An Expense Report is a detailed document that records and categorizes business-related expenditures for reimbursement or accounting purposes. It helps organizations track spending, ensure compliance with company policies, and manage budgets effectively. Employees submit Expense Reports to provide transparency and facilitate timely financial reconciliation.

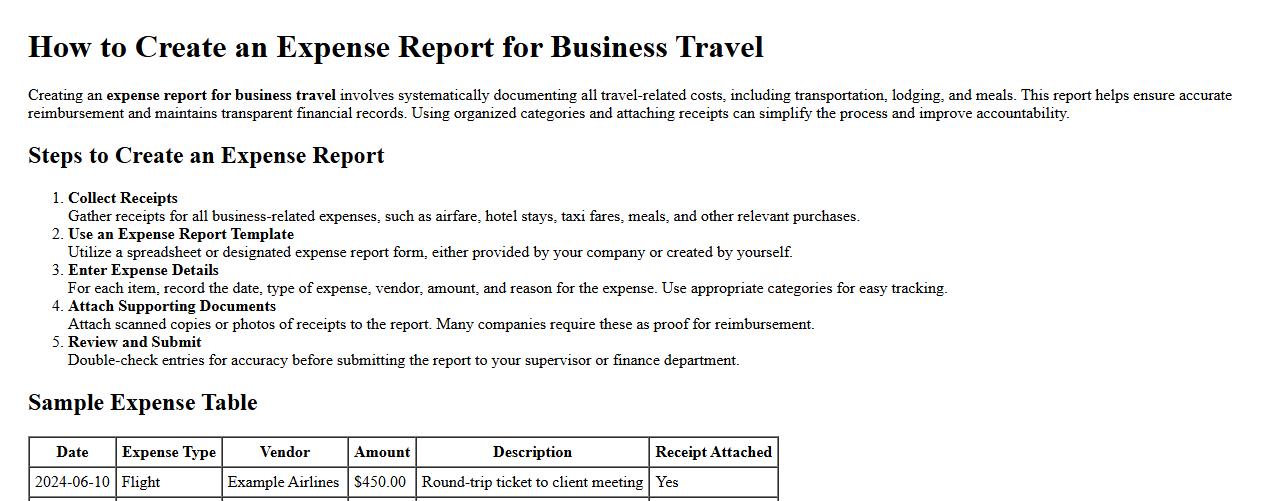

How to create an expense report for business travel

Creating an expense report for business travel involves systematically documenting all travel-related costs, including transportation, lodging, and meals. This report helps ensure accurate reimbursement and maintains transparent financial records. Using organized categories and attaching receipts can simplify the process and improve accountability.

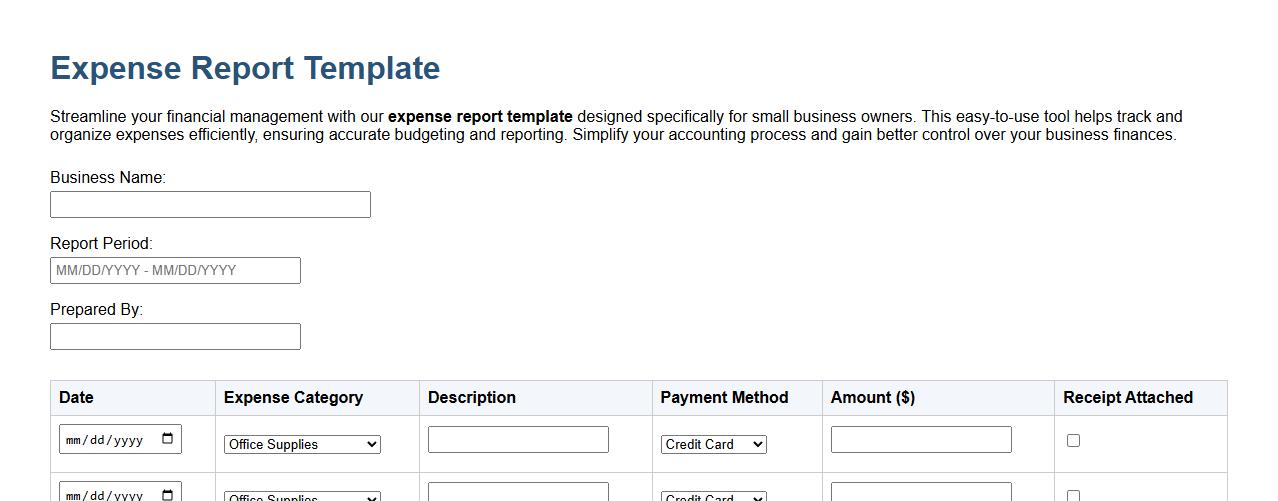

Expense report template for small business owners

Streamline your financial management with our expense report template designed specifically for small business owners. This easy-to-use tool helps track and organize expenses efficiently, ensuring accurate budgeting and reporting. Simplify your accounting process and gain better control over your business finances.

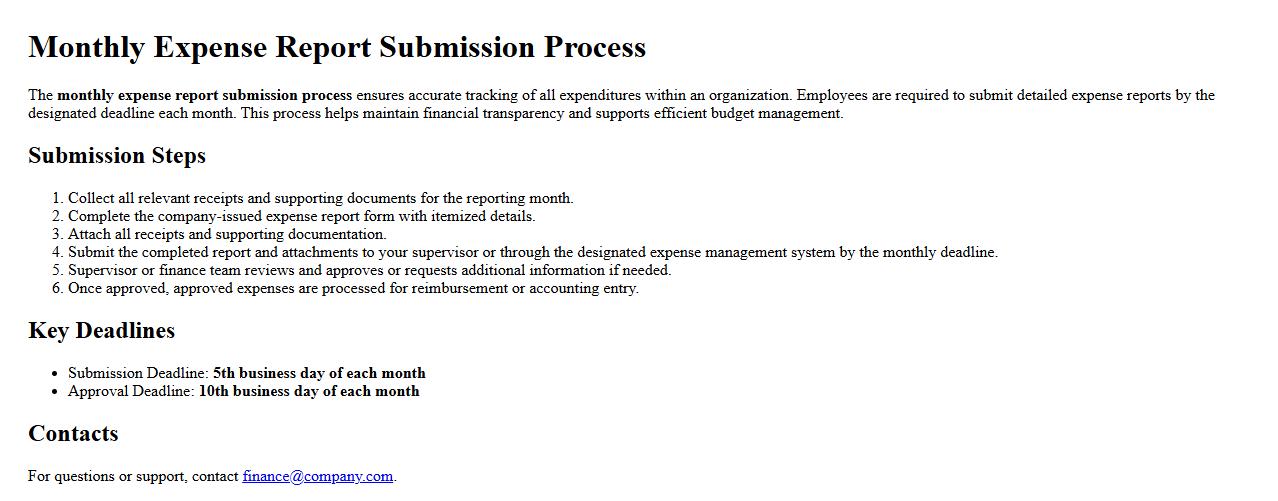

Monthly expense report submission process

The monthly expense report submission process ensures accurate tracking of all expenditures within an organization. Employees are required to submit detailed expense reports by the designated deadline each month. This process helps maintain financial transparency and supports efficient budget management.

Employee reimbursement expense report guidelines

Our employee reimbursement expense report guidelines ensure accurate and timely processing of expenses incurred during business activities. Employees must submit detailed receipts and approval forms to comply with company policies. Adhering to these guidelines helps maintain transparency and streamline expense management.

Expense report approval workflow automation

Streamline your financial processes with expense report approval workflow automation, ensuring faster and more accurate approvals. Automated workflows reduce manual errors and improve compliance by routing reports to the right approvers. Enhance transparency and save valuable time in managing expense reports efficiently.

Tax deductible items in expense report

An expense report may include various tax deductible items such as business-related travel, office supplies, and client meals. Proper documentation of these expenses ensures compliance with tax regulations and maximizes financial benefits. Keeping accurate records helps streamline the deduction process during tax filing.

Best software for expense report management

Choosing the best software for expense report management streamlines financial tracking and improves accuracy. These tools automate expense submission, approval workflows, and reporting, saving time and reducing errors. Efficient expense management software ultimately enhances budget control and organizational transparency.

Expense report policy for remote employees

Our expense report policy for remote employees ensures timely and accurate reimbursement of work-related costs. Employees must submit detailed expense reports with receipts within 30 days of the expenditure. This policy helps maintain transparency and accountability in managing remote work expenses.

GST compliance in expense report documentation

Accurate GST compliance in expense report documentation ensures proper tax credit claims and avoids penalties. It involves maintaining detailed records of transactions, including valid tax invoices and receipts. Consistent adherence to GST rules improves financial transparency and audit readiness.

Handling receipts in digital expense report systems

Efficient handling receipts in digital expense report systems ensures accurate tracking and reimbursement of business expenses. These systems streamline the submission, verification, and storage of receipts, reducing manual errors and saving time. Integrating receipt management with expense reports improves financial transparency and compliance.

What tax codes must be referenced in a compliant expense report letter?

A compliant expense report letter must reference applicable tax codes governing business expenses to ensure adherence to local and federal tax regulations. These codes typically include VAT, GST, or sales tax identifiers relevant to the jurisdiction of the transaction. Including precise tax codes helps to maintain transparency and facilitates easier audit processes.

How should unreceipted expenses be justified within the document?

Unreceipted expenses must be justified with a clear and detailed explanation outlining the reason for the missing receipt. The justification should include the date, amount, nature of the expense, and any attempts made to obtain the receipt. Properly documenting this information enhances the credibility and compliance of the expense report.

What is the preferred format for itemizing travel-related expenses in a formal letter?

The preferred format for itemizing travel-related expenses is to list each cost with date, category, description, and amount in a clear, tabular, or bullet-point format. This approach improves readability and ensures all individual expenses are distinctly documented. Grouping expenses by category such as transportation, lodging, and meals is also recommended.

Which approval signatures are mandatory on a departmental expense report?

A departmental expense report must include signatures from both the employee submitting the report and their immediate supervisor or department head. Additional signatures may be required from the finance or accounting department to validate budget compliance. These approvals confirm the legitimacy and authorization of the expenses claimed.

How are currency conversions documented in international expense letters?

Currency conversions in international expense letters should be documented by stating the original currency amount, the conversion rate used, and the equivalent amount in the reporting currency. It is important to reference the source of the exchange rate and the date it was applied. This ensures clarity and accuracy in financial reporting across different currencies.