A Credit Card Application Form Sample provides a clear example of the essential fields required for applying, such as personal information, employment details, and financial status. This sample helps users understand the documentation needed and simplifies the application process. Reviewing a well-structured form improves accuracy and speeds up approval time.

Downloadable credit card application form sample PDF

Download our credit card application form sample in PDF format for easy and convenient access. This template helps you understand the required information and accelerates your application process. Simply download, fill out, and submit to apply for your new credit card.

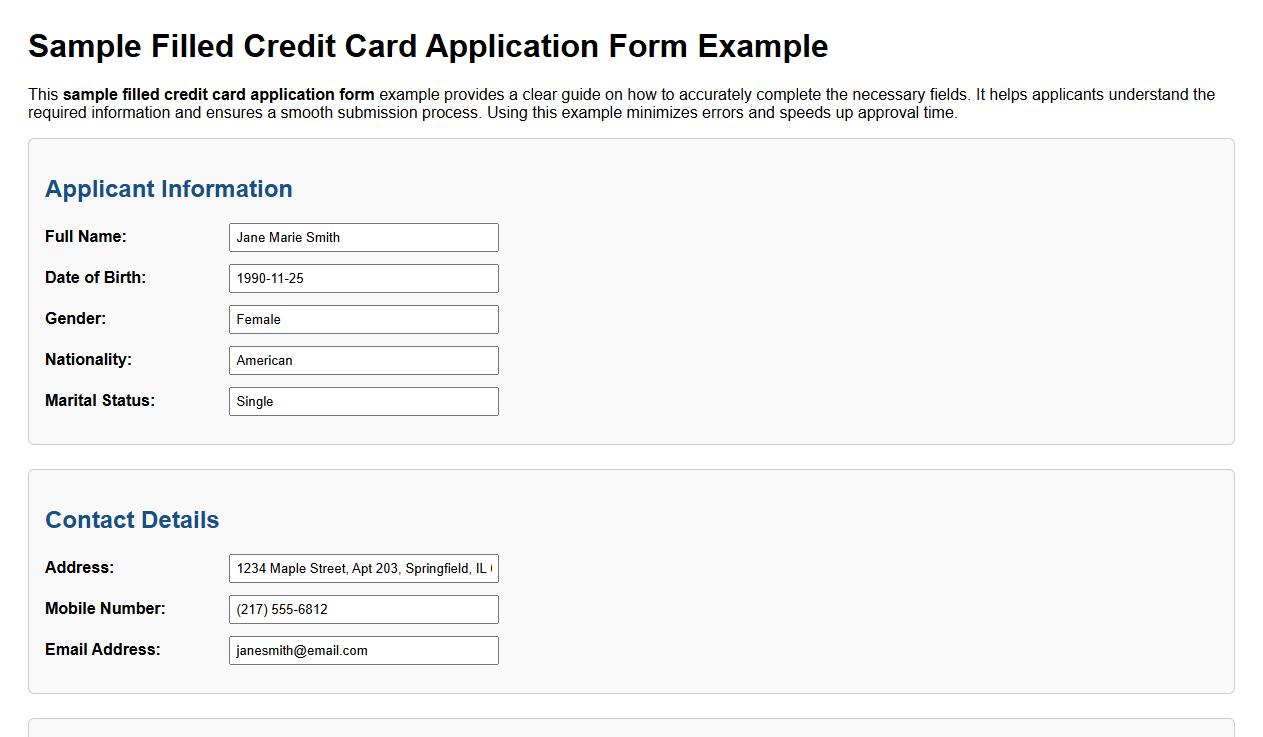

Sample filled credit card application form example

This sample filled credit card application form example provides a clear guide on how to accurately complete the necessary fields. It helps applicants understand the required information and ensures a smooth submission process. Using this example minimizes errors and speeds up approval time.

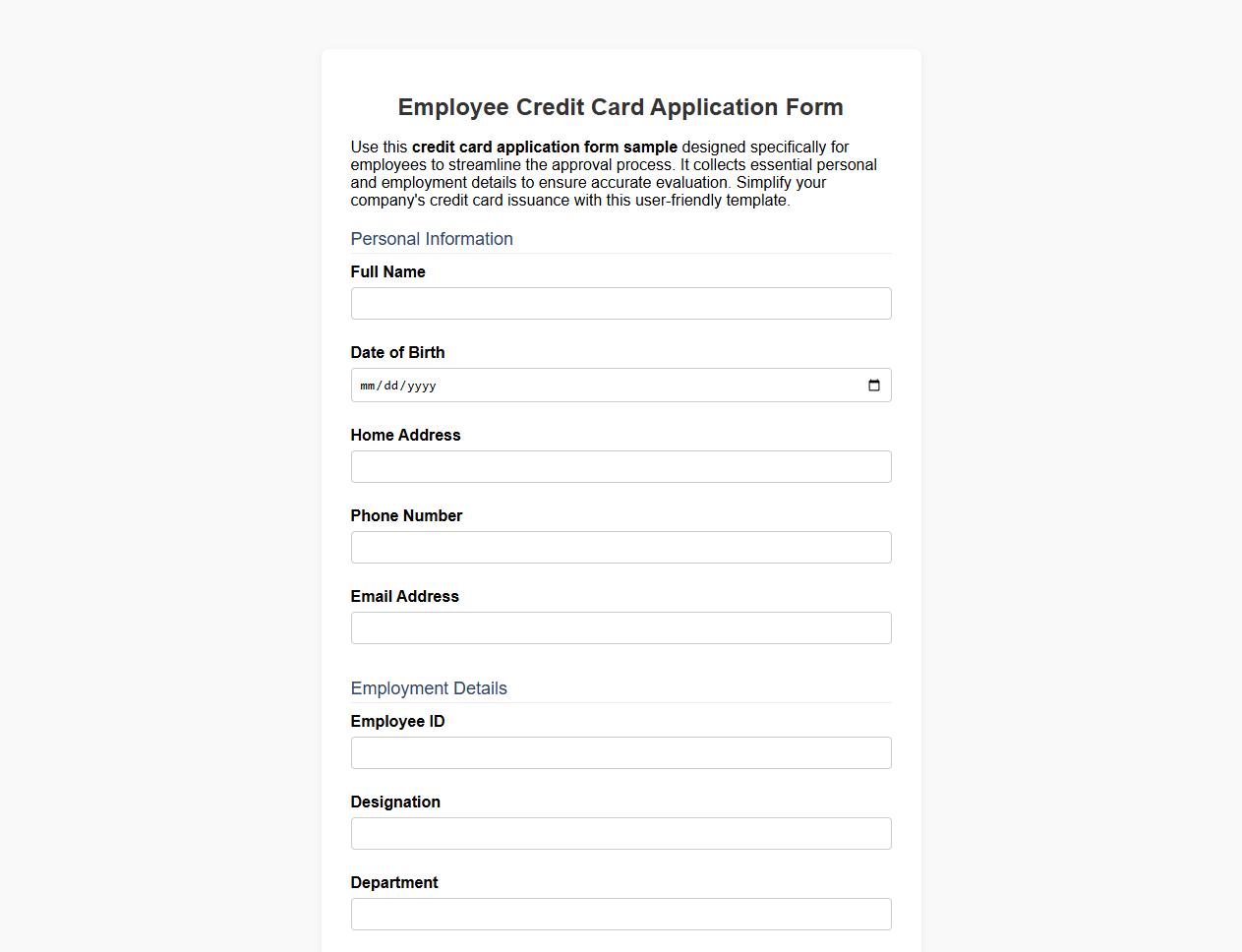

Credit card application form sample for employees

Use this credit card application form sample designed specifically for employees to streamline the approval process. It collects essential personal and employment details to ensure accurate evaluation. Simplify your company's credit card issuance with this user-friendly template.

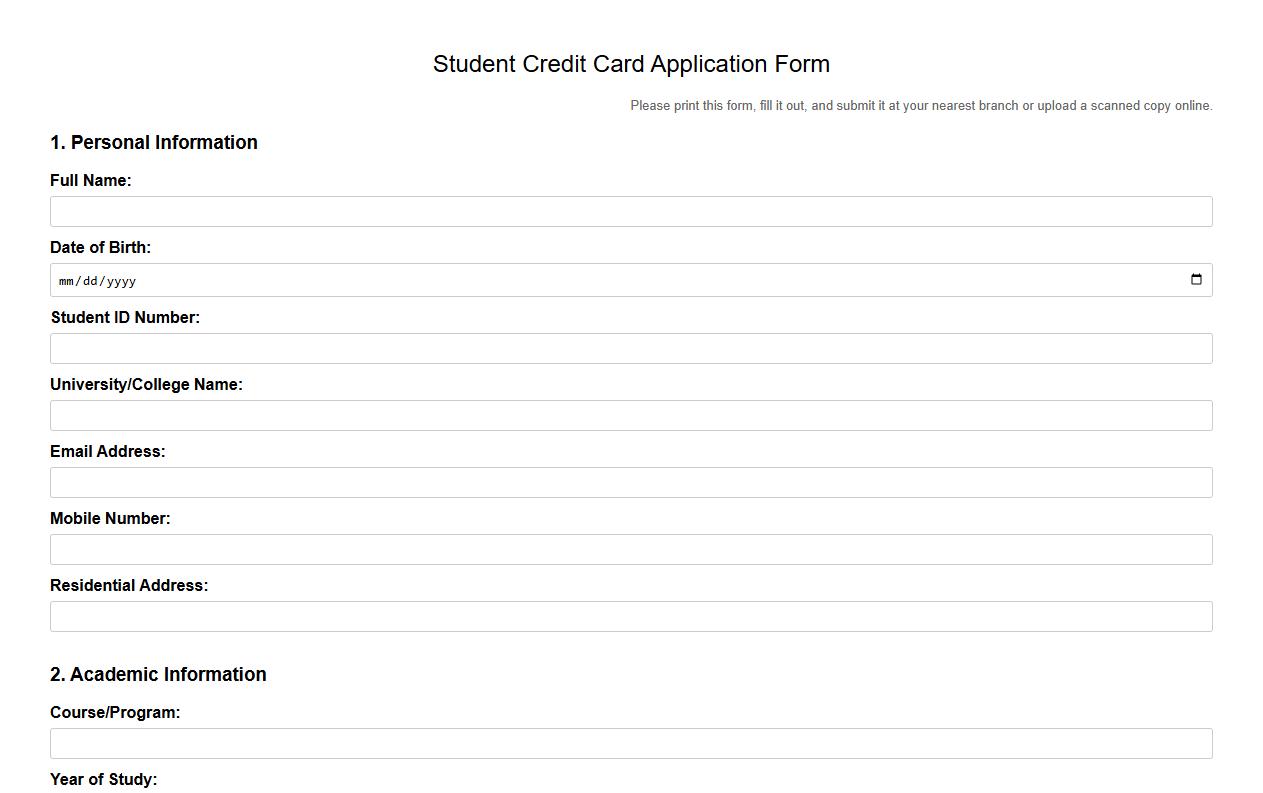

Printable credit card application form sample for students

Download a printable credit card application form sample designed specifically for students to simplify the application process. This easy-to-use template helps students provide necessary details clearly and accurately. Access and print the form instantly to apply with confidence.

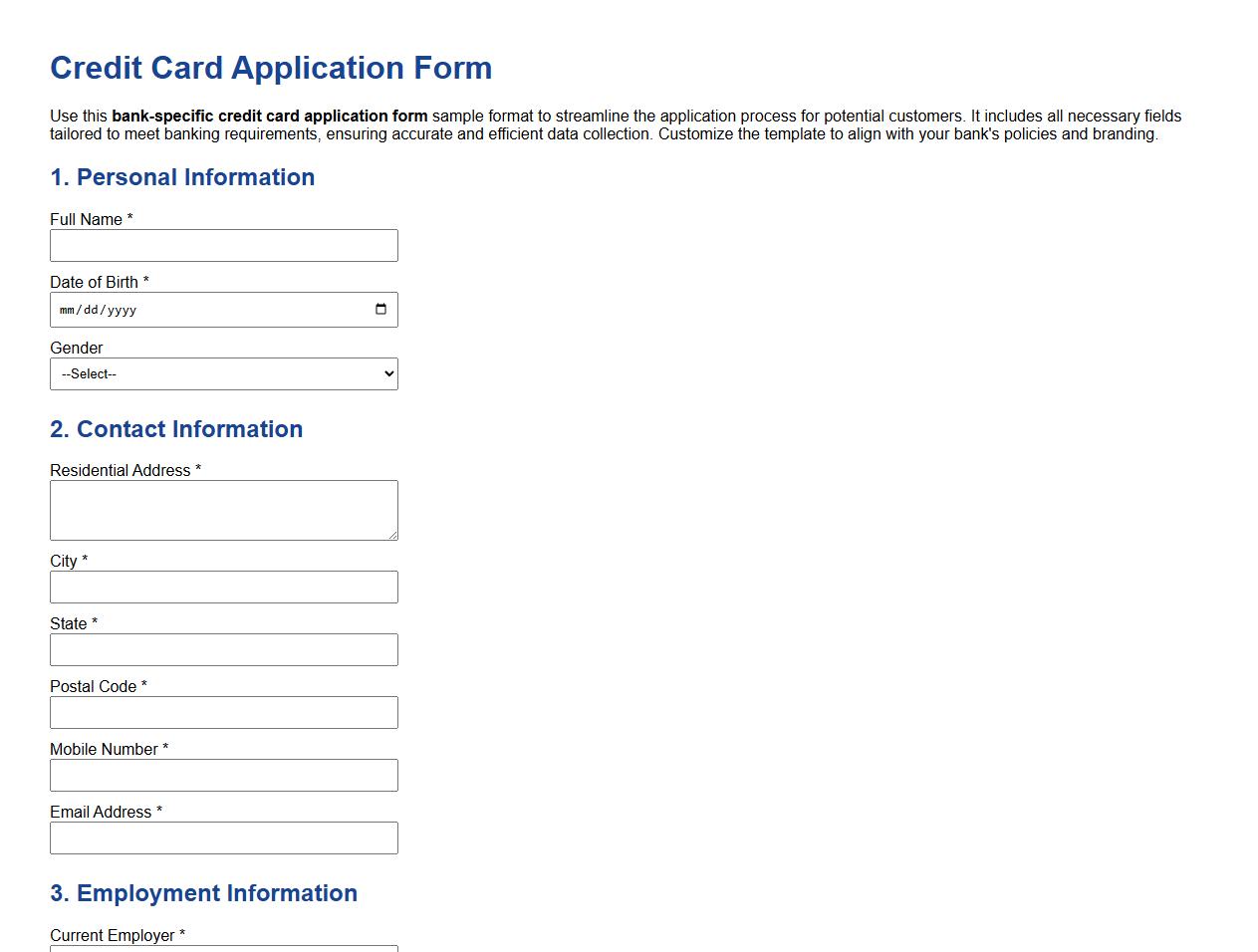

Bank-specific credit card application form sample format

Use this bank-specific credit card application form sample format to streamline the application process for potential customers. It includes all necessary fields tailored to meet banking requirements, ensuring accurate and efficient data collection. Customize the template to align with your bank's policies and branding.

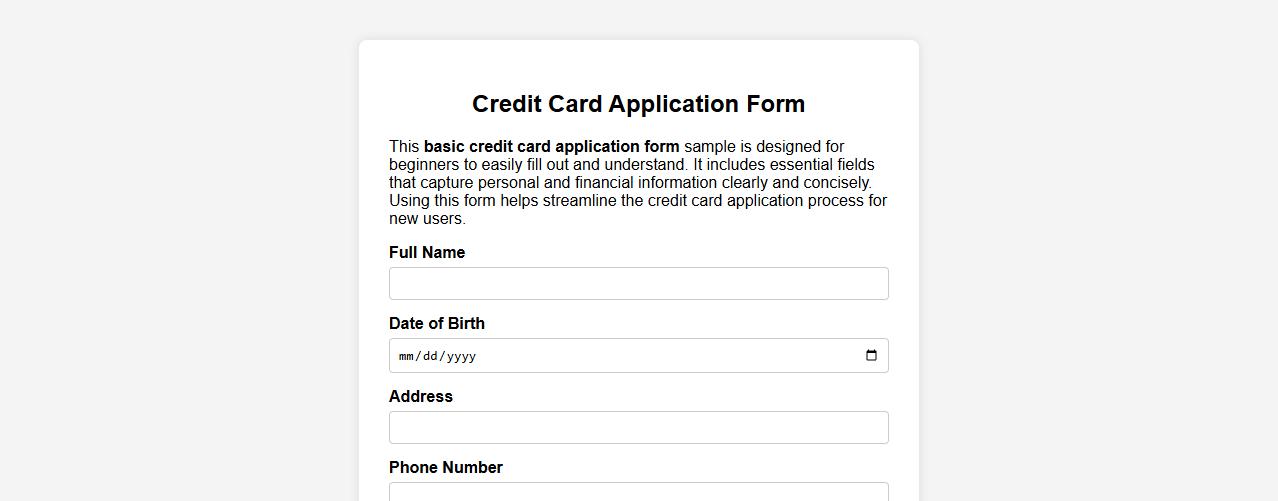

Basic credit card application form sample for beginners

This basic credit card application form sample is designed for beginners to easily fill out and understand. It includes essential fields that capture personal and financial information clearly and concisely. Using this form helps streamline the credit card application process for new users.

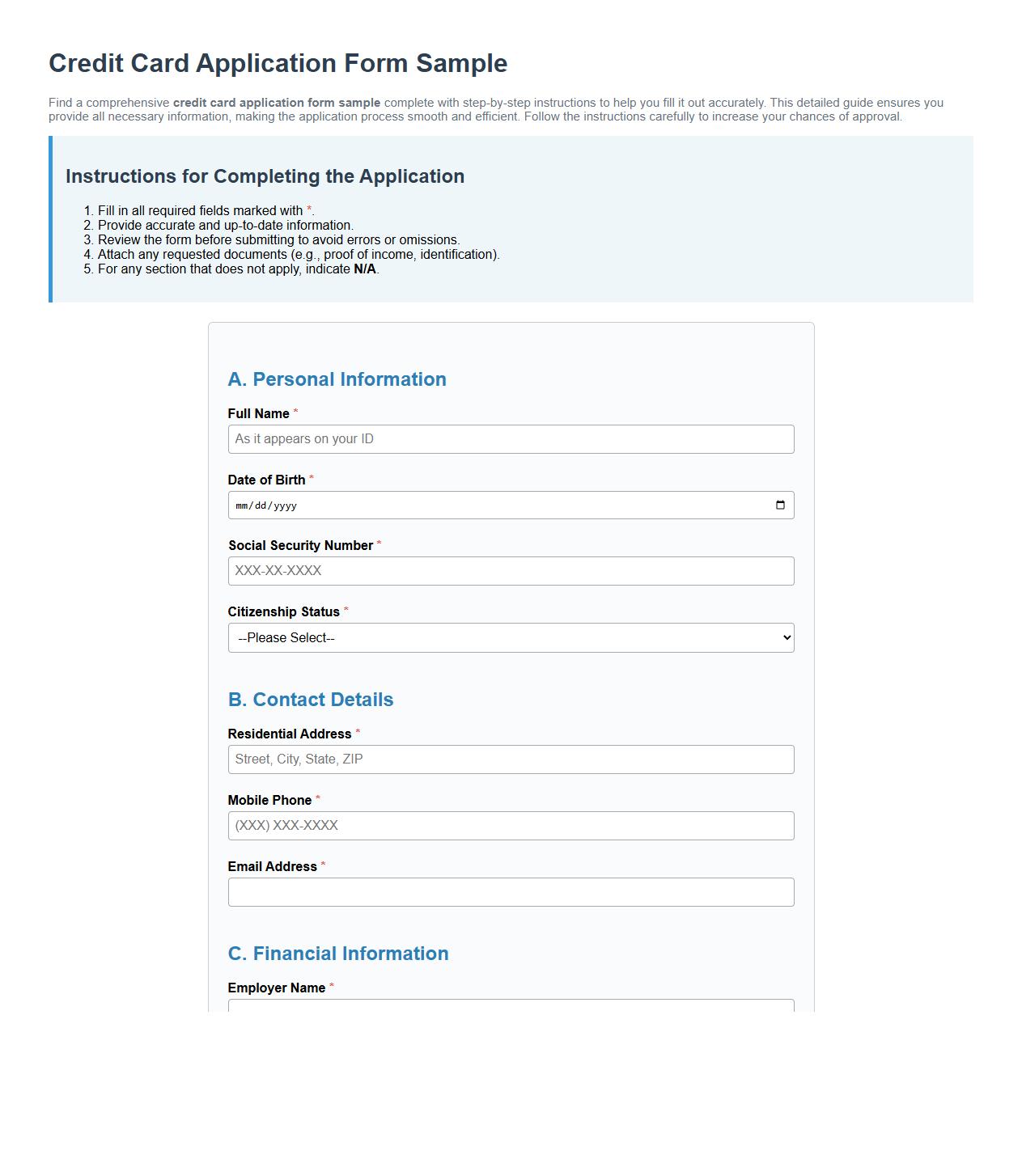

Detailed credit card application form sample with instructions

Find a comprehensive credit card application form sample complete with step-by-step instructions to help you fill it out accurately. This detailed guide ensures you provide all necessary information, making the application process smooth and efficient. Follow the instructions carefully to increase your chances of approval.

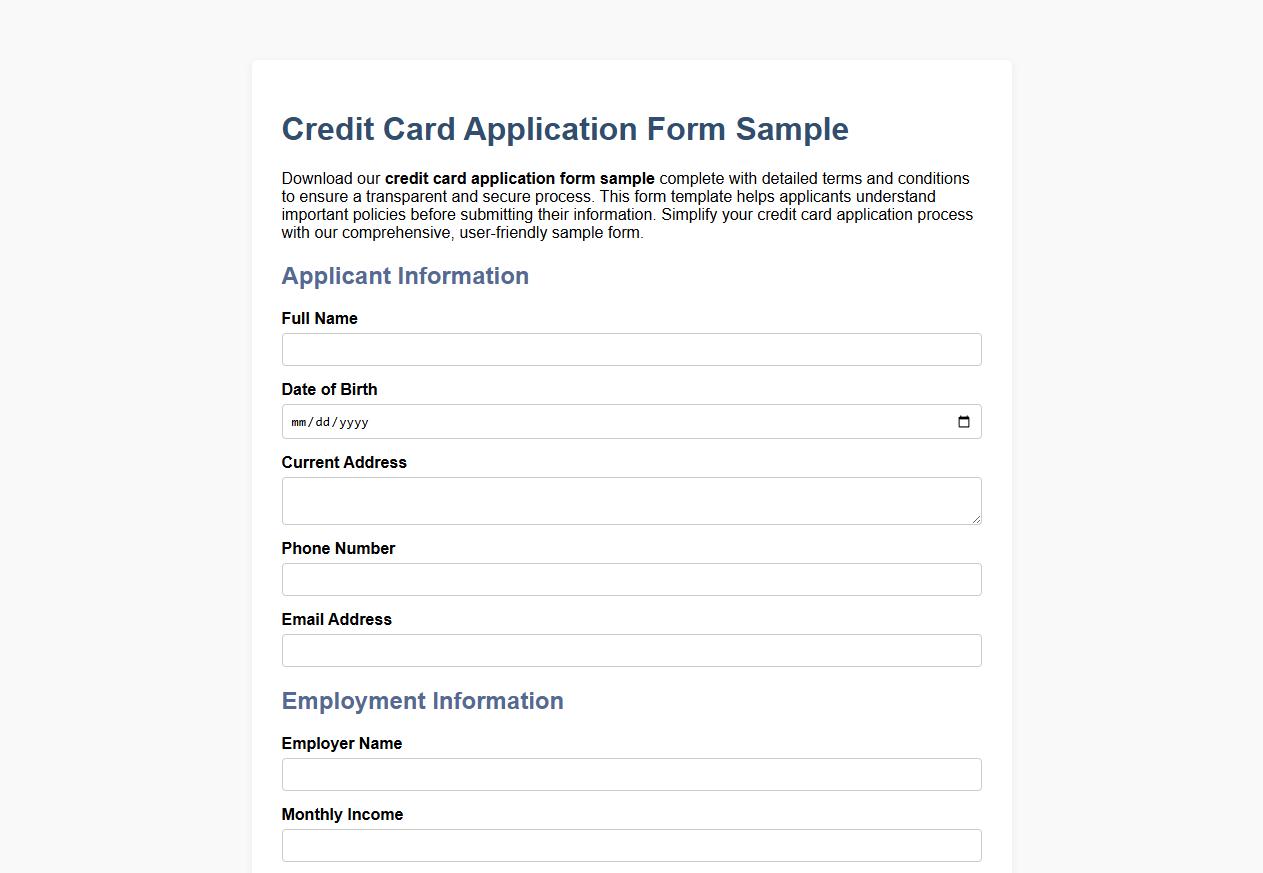

Credit card application form sample with terms and conditions

Download our credit card application form sample complete with detailed terms and conditions to ensure a transparent and secure process. This form template helps applicants understand important policies before submitting their information. Simplify your credit card application process with our comprehensive, user-friendly sample form.

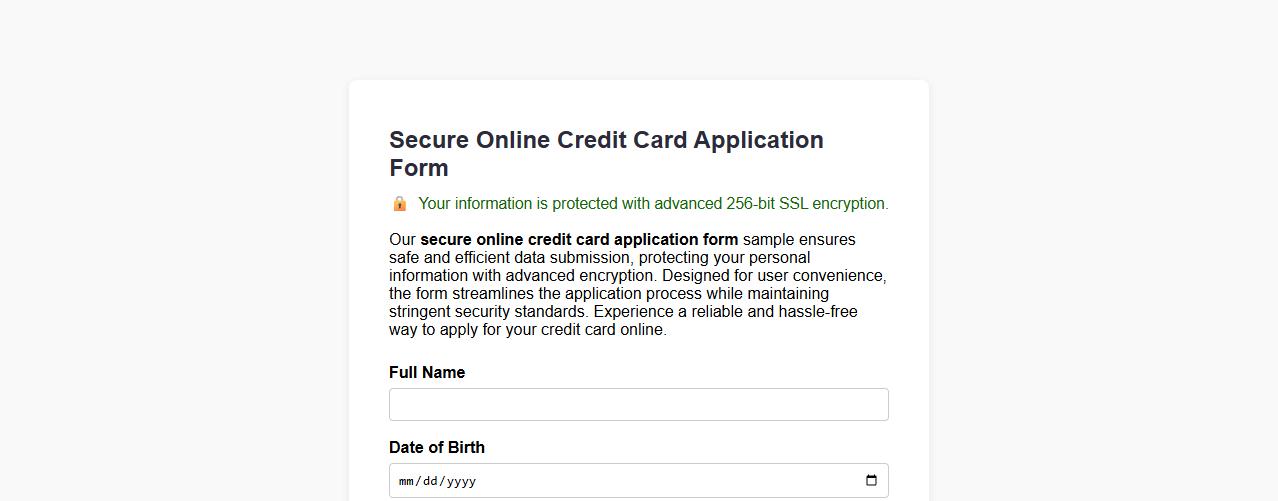

Secure online credit card application form sample

Our secure online credit card application form sample ensures safe and efficient data submission, protecting your personal information with advanced encryption. Designed for user convenience, the form streamlines the application process while maintaining stringent security standards. Experience a reliable and hassle-free way to apply for your credit card online.

What supporting documents are required for a credit card application form verification?

To verify a credit card application, applicants must provide proof of identity such as a government-issued ID or passport. Additionally, proof of address like a utility bill or bank statement is mandatory. Financial documents such as recent salary slips or bank statements are also required for income verification.

How do you address discrepancies in the employment section of the credit card application form?

Discrepancies in the employment section are resolved by contacting the employer for verification of employment details. The credit card issuer may request additional documentation such as an employment contract or recent payslips. If inconsistencies persist, the application may undergo further scrutiny or be declined.

Which sections of the form require handwritten signatures versus digital authorization?

Handwritten signatures are typically required on critical sections like the consent for credit checks and the agreement to terms and conditions. Digital authorization may be accepted for preliminary application submission or minor acknowledgments. However, final approval often depends on physical signatures to ensure authenticity.

How is the applicant's declared income validated during the credit card approval process?

The declared income is validated through submission of official documents such as salary slips, bank statements, or tax returns. Some issuers may also directly verify income with the employer. This process ensures the applicant's financial stability and repayment capability.

Are there privacy clauses specific to data sharing outlined in the credit card application document?

Yes, credit card applications contain specific privacy clauses that detail how applicant data is collected, used, and shared. These clauses comply with relevant data protection laws to safeguard personal information. Applicants are informed about data sharing with credit bureaus and third-party vendors as part of the approval process.