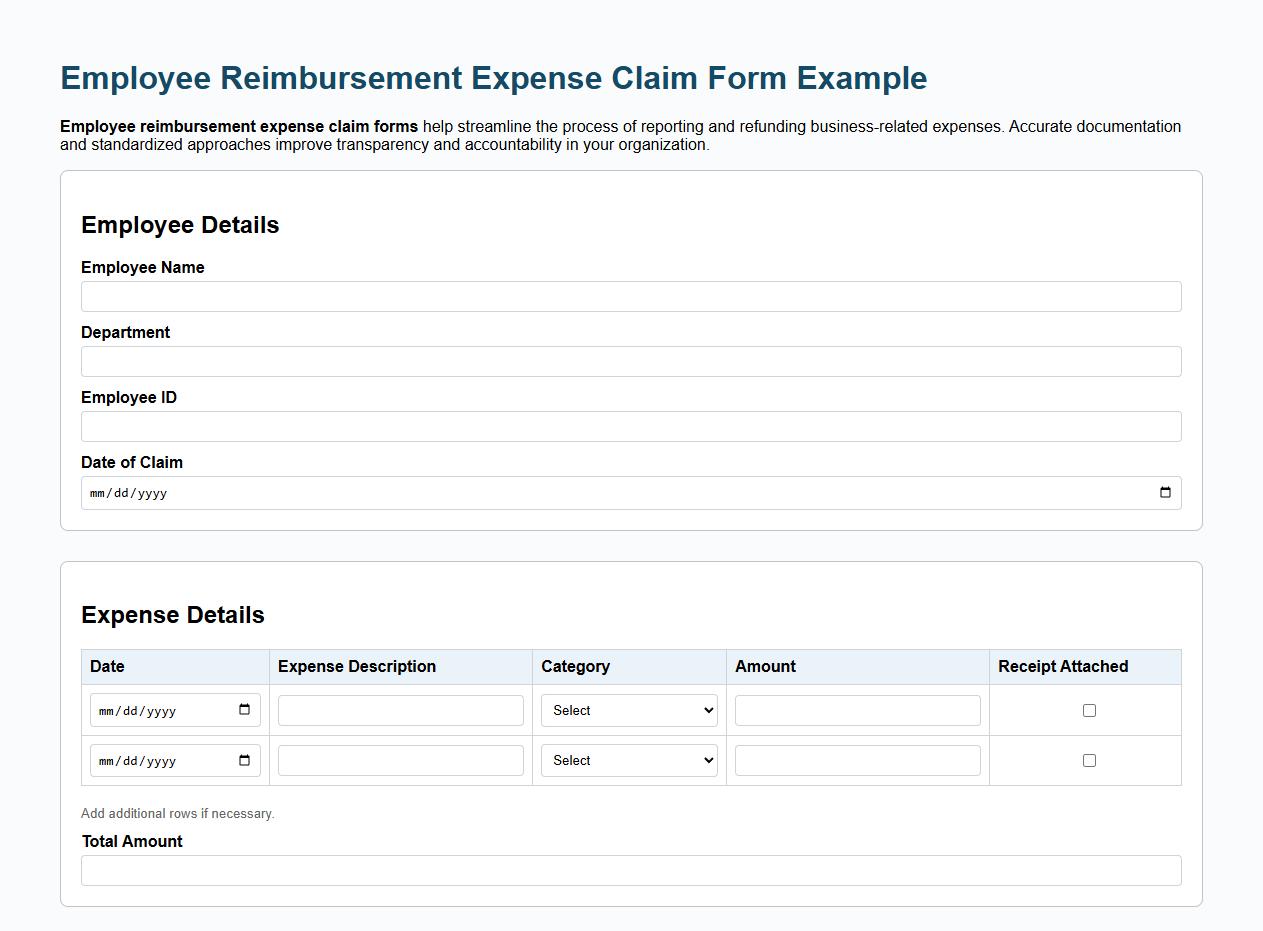

Employee reimbursement expense claim form example

An employee reimbursement expense claim form example helps streamline the process of reporting and refunding business-related expenses. It ensures accurate documentation and quick approval for employees to recover their out-of-pocket costs. Using a standardized form improves financial transparency and accountability within the organization.

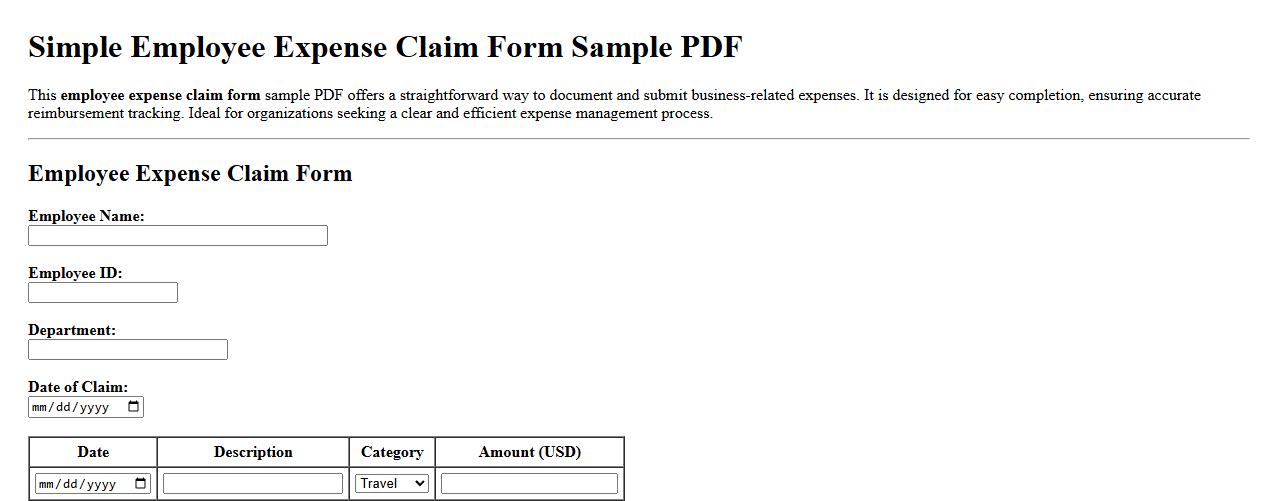

Simple employee expense claim form sample PDF

This employee expense claim form sample PDF offers a straightforward way to document and submit business-related expenses. It is designed for easy completion, ensuring accurate reimbursement tracking. Ideal for organizations seeking a clear and efficient expense management process.

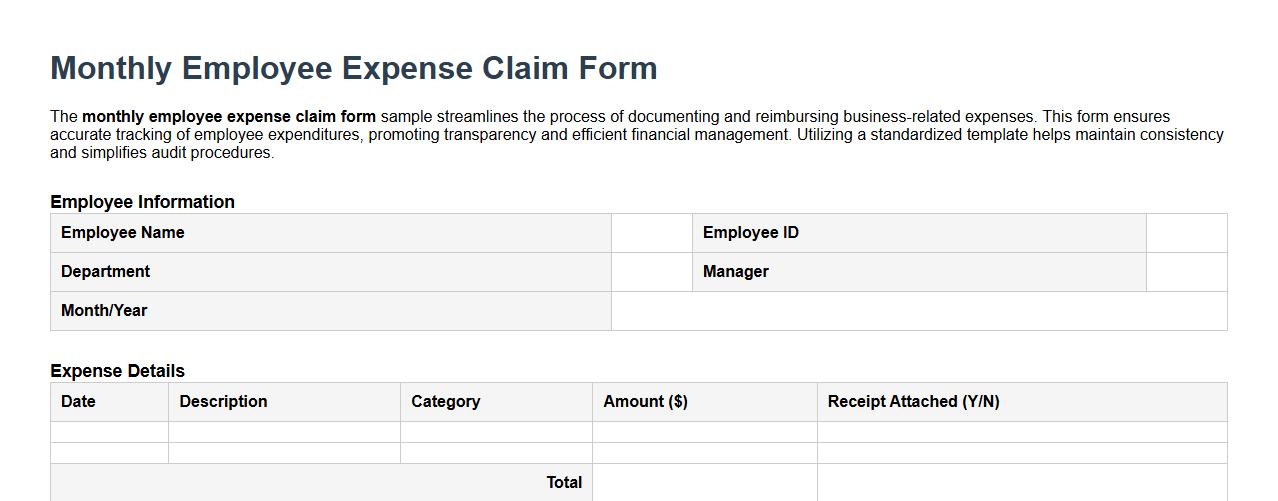

Monthly employee expense claim form sample

The monthly employee expense claim form sample streamlines the process of documenting and reimbursing business-related expenses. This form ensures accurate tracking of employee expenditures, promoting transparency and efficient financial management. Utilizing a standardized template helps maintain consistency and simplifies audit procedures.

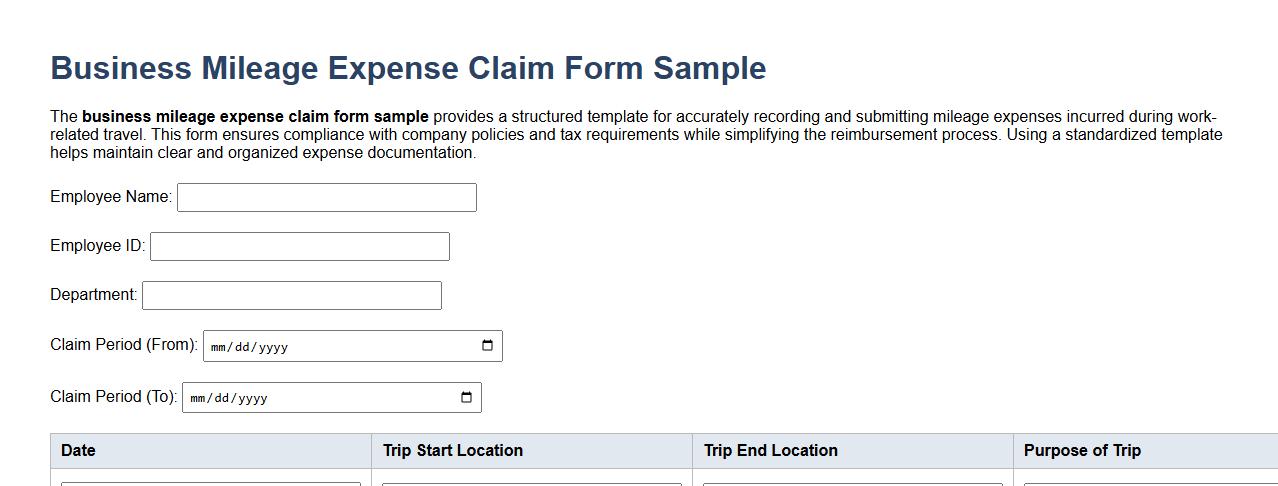

Business mileage expense claim form sample

The business mileage expense claim form sample provides a structured template for accurately recording and submitting mileage expenses incurred during work-related travel. This form ensures compliance with company policies and tax requirements while simplifying the reimbursement process. Using a standardized template helps maintain clear and organized expense documentation.

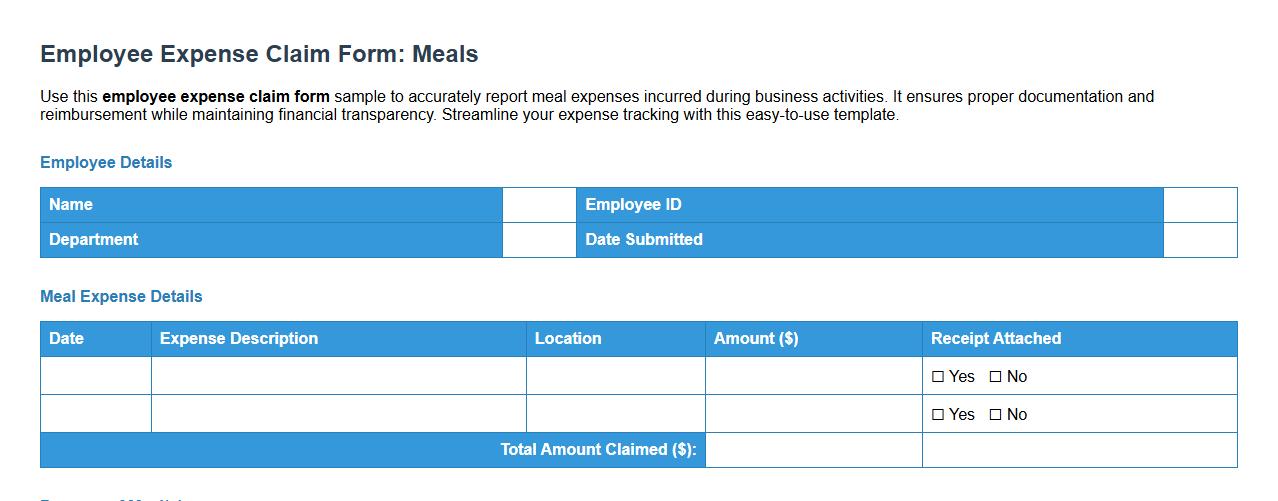

Employee expense claim form sample for meals

Use this employee expense claim form sample to accurately report meal expenses incurred during business activities. It ensures proper documentation and reimbursement while maintaining financial transparency. Streamline your expense tracking with this easy-to-use template.

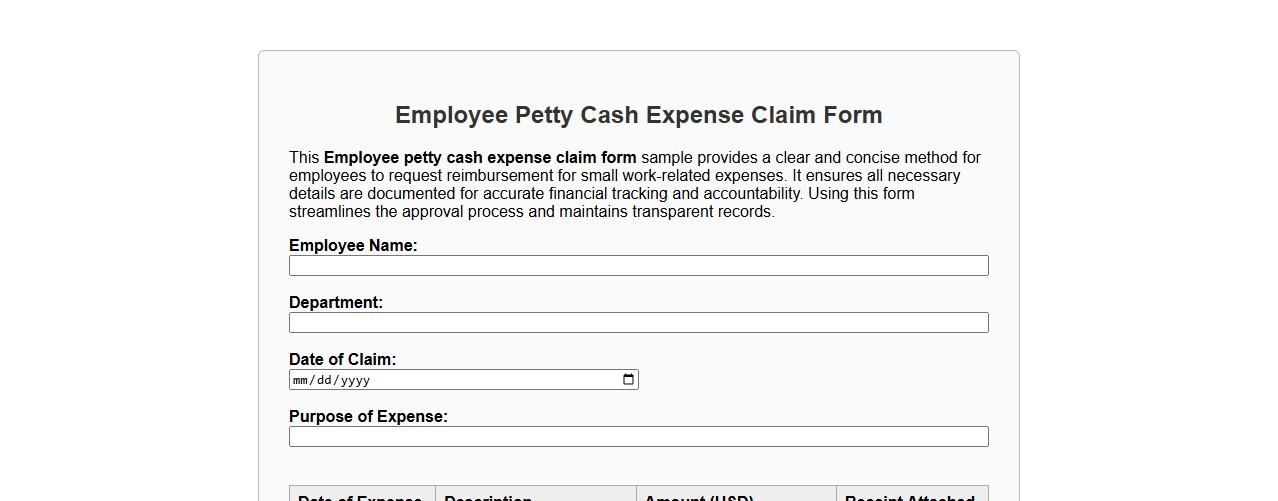

Employee petty cash expense claim form sample

This Employee petty cash expense claim form sample provides a clear and concise method for employees to request reimbursement for small work-related expenses. It ensures all necessary details are documented for accurate financial tracking and accountability. Using this form streamlines the approval process and maintains transparent records.

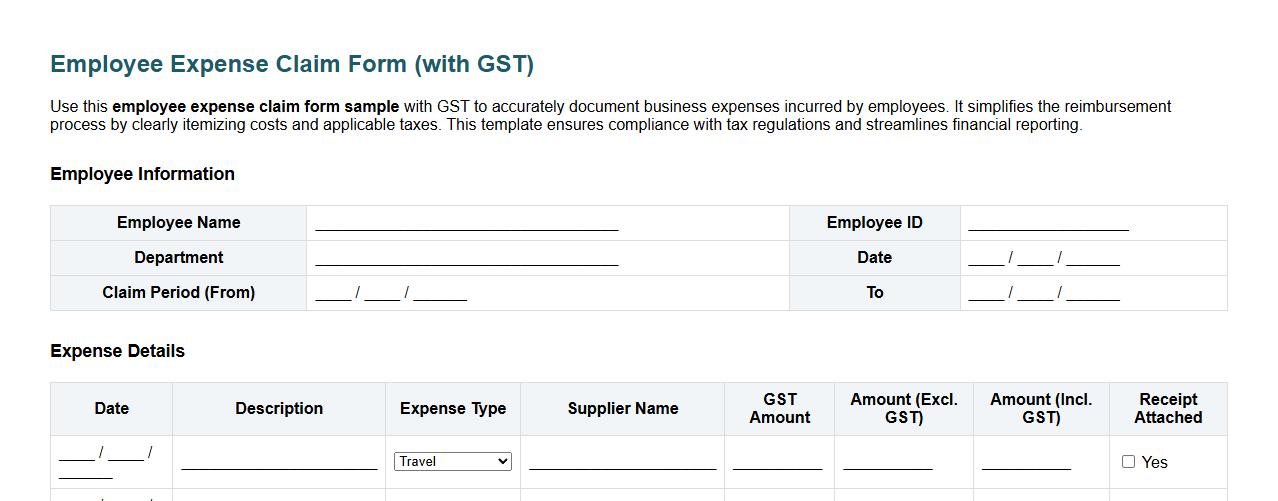

Employee expense claim form sample with GST

Use this employee expense claim form sample with GST to accurately document business expenses incurred by employees. It simplifies the reimbursement process by clearly itemizing costs and applicable taxes. This template ensures compliance with tax regulations and streamlines financial reporting.

What supporting receipts are required for meal reimbursements on the Employee Expense Claim Form?

For meal reimbursements, itemized receipts showing the date, vendor, and amount spent are required. Credit card statements alone are not sufficient to validate the expense. Receipts must clearly demonstrate that the purchase was for a meal related to company business.

How should mileage be documented for personal vehicle use in the claim?

Mileage claims must include the date of travel, starting point, destination, and total miles driven. A detailed log or mileage tracker app printout is recommended for accuracy. The reimbursement rate will be applied based on the current company mileage allowance.

Are there restrictions on claimable expenses based on employee position or department?

Yes, certain expenses are restricted depending on the employee's role and department. For example, executive level employees might have higher allowable limits for meals and lodging. Departments like sales may have specific guidelines for travel costs not applicable to others.

Is manager approval mandatory for all expense types listed on the form?

Manager approval is mandatory for all expenses submitted on the claim form. This ensures compliance with company policies and budget controls. Expenses without proper approval are subject to denial or delay in reimbursement.

What is the maximum duration after an expense occurred to submit the claim form?

The expense claim form must be submitted within a 60-day period from the date the expense was incurred. Late submissions may be rejected unless accompanied by a valid reason and special approval. Timely submission facilitates prompt reimbursement and accurate financial reporting.