A Insurance Inquiry Form Sample helps individuals gather essential information when requesting insurance quotes or coverage details. This form typically includes fields for personal data, insurance type, and specific coverage needs. Using a well-structured sample ensures efficient communication and accurate responses from insurance providers.

Auto insurance inquiry form sample template

Use this auto insurance inquiry form sample template to efficiently gather essential information from potential clients. Designed for quick completion, it streamlines the process of obtaining vehicle and personal details. This template ensures accurate data collection to facilitate tailored insurance quotes.

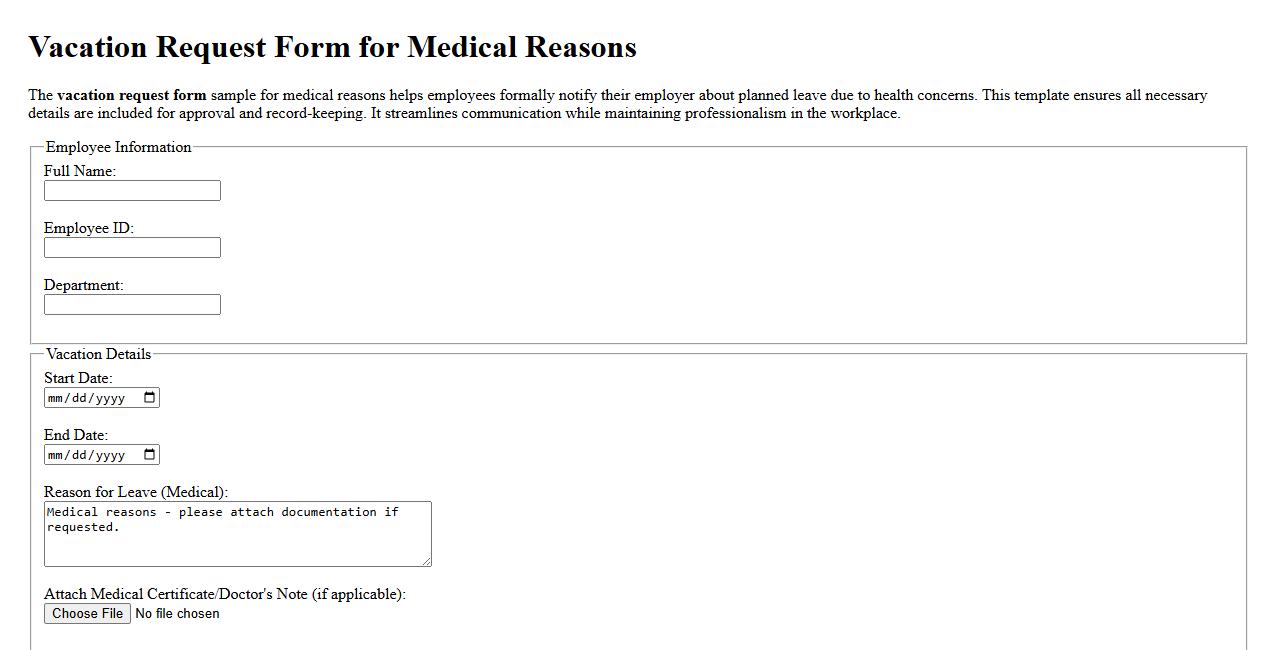

Health insurance inquiry form sample PDF

Download this Health insurance inquiry form sample PDF to facilitate a streamlined process for gathering essential personal and medical information. The form is designed to ensure accuracy and compliance in health insurance applications. Utilize this sample to improve client onboarding and enhance service efficiency.

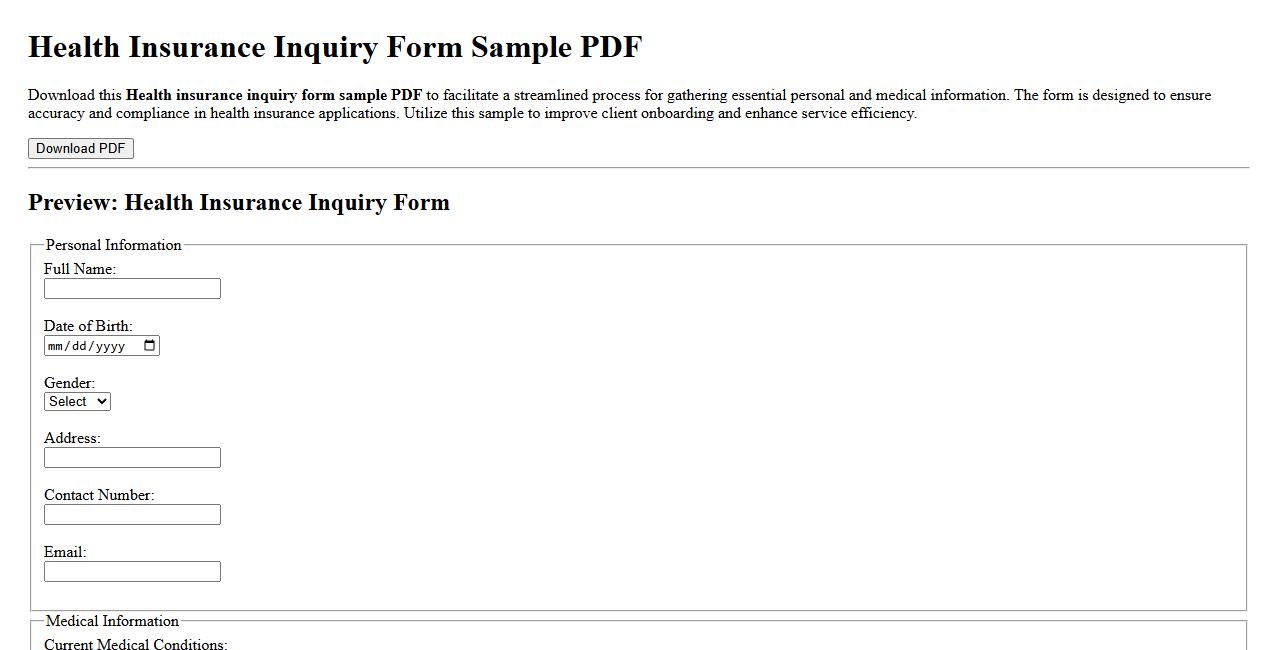

Homeowners insurance inquiry form sample download

Download our homeowners insurance inquiry form sample to easily gather essential information from clients. This template simplifies the process of assessing insurance needs and ensures accurate data collection. Get started today for efficient and organized inquiries.

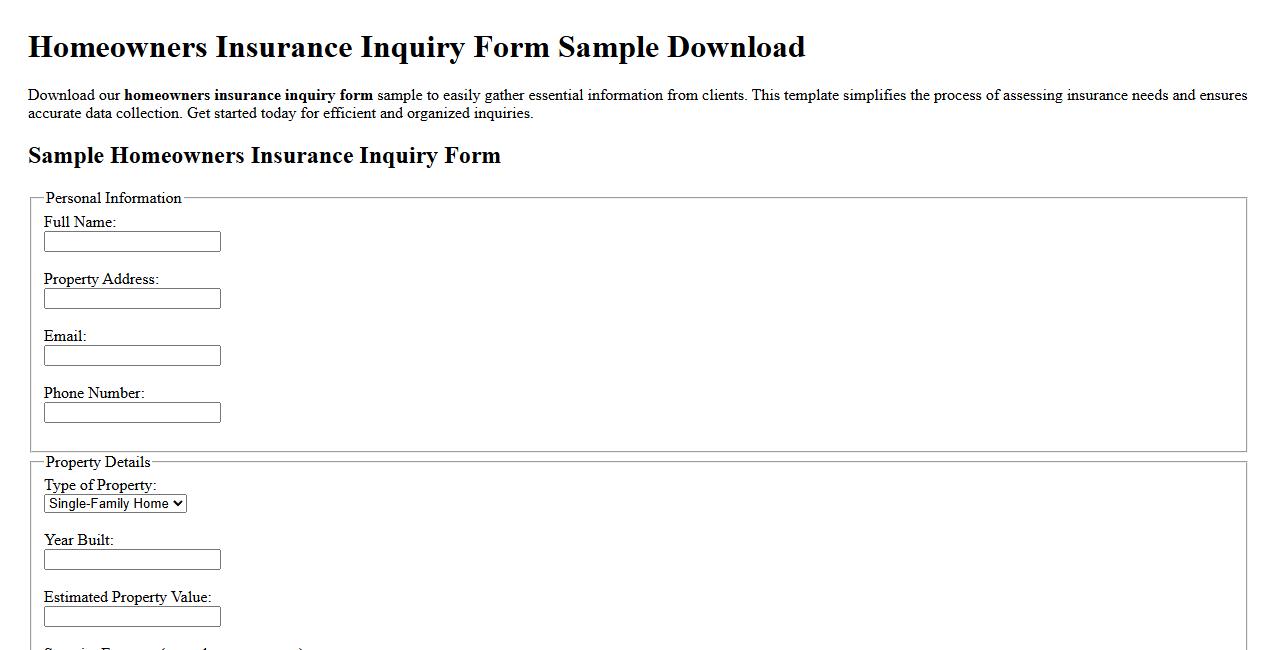

Life insurance inquiry form sample for individuals

Use this life insurance inquiry form sample designed for individuals to easily gather essential information from potential clients. It streamlines the process of assessing coverage needs and personal details efficiently. This form ensures accurate data collection for tailored insurance solutions.

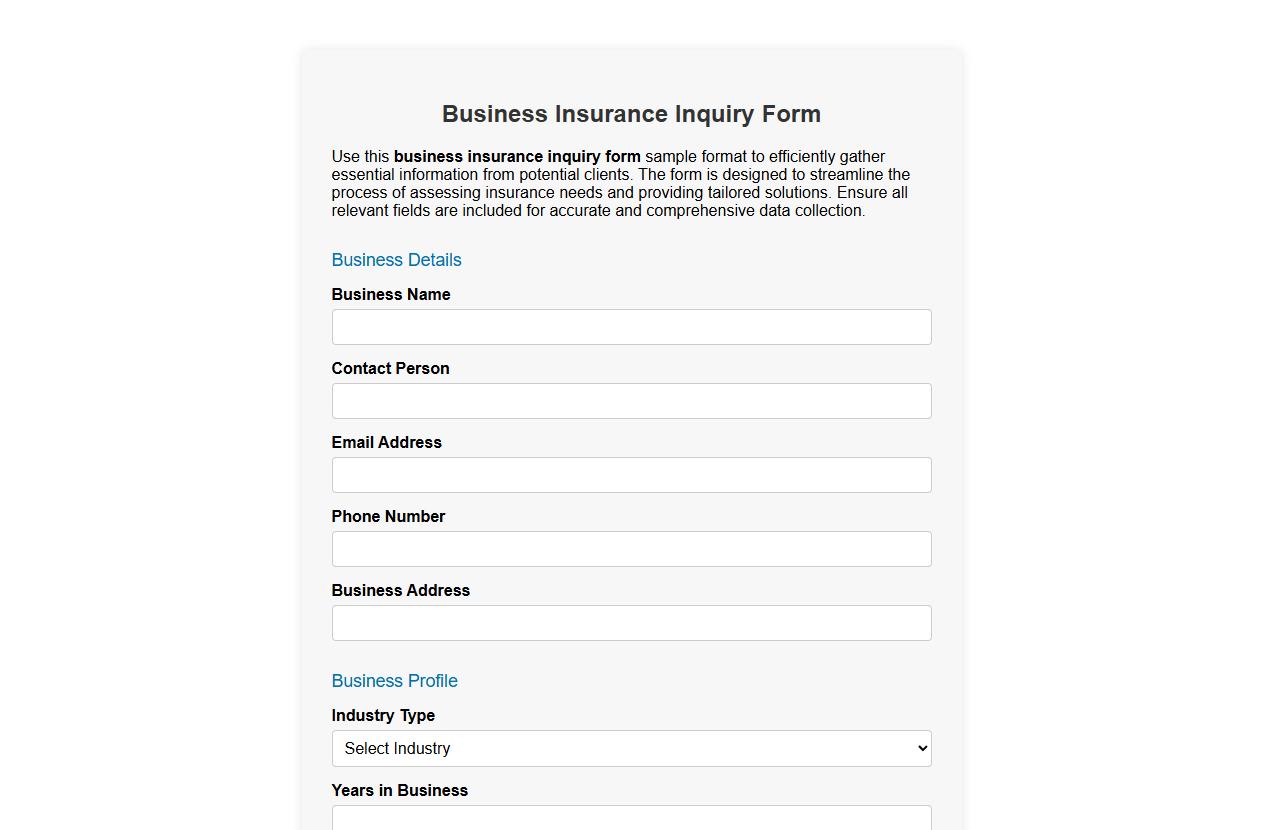

Business insurance inquiry form sample format

Use this business insurance inquiry form sample format to efficiently gather essential information from potential clients. The form is designed to streamline the process of assessing insurance needs and providing tailored solutions. Ensure all relevant fields are included for accurate and comprehensive data collection.

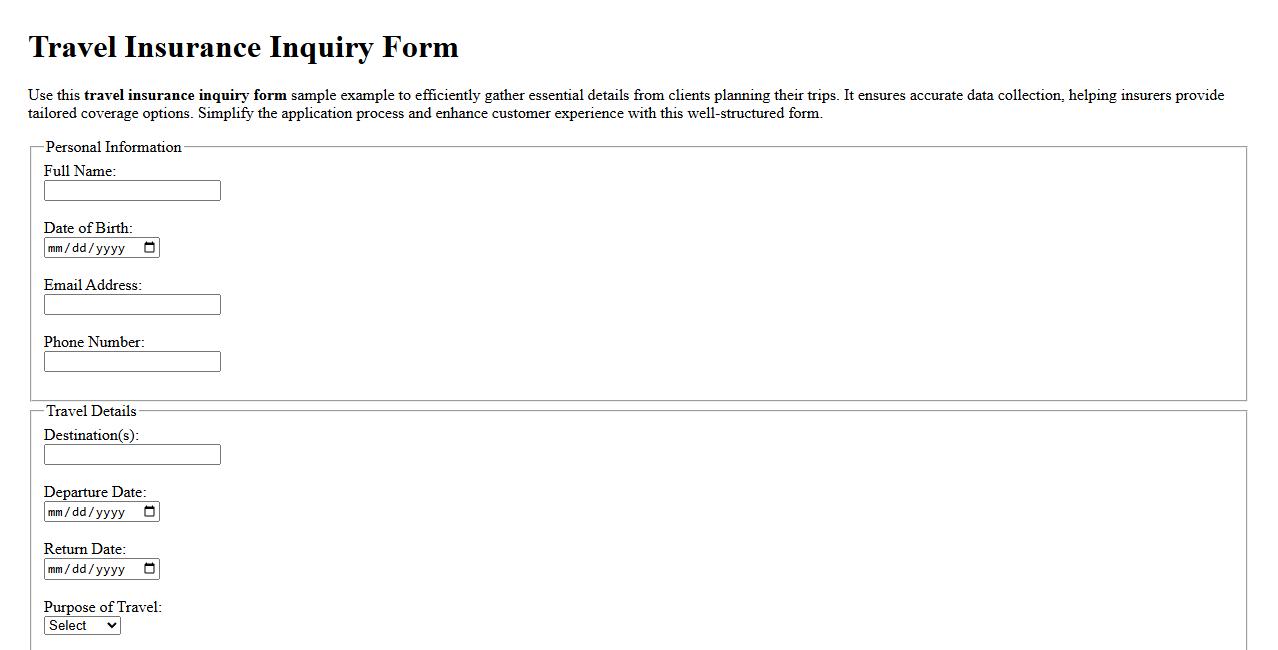

Travel insurance inquiry form sample example

Use this travel insurance inquiry form sample example to efficiently gather essential details from clients planning their trips. It ensures accurate data collection, helping insurers provide tailored coverage options. Simplify the application process and enhance customer experience with this well-structured form.

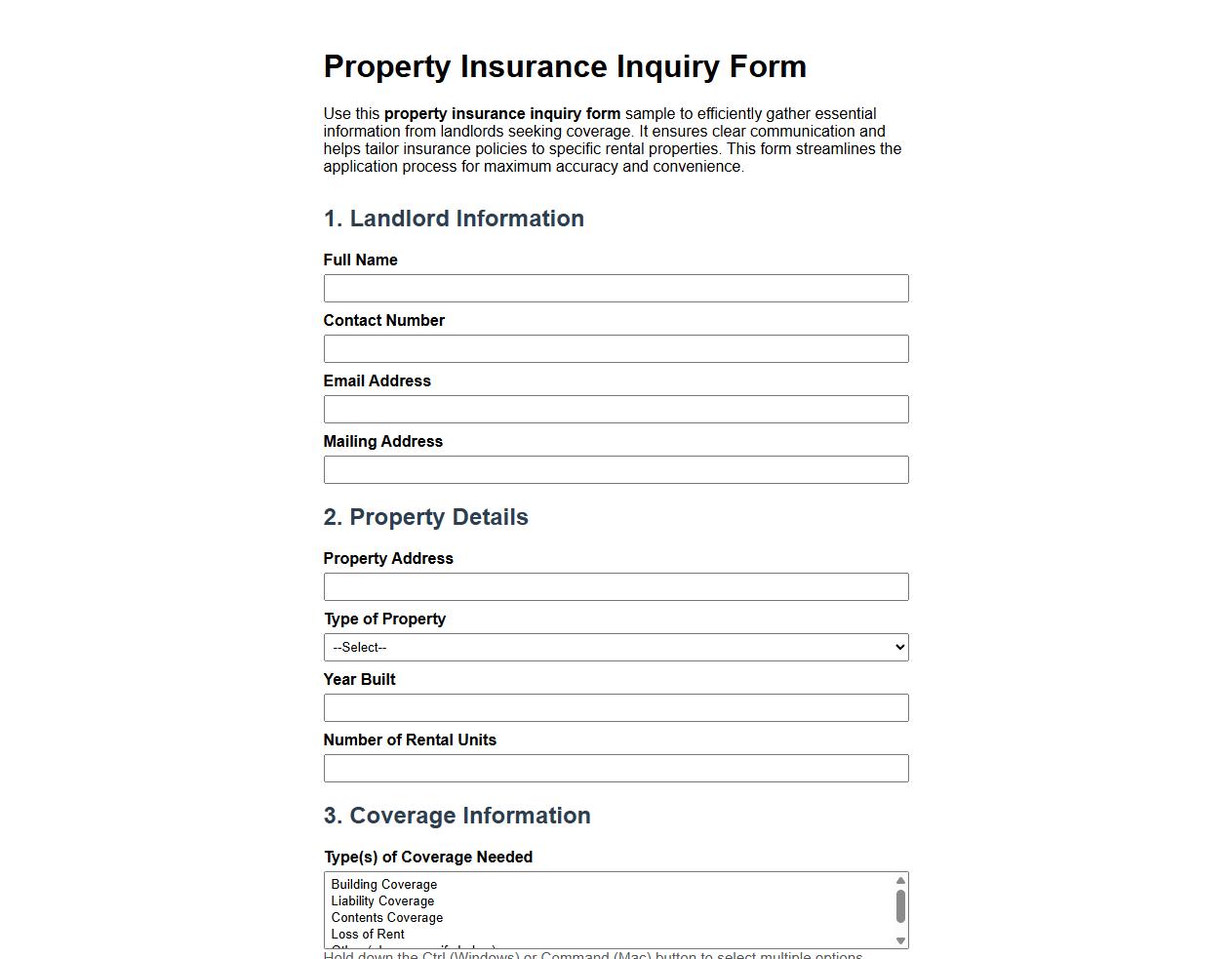

Property insurance inquiry form sample for landlords

Use this property insurance inquiry form sample to efficiently gather essential information from landlords seeking coverage. It ensures clear communication and helps tailor insurance policies to specific rental properties. This form streamlines the application process for maximum accuracy and convenience.

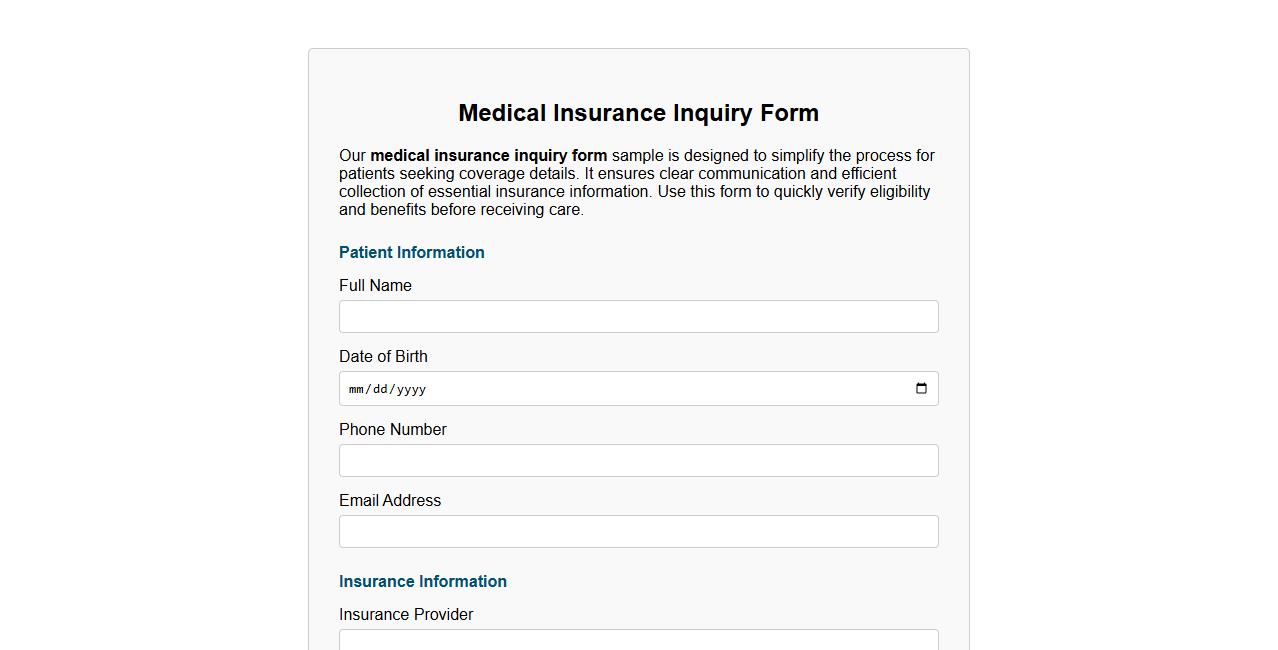

Medical insurance inquiry form sample for patients

Our medical insurance inquiry form sample is designed to simplify the process for patients seeking coverage details. It ensures clear communication and efficient collection of essential insurance information. Use this form to quickly verify eligibility and benefits before receiving care.

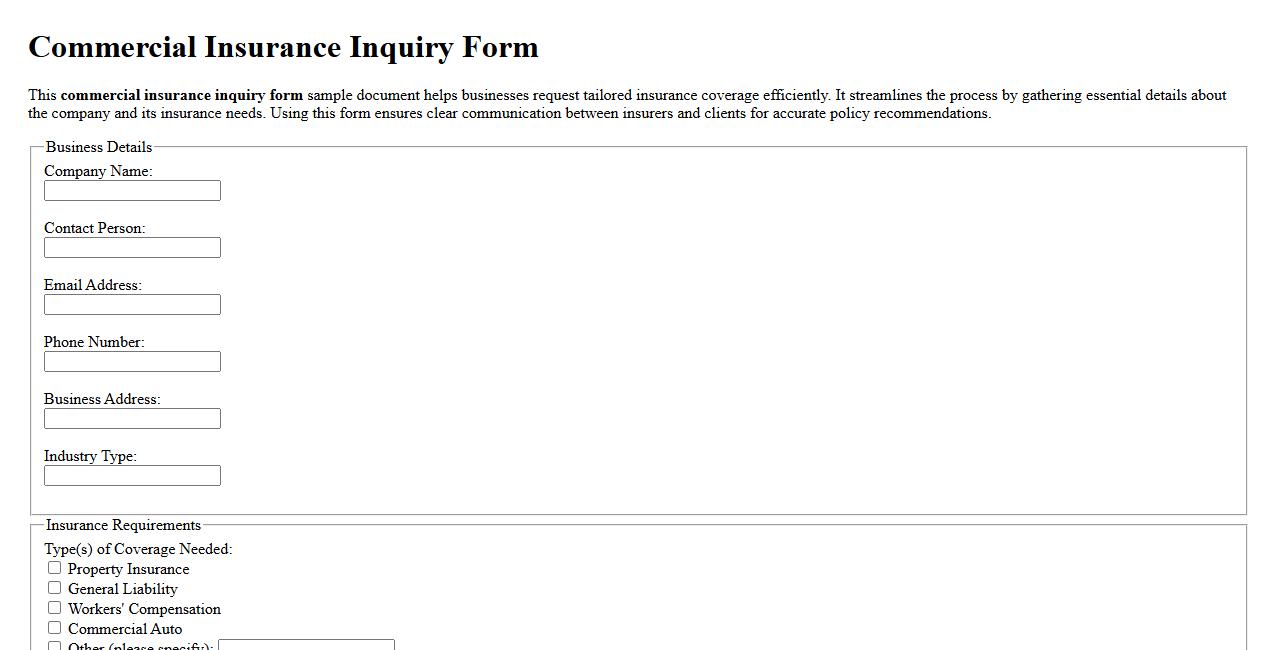

Commercial insurance inquiry form sample document

This commercial insurance inquiry form sample document helps businesses request tailored insurance coverage efficiently. It streamlines the process by gathering essential details about the company and its insurance needs. Using this form ensures clear communication between insurers and clients for accurate policy recommendations.

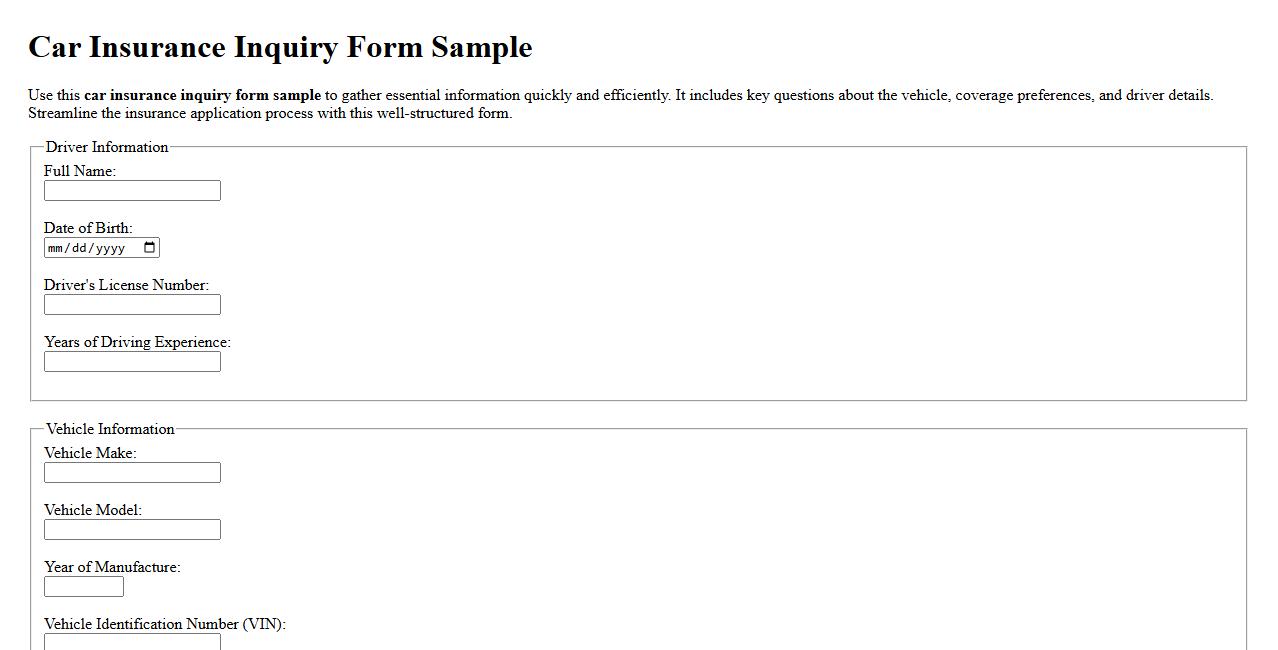

Car insurance inquiry form sample with questions

Use this car insurance inquiry form sample to gather essential information quickly and efficiently. It includes key questions about the vehicle, coverage preferences, and driver details. Streamline the insurance application process with this well-structured form.

What specific coverage options are available for high-value personal property?

High-value personal property policies offer specialized coverage designed to protect valuable items such as jewelry, fine art, and collectibles. These policies typically provide agreed value coverage, ensuring the insured amount is paid without depreciation. Additionally, coverage often includes protection against theft, accidental loss, and mysterious disappearance.

How does the claims process differ for commercial versus residential policies?

The claims process for commercial policies often involves more complex documentation due to business operations and potential liability issues. Commercial claims may require detailed loss verification, business interruption analysis, and coordination with multiple parties. In contrast, residential claims tend to focus more on property damage and personal contents, with a simpler and quicker resolution process.

Are there any exclusions unique to professional liability coverage?

Professional liability coverage typically excludes claims arising from fraud, intentional wrongdoing, or criminal acts by the insured. It also often excludes claims related to contractual disputes or services not explicitly covered by the policy. These exclusions are critical to understand when assessing the scope of professional liability protection.

What documentation is required to add additional insured parties?

Adding additional insured parties requires submitting a request form along with the names and roles of those to be added. Proof of relationship or interest in the policy, such as contract agreements, is often necessary. Insurers may also require updated certificates of insurance reflecting the additional insured status.

How does prior claim history affect premium calculations on renewal forms?

Insurers use prior claim history to assess the risk profile of the policyholder during renewal. Frequent or severe past claims typically lead to higher premiums due to perceived increased risk. Conversely, a clean claim history can result in premium discounts or more favorable renewal terms.